Global Fixed Income Markets Weekly

Idiosyncratic paces: it’s time to adjust

- Overview: Idiosyncratic macro dynamic came to the forefront of rates markets this week with a notable outperformance of EUR rates in a bull steepening move, driven by weak Euro area flash PMI for September and selective inflation data in France and Spain. Higher conviction in the broad disinflation process in the Euro area and downside risk on growth triggered a change in our ECB call. We view this as a shift in fundamentals and now expect the ECB to deliver back-to-back 25bp cuts starting in October, reaching 2% policy rate in June 2025, earlier than our previous call for September 2025. Risks are biased for even lower terminal even in absence of a recession. We refresh our indices to capture the Intensity of Expected policy rate Normalisation (IEN) as a function of the amount of easing priced in the OIS curve and of the proximity of the trough. Across US, Euro area and UK current IEN indices are now pricing a more aggressive normalisation than in late December 2023 with lower terminal and earlier troughs. Bullish duration bias expressed mostly via option structures or long real yields in Euro area, and long 5Y gilts in UK.

- Euro: Maintain bullish duration bias on risks of markets overshooting/pricing higher recession risks. Stay OW intra-EMU/€-SSA via OW 10Y Spain vs. Germany, OW 10Y EU vs. swap and OW 5-7Y KfW vs. Germany. Enter 5s/10s France steepener vs. Germany. Take profit on 10s/30s Italy flattener vs. Germany and long 5Y Italy CDS cash basis. Take profit and re-strike 1Yx1Y receiver spread versus OTM payer to enter at a net credit reflecting our increasing conviction of a limited back up in reds. Take profit in 2s/5s conditional bull steepener. Take profit and re-strike 2s/5s/10s conditional bull-belly cheapener via 3M receivers. Hold 10s/30s swap curve tactical flatteners hedged versus longs in reds (16% risk) on RV considerations. Keep Dec24 Schatz €STR swap spread widener as convex risk-off hedge to our long carry portfolio. Expect directionality to intra-EMU spreads to increase in a flight to quality/risk-off move potentially driven by macro or geopolitical concerns. Neutral on Bund swap spread. Initiate Dec24 Schatz/Bund €STR swap spread curve flattener. Sell 3Mx30Y gamma with infrequent delta hedging; stay short 6Mx10Y unhedged straddles.

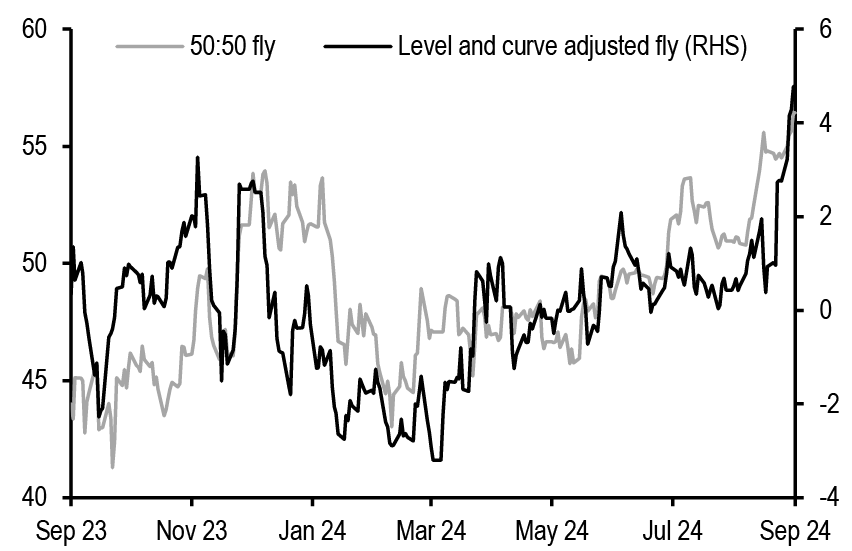

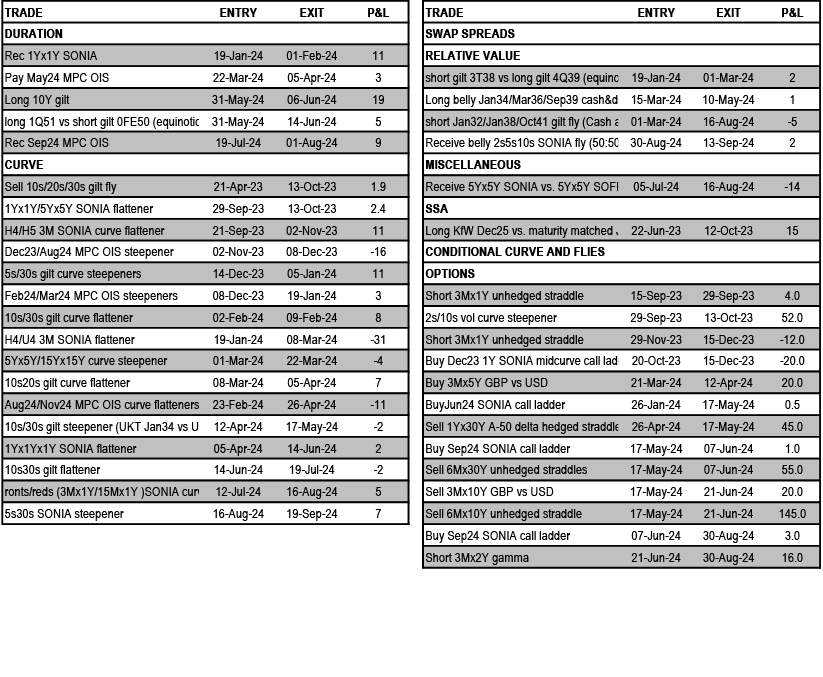

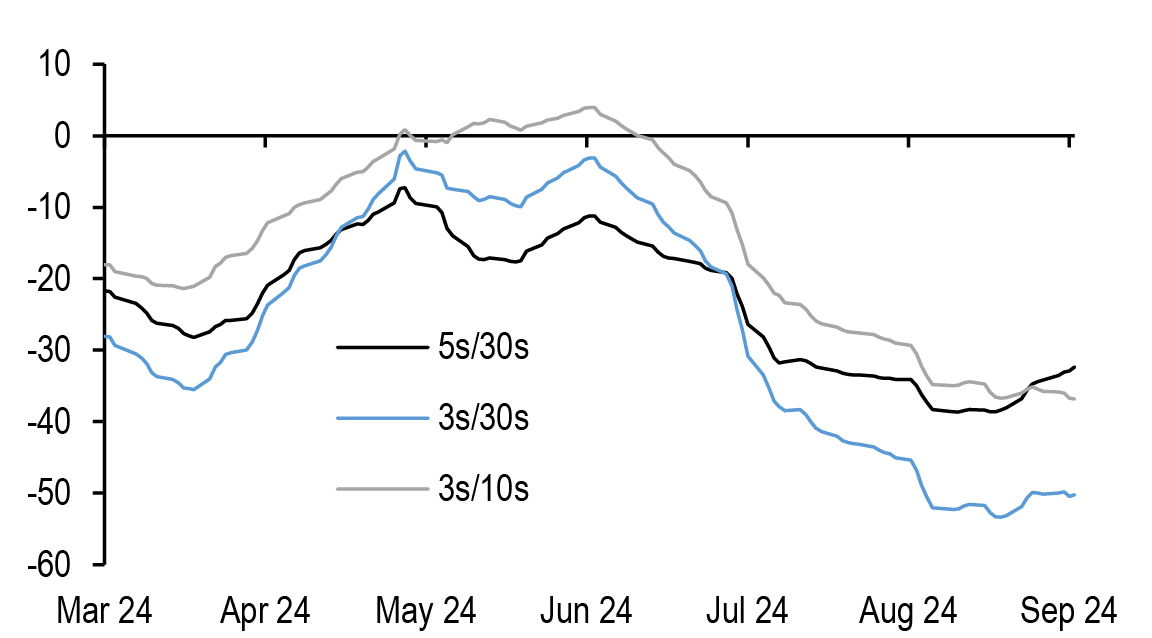

- UK: Enter tactical longs in 5Y gilts on relative valuations and asymmetric risks around US labour market data. Keep paying belly Mar25/May25/Jun25 MPC OIS fly. 10s/30s gilt curve is too steep on an RV basis. Go long belly 10s/30s/50s gilt fly (50:50). Keep 10Y swap spread narrower. Stay short 3Mx10Y unhedged straddle. We entered 10s/30s RPI swap curve flatteners.

