U.S. Fixed Income Markets Weekly

Cross Sector P. White, L. Wash, H. Cunningham

Softening inflation should allow the Fed to cut in November followed by a quarterly cadence thereafter. We remain patient to add duration and prefer carry trades. We think mortgages have the ability to outperform corporate credit in a high-for-longer environment. Balance sheet runoff should continue through year-end and we see limited funding stress implications. We revise higher our 2024 net issuance forecast to $3.275tn.

Governments J. Barry, P. White, A. Borges, L. Wash

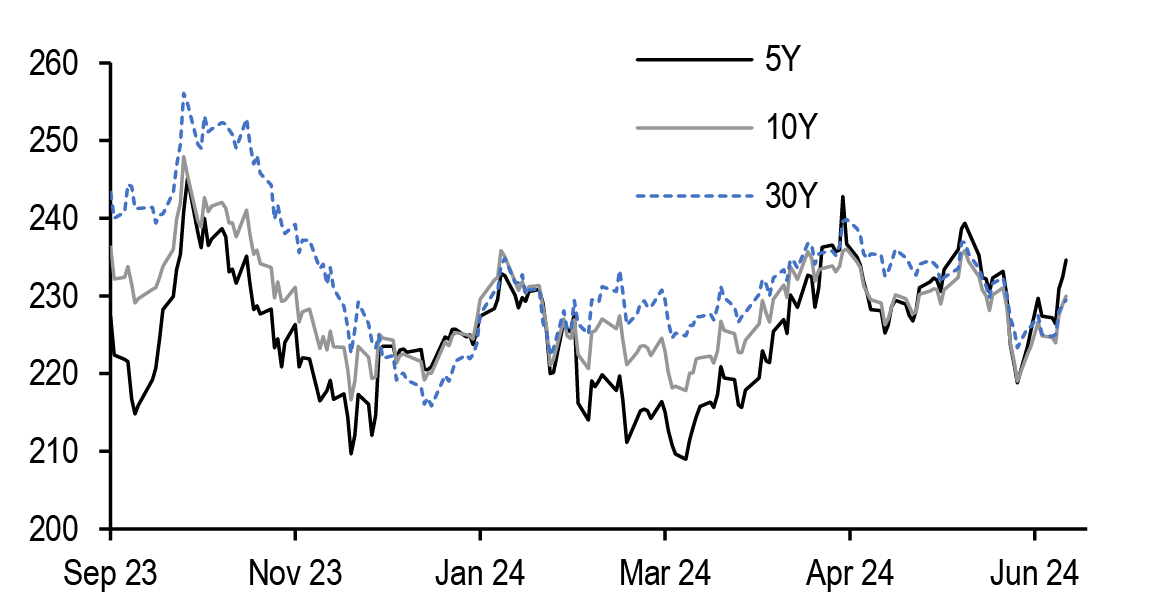

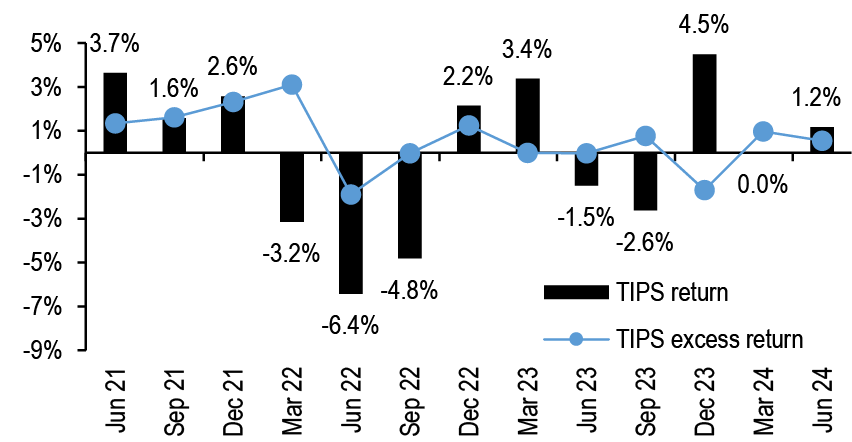

We expect a rangebound environment for Treasury yields in the months ahead. Even shallow easing cycles support lower yields, but Fed pricing and carry implications make it challenging to be long duration. We continue to see value in 5s/30s steepeners to position for Fed easing and fiscal dynamics. We discuss the impact of different election outcomes on the fiscal outlook and the Treasury market. We update our Treasury supply and demand forecasts. Remain bullish at the front end of the inflation curve. Though valuations have moved closer to fair, we expect a positive risk premium to emerge ahead of the US election: hold 1Yx1Y inflation swaps. Stay overweight $-SSA spreads.

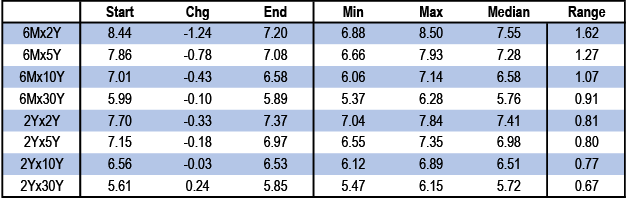

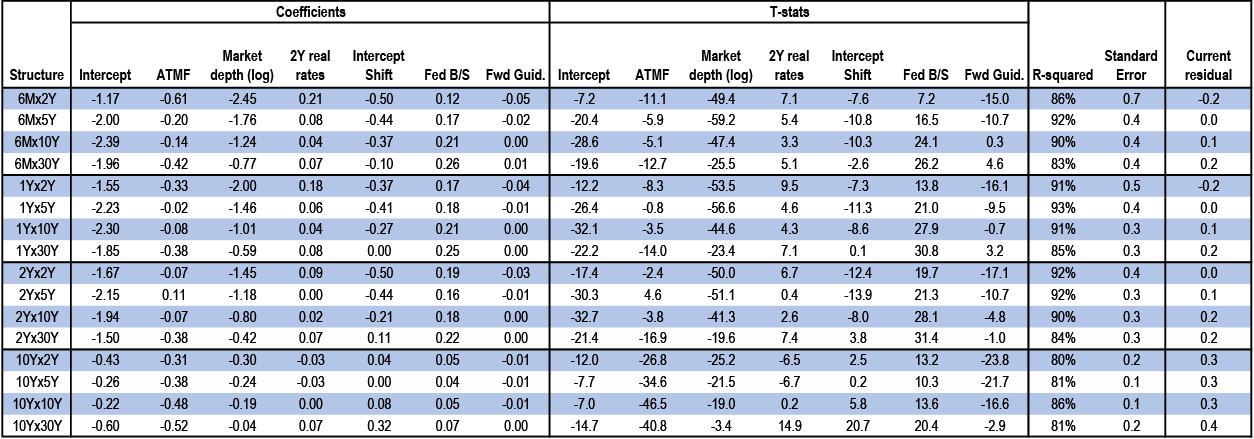

Interest Rate Derivatives S. Ramaswamy, I. Ozil, P. Michaelides, A. Parikh

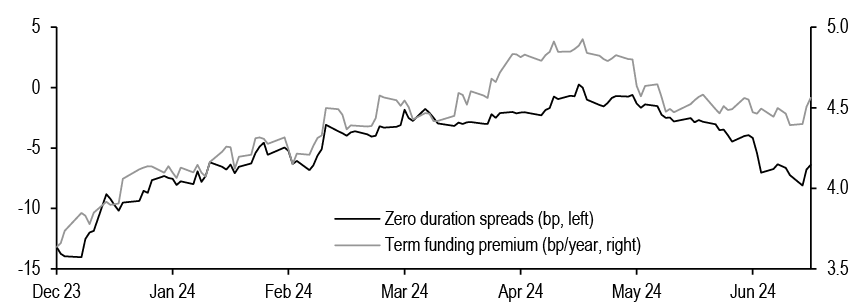

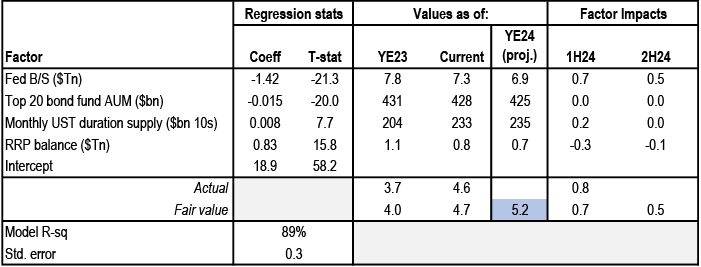

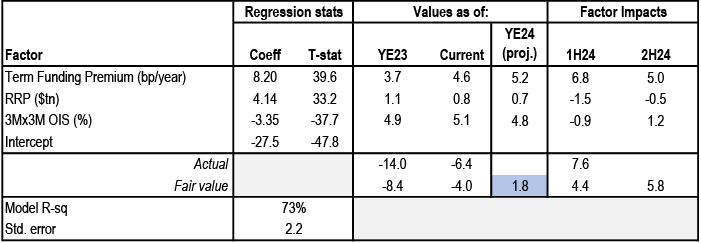

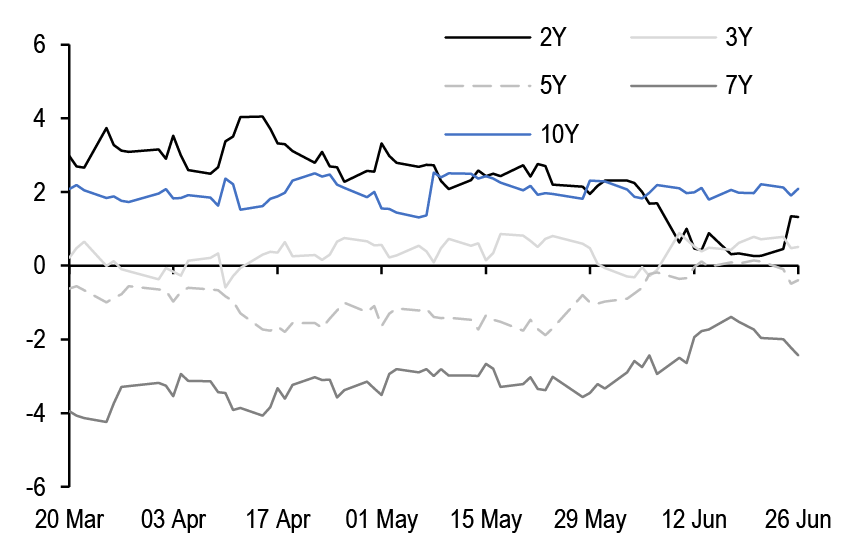

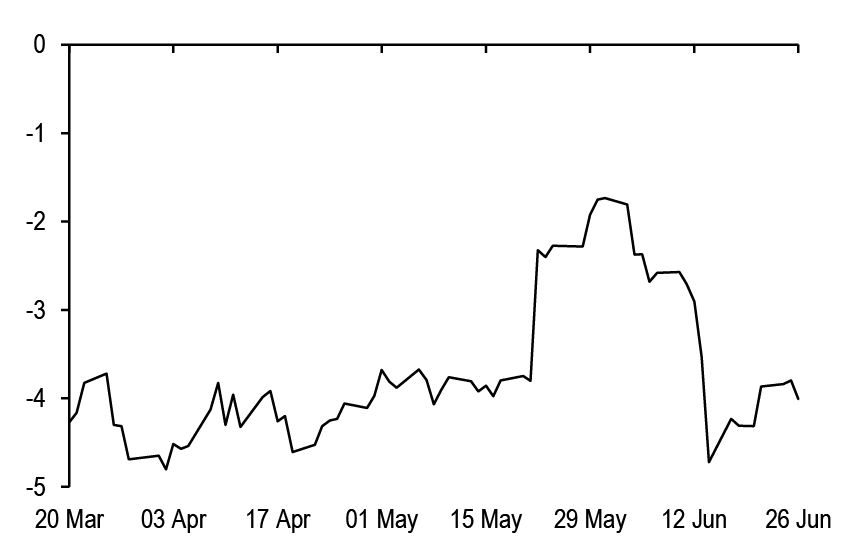

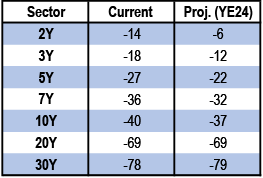

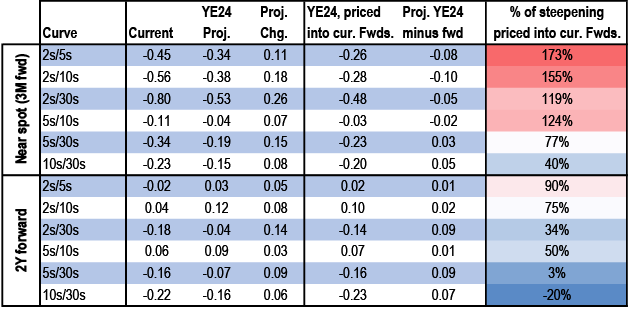

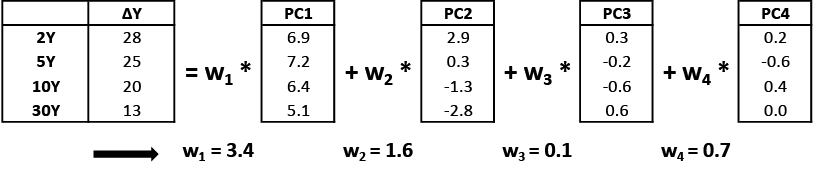

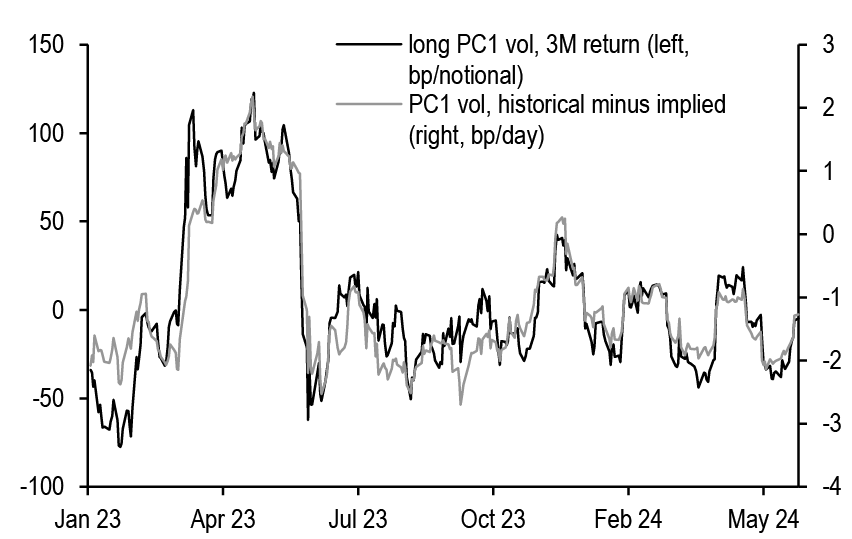

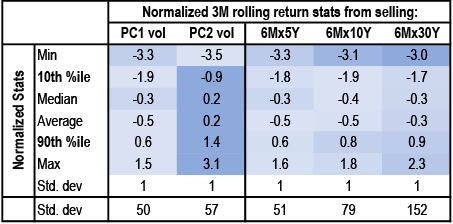

Swap curves should drift steeper in 2H24, but this is mostly priced into forwards except for curves anchored in the back end. Option-implied Fed expectations have coalesced around a moderate cutting path, which implies lesser jump risk and favors carry trades on the curve as well as short-gamma strategies. Term funding is expected to drift higher in coming months - we look for wider swap spreads in the front end, but long end spreads are likely to remain flat to current levels. We describe a new approach to trading the volatility of yield curve principal components that opens up a new class of relative value gamma trades - selling the volatility of the second principal component is likely to be attractive in coming months.

Short-Term Fixed Income T. Ho, P. Vohra, H. Cunningham

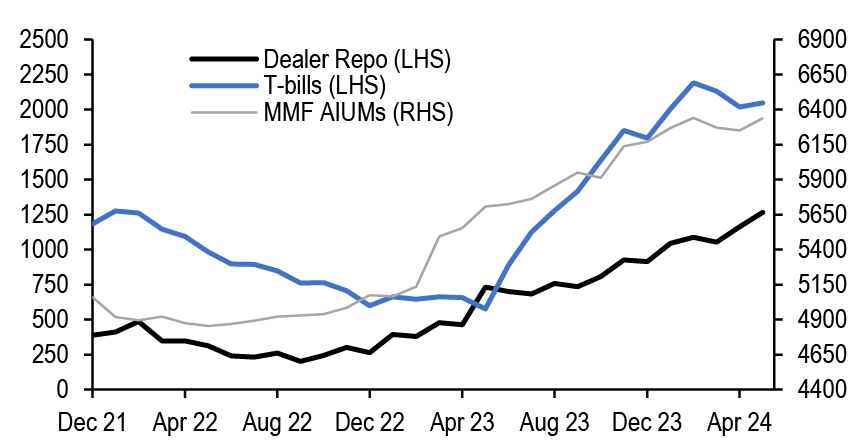

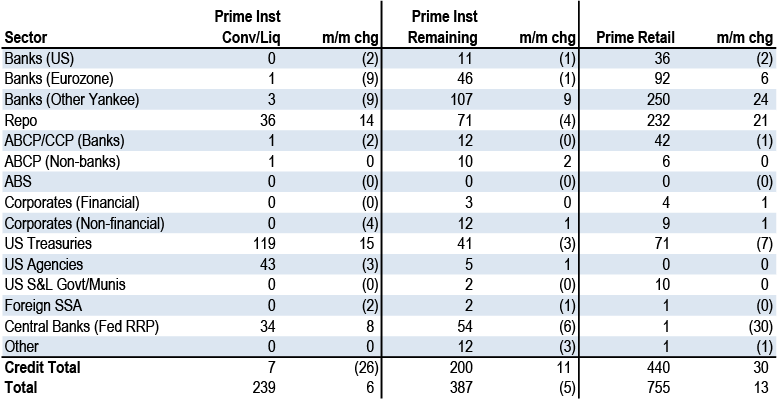

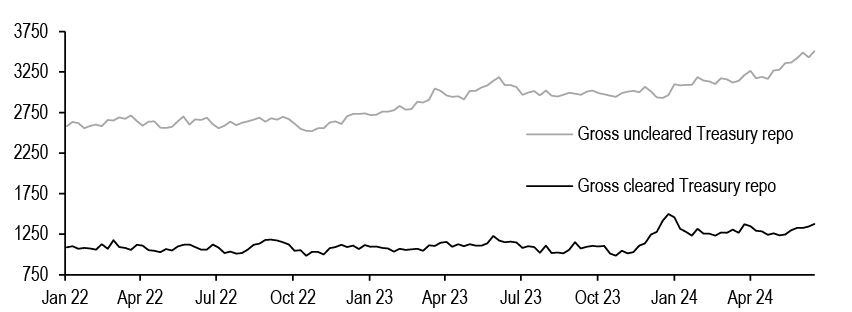

Funding conditions should remain benign, with liquidity remaining abundant, limiting any potential impacts to spreads. MMF reform should not have any outsized impact on money market credit spreads. Treasury repo clearing is work in progress, but concerns about readiness are emerging. Total money market supply (ex-Fed) should increase by nearly $550bn in 2H24, driven largely by T-bills and dealer repo.

MBS and CMBS J. Sim

Mortgages are a bit snug, but not terribly so. If our house rate forecast of a single cut this year is realized, higher coupons should again outperform in the second half of the year. CRE transaction cap rate expansion has been muted year-to-date through May. CMBS is no longer a ‘cheap’ asset class and spreads across the stack appear full.

ABS and CLOs A. Sze, R. Ahluwalia

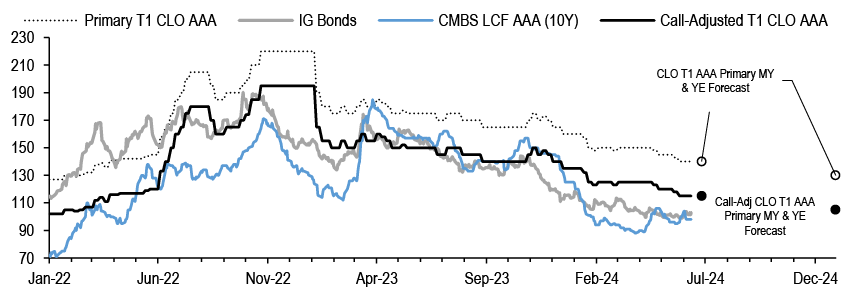

We expect that ABS should continue to outperform over 2H24, with tighter spreads despite brisk issuance, and structures holding up well against minimal credit deterioration. Demand for floaters is solid and CLO T1 AAAs swept through our 140bp MY target and are closer to our 130bp YE target we set back in April.

Investment-Grade CorporatesE. Beinstein, S. Doctor, N. Rosenbaum, S. Mantri

Spreads to stay tight, though we revise our YE24 HG bond spread forecast to 110bp from 95bp (current 109bp). 2H24 Demand to be less strong with slower growth and election uncertainty. We also revise gross issuance forecast up to $1.45tr.

High Yield N. Jantzen, T. Linares

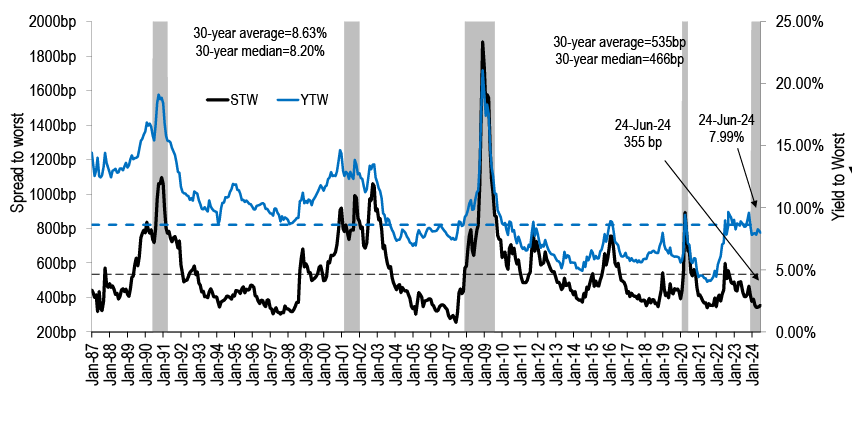

We believe leveraged credit will provide carry-esque returns over the next six months and spreads will finish 2024 well inside the long-term average.

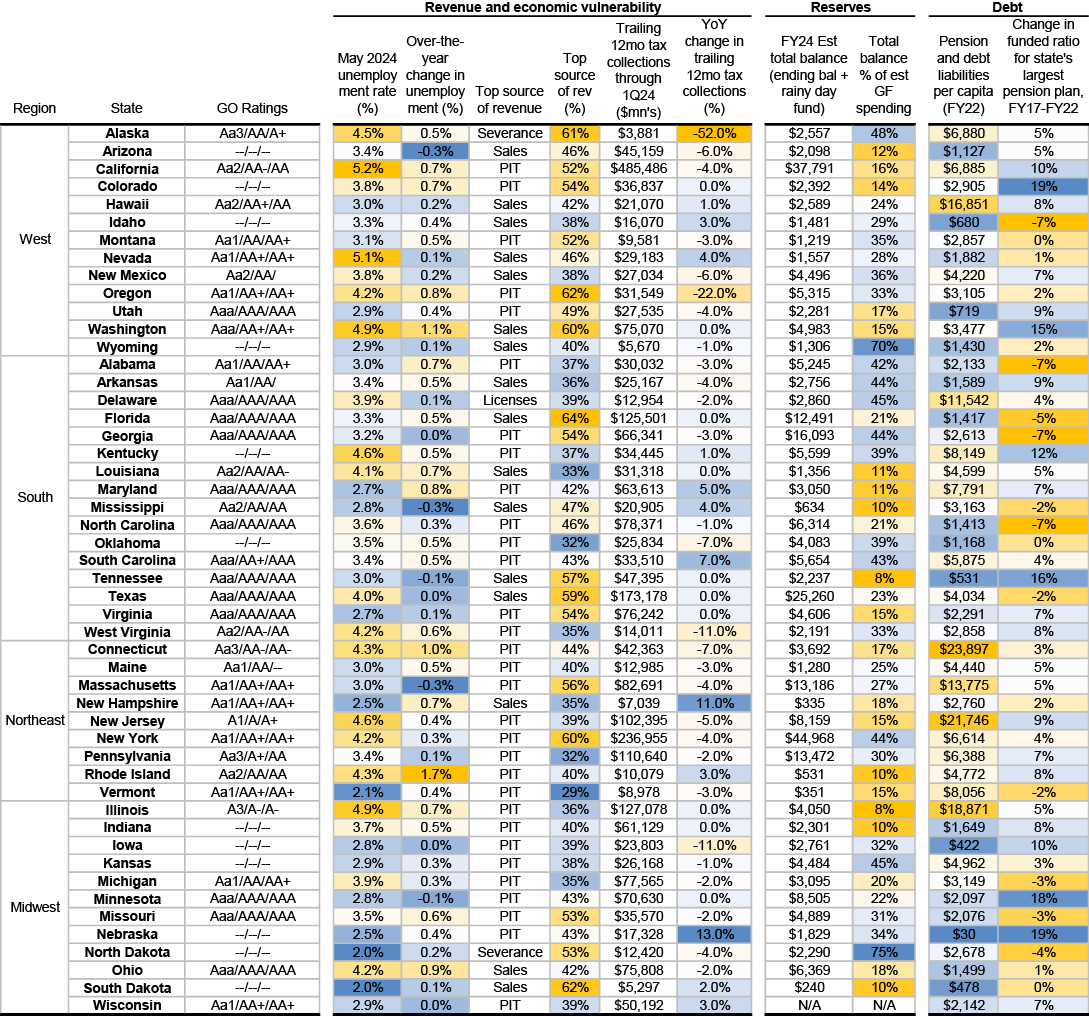

Municipals P. DeGroot, Y. Tian, R.Gargan

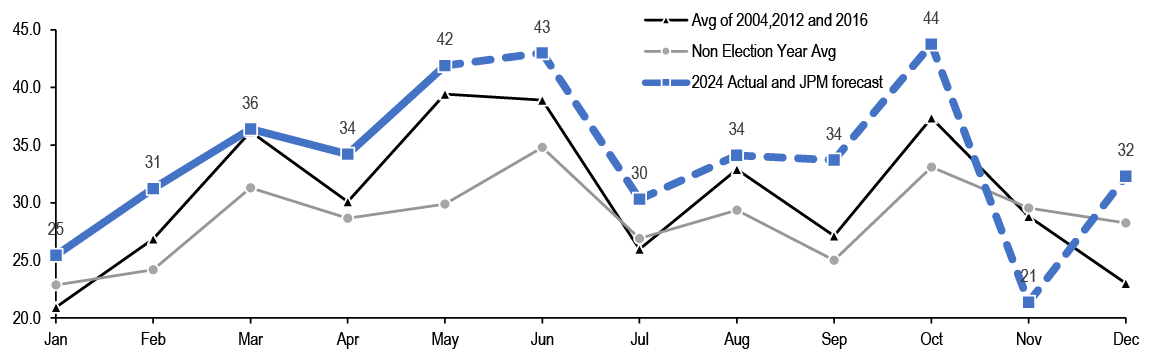

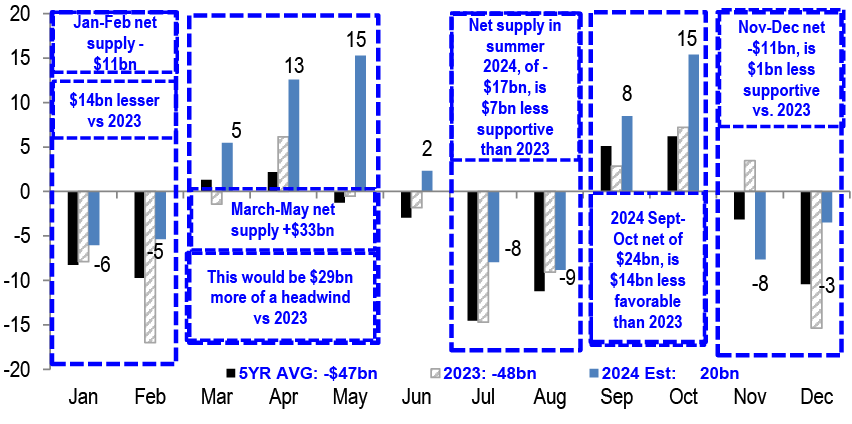

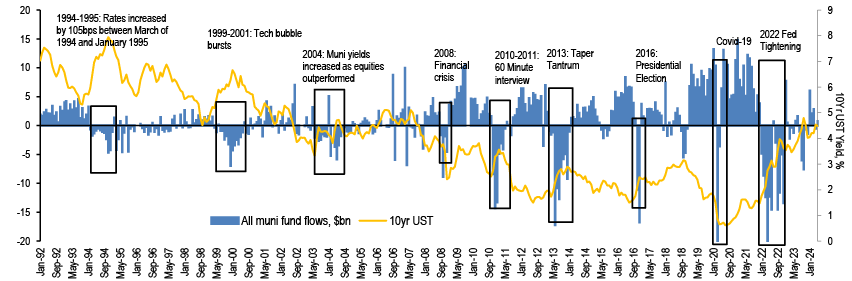

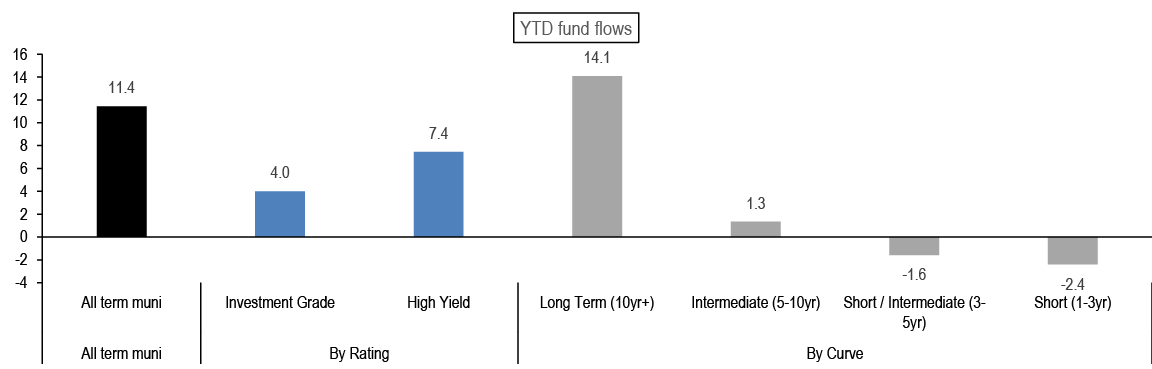

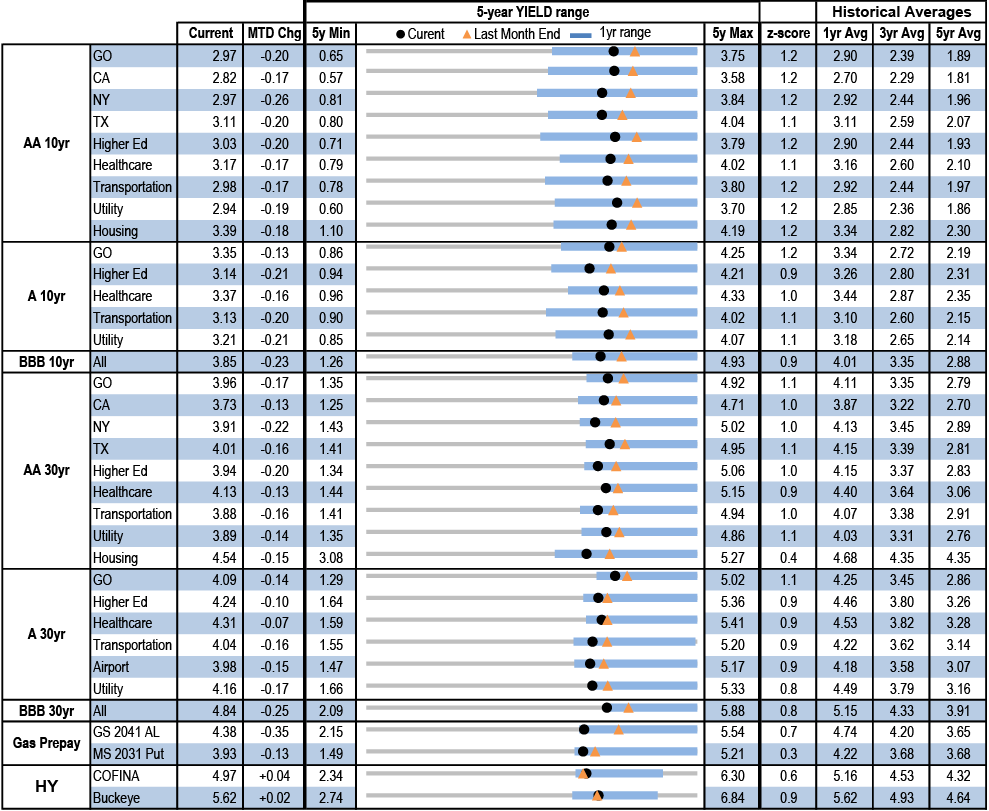

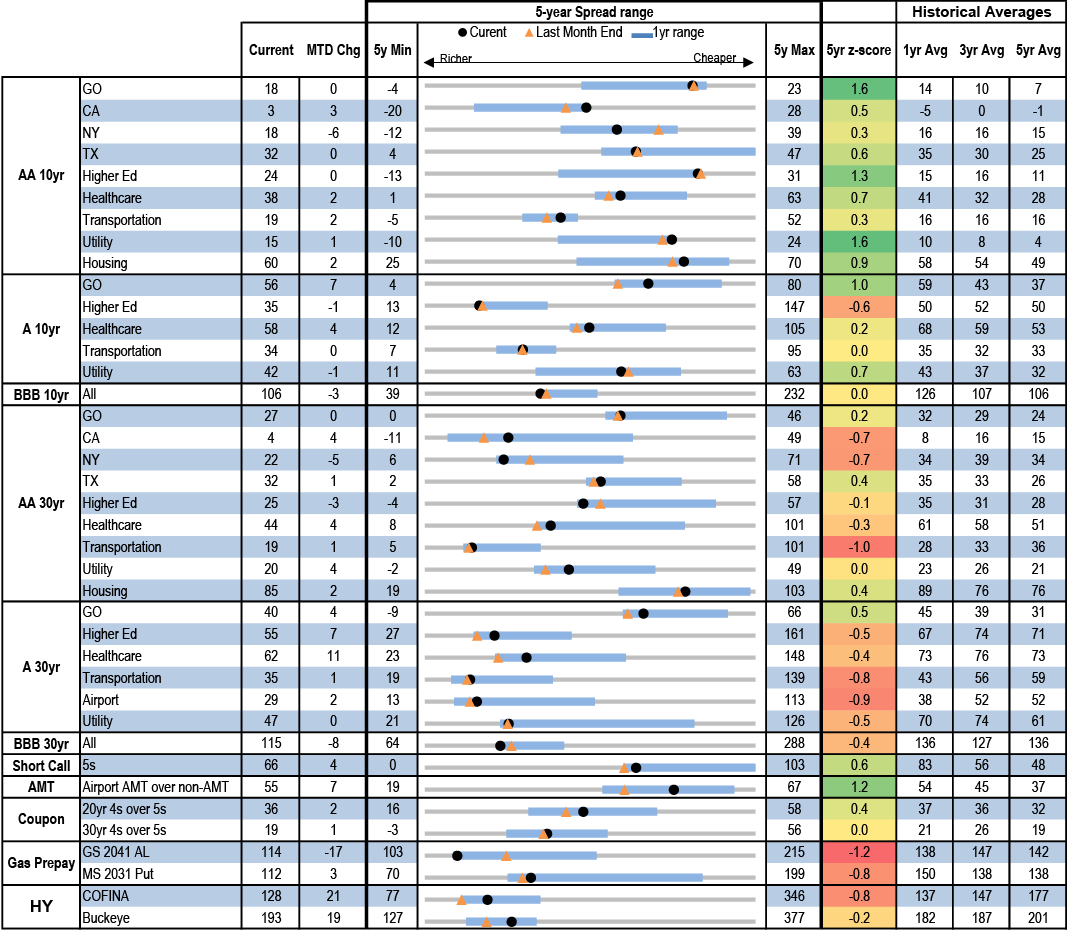

Finding sustained market consensus while transitioning to an easing cycle may be difficult, but we suggest investing with a longer-term perspective, particularly in periods where Treasuries sell-off. We look for 2H24 IG muni index performance of 3-3.5% and favor adding idiosyncratic municipal risk opportunistically on market weakness, and highlight potential market cheapening in the period before the election.

Emerging Markets L. Oganes

In EM fixed income, we are MW GBI-EM local rates, CEMBI and EMBIGD.

Summary of Views

| SECTOR | CURRENT LEVEL | YEAR END TARGET | COMMENT |

| Jun 28, 2024 | Dec 31, 2024 | ||

| Treasuries | |||

| 2-year yield (%) | 4.72 | 4.60 | Maintain 5-year shorts |

| 10-year yield (%) | 4.34 | 4.40 | Maintain 5s/30s steepeners and 75:6 weighted 5s/10s/30s belly-cheapening butterflies to position for higher term premium |

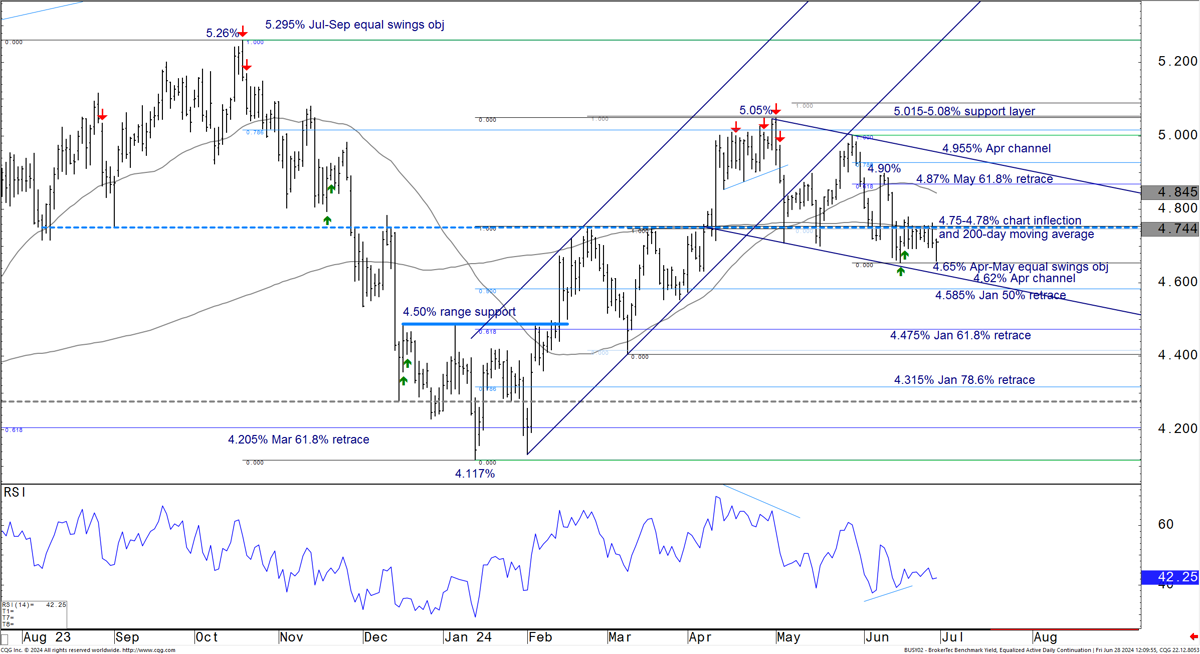

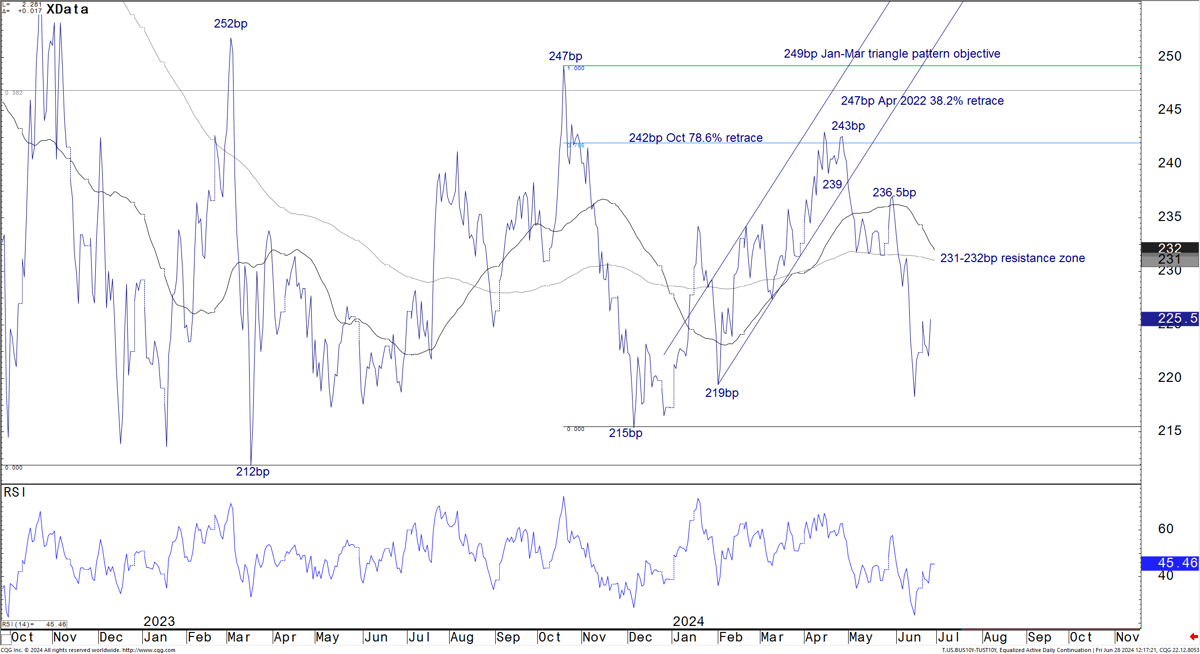

| Technical Analysis | |||

| 5-year yield (%) | 4.33 | 3.85 | Longer-term setup suggests an emerging bull market |

| 5s/30s curve (bp) | 17 | 45 | The curve continues to carve out a cycle bottom pattern |

| TIPS | |||

| 10-year TIPS breakevens (bp) | 227 | 230 | Hold 1Y1Y inflation swap longs |

| Interest Rate Derivatives | |||

| 2-year SOFR swap spread (bp) | -14 | -6 | Swap curves should drift steeper in 2H24, but this is mostly priced into forwards except for curves anchored in the back end. Option-implied Fed expectations have coalesced around a moderate cutting path, which implies lesser jump risk and favors carry trades on the curve as well as short-gamma strategies. TFP is expected to drift higher - look for wider swap spreads in the front end, but long end spreads are likely to remain flat to current levels. We describe a new class of RV trades involving selling the volatility of the second principal component, which is likely to be attractive in coming months. |

| 5-year SOFR swap spread (bp) | -28 | -22 | |

| 10-year SOFR swap spread (bp) | -42 | -37 | |

| 30-year SOFR swap spread (bp) | -79 | -79 | |

| Agency MBS | |||

| FNMA 30yr 6% Front Tsy OAS (bp) | 28 | 30 | Mortgages are a bit snug, but not terribly so. If our house rate forecast of a single cut this year is realized, higher coupons should again outperform in the second half of the year. |

| RMBS Credit | |||

| CRT M1B/M2 (DM@10CPR) | 1MS + 167bp | 1MS + 175bp | Mortgage credit spreads are already retracing wider from their tightest levels this year. We expect further widening into year-end as we enter a slower GDP-growth and election period, although a possible Fed rate cut could help. |

| RMBS 2.0 PT (6s) | 1-04bk of TBA | 1-12bk of TBA | |

| AAA Non-QM | I + 130bp | I + 150-175bp | |

| ABS | |||

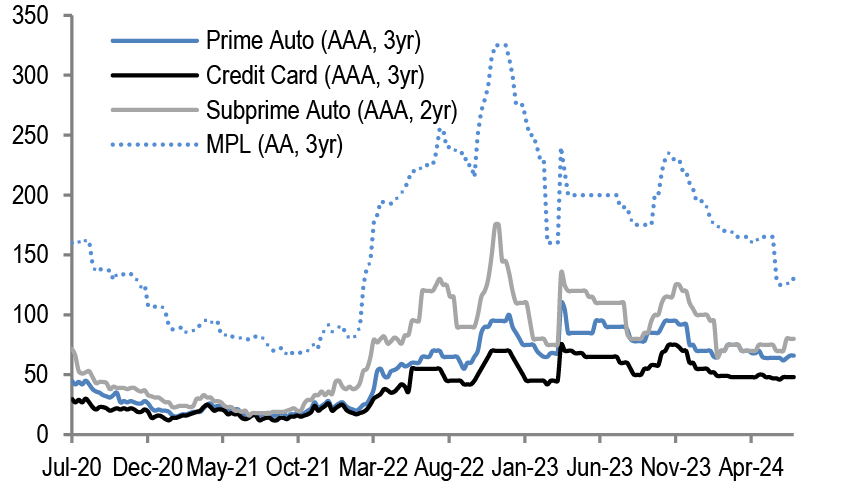

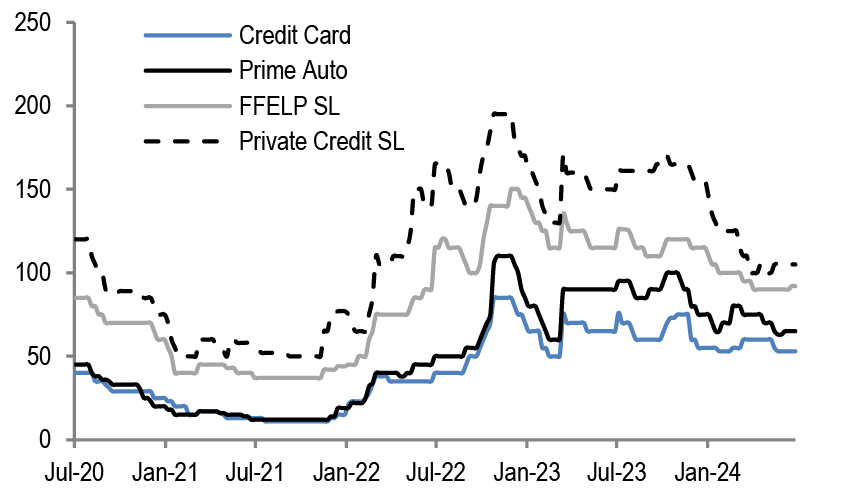

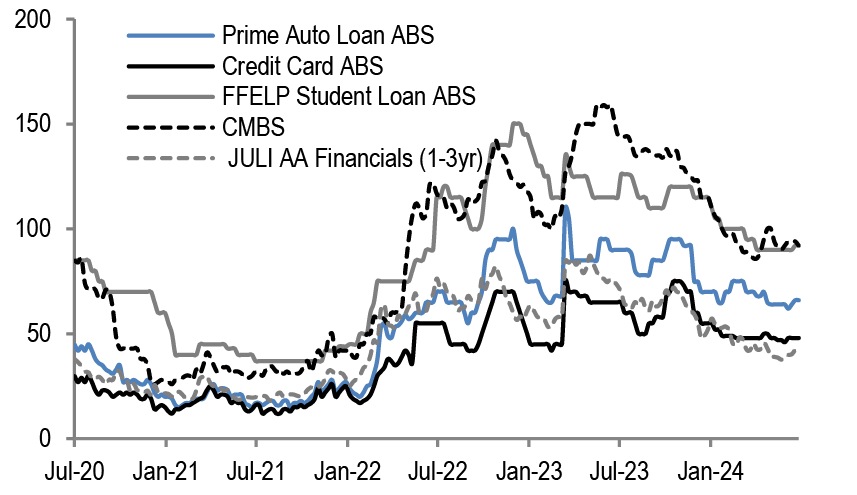

| 3-year AAA card ABS to Treasuries (bp) | 48 | 40 | Despite the recent spread rally, ABS remains relatively cheap to corporates; however, it is tough to make a case for material spread tightening from hereon given the macro uncertainty still ahead in 2024 |

| CMBS | |||

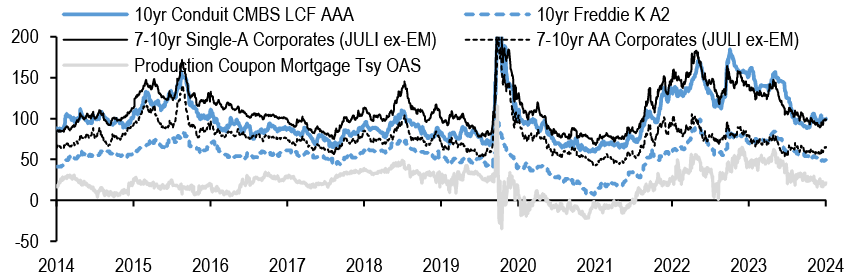

| 10yr conduit CMBS LCF AAA | 98 | 95 | LCF AAAs look Freddie K A2 spreads look about fair to their corporate and mortgage comps. |

| 10yr Freddie K A2 | 48 | 48 | |

| Investment-grade corporates | |||

| JULI spread to Treasuries (bp) | 109 | 110 | Less demand and less supply in 2H24 vs 1H24 argues for spreads slightly less tight than previously expected.Slower growth and election volatility are risks, duration demand post a Fed cut could drive tighter spreads. |

| High yield | |||

| Domestic HY Index spread to worst (bp) | 351 | 380 | We believe HY spreads will be supported in the near-term by low near-term recession risks and improving capital market access into 2Q. |

