-

We recommend fading the Argentine

external bond market's rebound following the Court's 'RSVP

order'

-

The RSVP order itself

should not change prospects for negative ruling or an unlikely

voluntary negotiation

-

Focus of investors

bidding the market may instead respond to expectations over the

post-ruling outlook

-

Stays on orders are

possible and can delay the litigation end-game, important for CDS

term structure

-

Yet feasibility of

'payment re-routing' as a Plan B to exit a hypothetical 'technical

default' is highly tentative

-

In contrast to external

law debt rebound the bid for domestic USD law bonds may have more

legs to it

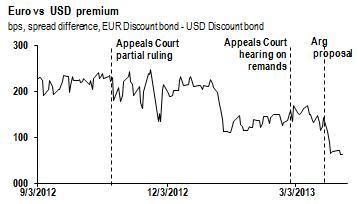

Surprisingly,

Argentina’s bond market rebounded last week off the back of the

Court’s ‘RSVP order’ directing holdout creditors to respond by

April 2 to Argentina's ‘cram down’ proposal of March 29 (See first

chart below)—even as 'technical default' risk remains high (see

second chart below)

Given the binary nature

of litigation outcome we are inclined to fade the rebound near-term

and to reassess the outlook once the Appeals Court delivers its

pending ruling.

Addmitedly, in some

respect, the price dynamics offers evidence of the supportive

‘technical position’ of the market (i.e. a lot of bad news is

already in bond prices). But if the current rebound is to

last—recall that the one following the Court's 'Proposal order' to

Argentina (March 1) was surprising but short-lived—then it should

be possible to identify a fundamental driver to give it its

legs.

Therefore, we ask

ourselves whether the market response to the issuance of the

Court's 'RSVP order'...

-

Suggests that the Court

might be inclined to avoid a negative ruling for

Argentina?

-

Suggests that the Court

might be effectively guiding Argentina and holdouts to a negotiated

solution?

-

Reflects a shift of

investor focus to a (potentially more hopeful) landscape

post-negative ruling?

We are unconvinced of

the first two possibilities. The third scenario is a plausible

explanation of price action. Indeed, it is consistent with the fact

that new investors entering the approaching Argentina's distress

opportunity are inclined to assume that Argentina is capable of

finding a way to efficiently delay, 'work around' (or 'work itself

out of') the potential 'technical default' threat that a negative

ruling represents. This is borne out by the recent spread

compression between USD and EUR discounts—where, given the

optionality of EUR paper being excluded from Court orders, new

entrants have concentrated bids (see chart below).

Delay is certainly

possible but at this stage we do not share the confidence in the

'work-around' scenarios. We do believe that domestic Argentine

politics would be supportive of a 'Plan B' to make debt payments on

restructured external debt. We discuss the alternative shapes of

such plans but we remain concerned that the current state of

discussion over the mechanics of such processes is green and too

many questions remain unanswered.

A negative ruling:

are 'second thoughts' justified? We do not think so.

The 'back and forth'

between the Court and parties involved can be interpreted as an

indirect sign of hesitation (or lack of consensus) from the panel

of Judges in the face of a decision to rule negatively (affirming

the District Court orders on remand). Does the Court’s issuance of

orders indicate that Judges are getting ‘cold feet’?

We are unconvinced of

this scenario and continue to expect a negative ruling. We continue

to anticipate that Argentina’s ‘cram down’ proposal will evaporate

any dose of sympathy the Judges might have harbored for Argentina.

Effectively, the lack of flexibility in the 'quantitative'

dimension of Argentina’s proposal unloads transfers all the burden

of compromise on the shoulders of the Court.

We note that this

week’s price action mimics the price rebound that followed the

Court’s ‘proposal order’ (March 1) directing Argentina to present

its payment formula. The latter ended up being a short-lived

affair.

That said, at this

point it is worthwhile to clarify what constitutes a negative

ruling. We believe that a negative ruling is one

that—notwithstanding possible 'silver linings or 'mitigating

factors' that may accompany it—effectively threatens to push

Argentina a step closer to 'technical default'.

The table lays out the

factors that may offer 'silver linings' but that would not change

the fundamental nature of a ruling if it is negative. We classify a

ruling as negative when it (a) constitutes a threat (at least) for

USD bondholder payments, (b) constitutes a constraint (at least) on

payment functions carried out by BoNY, and (c) when it defines a

ratable payment formula (either the District Court or, in

consideration of equities, an unknown alternative) that demands

greater compromise from Argentina than it is willing to deliver

(the 2010 'cram down').

A negotiated

solution: Is it being underestimated? We do not think

so.

We acknowledge—in

addition to reflecting 'due process'—the Court's recent orders

(both for a formula proposal from Argentina and for an RSVP from

holdouts) represent an active attempt to sponsor a dialogue between

the parties. We believe it is in the Court's interest to do so in

order to spare the Judges the uncomfort of a ruling that requires

choosing one of 'two evils' (either a 100% formula or a 'cram

down').

But we remain

unconvinced of the possibilities of such a convergence. We consider

that the NPV of Argentina's proposal (43-68% depending on spreads)

vs. holdouts court claims (334%) dashes any hope that the Court may

harbored in its own capacity to guide the parties toward a

voluntary reconciliation. Holdouts' negative response to the

'quantitative' aspect of Argentina's should be

predictable.

