|

|

North America Economic Research |

Will the US catch Dutch disease?

|

|

| |

| |

|

In economic parlance, Dutch disease isn't

something you catch in the streets of Amsterdam, but is rather an

economic malady whereby a country that has a natural resource boom

experiences weaker manufacturing activity. The causation runs

through the exchange rate: an increase in net exports due to

increased resource production should strengthen the value of the

country's currency. This, in turn, challenges the global cost

competitiveness of the country's factory sector, presenting a

structural headwind to industrial growth. The term got its name

from the experience of the Netherlands, which developed large

offshore oil and gas resources in the 1960s and 1970s, thereby

placing persistent upward pressure on the value of the guilder.

This currency strength was blamed for the slow decline of the Dutch

manufacturing sector.

The US is currently in the midst of its own

fossil fuel resource boom. Unlike the Netherlands, exports haven't

surged, however imports have declined, and so the directional

impetus to net exports is the same whether it's an increase in

exports or decrease in imports. Thus the currency implication

should be the same as the one diagnosed as Dutch disease. Of

course, the shale boom can impact domestic manufacturers in another

aspect as well: energy input costs should decline for US factories.

Qualitatively, the current energy production boom has two opposing

influences on the competitiveness of the American factory sector: a

stronger dollar should make US-made goods more expensive on global

markets, while lower energy costs should make American products

cheaper. Which of these two forces is more important is a

quantitative issue.

To address this we first need to develop an

estimate of the impact of the energy boom on the dollar.

Fortunately, our colleague in FX strategy John Normand has already

done that. In a recent piece ("American energy independence and the

dollar" 3/15/13) John notes a 1% reduction in the US current

account deficit lifts the trade-weighted dollar by 1.5%. In an

extreme scenario where domestic production soars enough to create

true energy independence, the support to the dollar would be about

3%. Full energy independence, however, is probably a best case

scenario. A more likely outcome in John's view is one which pushes

up the trade-weighted dollar by about 0.5%.

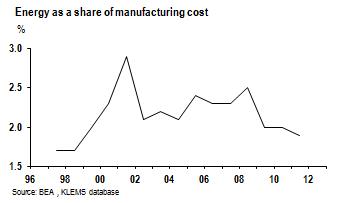

Energy accounts for 1.9% of total manufacturing

costs, according to the BEA's "KLEMS" data set. This means (by

applying a rule known as Shephard's lemma) that a 1% reduction in

energy costs should reduce total manufacturing costs by 0.019%. In

order for the decline in energy input costs to offset the loss in

competitiveness due to a 0.5% stronger dollar, total energy input

prices would have to decline by 26%. This might be a tall order:

over the past five years -- years in which energy production

increased significantly -- manufacturing energy input costs

increased by 2.5% annually. Even during the Great Recession, energy

prices for factories only fell by 16%. It would thus appear it's

possible the US could catch a very mild case of Dutch disease.

(While the net effect on output prices may be negative, both gross

effects are quite small). There are some potential mitigating

factors; for example, the KLEMS data does not consider

petrochemical feedstock as an energy input. However, the rough,

back-of-the-envelope calculations presented above indicate that

going from a partial equilibrium to a general equilibrium view of

the energy boom may alter the implications for US

manufacturing.

|

|

(1-212)

834-5523

JPMorgan

Chase Bank NA

|

The research

analyst(s) denoted by an "AC" in this report individually

certifies, with respect to each security or issuer that the

research analyst covers in this research, that: (1) all of the

views expressed in this report accurately reflect his or her

personal views about any and all of the subject securities or

issuers; and (2) no part of any of the research analyst's

compensation was, is, or will be directly or indirectly related to

the specific recommendations or views expressed by the research

analyst(s) in this report.

Company-Specific

Disclosures: Important

disclosures, including price charts, are available for compendium

reports and all J.P. Morgan–covered companies by visiting https://mm.jpmorgan.com/disclosures/company,

calling 1-800-477-0406, or e-mailing research.disclosure.inquiries@jpmorgan.com

with your request. J.P. Morgan’s Strategy, Technical, and

Quantitative Research teams may screen companies not covered by

J.P. Morgan. For important disclosures for these companies, please

call 1-800-477-0406 or e-mail research.disclosure.inquiries@jpmorgan.com.

Confidentiality

and Security Notice: This transmission may contain information that

is privileged, confidential, legally privileged, and/or exempt from

disclosure under applicable law. If you are not the intended

recipient, you are hereby notified that any disclosure, copying,

distribution, or use of the information contained herein (including

any reliance thereon) is STRICTLY PROHIBITED. Although this

transmission and any attachments are believed to be free of any

virus or other defect that might affect any computer system into

which it is received and opened, it is the responsibility of the

recipient to ensure that it is virus free and no responsibility is

accepted by JPMorgan Chase & Co., its subsidiaries and

affiliates, as applicable, for any loss or damage arising in any

way from its use. If you received this transmission in error,

please immediately contact the sender and destroy the material in

its entirety, whether in electronic or hard copy format.

|

|