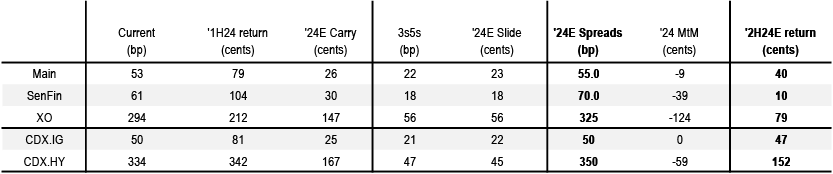

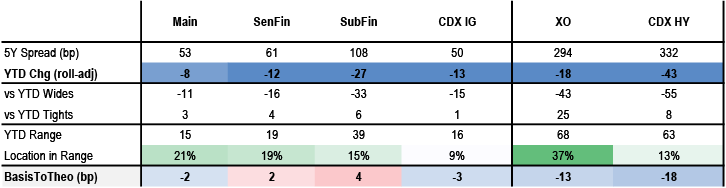

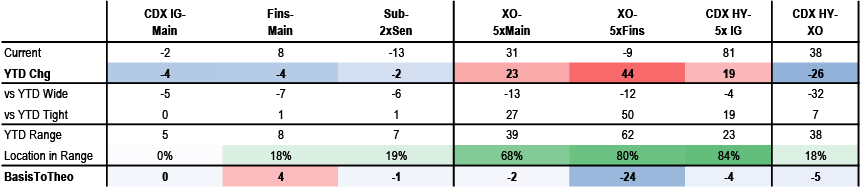

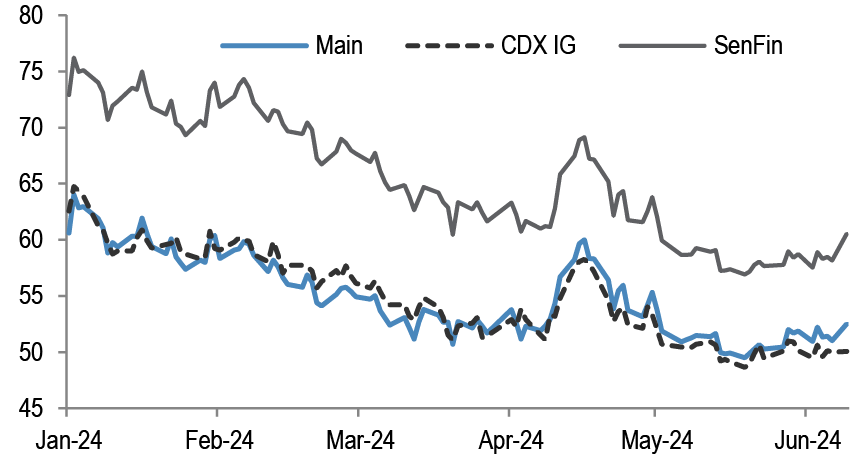

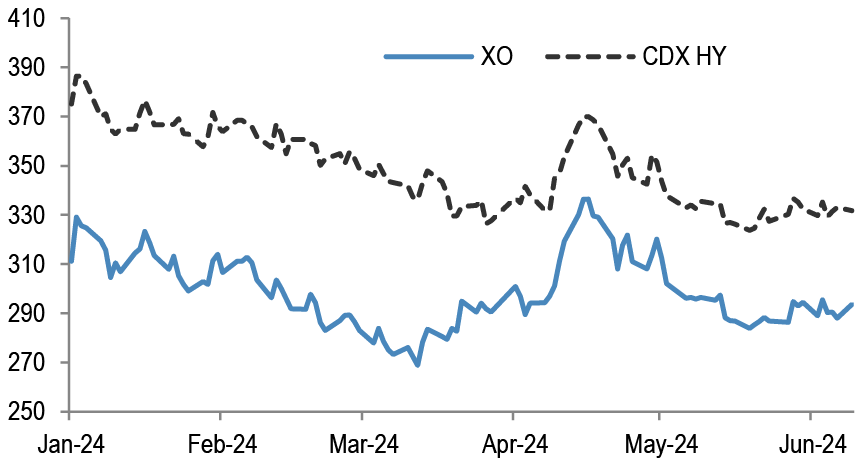

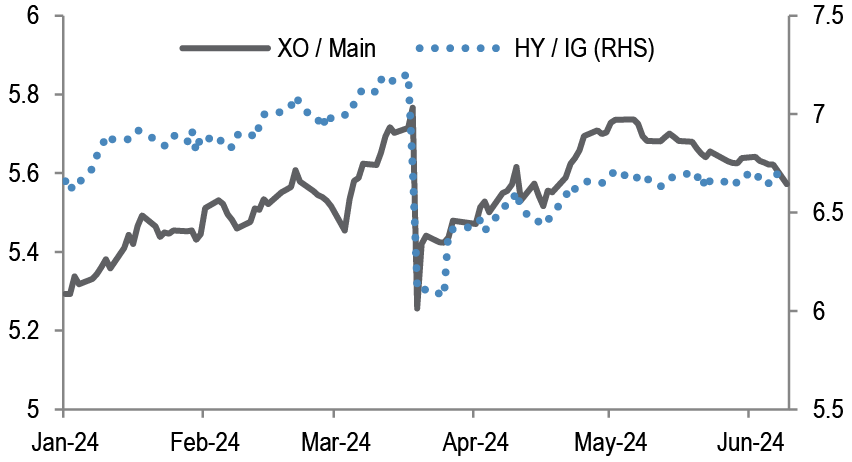

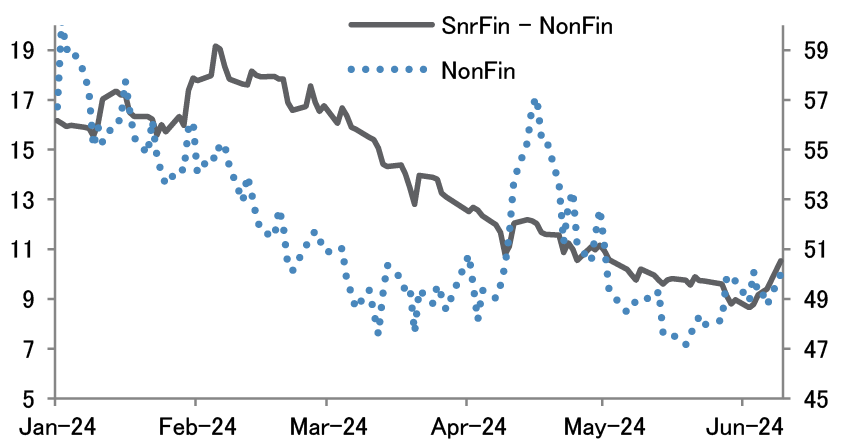

| Credit Derivatives | |||

| High Grade (bp) | 53 | 50 | We prefer our longs in Cash and shorts in Derivatives as the latter looks stretched. We are sticking with Decompression as Recession remains on the horizon and Rates volatility subdued. We use Credit options to buy cheap Rates optionality. We expect US indices to outperform. |

| High Yield | $106.4/341bp | 350 | |

| Short-term fixed income | |||

| EFFR (%) | 5.33 | 5.10 | Funding conditions should remain benign, with liquidity remaining abundant, limiting any potential impacts to EFFR/SOFR, T-bills/OIS, and CP/OIS spreads. We do not expect MMF reform to have any outsized impact on money market credit spreads. Treasury repo clearing remains work in progress, though concerns about readiness are emerging. |

| SOFR (%) | 5.34 | 5.10 | |

| CLOs | |||

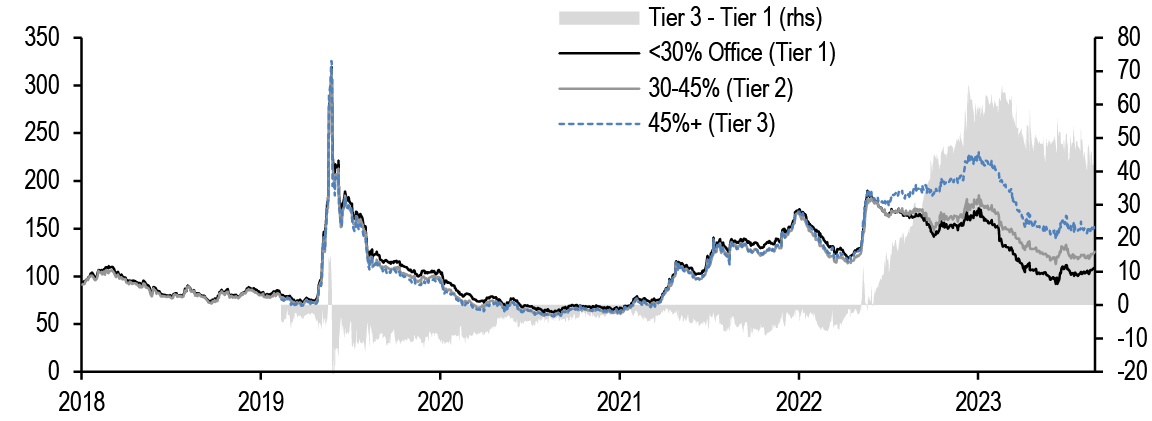

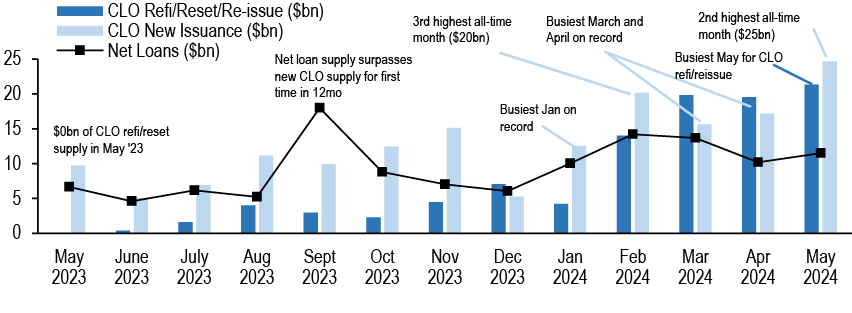

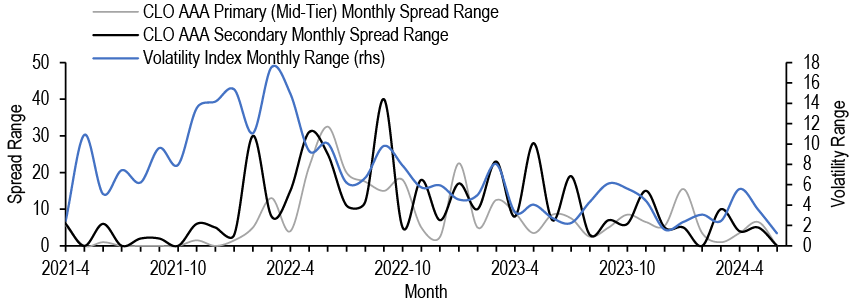

| US CLO Primary AAA (Tier 1, bp) | 138 | SOFR + 130 | CLO new issue T1 AAAs recently reached our MY spread forecast of 140bp in the US. Our 130bp YE target may well be met sooner on strong technicals and bid for floating rates. |

| Municipals | |||

| 10-year muni yield (%) | 2.84 | 2.60 | Finding sustained market consensus while navigating transition to an easing cycle may be difficult, but we suggest playing the long game, and buying municipal bonds with a longer term perspective, particularly in periods where Treasuries sell-off. We suggest adding idiosyncratic municipal risk opportunistically on market weakness, and highlight potential market cheapening in the period before the election. |

| 30-year muni yield (%) | 3.72 | 3.55 | |

| Emerging Markets | |||

| Hard currency: EMBIG Div (bp) | 395 | 400 | MW EMBIGD |

| Hard currency: CEMBI Broad (bp) | 225 | 220 | MW CEMBI Br |

| Local currency: GBI-EM yield (%) | 6.56% | 5.58% | MW local rates |

Source: J.P. Morgan

US Fixed Income Overview

2024 Mid-Year Outlook

- We expect core PCE inflation to soften sequentially and GDP growth to step down to 1% saar in 2H24. We see the first Fed rate cut in November, followed by a quarterly cadence thereafter. We think balance sheet runoff can continue at the now-tapered pace over the remainder of the year

- We revise up our 2024 long-term net issuance forecast across US fixed income markets by $225bn to $3.275tn given heavy corporate credit supply in 1H24. We do not expect further Treasury coupon auction size increases until November 2025

- Treasuries: We expect a rangebound environment for Treasury yields in the months ahead. Even shallow easing cycles support lower yields, but Fed pricing and carry implications make it challenging to be long duration. We continue to see value in 5s/30s steepeners. Remain bullish at the front end of the inflation curve. Though valuations have moved closer to fair, we expect a positive risk premium to emerge ahead of the US election

- Derivatives: Option-implied Fed expectations have coalesced around a moderate cutting path, which implies lesser jump risk and favors carry trades on the curve as well as short-gamma strategies. Term funding is expected to drift higher in coming months. We look for wider swap spreads in the front end, but long-end spreads are likely to remain flat to current levels

- Short Duration: Funding conditions should remain benign, with liquidity remaining abundant. MMF reform should not have any outsized impact on money market credit spreads

- Securitized products: Mortgages are a bit snug, but not terribly so. If the Fed delivers one cut this year, higher coupons should again outperform in the second half of the year

- Corporates: We look for HG spreads to stay tight, though we revise our YE24 HG bond spread forecast to 110bp from 95bp. 2H24 demand to be less strong with slower growth and election uncertainty. We also revise our gross issuance forecast up to $1.45tn

- Near-term catalysts: May JOLTS (7/2), June FOMC minutes (7/3), June employment (7/5), June CPI (7/11)

The outlook for rates and spreads in 2H24

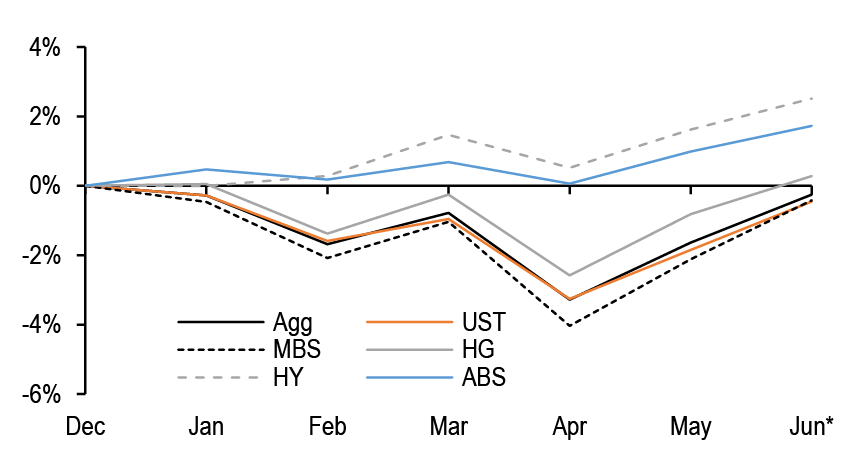

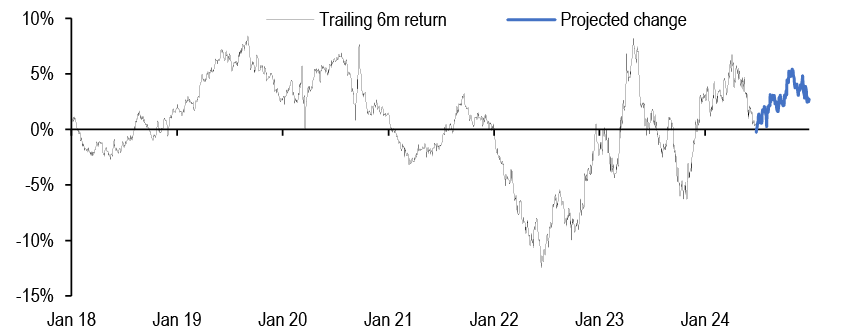

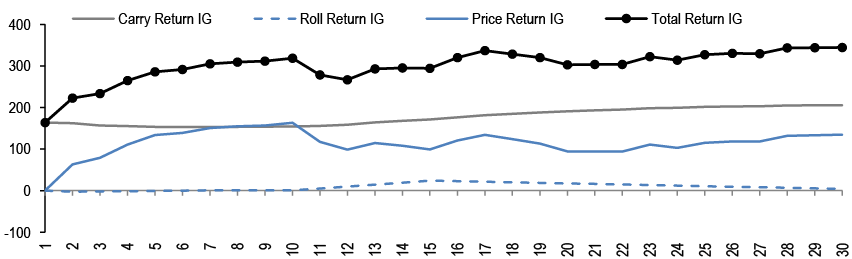

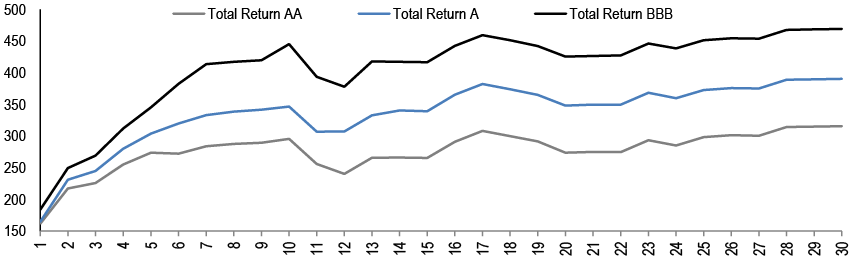

In our year-ahead outlook published last November, we predicted that the disinflationary trend that gained momentum in 2H23 would continue in early 2024, alongside slowing growth and a cooling in labor markets, driving further declines in yields and spread decompression. Instead, core inflation accelerated over the first quarter and job growth continued to surprise to the upside, driving yields higher and spreads tighter across most fixed income products. Yields have retreated from their highs as the last two months of inflation data have been more benign, and there are clear signs that activity growth has stepped down from elevated levels observed in 2H23. Still, Treasury yields are 40-70bp higher YTD, the curve has flattened, and high-yield credit has outperformed other fixed income products ( Figure 1). As we look ahead, we expect GDP growth to step down further toward a 1% pace in 2H24, but with markets already priced for roughly 140bp of easing over the next 18 months, we look for yields to remain broadly rangebound in the second half of the year and for spreads to trade sideways. Against this backdrop, seeking positive carry trade opportunities is likely to remain a theme. Moreover, the US election could be a key catalyst for fixed income markets in the second half of the year, as well as various elections that will take place globally over coming months.

Figure 1: Rising yields drove returns negative early in the year before reversing. HY credit has outperformed

Cumulative returns on the Bloomberg US Aggregate Bond Index, together with its subcomponents, YTD*; %

Source: Bloomberg Finance L.P.

*June data through 6/28/2024

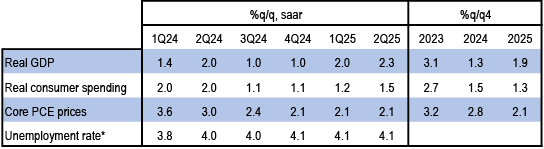

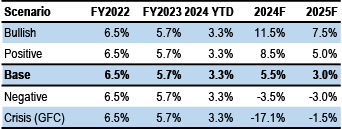

Figure 2: We look for moderate economic cooling over the next year without an outright contraction

J.P. Morgan Economic Forecast; units as indicated

Source: J.P. Morgan

* Average level for the period

Economics & Rates: Consumer spending growth has moderated recently, as the post-pandemic tailwinds supporting last year’s exceptional growth have begun to normalize. While there are mixed signals from the labor market, the broad thrust of the data indicates that nominal labor income growth should continue coming back down to earth in 2H24, providing a further tempering influence on consumers. Business capital spending has been supported by IRA and CHIPS Act-related spending. The more recent data suggest that the growth in this policy-supported capex is starting to peter out. Outside of this category, business capital spending growth has been soft, and business surveys indicate that this should remain the case in coming months. Though the inflation process has been bumpy over 1H24, we look for core inflation to cool gradually on a sequential basis over the second half, though base effects should drive core PCE slightly higher again later in the year. We forecast core PCE inflation to run at 2.8% q4/q4 in 2024 ( Figure 2). Against this backdrop, we expect the Fed will cut rates at the November FOMC meeting and continue at a quarterly cadence in 2025. While a September cut remains a risk, we think it may take the five reports available between now and the November FOMC meeting to see a broader weakening in job growth (see Economics).

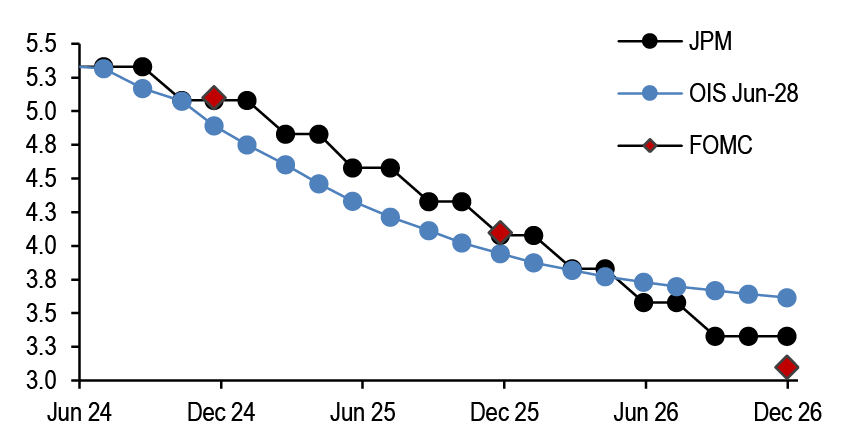

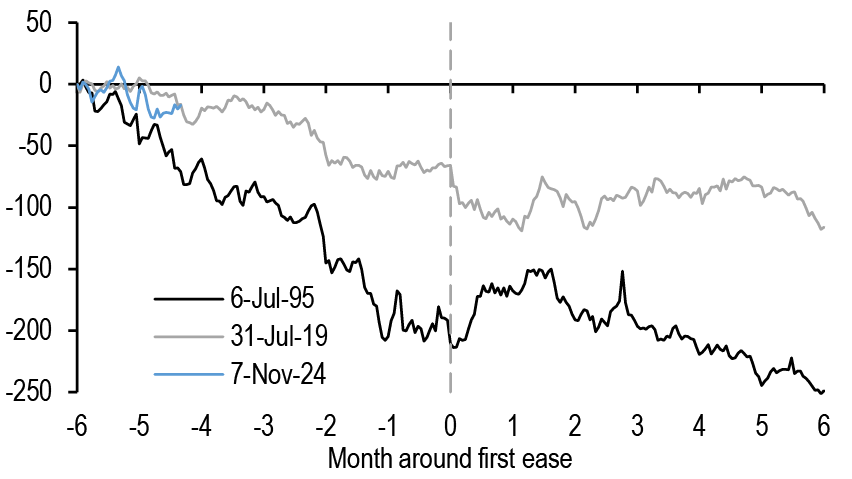

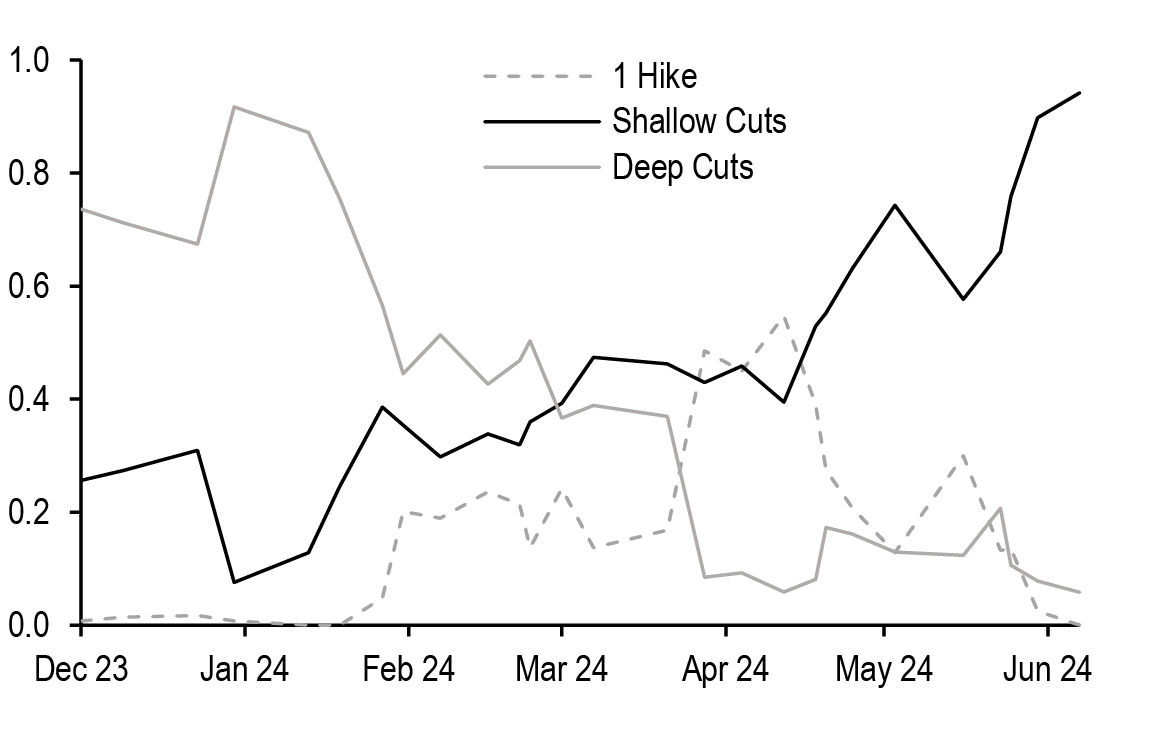

Meanwhile, markets are pricing roughly 140bp of easing over the next 18 months, slightly more than our own forecast ( Figure 3). Moreover, we recognize that the lack of clear economic vulnerabilities together with an uncertain inflation outlook may leave the upcoming easing cycle shallower than many prior cycles, perhaps more closely resembling the experiences of 1995 and 2019. However, even in those cycles, yields declined more than 125bp on average in the six months prior to the first cut. Thus, we believe there is still room for yields to decline ( Figure 4). Nonetheless, even though the onset of the easing cycle appears to be just a few months away, we will be patient in adding duration longs, given negative carry implications and outright valuations. Along the yield curve, we think long-end steepeners provide the best value as we approach the start of an easing cycle, especially as most curve pairs remain near their flattest levels of the last 3 years. We prefer 5s/30s steepeners: this curve displays a high sensitivity to medium-term Fed expectations, should benefit from rising term premium, and appears too flat versus our fair value framework (see Treasuries).

Figure 3: Markets are pricing in close to 140bp of easing over the next 18 months. We and the Fed are projecting 125bp of cuts

OIS forward rates by meeting date versus J.P. Morgan forecast and median SEP dot from June FOMC meeting; %

Source: J.P. Morgan, Federal Reserve Board

Figure 4: We look for yields to remain rangebound through the summer and for the front-end to lead the move to lower yields in the fall

J.P. Morgan US interest rate forecast; %

| Actual | 3Q24 | 4Q24 | 1Q25 | 2Q25 | |

| 28-Jun | 30-Sep | 31-Dec | 31-Mar | 30-Jun | |

| Rates (%) | |||||

| Fed Funds | 5.33 | 5.35 | 5.10 | 4.85 | 4.60 |

| SOFR | 5.34 | 5.35 | 5.10 | 4.85 | 4.60 |

| 2-yr UST | 4.72 | 4.75 | 4.60 | 4.30 | 4.05 |

| 3-yr UST | 4.51 | 4.55 | 4.40 | 4.15 | 3.95 |

| 5-yr UST | 4.33 | 4.40 | 4.25 | 4.00 | 3.80 |

| 7-yr UST | 4.32 | 4.40 | 4.25 | 4.00 | 3.80 |

| 10-yr UST | 4.34 | 4.50 | 4.40 | 4.20 | 4.00 |

| 20-yr UST | 4.60 | 4.70 | 4.60 | 4.40 | 4.20 |

| 30-yr UST | 4.50 | 4.65 | 4.60 | 4.50 | 4.35 |

Source: J.P. Morgan

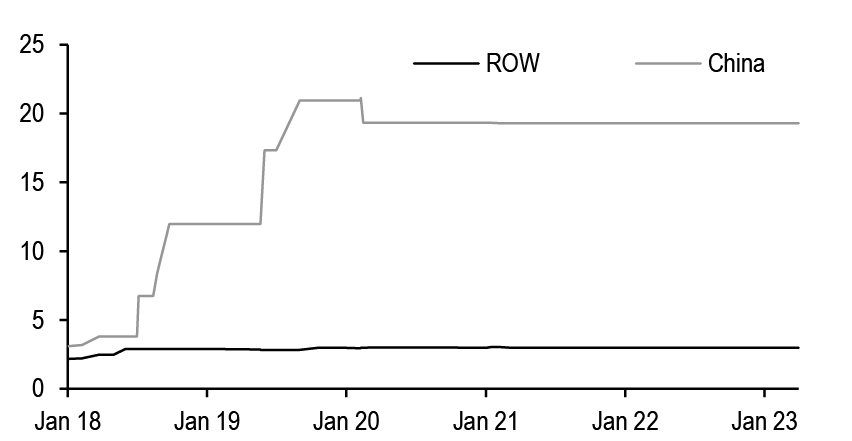

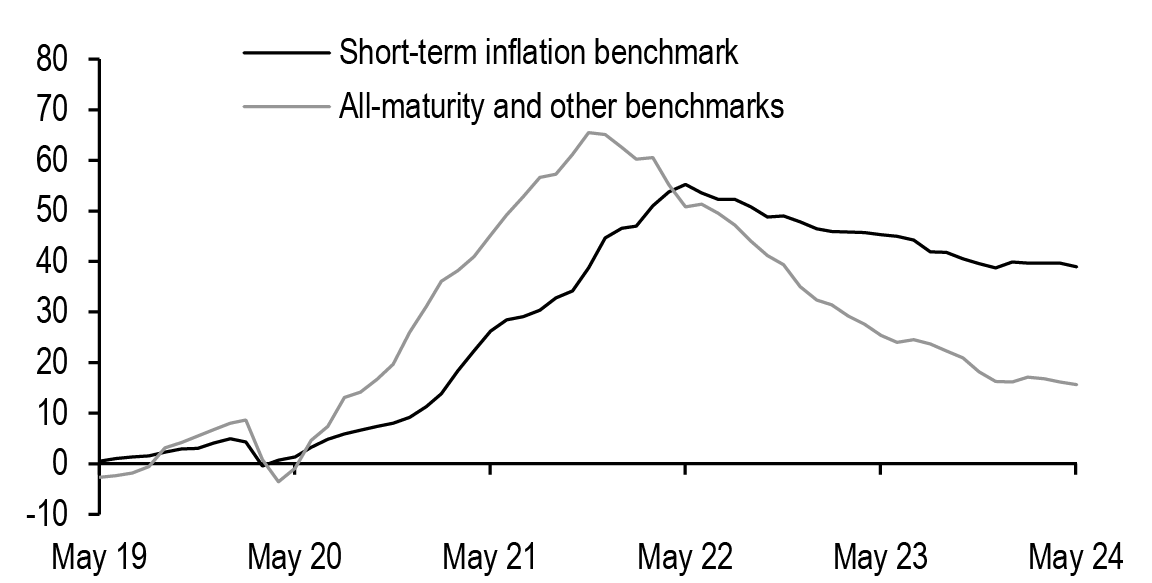

In inflation markets, we remain bullish at the front end of the curve. Even with inflation and growth projected to cool gradually, recession fears are likely to remain at bay, the disinflationary process is likely to be bumpy, and the market remains priced for weaker inflation outturns over the second half of the year relative to our own forecast. Additionally, as the US election comes into focus, we expect the front end of the inflation curve to price additional risk premium, as trade policy is one of the few issues garnering bipartisan support in a polarized US political environment. Importantly, in the event of a Trump victory, we would expect the Former President to take a harder line on foreign policy, particularly with China, through a greater use of Executive Orders. If Trump proceeds with the tariffs that have been floated, our economists estimate a 1.1% increase in price level from a 60% tariff on China and a 1.5% increase in price level coming from the 10% universal tariff (see US: Economic policy implications of the election, Michael Feroli, 6/28/24). With IOTAs trading near their tightest levels in nearly two years, we think inflation swaps can outperform cash breakevens, and we maintain longs in 1Yx1Y inflation swaps (see TIPS).

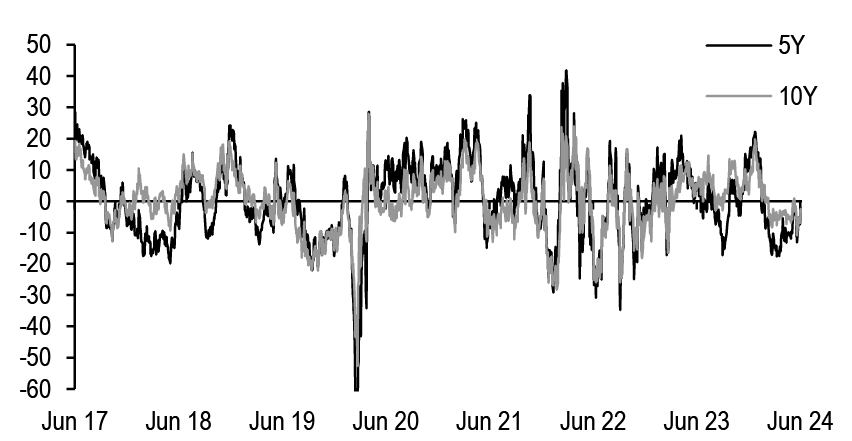

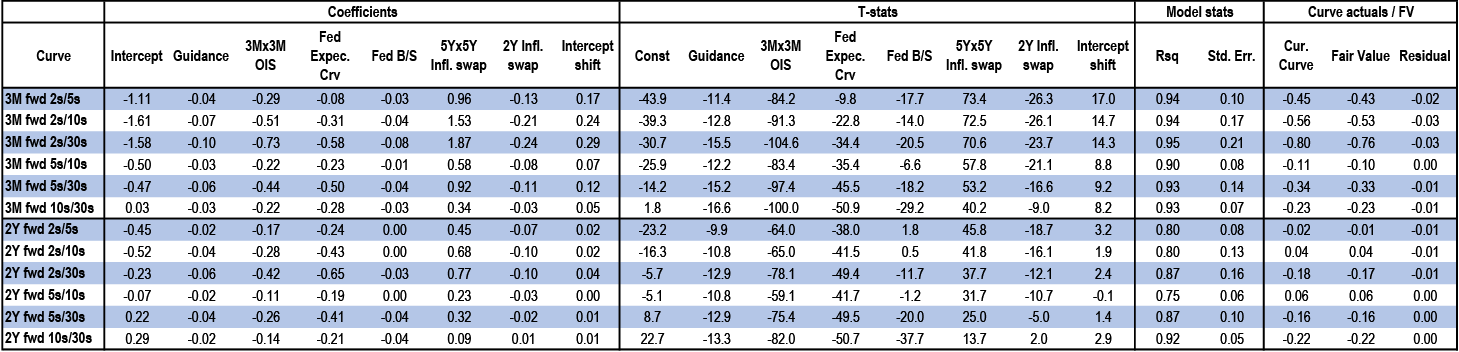

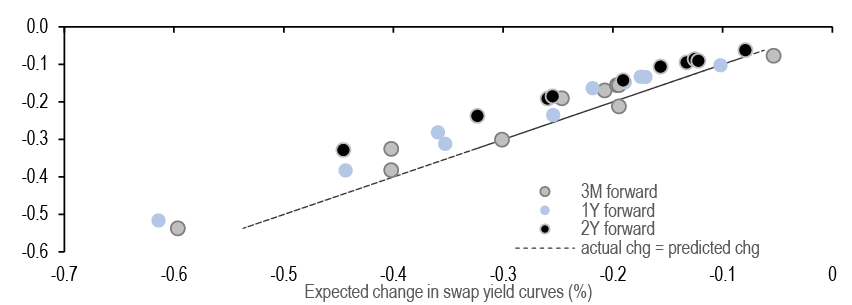

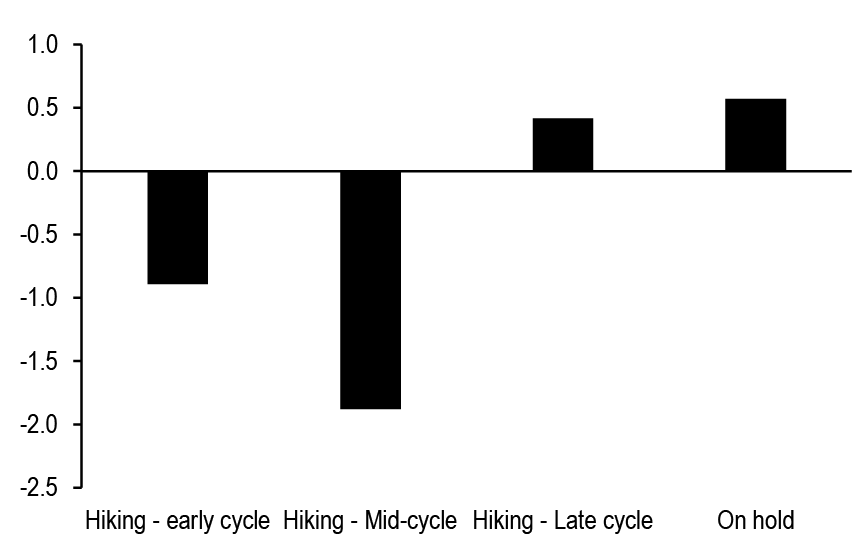

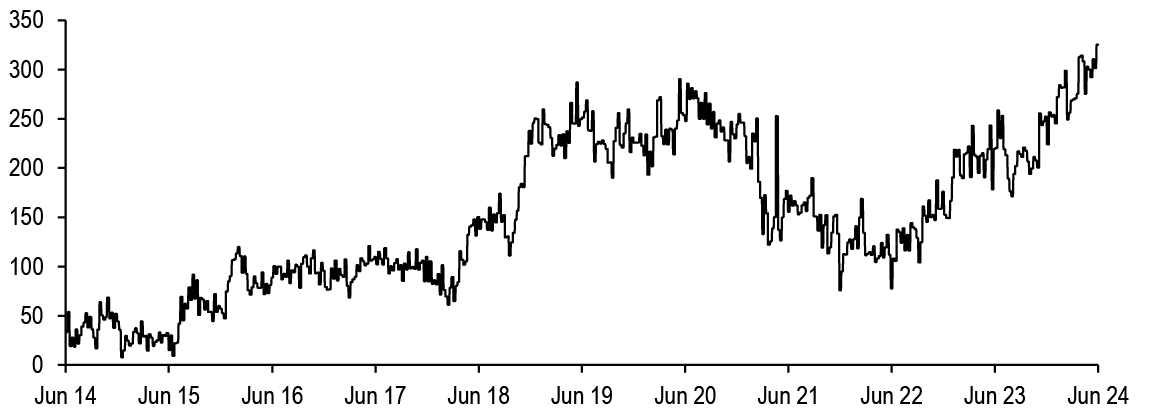

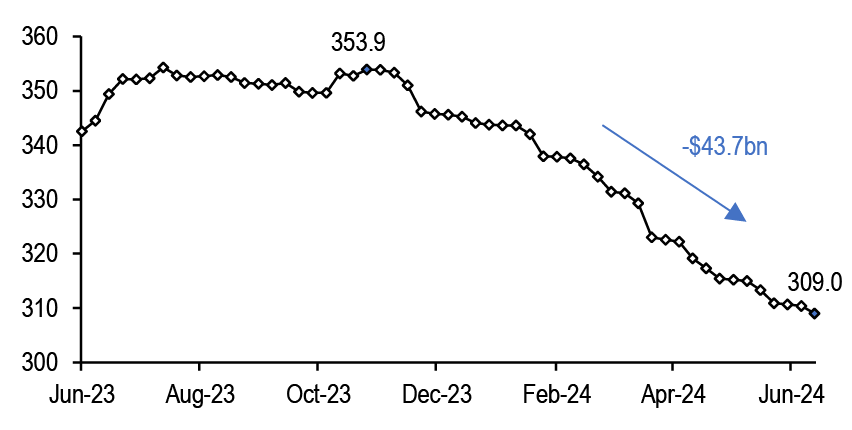

With Fed expectations coalescing around a path of moderate rate cuts and tails thinning, this implies reduced jump risk in markets going forward and makes swap yield curve carry trades attractive as a theme. We continue to advocate for well-hedged carry trades that mitigate directional curve exposure while enhancing carry-to-risk ratios. This also implies broadly supportive conditions for short gamma strategies. That said, implied volatility levels are close to our fair value estimates, suggesting gamma strategies should be actively managed in coming months. Swaps spreads have also traded in a wide range in 1H24, but not driven by a correlation with yield levels. Instead, swap spreads have reflected swings in macro factors affecting the entire term structure. Indeed we think term funding premium - the incremental compensation demanded by Treasury investors for each additional year of duration after hedging interest rate risk - has risen in part due to declining liquidity amid ongoing Fed balance sheet reduction (see Term Funding Premium and the Term Structure of SOFR Swap Spreads, Srini Ramaswamy, 4/29/24). We expect that QT can continue at the now-tapered pace for the remainder of the year, increasing term funding premium and leading the swap spread curve to twist flatter. The upcoming US Presidential elections add some upside risk to term funding premium, as concerns around fiscal expansion and longer-term risks to Treasury supply could provide incremental narrowing pressure at the long end (see Interest Rate Derivatives).