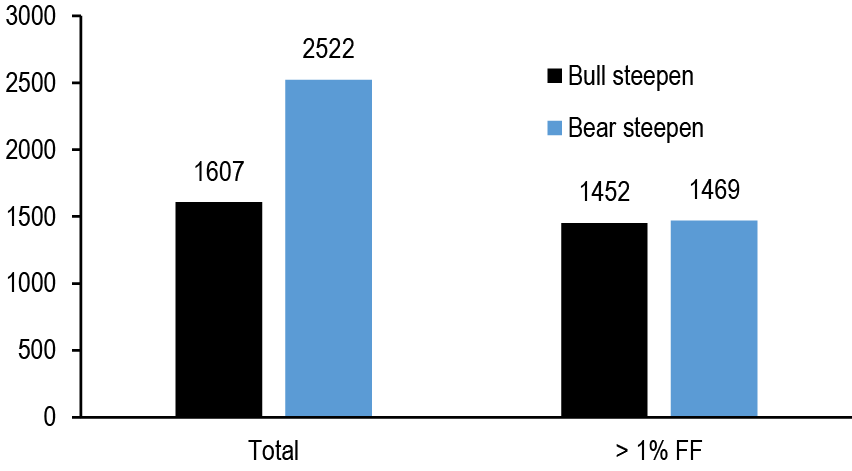

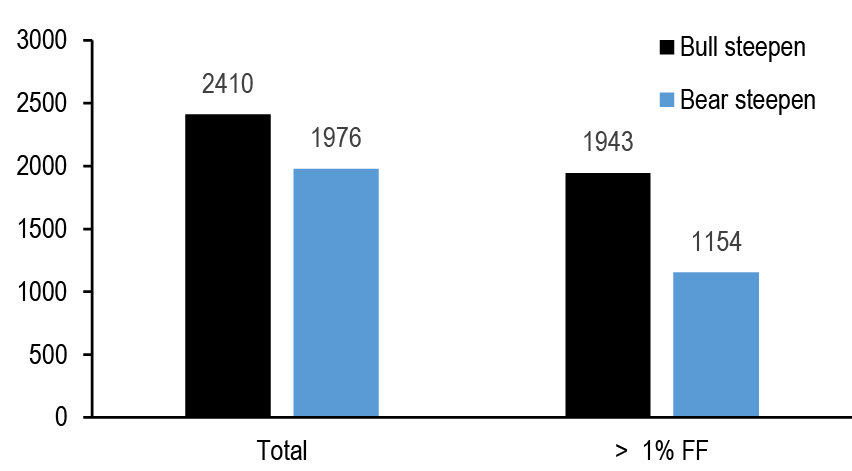

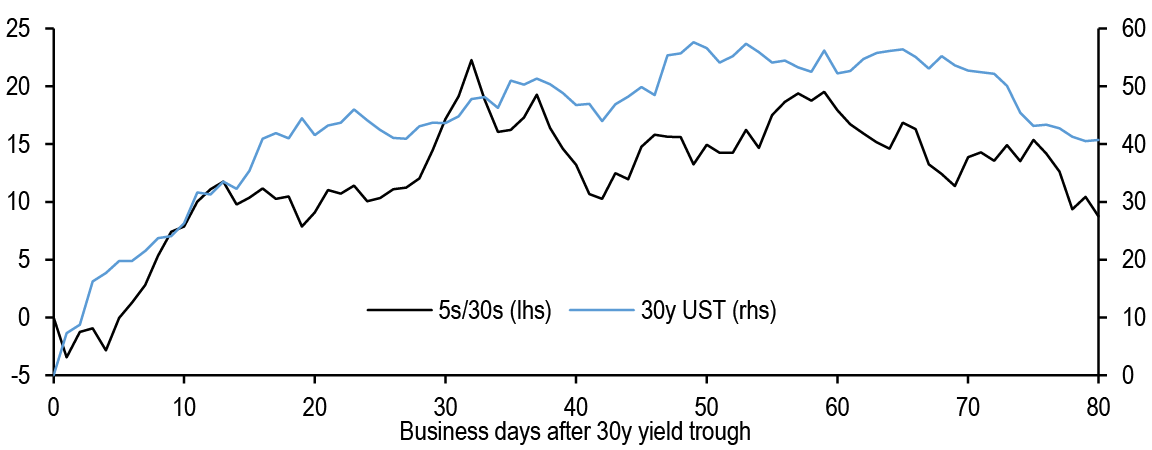

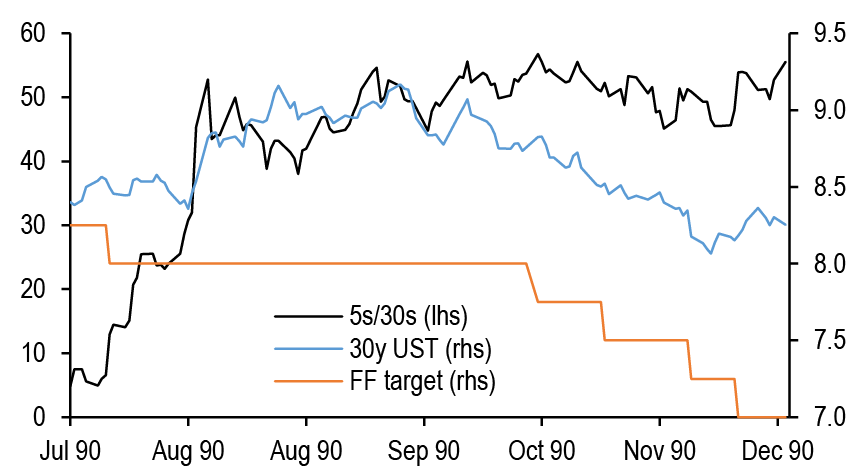

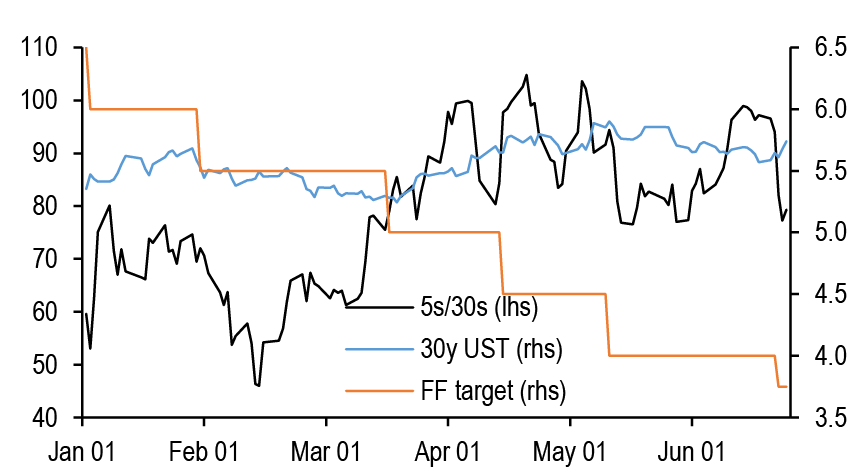

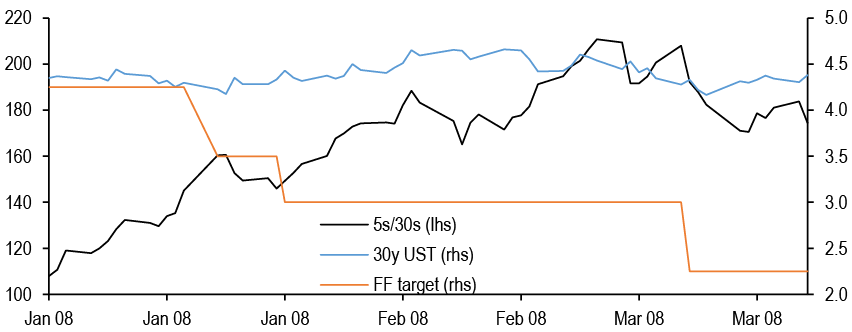

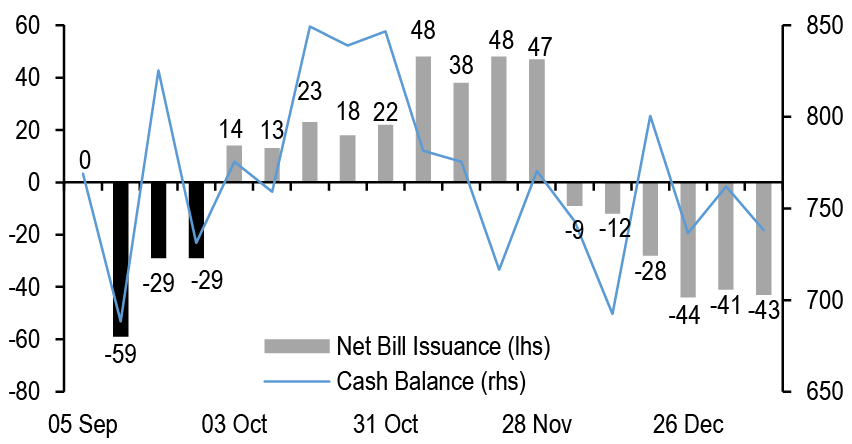

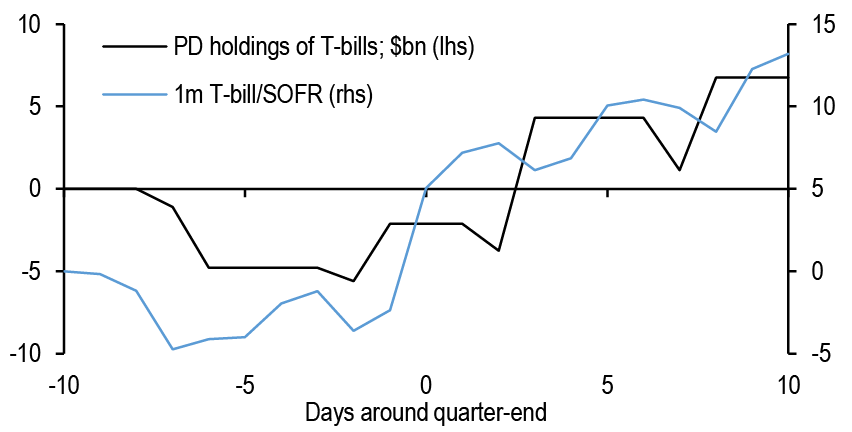

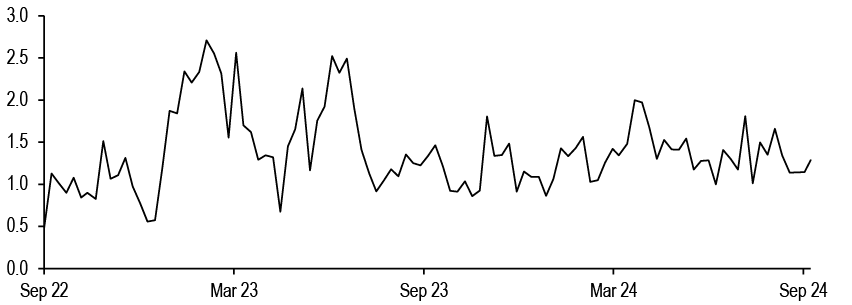

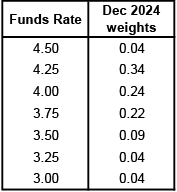

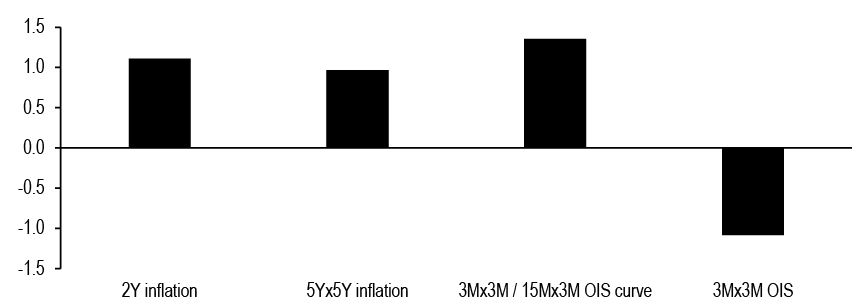

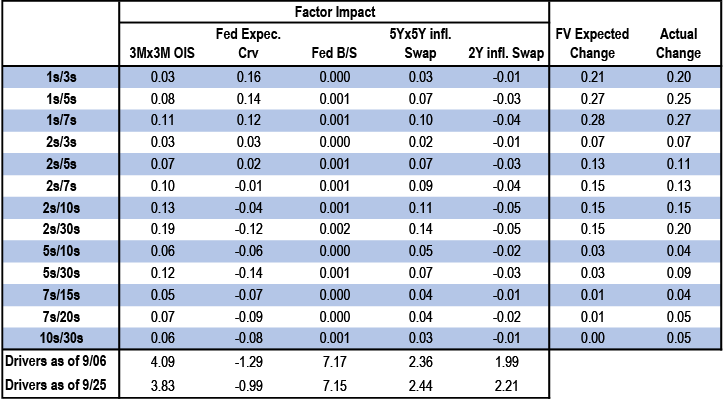

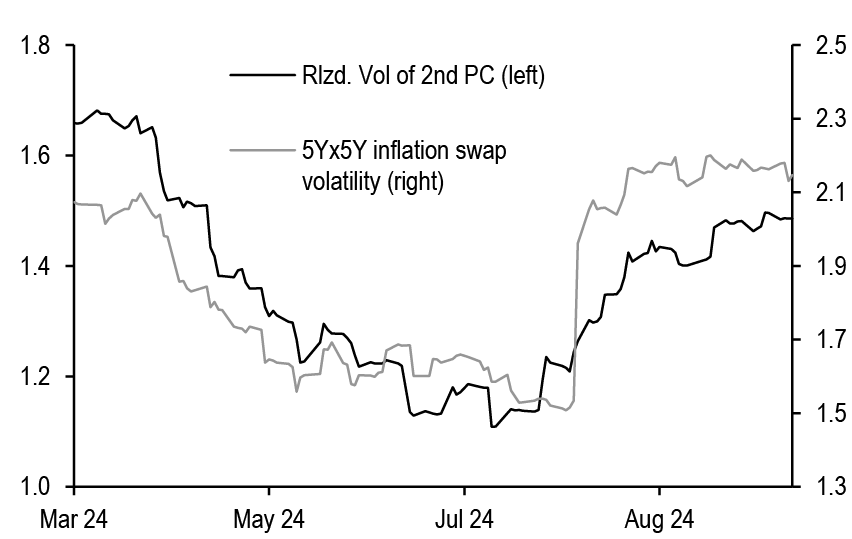

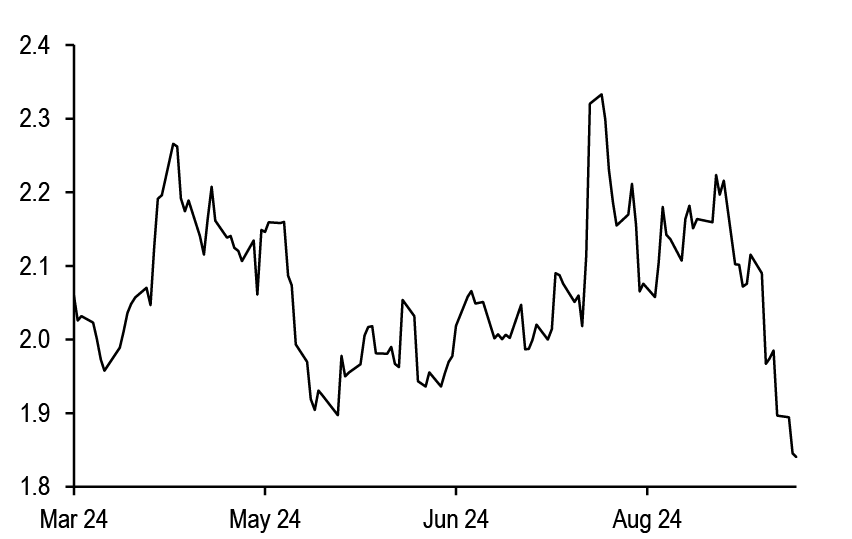

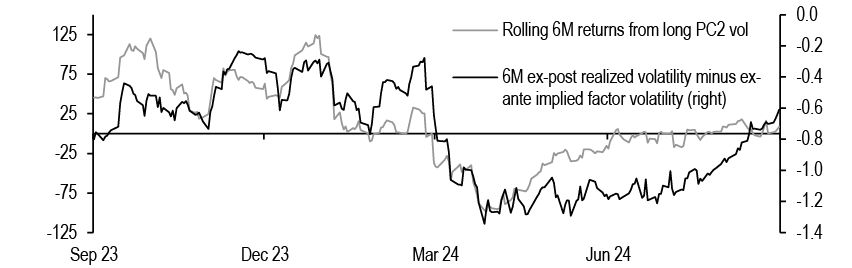

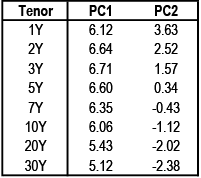

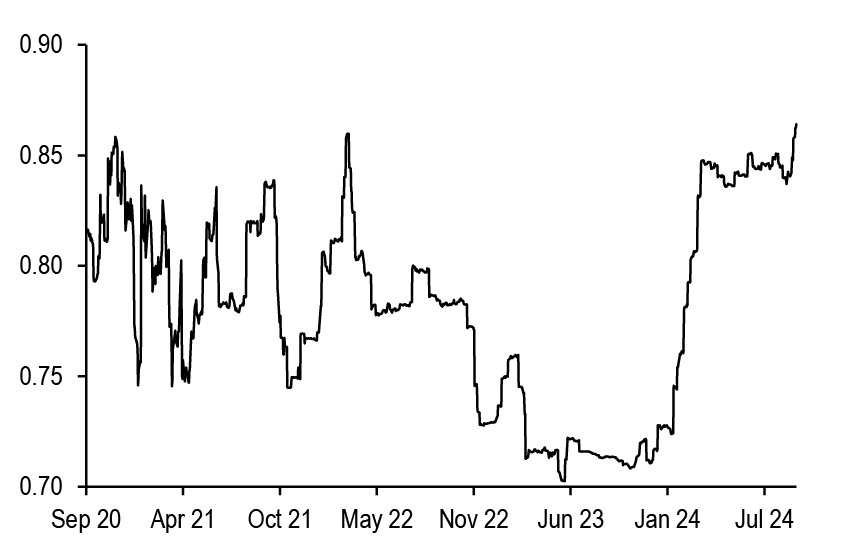

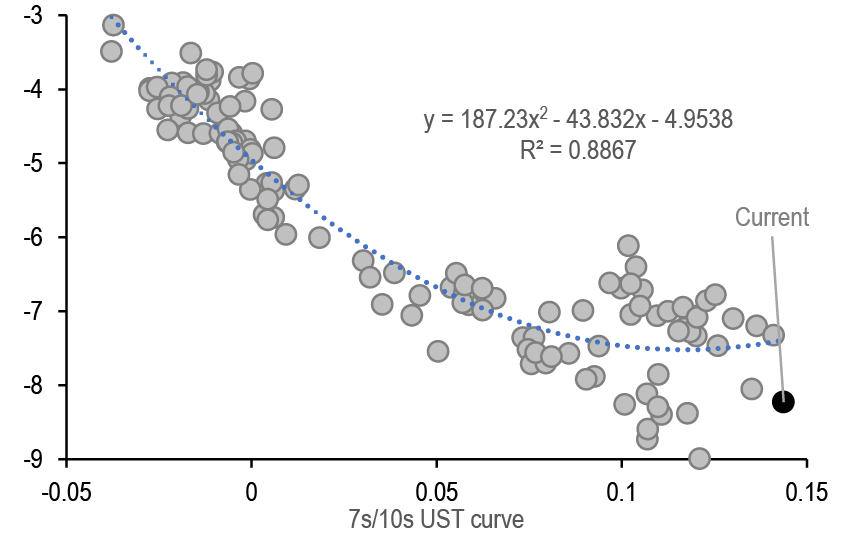

- US: If our above-consensus unemployment rate forecast come to fruition, this should bias Treasury yields lower in the near-term. We recommend expressing this bullish view with curve steepeners: curves look less steep when we also adjust for the market’s medium-term inflation expectations and the Fed’s share of the Treasury market: initiate 3s/20s steepeners. We discuss historical bear steepening periods over the last 35 years, particularly other instances when these moves took place alongside Fed easing: overall, the curve tends to consolidate after a brief bout of steepening, and long-end yields tend to stabilize or move lower as the Fed eases further. We review the tenth annual Treasury market conference, focusing on the panel discussions. T-bill supply is about to turn positive and we see $270bn of net issuance in the Oct-Nov period. Front-end bills are in the richer quartiles of their recent ranges, and the combinations of positive supply and quarter-end dynamics support some cheapening in the near term; risks are more balanced further out the T-bill curve. Stay neutral TIPS but hold energy-hedged 5s/10s BE curve steepeners. A strike among ILA dockworkers appears likely which could disrupt supply chains and push up CPI inflation around the end of the year. The bear steepening of the curve in recent weeks is partly explained by moves in long term inflation expectations, which is also helping to spur second-principal component volatility higher - underweight volatility on 10-year tails versus 30-year tails, overweight 2-year tail volatility versus 5-year tails, and overweight 5s/30s YCSO volatility versus swaptions. Stay neutral on swap spreads outright, but initiate exposure to a steeper 7s/10s maturity matched swap spread curve. Turn tactically neutral on volatility on an outright basis ahead of next week’s data.

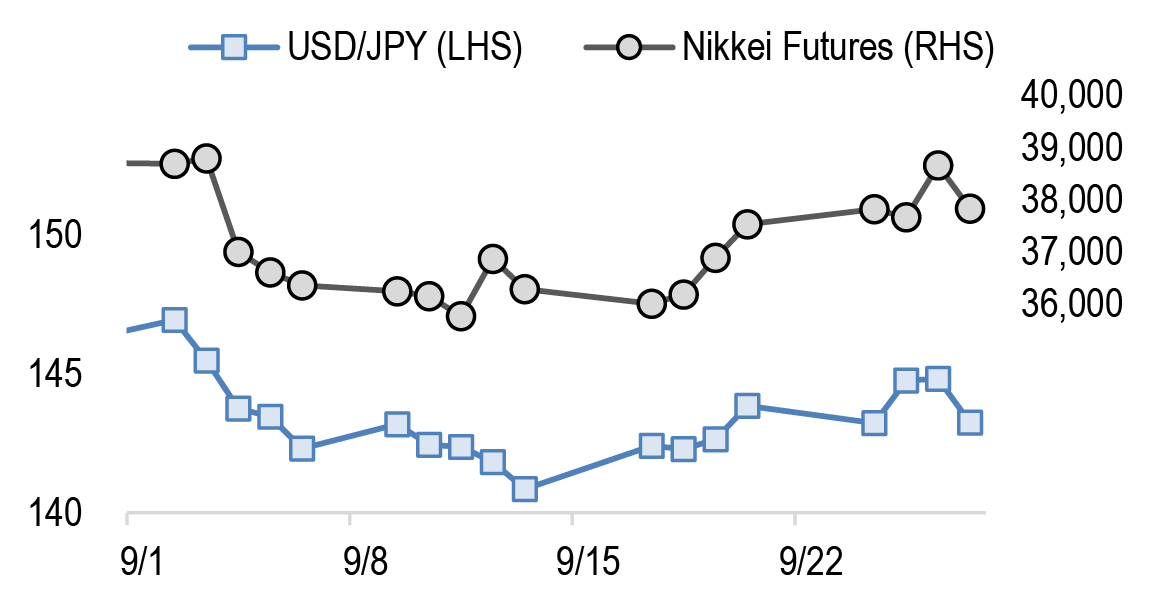

- Japan: Former Secretary-General Ishiba won the LDP leadership election. As the market priced in a Takaichi win scenario, we expect yields to reprice higher and curves to flatten in coming days. Keep 2s/10s JGB curve flatteners.

- Australia & New Zealand: Stay paid AUD 1s/2s IRS curve, and received AUD 5Yx5Y vs. US. Stay paid the Nov ’24/Feb ’25 RBNZ OIS spread ACGB Apr-2026s on ASW.

Overview

Idiosyncratic paces: it’s time to adjust

- Idiosyncratic macro dynamic came to the forefront of rates markets this week, with a notable outperformance of EUR rates in a bull steepening move, driven by a weak Euro area flash PMI for September and selective inflation data in France and Spain. Higher conviction in the broad disinflation process in the Euro area and downside risk on growth triggered a change in our ECB call. We reckon this is a shift in fundamentals and now expect the ECB to deliver back-to-back 25bp cuts starting in October, reaching 2% policy rate in June 2025, earlier than our previous call for September 2025. Risks are biased for even lower terminal even in the absence of a recession. We refresh our indices to capture the Intensity of Expected policy rate Normalisation (IEN) as a function of the amount of easing priced in the OIS curve and of the proximity of the trough. Across US, Euro area and UK current IEN indices are now pricing a more aggressive normalisation than in late December 2023, with lower terminal and earlier troughs. Bullish duration bias expressed mostly via option structures or long real yields in the Euro area, and long 5Y gilts in the UK.