However, it will be

important to analyze the response from holdouts to the

'qualitative' aspects of Argentina's proposal. These may have a

bearing on Judges and any potential surprises from the subsequent

Court ruling could originate on this dimension.

By 'qualitative'

aspects we refer to the arguments Argentina included in its filing

to justify the 'quantitative' proposal (2010 'cram down'). In

reviewing the holdouts' response to that proposal Judges might feel

drawn to weighing the competing definitions of the equity of the

remedy, or of the economic feasibility of the payment, or of the

way interest claims ('past due' vs. 'retroactive') should be

defined on bonds that matured many years ago.

Holdouts are likely to

argue that these issues have been settled. However, we would point

out that—as an example to the contrary—during the February 27

hearing one of the judges hinted that the record may not

demonstrate the feasibility of the District Court's payment formula

(not surprisingly, in filing its proposal Argentina chose to claim

that Judge Griesa lacked ‘due process’ on this issue... hoping for

remand?).

Does the post-ruling

outlook offer hope? We take limited comfort from

stays/swaps.

We believe distress

situation investors buying Argentine in the last weeks may be

expressing a constructive view beyond a (likely negative) ruling.

The main post-ruling factors that will drive prices are stays and

swaps.

Stays/further

review: Delay tactics

Legal opinions

generally downplay the odds of a Supreme Court review (although in

2011 the so-called ‘alter ego’ litigation between Argentina and

holdouts was settled favorably for the latter by the Supreme

Justices). However, it is plausible that the Appeals Court's 'back

and forth' issuance of orders may inspire market confidence in the

possibilities that stays on Court orders are extended. If issued

free of conditionality (i.e. escrow deposit), stays would at least

protect coupon payments during the period that Argentina petitions

for review by the Supreme Court.

A delay tactic will not

dispel uncertainty and may only serve to avert 'technical default'

risk temporarily. But it requires acknowledging the optionality has

some value however low the probabilities (for instance, a delayed

final ruling beyond mid-term elections might be thought to

facilitate an Argentina negotiation; or a review by Supreme Court

could reverse the Appeals Court ruling in 2014).

Swaps

and re-routing of payments: Exit strategies

Recent comments by

Argentine government officials might also be inspiring expectations

for a resolution to a potential 'technical default' scenario. Those

statements have shifted the discussion in the market to the

assessment of a potential Argentine re-routing of payments on the

existing NY/UK law restructured bonds to an off-shore

location.

We are concerned that

the faith in a re-routing of payments may largely be based on

little more than the premise that ‘if there is a will, there is a

way’. If so, markets may risk underestimating the

mechanical/operational challenges that a re-routing strategy by

Argentina would face due to outstanding Court orders.

Note that the Court

orders not only bar intermediaries from making payments to

restructured bondholders in the absence of payments to holdouts

(order stayed). They also bar intermediaries from assisting

Argentina in re-routing payments on restructured bonds (order

effective).

Tactics to elude or to

exit a potential ‘technical default’ situation might be expected to

rely on one of the following alternatives:

-

A

'democratic' re-routing: A supra-majority vote by

restructured bondholders can change the terms—including payment

location—on the existing NY/UK law bonds (CACs allow a ‘cram down’

of dissenting investors);

-

A

'dictated' re-routing: A direct Argentine offer for

investors to tender existing NY/UK law bonds into new ARG law

bonds;

-

A

'stealth' re-routing: A secondary market purchases by an

Argentine agency of existing NY/UK law bonds (but settled with

simultaneous delivery of new ARG law bonds);

-

A

'force majeure' re-routing: A restructured bondholder vote to

adopt an off-shore trustee in response to a resignation of BoNY

(providing a 90-day notice).

We believe that the

comfort afforded from these alternatives may be overstated.

Practical difficulties to carrying them out are unlikely to be

fully appreciated at this stage.

The first two options

clearly expose financial intermediaries involved to the risk of

being held in contempt of Court if they assist the process. The

third option relies on arguing that legitimate secondary market

operations would protect intermediaries from contempt of Court.

(and if carried out, this strategy is liable to result in

piece-meal and protracted execution). The fourth alternative may

also expose intermediaries to liability although the transfer

functions to an off-shore trustee can be framed in the context of

'force majeure' if and when available alternative on-shore trustees

(required by contract to replace BoNY) decline the

job.

If legal/mechanical

risks to a Plan B are high then the ease with which Argentina might

be able to deliver an 'exit strategy' for a hypothetical 'technical

default' scenario after just one or two coupon misses is

questionable. However, even if a 'technical default' of external

debt is harder to repair than markets might expect, we remain

confident that the local law USD bonds (which the NY Court is not

interfering with) can continue being paid—thus, justifying the

negative local law - NY law risk premia.

Note that after the

'RSVP order' the widening negative local law risk premia (Boden

15-Rep 17) snapped back (see chart below). Yet we would expect that

negative spread to continue widening if a negative Court ruling

materializes. Indeed, we highlight that the local law USD sovereign

bonds constitute one of few vehicles to gain USD exposure that

locals can access and which has favorable tax treatment. They are

also shorter duration than external law bonds which is favorable in

a muddle-through scenario. Consequently, in the context of capital

controls and lack of new issuance from the government the resident

bid for local law USD paper can linger.

|