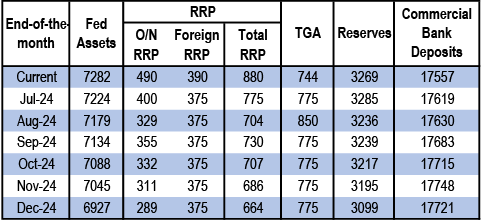

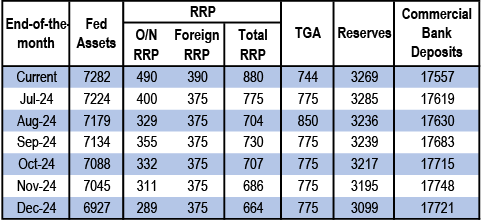

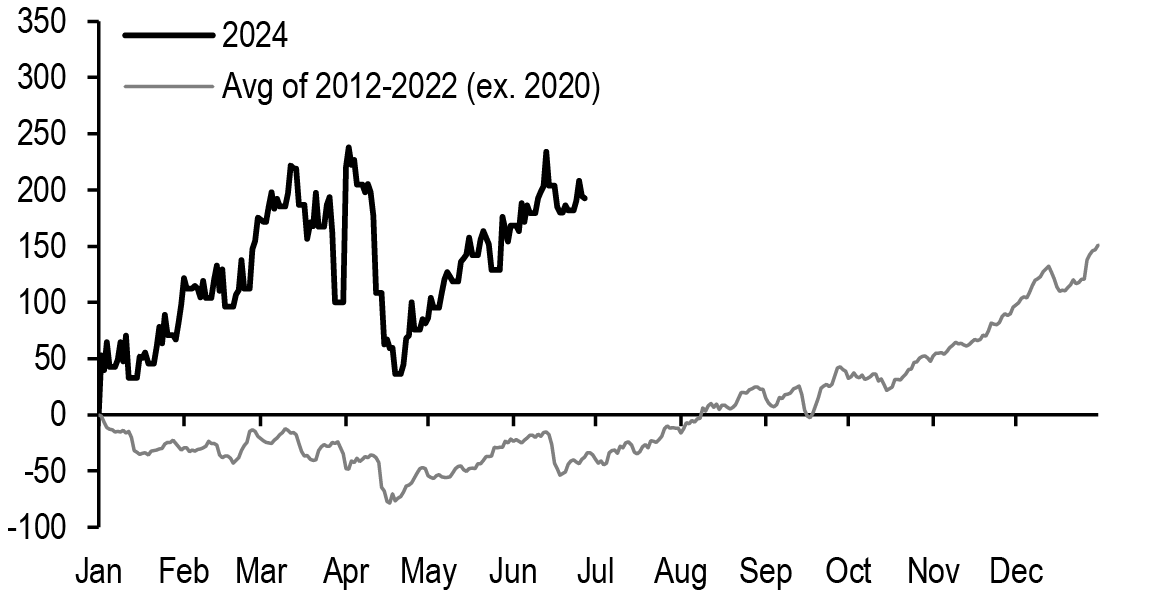

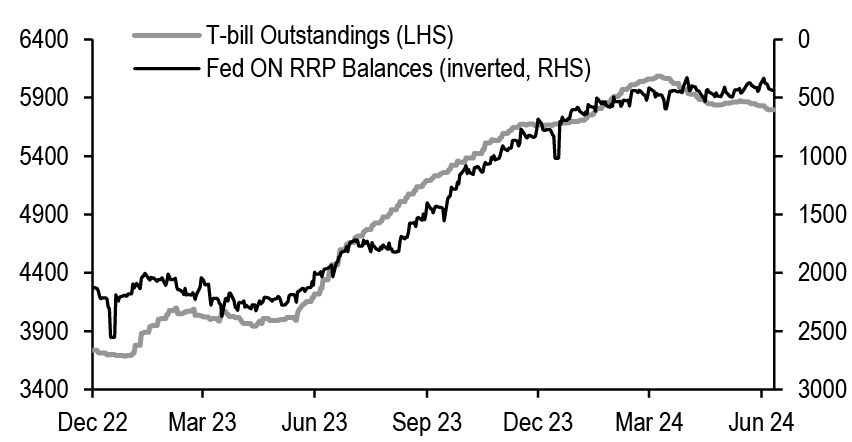

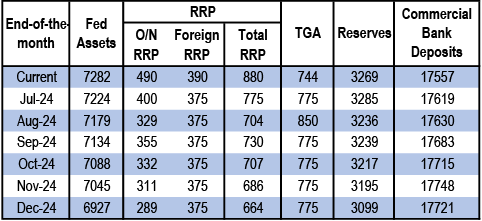

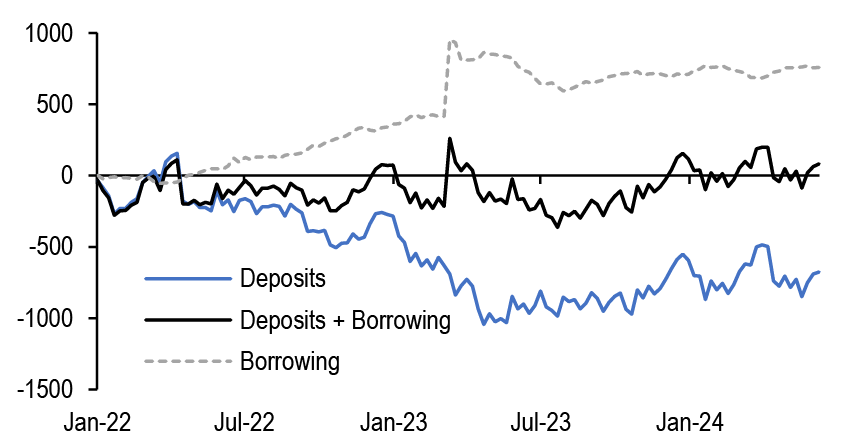

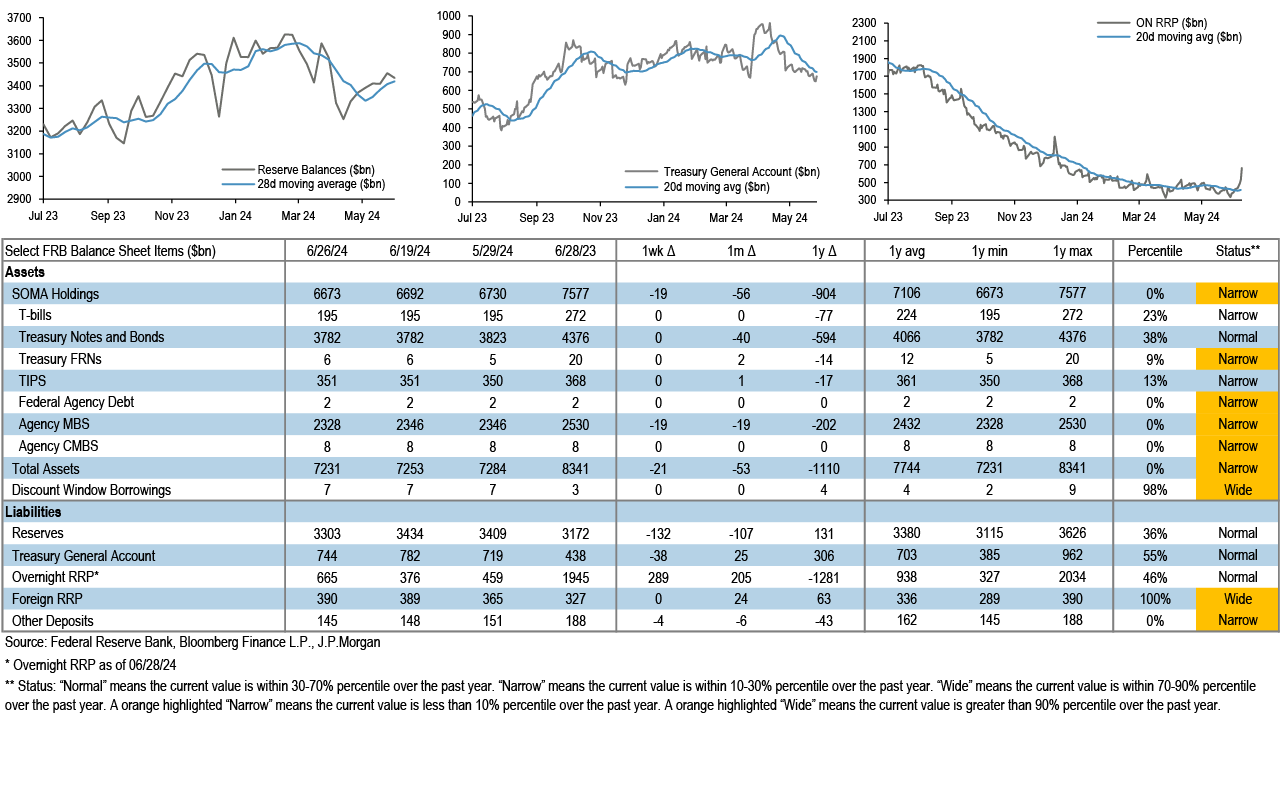

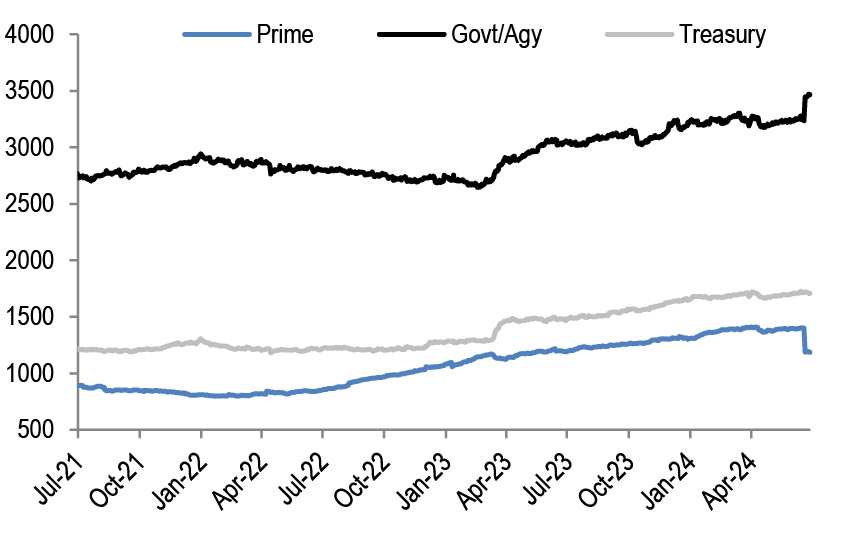

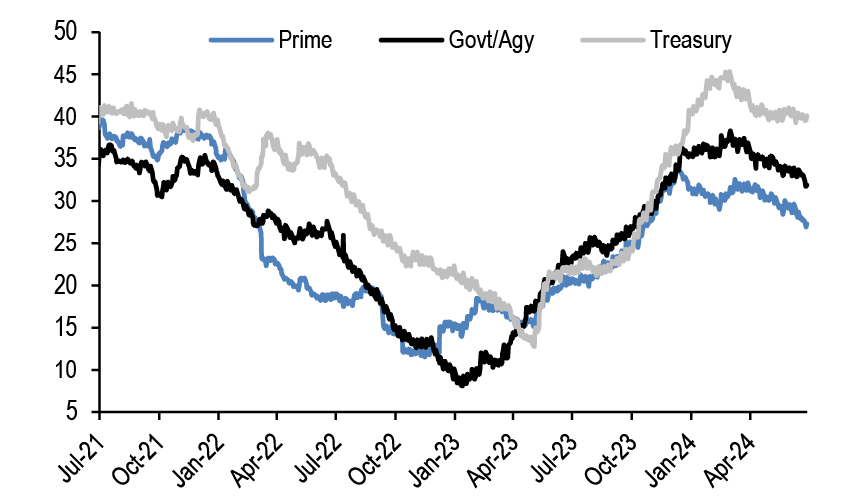

In 2H24, we believe funding conditions will continue to be relatively benign, though acknowledge there are a variety of risks that liquidity investors will have to grapple with in the coming months. Even with QT taper, the Fed’s balance sheet is still shrinking, albeit at a slower pace, which means reserves are still increasingly approaching scarcity. As of the time of writing, reserve balances registered $3.4tn. Market expectations have largely coalesced around $3.0-$3.1tn as the lowest comfortable level of reserves (LCLoR), and while our Fed balance sheet expectations call for reserve balances to remain comfortably above $3tn during 2H24, signs of reserve scarcity could start to emerge towards year-end as we come closer to approaching LCLoR ( Figure 5). The good news is that we also project ON RRP balances to remain near $400bn for at least a few months and over $300bn for the remainder of the year, which will help to offset any funding pressures arising from balance sheet normalization. Looking beyond year-end, we expect QT to come to a halt in 1Q25 when the O/N RRP balance falls to near or below $300bn--a reasonably sized RRP facility is likely necessary as a buffer against stress in funding markets, given that the marginal propensity of RRP investors to lend in response to spikes in repo rates is higher than the marginal propensity of banks to do the same. We could see increased rotation out of the credit side of money markets as the remaining institutional prime funds shore up liquidity heading into the MMF reform deadlines this October, though it is likely any cheapening in CP/CD will be minimal, as we suspect other liquidity buyers will step in. The scaling back of both the timing and depth of the upcoming Fed easing cycle has likely extended the attractiveness of the front-end, and we expect MMF AUMs will stay elevated for the remainder of the year (see Short-Term Fixed Income).

Figure 5: We estimate that Quantitative Tightening can continue over the remainder of the year at the now-tapered pace

Current* and projected** values for Fed balance sheet assets, RRP, TGA, Reserves, and Commercial bank deposits*** through 2024; $bn

Source: J.P. Morgan, FRED, Federal Reserve H.4.1, Federal Reserve H.8

* Current as of 6/27/2024 Fed H.4. release

** Deposits as of 6/21/2024 Fed H.8. release

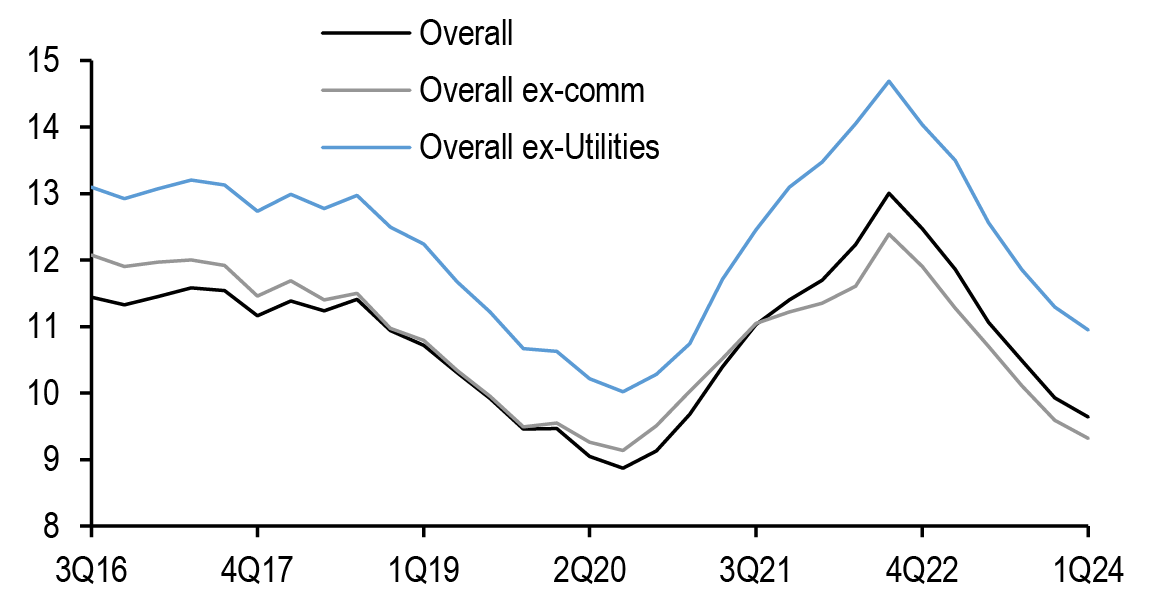

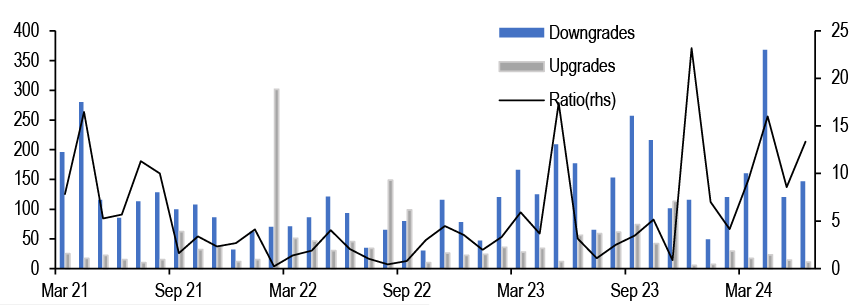

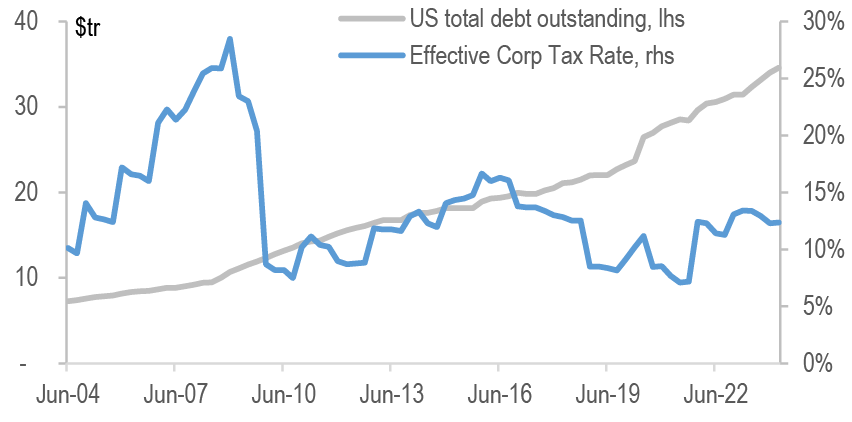

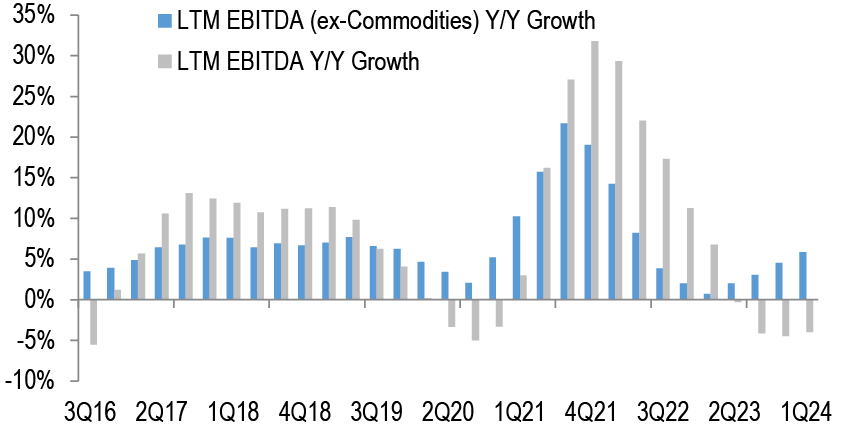

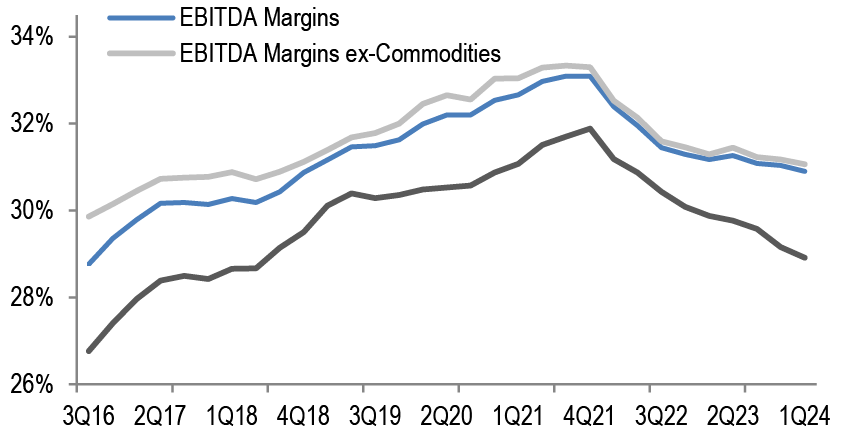

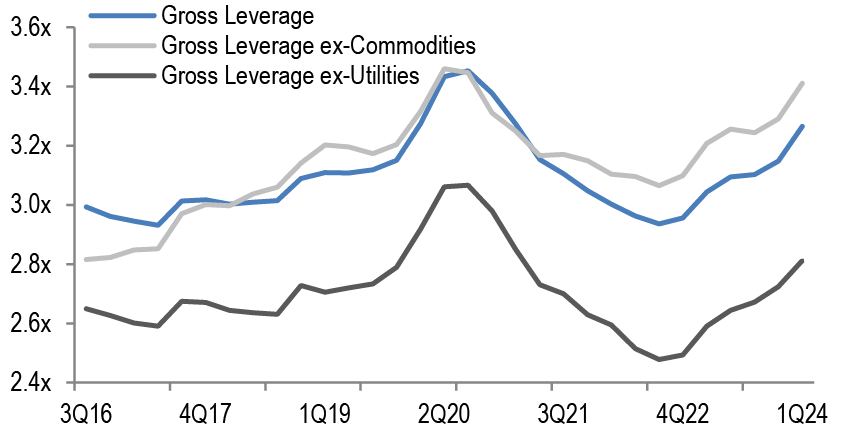

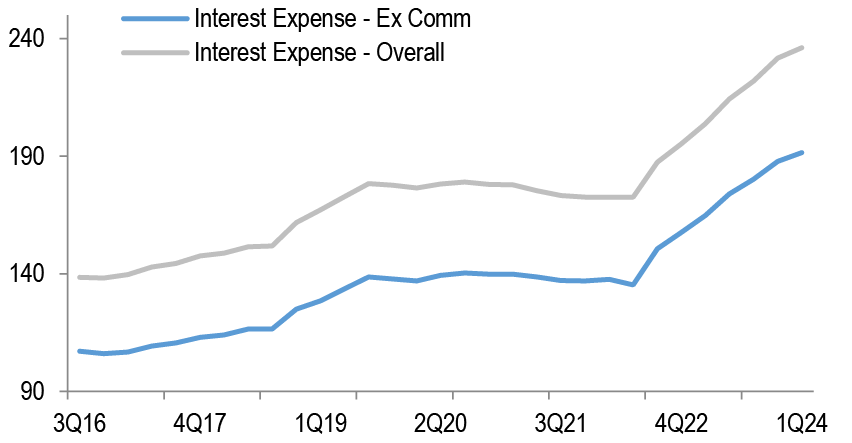

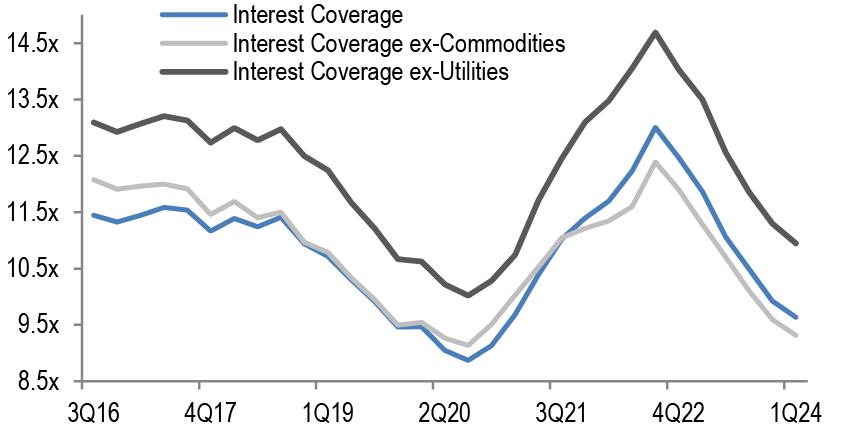

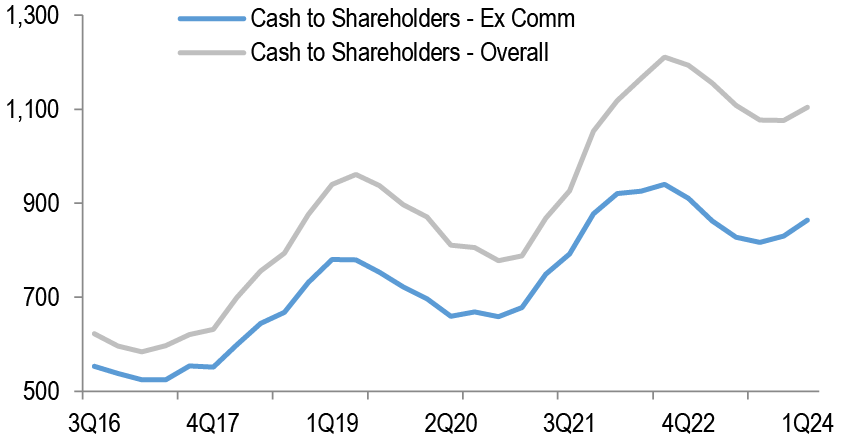

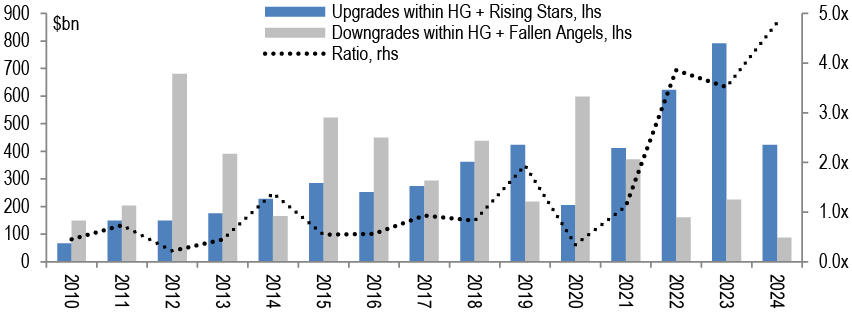

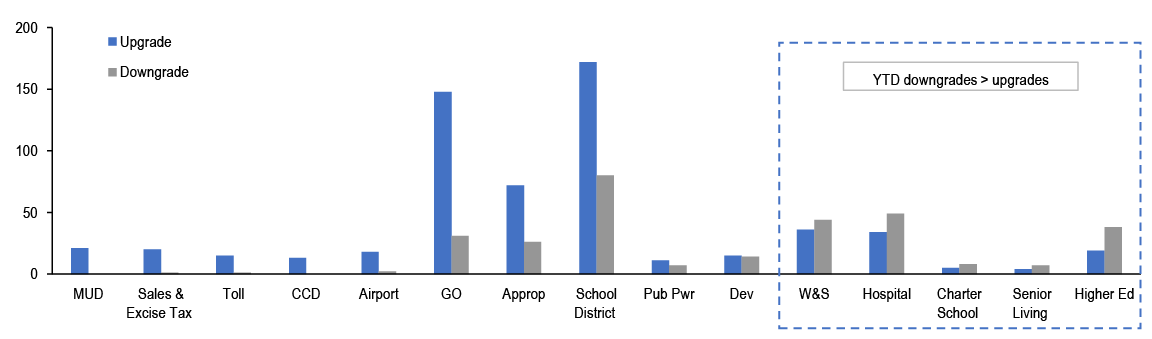

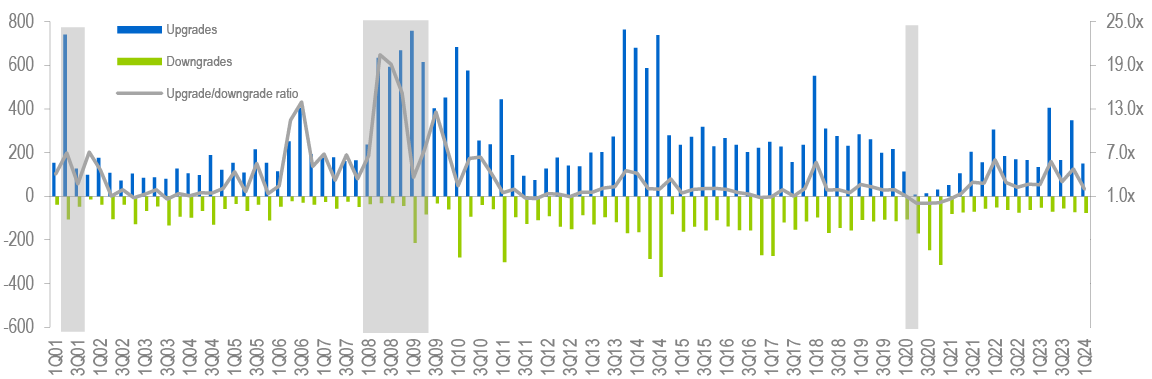

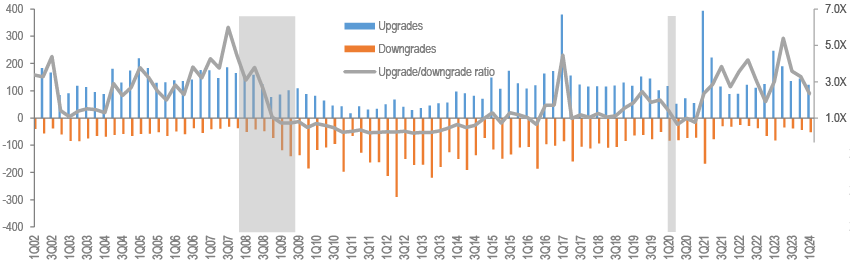

Corporate credit: Corporate balance sheets continue to come under strain with credit metrics steadily deteriorating, but we think they are overall still in solid shape. For high-grade issuers, the recent deterioration has been driven primarily by negative EBITDA growth combined with rising debt and interest expense. Weakness in commodity prices and reduced profit margins are eating into EBITDA, leading to increasing leverage and interest coverage metrics, but they are within long-term averages ( Figure 6, see HG Credit Fundamentals: 1Q24 Review, Eric Beinstein, 5/31/24). Companies have responded to weakening earnings by lowering buybacks and dividends, which have contributed to positive rating developments. Indeed the ratings momentum in HG has been extremely robust with an upgrade/downgrade ratio at record 4.8x, and 4.5% of the HG market has been upgraded in 2024 on a net basis.

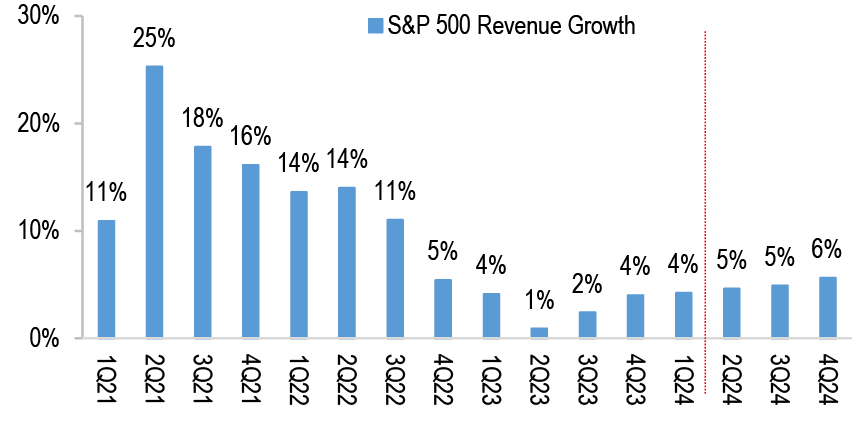

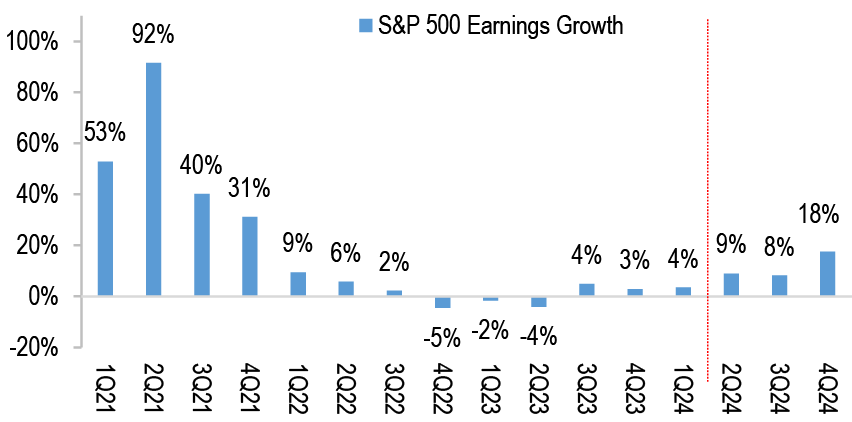

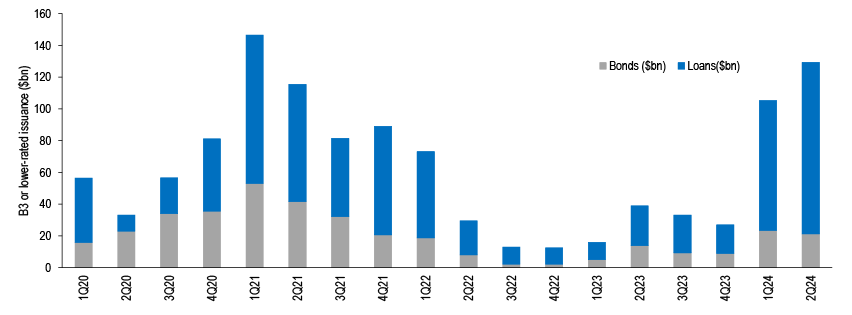

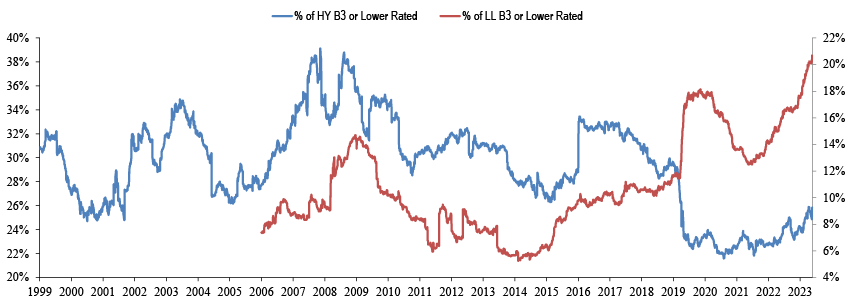

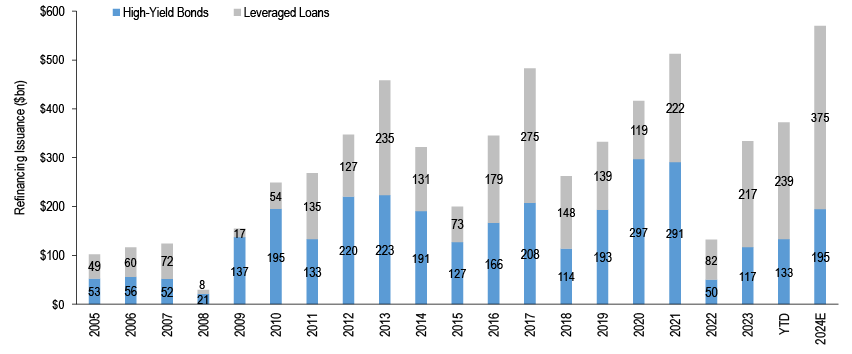

The story is similar down the credit spectrum where US HY issuer balance sheets remain strong heading into what could prove a more challenging 2H24. We have seen modest erosion across most credit metrics including declining EBITDA and rising leverage, but they have yet to reach worrying levels. Meanwhile inflation has been stickier on the cost side than the revenue side, degrading profit margins and leading coverage ratios to soften, even more so for private companies (see 1Q24 High Yield Credit Fundamentals, Nelson Jantzen, 6/12/24). That said these metrics still stand near long-term averages and ratings are historically benign. While the ratings narrative is less supportive for loan issuers, the product is already trading near a historic extreme discount versus bonds and we are seeing access to capital broadening for B3 or lower ratings amid a historic refi wave. A slowing but not contracting economy is an ideal recipe for corporate credit, especially as EPS growth is expected to increase from 3.5% in 1Q to 18% by 4Q, based on consensus equity analyst forecasts. As we look ahead, we think deteriorating credit metrics will not become a primary driver of spreads unless economic growth weakens materially and thus we think technicals will play a much larger role over the near-term.

Figure 6: Interest coverage ratio is declining but remains modestly above its pre-Covid level

Interest coverage metrics; %

Source: J.P. Morgan

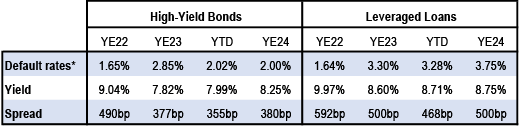

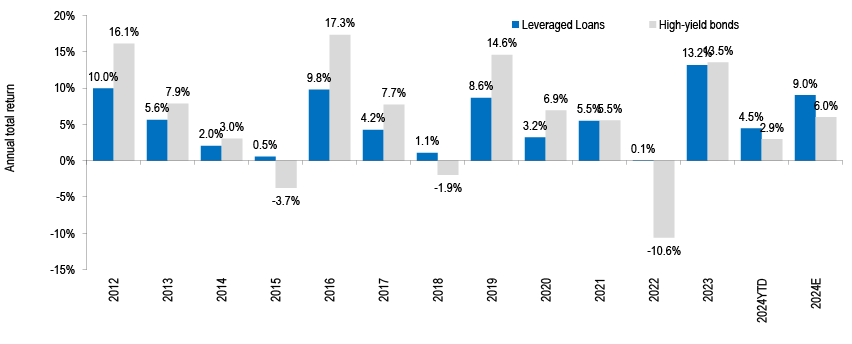

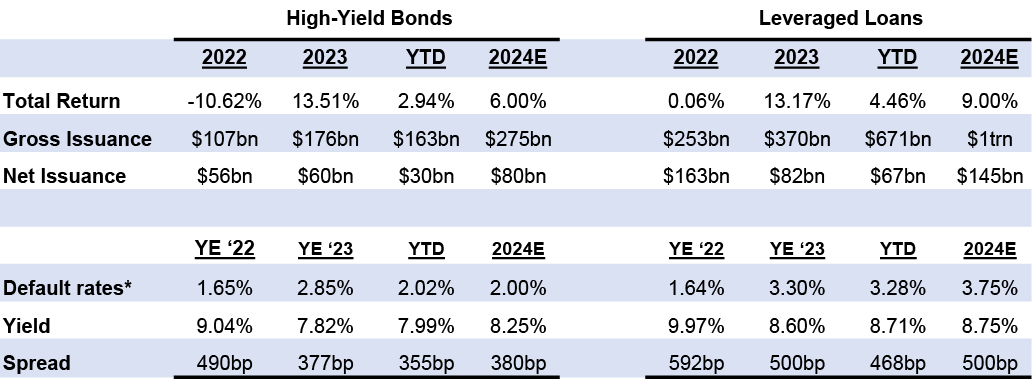

Figure 7: We see default rates rising to 2.00% for bonds and 3.75% for loans by YE24

High yield and leverage loan default rates, yield, and spread forecasts for YE24; units as indicated

Source: J.P. Morgan*par-weighted default rates

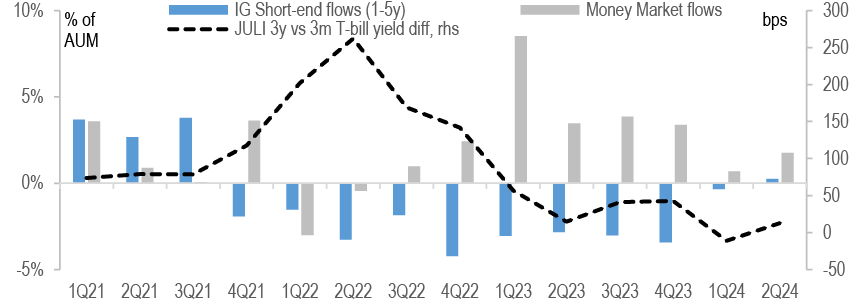

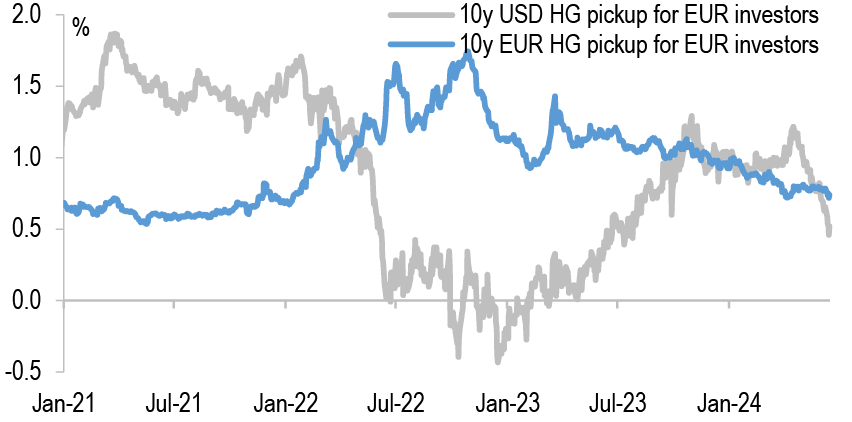

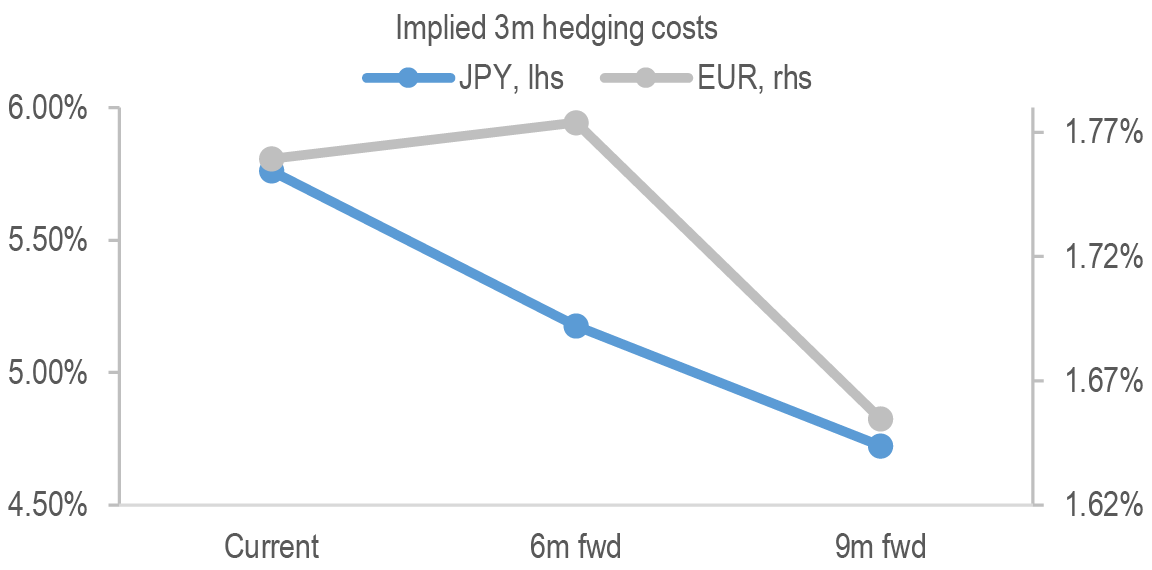

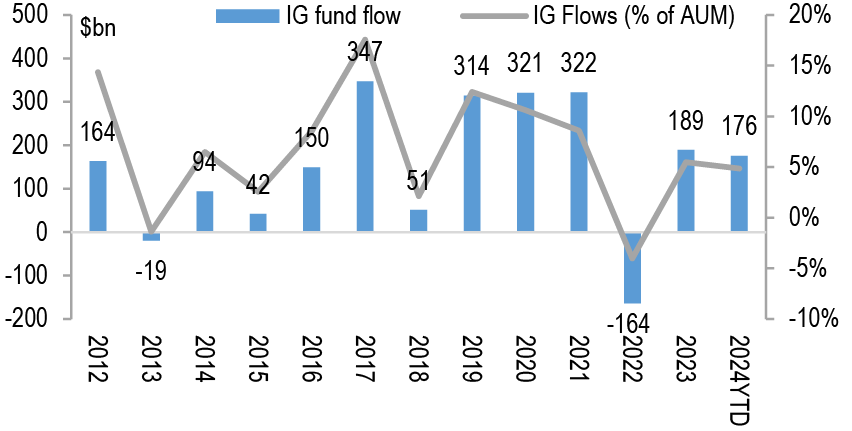

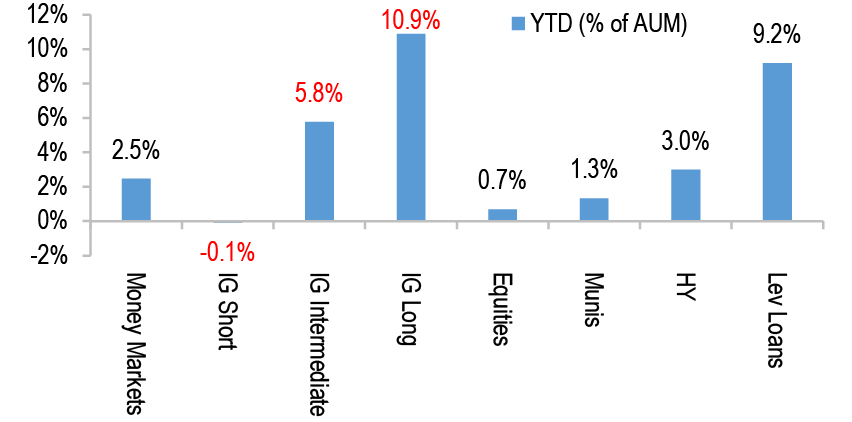

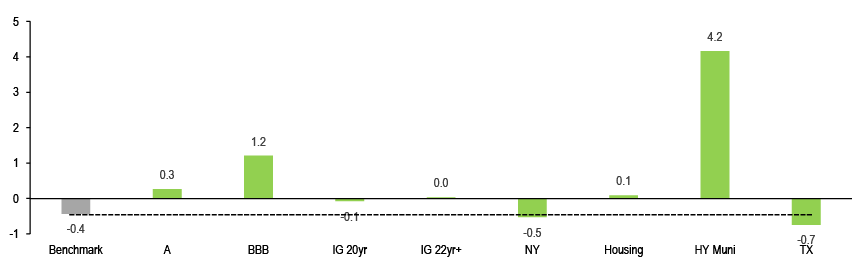

Stronger-than-expected economic growth and higher-than-expected yields led to very strong demand technicals over the first half of the year. Despite this, HG spreads did not stay sustainably below 100b. In 2H24, we expect some of the demand technicals to become less strong, especially if the start of the Fed easing cycle drives yields lower. Also, global rates dynamics have made US credit less attractive to overseas investors, and domestic fund inflows have slowed in line with middling YTD total return. Election uncertainty could increase volatility, generally a market negative. Overall, we have revised our year-end spread target to 110bp (from 95bp previously)--still a tight spread historically (see Corporates).

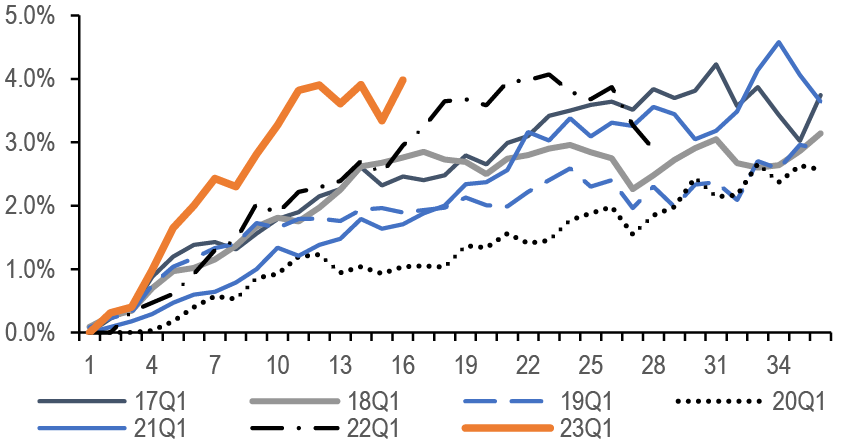

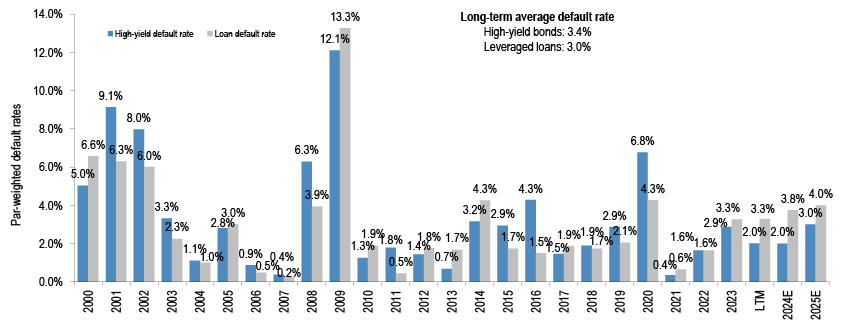

For high yield bonds, weakening credit fundamentals, a less supportive technical backdrop, and negative agency rating trends are expected to be offset by supportive factors such as elevated yields, strong balance sheets, benign credit ratings, improving capital market conditions, resurfacing retail inflows, and a yoy decline in default activity. For leveraged loans, the negative fundamental ramifications from elevated rates and slower growth should lead to ongoing downgrade and default risk, which we expect to be offset by elevated coupons (9%), earnings delivery, a record pace of CLO origination, steady inflows, and a negligible pace of net new supply. We believe credit will provide carry-esque returns over the next six months, with high yield bond spreads widening 25bp to 380bp, comfortably inside the long-term average, while leveraged loan spreads end the year at 8.75%. We see default rates rising to 2.00% for bonds and 3.75% for loans by YE24 ( Figure 7, see High Yield).

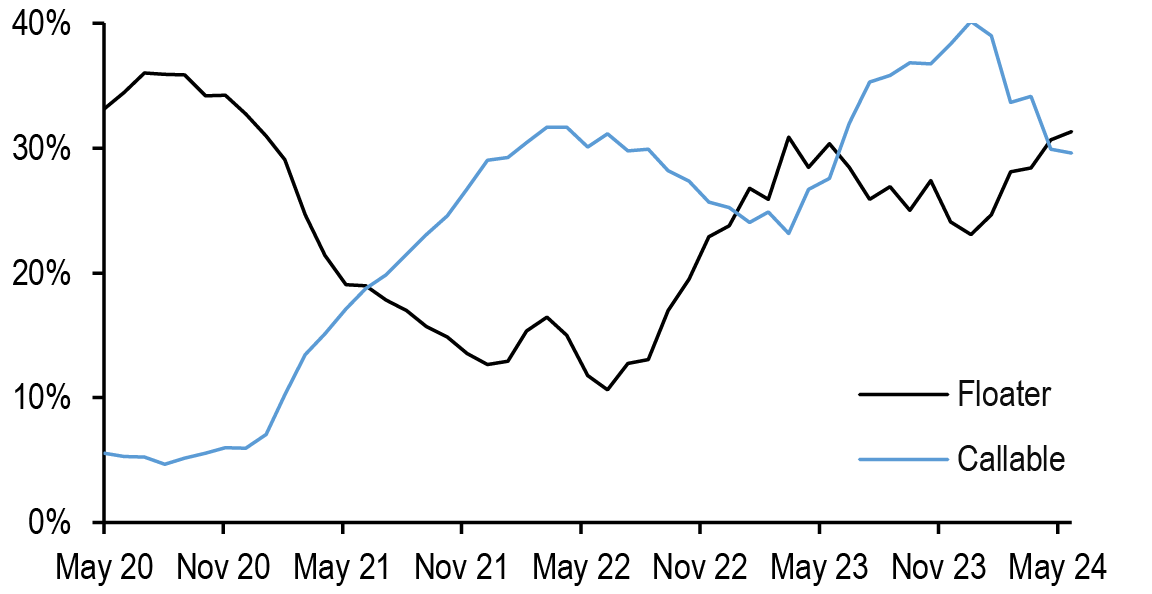

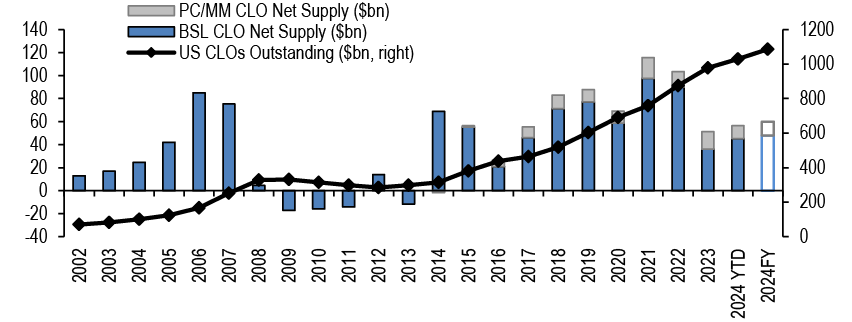

Given our modest default forecast, we think CLO credit performance is unlikely to meaningfully turn in 2H24 unless the economy falls into a recession. That said, we think the 1H24 bullish tone in CLOs is susceptible to macro events from geopolitics to disinflation, as demand for floaters has largely been driven by yield curve inversion. While technicals could prove strong, with US CLO new origination at near-consecutive monthly records despite little net loan creation, portfolios could be at risk of future extensions as tight spreads encourage CLO resets and as the loan maturity wall extends. We look for our CLOIE to return 3.2% for the remained of the year. We like relative value in selectively selling par-plus AAA in secondary to buy short refi at par or buying deleveraging/near-deleveraging AA and A for low spread duration while earning carry (see CLOs).

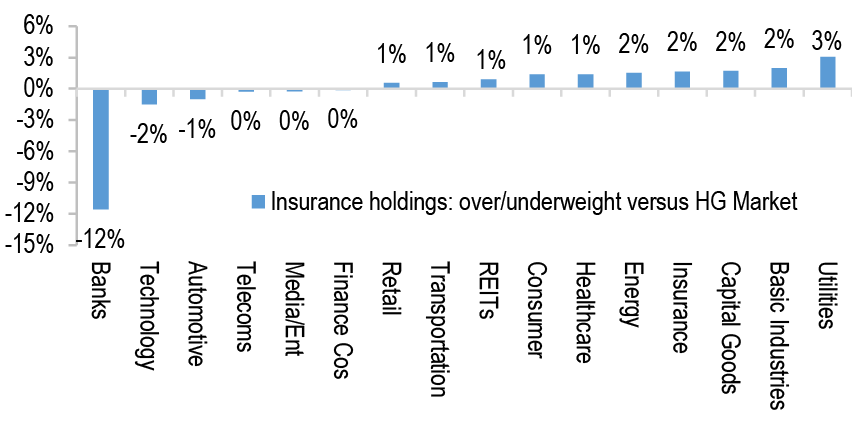

In terms of sector recommendations, in HG we have overweights in Yankee Banks, Finance Cos, Consumer, Basics, Domestic Telecoms, Insurance and Media/Entertainment, while we have underweights in Technology and Retail. In HY we are overweight in Financials, Metals/Mining, Media, and Utility while we are underweight Consumer Products, Housing, Industrials, and Paper/Packaging.

