|

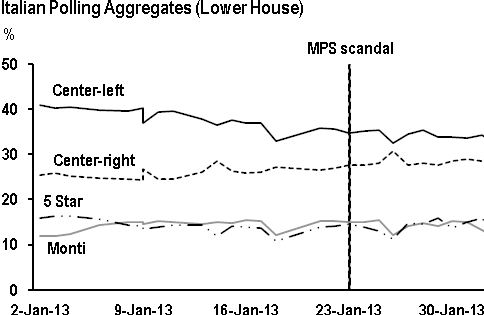

* Polls appear to

confirm that the Monte Paschi scandal has tightened the Italian

election

* We

still think the centre-left will take the lower house, but with a

slightly reduced degree of certainty

*

European policymakers are beginning to take the possibility of a

Berlusconi win more seriously (although we still think it is

unlikely)

* We

look at possible scenarios for the region if he is able to

capitalise on recent momentum and close the gap

Before the Monte Paschi

(MPS) scandal, Italy was set for a close election on Feb

24th/25th but there seemed to be little

likelihood of Silvio Berlusconi closing the gap in the lower house,

with polls showing the centre-left at least 8-10 points ahead. Over

the past week the scandal has helped narrow the gap to 5-6 points

in the national polls, which we consider to be in the danger zone.

While six points may be considered a comfortable lead in many

countries, Italian polling has historically underestimated support

for Berlusconi by around 3%. This is as a result of voters feeling

uncomfortable about revealing their preferences to pollsters; the

effect could be even more pronounced in this election cycle (given

the concerns around a Berlusconi victory), and may be worth around

4 points – if the polls are not displaying existing bias. On that

basis, we would estimate the centre-left to hold a real lead

somewhere in the 1-3% range; well below the margin of comfort (see

chart).

However, the accuracy

of some polling could be questioned, since many of the polls

available are connected to the Berlusconi press and the possibility

of bias exists. There is also evidence that polls at regional level

(for Senate votes) are showing an increase in support for the

centre-left, suggesting that any pro-Berlusconi trend is not

uniform. However, regardless of the absolute levels; the direction

the polls are travelling in (at least for the lower house) appears

to be clearly in favour of Berlusconi.

Risks

rising too close for comfort?

It is possible that the

impact of the MPS scandal, and recent positioning by Berlusconi

(including veiled bids for far-right support, and a populist

position on tax) could prove short-lived. However, to have more

clear comfort on a centre-left win we would need to see the gap

beginning to widen again in the coming days. This is unlikely to

happen; no more official polls will be made available after

February 8th, so it will be unclear precisely

how much momentum Berlusconi has gained, and whether the trajectory

of voter intentions will continue to move in his favour. Two

set-piece events in the courts may muddy the waters even more;

there is to be are a further hearing on the MPS scandal on Feb

20th (which could set the tone for the

final days of the campaign), as well as a hearing in one of

Berlusconi’s own trials. Overall however, the MPS events, and the

way in which they have been reflected in polling data over the past

week, lead us to shorten the odds on Berlusconi closing the gap on

the centre-left. A recent dip in support for Monti and a poll boost

for the radical 5 star movement complete a challenging picture for

the centre and centre-left.

Sticking with our

call

Despite this movement,

the choice of outcomes still looks much as we anticipated last

month. If the centre-left manage to hang on in the lower house as

we expect, they should also be able to patch together a deal with

Monti and the centrists in the Senate. The lower house is

essentially winner takes all (55% of seats to the first placed

party), while the Senate uses the same system on a region by region

basis. Our analysis still shows that Berlusconi is very unlikely to

win control of the Senate without the kind of nationwide

performance which would also hand him the Chamber, especially as

regional polls show him further behind (see ‘Italian

election: expect short-term relief, long-term

doubts’). We

continue to think Berlusconi is likely to secure a powerful voice

in both houses but will fail to reach a governing majority (see

charts below).

But,

what if…..?

Like us, European

policymakers have (so far) regarded a Berlusconi victory as a

tail-risk event, but they are now increasingly focused on the need

to prepare for such a potential outcome. Concentrating their minds

is a possible worse-case scenario, the ‘bad’ trajectory which we

lay out below. We also lay out a more likely trajectory of events

as we think they might unfold if Berlusconi were to

win.

A bad

trajectory

The worst fear for

regional policymakers is that a Berlusconi victory, if managed

poorly, results in heavy market pressure on Italy - ultimately

forcing it to seek an ESM-ECCL package as a precursor to activating

the OMT. German MPs would then be forced to vote on a support

package that opened the door to ECB intervention for Italy with all

of their moral hazard questions remaining unanswered (and with a

Berlusconi Government the recipient of any support). Voters in

Germany would be left asking serious questions about the OMT

(effectively being faced with the evidence of what the ECB

commitment can mean) and punish the Chancellor accordingly. Add in

the (currently rather remote) fear of Draghi being further damaged

by the MPS scandal and there is a risk of a very damaging hit to

sentiment and to the prospects of Chancellor Merkel’s reelection.

We think this is unlikely to happen; but it is the scenario that

policymakers are focused on avoiding.