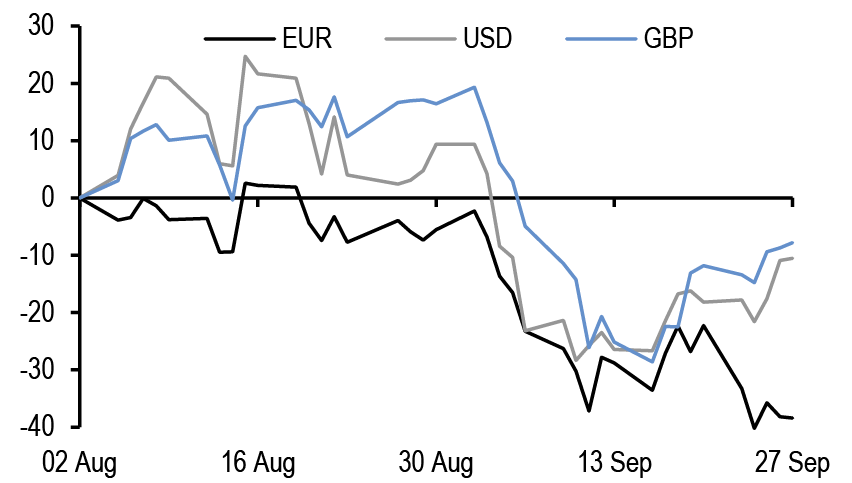

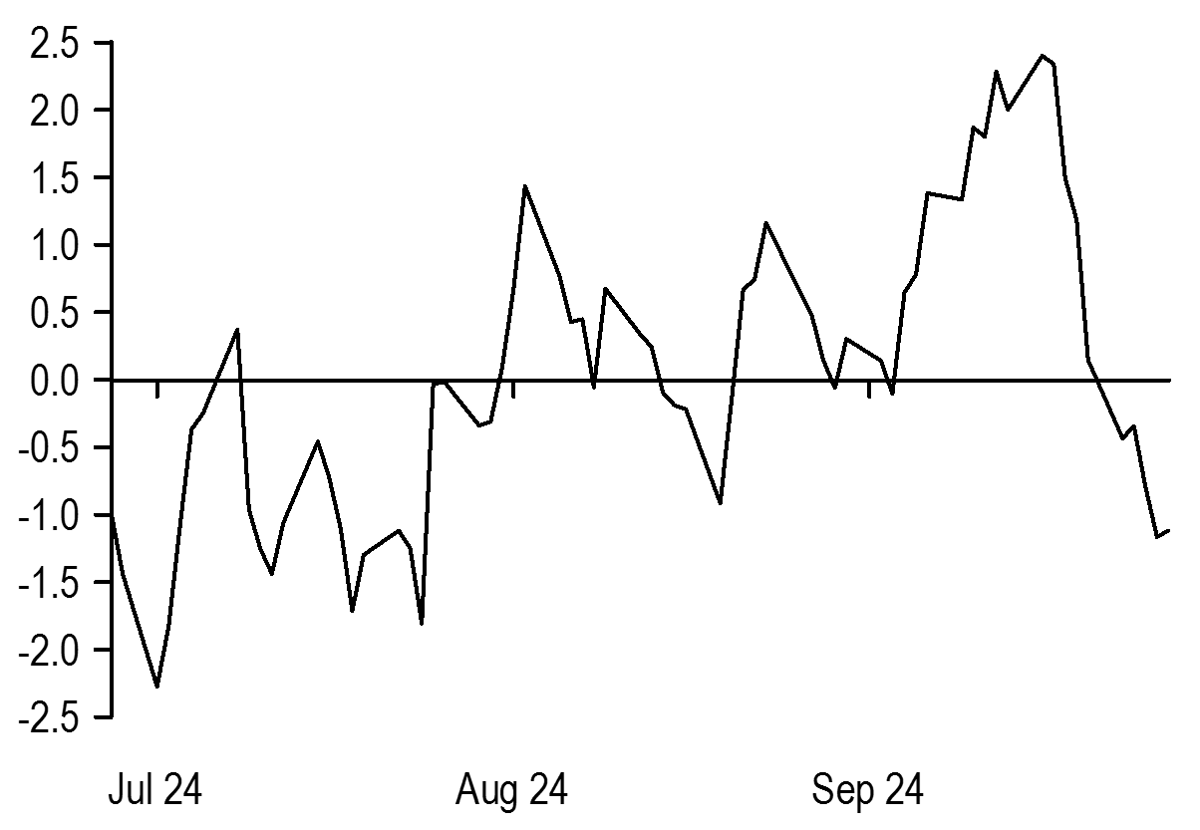

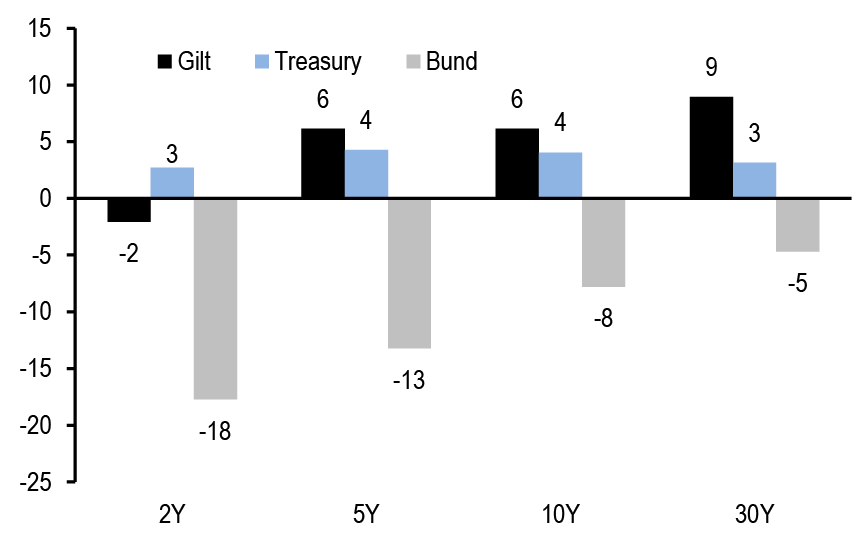

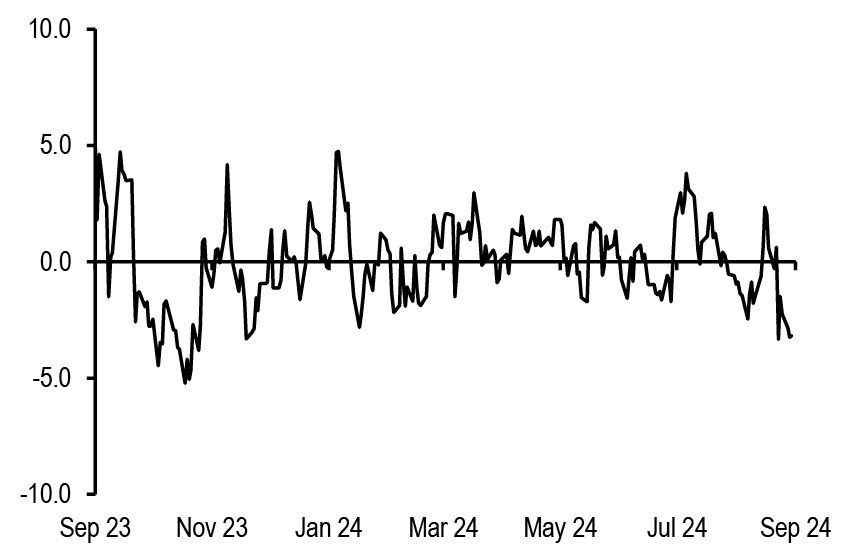

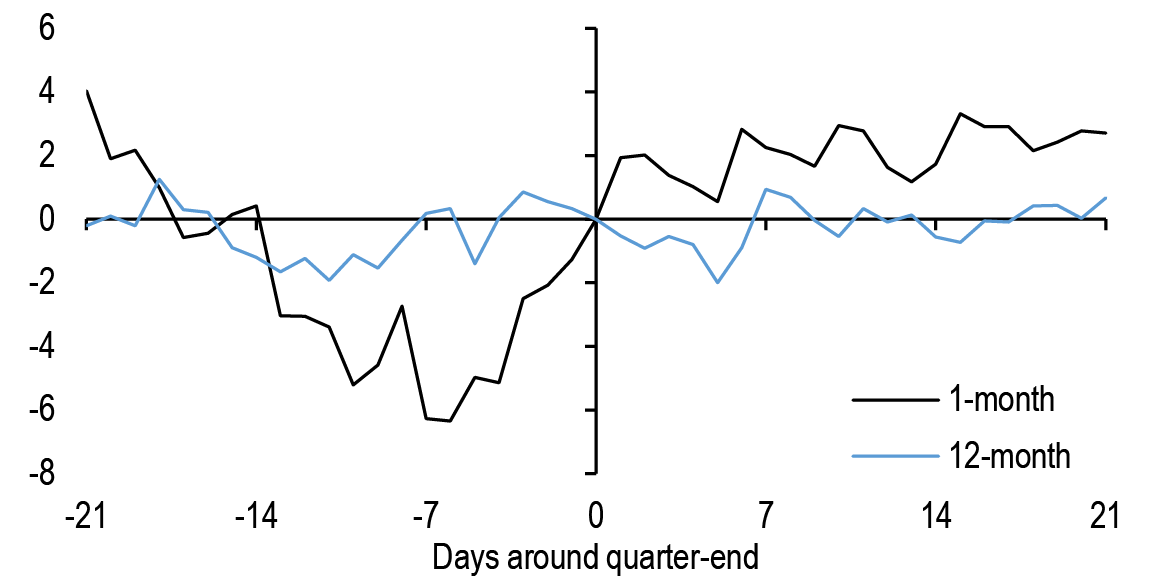

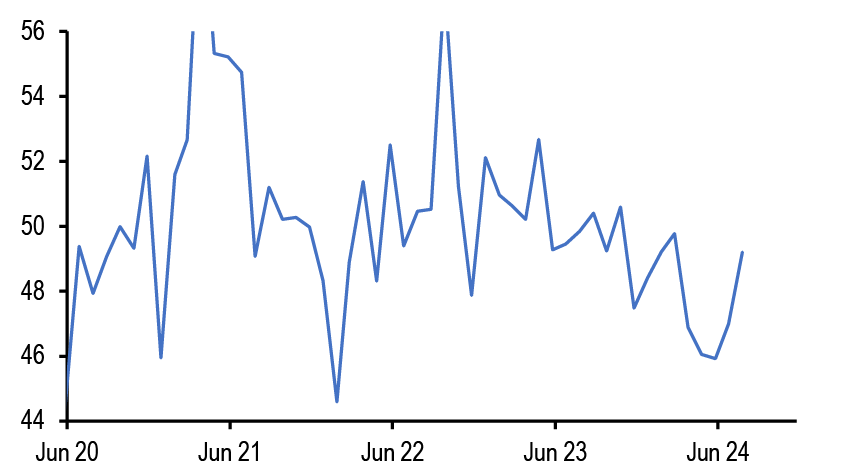

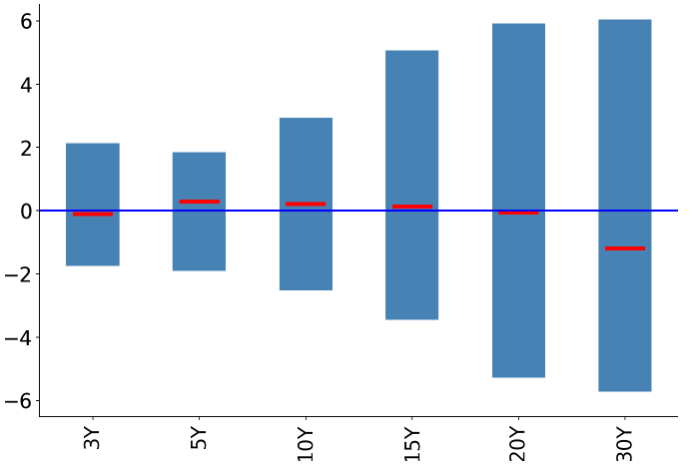

Idiosyncratic macro dynamic came to the forefront of rates markets this week with a notable outperformance of EUR rates in a bull steepening move ( Figure 1), led by a short-end rally of around around 17bp. The outperformance of the Euro area was driven by a weak flash PMI for September and selective inflation data in France and Spain. UK rates twist steepened with a 5-8bp sell-off at the long-end of the curve, while in the US rates sold off modestly relative to last week.

Figure 1: Idiosyncratic macro dynamic came to the forefront of rates markets this week with a notable outperformance of EUR rates in a bull steepening move

Cumulative change in 1Yx1Y OIS rate in EUR, USD and GBP; since Aug 2024; bp

Source: J.P. Morgan.

Cumulative change in in 5Yx5Y OIS rate in EUR, USD and GBP; since Aug 2024; bp

Source: J.P. Morgan.

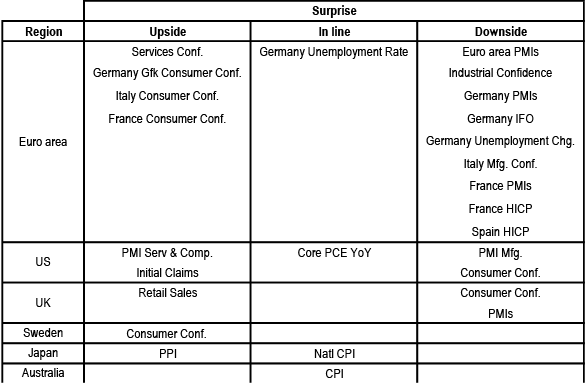

Euro area data was particularly in focus, given the release of the September PMIs, the consumer confidence readings, inflation data in France and Spain and the German employment report over the past week. The September PMIs delivered a disappointment, with the strongest weakness showing up in France and Germany; the German IFO also printed below expectations further reinforcing the PMI disappointment. While the weakness in the French survey could be rationalized as an Olympics-related retracement, the more acute miss in Germany (and the modest softening also in other countries) raises doubts over the growth outlook. Of particular concern was the weakness registered in the PMI employment index in Germany, which was further confirmed by the downside surprise in the unemployment data released later in the week. Indeed, while German production had been depressed for a while and services had been slowing down, the recent data indicate that this is now accompanied also by a softening in the labour market. Despite consumer confidence still being quite strong, we now believe that risks to growth are tilting. As discussed in Both sides now:Widening global growth tails, B. Kasman, 26 September, we continue to see around 35% probability of recession globally over the coming months, but the recent data indicate that the tail risks around our forecast are widening, being the lowest in the US but the highest in the Euro area. On the inflation side, CPI Spain and France considerably missed expectations, with energy prices being the major driver of the decline in both countries even though also core inflation dropped below expectations in Spain and services disinflation was noted in the French press release. We still have to see the inflation numbers for the rest of the Euro area, but we believe that the Spanish and French prints already suggest a higher conviction in the broad disinflation process in the Euro area.

All in all, we believe that this week’s data have moved the needle and give reason to believe that the ECB will have to break away from its gradual stance given the signs of weakening on the growth side. We have thus changed our ECB call (see ECB to go meeting-by-meeting, starting in October, G. Fuzesi, 27 September) and now expect the next ECB cut at the upcoming October meeting (vs. December previously) and consecutive 25bp cuts thereafter (while we had previously penciled in back-to-back cuts only from March 2025). Concerns about services inflation are likely still there, but there is a strong case for delivering cuts a bit more quickly to help avoid a more abrupt growth slowdown and thus a disorderly disinflation process. We believe that the Governing Council could easily shift its rhetoric and present the October cut as an “insurance” cut and not pre-commit to a particular path thereafter. We believe that the ECB will reach a terminal rate of 2% in June. We note that this remains our best guess for neutral rate, but there are risks that the ECB could cut rates even below 2%, even in absence of a recession, given the possibility of inflation undershooting due to a lower r*. Risks around medium-term inflation indeed remain balanced on both sides in the Euro area more than elsewhere.

Turning to central banks, this week the RBA left policy rates on hold at 4.35% with the overall delivery being perceived by markets as less hawkish relative to previous meetings given the absence of a discussion on rate hikes. The board seemed to indicate that they are not yet confident on inflation but they appeared less dismissive on rate cuts. Our economists continue to call for a start of easing in February 2025 given our expectation that inflation would annualize within the target band in 2H24; however, there are risks of an earlier cut if inflation slows at a faster than expected pace. On Wednesday, the Riksbank cut rates by 25bp in the morning to 3.25% and signaled rates would likely cut at the two remaining meetings of the year. The Riksbank communication was broadly dovish as they highlighted the possibility of a 50bp cut, even though this was not evident from the official rate path which showed 100% probability of two 25bp cuts in 2024. Finally, this week also the SNB cut the policy rate another 25bp, down to 1%.

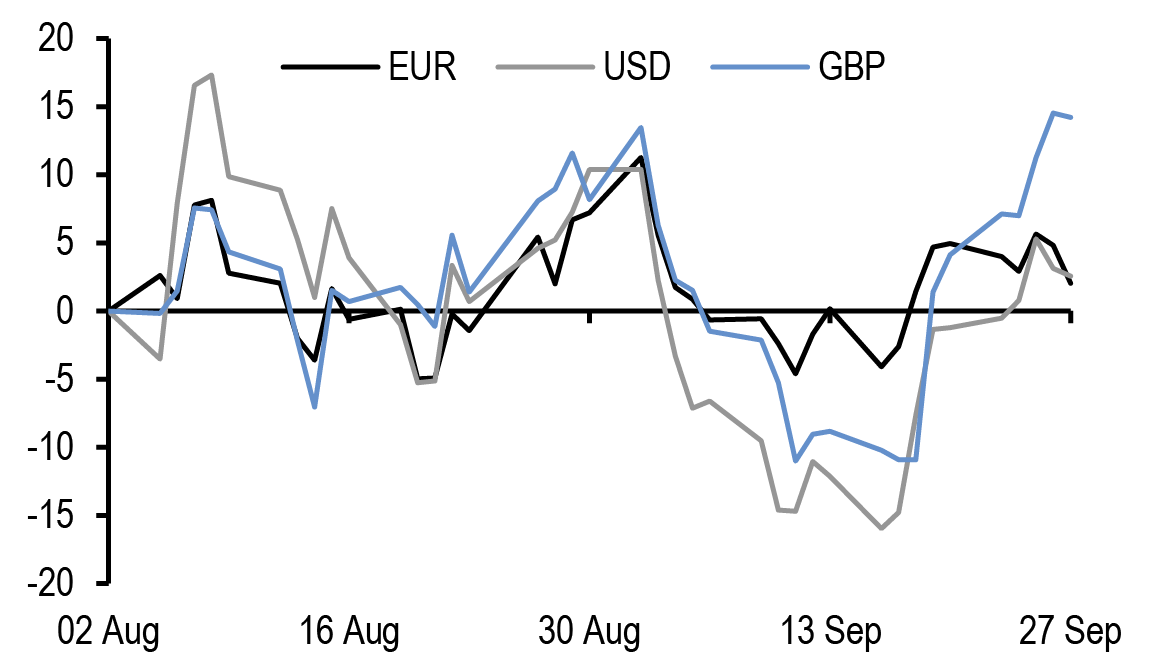

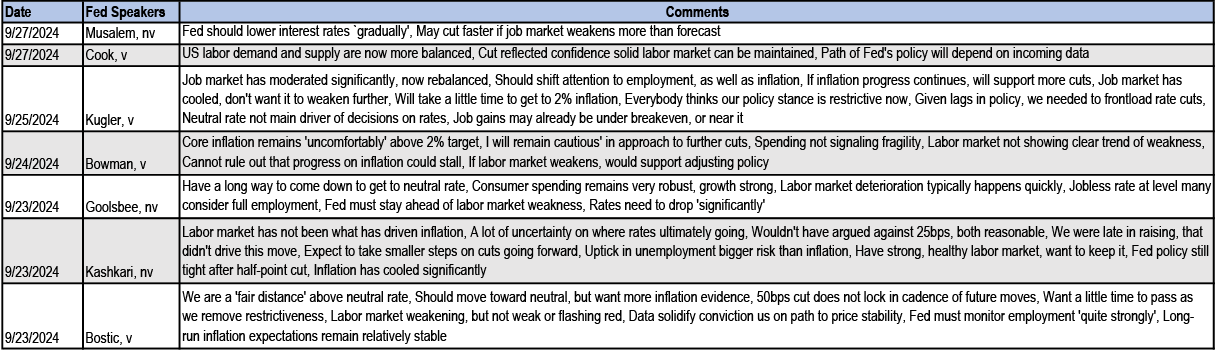

Over the past week, board members of ECB, Fed and BoE spoke at several scheduled events ( Figure 2). The message from the Fed broadly confirmed last week’s meeting delivery, with FOMC members indicating that the labour market is weakening but not yet weak. Board members mentioned that the 50bp cut was therefore intended to preserve labour markets from a substantial deterioration and that the upcoming cuts could possibly come in smaller steps. Across the ocean, ECB rhetoric over the week continued to indicate that the direction for policy rates is downward, although the pace of cuts will have to be determined based on the data with Governing Council members still being quite uncertain on an October cut, which is now our base case. In UK, the BoE commentary was broadly in line with the message delivered at last weeks’ meeting as MPC members continued to highlight that they do see themselves cutting rates further, although such easing will have to be “gradual” and “cautious”. It could be argued that, after the Fed 50bp cut, there is now more pressure on BoE to act more quickly; however, we believe that we would need to see a shift in the data, especially in the super core measure that is being closely watched by BoE, to have good chances of two consecutive cuts at the November and December meetings this year.