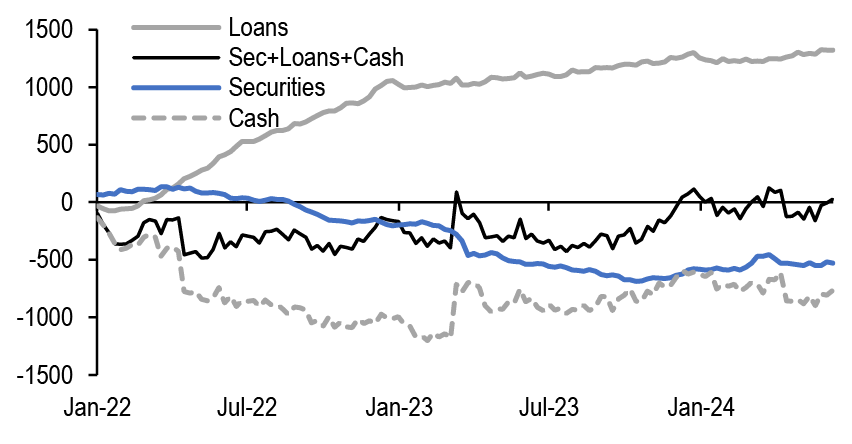

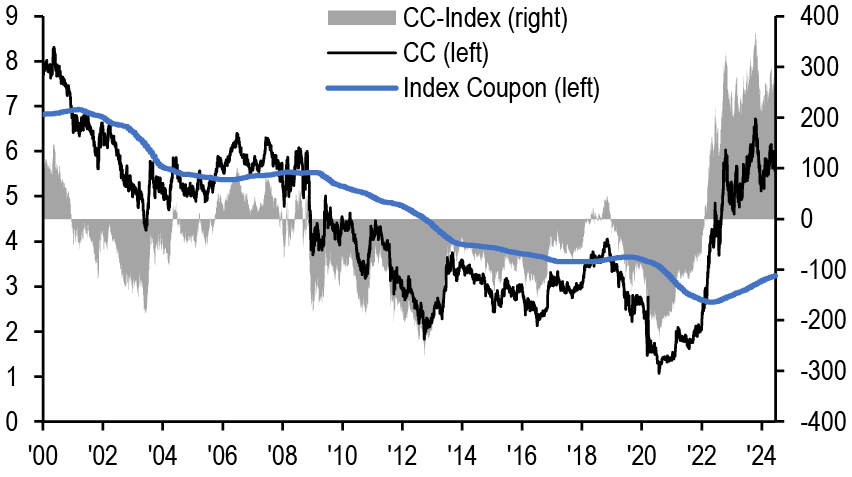

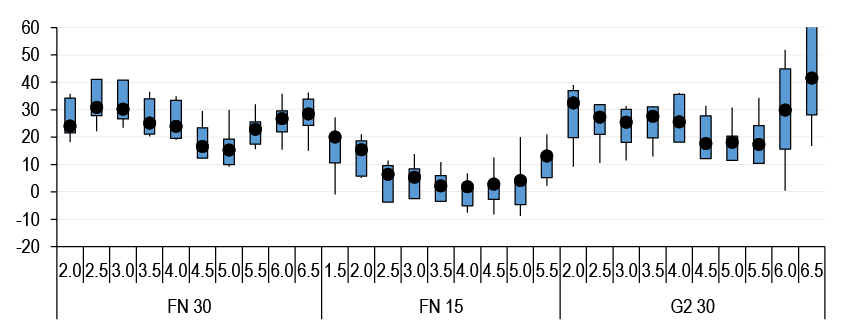

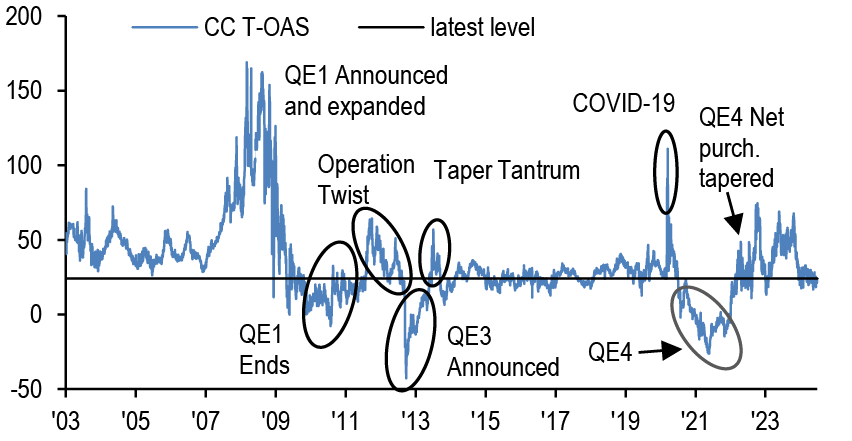

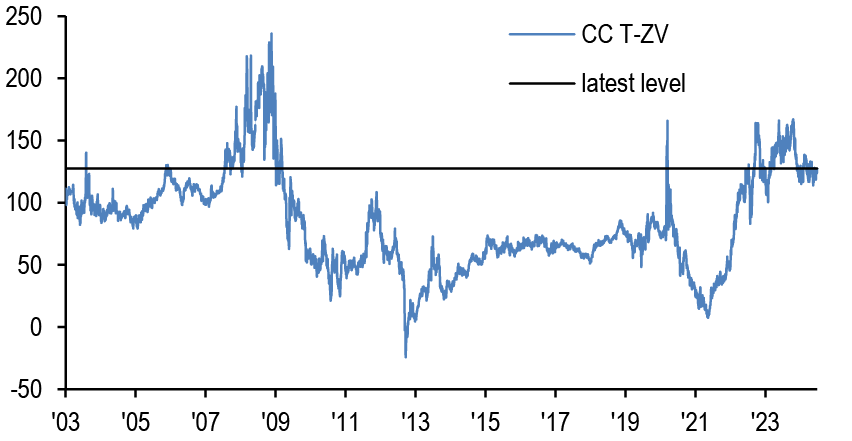

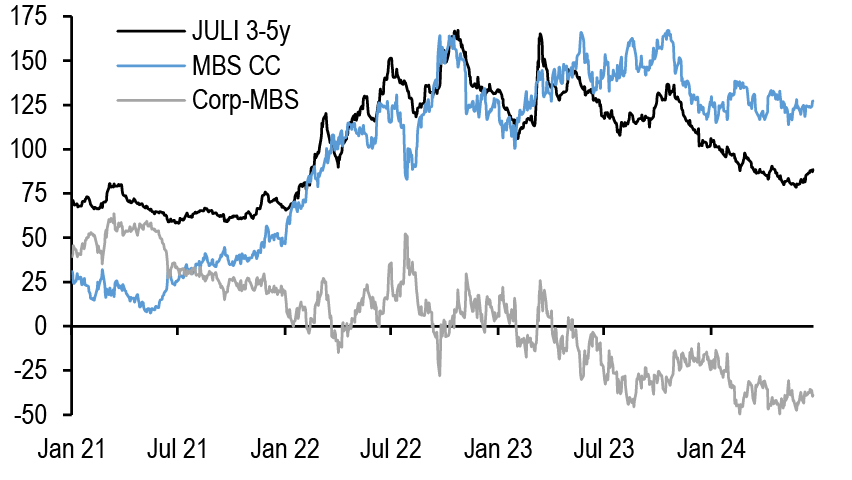

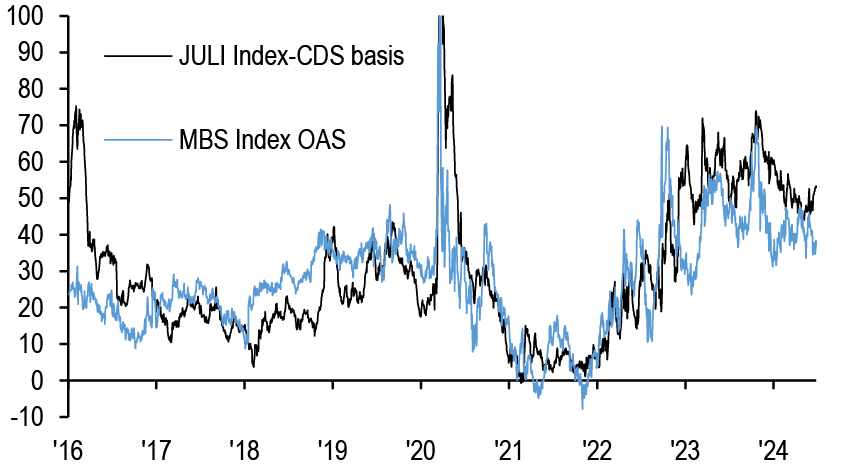

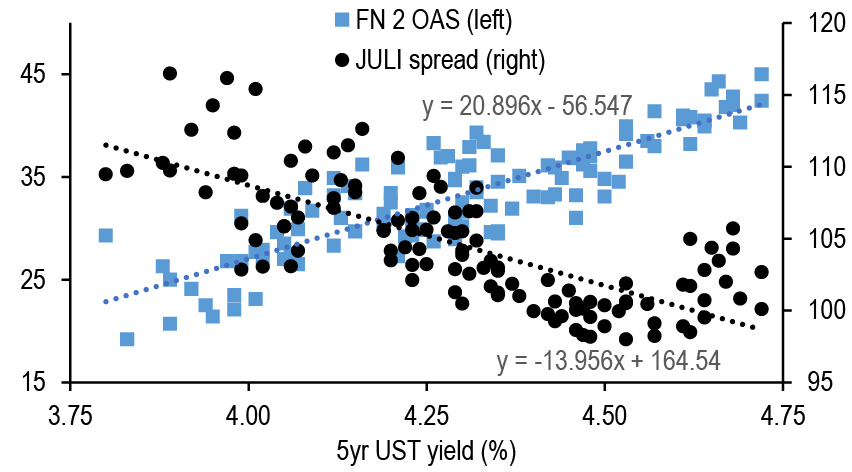

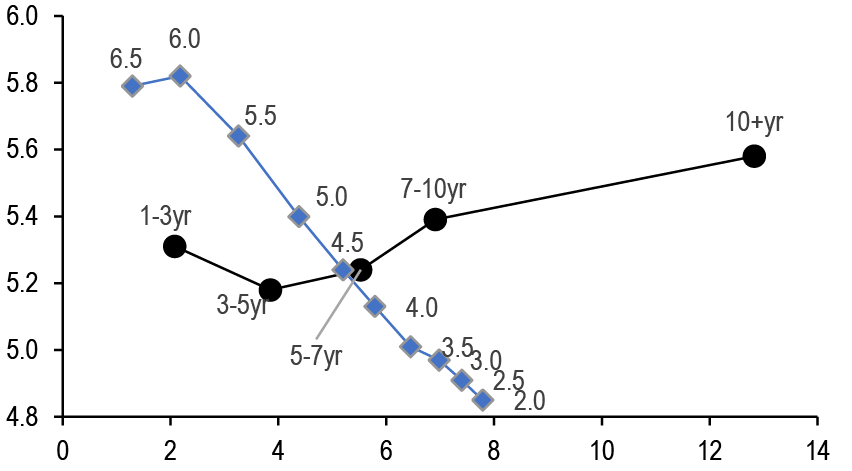

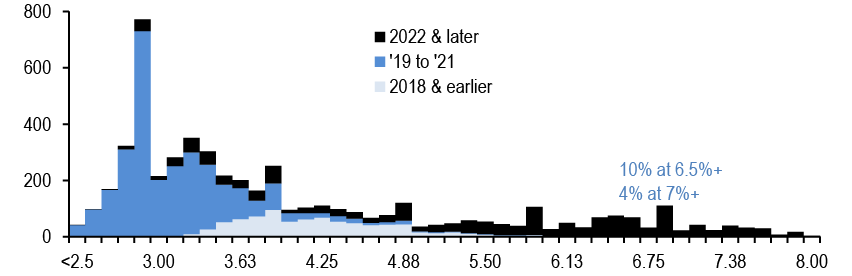

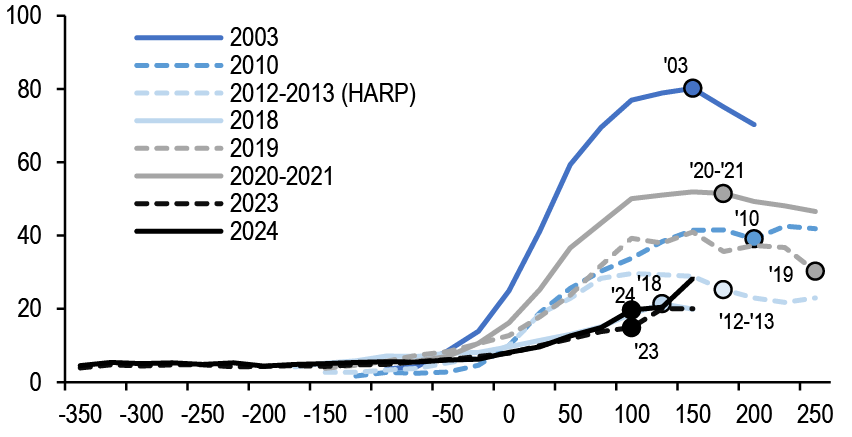

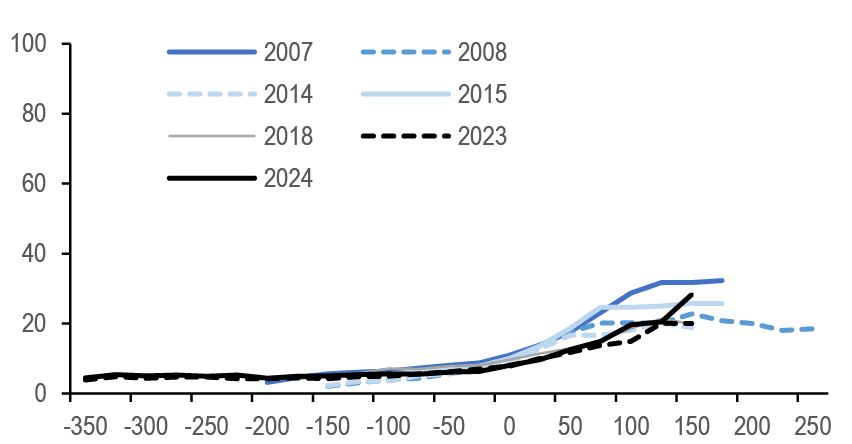

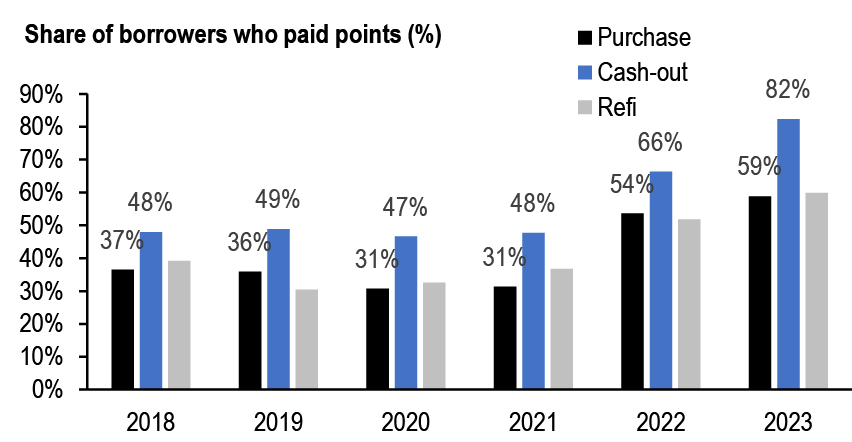

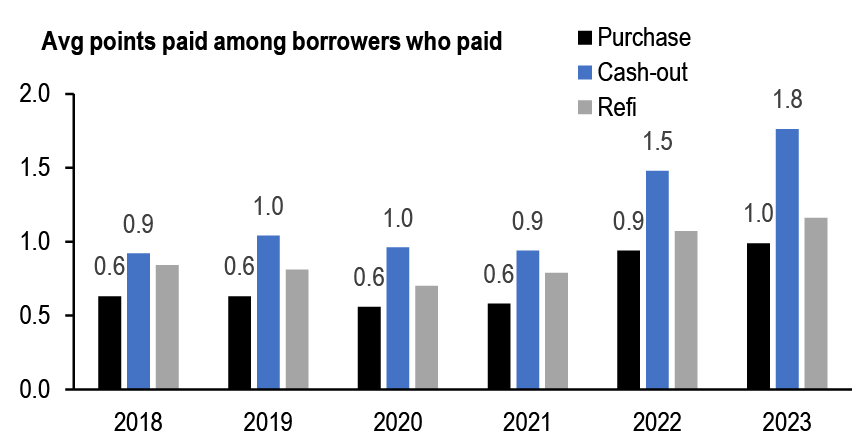

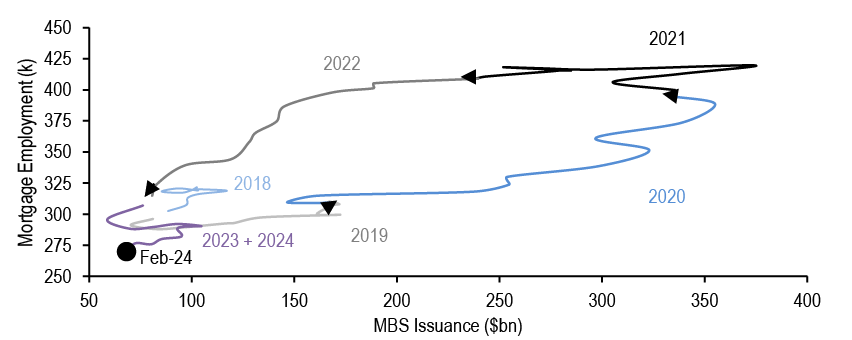

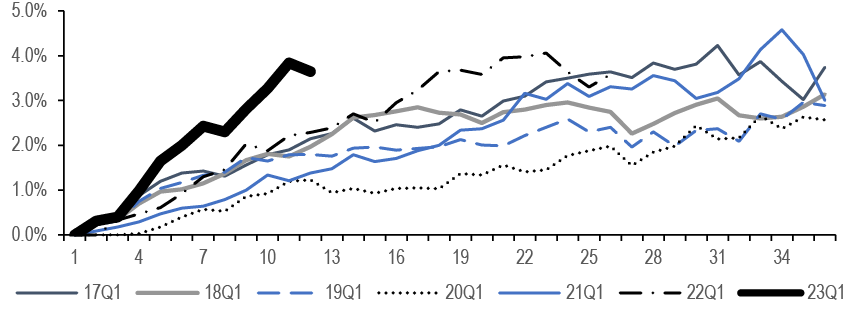

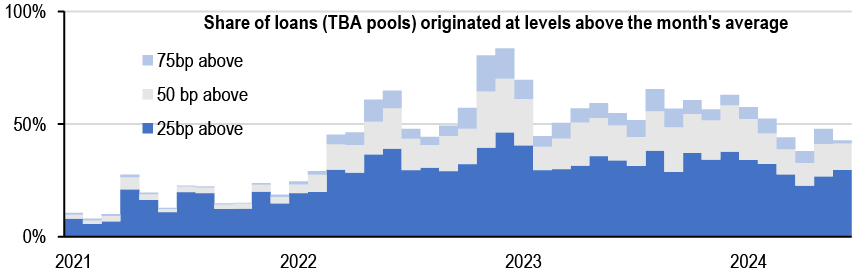

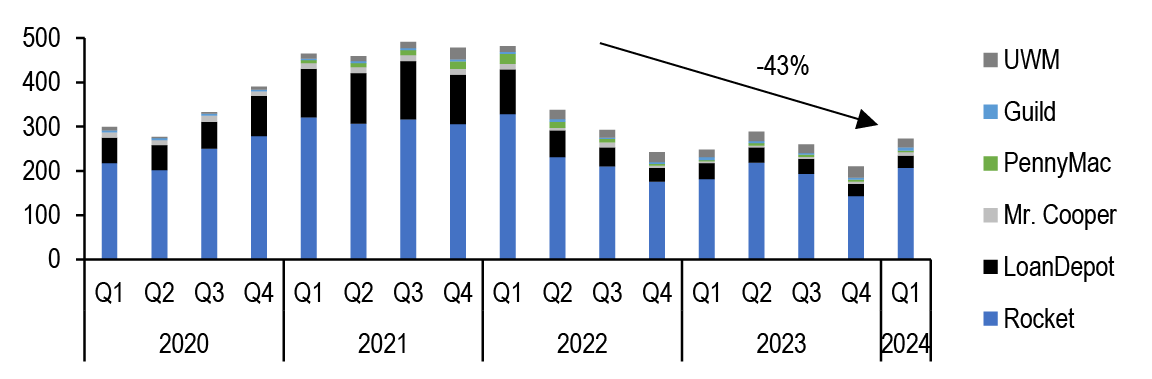

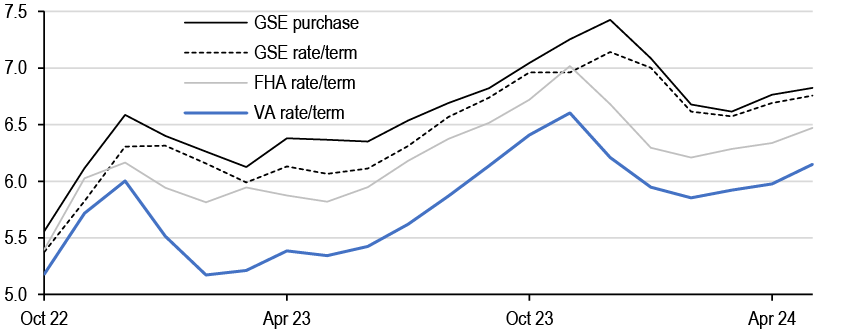

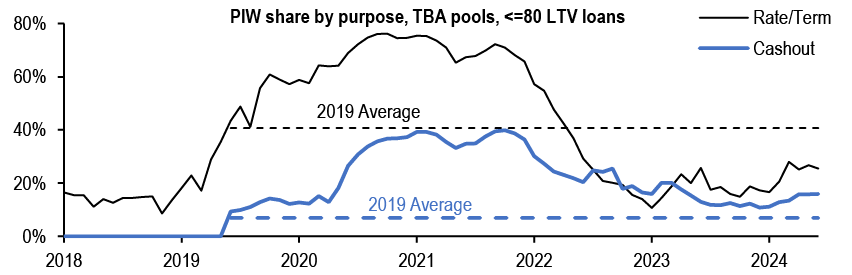

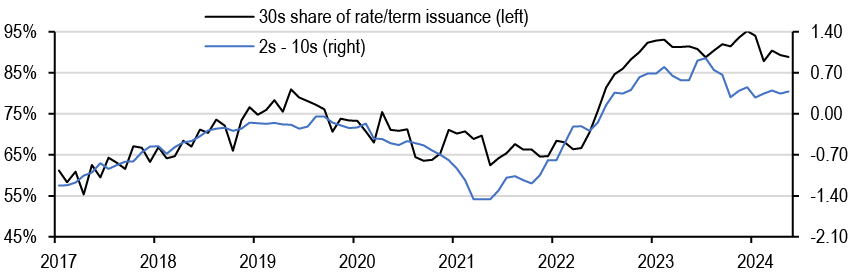

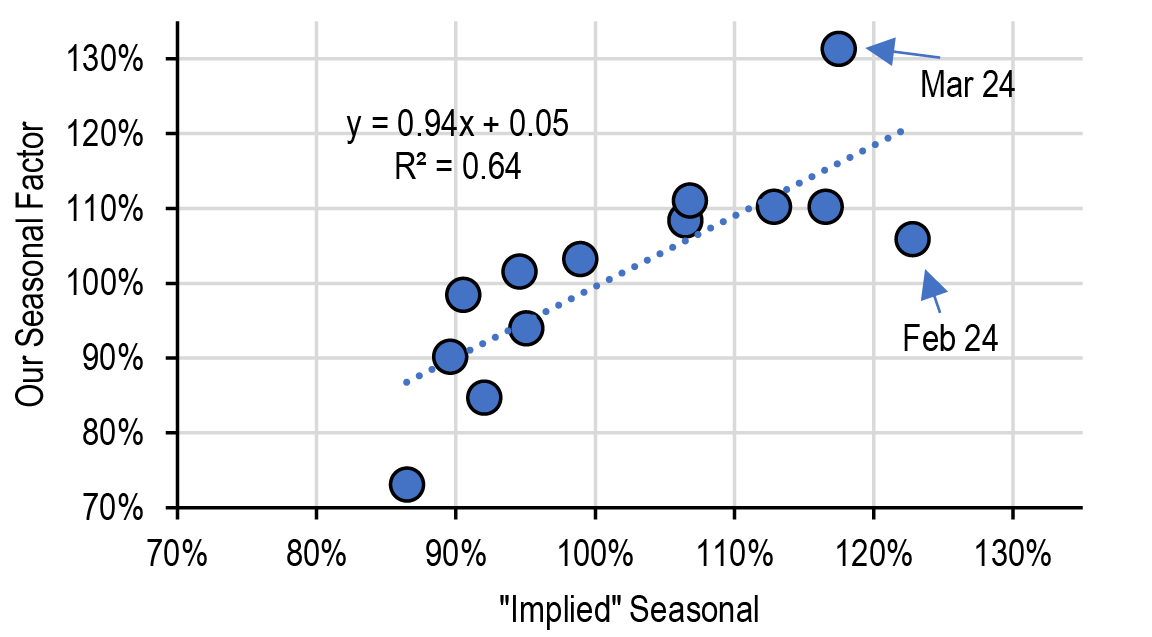

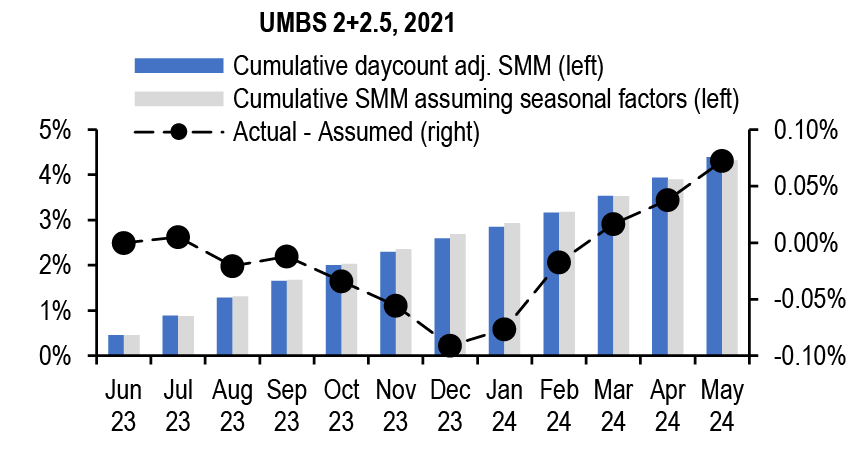

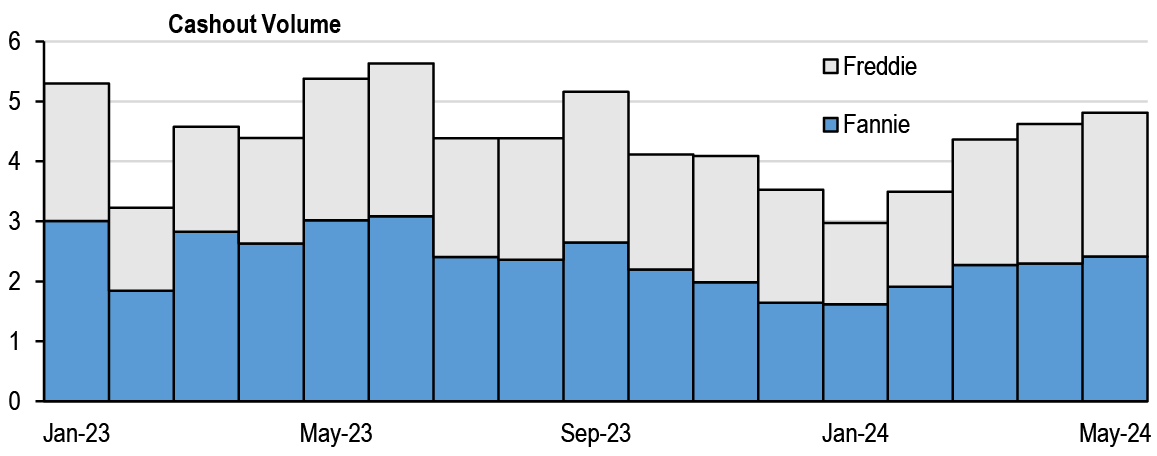

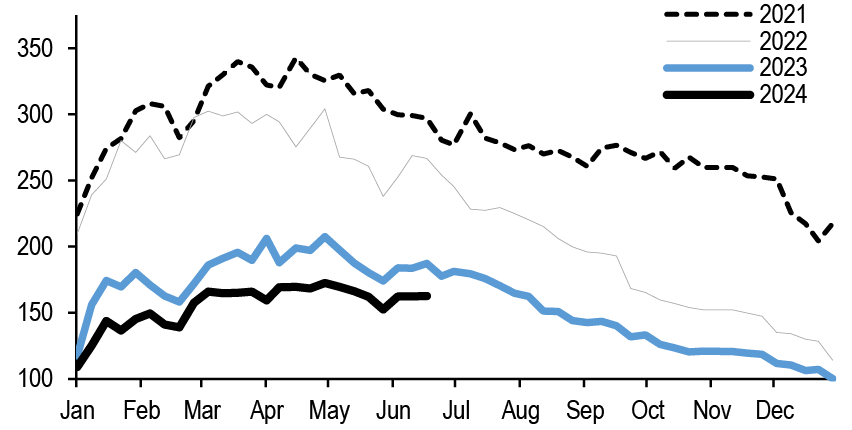

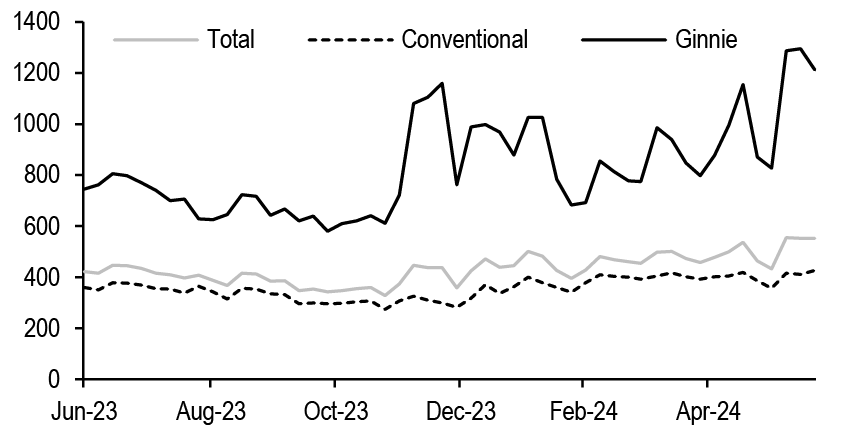

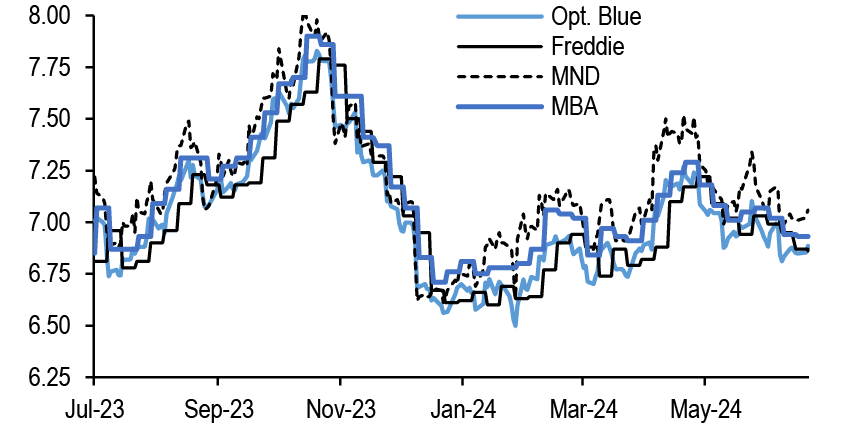

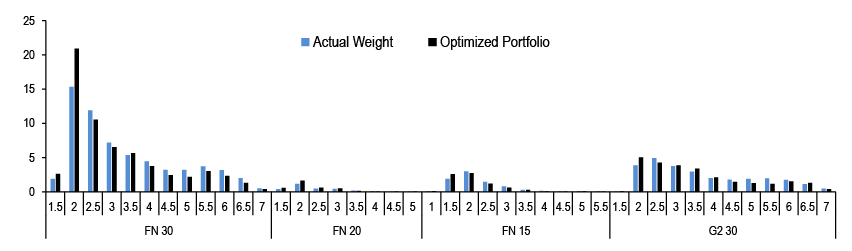

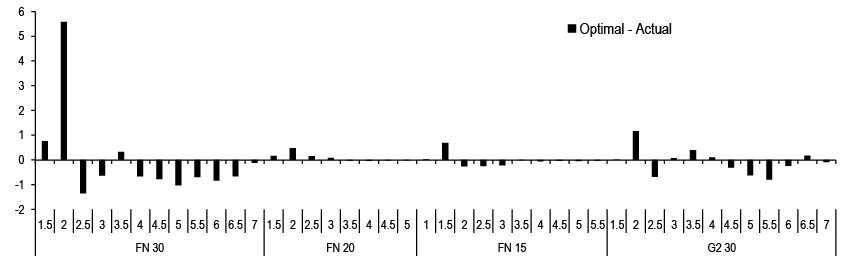

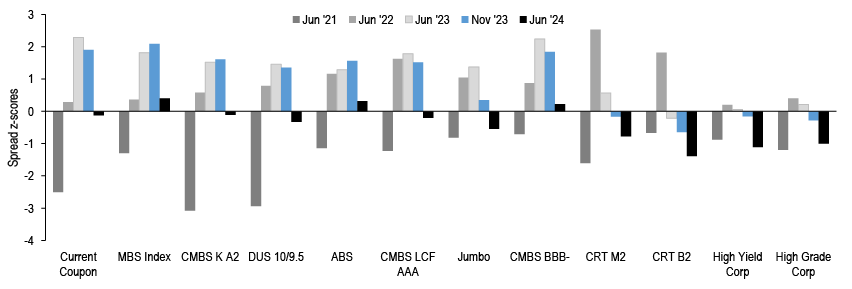

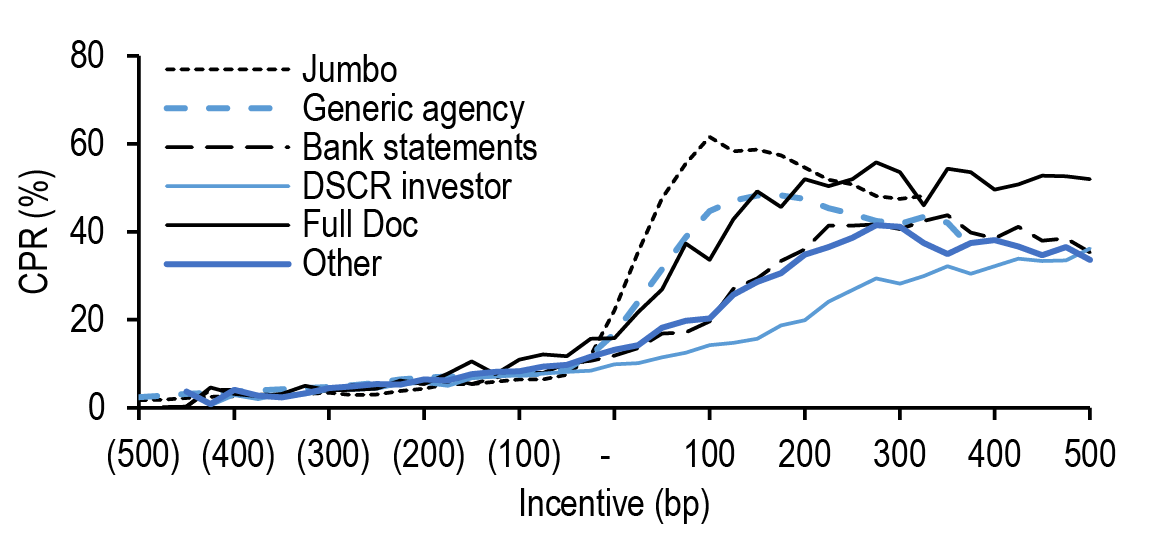

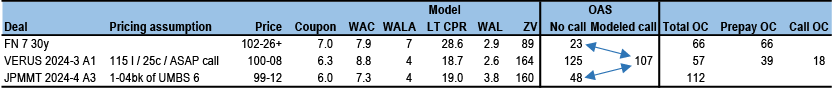

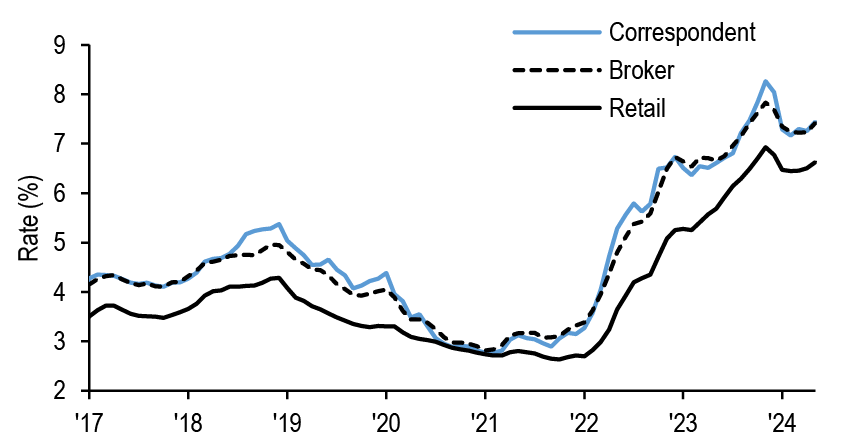

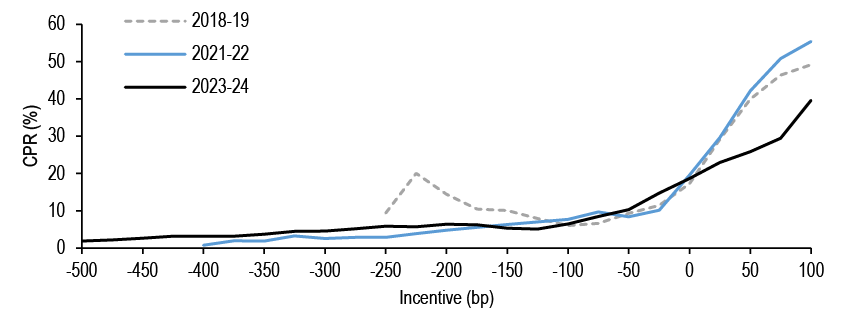

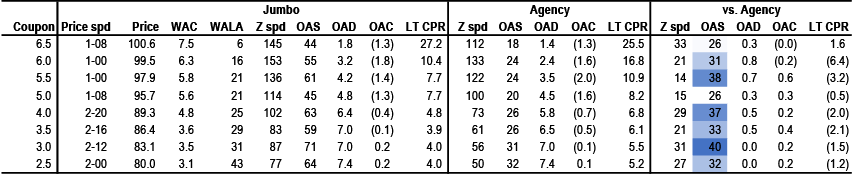

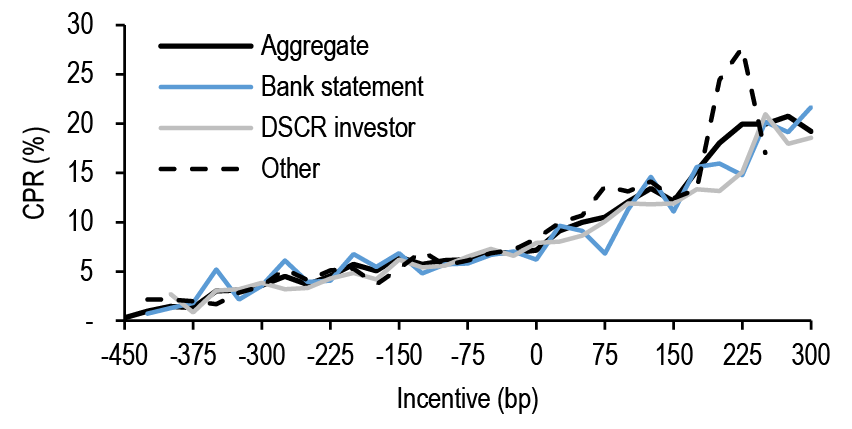

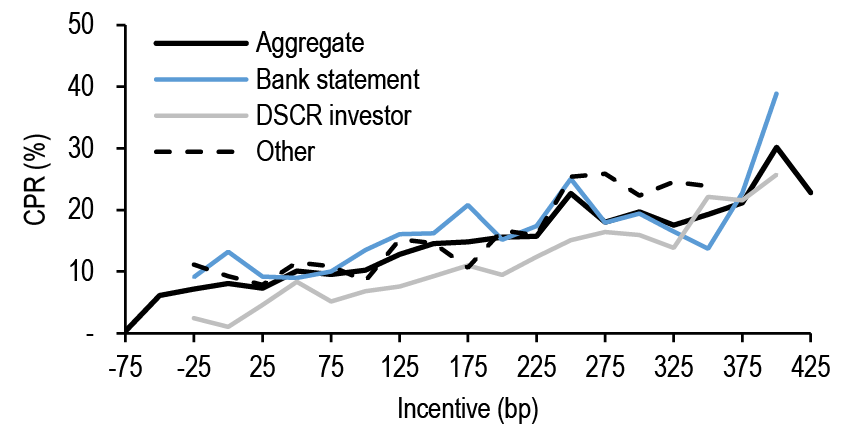

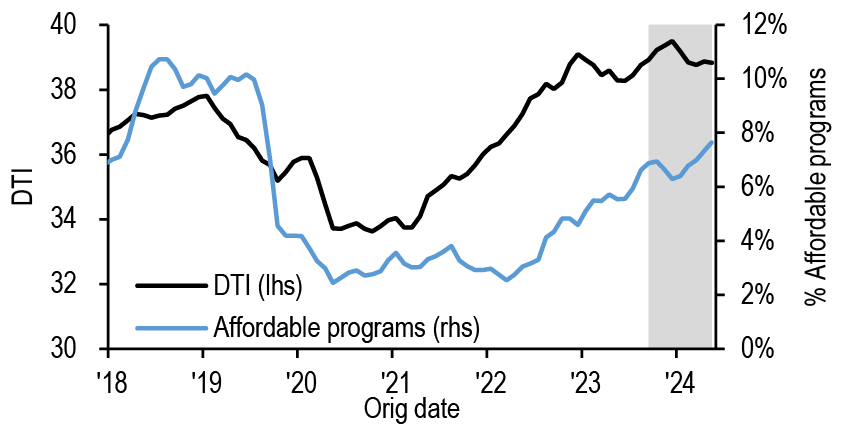

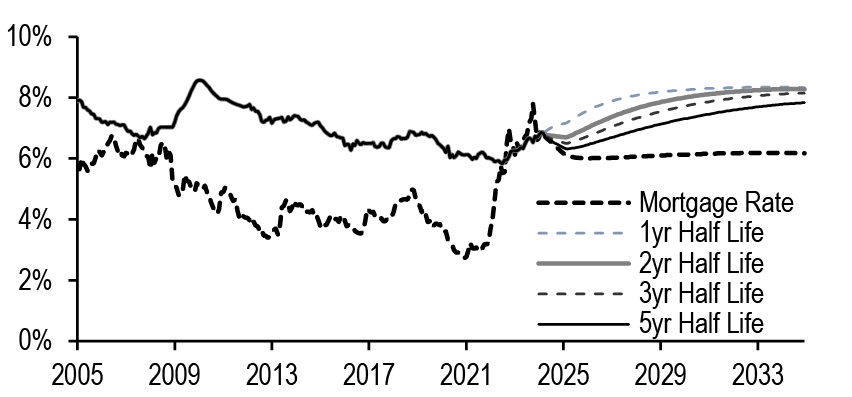

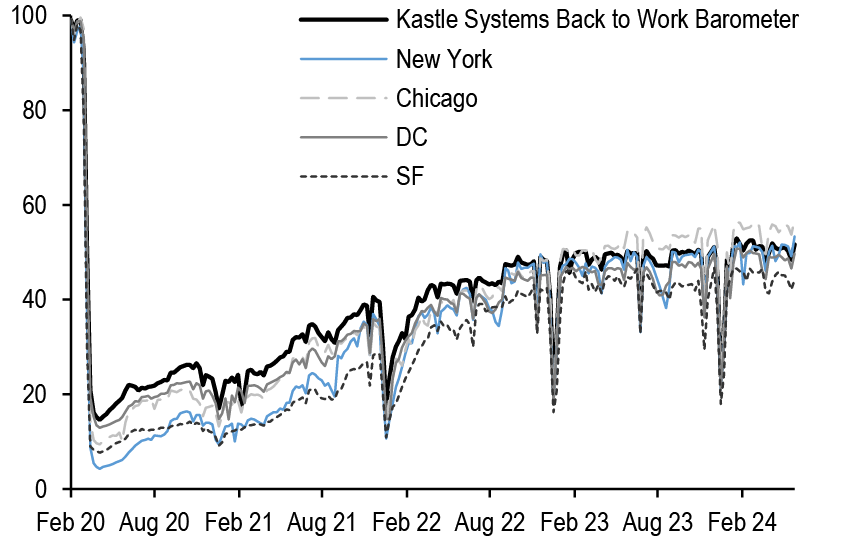

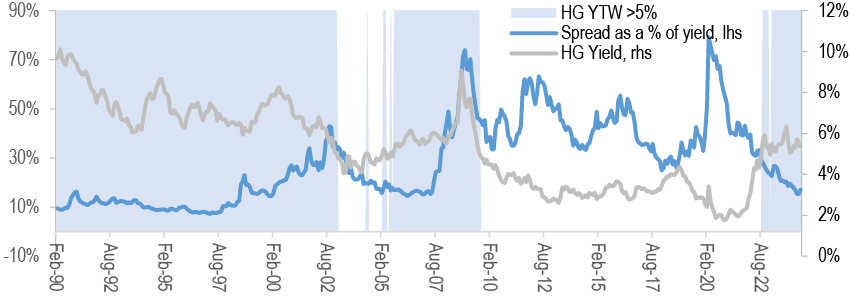

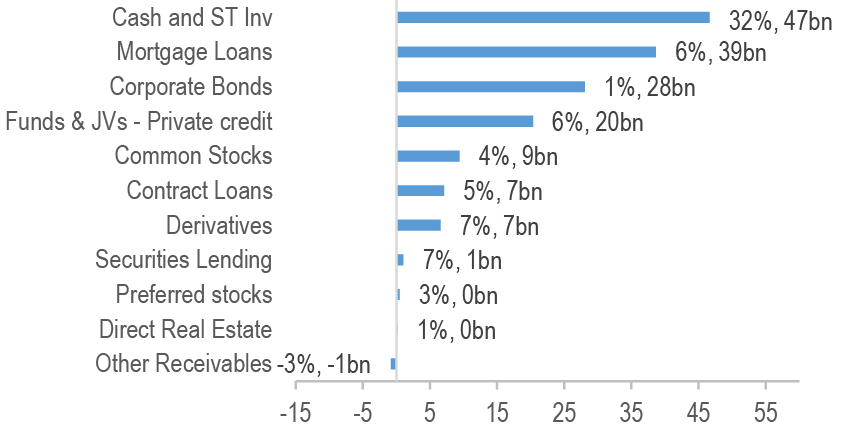

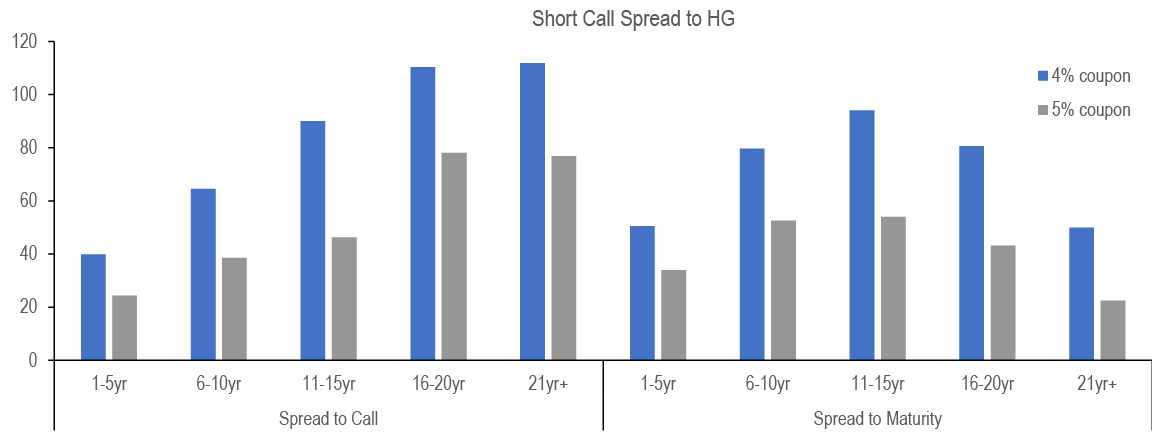

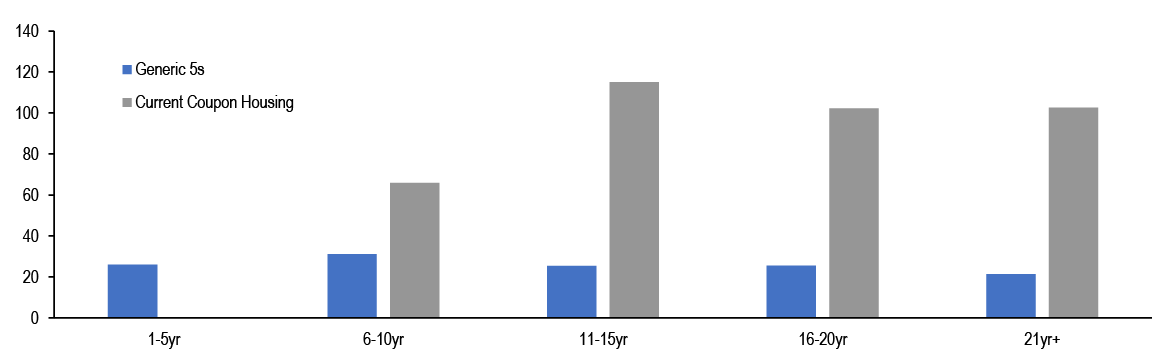

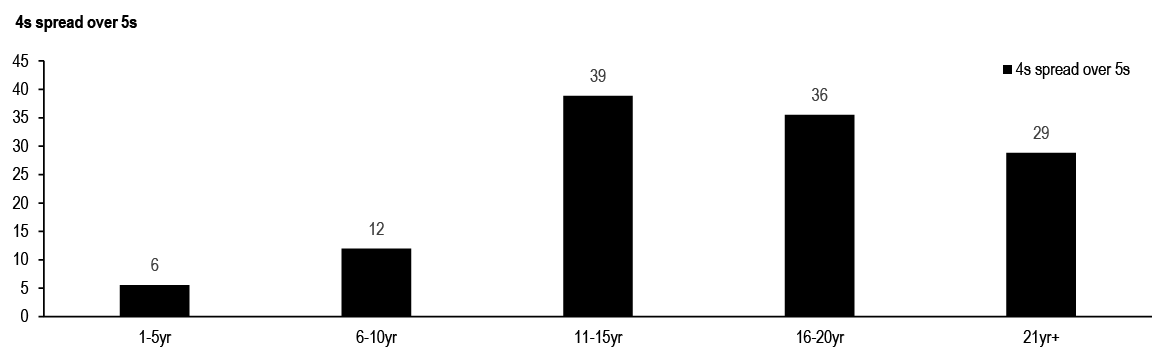

Securitized products: Turning to the mortgage space, we head into 2H24 with OASs looking a bit snug, ZVs still historically wide, and the supply/demand picture looking manageable. Higher coupons have generally outperformed Treasuries thanks to a combination of carry and spread tightening while discounts have lagged on the back of technical pressures from bank portfolio reallocations. Even after portfolio repositioning in the second quarter, bank activity has surprised to the upside and we now think they can be a net buyer over the course of the year. That said, banks have generally been letting their lower yielding fixed rates burn off and replacing with Ginnie floaters, partially offsetting otherwise positive demand for mortgages. Risks to lower total capital build from a revised Basel 3 Endgame remains a medium-term risk and risk capital constrained banks will prefer Ginnies. Meanwhile money managers have been responsible for most net conventional buying to start the year. With corporate spreads moderately higher and YTD excess returns on higher coupons giving more credence to the mortgage vs. corporate trade, we think that money managers can maintain their current allocations given the yields available. If our base rates forecast is realized, higher coupons will likely outperform, but with OASs in the 20-30bp range and the marginal buyer still spread sensitive, we think excess returns will need to be driven by earned spread rather than tightening.