A more

likely trajectory

We think any scenario

in which Berlusconi wins is unlikely to be positive for the broader

region, but it is unlikely to be as damaging as the worse case

scenario. All sides have an interest in compromise and managing the

fallout; not least Berlusconi himself who will not want to have his

election greeted with a major sell off in financial markets. We

think there is a strong chance that he will seek to lead behind

more consensus candidates (and may even try to persuade Monti to

stay on). Berlusconi would obviously retain enormous influence over

the policy direction any incoming Government might take, but has

already indicated that he would take the Economy Ministry rather

than the premiership. We would expect a significantly less hostile

approach towards the rest of the region than we have seen so far on

the campaign trail, Berlusconi would likely come back towards the

centre-ground on his engagement with Germany in

particular.

For their part, German

policymakers are likely to play ball with such an approach. No one

in Europe would be more concerned about a Berlusconi victory than

Chancellor Merkel, who has her own tough campaign leading up to the

election in September. Moral hazard issues around the OMT and Italy

will be uppermost on her mind. However, we would also expect a

conciliatory approach in the near-term; Germany will have a strong

interest in making sure that the situation doesn’t get out of

control and will likely take constructive steps near-term

(especially if there are other Government figures in Rome that the

Chancellery feels it could deal with). The Chancellor will need to

walk through some extremely delicate ground, too conciliatory an

approach will risk a domestic political backlash, but the key

objective will be to avoid the form of overt market pressure that

could lead towards an OMT request. Over time, a new Government

could potentially come to look more like the Monti administration;

a fissiparous coalition of interests with Berlusconi wielding (much

stronger) influence behind the scene.

Both

sides would deal, but damage would nonetheless be

substantial

Until now, the

prevailing strategy from the rest of Europe has been to both hope

and assume that Italians will vote against Berlusconi. Discussions

are now beginning to take place about how to manage an eventuality

that had previously been seen as a remote tail risk. The region

should be capable of managing the impacts of a Berlusconi win, but

the political costs (particularly in Germany) could be large. At

present, all of these outcomes remain unlikely – but somewhat less

so than they appeared a few weeks ago.

Senate

results: Estimates, 18th

January

and 4th

February

|

|

Centre-right

|

Centre

|

Centre-left

|

Left

|

5

stars

|

|

National

|

110

|

36

|

133

|

3

|

33

|

|

Valle

d'Aosta

|

0

|

0

|

1

|

0

|

0

|

|

Piemonte

|

5

|

2

|

13

|

0

|

2

|

|

Liguria

|

1

|

1

|

5

|

0

|

1

|

|

Lombardia

|

27

|

5

|

11

|

0

|

6

|

|

TAA

|

1

|

0

|

6

|

0

|

0

|

|

Veneto

|

14

|

3

|

4

|

0

|

3

|

|

Friuli VG

|

4

|

1

|

1

|

0

|

1

|

|

Emilia

Romagna

|

4

|

2

|

13

|

0

|

3

|

|

Toscana

|

3

|

2

|

10

|

0

|

3

|

|

Marche

|

1

|

1

|

5

|

0

|

1

|

|

Umbria

|

1

|

1

|

4

|

0

|

1

|

|

Lazio

|

6

|

3

|

16

|

0

|

3

|

|

Abruzzo

|

1

|

1

|

4

|

0

|

1

|

|

Molise

|

1

|

0

|

1

|

0

|

0

|

|

Campania

|

16

|

4

|

5

|

2

|

2

|

|

Puglia

|

4

|

3

|

11

|

0

|

2

|

|

Basilicata

|

1

|

1

|

4

|

1

|

0

|

|

Calabria

|

2

|

1

|

6

|

0

|

1

|

|

Sicilia

|

14

|

4

|

4

|

0

|

3

|

|

Sardegna

|

2

|

1

|

5

|

0

|

0

|

|

Foreign

|

2

|

0

|

4

|

0

|

0

|

|

Centre plus

centre-left

|

|

|

|

169

|

|

Source:

JP Morgan Rates Strategy

|

|

|

Centre-right

|

Centre

|

Centre-left

|

Left

|

5

stars

|

|

National

|

110

|

35

|

136

|

2

|

32

|

|

Valle

d'Aosta

|

0

|

0

|

1

|

0

|

0

|

|

Piemonte

|

5

|

2

|

13

|

0

|

2

|

|

Liguria

|

1

|

1

|

5

|

0

|

1

|

|

Lombardia

|

27

|

5

|

12

|

0

|

5

|

|

TAA

|

1

|

0

|

6

|

0

|

0

|

|

Veneto

|

14

|

2

|

5

|

0

|

3

|

|

Friuli VG

|

4

|

1

|

1

|

0

|

1

|

|

Emilia

Romagna

|

3

|

2

|

13

|

0

|

4

|

|

Toscana

|

3

|

2

|

10

|

0

|

3

|

|

Marche

|

1

|

1

|

5

|

0

|

1

|

|

Umbria

|

1

|

1

|

4

|

0

|

1

|

|

Lazio

|

5

|

4

|

16

|

0

|

3

|

|

Abruzzo

|

1

|

1

|

4

|

0

|

1

|

|

Molise

|

1

|

0

|

1

|

0

|

0

|

|

Campania

|

16

|

4

|

5

|

2

|

2

|

|

Puglia

|

4

|

3

|

11

|

0

|

2

|

|

Basilicata

|

2

|

1

|

4

|

0

|

0

|

|

Calabria

|

3

|

1

|

6

|

0

|

0

|

|

Sicilia

|

14

|

3

|

5

|

0

|

3

|

|

Sardegna

|

2

|

1

|

5

|

0

|

0

|

|

Foreign

|

2

|

0

|

4

|

0

|

0

|

|

Centre plus

centre-left

|

|

|

|

171

|

|

Source:

JP Morgan Rates Strategy

|

|