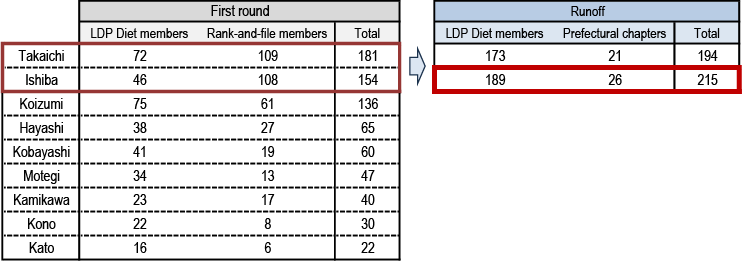

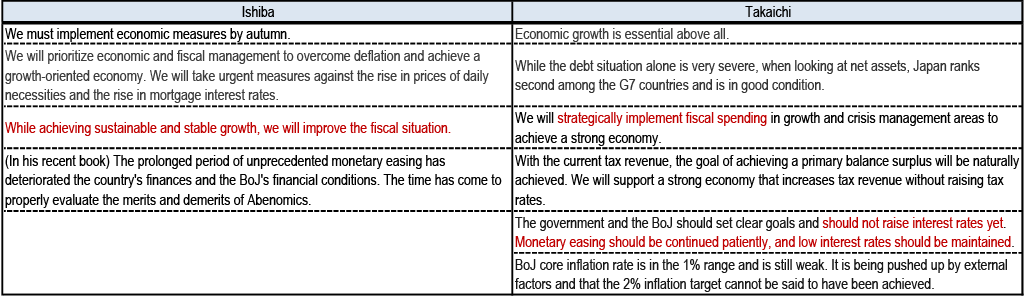

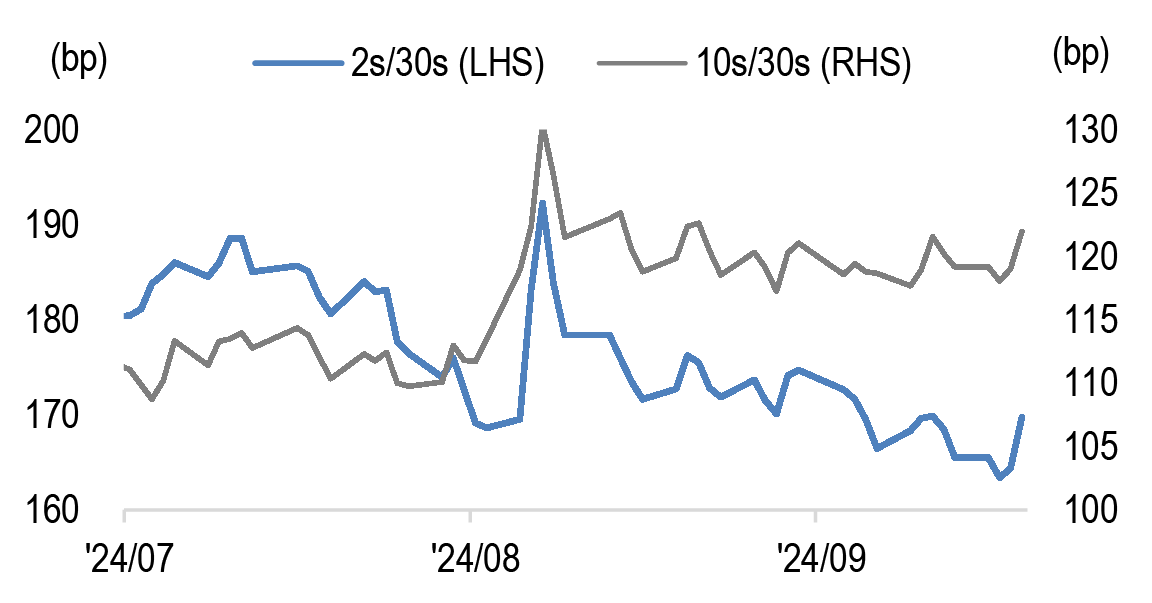

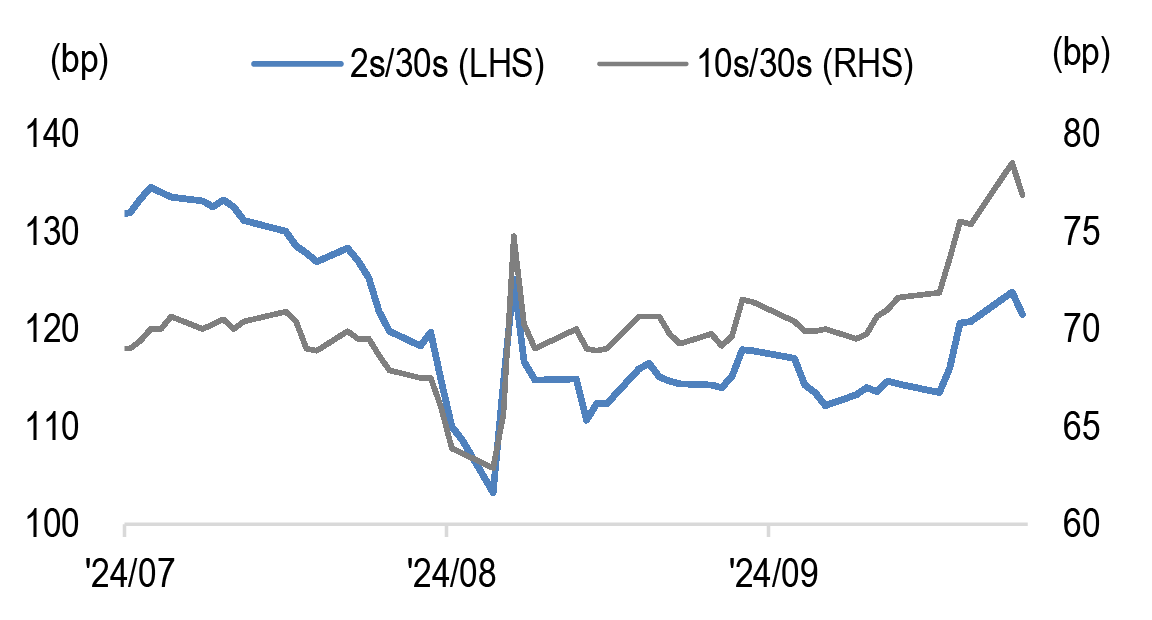

Finally, on a different note, investor focus in the Japanese markets shifted this week to the LDP leadership contest. The first round of the LDP election on Friday delivered a surprising turnaround with the victory of Ishiba over the Takaichi, who was seen to have good chances of winning. While Takaichi would favour fiscal expansion and oppose BoJ rate hikes, Ishiba is considered a relative hawk due to his support for fiscal consolidation and would not oppose the BoJ policy trajectory. Since the market had priced in a Takaichi win scenario, we expect yields to reprice higher and curves to flatten in coming days.

Figure 2: Central bank commentary from Fed, ECB and BoE continued to suggest that the path of rates going forward is clearly downwards, even though the pace of cuts over the coming months remains highly uncertain

Selected comments from Fed, ECB and BoE Board Members;

Source: Media articles, J.P. Morgan.