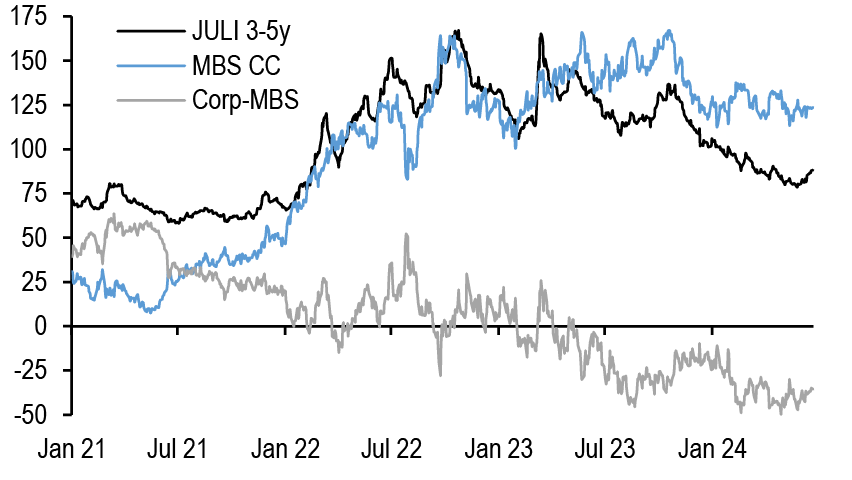

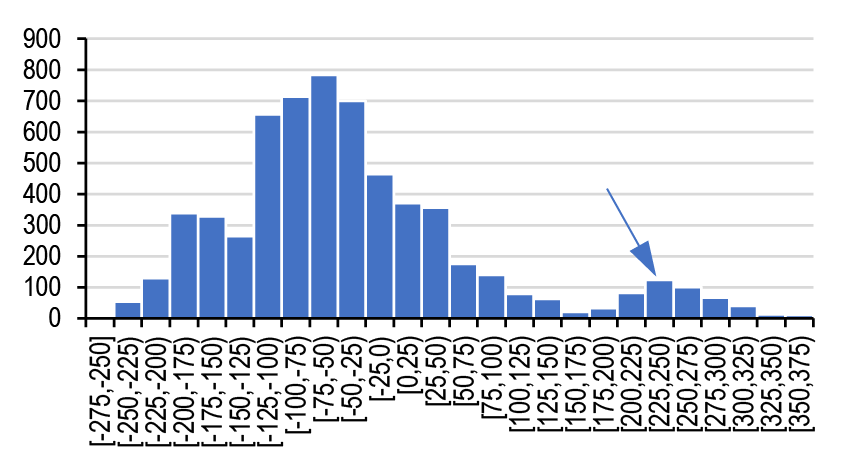

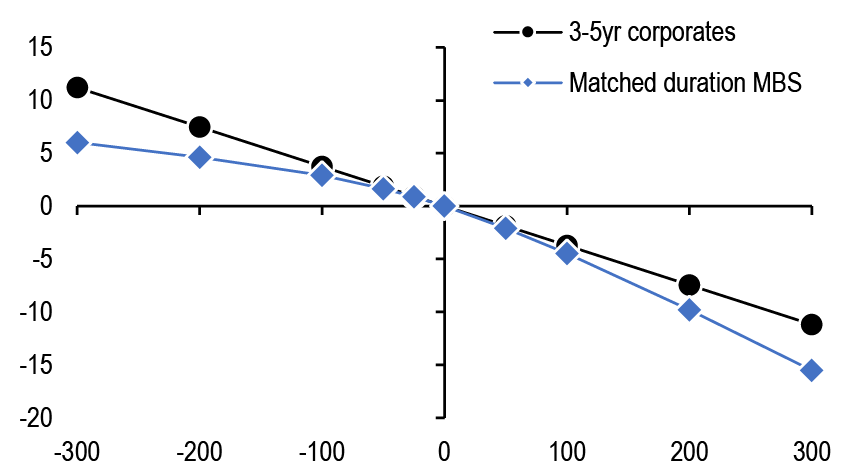

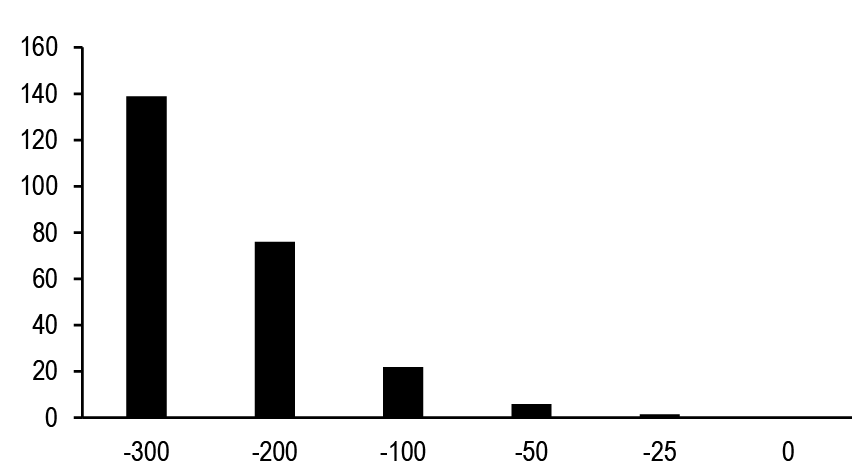

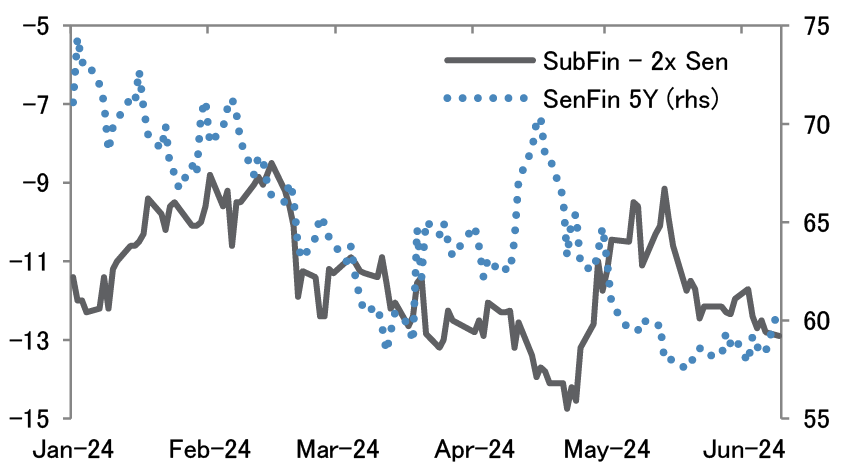

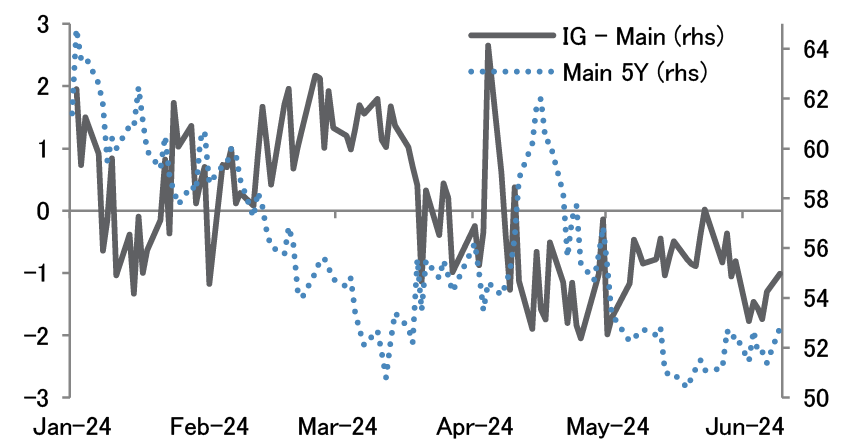

Given the importance of bank and money managers to mortgage demand, a key question among cross asset investors is whether mortgages look cheap on a relative basis to Treasuries and IG corporates. We have argued in the past this depends on which mortgage one buys, but we also note it depends on how one is using mortgages as either a relative value play or as a way to position for a potential recession. Broadly speaking, we think lower coupons remain compelling 5-7yr Treasury proxies with spread pickup, while higher coupons are a way to pick up carry, fade vol, and arguably shed some exposure to historically tight IG corporate spreads. At the present, current coupon mortgages pick up ZV spread vs. similar duration corporates, but OAS doesn’t look particularly cheap vs. the bond/CDS basis ( Figure 8). Indeed at the local level mortgages have displayed a positive correlation and corporates a negative relation with yield moves given technical demand factors, but this is unlikely to hold in large rate rallies predicated on worsening economic outcomes. Our mortgage analysts compute ‘break-even spreads’ which show that unless IG corporate spreads widen by more than these thresholds, they will likely outperform negatively convex current coupon mortgages in such rate moves ( Figure 9). The question remains that if shorter duration mortgages offer relatively competitive yields vs. corporates, whether recession scenarios are priced well (see Agency MBS).

Figure 8: Current coupon mortgages still look cheap to similar duration corporates on a ZV basis…

JULI 3-5y Treasury spread, FN 30yr cc ZV spread, and difference; bp

Source: J.P. Morgan

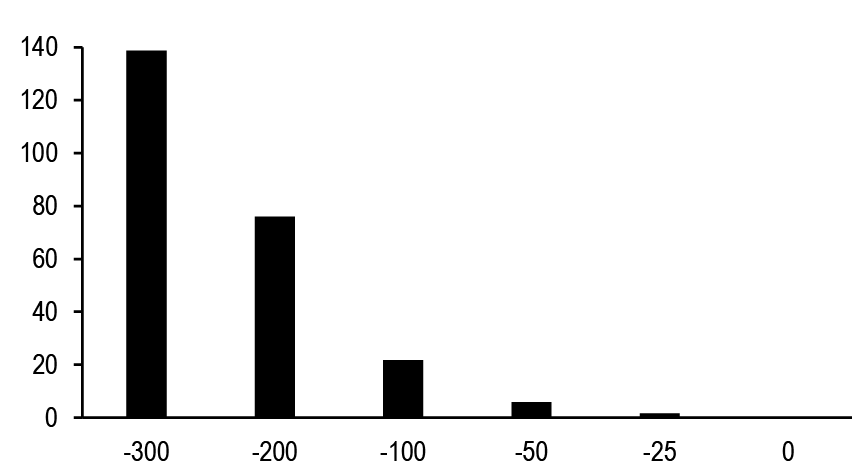

Figure 9: …but are likely to underperform IG corporates in large rate rallies unless IG spreads widen materially

Amount of spread widening on 3-5yr IGs to make their price move equivalent to an even duration blend of FN 5s/5.5s in different rate rallies; bp

Source: J.P. Morgan

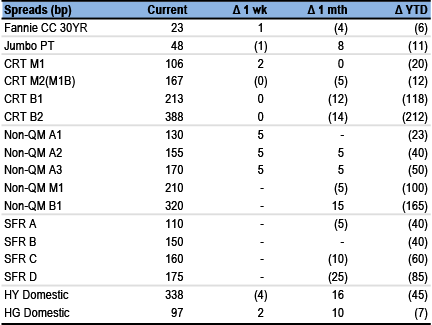

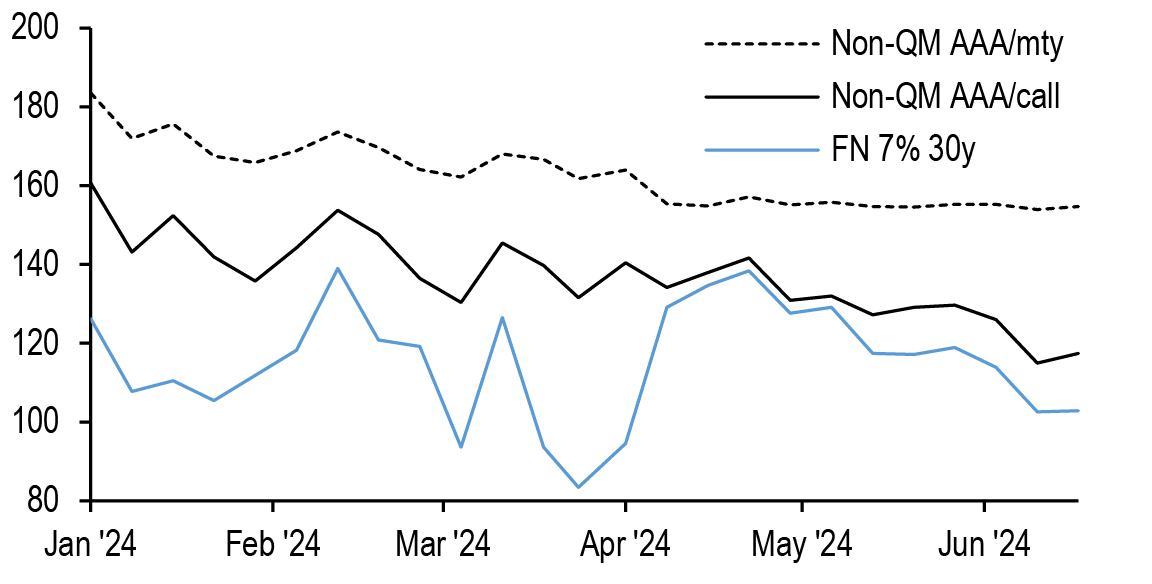

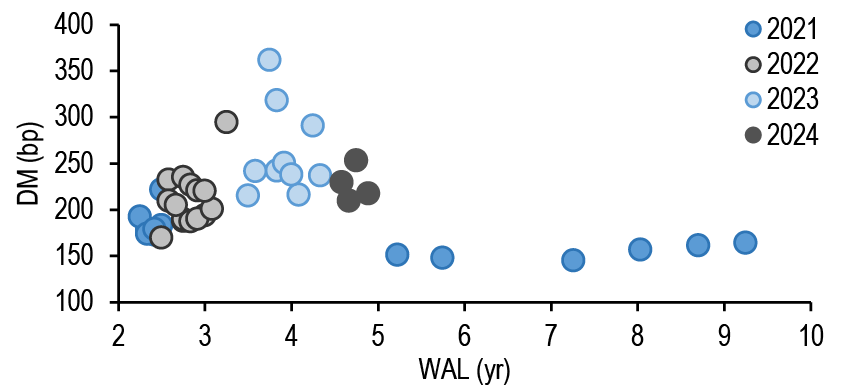

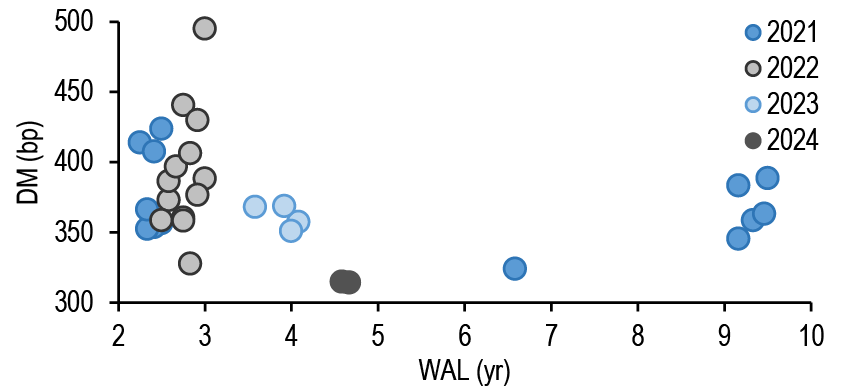

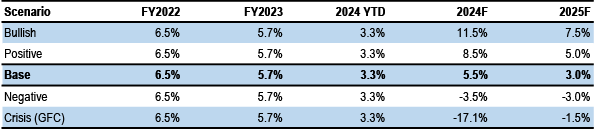

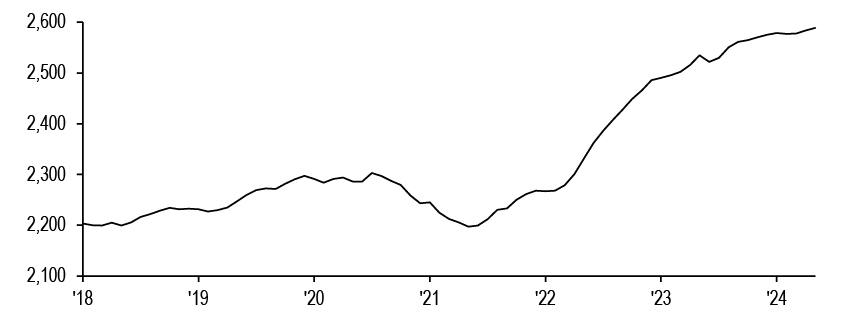

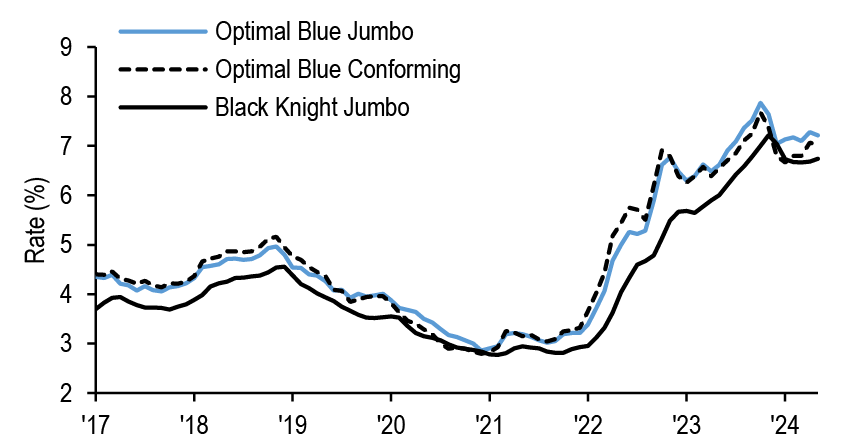

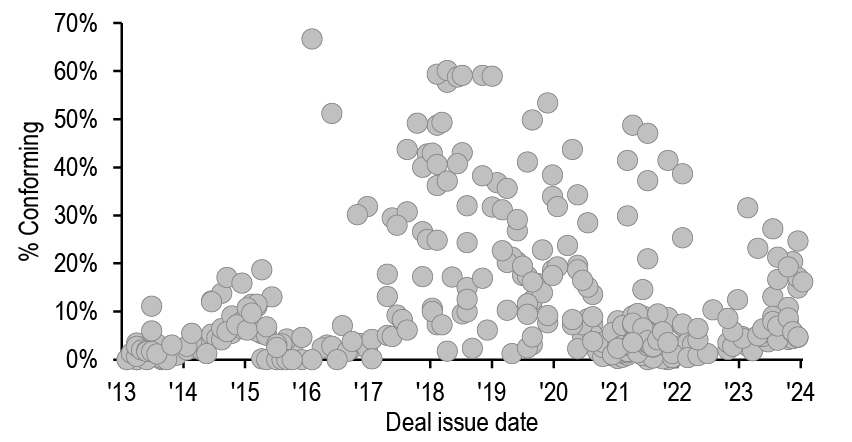

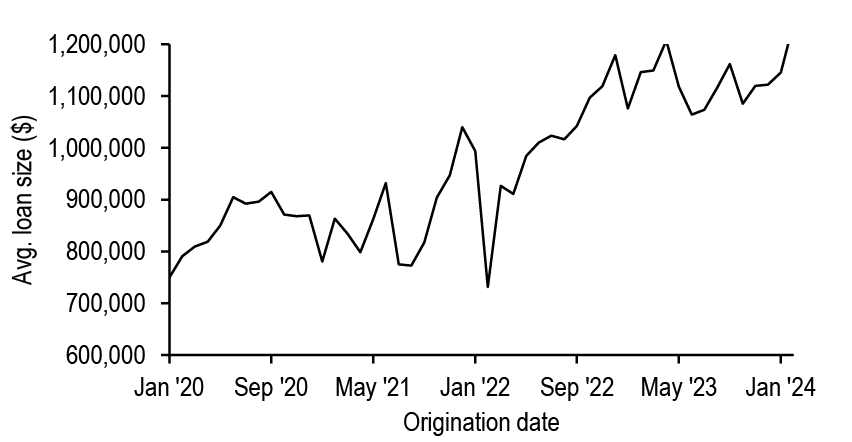

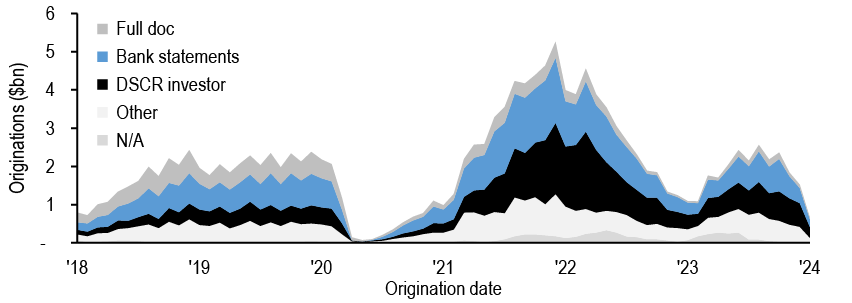

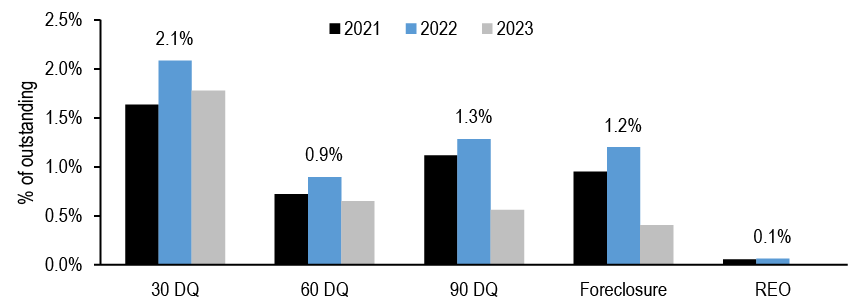

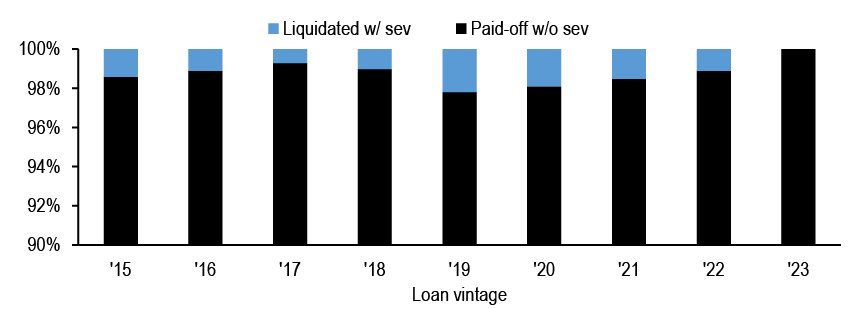

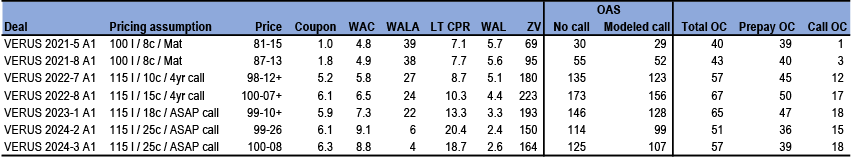

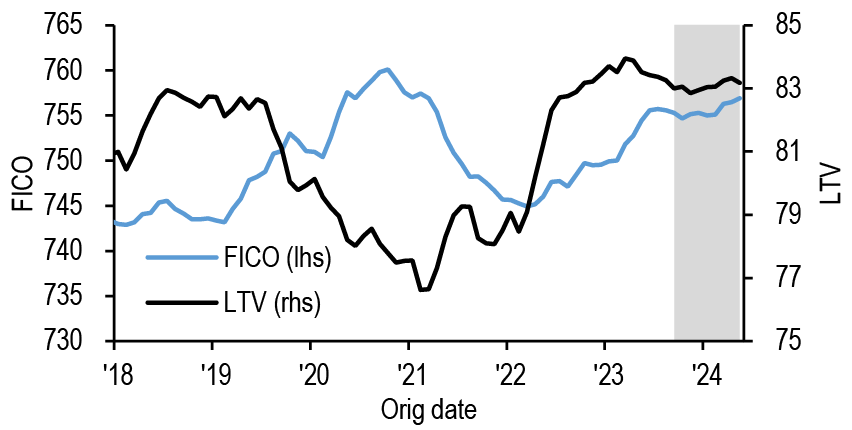

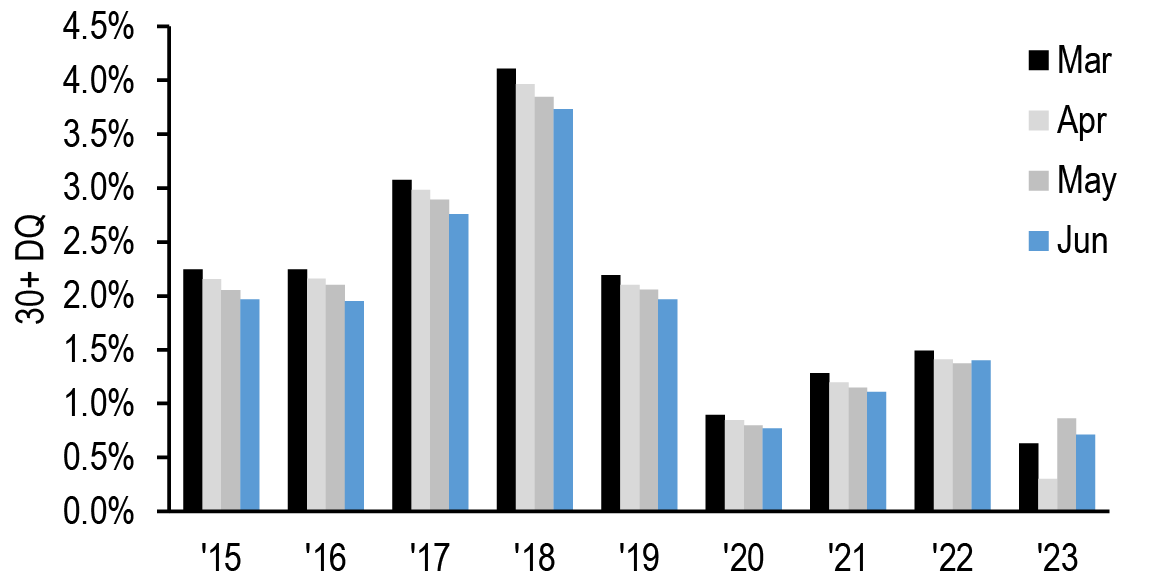

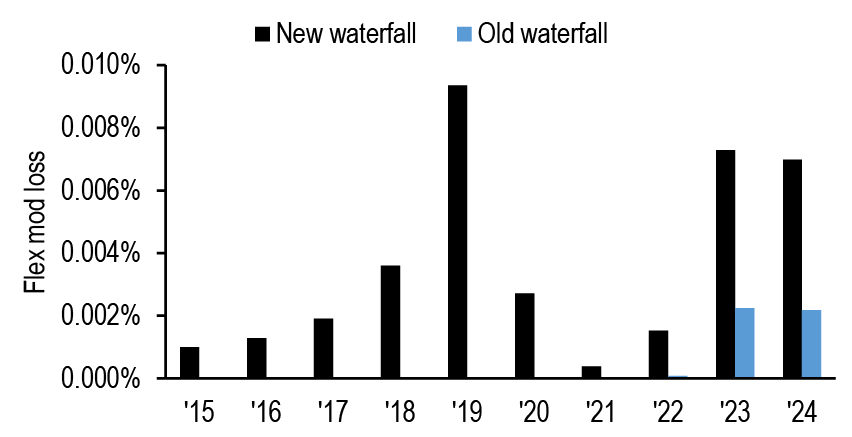

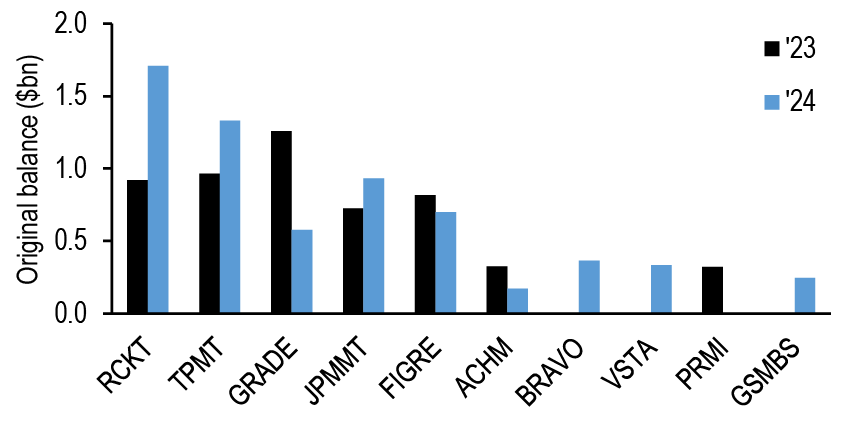

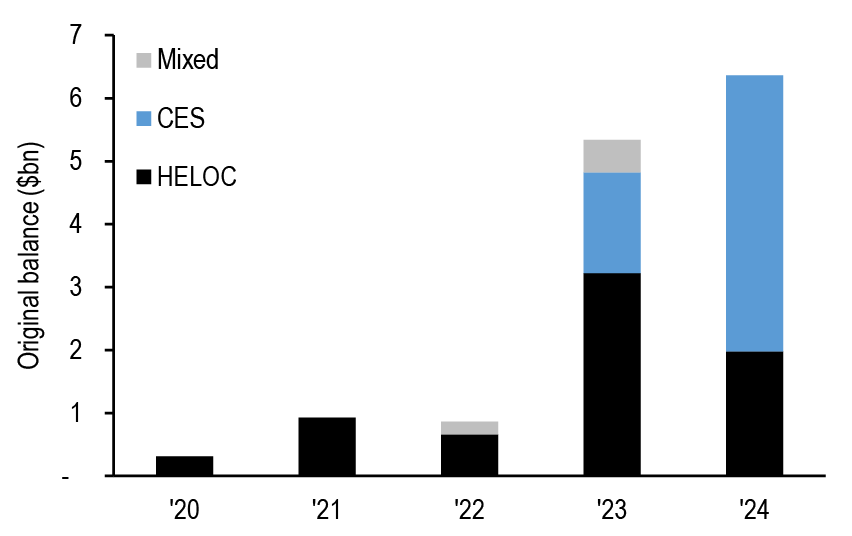

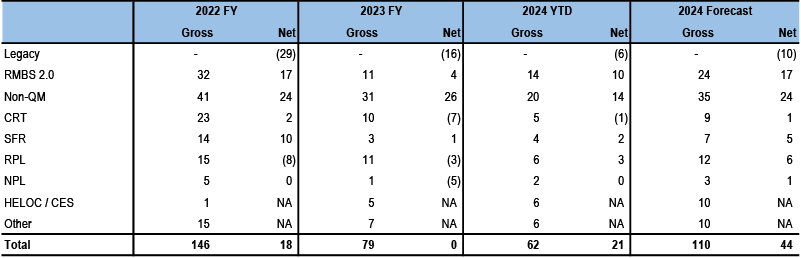

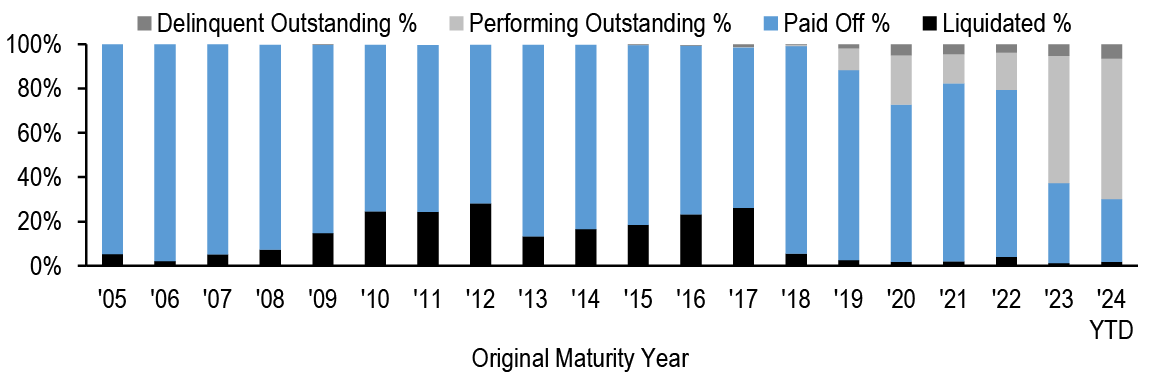

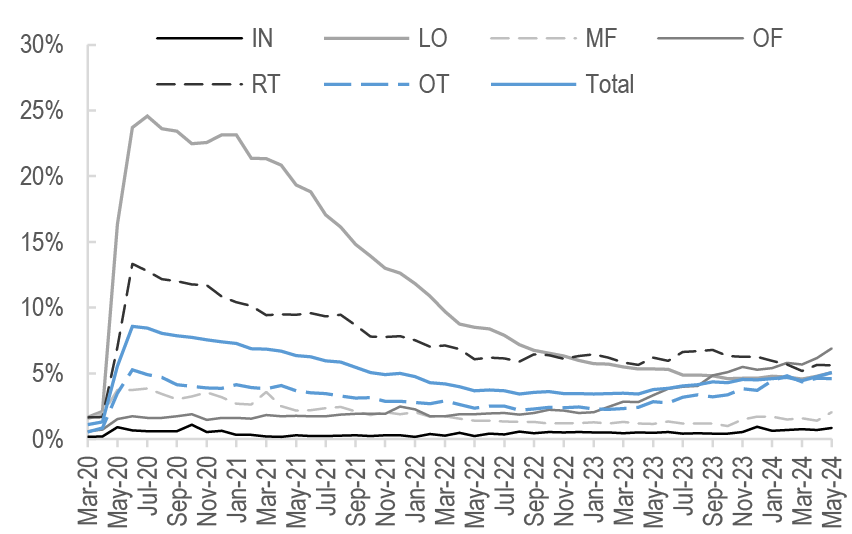

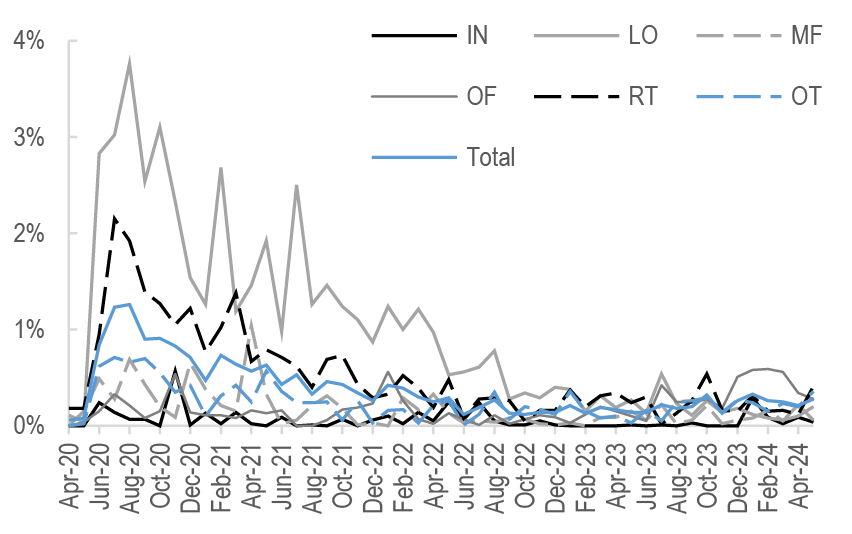

Mortgage credit spreads continued their tightening trend in the first half of the year but are bouncing back and we believe a weakening economic outlook leaves room for spreads to widen more, with jumbo 2.0 pass-through spreads softening to 1-12 back, nearer to 70 TOAS. Our empirical models favor non-QM over TBA 7s, although investors could be hesitant with very few and largely untested prepayment models for the product. We see non-QM spreads widening back out to 150-175bp on slower demand. Looking ahead, we think strong fundamentals are fully priced in and we expect mortgage credit to be more rangebound. While the top of the capital structure appears to have room to widen, technicals in the form of a limited supply of mortgage credit could keep spreads a bit firmer. Calls and tenders in CRT have most investors looking at the bonds as having a 5yr (or shorter) maturity. We continue to think the extra home appreciation and call/tender potential of ‘21/‘22 vintage CRT B2 spreads make them cheap to new issue collateral which benefits from increased credit enhancement. On the regulatory front, the FHFA approved the Freddie proposal for closed-end second liens, but only allows the agency to purchase $2.5bn over the next 18 months, significantly below initial expectations. On the housing side, we revise our home price forecast higher to 5.5% for 2024, but note risks to the upside as we head into the seasonally strong summer months ( Figure 10). Supply remains constrained and while builders are already pulling back on forward builds, they will likely suffer if rates remain elevated well into 2025 (see RMBS).

