In this note we focus

on the possible implications of Argentina's proposal of a 'pro

rata' formula—the first issue on remand by the Court of Appeals. We

refrain from revisiting the second issue on remand (i.e. whether

financial intermediaries like BoNY will be constrained by Court

orders). Sufficient is to say that, while acknowledging that the

latter is not a settled matter yet, we expect that BoNY will not be

spared from the Court orders (see

Argentina: NY Court ready to slam the door of the US payment system

shut in Argentina's face, Feb 28).

We have been concerned

that if Argentina does not deliver enough flexibility (in NPV

terms) the Court will be inclined to rule against Argentina. The

analysis below suggest that despite variations around the 2010

proposal that can be used to "sweeten" the it, the NPV of most 'pro

rata' payment formulas proposed by Argentina will inevitably

represent a confrontational strategy rather than a compromise

strategy.

But we are watchful,

particularly given an article in the local press this morning

suggesting a possible package that might be considered a game

changer (although the devil is in the details) and, if so, may

offer the 'silver lining' in Argentina's 'pari passu' saga. See

below.

The package described

in today’s local press: a potential game-changer?

In contrast, to

packages that are limited to 'sweetening' the 2010 deal, any

proposal from Argentina that fully recognizes PDI—and hence,

deviates substantially from the 2010 offer—can shift expectations

in favor of a potential 'compromise' that materially diminishes

risks of future technical default. We lay out a simple

(theoretical) example of such a proposal consisting of a Par bond

payment for full claims and show that the NPV is attractive to

holdouts- and hence, to the Court.

In addition, we note an

article in today's

Ambito Financiero suggests a different package (a Par

bond for principal claims and a Discount bond for PDI claims) that

might be presented and - while not as attractive as the one above -

may be valuable enough to fall into the category of ‘compromise’.

We incorporate this package into the analysis below. Of course, we

cannot anticipate whether this article adequately characterizes the

proposal that Argentina will present on March 29– but if it does,

we point out that its NPV is potentially attractive for

holdouts.

This is because the

package described in the article would imply recognition of past

due interest (PDI) – and this implies a significant deviation from

the 2010 debt restructuring terms. While Courts have said that "we

are here to enforce contracts, not rewrite them" we believe that

holdouts have an interest in signaling their interest or lack

thereof in any proposal Argentina makes. And if, despite a

rewriting of contracts by Argentina, the NPV is attractive to

plaintiffs we find it hard to believe that the Court would ignore

the latter's opinion.

Is Argentina really

ready to ‘blink’ in the game of chicken and, hence, will President

Kirchner betray her promise to not pay holdouts more than

restructured bondholders? Ambito’s article implies that this may be

the case. We will have to wait until March 29 for certainty

regarding Argentina’s offer. But we want to highlight that this bit

of local press information provides an interesting option to watch

out for on March 29.

What to look for on

March 29

Upon disclosure of

Argentina’s ‘pro rata’ formula we believe it will be important to

classify that proposal in one of two possible buckets:

-

A

‘confrontational’ strategy: This would be the case if Argentina

stands by its promise to deliver a proposal along the lines of the

2010 restructuring (or one of several possible variations around

it). In this scenario the NPV of the proposal (even if enhanced

beyond the 2010 offer) falls significantly short of the value of

the plaintiffs' Court claims. This implies Argentina is seeking an

unprecedented sovereign ‘cram down’ from the Court. Market

uncertainty regarding the likelihood of that occurring will linger

until the Court effectively delivers a ruling. But bond prices are

likely to slip if the proposal falls into this category given the

heightened risk of technical default that such a strategy entails

if it fails.

-

A

‘compromising’ strategy: This would the case if instead,

Argentina surprises with a (significantly) better than expected

proposal—and one that offers an NPV that approximates the value of

the plaintiffs' Court claims. Here again, market uncertainty will

linger given the Court ruling remains pending. But bond prices may

rise given the risk that holdout creditors might respond by

signaling to the Court their willingness to embrace this offer.

That signal can go a long way to deterring the Court from imposing

one of two uncomfortable extremes: a ‘cram down’ (favorable to

Argentina) or a strict contractual interpretation (favorable to

holdouts).

Until today's Ambito

article we were expecting that Argentina's filing would represent a

‘confrontational’ strategy. President Kirchner has stated that

proposing anything better than the 2010 deal would be "illegal, not

economically feasible, and unfair." And the Minister of Economy has

stated that the strategy involves "convincing the judges, not the

holdouts"—suggesting the NPV enhancements that might be hung on the

2010 proposal are unlikely to go as far as tempting holdouts to

voluntarily embrace it.