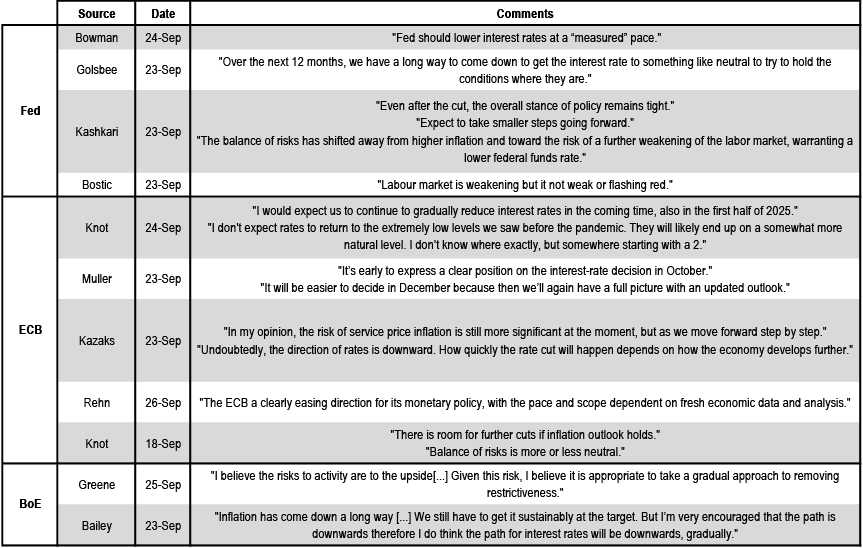

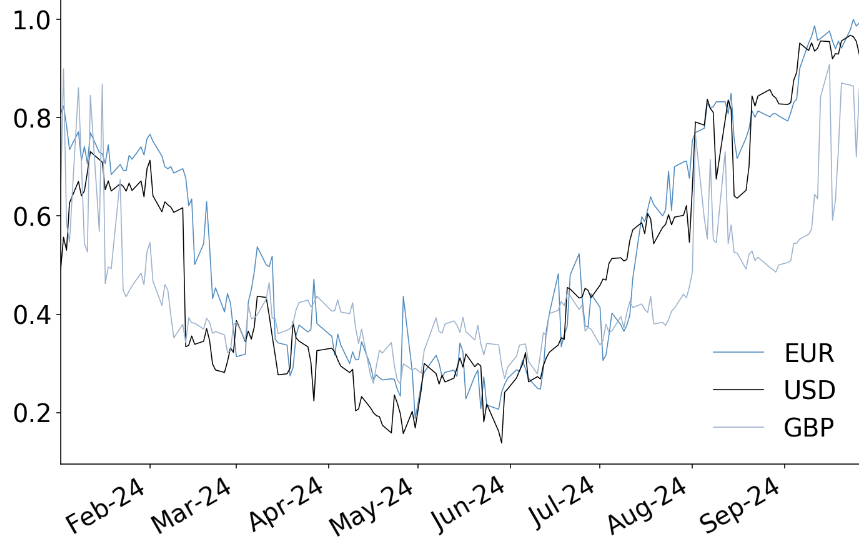

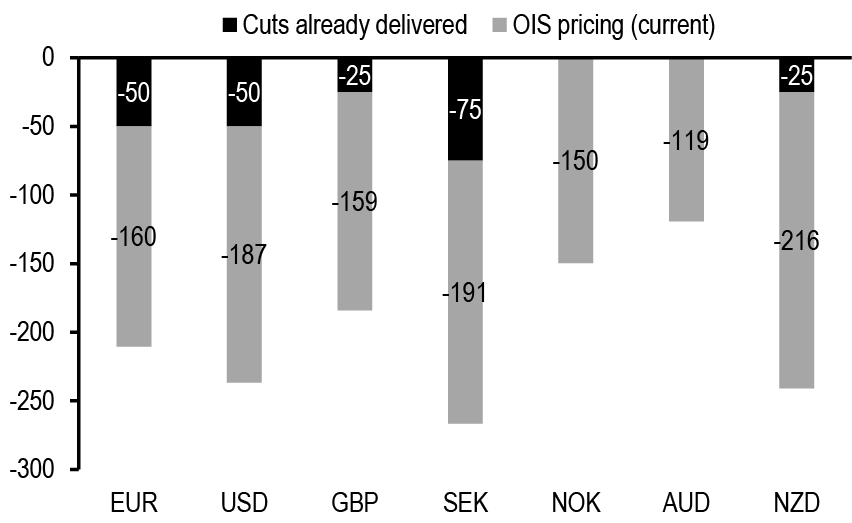

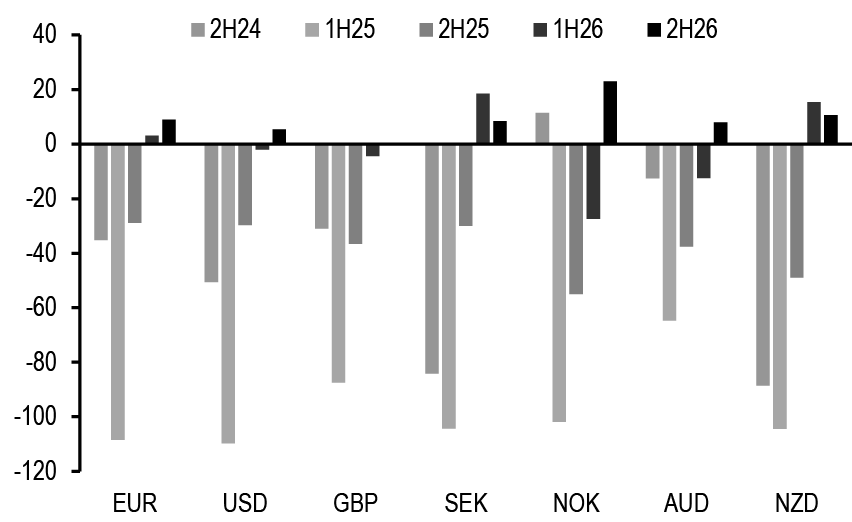

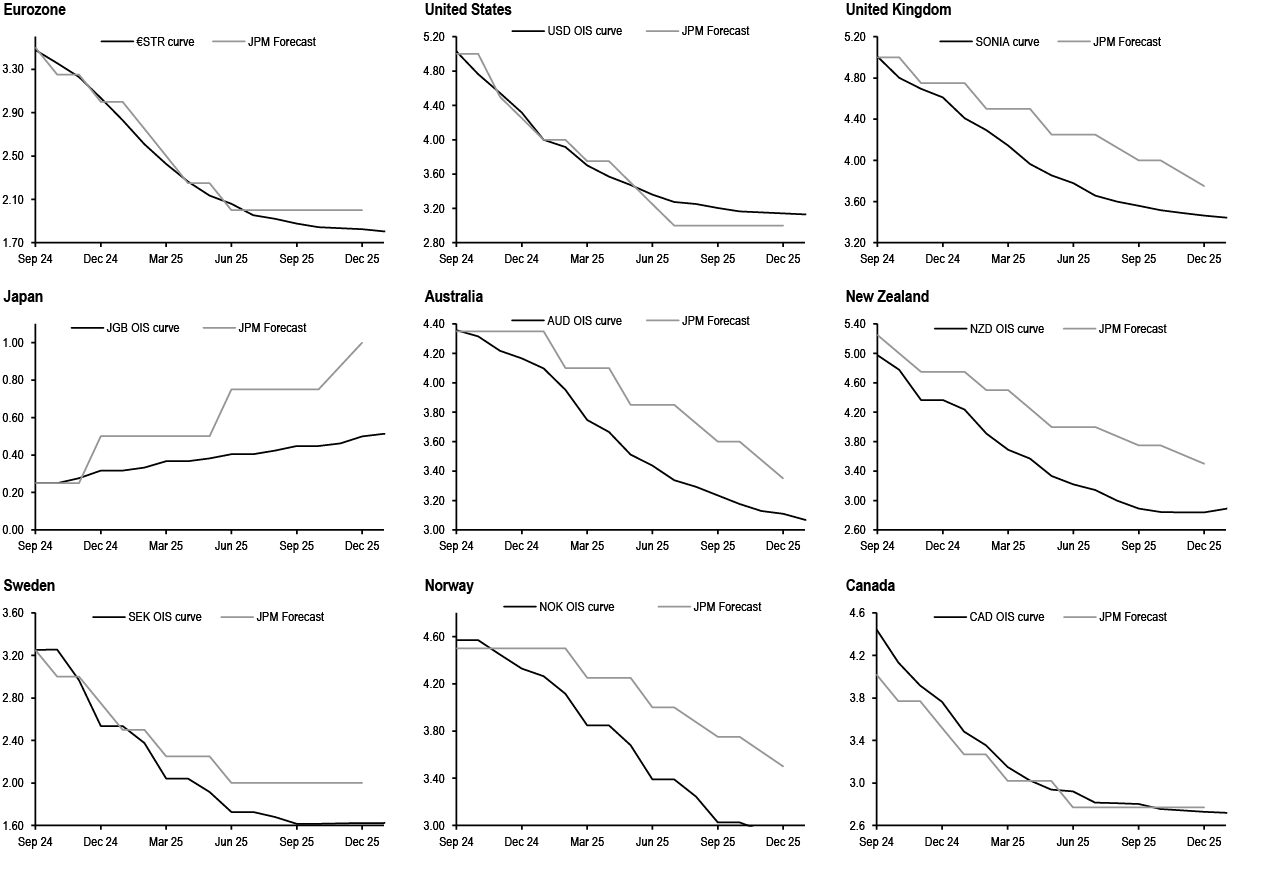

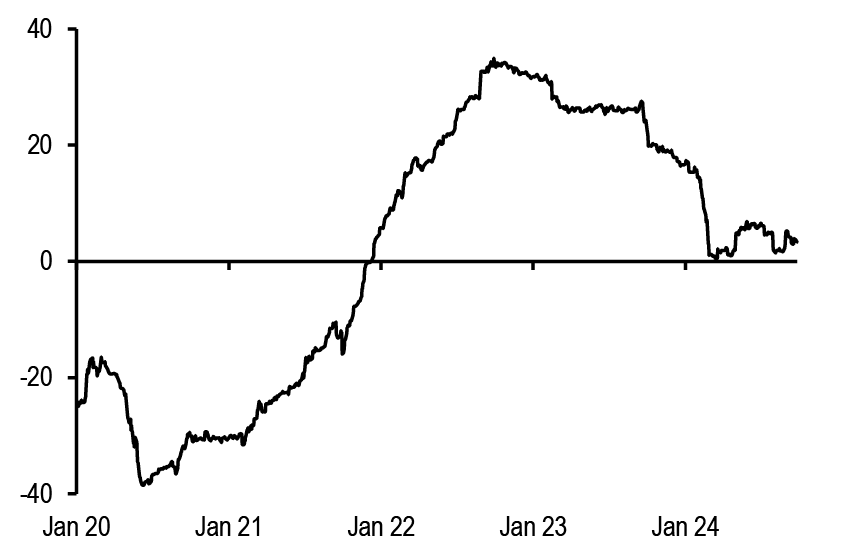

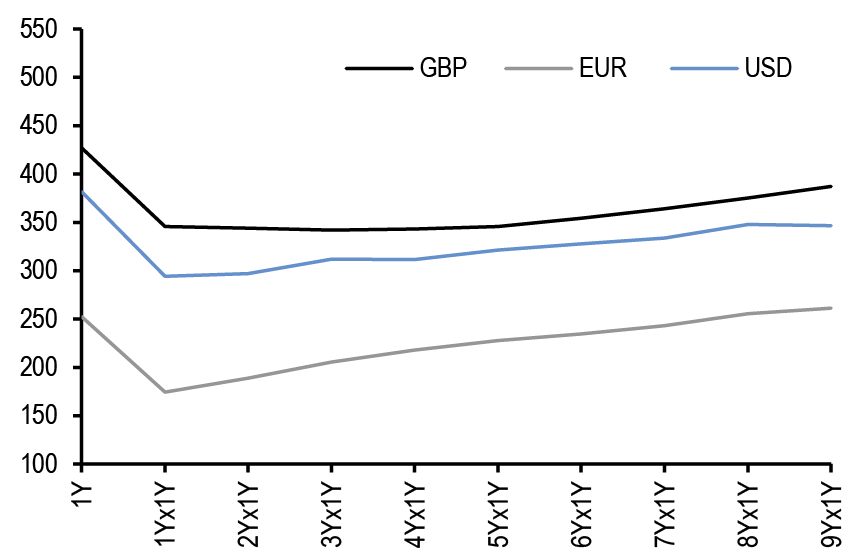

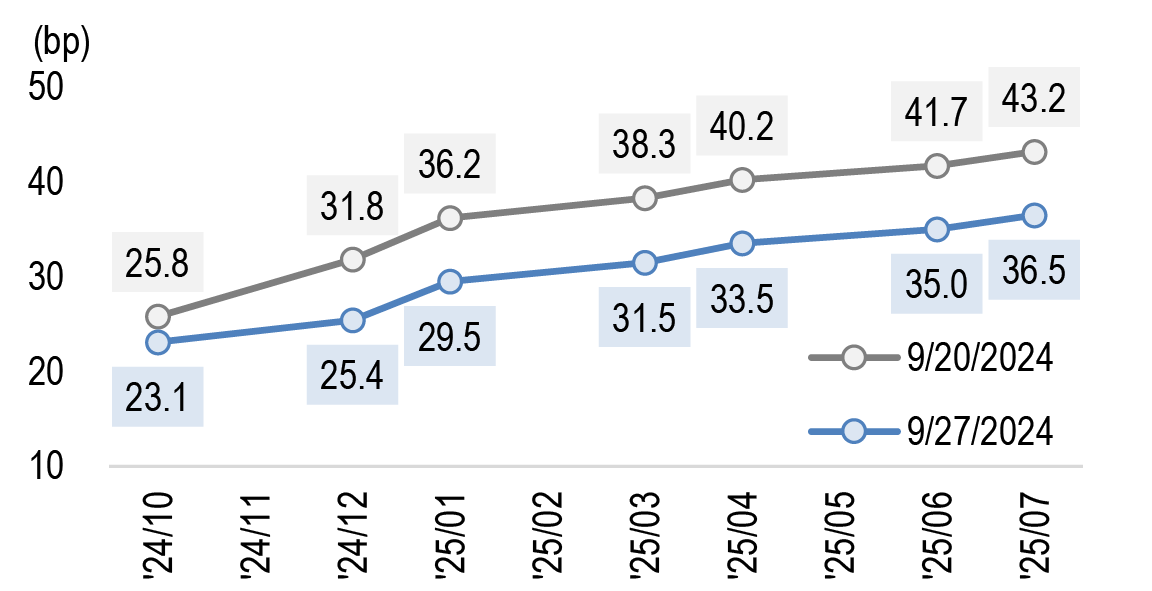

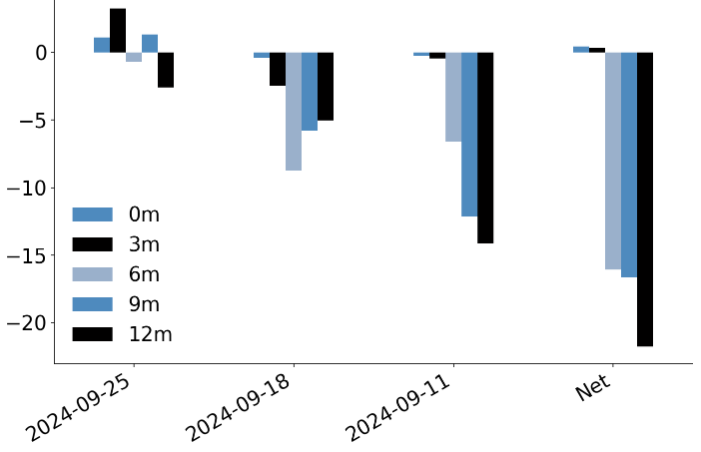

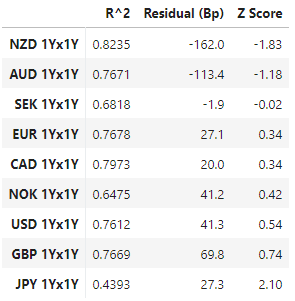

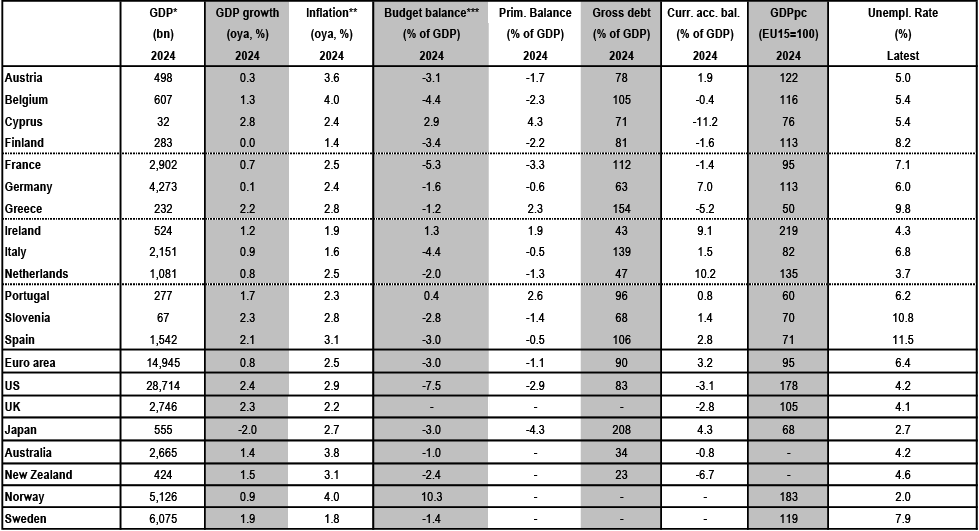

Looking at market pricing of policy expectations, we note that OIS markets have priced in expectations of a more aggressive easing to be delivered by the Fed, ECB and BoE relative to the start of the year ( Figure 3). Indeed, our Indicator of Expected monetary policy Normalisation (IEN), a measure that captures the intensity of the policy rate normalisation path priced in money markets as a blend of the speed (months to the trough of the cycle) and breadth of cuts (cumulative amount of easing expected until the trough of the cycle), has increased recently to its peaks since the beginning of the year for the G3 central banks. Across DMs, OIS markets are expecting that most central banks will have eased rates between 200bp and 250bp by the end of 2026 with a more aggressive expected pace of easing next year, especially from the Fed, and the cutting cycle likely to be concluded in 2H25 across most jurisdictions ( Figure 4). Norway and Australia are the exceptions to this as they are showing less cumulative cuts and a delayed easing cycle relative to others.

Overall, relative to our call, markets are pricing in less cuts for Fed by end-2024, around the same amount for ECB and more cuts for the other central banks ( Figure 5). In Japan, markets continue to be reluctant to price in more hikes for the BoJ, while we are still calling for a December hike.

Figure 3: OIS markets have priced in expectations of a more aggressive easing to be delivered by the Fed, ECB and BoE relative to the start of the year in terms of pace and breadth of the cutting cycle

J.P. Morgan Index of Expected policy rate Normalisation for Fed, BoE and ECB

Note: To construct the IEN index, we first normalise the total amount of easing expected to be delivered over the whole easing cycle (i.e. the cumulative cuts priced in by OIS curves as well as those delivered so far) and the number of months to the expected trough. This means that the variables are scaled relative to their min and max since the last hike, i.e. (value – min)/ (max – min). We then compute the IEN index for each country as IEN = 1 – (0.5 * cumulative_easing_normalised + 0.5 * time_to_trough_normalised).

Source: J.P. Morgan.

Figure 4: OIS markets are expecting that most central banks will have eased rates between 200bp and 250bp by the end of 2026 with a more aggressive expected pace of easing next year, especially from the Fed, and the cutting cycle likely to be concluded in 2H25 across most jurisdictions

Cuts already delivered and cumulative easing priced in by the end of 2026 across DM OIS markets; bp

Source: J.P. Morgan.

Cumulative change in OIS rate priced in the money market curve for end-2024, mid-2025, end-2025, mid-2026 and end-2026; bp

Source: J.P. Morgan.

Figure 5: Relative to our call, markets are pricing in less cuts for Fed by end-2024, around the same amount for ECB and more cuts for the other central banks

Summary of current policy rates, J.P. Morgan forecast for next policy rate change and current market pricing in OIS over the next 36 months across DM central banks

Source: J.P. Morgan.

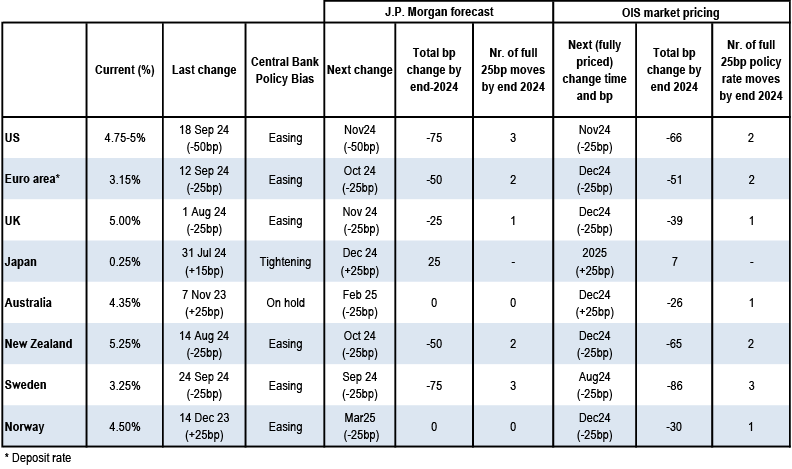

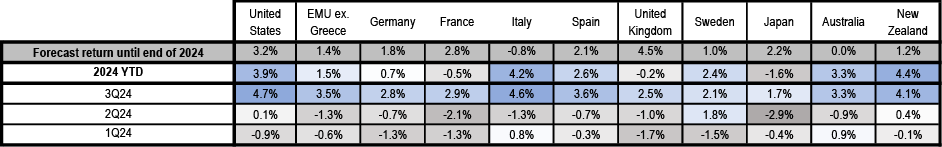

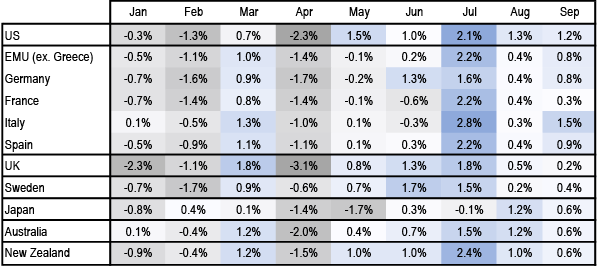

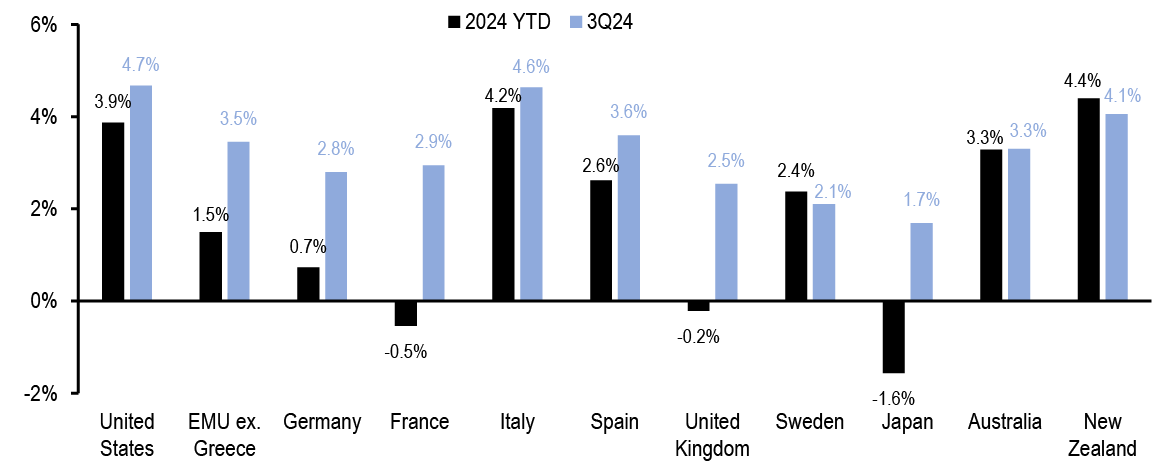

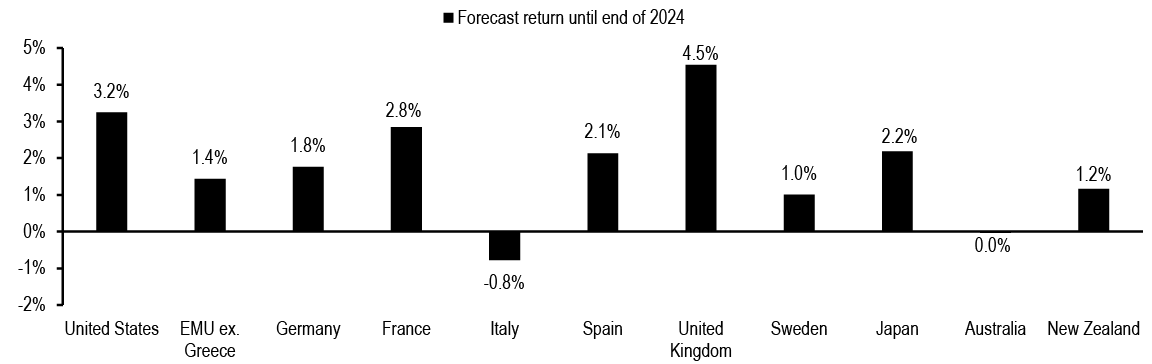

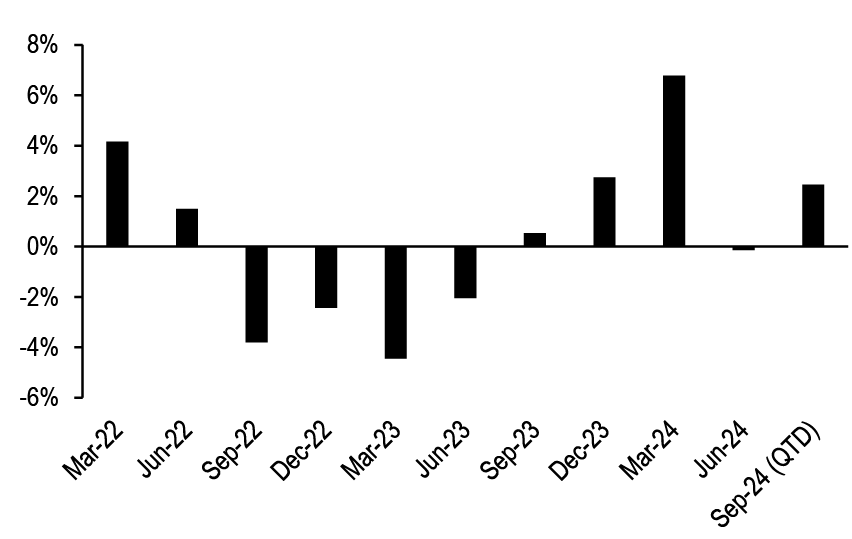

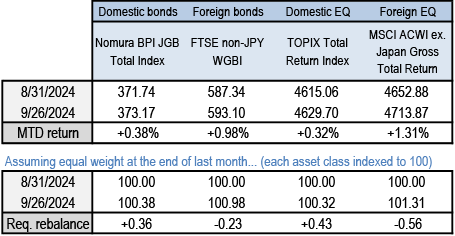

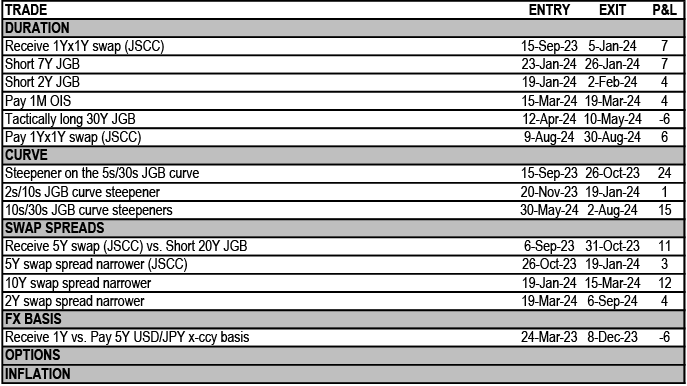

As the end of the quarter is approaching, we refresh our analysis of bond returns. We had already highlighted that the month of July delivered particularly strong returns for bond investors and we now note that, even though the pace of gains moderated, also August and September continued to positive bond performance. Therefore, despite the disappointing DM bond returns during the first part of the year, 3Q delivered a strong performance to rates investors, with July being the month with the highest YTD returns ( Figure 6). Overall, the positive 3Q returns outpaced the losses accumulated during 1H24 with larger 3Q returns than total YTD returns across all DM jurisdictions except Sweden and New Zealand ( Figure 7). The highest YTD bond returns were delivered in New Zealand (4.4%), Italy (4.2%) and US (3.9%), while in Japan (-1.5%), France (-0.7%), and UK (-0.2%) bond returns so far this year remain negative. From now until the end of the year, we still expect decent strong positive bond returns across DMs around 1-3% across most countries ( Figure 8). The highest returns over 4Q are expected in the UK (4.5%), while the lowest will be in Italy (-0.8%) and Australia (0%).

Figure 6: Despite disappointing bond returns across DM in the first half of the year, DM bonds delivered a strong performance in 3Q, with July being the month with highest YTD returns

Quarterly breakdown of bond returns for the country components of the JP Morgan Global Bond Index and projected return until the end of 2024; %

Source: J.P. Morgan.

Monthly breakdown of bond returns for the country components of the JPMorgan Global Bond Index; %

Source: J.P. Morgan.

Figure 7: The positive bond returns in 3Q broadly outpaced the losses of the first half of 2024 with the strongest YTD returns delivered in New Zealand, Italy and US…

Bond returns delivered in 3Q24 and total YTD bond returns for DM countries; %

Source: J.P. Morgan.

Figure 8: …From now until the end of the year, we still expect decent strong positive bond returns

Bond returns projected until the end of 2024; %

Source: J.P. Morgan.