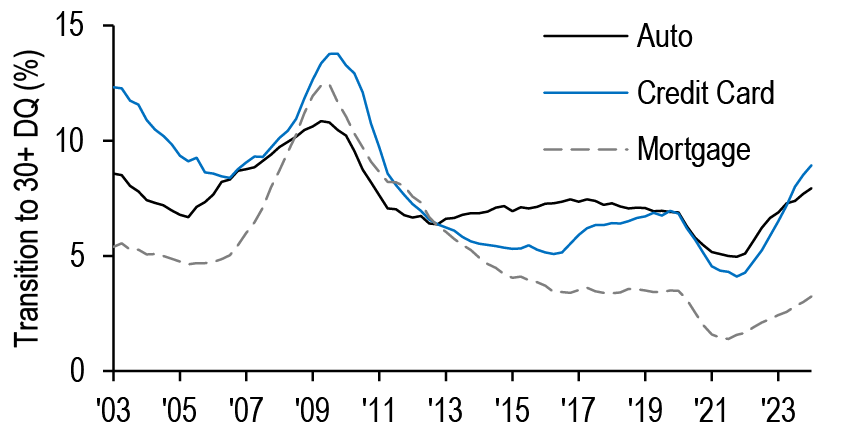

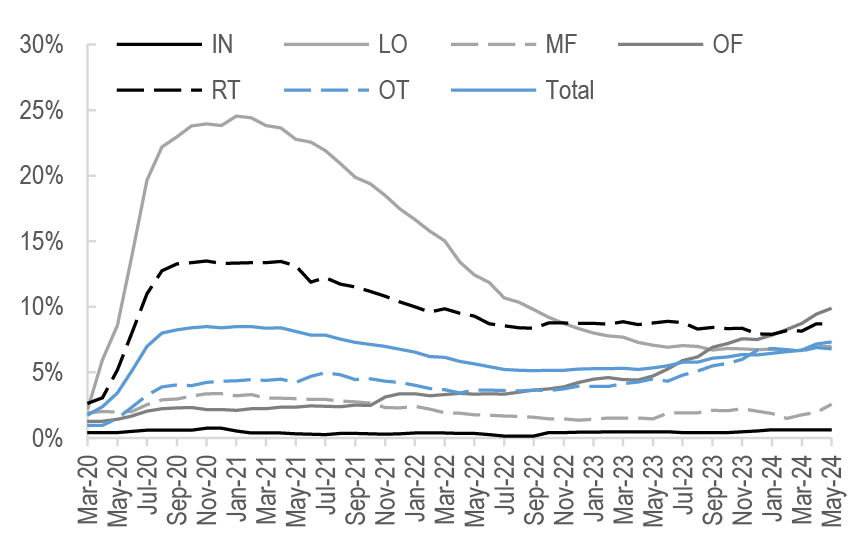

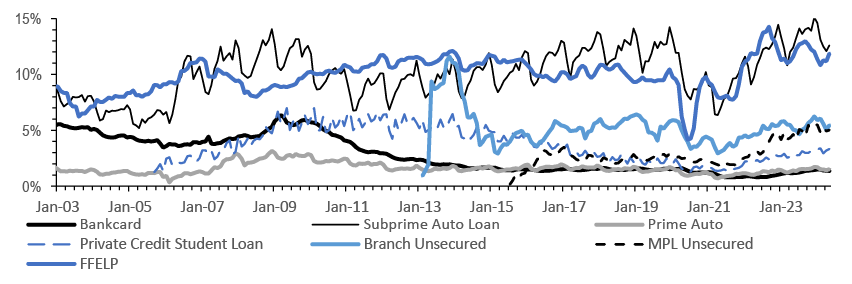

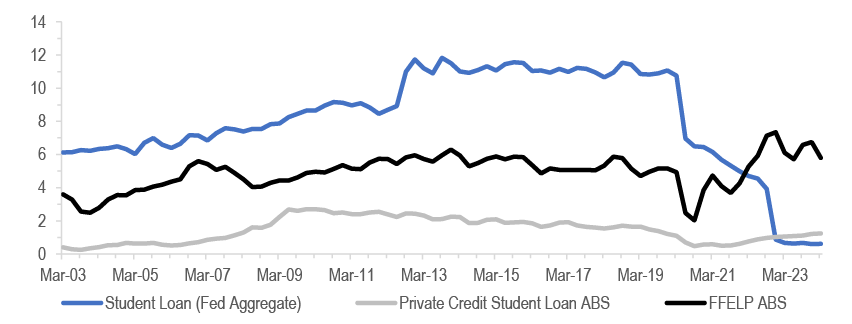

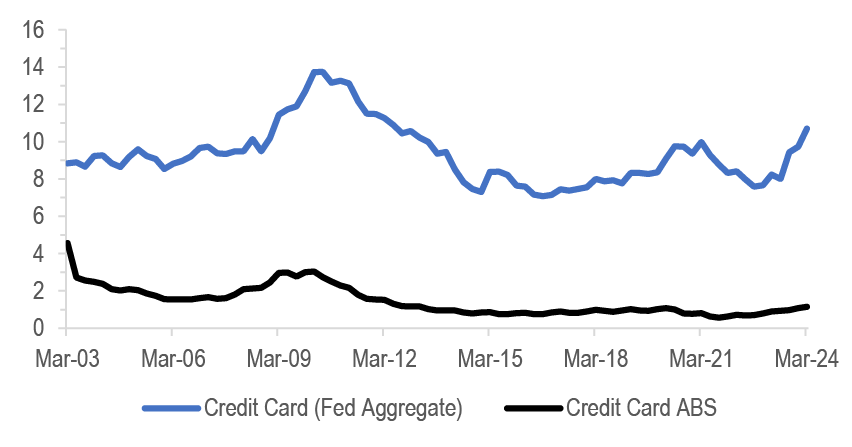

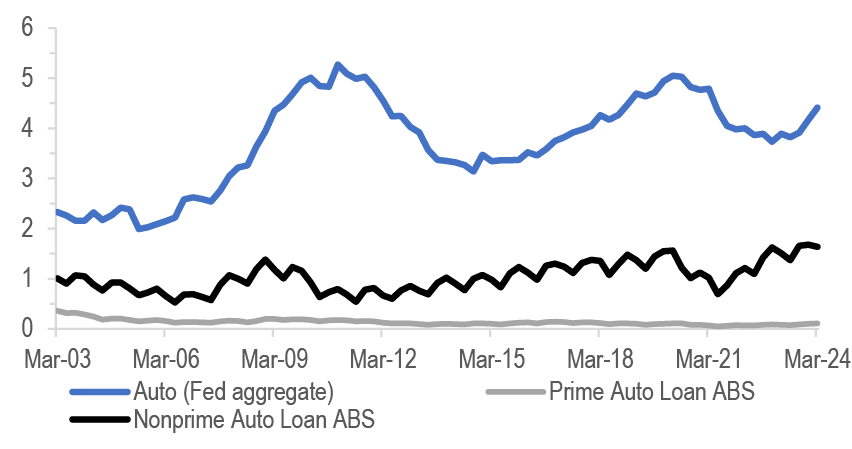

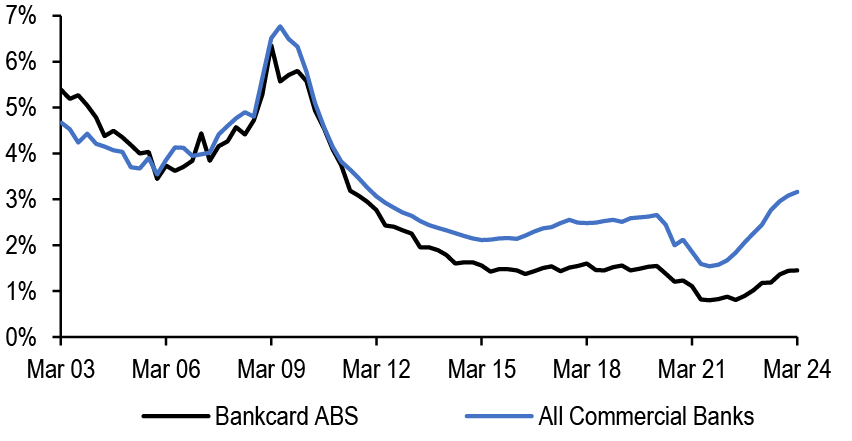

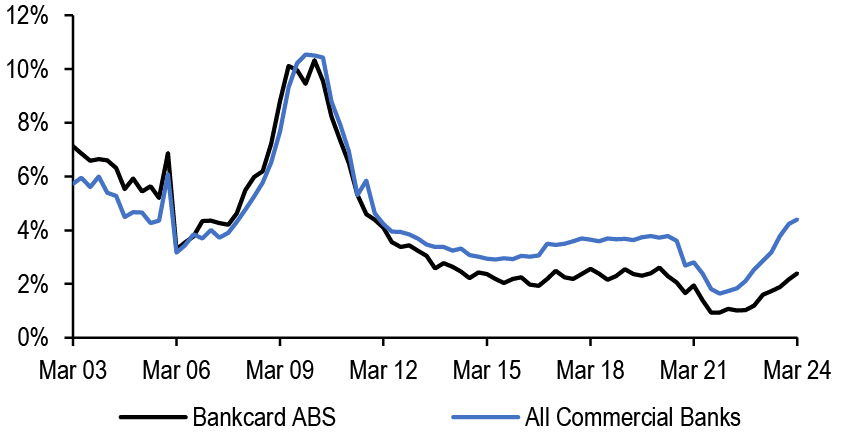

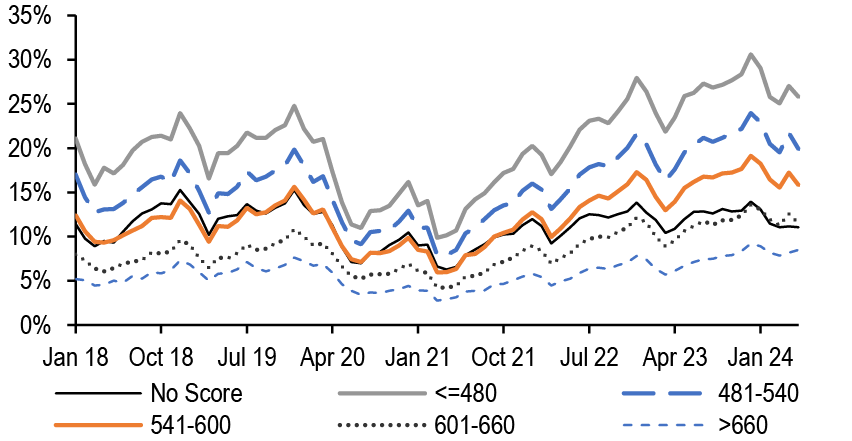

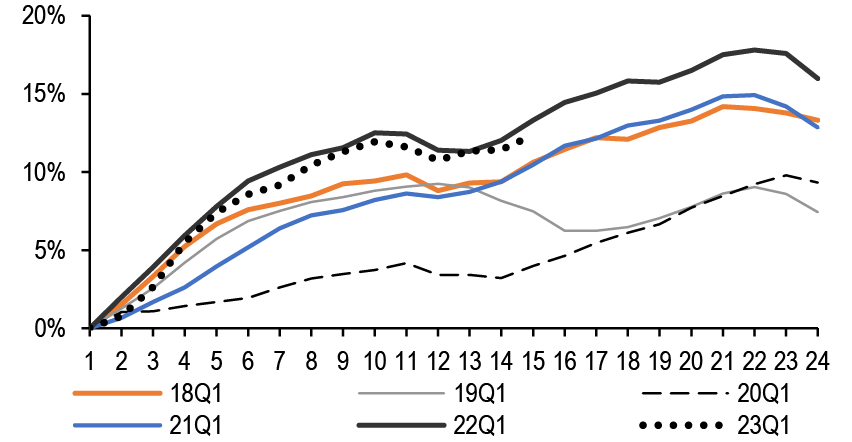

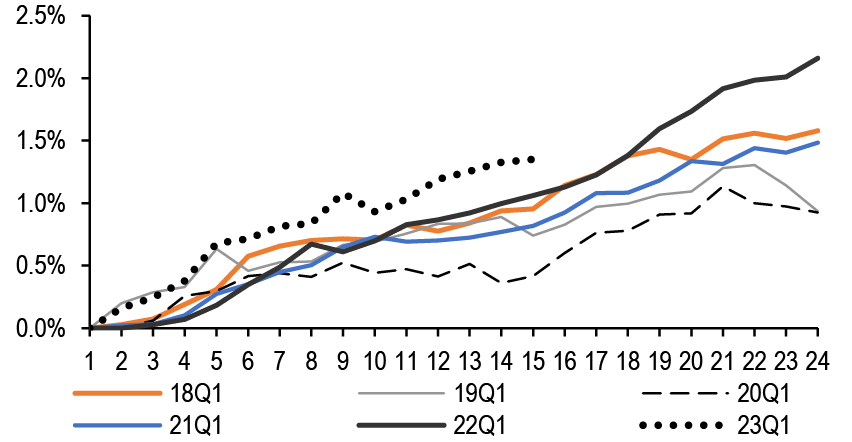

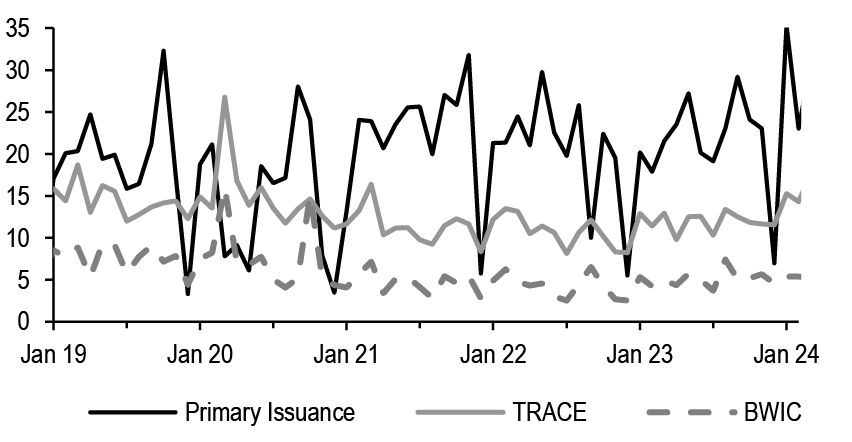

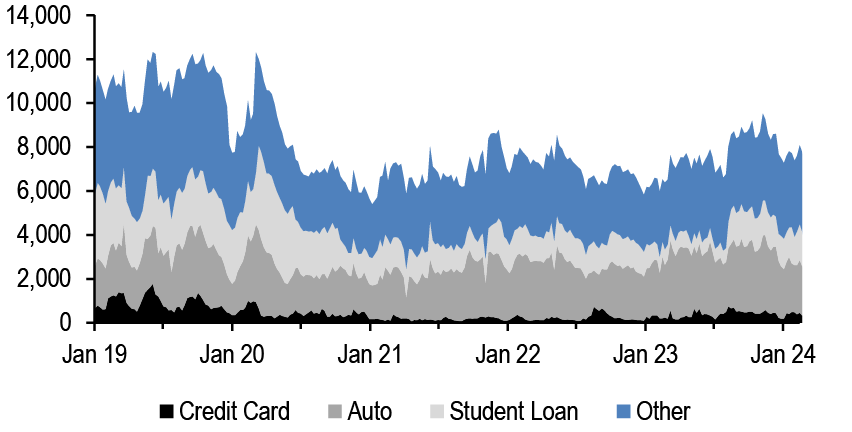

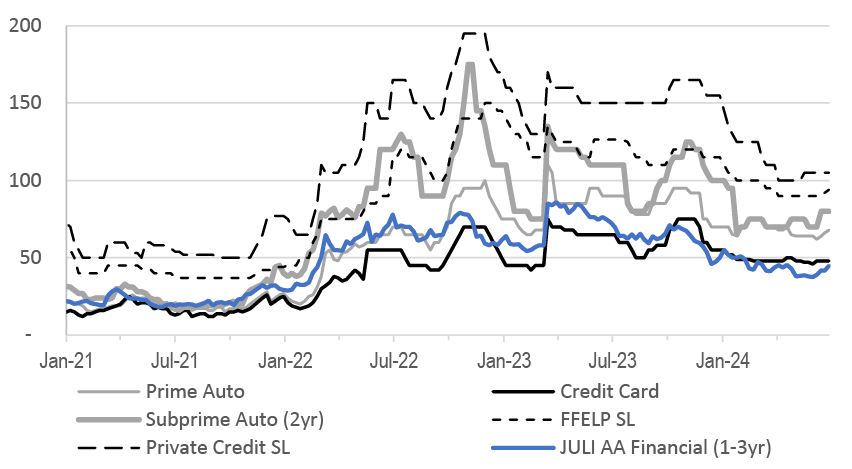

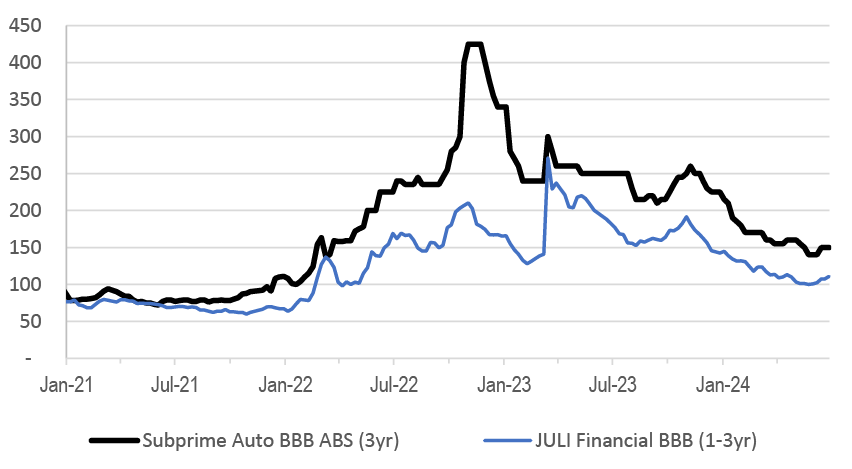

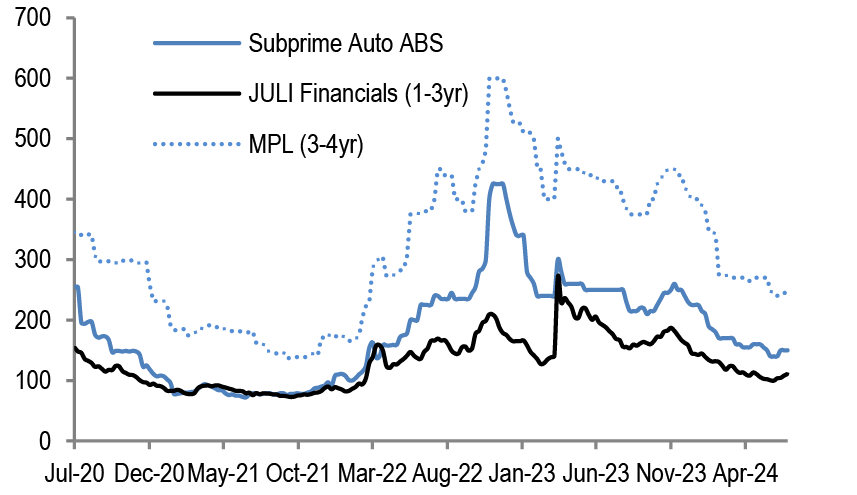

We look for the ABS market to finish 2024 with record new issue supply, spreads at the tight end of their two-year ranges and solid structures against minor underlying credit deterioration. We have seen some deterioration in credit quality, with delinquencies rising in auto and credit card debt among lower FICO borrowers indicating some stress for low-end consumers ( Figure 11). That said, ABS is often much better than what sits on bank balance sheets given heavy concentration among prime borrowers with seasoned accounts. Looking ahead, we expect minimal further deterioration if our 4.1% 4Q24 unemployment rate forecast is realized. We expect ABS spreads to reach the tights of their two-year ranges, with our indicative 3-year AAA credit card ABS at Treasury + 40bp and 3-year BBB subprime auto ABS at +135bp. We could see downside risk stemming from heavy supply in 2H24 and investor fatigue. However we note that even after the 1H24 rally, ABS still offers pickup versus comparable corporates and we think AAA benchmark bankcard and prime auto loan ABS should lead this spread narrowing given their history of solid credit fundamentals. Our top pick is AAA 3-year private credit student loan ABS which offers significant spread concession, has a robust capital structure, and reflects high underlying asset collateral (see ABS).

Figure 10: We expect home prices will be up 5.5% in 2024

Historical and projected home price growth for the Case-Shiller HPI Index; %

Source: J.P. Morgan

Figure 11: Auto and credit card delinquencies are rising above pre-COVID levels, while mortgage delinquencies increase at a slower pace

% of 30+ delinquencies by consumer debt category; %

Source: J.P. Morgan, New York FED, Consumer Credit Panel/Equifax

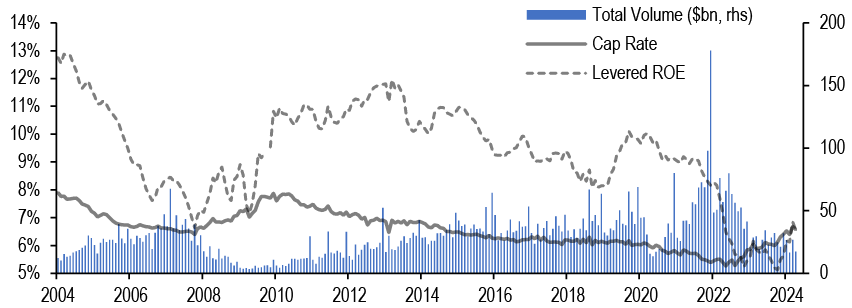

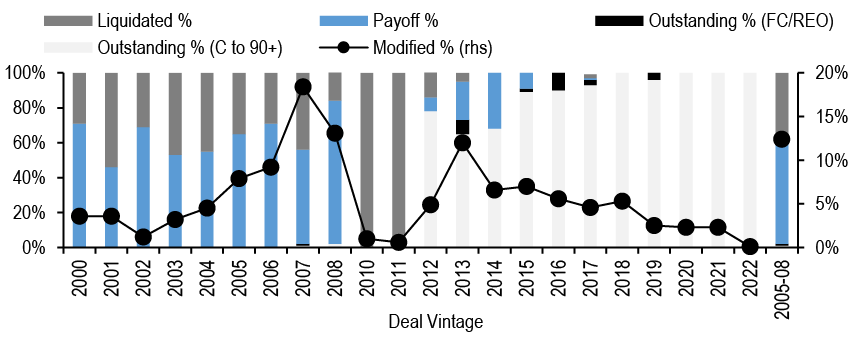

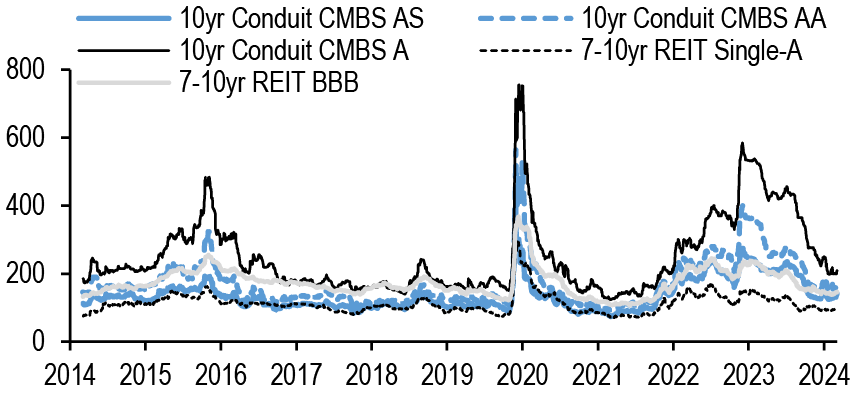

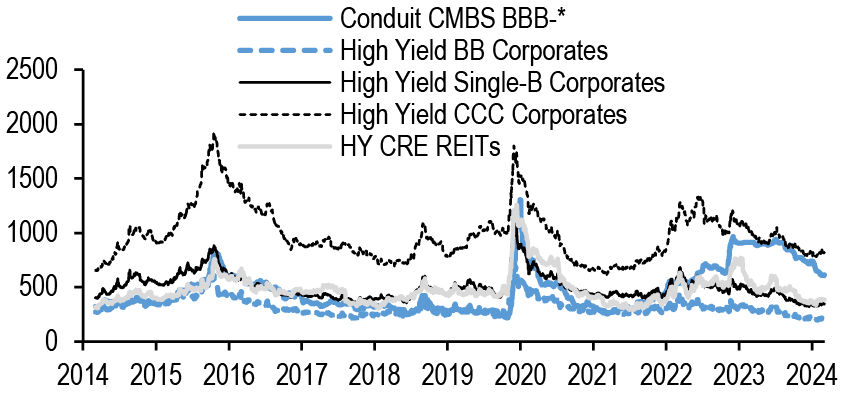

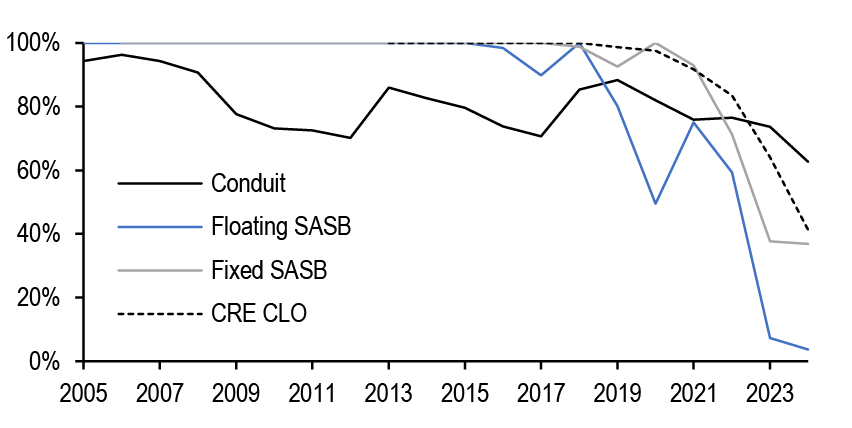

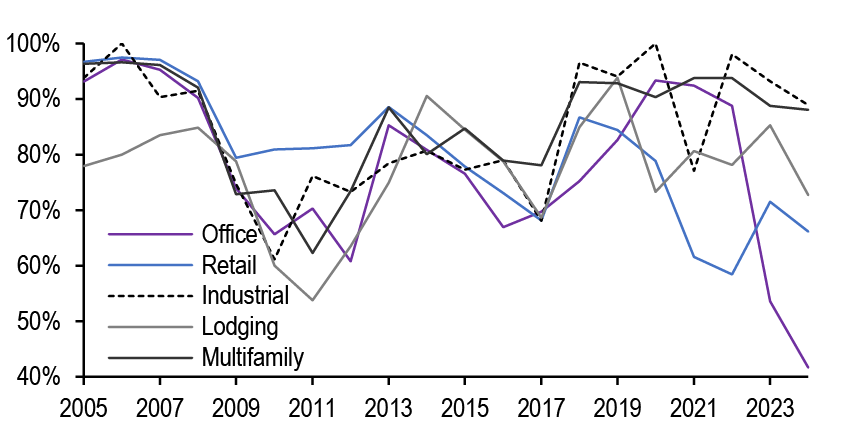

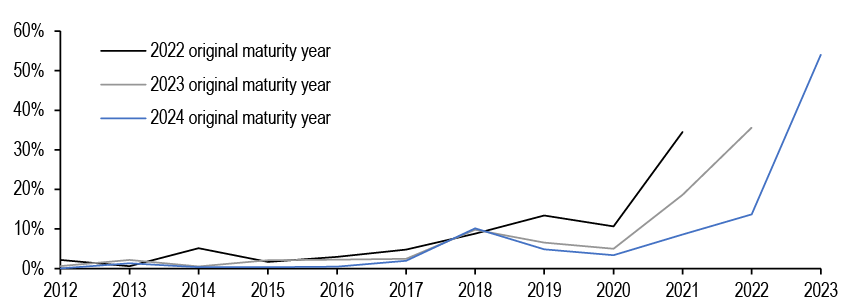

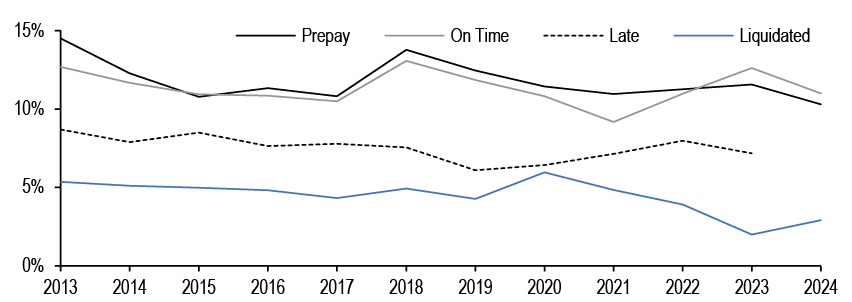

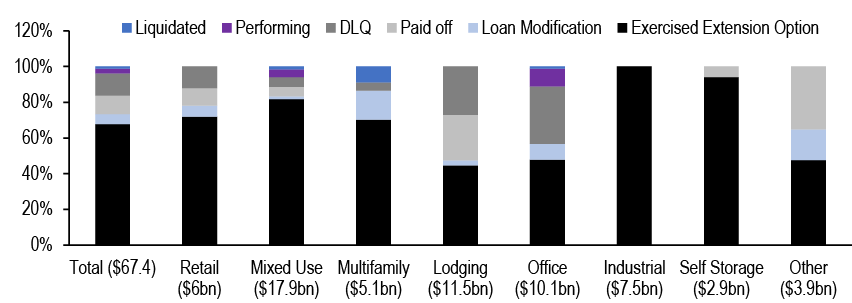

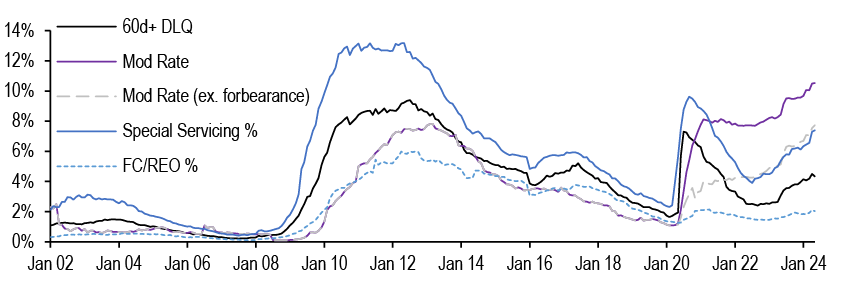

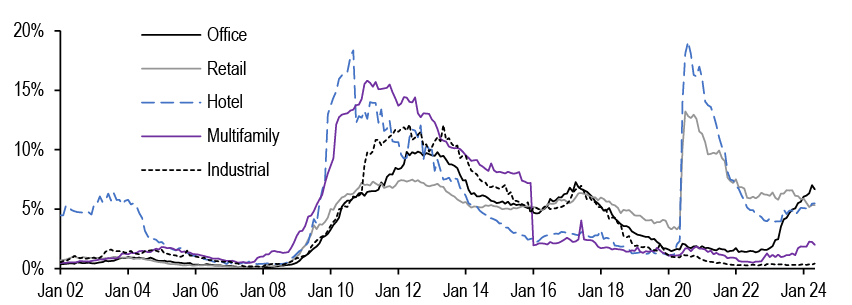

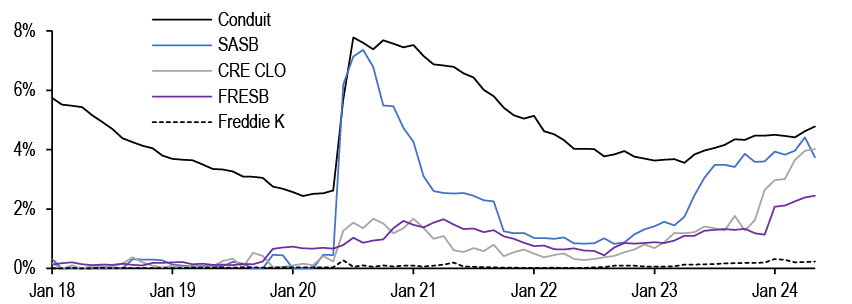

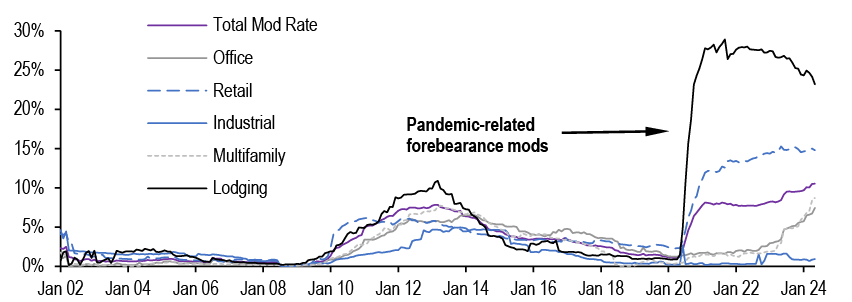

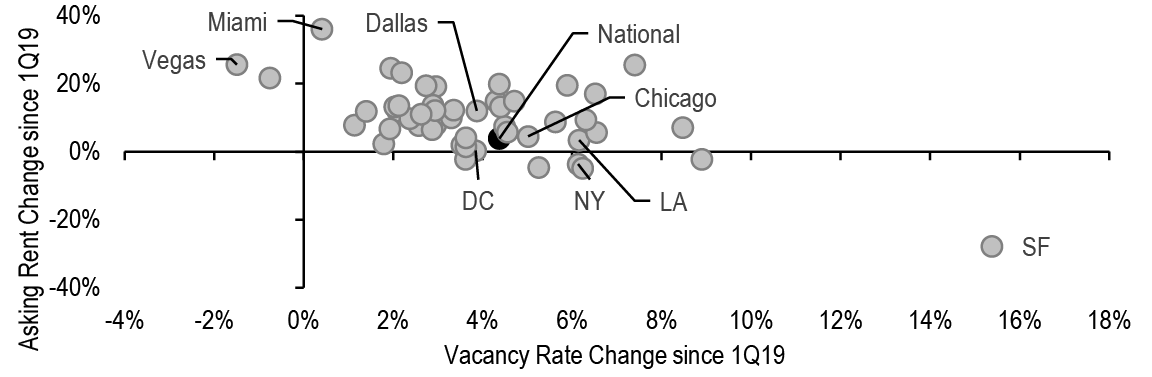

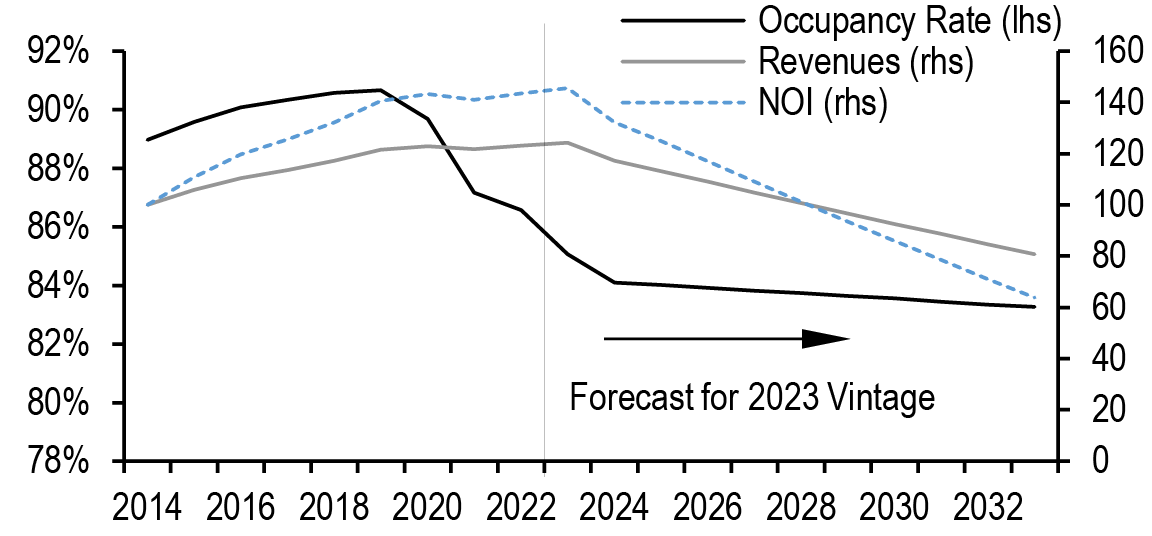

CRE transaction cap rate expansion has been muted YTD with blended cap rates across the major property types sitting roughly 6.5%. Levered return on equity (ignoring NOI growth and exit cap rates) has remained low as borrowing rates have remained high while LTV expansion has been limited, suggesting financing remains less accretive to returns relative to the past and this, in turn, has kept transaction activity low. We think cap rates can expand to 7% driven by seller capitulation if the high for longer rate narrative persists. We no longer think CMBS is trading cheap on a cross-asset perspective. The top of the conduit CMBS stack should largely avoid meaningful extensions over the medium-term as refi success rates are high, but spreads no longer look compelling to single-A corporates. The middle of the stack is more exposed to extension risk and spreads have closed to similar duration REIT bonds. Conduit BBB-s remain optically wide to HY CRE REIT bonds as investors question their relative value given thin enhancements. However there is value to be gained in the CRE space. We like floating SASB AAAs versus BLS CLO AAAs given their attractive spreads, low probability of losses, and sound collateral. We also like FRESB A10Fs versus 10yr Freddie K A2s which suffers from worse liquidity but offers better spread pickup with similar legal hard finals (see CMBS).

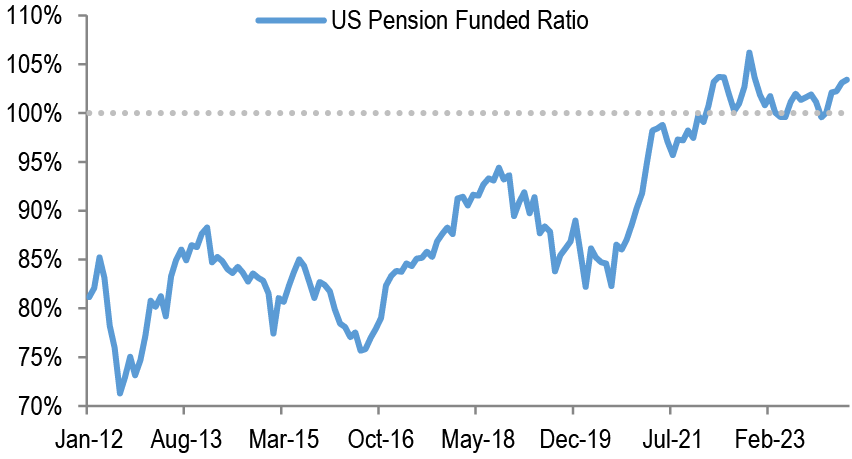

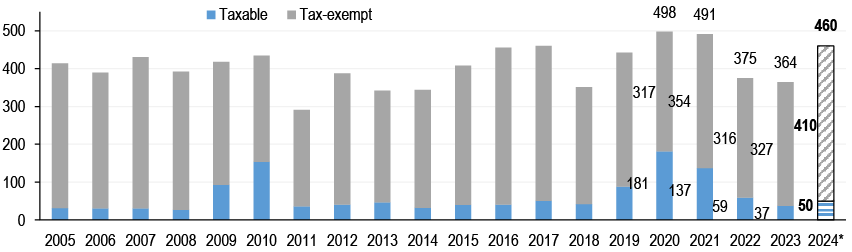

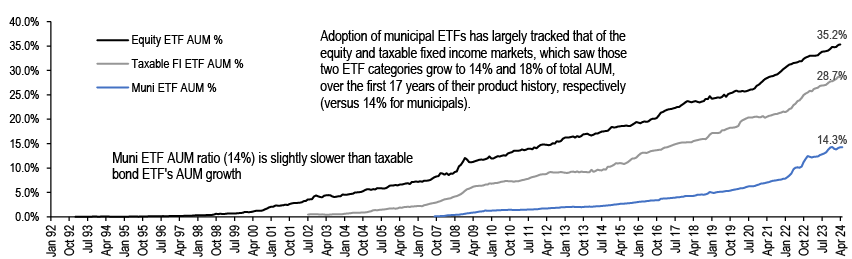

Municipals: In the municipal space we continue to favor playing the long game, and buying municipal bonds with longer term perspective, in periods where Treasuries sell off. We believe that bouts of illiquidity should be viewed as an opportunity to add idiosyncratic risk, given that a cycle turn is in the offing. We highlight that prices will be particularly vulnerable in the September/October period given an expected spike in supply as issuers look to avoid election-related market volatility. Both the slowing economy and election supply technicals should drive solid performance by year-end and slightly tighter spreads, as capital continues to chase yield. While the timing remains elusive, this should drive a sustained bull steepening of the curve and lead to inflows across municipal fund complexes, thus driving continued demand for yield, suggesting adding to duration, off-the-run structures, lower BBB & HY (on dips) before the Fed eases and the bull steepening takes hold (see Municipals).

Emerging markets: EM credit has outperformed local markets YTD, as EM sovereign spreads tightened 41bp (when properly adjusted for Venezuela’s index inclusion) and EM corporates tightened 58bp, for total returns of 2.2% and 3.3% respectively. Local markets have been hurt by higher yields (+40bp), while carry has helped limit the total return loss to -2.9% on local bonds in USD terms. Looking ahead, EM does not offer attractive risk/reward at the current juncture. Given a lack of risk-premia in EM assets ahead of the US election, there is an element of complacency. On the positive side of the ledger, we still think EM has good idiosyncratic carry in places where two cycles of distress have abated: an EM default cycle and an EM inflation cycle. Both were precipitated by a generational US hiking cycle and there is still some excess risk premia we think in some high yielding local and hard currency markets to exploit. Harvesting this idiosyncratic carry while remaining hedged against market beta is how we are currently recommending to position within EM. In terms of trading themes, we have OWs in Latam and EMEA EM while UW in Asia. Within EM sovereigns, we stay MW EMBIGD. Turning to EM corporates, we also remain MW given CEMBI outperformance and compressed relative spread. We prefer EM Europe and Africa HY for further spread compression and carry trades in Latam. We prefer non-financials over financials and like commodity segments (see Emerging Markets)

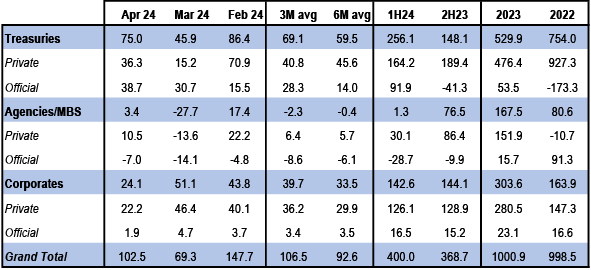

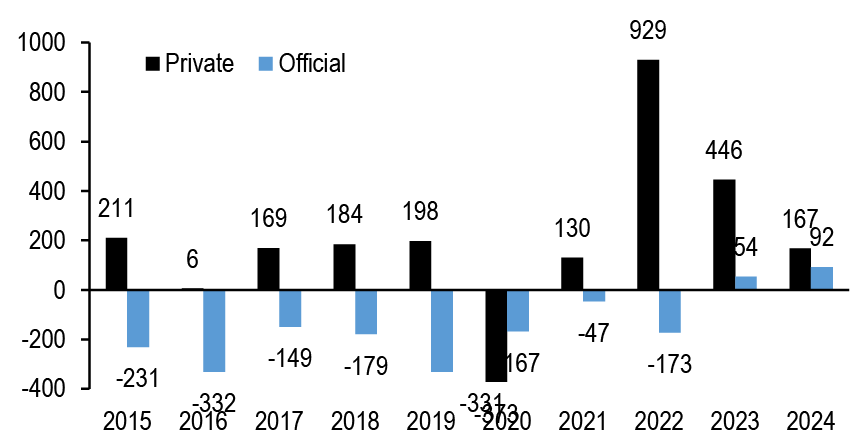

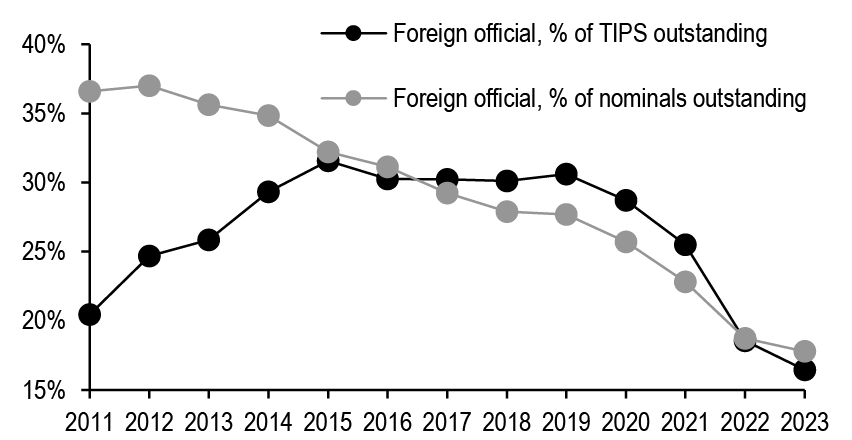

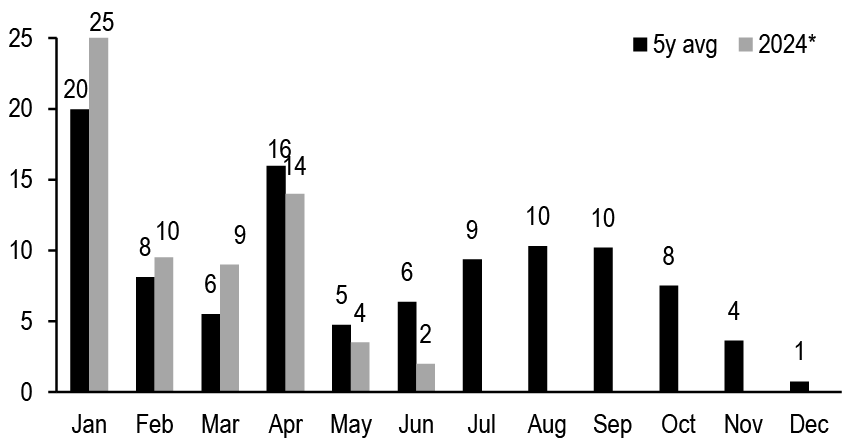

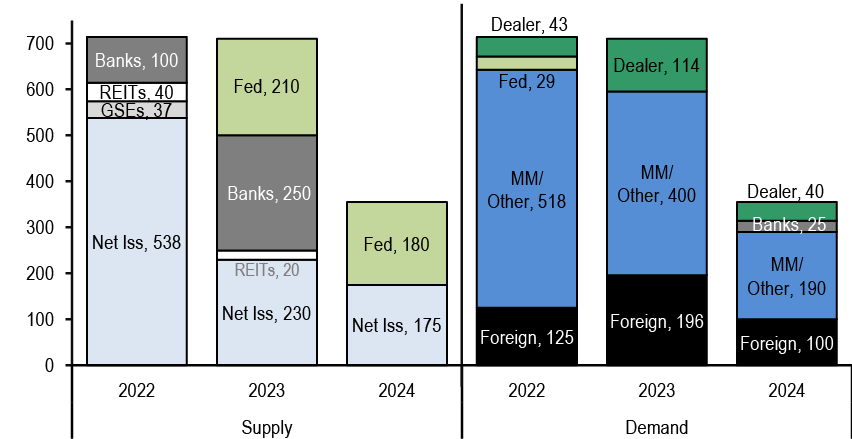

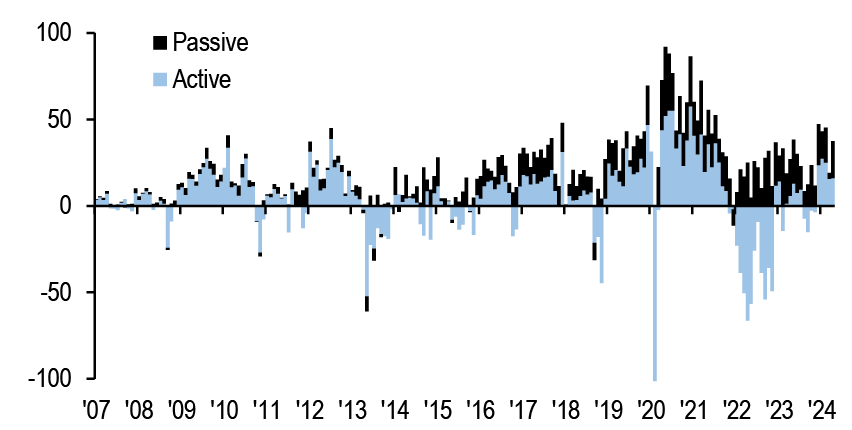

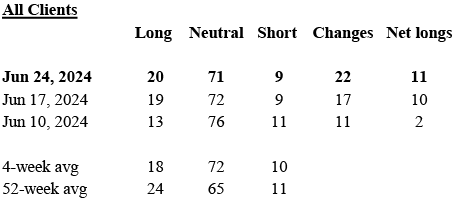

Supply & Demand update

Demand for US fixed income from abroad accelerated in 1H24 after net purchases stepped down late last year. Indeed, foreign investors purchased $400bn of long dated (>1Y) US fixed income securities through April, an increase from the $370bn bought over 2H23 but a reduction from the $630bn purchased in 1H23 ( Figure 12). Demand was once more concentrated in the foreign private sector, which represented 80% of these net purchases, with the foreign official sector contributing to the remainder. Moreover these net purchases were almost exclusively concentrated in Treasuries ($260bn) and corporates ($140bn), with foreign investors net buying only $1bn of Agencies/MBS over the course of the year to date. European investors alone account for over a third of corporate purchases but we think such demand wanes as French and UK election uncertainty combined with increasing hedging costs stemming from the recent ECB cut have helped contribute to EUR credit once more appearing attractive versus USD credit (see HG Credit Foreign Demand Monitor, Nathan Rosenbaum, 6/24/24). Meanwhile demand for Treasuries was more varied to start the year, but was mostly concentrated among investors based in Europe, Japan, and emerging markets (ex-China). We think demand will moderate over 2H24 as continued EM FX reserve drawdowns should restrain foreign official demand whereas we think some of the private demand to start the year was to position for an easing Fed.

Figure 12: Foreign investors were prolific buyers of USD corporate debt in 1H24

Net sales by US residents of long-term (>1Y to maturity) US securities to foreigners by sector, investor type*, and by month, as well as 1H24, 2H23, 2023, and 2022 totals; $bn

Source: Treasury International Capital (TIC) System, J.P. Morgan

*Excludes International Regional Organizations (IROs)

Note: Corporations include corporate ABS. Agencies/MBS is calculated as price-adjusted change in holdings

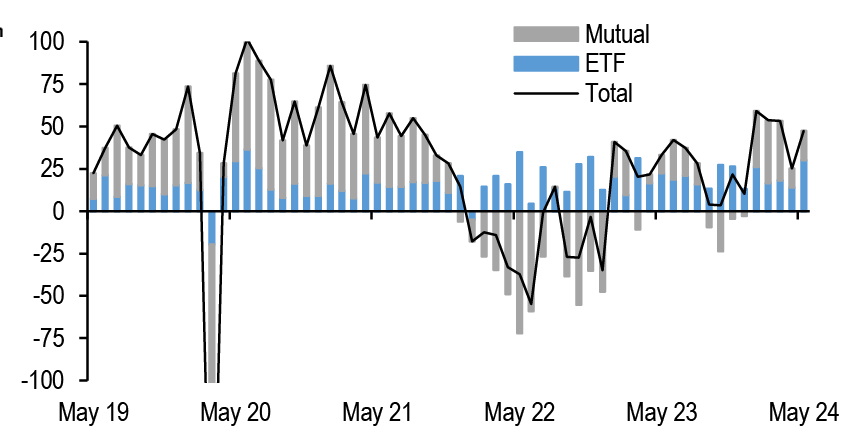

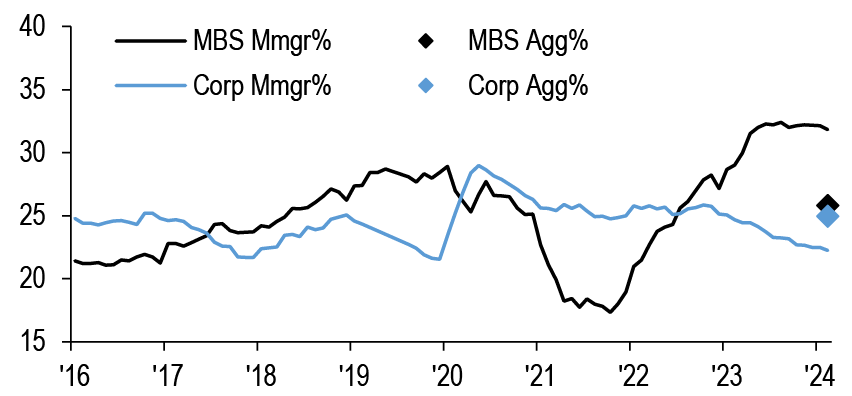

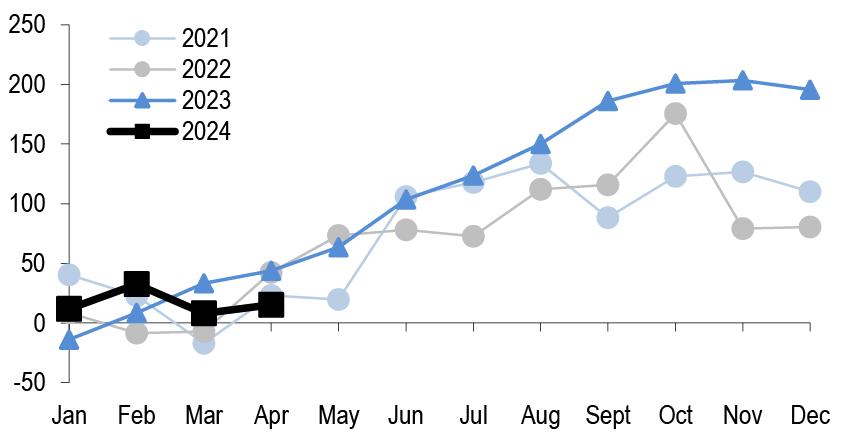

Figure 13: Bond fund inflows have been robust in 1H24

Monthly* net flows into domestic US bond funds, mutual and ETF; $bn

Source: EPFR, J.P. Morgan

*Data through May

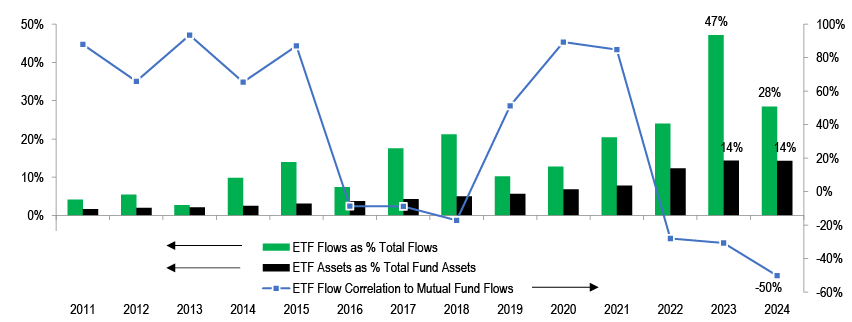

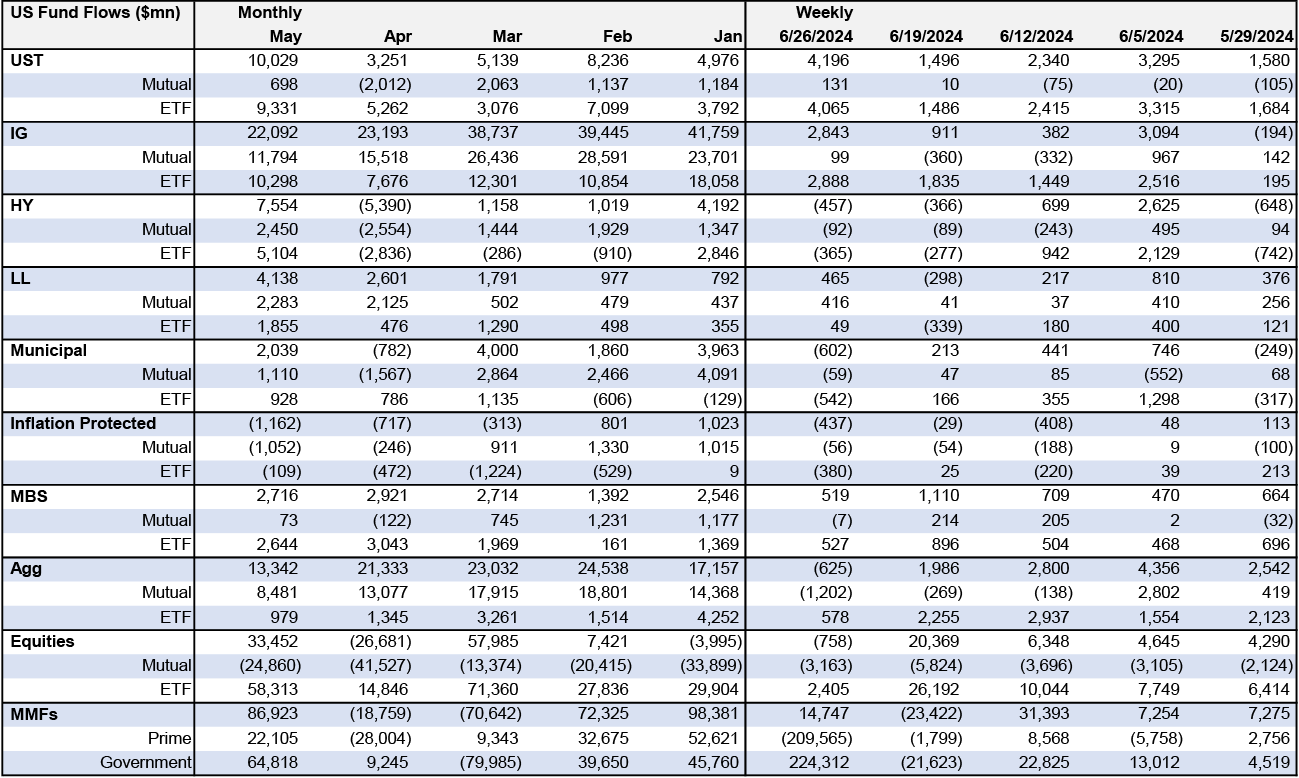

Mutual funds and ETFs continue to remain a strong source of demand for fixed income thus far in 2024 ( Figure 13). As of May, bond funds have accumulated roughly $240bn of inflows (+3.9% of YE23 AUM), compared to $300bn of inflows over the course of 2023 (+4.4% of YE22 AUM), and this represents the second largest 1H intake of inflows in dollar terms and third largest in %-age of AUM terms over the past decade. Inflows have been predominantly skewed towards Agg and IG credit funds. Much of this growth came early in the year as the combination of elevated yields, expectations of near-term Fed easing, and lagging returns from the 4Q23 rally led to a surge in retail inflows. As we look ahead, inflation uncertainty and rangebound yields are likely to keep inflows modest over the summer and will likely only pick up alongside the Fed easing cycle if the economy softens materially. Indeed we have previously shown that more prolonged and deeper easing cycles, which are often associated with worse economic recessions, see a more pronounced increase in the volume and duration of inflows as retail flows follow returns and seek safety (see Overview, U.S. Fixed Income Markets Weekly, 12/15/23).