Distinguishing a

‘confrontational’ from a 'compromising' strategy

In this brief we

provide investors guidelines to compare the value of potential

proposals that Argentina may offer the Court. While expecting

Argentina to adhere to the broad guidelines of the 2010 offer, we

allow room for variations in the offer that can enhance its

value.

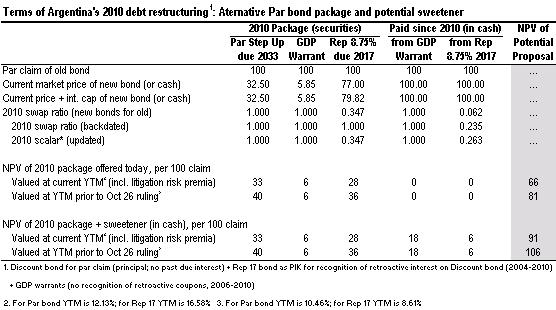

One variation of this

sort would be to offer a Par bond instead of a Discount bond. Other

sweeteners include recognizing retroactive payments on GDP warrants

and/or retroactive interest on Republic 17s. We note that the net

present values (NPVs) of all these alternative proposals fall

visibly short of the value of court claims currently held by

holdouts.

This is true even when

the variations around the 2010 proposal are valued at a (lower) YTM

than that which prevails on Argentina's restructured bonds today.

Thus, we believe that all of these possible packages will be viewed

by the holdouts and the Court as representing a ‘confrontational’

strategy by Argentina in pursuit of a ‘cram down’

ruling.

In our view, the

potential "swing factor" that could signal a ‘compromising’

strategy acceptable to the Court would involve commitment to more

favorable treatment of past due interest (PDI) on old bonds than in

2010 (see

Argentina: The (improbable) "smoke screens" Kirchner needs to

deploy to obtain a surprise sovereign "cram down", March 3). This involves a

substantial (and hence, politically risky) deviation from the 2010

deal which we do not anticipate Argentina proposing. However, if

Argentina were to consider 'blinking' first (rather than waiting

for the Court to do so) we would look for that signal in its

proposed treatment of PDI claims.

Recall that the 2005

and 2010 deals recognized principal but not the PDI claims. The par

claims tendered by investors in 2010 were slightly above the 100%

principal claim (claim ratios varied widely from 10% to 135% but

the extremes reflected coupon strips—at the low end—and

capitalizing bonds—at the high end).

In contrast, currently,

the share of holdout creditor Court claims represented by PDI

claims far exceeds the principal claims. The Exchange Bondholder

Group (EBG) filings suggest that the plaintiffs’ $1.43 billion

claim against Argentina involves a principal claim of only $428

million. If so, this implies that plaintiffs’ par claim today

stands at 334% (composed of 100% principal + 234% ‘past due’

interest)—far above the ‘eligible claims’ (as unilaterally defined

by Argentina in both its 2005 and 2010 tender offers).

The difference between

the ‘eligible claim’ ratio (near 100%) of the 2010 offer and

plaintiff’s (334%) contractual claim is enormous. Thus, PDI

recognition is the single most important factor which can be

adjusted in order to approximate the NPV of the 2010 proposal to

the value of Court claims and determine a compromise.

The NPV of proposals

that follow the guidelines of the 2010 offer

Valuing Argentina’s

‘pro rata’ proposal of March 29 in order to determine whether it

reflects an ‘confrontational’ strategy or a ‘compromise’ involves

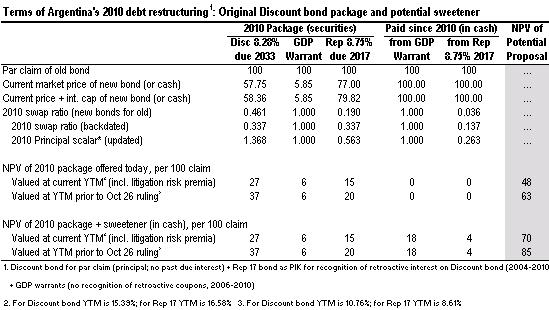

some arithmetic. The first two tables provide parameters to value a

proposal and the NPV associated to each of them.

First, we estimate the

value (at current YTM) of the "original" 2010 proposal (a Discount

bond exchange) if offered today. We also value an "alternative"

2010 proposal (a Par bond exchange) and the potential addition of

"sweeteners" to either (retroactive payments on GDP warrants and

Republic 17s). These valuations are all based on proposals that

preserve the critical feature of not recognizing PDI on old bonds

of the original 2010 offer. Therefore they represent a major

deviation from contractual law interpretation the Court might be

expected to embrace.