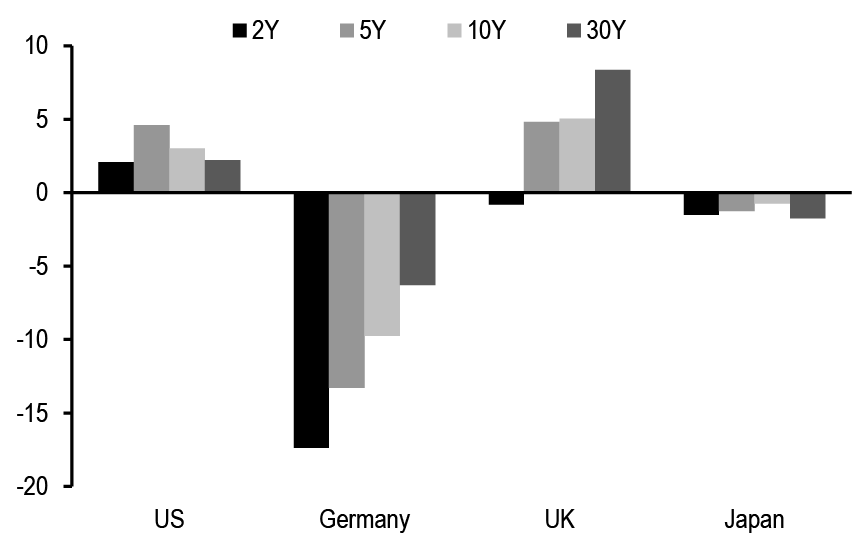

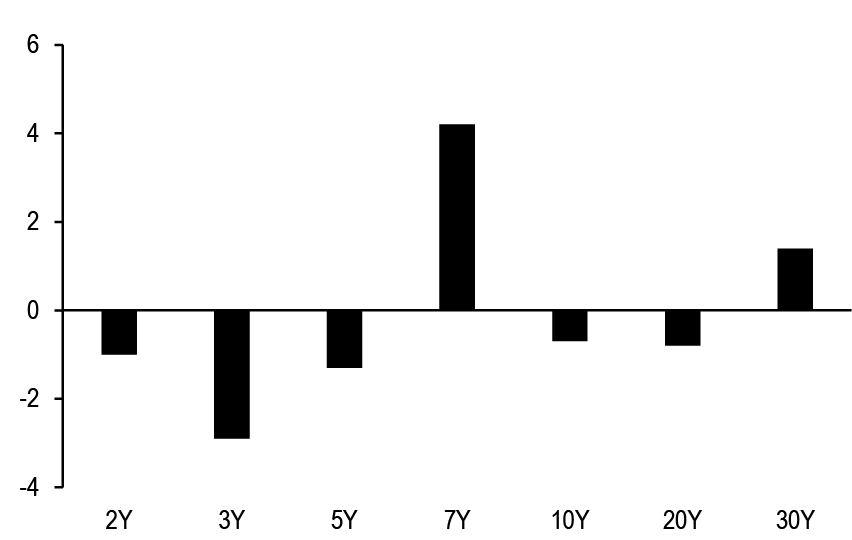

Figure 9: This week EUR rates outperformed in a bull steepening move. UK rates twist steepened with a 5-8bp sell-off at the long-end of the curve while in US rates sold off modestly relative to last week.

Change in b/m yield since 20th September by region, bp

Source: J.P.Morgan.

Figure 10: Busy data calendar in the Euro area with PMI disappointing in France and Germany, broad weakness in German data and downside surprise in French and Spanish HICP

Actual print vs. consensus expectations since 20th September 2024

Source: Bloomberg Finance L.P.

Note: Jobless claims are reported as upside (downside) surprises if they are lower (higher) than consensus expectations. Inflation expectations are reported as upside (downside) surprises if they are higher (lower) than consensus.

Figure 11: Central bank policy rate expectations inferred from money market rates

Central bank policy rate expectations (1M forward OIS rates starting at month end) and J.P. Morgan policy rates forecasts*, %

Source: J.P. Morgan.

* Adjusted for the differential between policy rates and O/N OIS rates. For USD OIS, adjusted for the differential between the O/N OIS rate and the upper bound of the Fed funds target range.

Levels as of COB 26th September 2024.

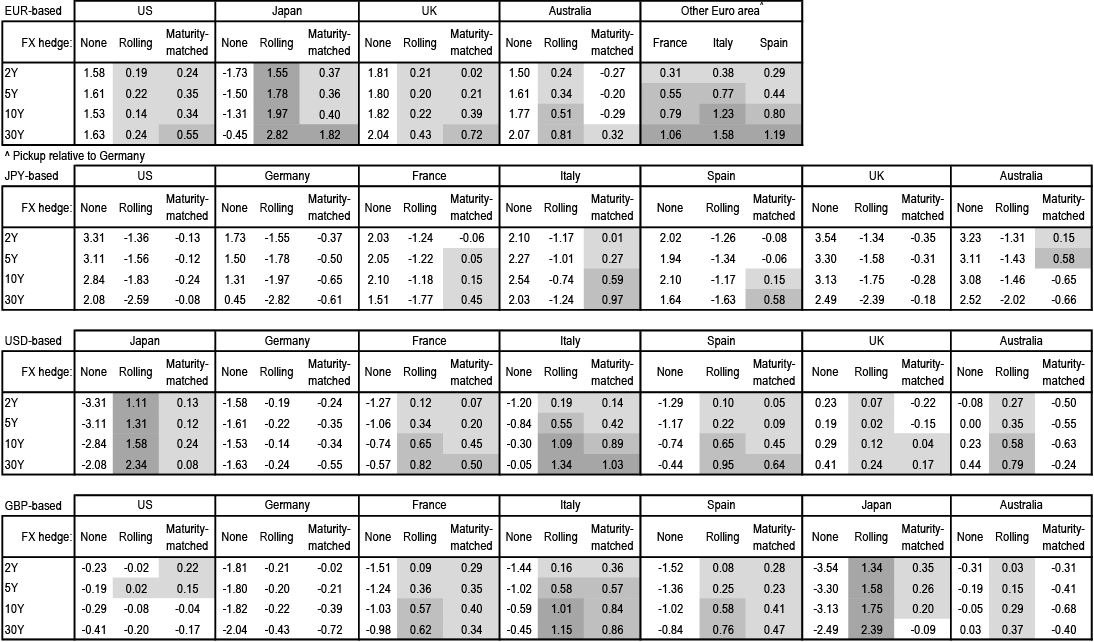

Figure 12: Yield pick-up available via foreign bonds by country and investor currency, on a currency-hedged basis (3M rolling and maturity-matched hedges) and unhedged

Annualised yield pick-up* for euro-, yen-, US dollar- and sterling-based investors from foreign currency bonds vs. domestic bonds (German bonds for euro-based investors) of the same maturity, with no hedge, 3M rolling**and maturity-matched*** currency hedges; shaded regions for rolling and maturity-matched hedges show >1% yield pick-up (darkest shading), between 0.5% and 1%, and between 0% and 0.5% (lightest shading), %

Source: J.P. Morgan. * Yield pick-up defined as foreign currency yield + hedge cost – domestic currency yield, using par govie curves (except Sweden, where we use benchmark bonds).** Cost of 3M rolling hedge defined as 3M FX cross-currency basis + domestic 3M swaprate (3s curve) – foreign-currency swaprate (3s curve).*** Cost of maturity-matched hedge defined as the maturity-matched FX cross-currency basis + domestic swaprate (3s curve) – foreign-currency swap rate (3s curve). Levels as at COB 26th September 2024.

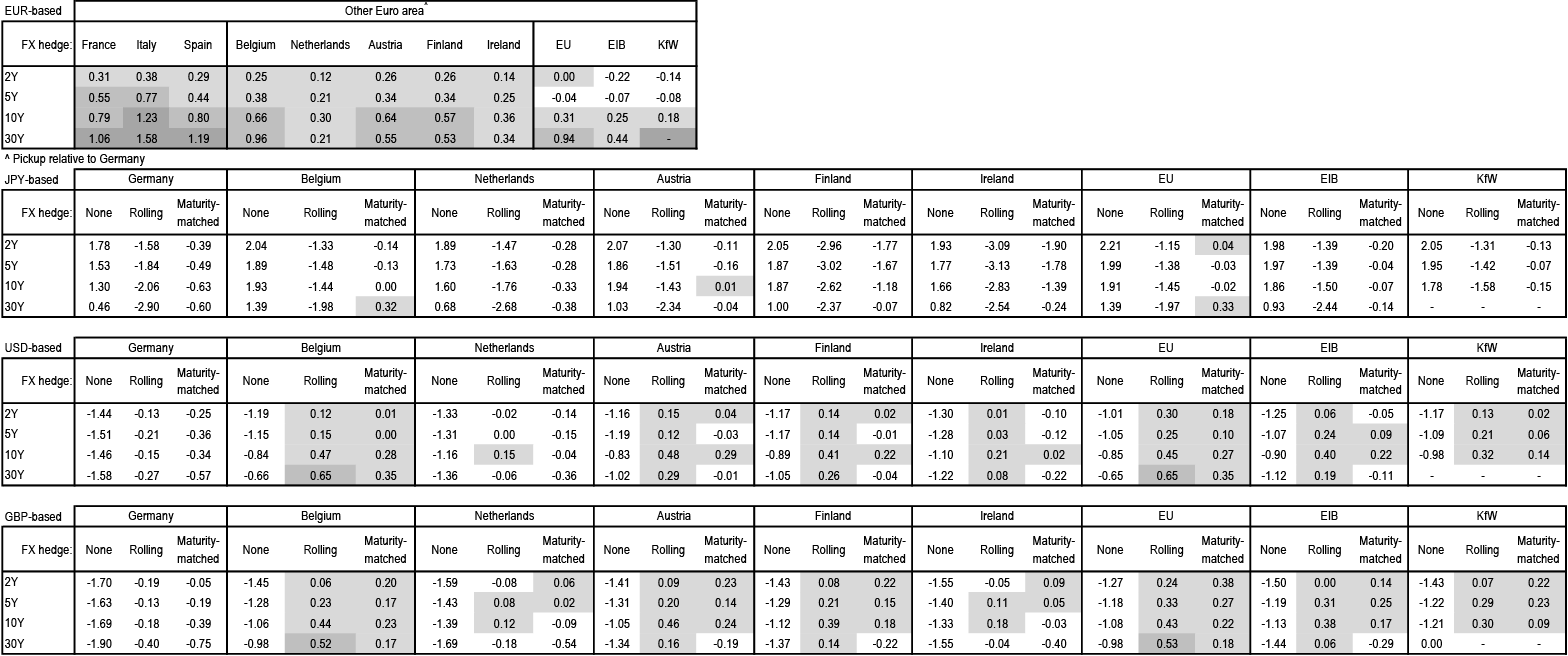

Figure 13: Yield pick-up available via foreign bonds by country and investor currency, on a currency-hedged basis (3M rolling and maturity-matched hedges) and unhedged (EUR countries and SSA )

Annualised yield pick-up* for euro-, yen-, US dollar- and sterling-based investors from different Euro-based bonds of the same maturity, with no hedge, 3M rolling** and maturity-matched*** currency hedges; shaded regions for rolling and maturity-matched hedges show >1% yield pick-up (darkest shading), between 0.5% and 1%, and between 0% and 0.5% (lightest shading), %

Source: J.P. Morgan.

* Yield pick-up defined as foreign currency yield + hedge cost – domestic currency yield, using par govie curves (except Sweden, where we use benchmark bonds).

**Cost of 3M rolling hedge defined as 3M FX cross-currency basis + domestic 3M OIS rate – foreign currency OIS rate.

*** Cost of maturity-matched hedge defined as the maturity-matched FX cross-currency basis + domestic OIS rate – foreign-currency OIS rate.

Levels as of COB 26th September 2024.

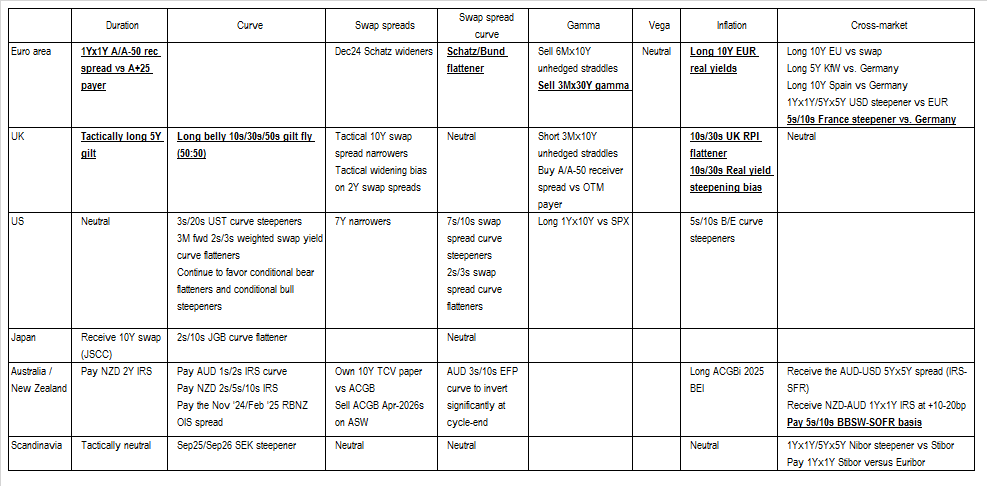

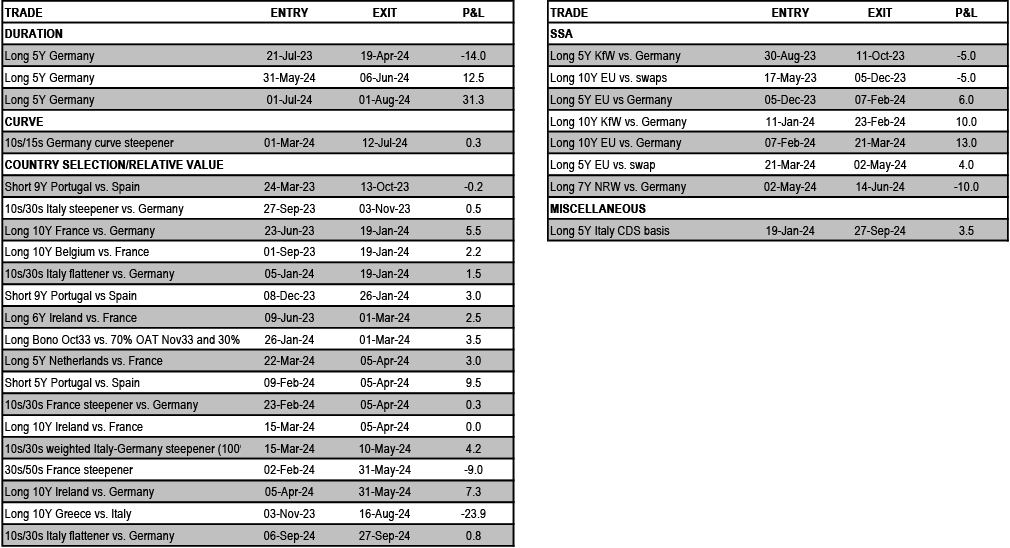

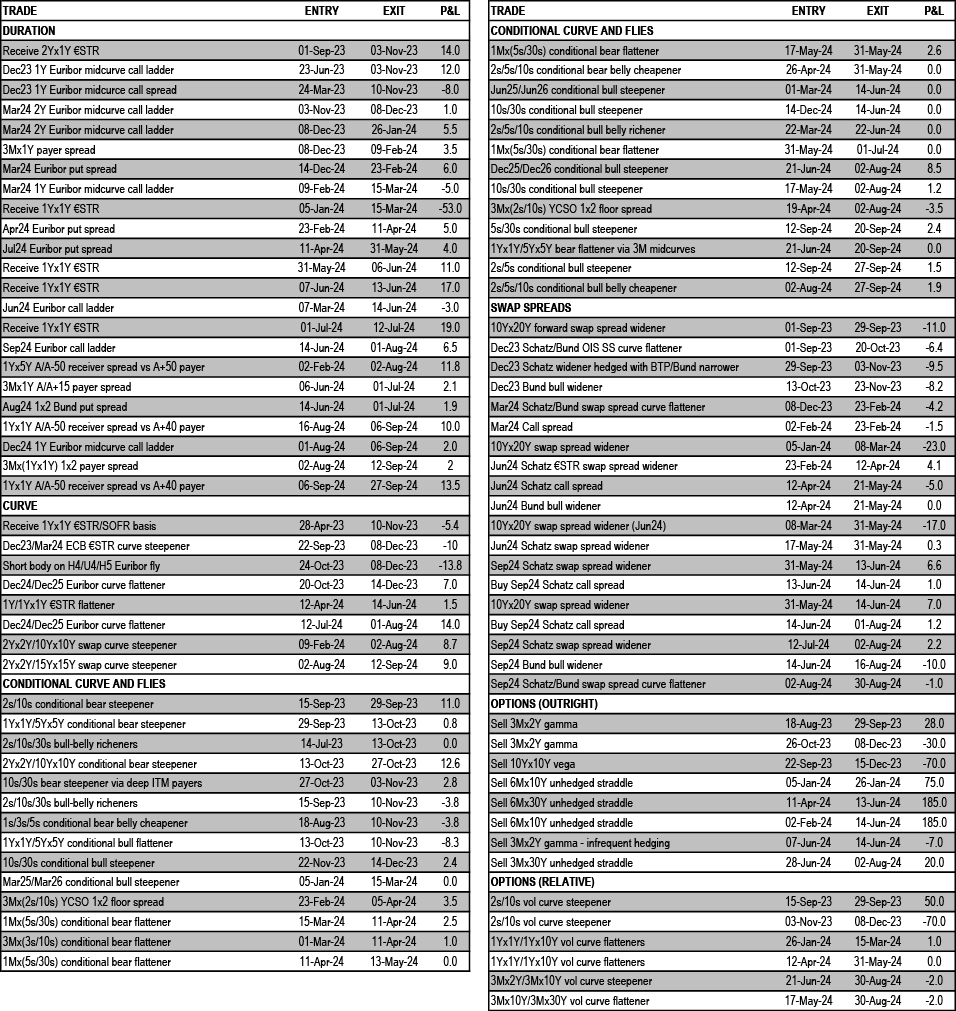

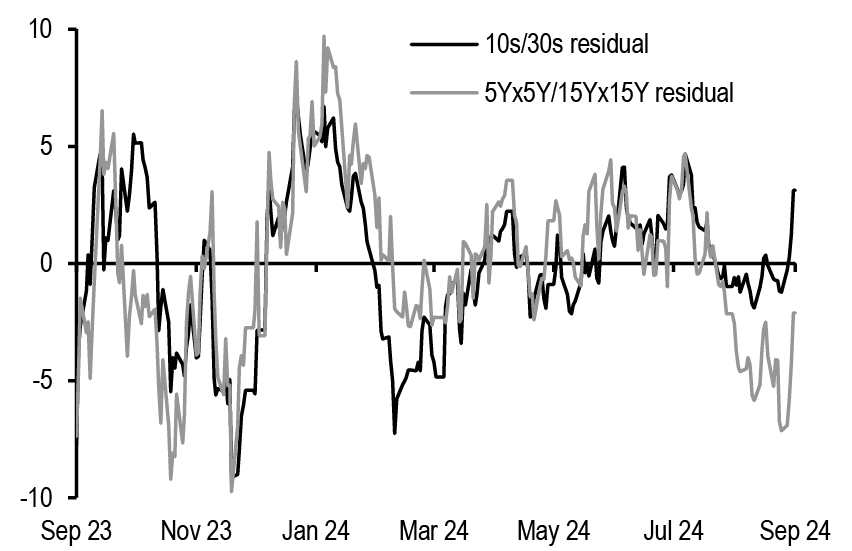

Figure 14: Current Global Rates trade recommendations

Changes are in bold and underlined

Source: J.P. Morgan.

