|

|

|

13 Mar 2014 |

|

|

North America Economic Research |

|

Retail sales report implies weaker Q1 consumption

|

|

| |

| |

|

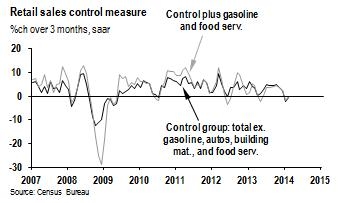

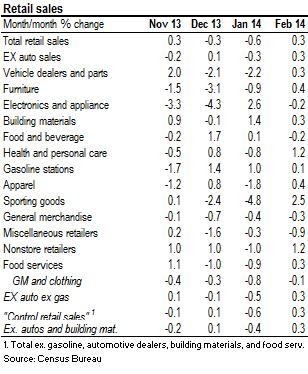

February retail sales increased a trend-like 0.3%

for the headline, ex-auto, and ex-auto, gas and building material

categories. This outcome was a touch better than expectations,

though was coupled with significant downward revisions to December

and January. The net result is to take our tracking of real

consumer spending growth in Q1 from 2.4% annualized before the

report, down to 2.1% after the report. Today's data also make it

somewhat harder to square the consumer spending step-down with a

predominantly weather-driven story: February was the most

unseasonably cold month of the winter, yet had the best retail

sales outcome since October. Sales in the retail control category

(ex-autos, gas and building materials) were revised down in

December by 0.2%-point, to 0.1%, and revised down in January by

0.3%-point, to a rather weak -0.6%. The more normal February

outcome suggests that the retail soft patch which began in November

may be coming to an end. We are leaving our Q1 GDP tracking at

2.0%, though today's retail sales number adds further downside risk

to that call.

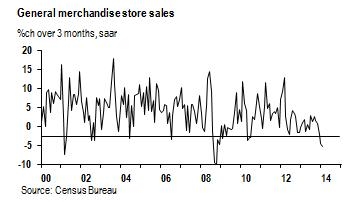

The details of the February outcome showed mixed

results across retail categories -- decent gains for sporting goods

and personal care stores, and weakness at electronics and grocery

stores (the 0.3% gain in restaurant sales was actually pretty

respectable given the cold conditions). With the revisions, January

now looks weak across the board. While weather often gets singled

out for that disappointment, we think the reduction in disposable

income with the expiration of extended unemployment benefits may be

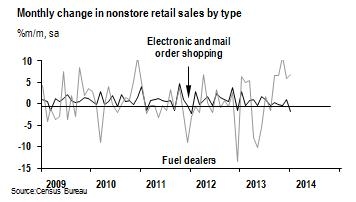

more to blame. Sales at internet stores -- normally quite resilient

to weather effects -- fell 1.7% in January, the second worst

outcome since the end of the recession. Internet sales are reported

with a one-month lag. For the most recent month (in this case

February) only the broader category "nonstore retailers" are

reported, which is primarily internet and fuel dealers. Not

surprisingly fuel dealers do well in colder months. Last month

non-store retailers could account for about 70% of the increase in

retail control sales, so while the control number printed a pretty

bland 0.3%, under the surface, weather may have subtracted from

that number, through less consumer discretionary spending, and

supported that number, through higher heating fuel

sales.

|

|

(1-212)

834-5523

JPMorgan

Chase Bank NA

|

The research

analyst(s) denoted by an "AC" in this report individually

certifies, with respect to each security or issuer that the

research analyst covers in this research, that: (1) all of the

views expressed in this report accurately reflect his or her

personal views about any and all of the subject securities or

issuers; and (2) no part of any of the research analyst's

compensation was, is, or will be directly or indirectly related to

the specific recommendations or views expressed by the research

analyst(s) in this report.

Company-Specific

Disclosures: Important

disclosures, including price charts, are available for compendium

reports and all J.P. Morgan–covered companies by visiting https://jpmm.com/research/disclosures,

calling 1-800-477-0406, or e-mailing research.disclosure.inquiries@jpmorgan.com

with your request. J.P. Morgan’s Strategy, Technical, and

Quantitative Research teams may screen companies not covered by

J.P. Morgan. For important disclosures for these companies, please

call 1-800-477-0406 or e-mail research.disclosure.inquiries@jpmorgan.com.

Confidentiality

and Security Notice: This transmission may contain information that

is privileged, confidential, legally privileged, and/or exempt from

disclosure under applicable law. If you are not the intended

recipient, you are hereby notified that any disclosure, copying,

distribution, or use of the information contained herein (including

any reliance thereon) is STRICTLY PROHIBITED. Although this

transmission and any attachments are believed to be free of any

virus or other defect that might affect any computer system into

which it is received and opened, it is the responsibility of the

recipient to ensure that it is virus free and no responsibility is

accepted by JPMorgan Chase & Co., its subsidiaries and

affiliates, as applicable, for any loss or damage arising in any

way from its use. If you received this transmission in error,

please immediately contact the sender and destroy the material in

its entirety, whether in electronic or hard copy format.

|

|