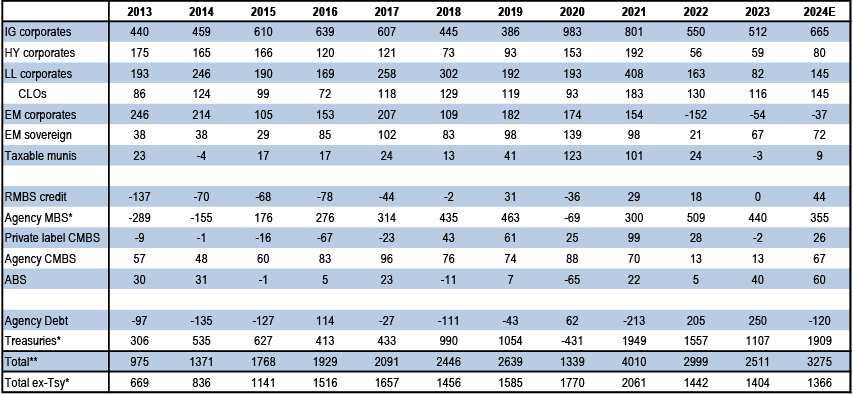

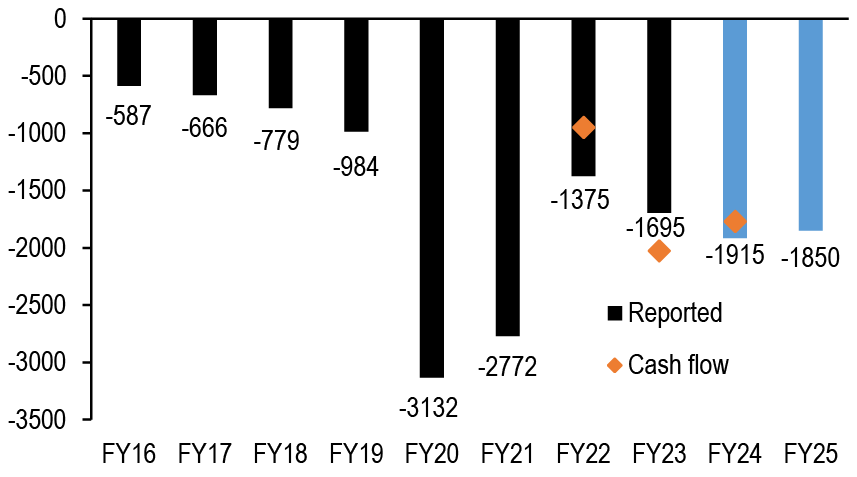

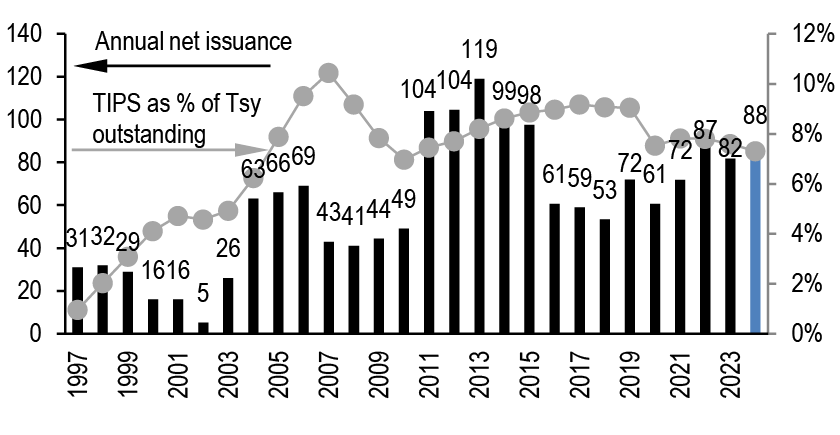

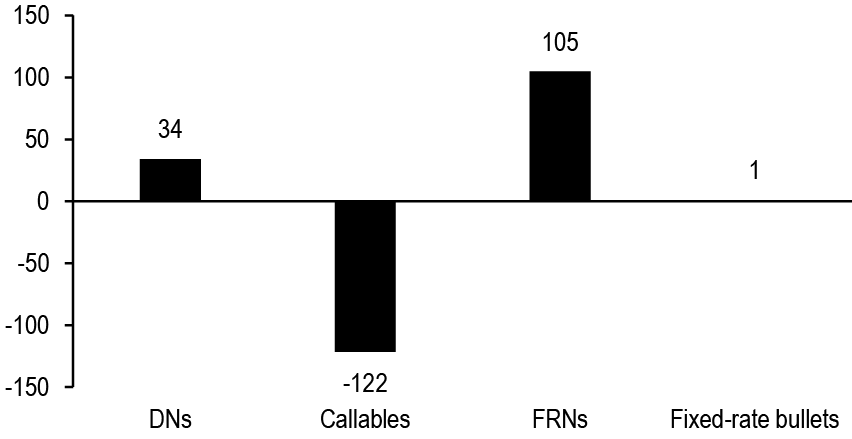

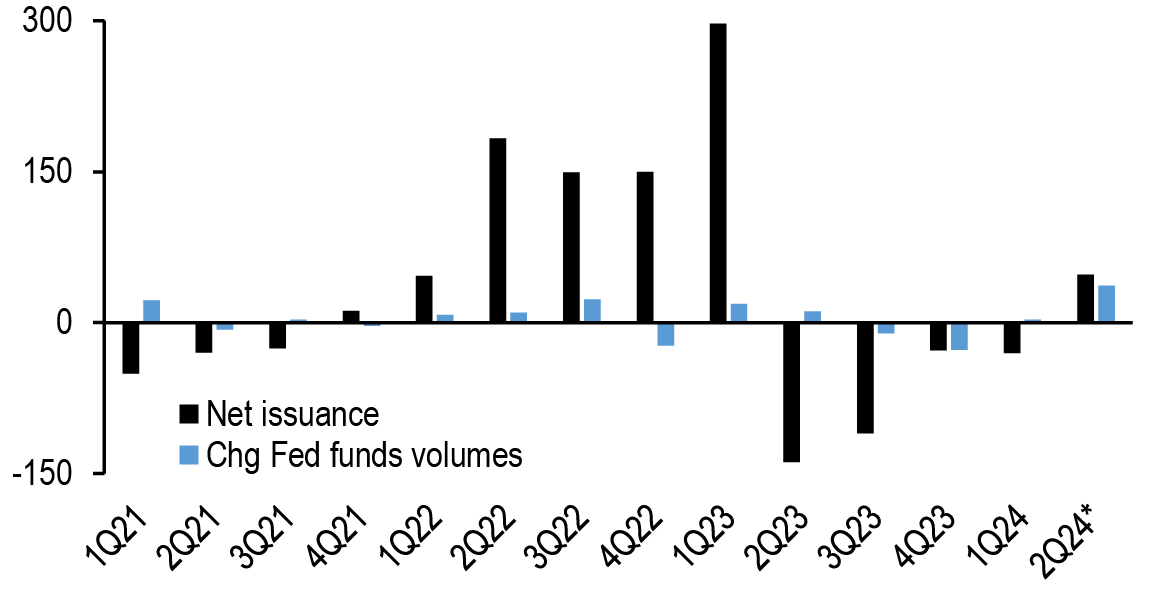

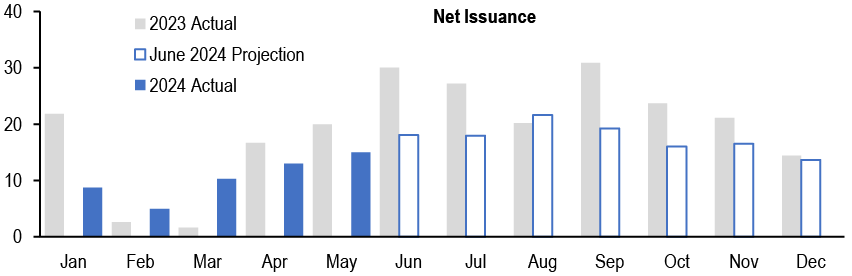

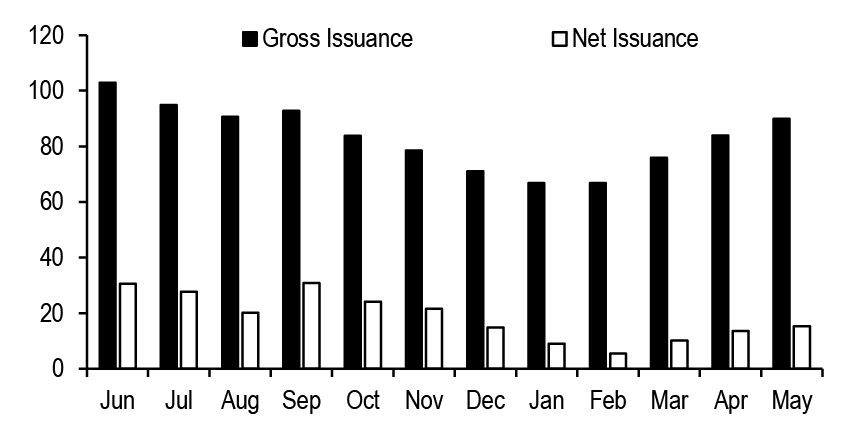

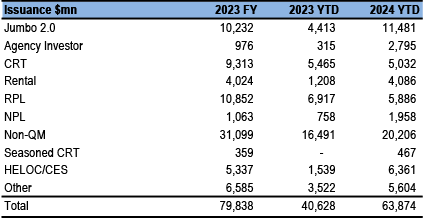

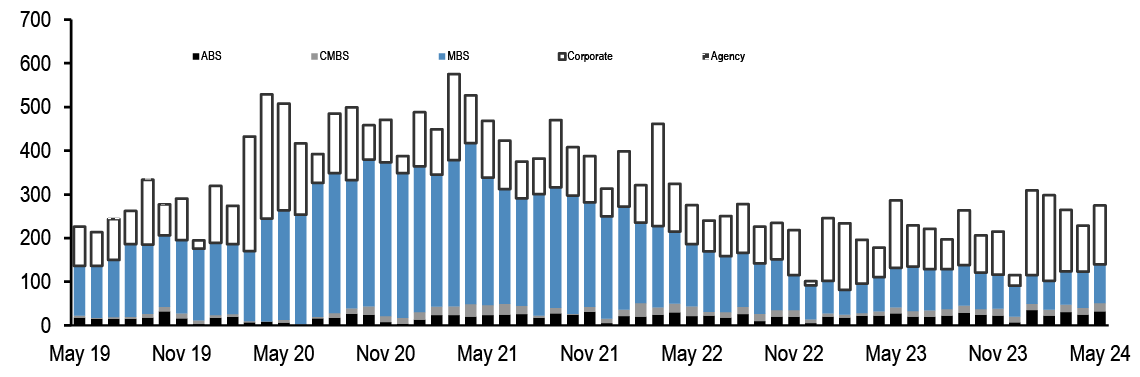

Turning to supply, we have updated our 2024 cross-sector fixed income net issuance forecast since our last supply update in March ( Figure 14). We now see a total of $3.275tn in fixed income net issuance for 2024 (from $3.05tn previously), which would make for an increase of over $760bn in net supply from 2023. The primary driver behind this upward revision is IG corporate credit, which we revised up by $127bn to $665bn, though supply should moderate from here relative to the rapid pace of 1H24, a seasonal dynamic likely to be accentuated by the US election. Other products with substantial upward revisions include emerging markets (+$54bn), ABS (+$40bn), and leveraged loan corporates (+$25bn), and we now expect this year’s ex-Treasury net supply to come pretty close to matching that of 2023.

Figure 14: We revise higher our total US fixed income net issuance forecast by $225bn to $3.275tn, driven primarily by an increase in IG corporate supply

Historical and J.P. Morgan forecast for long-term (>1Y) net issuance in 2024; $bn

Source: J.P. Morgan, Dealogic, Bloomberg Finance L.P., Bond Radar, Commercial Mortgage Alert, INTEX, FNMA, FHLMC, FHLB, GNMA, LoanPerformance, US Treasury, Thomson SDC, S&P, SIFMA, Trepp

* Net of Fed purchases

** The CLOs row is not included in the totals to avoid double-counting

Notes: For IG, net issuance figures exclude EM corporates. HY net issuance is calculated as gross issuance – refis, and LL net issuance is calculated as gross issuance – refis – repricings. For CLOs, figures represent US Arbitrage CLOs only. EM corporates includes IG, HY, and quasi-sovereigns and is only net USD issuance. Additionally, the issuance is adjusted for tender/buyback/call activity. EM sovereign figures reflect net USD issuance only, which is calculated using the historical average of 80% of total net issuance. Muni figures reflect taxable munis and muni corporate bonds with municipal industry codes. RMBS credit includes the following sectors: legacy, jumbo 2.0, non-QM, CRT, SFR and RPL/NPL. ABS includes all maturities. Agency debt includes FNMA, FHLMC, and FHLB. Treasuries includes TIPS and represents net issuance to the public.

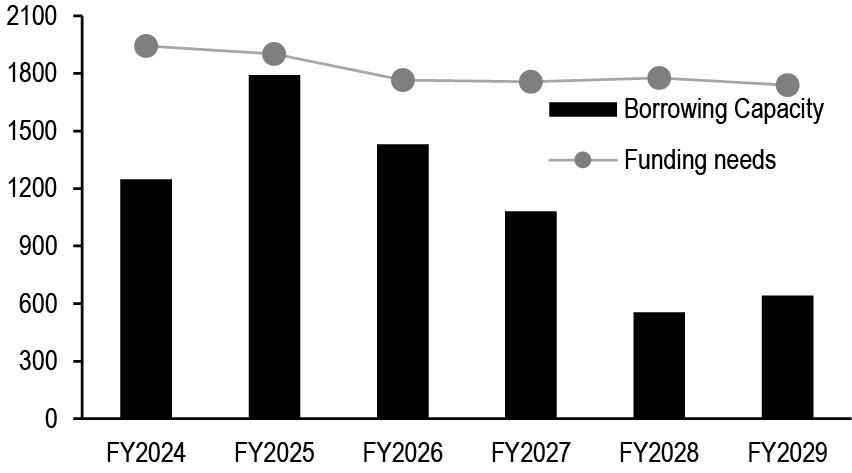

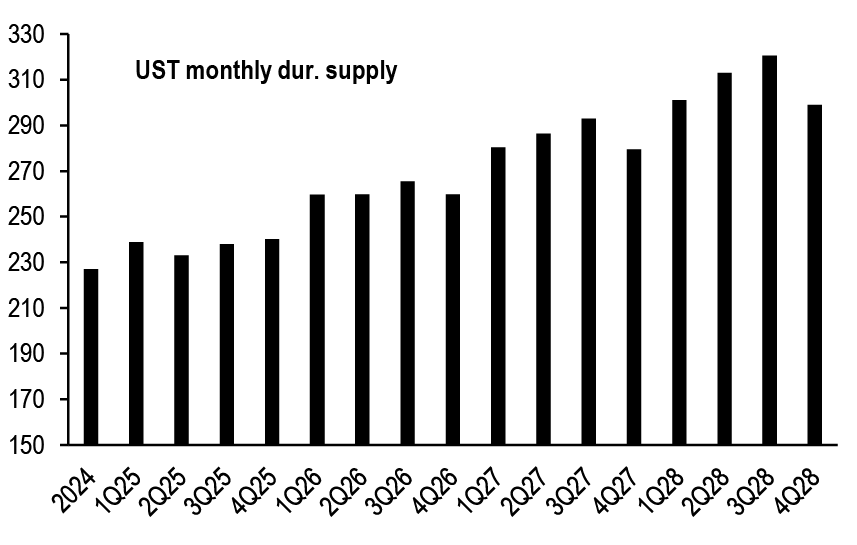

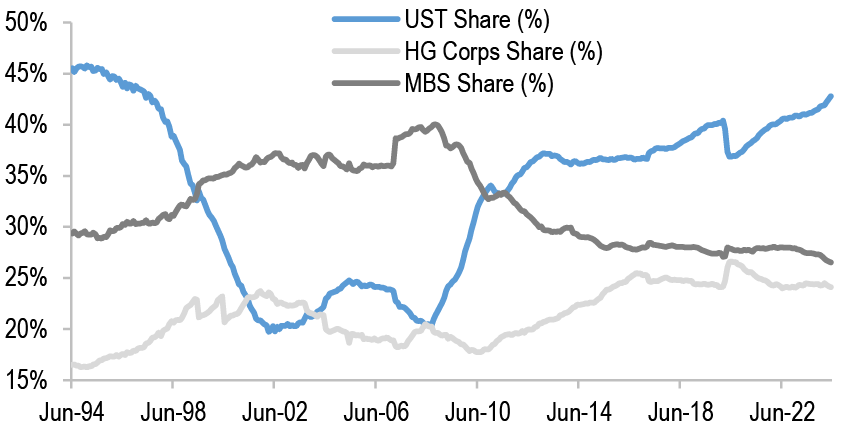

While most of the changes stem from the spread side of the fixed income universe, we would be remiss to not discuss the evolving outlook for Treasury supply. In recent years Treasuries’ share of annual net US fixed income issuance has ballooned from an average 31% in the five years proceeding the pandemic to a projected 58% in 2024. Indeed we forecast $1.9tn net long-term Treasury supply in 2024, nearly unchanged from our initial estimate in November but roughly $800bn larger than in 2023. Given the increases in auction sizes over the last year, Treasury created approximately $600bn in additional borrowing capacity for FY25 relative to FY24. Accordingly, we see no need for Treasury to make any further changes to auction sizes this year. However, we estimate Treasury will have to address a financing gap of approximately $3.3tn from FY26-FY29, and we estimate auction sizes will begin increasing again in 4Q25 (see Wait till next year: Dissecting Treasury’s financing needs in the coming years, Jay Barry, 5/24/24).

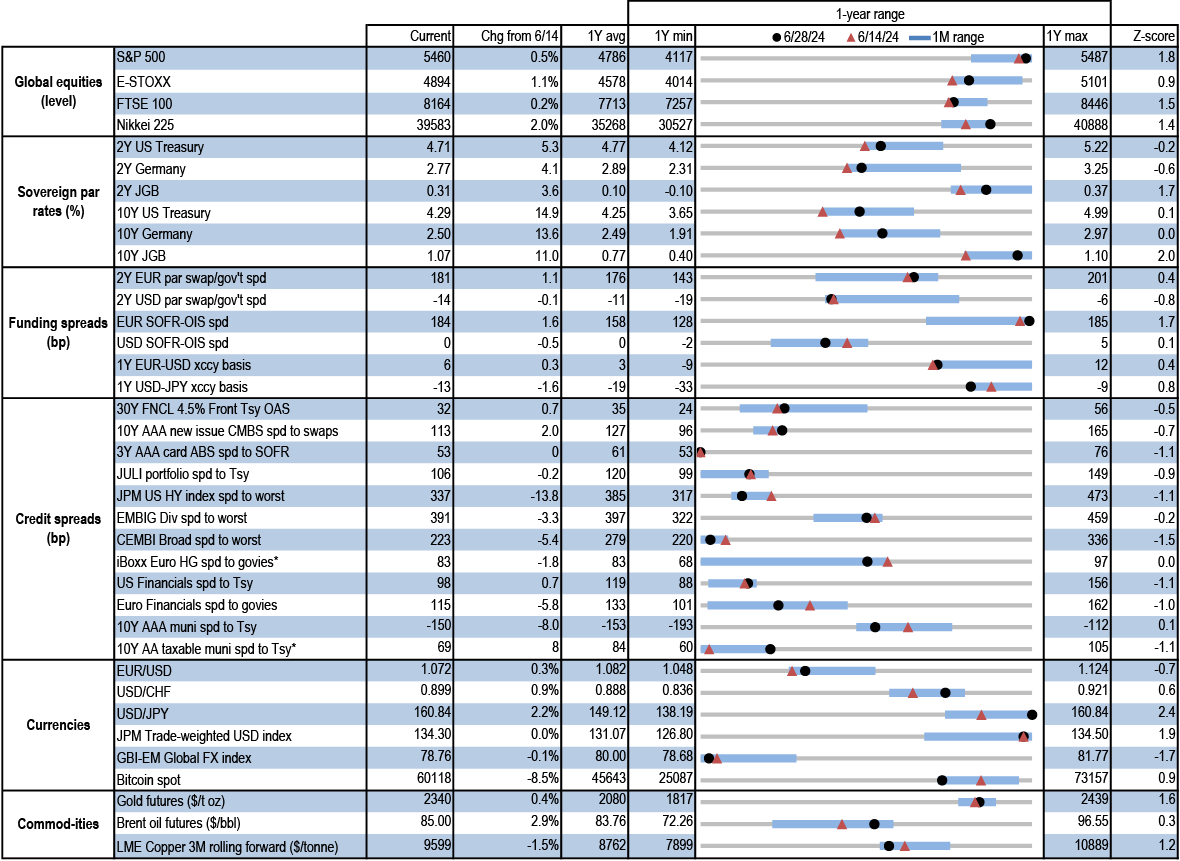

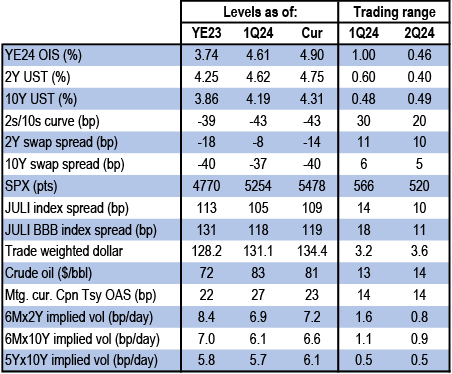

Cross Sector Monitor

Figure 15: Treasury yields rose and credit and mortgage spreads tightened over the week

Current levels, change since 6/14/24, 1-year average, minimum, maximum, and current z-score for various market variables; units as indicated

Source: J.P. Morgan, Bloomberg Finance L.P., ICE, IHS Markit

* 6/27/24 levels for iBoxx Euro HG and AA taxable munis; 6/28/24 levels for all others

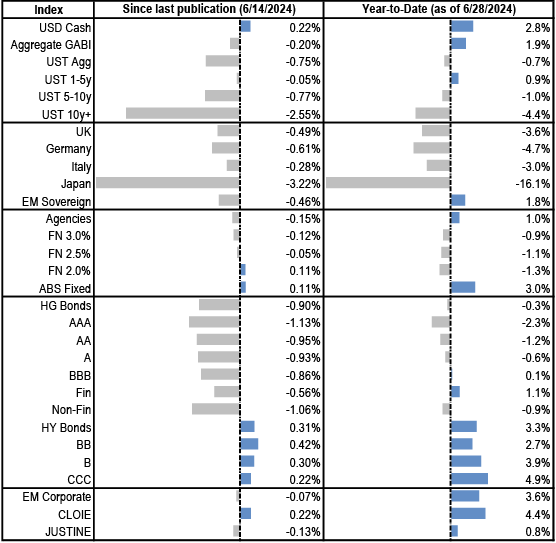

Figure 16: YTD returns on various fixed income indices; %

Source: J.P. Morgan

Economics

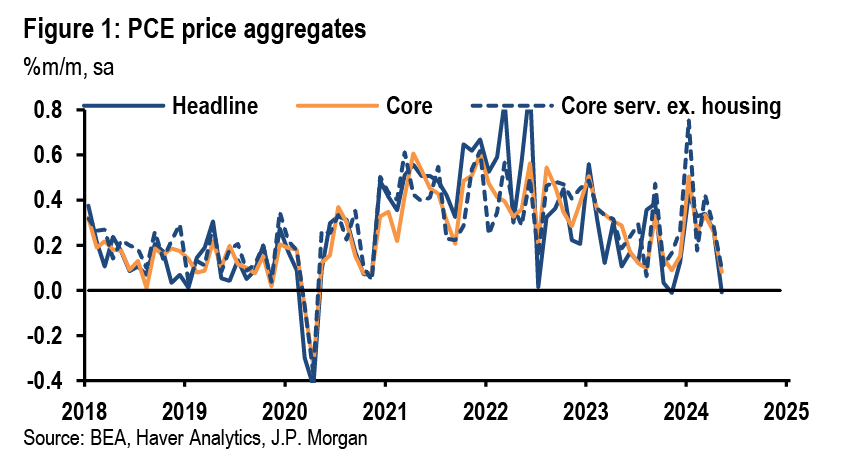

- May core PCE at 0.08% should help build some confidence for continued disinflation

- Real consumer spending looks to be downshifting in 1H

- Housing market revival has lost momentum

- We look for 200K payroll gains in June, steady 4% unemployment rate

This week attention was squarely focused on the looming presidential election. For the economy-minded, the outcome of that election will shape the macro backdrop next year and beyond. We provide a brief sketch of the relevant policy issues in an accompanying note. Meanwhile the data flow marches on, and this week’s figures point to only modest growth in current economic activity.

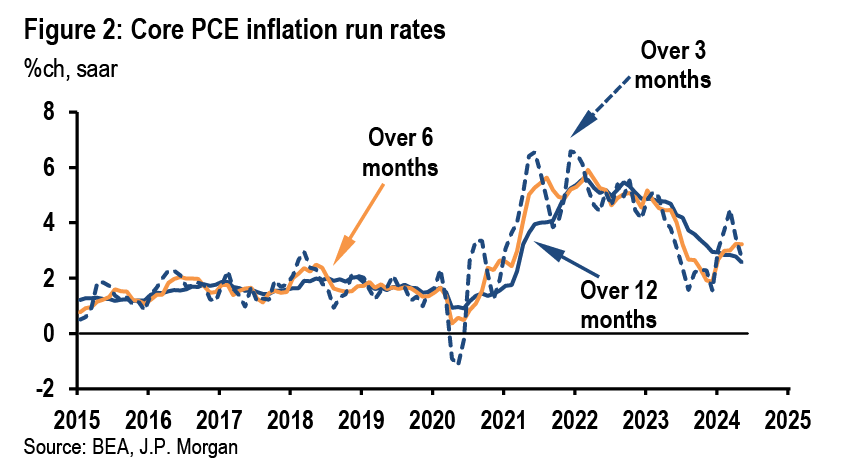

Perhaps more important for markets and Fed-watchers was the very soft reading on the May core PCE price index, the Fed’s preferred inflation gauge. Core PCE prices advanced only 0.08% last month, taking the year-ago reading down to 2.6%. The soft sequential increase—the lowest in over three years—suggests the disinflationary trends that were interrupted in 1Q are getting back on track. We still think this trend will continue, giving the Fed enough comfort to begin lowering the funds rate starting in 4Q.

Economy-wide spending growth appears to have moderated recently. Real consumer spending increased a respectable 0.3% last month, but this came after a modest decline in April and it looks like consumption growth this quarter is running a little shy of a 2% annual rate. This slowing comes after we also learned this week that consumption growth only expanded at a downward-revised 1.5% annual pace in 1Q.

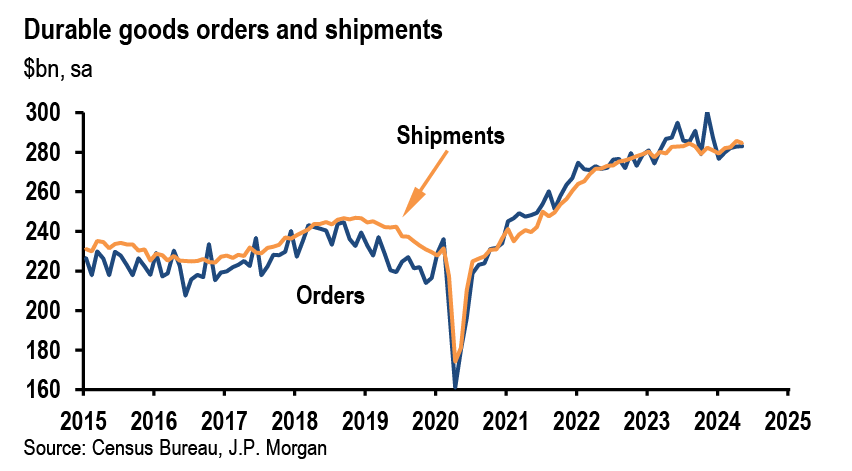

Indicators on the interest-sensitive sectors also came in light this week. Real business investment spending on equipment in 2Q will likely benefit from a bounceback in civilian aircraft outlays (a very volatile category), as well as growth in vehicle sales and imported capital goods. But this week’s data for domestic manufacturers’ May orders and shipments for nondefense capital goods excluding aircraft dipped, and have been moving sideways over much of the past year.

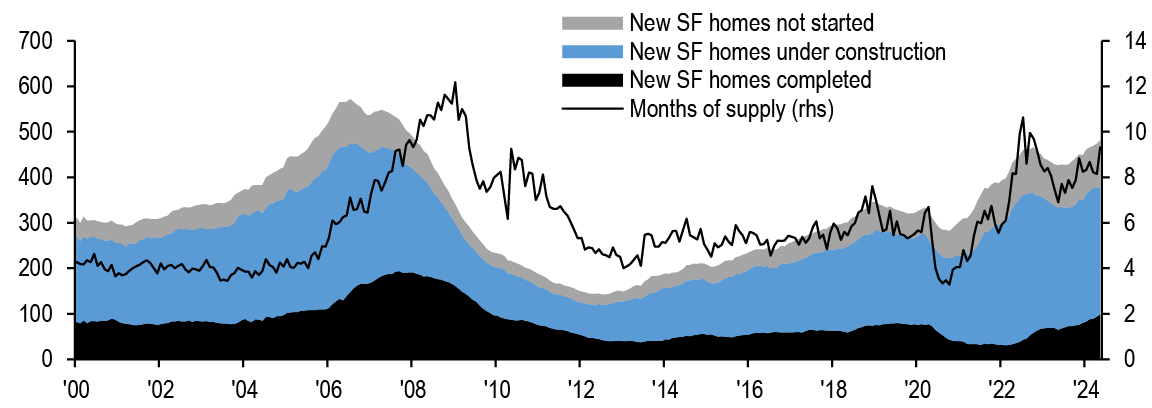

After showing some hints of recovery earlier in the year, most housing figures have turned south again more recently. That trend continued this week, as both new and pending home sales fell materially in May. Inventories of unsold new homes have been creeping higher recently, and we think this will weigh on home building in the second half, something we discuss more in this week’s Focus.

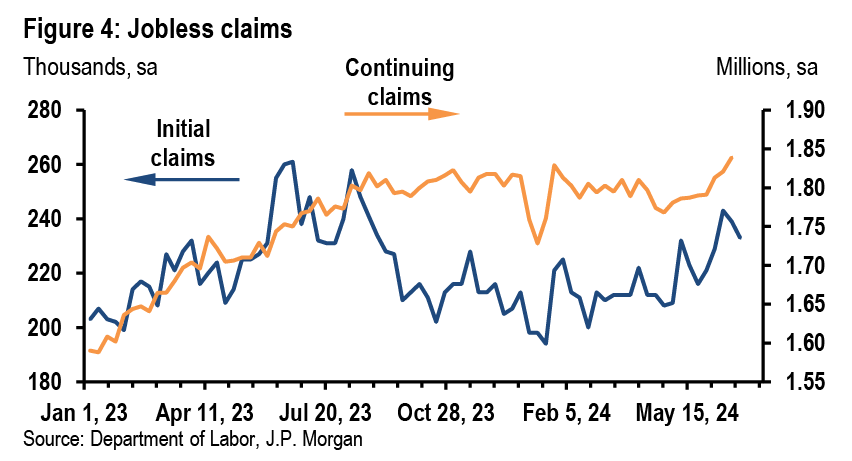

The labor market news this week was mixed. Initial jobless claims eased off a little, although continuing claims grinded up to the highest since late 2021. The labor market will remain front and center in next week’s holiday-shortened calendar. We get the May JOLTS report on Tuesday and the June employment report on Friday. For the latter we expect nonfarm payrolls to rise 200k and the unemployment rate to be unchanged at 4.0%.

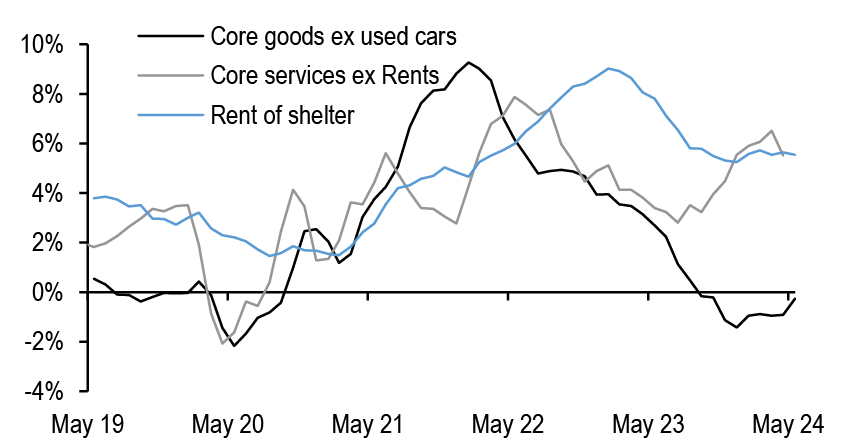

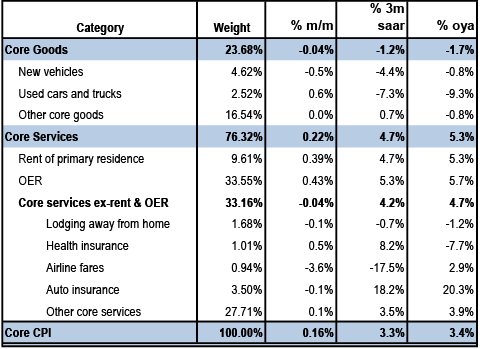

Cooler inflation, softer consumption growth

Core PCE price growth for May, at 0.083% to three decimals, was the softest monthly reading since November 2020 (Figure 1). Services excluding housing was also only up 0.1%m/m (3.4%oya), and headline inflation was flat (2.6%oya). These data are good news for the Fed, though FOMC members will want to see more low readings to gain confidence that inflation is moving back to 2%. Over the last three months core inflation rose 2.7% saar, down from a recent peak of 4.5% in March (Figure 2). While consistent with the story that the firm inflation we saw in 1Q was a bump amidst a gradual moderation, the May month-on-month change probably overstates how quickly core price growth will drop. Even so, we think that the FOMC will take enough comfort from this trend to begin lowering the funds rate starting in 4Q.

Real consumer spending rose 0.3%m/m (0.26%) in May, which brought the 2Q run-rate to 1.4%q/q, saar, and we now see a risk that the full 2Q growth could come in a bit below 2%. Growth for the first quarter had originally been reported at 2.5%, then 2.0% after Thursday’s final GDP report that had been revised down to 1.5%. 1H24 consumption growth around 1.5% is a notable downshift from 2H23, when growth ran a touch over 3%. That said, relatively healthy labor markets and wage gains should still provide some support for consumers. The May personal income and outlays data offered some evidence for this, with nominal personal income increasing 0.5%m/m and compensation up 0.6%m/m. With overall prices flat during the month real DPI increased a robust 0.5%m/m, the strongest gain seen within the past year. For the quarter, however, real DPI is increasing at a milder 1.4% annualized pace, similar to the 1.3% gain in 1Q.

Some weakness in core capital goods

The details of the durable goods report were somewhat soft in May. Core capital goods shipments (nondefense ex aircraft) slid 0.5%m/m and are down at a 1.9%q/q, saar pace so far in 2Q, while core capital goods orders fell 0.6%m/m. On a 12-month basis both core capital goods shipments and orders are roughly unchanged (Figure 3). Moreover, regional Fed surveys of capex intentions point to little if any growth in core shipments in coming months, although the relationship between these surveys and the shipments data is loose. Ex-transportation shipments are tracking a 0.7%q/q, saar increase in 2Q, while total shipments are up at a 6.8% pace, reflecting 48%q/q, saar growth in volatile civilian aircraft shipments. Thus we still think overall equipment spending will be a boost for 2Q output growth despite the soft details in this week’s May report. This is also consistent with the strength in capex we have been tracking globally.

The housing revival, no more

The prospects of high-for-longer interest rates are again weighing on the housing recovery. After some glimmers of hope for the sector earlier in the year, recent readings from the housing market have been weaker. This week both new and pending home sales dropped in May. New home sales were down 11.3%m/m to a 619k annualized pace, but the blow was cushioned by material upward revisions to the prior three months. The May reading is the lowest since November 2022, but with the upward revisions it would be too early to conclude that new home sales are breaking lower for good. Similarly, the index of pending home sales, which lead existing home sales by one to two months, declined 2.1%m/m (-6.6%oya) to a new all-time low (ex-COVID) in May, signaling ongoing weakness in the existing home market. While a new low, the most recent reading is a just a bit below other recent observations. We think these recent readings imply that residential investment will fall 4-5% during 2H. For more on the single-family side of this, see this week’s Focus.

Calmer claims ahead of solid jobs report

Ahead of a week full of labor market data, initial jobless claims fell for the second consecutive week after heading higher for a number of weeks prior, which may have been partially related to noise around the earlier holidays. Initial claims pulled back to 233k in the week ending June 22, from 239k (previously 238k) in the prior week (Figure 4). On the other hand, continuing claims rose to 1.839m in the week ending June 15, from 1.821m. This is a new post-COVID high and is something to keep an eye on, though the latest reading isn’t that far above values in 4Q23.

The highlight of the holiday-shortened week next week will be the June jobs report. While we continue to look for the labor market to gradually cool over the rest of this year, we look for a firm report next Friday with nonfarm payrolls gaining 200k and the unemployment rate holding steady at 4.0%. Pandemic-distorted services, such as education and health care, as well as government, are likely to again account for the bulk of the job growth. Wage growth should also remain fairly firm, with average hourly earnings expected to rise 0.3% on the month. But this should put year-ago growth in earnings below 4% for the first time since mid-2021, another encouraging sign for the Fed. Earlier next week the May JOLTS report is expected to show job openings slipped below 8 million for the first time since early 2021—a further easing of labor demand and an indication that the labor market is continuing to gradually move into better balance.

Excerpted from, United States Data Watch , Michael Feroli, June 28, 2024

Treasuries

2024 Mid-year Outlook

- We expect Treasury yields to remain rangebound through the summer, with a decline from current levels expected later this year only once the Fed begins easing

- Yields tend to decline ahead of shallow easing cycles, as seen in 1995 and 2019. However, current market pricing and carry implications make it challenging to be structurally long duration. We find the most value in the 3- to 5-year sector

- We forecast a 25bp cut at the November FOMC meeting, followed by a quarterly cadence of cuts thereafter. We project 2-year yields to decline to 4.60% and 10-year yields to sit at 4.40% at YE24

- Synthetic forwards created from equi-notional curve flatteners provide a better carry profile for bullish duration exposure than outright longs

- Given the expected Fed easing and fiscal dynamics, long-end steepeners offer value: we find the most value in 5s/30s which appears too flat after adjusting for market-based Fed policy and inflation expectations, and the Fed’s share of the Treasury market

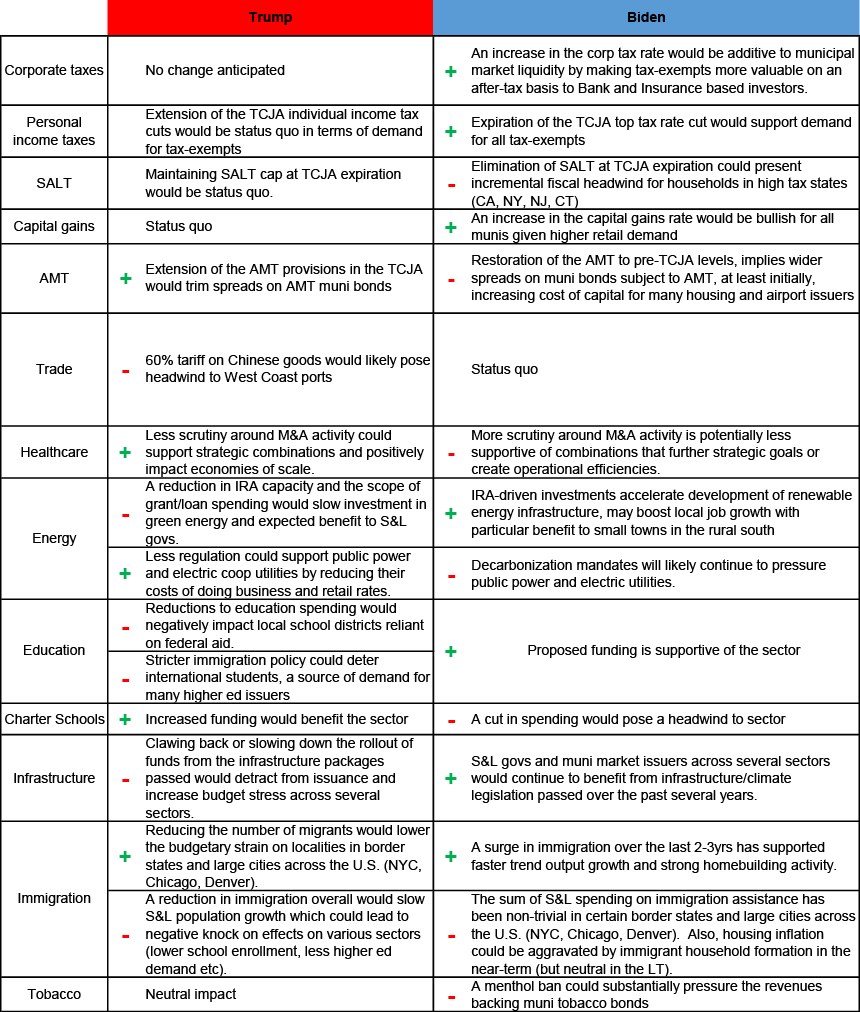

- The US Presidential and Congressional elections could impact the fiscal outlook and Treasury market. A Trump victory with a Republican sweep could lead to higher yields and steeper curves due to elevated volatility and fiscal concerns, while a Biden victory with a blue sweep could result in modestly lower yields

- We expect nominal coupon auction sizes to remain stable through fall 2025, as Treasury has created ample borrowing capacity for the next year. The risks to this baseline stem from potential changes to Treasury’s debt management strategy, the Fed’s balance sheet reinvestment strategy for MBS paydowns, and the results of the November election

- Demand from foreign investors and US banks has been stronger than anticipated in 1H24, and we revise our forecasts higher for the year. However, asset manager demand has been weaker than expected. Given the transition to more price-sensitive investor demand, dealer inventory in Treasuries have risen to record highs

Market views

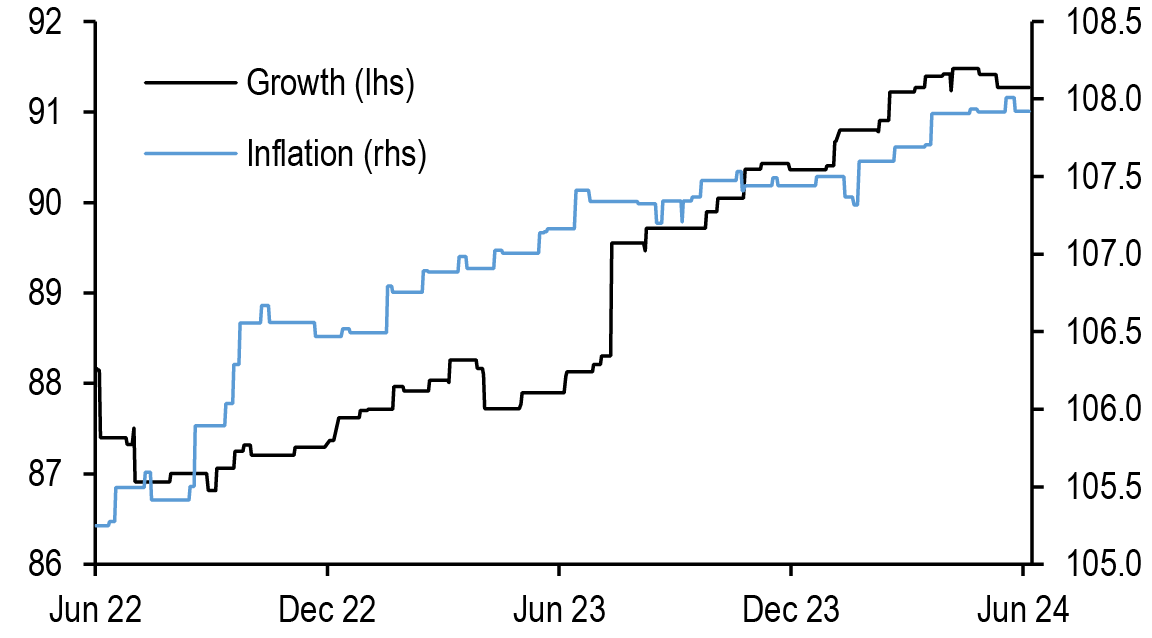

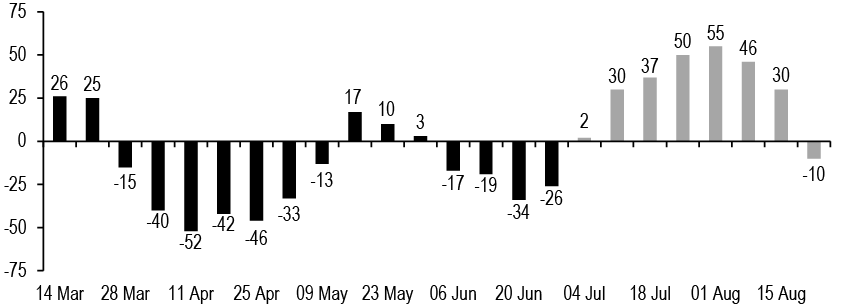

Rates market participants entered 2024 with peak optimism: core PCE had risen 1.9% at an annualized rate in 2H23, and the outcome of the December 2023 FOMC meeting was decidedly dovish. Given this backdrop, by mid-January, OIS forwards had priced a full 25bp ease by the March 2024 FOMC meeting and 175bp of easing in 2024. This optimism was relatively short-lived though, as a series of firmer-than-expected inflation prints in 1Q24 derailed the notion of an “immaculate disinflation.” This was accompanied by a series of upside surprises to growth, driving our US growth and core CPI Forecast Revision Indices higher over most of 1H24 ( Figure 17). In response, markets priced in a high for long path for the Fed, and money markets are not pricing a full 25bp ease until the November FOMC meeting ( Figure 18). Given this pendulum shift, Treasury yields rose in 1H24, though have retreated from their local peaks, as the May CPI report assuaged the worst fears that inflation was accelerating, retail sales indicated consumption is slowing, and both JOLTS as well as initial claims gave further sense the labor market continues to slowly rebalance. Net of these factors, 2-, 5-, 10-, and 30-year yields have risen 66bp, 55bp, 48bp, and 43bp, respectively, but are also 30-40bp off their highest levels seen just a month ago.