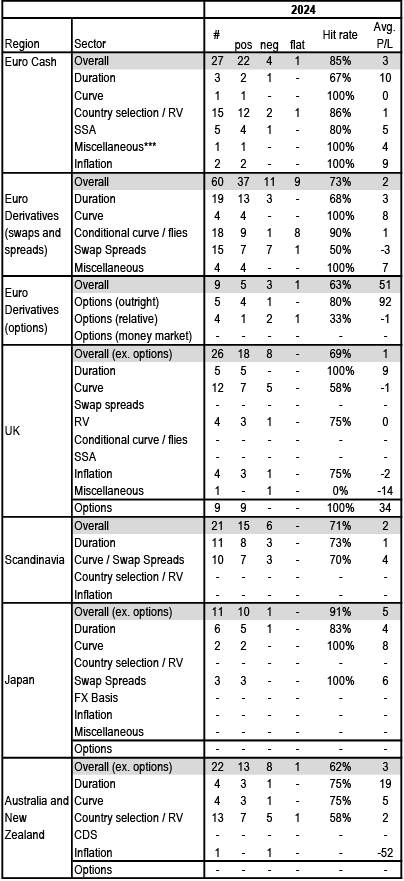

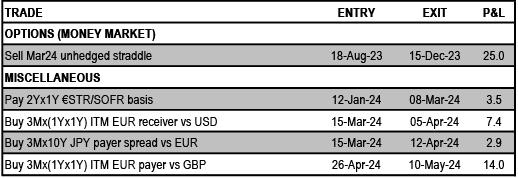

Figure 15: 2024 trade performance summary

Hit rate* and average P/L** for all trades closed in 2024; bp of yield***

Source: J.P. Morgan.

* Hit rate defined as # positive trades / (total # trades - trades closed at flat).

** Avg. P/L across total # trades. Options trades are shown in bp of notional, except for money market trades which are shown in bp of yield and not included in avg P/L calculation.

*** Previously called CDS.

Note: For individual trade performance data, please see Global Fixed Income Markets Weekly: Trade Statistics, Fabio Bassi et al.

Table 1: Highlights from recent publications with hyperlinks

Source: J.P. Morgan

Euro Cash

Fundamental shift

- German yields declined sharply on large downside surprises on both growth and inflation front over the week

- Despite the sharp rally we still keep a bullish duration bias on Euro rates on risks of markets overshooting/pricing higher recession risks

- We continue to express OW duration bias via option structures and OW Euro real yields and will be looking to scale in outright duration OW on any retracement

- Over near-term OW front-end duration is a better long exposure than curve steepeners given steep valuations

- Maintain strategic OW intra-EMU/€-SSA stance with the Euro data developments this week adding further conviction in carry themes

- Hold OW 10Y Spain vs. Germany as benchmark OW intra-EMU exposures

- Also keep OW 10Y EU vs. swaps and OW 5-7Y KfW vs. Germany as medium-term OW €-SSA exposures

- France: stay neutral until there is clarity on the budget delivery; enter 5s/10s France steepener vs. Germany as low-beta hedge against disruptive French budget tail risk scenarios

- Italy: given strong fiscal performance, we shift lower our expected range of 10Y Italy-Germany spread to 120-150bp vs. 130-155bp previously; take profit on 10s/30s Italy flattener vs. Germany and long 5Y Italy CDS cash basis

- Belgium: now cheap; we find OW 10Y Belgium vs. 10Y France (60%) and 10Y Germany (40%) attractive

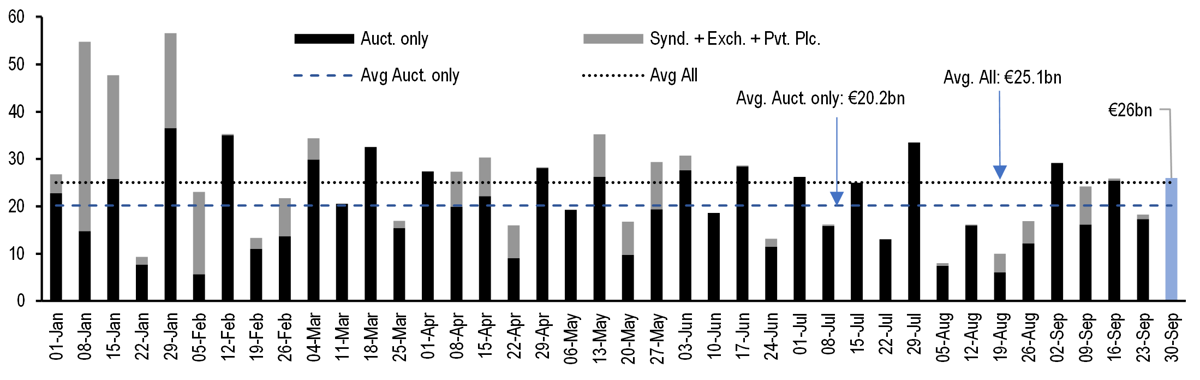

- Supply: around €26bn of conventionals via auction next week in France, Germany and Spain

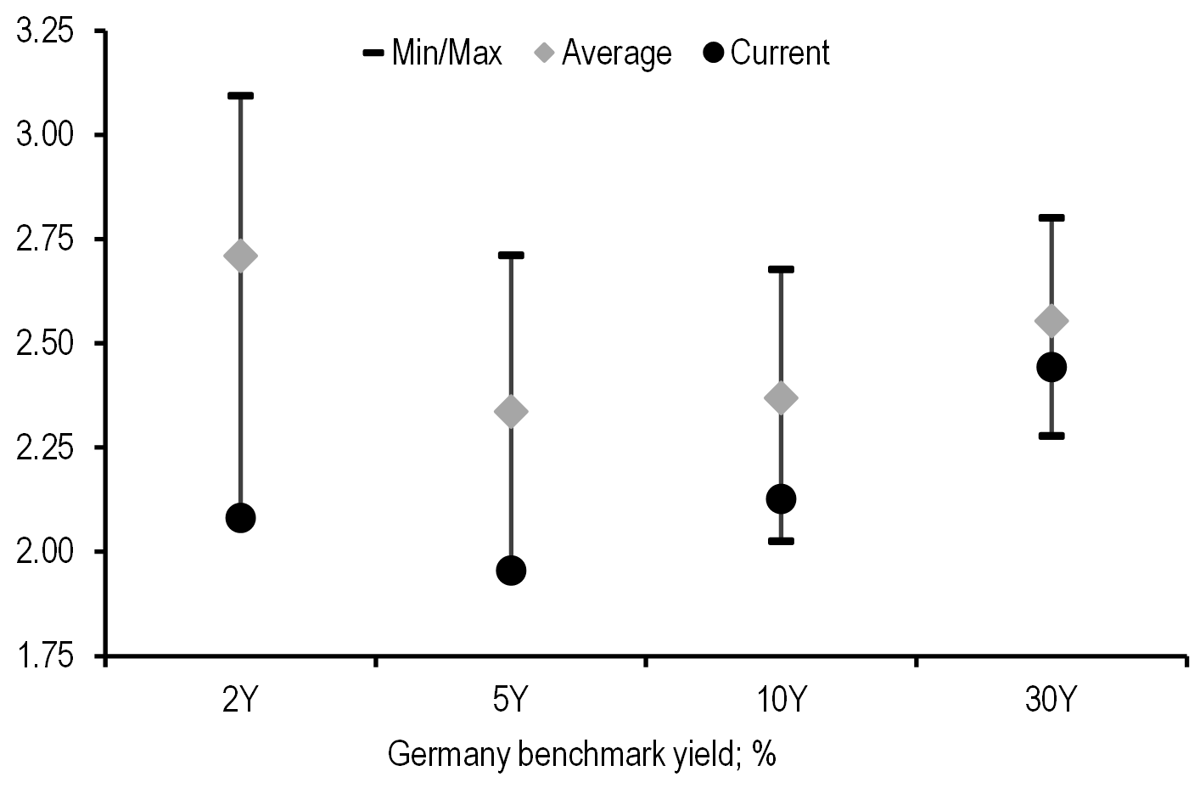

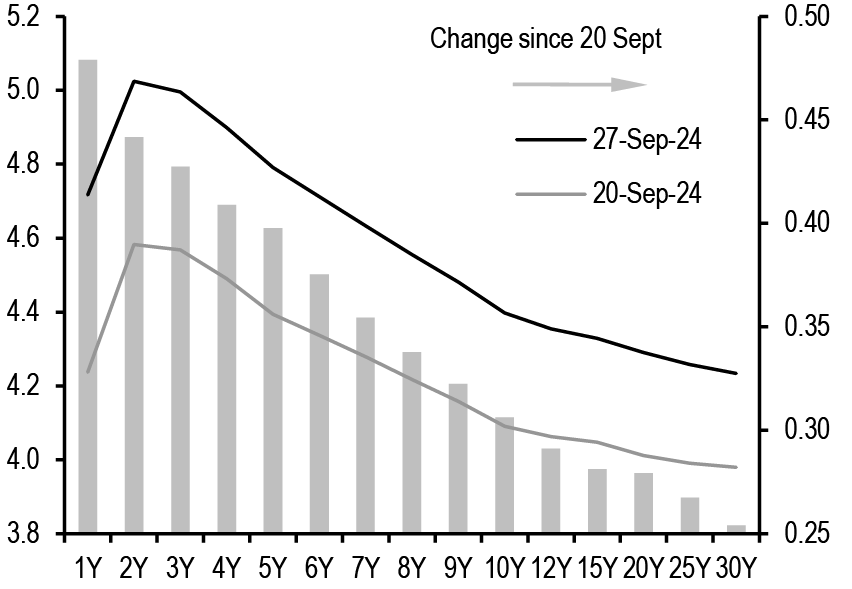

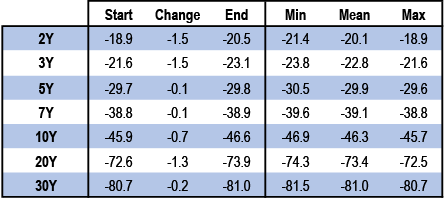

German curve sharply bull steepened, with short and intermediate yields making new YTD lows ( Figure 16), on large downside surprises on both growth and inflation front over the week (see here and here). German yields also sharply outperformed vs. DM peers.

Figure 16: German curve sharply bull steepened over the week with short and intermediate yields making new YTD lows

YTD statistics on German benchmark yield; %

Source: J.P.Morgan

This week in our view saw a fundamental shift in Euro area disinflation journey with sharp decline in PMIs adding further downside risk to growth but more importantly the large downside surprises in core CPI for France and Spain moving the risks on disinflation narrative from being balanced to clearly on the downside. Our economists now expect the ECB to cut 25bp in October and continue cutting at 25bp/meeting pace at lest until they reach 2% by June 2025 with increasing risks of them easing below 2%. Until last week our expectation was that under central scenario of gradual disinflation and soft landing ECB will stop at 2% with a recession scenario forcing them to ease below 2%. However, the increasing downside risks to inflation we see higher chances of the ECB easing below their expected neutral (2%) on risks of inflation undershoot even in absence of a recession. Indeed after the recent repricing money markets are now expecting high chances of ECB easing 25bp every meeting till mid-2025 with a terminal rate closer to 1.80%. Given our assessment above a terminal of 1.80% is broadly fair under our central scenario. However, at current level we don’t see market pricing enough risk premia for a recession scenario in current terminal pricing.

Overall, despite the sharp rally we still keep a bullish duration bias on Euro rates on risks of markets overshooting/pricing higher recession risks. We continue to express our OW duration bias via option structures (see European Derivatives) and OW Euro real yields (see here) and will be looking to scale in outright duration OW on any retracement.

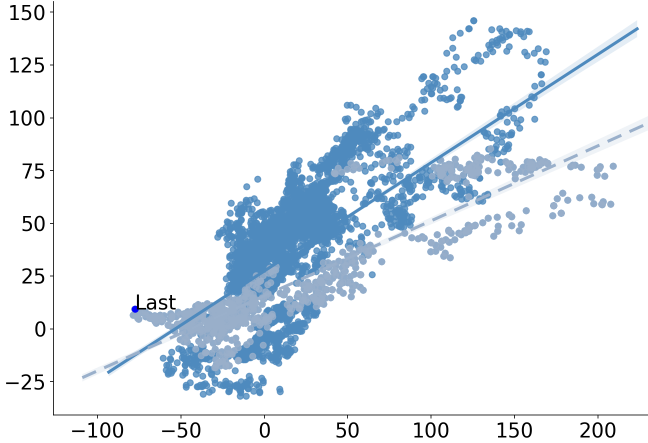

The US payroll data will be the main event for the DM rates next week. Our economists expect a tick-up in unemployment to 4.3% and payroll around 125k, which would likely increase likelihood for Fed to deliver second 50bp cut at their November meeting. A weak labour data report next week would increase recession risks in the US with some pass through to the global economy also. We, therefore, would expect the market to start pricing a higher risk of a hard-landing (dovish) scenario in Euro area and likely pushing ECB terminal below 1.75%. In case of a strong payroll data, we expect the Euro rate sell-off/beta to US being limited given the fundamental shift in Euro area disinflation journey. Also despite the sharp outperformance of Germany vs. US over the past week, we still find US-Germany spread too tight (i.e. US yield expensive vs. Euro) after adjusting for relative money-market expectations and relative change of forecast revision indices ( Figure 17). The relative cheap valuations (Germany vs. US) further reduces the risk of material German sell-off on a strong payroll. We will be looking to enter OW 2Y German duration on any sell-off on back of strong payroll.

