|

- The CBRT raised

the upper band of the interest rate corridor by 50bp but only for

non-primary-dealers.

- The

frequency of the extraordinary days will determine the extent of

the monetary tightening

- The

cautious language used in the interest rate note leaves the door

open to further hikes.

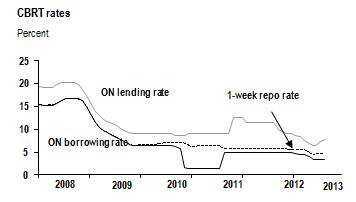

The CBRT managed to

surprise the markets yet again and introduced extra creativity and

complexity to its unorthodox monetary policy scheme further by

creating a new interest rate corridor within the already existing

corridor. According to survey results, market players were divided

between those expecting no change and those expecting a 50bp hike

in the upper band (the CBRT’s ON lending rate) of the corridor. The

decision came out to be something in-between. The CBRT kept the

upper band for primary dealer banks unchanged at 6.75% and hiked

the upper band for non-primary dealer banks by 50bp to 7.75%. The

other parameters of the scheme (ie the lower band of 3.5%, the

policy rate of 4.5% and the ROCs and RRRs) were left unchanged as

expected.

Before starting to

analyze the decision, we should note that primary dealers are

allowed to borrow at a discount from the CBRT only on normal days

while on extraordinary days all market players borrow at the more

expensive non-PD rate (which is now 7.75%). The decision suggests

that on normal days when the CBRT opens its traditional 1-week repo

auctions, the upper band of the interest rate corridor will still

be 6.75%. However, on extraordinary days when the CBRT refrains

from funding the market through 1-week repo auctions, the upper

band of the corridor is raised to 7.75% from a pervious 7.25%. This

means that inside the normal interest rate corridor of 3.50-7.75%

there is now another (and widening) interest rate corridor this

time only for the upper band that extends between 6.75% and

7.75%.

This new scheme will 1)

allow the CBRT to increase its effective funding rate swiftly

towards 7.75% on extraordinary days when the lira gets under

pressure and 2) create extra volatility in funding rates that could

discourage the banks from extending new loans and thus helping the

CBRT in demand management and thus in bringing inflation

down.

Not surprisingly,

market participants are having difficulty in evaluating the CBRT

decision. This is surely a type of monetary tightening but its

impact will most probably not be as large as a regular rate hike or

even a regular upper band hike. The extent of the monetary

tightening will depend on the frequency of the extraordinary days.

Note that the CBRT had only three extraordinary days in the last

thirty days. Unless the frequency increases, today’s decision will

not produce any result.

The main risk with

increased complexity is that of a further loss of interest by the

international investors. Given Turkey’s continued need for

portfolio inflows, this could create further market volatility. On

the other hand, more frequent extraordinary days and thus higher

funding rates along with the expected downward trend in inflation

would help to recover investor appetite and thus support Turkish

financial asset prices.

Looking at the one-page

announcement note, we see that as expected the CBRT maintains its

cautious tone. Importantly, the note states that “in order to

contain the adverse impact of the above-target inflation indicators

on the pricing behavior, the Committee has decided to strengthen

the cautious stance of the monetary policy” and that “the cautious

stance will be maintained until the inflation outlook is in line

with the medium term targets’. “ In this respect, additional

monetary tightening will be implemented whenever needed.’ This

cautious rhetoric shows that the CBRT leaves the door open for

further rate hikes if needed.

Elsewhere, the CBRT has

slightly downgraded its domestic demand outlook. After saying that

“domestic demand follows a healthy recovery”, the Bank now sees

“domestic demand growing at a moderate pace”. Finally, the CBRT

sounds more upbeat on the external balances. The CBRT emphasizes

the continuing improvement in the current account deficit and

states that “the current policy framework, with the additional

support from recent macroprudential policies, will continue to

improve the current account balance.”

|