Figure 17: There were serially upward revisions to growth and core inflation forecasts in 1H24...

J.P. Morgan US Growth FRI (lhs) and US core CPI FRI (rhs); index

Source: J.P. Morgan

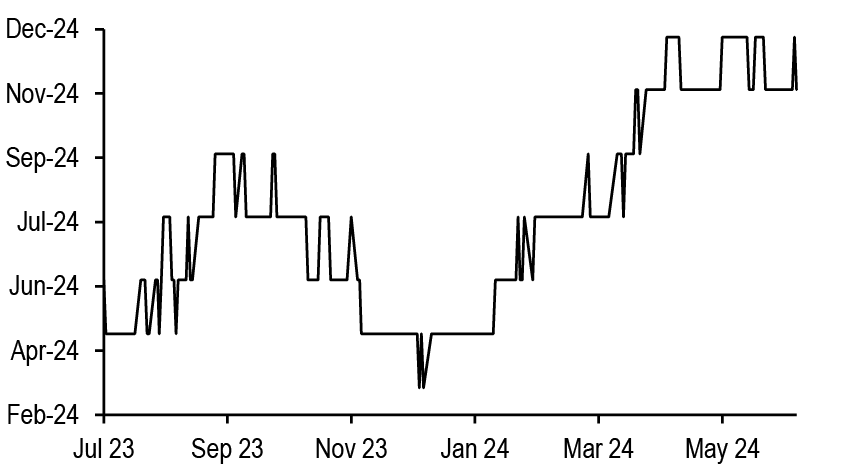

Figure 18: ...and the market-implied timing of the first cut has moved back to late-2024

Date of first expected Fed ease as derived from FOMC meeting date OIS forwards;

Source: J.P. Morgan

The rise in yields has certainly been justified by fundamentals: Figure 19 uses our fair-value framework in an attempt to attribute the YTD move in 10-year yields, and shows that rising inflation and Fed policy expectations explain substantially all the 48bp rise in yields in 1H24. First, 5- to 10-year ahead seasonally adjusted TIPS breakevens have risen 26bp YTD, but they are also considerably off their highs in April, and can explain 29bp of the bearish move. Second, 3- to 6-month ahead Fed policy expectations have risen 25bp as markets have pushed back on the timing of the first expected rate cut, contributing 12bp to the rise in yields. In aggregate, our fair-value framework would have implied a 44bp rise in yields over the first six months of the year, very close to the actual increase. It’s notable, however, that 10-year Treasuries continue to appear somewhat cheap to their drivers, and have not traded consistently rich on this basis since the wake of the regional banking crisis in spring 2023, and could perhaps reflect some implicit rise in term premium.

Figure 19: The rise in 10-year yields YTD has been justified by rising Fed policy and inflation expectations, and yields remain somewhat elevated after controlling for their fundamental drivers

Attribution analysis of 10-year Treasury yield changes 12/29/23-6/28/24*

| Variable | Current value | YTD Chg | Coeff. | Expected chg; bp |

| Intercept | -2.87 | |||

| 3m3m OIS rate; % | 5.10 | 0.25 | 0.470 | 12 |

| Fed fwd guidance; months | 0.0 | 0.0 | -0.01 | 0 |

| 5y5y TIPS breakevens; % | 2.23 | 0.26 | 1.105 | 29 |

| JPM US FRI; % pts | 91.3 | 0.9 | 0.026 | 2 |

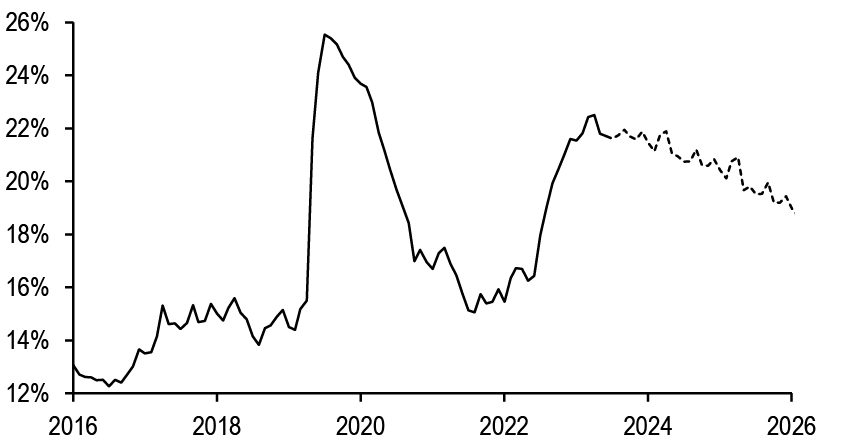

| Fed share of UST mkt; % | 20.1 | -2.0 | -0.010 | 2 |

| Expected change from all factors; bp | 44 | |||

| Actual chg; bp | 48 | |||

| Residual on 29-Dec-23 | 17 | |||

| Residual on 28-Jun-24 | 20 |

Source: US Treasury, Federal Reserve Bank of New York, J.P. Morgan

* Regression from 1/4/19-12/29/23, R-squared = 98.1%, SE = 16.1bp

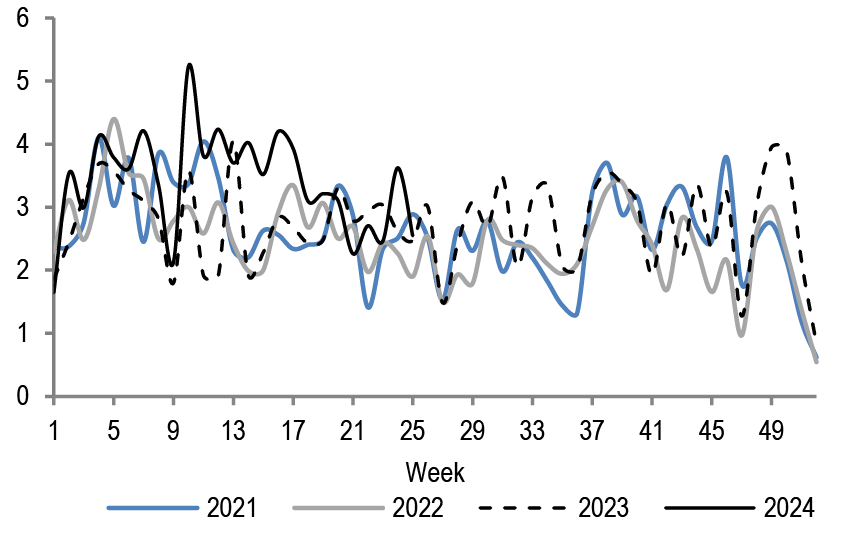

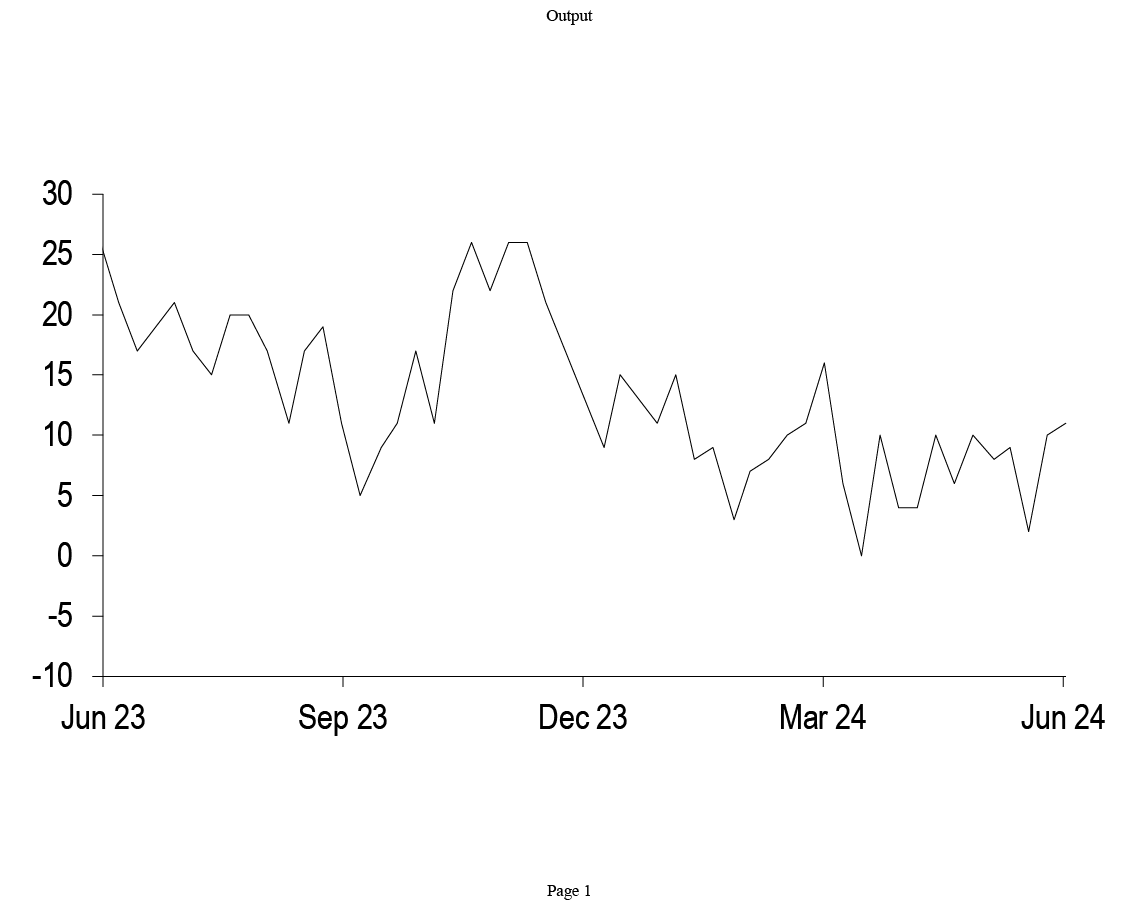

The market’s Fed expectations are likely to remain the dominant driver of Treasury yields over the 2H24. Overall, we continue to forecast a 25bp cut in November, followed by a quarterly cadence of cuts after that, and there is growing comfort the Fed will have room to ease for a number of reasons. First, consumption is slowing: after rising at a 3% annual rate in 2H23, real consumer spending is rising closer to 2% in 1H24. Second, job openings continue to decline sharply in 1H24, falling to their lowest levels since early-2021, giving an indication the labor markets continue to rebalance. Third, we see some indication that growth momentum is slowing in other labor market indicators as well: the 4-week average of initial claims has been steadily rising for the last two months and is now approaching its highest levels since last fall, indicating the labor markets are loosening somewhat ( Figure 20). Though claims have been rising, this does not give us immediate concern about a sharper rise in the unemployment rate, as we do not see a rising trend in layoffs at this point (see Focus: Claims could move up with falling job finding rates, Murat Tasci, 6/21/24).

Figure 20: Initial claims have risen to their highest levels since September, indicating some loss of growth momentum

Initial jobless claims, 4-week moving average; ‘000s

Source: Department of Labor

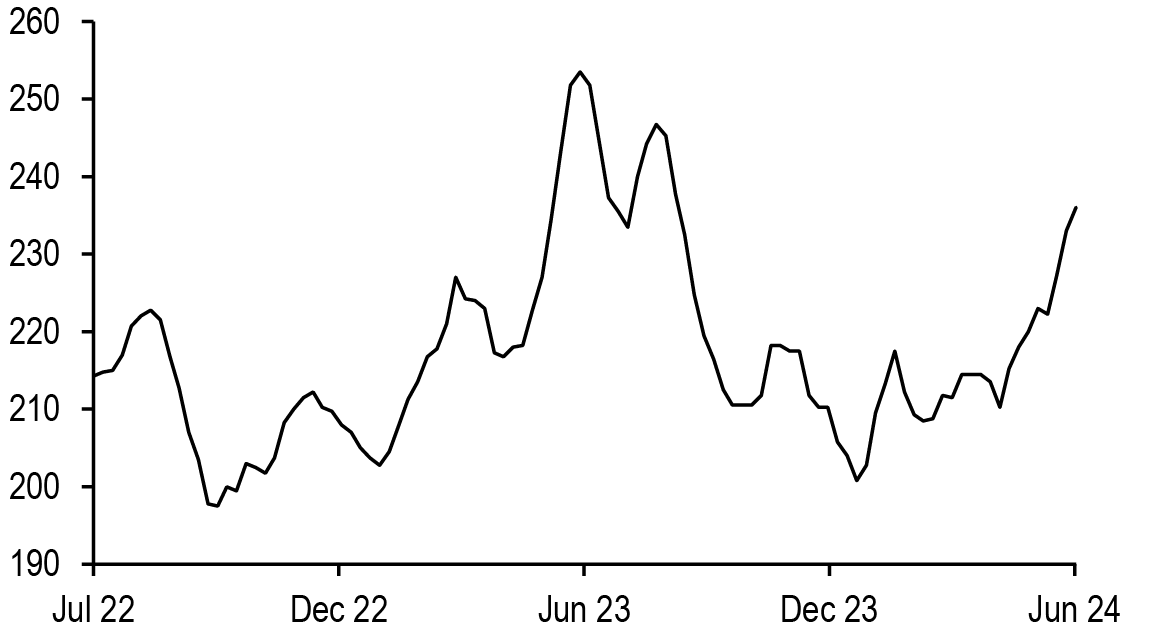

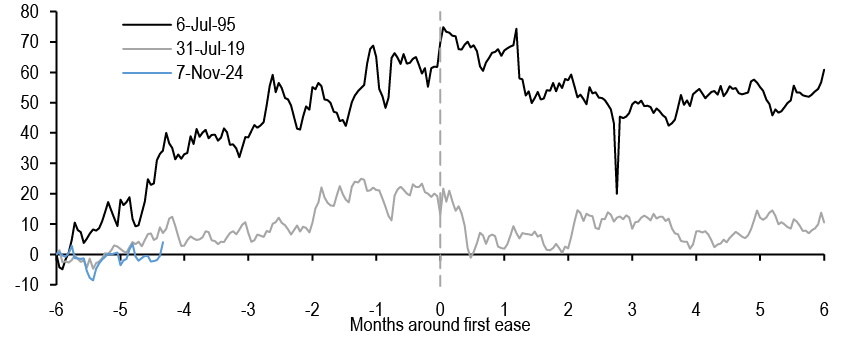

Figure 21: Yields have declined ahead of other shallow easing cycles in 1995 and 2019...

Cumulative change in 5-year Treasury yields in the months around the first ease in a shallow Fed easing cycle*; bp

Source: J.P. Morgan

*Dates used: 7/6/1995, 7/31/2019, 11/7/2024

Nevertheless, given the inability to identify vulnerabilities that would drive the US economy into a severe recession, it remains likely this easing cycle will be shallower, and perhaps more closely resemble the 1995 and 2019 easing cycles rather than the aggressive easing cycles during the 2001 recession and the GFC in 2007-2008. In that vein, it would seem there is still room for yields to decline, even if the Fed eases in a shallower fashion. Figure 21 tracks the changes in 5-year yields from 6 months prior to the first ease in these “mini” easing cycles to 6 months after, assuming the Fed first lowers rates at the November 7 FOMC meeting. On average, yields tend to decline more than 125bp in the six months prior to the first cut in these more muted easing cycles.

These factors make the case to be long duration as we enter 2H24, but we think market pricing is a limiting factor, as the inversion of money market curves means long duration trades incur negative carry. Indeed, OIS forwards are pricing in 140bp over the next 18 months ( Figure 22). This is roughly in line with our own forecast, and means it will be hard for yields to decline considerably from current levels, unless markets are willing to price in an earlier start to the easing cycle, a series of faster cuts, or a deeper cutting cycle. As a result, even though the onset of the easing cycle appears to be just a few months away, carry implications and outright valuations make it challenging to be structurally long duration. Therefore, we prefer to add duration when yields are near the upper end of their recent ranges, unless we see the data give us some sense the Fed needs to lower rates more aggressively than we expect, and we will be actively watching the trends in initial claims for signs of broader labor market weakness.

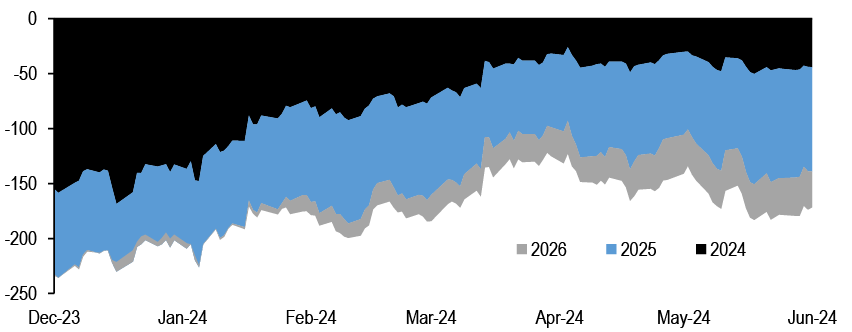

Figure 22: ...but money markets are already priced for such an outcome, with OIS forwards pricing 140bp in easing over the next 18 months

Amount of easing implied in 2024, 2025, and 2026 by OIS forwards; bp

Source: J.P. Morgan

Overall, while even shallower easing cycles are supportive of lower Treasury yields, given that money markets are priced for a path of Fed easing that looks similar to our own forecasts, we think it will be challenging for yields to decline further unless we price a faster or deeper easing cycle. As a result, with our own forecast looking for the first cut in November, we look for yields to remain rangebound through the summer, only declining more significantly once the Fed begin to deliver a series of quarterly cuts early in 2025 ( Figure 23). Overall, we look for 2-year yields to decline to 4.60% by YE24, while our forecast projects 10-year yields will sit at 4.40% by 4Q24.

Figure 23: We look for yields to remain rangebound through the summer and for the front-end to lead the move to lower yields in the fall

J.P. Morgan interest rate forecast; %

| Actual | 1m ahead | 3Q24 | 4Q24 | 1Q25 | 2Q25 | |

| 28-Jun-24 | 28-Jul-24 | 30-Sep-24 | 31-Dec-24 | 31-Mar-25 | 30-Jun-25 | |

| Rates (%) | ||||||

| Effective funds rate | #N/A Requesting Data... | 5.35 | 5.35 | 5.10 | 4.85 | 4.60 |

| SOFR | #N/A Requesting Data... | 5.30 | 5.35 | 5.10 | 4.85 | 4.60 |

| 2-yr Treasury | 4.72 | 4.70 | 4.75 | 4.60 | 4.30 | 4.05 |

| 3-yr Treasury | 4.51 | 4.50 | 4.55 | 4.40 | 4.15 | 3.95 |

| 5-yr Treasury | 4.33 | 4.30 | 4.40 | 4.25 | 4.00 | 3.80 |

| 7-yr Treasury | 4.32 | 4.30 | 4.40 | 4.25 | 4.00 | 3.80 |

| 10-yr Treasury | 4.34 | 4.35 | 4.50 | 4.40 | 4.20 | 4.00 |

| 20-yr Treasury | 4.60 | 4.60 | 4.70 | 4.60 | 4.40 | 4.20 |

| 30-yr Treasury | 4.50 | 4.50 | 4.65 | 4.60 | 4.50 | 4.35 |

Source: J.P. Morgan

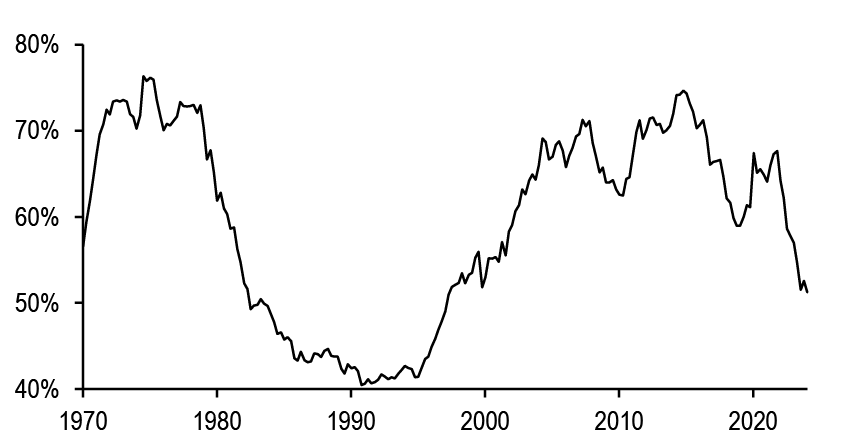

Along the curve, given how little is priced into 2026, we think there is value in being long in the greens, or in the 3- to 5-year sector of the spot curve. Locally, with yields near the bottom end of their recent ranges, it’s tough to be long duration, even though Treasuries appear modestly cheap on a fair value basis. Furthermore, we think the ongoing rapid growth of the Treasury market will continue to outstrip demand from more price-insensitive investors, and this shift in demand will over time lead to higher term premium, which should result in a gentler decline in long-end yields even as the Fed begins easing (see In the eye of the beholder, 9/12/23). Thus, when we add duration we prefer to stay shorter in the curve to insulate against the risks of higher term premium.

Even front-end longs incur negative carry, but as we have discussed for the last few months, there are ways to thoughtfully construct long-duration proxies with better carry profiles. Equi-notional flatteners synthetically replicate exposure to Treasury forward yields and replicate bullish duration exposure with better carry profiles than outright longs (see Treasuries, US Fixed Income Markets Weekly, 3/22/24). By maintaining equal notionals, these flatteners have a smaller bearish exposure in the short-duration leg of the trade when compared to a duration-neutral flattener, resulting in a bullish duration exposure. Figure 24 displays various synthetic forward Treasuries constructed using equi-notional flatteners, with their carry statistics, the proportion of the variation in these forwards explained by underlying spot Treasury yields, and the beta to changes in spot yields. The table shows that spot Treasuries in the short- to intermediate sector explain a high share of the variation in these equi-notional flatteners, with relatively high betas as well. Along the curve, synthetic 2y3y and 3y2y forward Treasury yields are sitting above their 6-month averages, and exhibit a high correlation with changes in 3- to 7-year Treasury yields and relatively neutral carry profiles. Thus, we would use any bearish move to add synthetic front-end forward exposure via one of these equi-notional flatteners.

Figure 24: Synthetic forwards created from equi-notional Treasury curve flatteners create bullish duration exposure, but with a better carry profile than outright longs

Statistics of various synthetic forward rates created from equally-notional weighted curve trades*, 3-month percentile, and 3-month carry + roll, and statistics of 6-month regressions of 5-day changes versus different points of the Treasury curve; units as indicated

| R-squared | Beta | ||||||||||||||

| Forward | Level (bp) | 6m % | 3m C+R (bp) | 1y | 2y | 3y | 5y | 7y | 10y | 1y | 2y | 3y | 5y | 7y | 10y |

| 1y1y | 212 | 59% | -6.7 | 55% | 95% | 92% | 90% | 85% | 79% | 0.85 | 0.72 | 0.65 | 0.61 | 0.41 | 0.62 |

| 2y1y | 127 | 44% | -0.5 | 61% | 79% | 92% | 91% | 91% | 88% | 0.53 | 0.38 | 0.38 | 0.37 | 0.37 | 0.38 |

| 2y3y | 233 | 55% | 0.6 | 54% | 80% | 89% | 97% | 99% | 99% | 0.85 | 0.66 | 0.64 | 0.64 | 0.65 | 0.69 |

| 3y2y | 154 | 59% | 0.9 | 47% | 75% | 82% | 93% | 96% | 98% | 0.52 | 0.42 | 0.40 | 0.41 | 0.42 | 0.45 |

Source: J.P. Morgan

*2y1y is derived from an equi-notional weighted combination of 2- and 3-year Treasuries

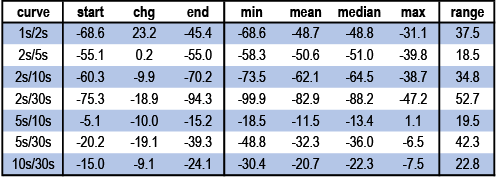

Turning to the curve, Fed easing supports a steeper curve, and our work has shown that the long end tends to steepen first in the period between the last hike and the first ease, while the front end reacts only once the Fed begins easing (see Treasuries 2023 Outlook, 11/22/22). For this reason, we have preferred long-end steepeners as a more strategic representation of our view, but these steepeners have had limited success thus far. Our work has also shown that the curve still steepens into shallow easing cycles ( Figure 25). However, the magnitude of steepening varies, as 5s/30s steepened about 75bp prior to the first ease in 1995, then traded in a range in the ensuing months, while the curve steepened just 25bp in the months leading up to the first cut in 2019. This makes sense to an extent: in 1995 the Fed eased modestly into an economy that was benefitting from rising productivity and trend growth rates, supporting a rising neutral policy rate, as policy rates passively became less restrictive over time. Meanwhile in 2019, the Fed preemptively eased in order to better anchor inflation expectations in an environment where core inflation was struggling to rise to 2%.

Figure 25: Similarly, the long end has steepened ahead of shallow easing cycles, though the curve steepened more aggressively in 1995 compared to 2019

Cumulative change in 5s/30s Treasury curve in the months around the first ease in a shallow Fed easing cycle*; bp

Source: J.P. Morgan

*Dates used: 7/6/1995, 7/31/2019, 11/7/2024

Figure 26: The market’s medium-term monetary policy and inflation expectations, alongside the Fed’s footprint in the Treasury market explain most of the variation in curve pairs and the long end appears somewhat flat on this basis

Statistics for various Treasury curves over the last 3 years, with statistics from 3-year regressions on 1y1y OIS (%), 5Yx5Y TIPS breakevens (%), and Fed share of the Treasury market (%); bp unless otherwise indicated

| Curve | Last | Min | Max | Avg | % | R^2 | Partial betas | Residual | Z-score | |||

| 1y1y OIS | 5y5y BE | Fed share | 3m C+R | |||||||||

| 2s/5s | -39 | -78 | 78 | -13 | 39% | 87% | -0.28 | 1.14 | 2.44 | 7.8 | 0.5 | -11.6 |

| 2s/7s | -40 | -91 | 108 | -9 | 37% | 88% | -0.38 | 1.31 | 1.05 | 3.5 | 0.2 | -13.9 |

| 2s/10s | -38 | -109 | 129 | -10 | 47% | 89% | -0.47 | 1.40 | -0.73 | 4.0 | 0.2 | -15.9 |

| 2s/20s | -11 | -96 | 183 | 24 | 42% | 90% | -0.51 | 1.34 | -0.39 | 1.3 | 0.1 | -18.7 |

| 2s/30s | -22 | -119 | 190 | 11 | 48% | 92% | -0.60 | 1.36 | -2.39 | 0.8 | 0.0 | -18.1 |

| 3s/7s | -19 | -55 | 81 | -2 | 41% | 90% | -0.28 | 0.69 | -1.86 | -5.0 | -0.5 | -8.1 |

| 3s/10s | -17 | -76 | 106 | -4 | 51% | 91% | -0.36 | 0.77 | -3.64 | -4.4 | -0.4 | -10.1 |

| 3s/20s | 9 | -63 | 162 | 31 | 43% | 91% | -0.41 | 0.71 | -3.30 | -7.2 | -0.5 | -12.9 |

| 3s/30s | -1 | -86 | 169 | 18 | 52% | 93% | -0.49 | 0.73 | -5.30 | -7.7 | -0.6 | -12.3 |

| 5s/10s | 1 | -36 | 61 | 3 | 62% | 90% | -0.19 | 0.25 | -3.17 | -3.8 | -0.6 | -4.2 |

| 5s/20s | 27 | -23 | 117 | 37 | 46% | 86% | -0.23 | 0.20 | -2.83 | -6.5 | -0.7 | -7.1 |

| 5s/30s | 17 | -46 | 124 | 24 | 60% | 91% | -0.32 | 0.22 | -4.83 | -7.0 | -0.7 | -6.5 |

| 7s/10s | 2 | -21 | 25 | -1 | 75% | 88% | -0.08 | 0.09 | -1.78 | 0.6 | 0.2 | -2.0 |

| 7s/20s | 28 | -8 | 82 | 33 | 47% | 77% | -0.13 | 0.03 | -1.44 | -2.2 | -0.3 | -4.8 |

| 7s/30s | 18 | -37 | 91 | 20 | 65% | 88% | -0.21 | 0.05 | -3.44 | -2.7 | -0.4 | -4.2 |

| 10s/20s | 26 | 13 | 58 | 35 | 22% | 55% | -0.05 | -0.06 | 0.34 | -2.7 | -0.5 | -2.8 |

| 10s/30s | 16 | -18 | 68 | 21 | 52% | 84% | -0.13 | -0.04 | -1.66 | -3.2 | -0.6 | -2.2 |

Source: J.P. Morgan

Nonetheless, we need to be discerning in choosing the right pair to express this view. Figure 26 shows that the market’s medium-term Fed policy and inflation expectations, as well as the Fed’s ownership share of the Treasury market can explain more than 50% of the variation in most Treasury curve pairs, with the R-squared above 77% for every pair except for 10s/20s, which has had a unique set of drivers in recent years. A few things stand out from this table. First, many curve pairs remain near their flattest levels of the last 3 years, making steepeners attractive if the Fed does indeed begin easing later this year. Second, most front-end pairs look too steep after controlling for these 3 factors, and when combined with exceedingly negative carry profiles, make these steepeners very unattractive. Third, most long-end pairs appear somewhat flat relative to their drivers, and the carry profiles are more reasonable than their front-end brethren. Accordingly, we think long-end steepeners offer value to position for the coming easing cycle, and we like 5s/30s, given it displays relatively high sensitivity to the market’s medium-term Fed policy expectations, and appears 7bp too flat in our fair-value framework.

The 2024 election and risks to the modal view

There are two distinct sets of risks to this modal view. On one hand, if the nascent signs of slowing we observe via consumer spending, demand for labor, and housing markets become more nefarious, this could force the Fed to ease earlier and more aggressively than we have forecast, which would present downside risk to our interest rate forecast. On the other, we think that this fall’s US presidential and congressional elections could also present risks to this modal view, particularly as it pertains to the fiscal outlook.

On that note, CBO’s latest 10-year budget projections forecasted $22tn in deficits over the next decade, an approximately $2.1tn increase from its prior projections. 1As a result, CBO projects debt held by the public rising from 97% of US GDP to 122% over the next decade, even with the baseline assumption that the individual income tax cuts from the 2017 TCJA expire after 2025. As a result, there’s been an intense amount of focus on how the elections could move the fiscal needle beyond this baseline. As a starting point, it seems there is little room for a major amount of fiscal expansion in a divided government, and it seems this is a consensus view, with the Senate likely to flip to Republican control, while the Democrats take the majority in the House of Representatives. In this case, some extension of the TCJA for low- and middle-income taxpayers seems likely, but in all likelihood this would be funded by higher corporate tax rates, thus mitigating the impact on the deficit in future years. Thus, purely from a fiscal perspective, we do not think a Biden or Trump victory, accompanied by a split Congress, should have major implications on the Treasury market.

However, we found that former President Trump’s relatively unorthodox style of addressing trading and monetary policy via social media played a statistically significant role in elevating implied volatility (see Introducing the Volfefe Index: Quantifying the impact of presidential tweets on rates volatility, 9/6/19). Should he proceed similarly in a second term, elevated volatility could also contribute to higher term premium, as we have found volatility is a key driver in academic measures of term premium (see In the eye of the beholder, 9/12/23). Thus, a Trump presidency, even with a divided government, could result in modestly higher yields and steeper curves, all else equal.

Meanwhile, sweeps in either direction matter for fiscal outcomes. On one hand, if President Biden is reelected with a blue sweep in Congress, his Administration would likely raise the corporate tax rate from 21% to 28% and also raise taxes on high income earners, and this would likely reduce the federal budget deficit by $2.2tn over the next decade. 2 On margin, this would be seen as a relief from a financing perspective, but the Tax Foundation also notes that this budget would reduce GDP by 2.2% over the next decade with lower wages and fewer jobs. As a result, we think a blue sweep would likely result in modestly lower Treasury yields.

Conversely, a red sweep could have serious consequences for Treasury yields. Former President Trump has talked about extending the tax cuts from the 2017 TCJA. Already CBO has published on how this could impact the budget, finding extending the 2017 act would add more than $4tn in primary deficits to the debt over the next decade if not accompanied by new revenue.3

On that note, former President Trump has also talked about imposing a 10% tariff on all imported goods, with a 60% tariff for imported Chinese goods. The US imported $3.1tn of good in 2023, with China comprising 16.5% of that total. At face value, this would be worth about $565bn in revenue annually, more than offsetting the loss of revenue from the TCJA extension. However, the Committee for a Responsible Federal Budget (CRFB) estimates that given expected behavioral shifts, this 60% Chinese tariff would raise only $300bn over a decade on the high side, and a $50bn loss of revenue on the low side. If we take the average of these two numbers, it’s only about $125bn in new revenue over the next 10 years. CRFB also estimated the 10% global tariff would bring in $2tn in revenue over a decade, though this was before the statement was made on Chinese tariffs. Accordingly, we would need to haircut this number by about $125bn.

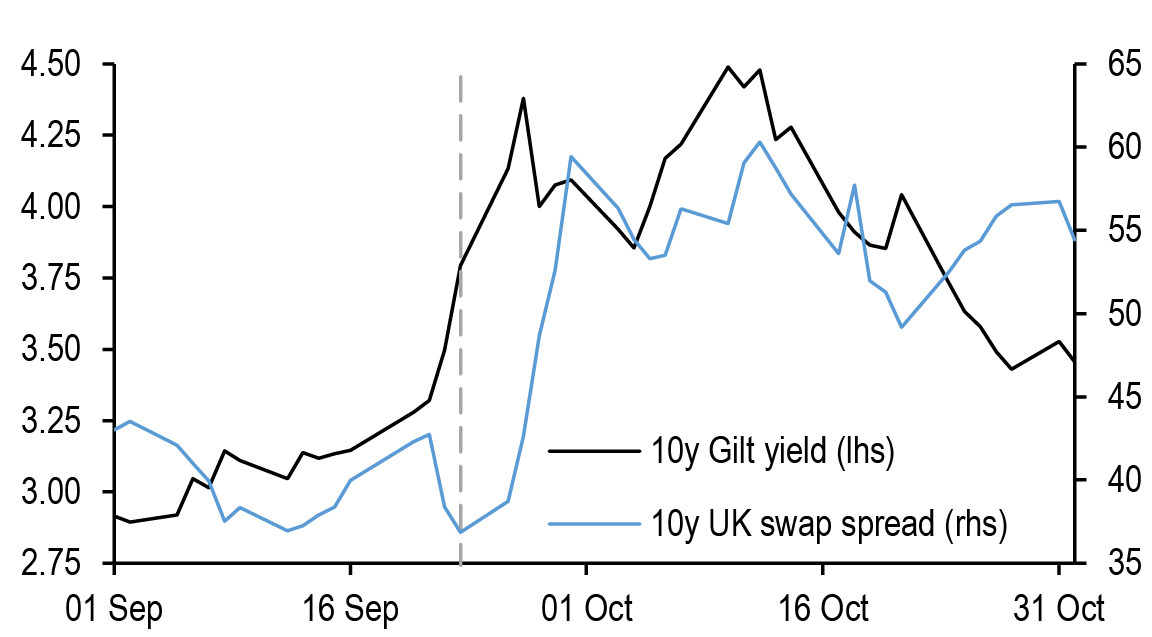

In sum, the net of an extended TCJA would forego over $4tn in revenue over the next decade, with an additional $600bn in interest expense, but this would be offset by approximately $2tn in tariff revenue. Still, the deficit would widen by close to $2.5tn over the next decade, with much of this move occurring in FY26 onward. We think the fiscal concerns that briefly captured market participants’ attention last fall could come back to the forefront, driving the Treasury curve bearishly steeper. There is no perfect analog for this scenario, but 10-year yields rose more than 100bp last fall. To be fair, even though the Fed last hiked in July 2023, markets were pricing further Fed tightening through the fall, so this rise was definitely not primarily about fiscal concerns. However, the residual of our fair-value model rose more than 70bp over that period as yields rose, indicating that a substantial part of this increase was not driven by shifts in Fed policy, growth, or inflation expectations, and fiscal concerns could be responsible for part of the rise in yields ( Figure 27).

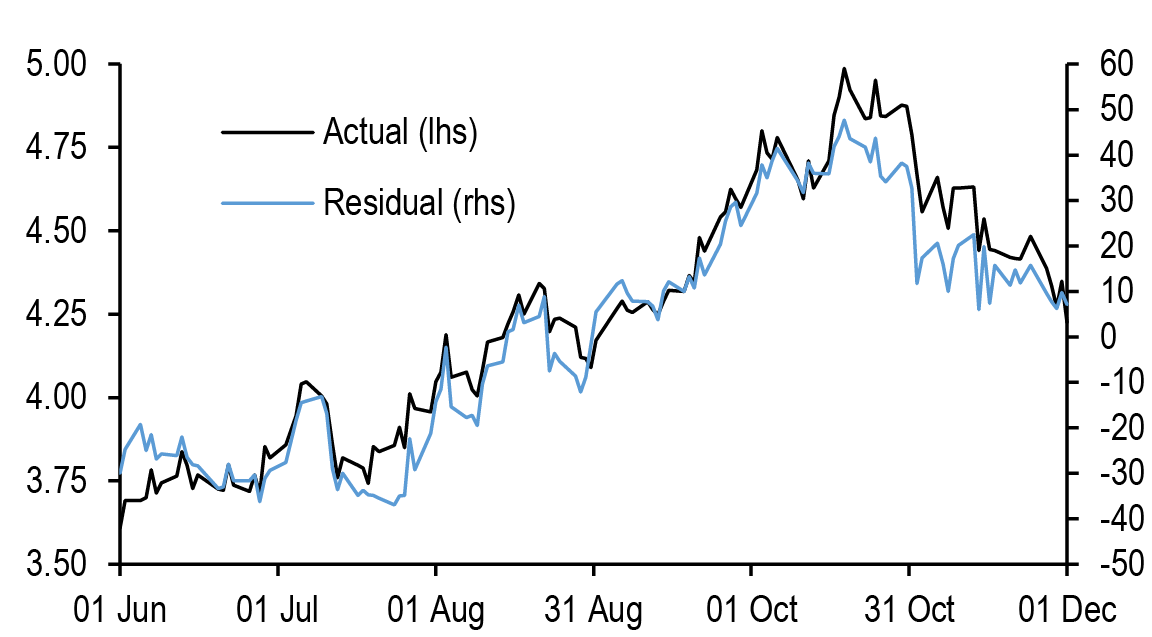

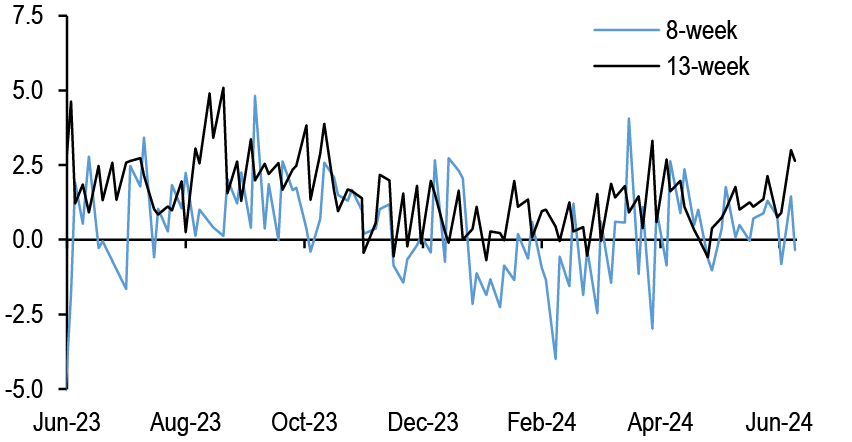

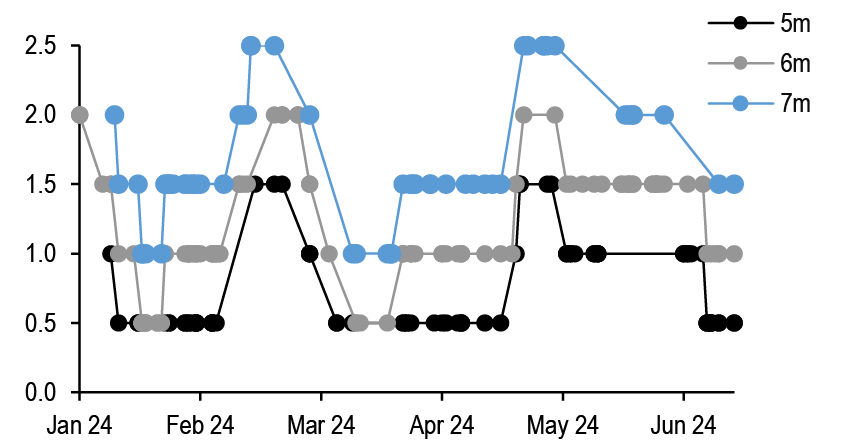

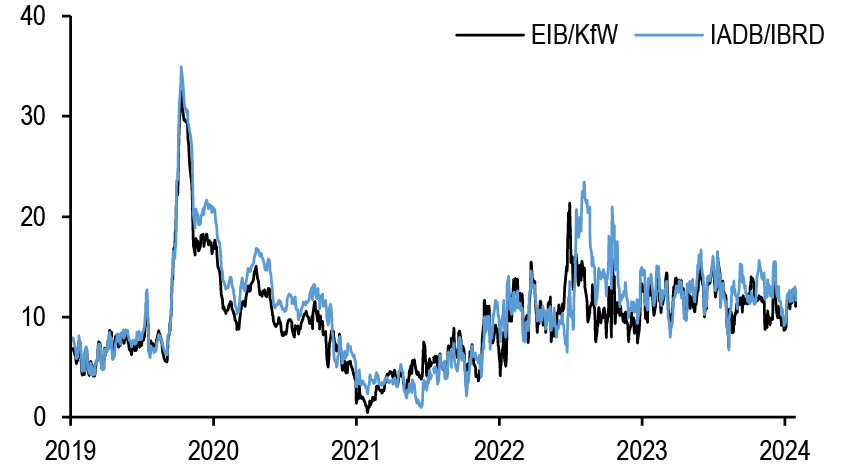

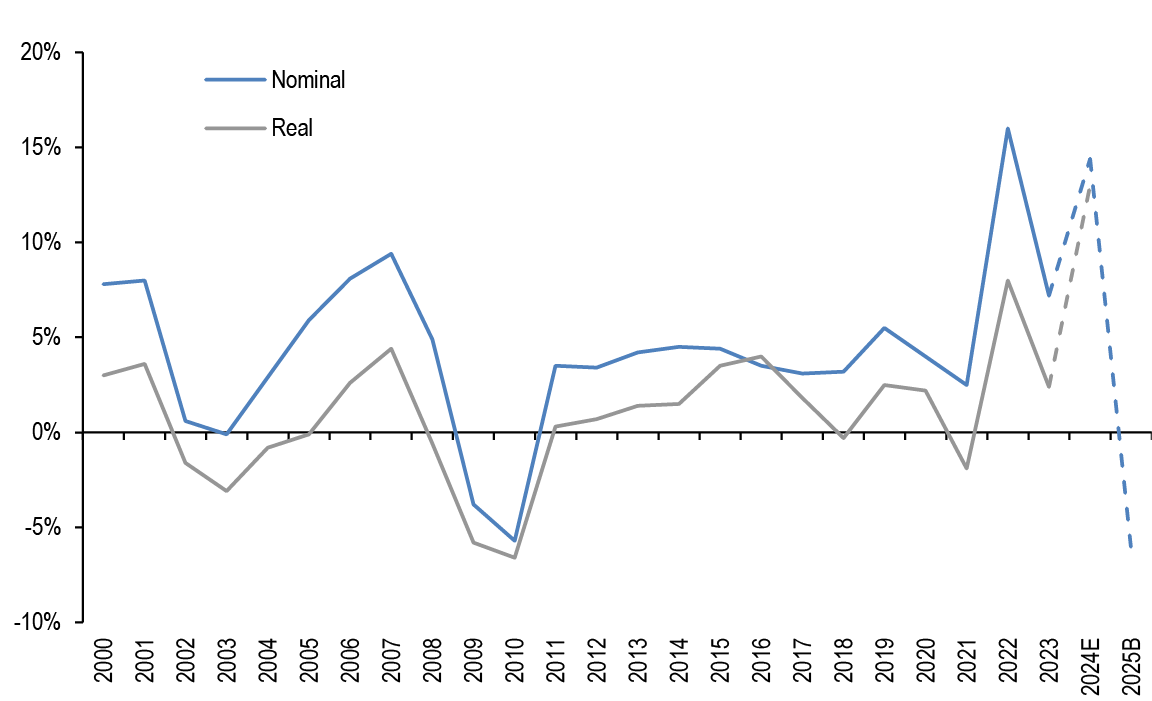

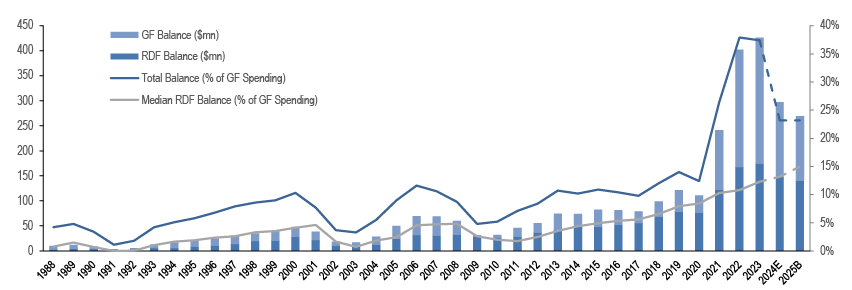

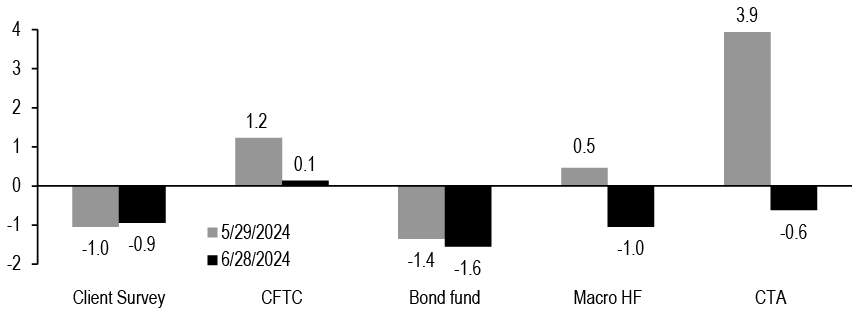

Figure 27: Long-end yields rose 100bp+ in the fall and summer of 2023, with the residual on our fair-value model rising more than 70bp over the period, indicating this move was not just about rising growth, inflation, and policy expectations...