Second, we value these

same proposals at (lower) YTM: for instance, at the YTM prevailing

prior to the October 26 ruling, which is some 460 to 800 bps lower

than today. Why do we emphasize this metric? We use the lower YTM

prior to the adverse October 26 Court of Appeals ruling in order to

illustrate the potential (higher) value of such packages if markets

anticipate that holdouts will embrace the offer. There is no doubt

that holdout creditors are aware that this litigation risk premium

should disappear if they accept the deal and hence, they should be

expected to value Argentina proposal from a perspective of a lower

discount factor.

The rationale for

tweaking the 2010 deal and alternatively offering a Par bond (as

was the case in the 2005 restructuring) is that it provides more

favorable optics (relative to a Discount bond) for the Court since

it does not involve a principal haircut (while the Discount bond

offered in 2010 implies a 66.3% principal haircut). Judges might be

attracted to a proposal that leaves face value (FV) intact—and a

Par bond option offers a higher NPV recovery to holdouts than does

a Discount bond option. Of course, plaintiffs have an interest in

educating the Court regarding the vastly inferior NPV a Par bond

package (that only recognized principal claims and not PDI) brings

to the table relative to the value of a recognition of full legal

claims on record.

Indeed, the NPVs of

such proposals fall far short of the 334% value of the Court claims

held by holdout creditors. At current YTM the NPV ranges from

48-91% of principal ('eligible claim'). At the YTM prior to October

26 ruling their NPV rises to a range of 63-106% of principal

('eligible claims'). Therefore, while substantially above the value

conventionally associated with Argentina's 2005 or 2010 proposals

these valuations fall short of what holdouts might aspire to

collect on their claims after almost a decade of passing up

Argentina's offers and relying on litigating strategies. We

consider that all these variations of the 2010 proposal will be

viewed by the Court as 'confrontational' strategies—rather than a

sign of 'compromise'.

The potential ‘swing

factor’: The NPV of a proposal that recognizes PDI

Finally, we analyze the

value of a simple offer consisting of a Par bond and a Republic 17

(as PIK of retroactive interest on the Par bond) exchanged for full

principal and PDI claims as defined in court (estimated at 334%)

rather than claims as defined in the 2010 restructuring (in the

neighborhood of 100%).

Unlike the proposals

analyzed before, the theoretical Par bond proposal (recognizing

full Court claims) can unambiguously classify as a 'compromise'

because it yields an NPV of 225-287% of par compared to the 310%

par claim. Effectively, it represents an offer of 67-93% relative

to the court claims (vastly superior to the aforementioned offers

representing 20-34% relative to Court claims). The last two tables

summarize the proposals (valuing them alternatively at the current

YTM or at the YTM prior to October 26 ruling).

And what about the

'Ambito package'? The devil is in the (unknown

details)

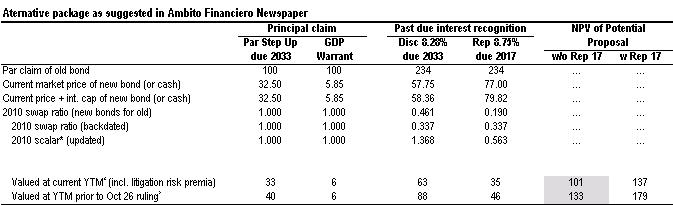

In light of the

suggestions in the Ambito Financiero article we add the NPV

analysis implied by this package too – emphasizing that, if

proposed, it would imply a significant deviation from the 2010

offer and a political acknowledgement of defeat by President

Cristina Kirchner. The article only mentions payment of a Par bond

for principal and a Discount bond for PDI. It does not mention GDP

warrants nor does it clarify if the retroactive interest on the

Discount bond will be paid in kind (PIK) in the form of a Republic

17 (as was the case in 2010). Thus, we lay out two scenarios. One

with a Republic 17 bond (in line with 2010 proposal) and one

without (strict interpretation package in the Ambito article). The

results are in the table below:

The "Ambito proposal"

falls in a grey area. If it does not include a Republic 17 in the

package then the NPV is 133% in the best case (assuming pre-Oct 26

YTM) and looks like a "confrontational" proposal that would require

the Court to deviate significantly from contractual law (cram down)

to support it - unlikely in our view.

However, if a Republic

17 is included (which the article makes no mention of) then the

metrics start to change in a meaningful way. Now the NPV (while

nowhere near a simple Par bond package) is potentially worth 179%

of par claim in the best scenario (valued at pre Oct 26 YTM). True

falls short of 334%. But it exceeds by multiples the value at which

holdouts likely purchased the claims (implying a meaningful

economic windfall) and also the package that restructured

bondholders received in 2005 and 2010 (implying a compromising

offer by Kirchner).

Investors focused on

Argentine markets have been forced to second-guess the response of

Courts, Argentine politicians, third party intermediaries involved

in litigation. To anticipate markets, the time is now coming when

it becomes important to assess the potential value the NPV of the

March 29 proposal and second-guess the response from holdout

creditors.

Stay

tuned.

|