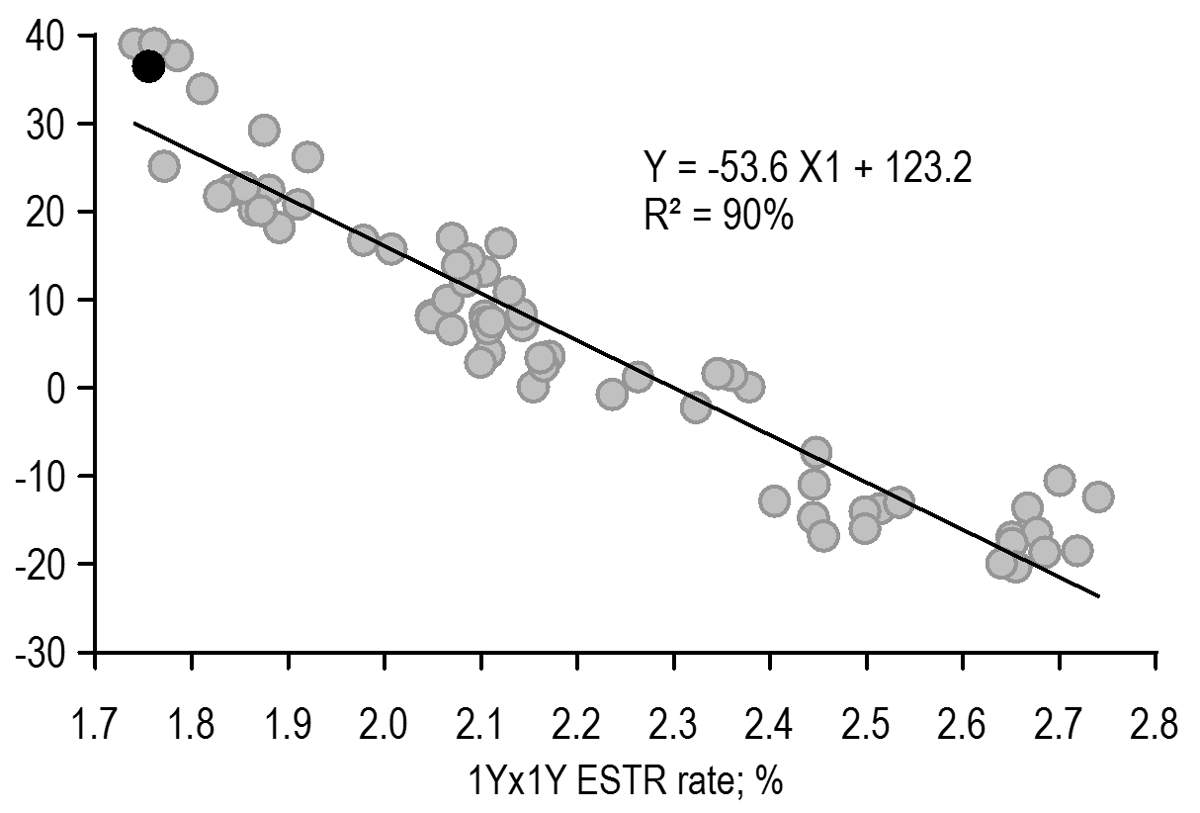

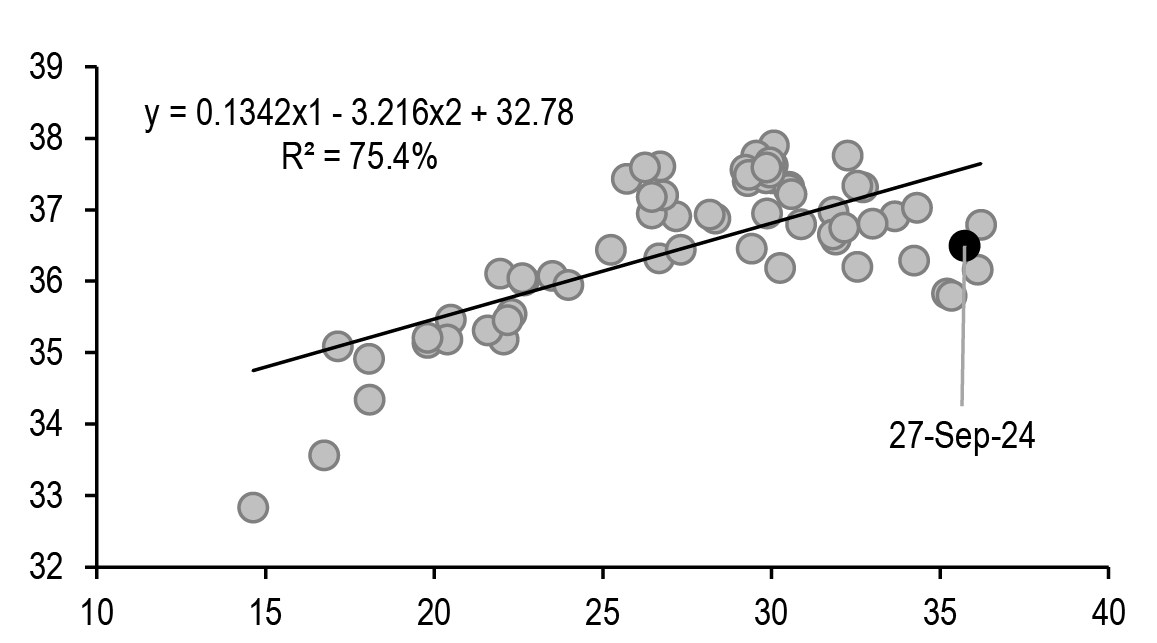

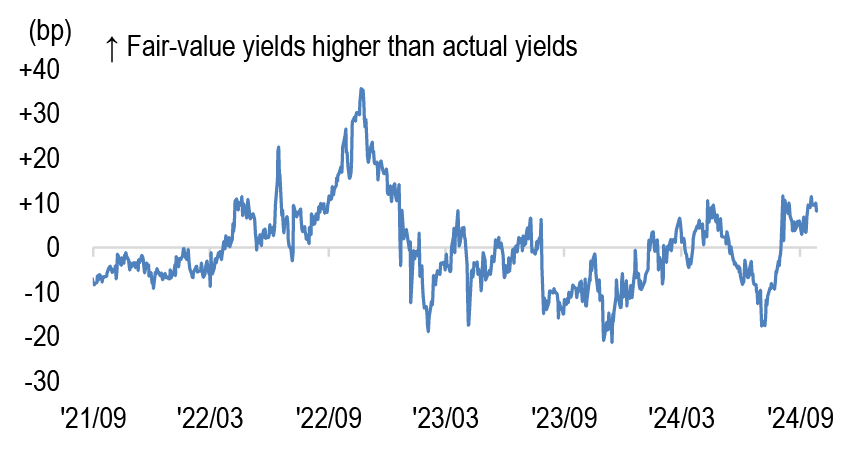

German curve bull steepened sharply over the week, in line with the expected bull steepening/bear flattening dynamics. Given our bullish duration bias we also have a strategic steepening bias. However, we still find 2s/30s curve too steep after adjusting for ECB monetary policy expectations ( Figure 18). Hence over the near-term OW front-end duration is better long exposure than curve steepeners given the steep valuations.

Figure 17: We still find US-Germany spread modestly tight (i.e. US yield expensive vs. Euro) after adjusting for relative money-market expectations and relative change of forecast revision indices

2Y US-Germany yield spread regressed against 1Yx1M USD-EUR OIS rate (X1) and US-Euro Forecast revision index (FRI, X2)*; past 6M; bp

* 2Y US-Germany = 0.68*1Yx1M USD-EUR OIS – 10.5*US-Euro FRI + 280.1; R-squared: 96%

Source: J.P.Morgan

Figure 18: We still find 2s/30s curve too steep after adjusting for ECB monetary policy expectations

2s/30s German curve regressed against 1Yx1Y €STR rate; past 3M; bp

Source: J.P.Morgan

Intra-EMU spreads

Intra-EMU spreads moved in wide ranges over the week with Italy tightening sharply, France widening and rest of the spreads moving in tight +/-2bp range.

We maintain a constructive medium-term intra-EMU ex-France/€-SSA stance on expectation of ongoing focus on carry trades on back of easing financing conditions as ECB continues to gradually ease amidst declining supply pressures over the rest of 2024 given strong issuance front-loading and French political uncertainty remaining an idiosyncratic story with limited systemic risks. As discussed above, there has been a fundamental shift in Euro area disinflation journey, which is increasing confidence on ongoing ECB easing, thereby increasing further confidence on spread carry trades. The key near-term risk to our constructive outlook comes from sharp repricing of recession risks leading to broader risk-off sentiment across global risk markets. Our economists still assign low risk to Euro area economy going into sharp recession despite the recent weakness in the PMI (see here). A disappointing US payroll data next week could lead to recession risk repricing in the US and thus lead to broader risk-off tone in global markets. In our view widening on back of strong payroll would be good entry points to scale into OW spread exposures.

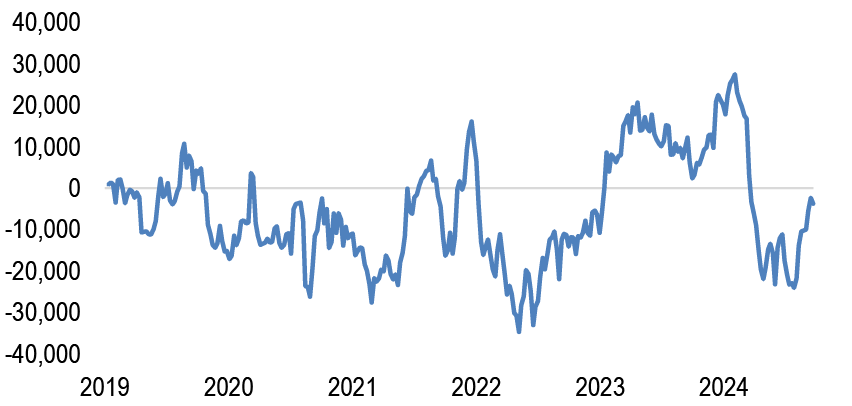

On positioning, as per our latest client survey, 26 September, European real money investors modestly increased their OW peripheral exposure over the past two weeks ( Figure 19). Investors’ current OW exposure is still close to the highest since early-2022 (before the beginning of the ECB’s tightening cycle), but remains well below the OW exposure witnessed during the PEPP period. We do not see this OW exposure as a material risk to carry exposures given the still modest size of the positioning.

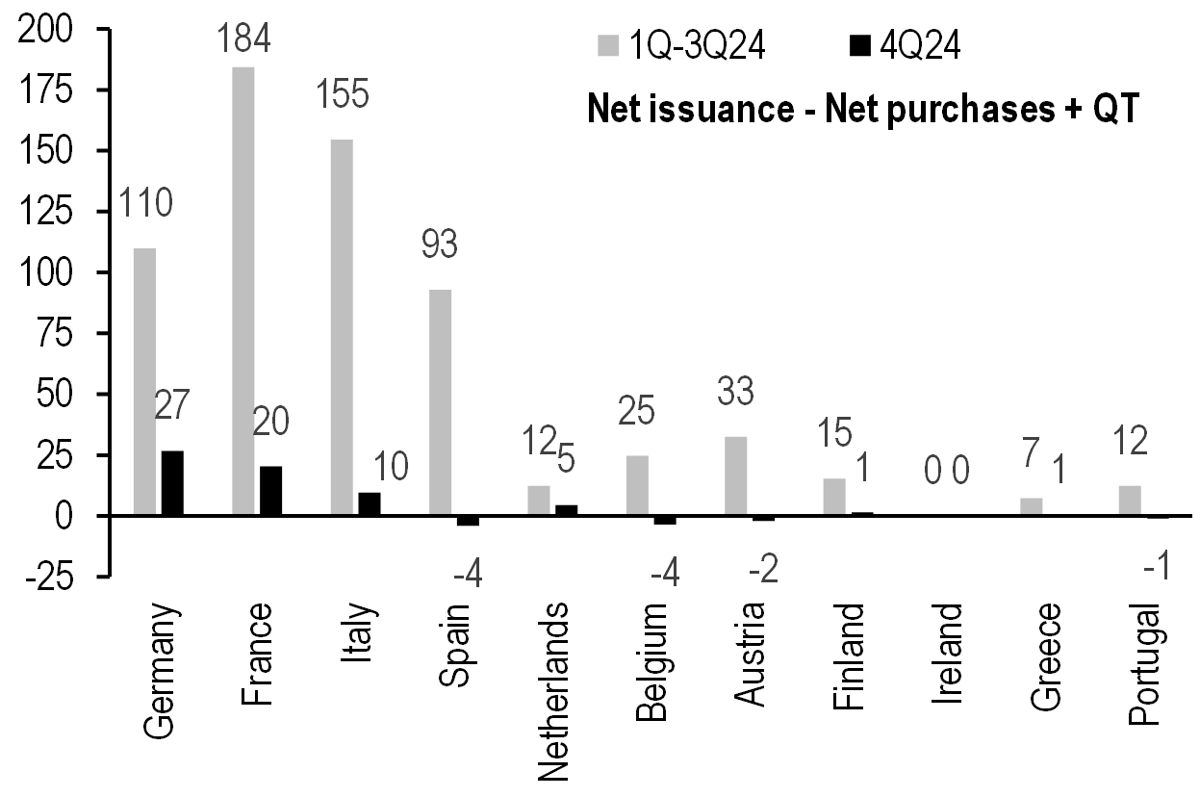

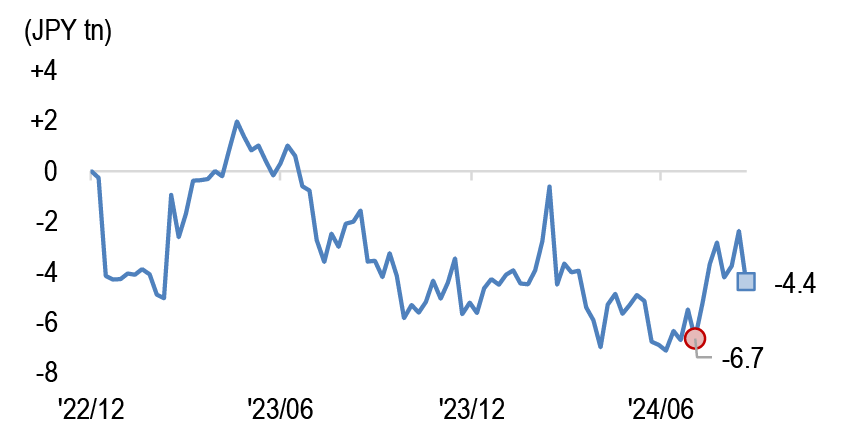

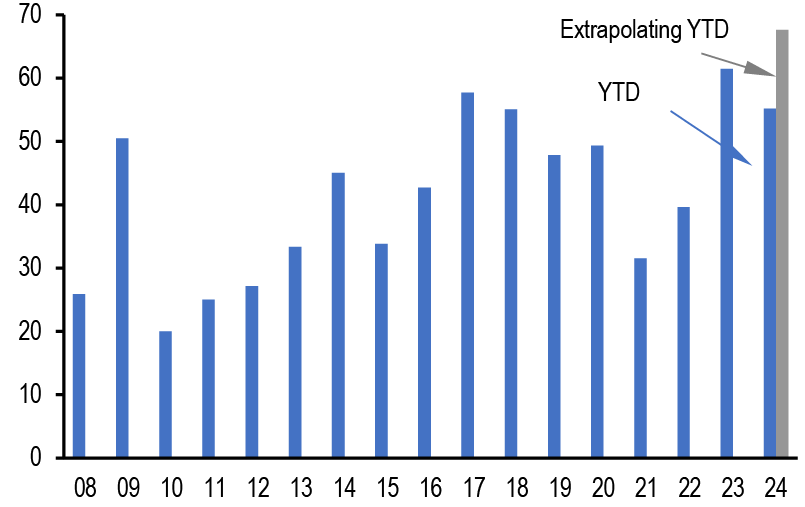

On issuance, as discussed in our Euro area government issuance 4Q24 update, we expect pressure on primary markets to ease materially in 4Q24 despite ongoing APP and partial PEPP QT ( Figure 20).

Figure 19: European real money investors are holding a modest OW peripheral exposure

Net exposure of Euro area investors to peripherals vs. core; %

Source: J.P. Morgan European Client Survey, 26 September

Figure 20: Pressure on primary markets to ease materially in 4Q24 despite ongoing APP & partial PEPP QT

J.P. Morgan estimates on supply, redemptions, ECB purchases by sovereign; central government bonds only, €bn

Source: J.P. Morgan

On French politics, PM Barnier announced the members of new French government on 22 September. As discussed in France: A new government and big fiscal challenge, R. Brun-Aguerre, 23 September, the government has weak support in the lower-house and will likely need support of National Rally (RN) to survive no confidence motions. The lower house will open on 1 October and PM Barnier is expected to lay out the government agenda. The left NFP coalition has argued that it would trigger a motion of no confidence then. We believe the government will survive such no confidence motion with abstention of RN this time. The key near-term economic issue is the 2025 budget which the government is planning to present during the week of 7 October. The recent commentary from the government suggests that the deficit for 2024 could be around 6% of GDP this year if no tightening measures are taken, instead of the 5.1% official forecast (a near €25bn gap). The recent developments broadly go in-line with the assessment we made when Macron nominated Barnier as PM in early September, that Barnier has a quite challenging task to deliver a fiscally prudent budget while avoiding a government collapse. Our base case remains that the Barnier government will eventually be able to deliver a 2025 budget which shows modest credible fiscal tightening and avoid rating downgrades from Fitch and S&P at their upcoming reviews. However,we remain of the view that market will maintain a cautious stance on France and will wait for clarity on budget delivery to gradually remove the political risk premia priced in current French spreads. Indeed, French spreads came under pressure this week, with 10Y spreads breaching 80bp level before retracing modestly, on concerns around large slippages in 2024 budget.

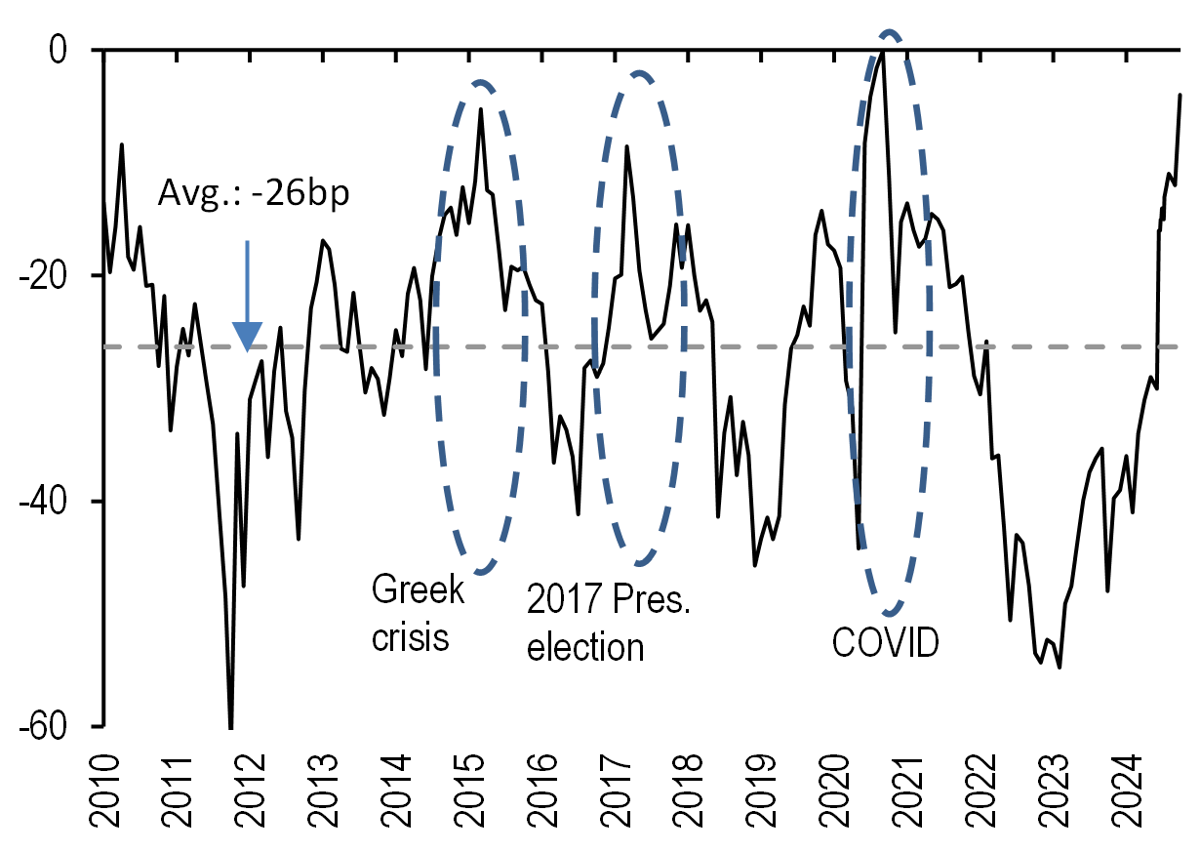

We also look at our sovereign risk index to assess French spread fundamental valuations over time. See Euro Cash 2H24 Outlook for details on the sovereign risk index framework. France has historically traded quite dear on our sovereign risk framework ( Figure 21), on average almost 25-30bp dear over long history. We attribute this persistent expensiveness to factors such as market liquidity, strong institutions, macro-financial stability, a deeper and stickier investor base, and availability of a liquid bond futures contract. Indeed, rating agencies have also highlighted France’s diversified economy, strong institutions and a record of macro-financial stability as factors behind rating France in the AA bucket despite having higher debt/GDP vs. similar rated peers. As discussed in our recent publications, the recent political developments weakened the robustness of France’s strong institutional and macro-financial stability pillars which have historically kept French spreads persistently dear vs. fundamentals, thus warranting a wider steady state level. After the widening over the past few weeks the residual of French spreads has almost fully corrected. In the disruptive tail risk scenarios (like Barnier govt. losing no-confidence vote before budget or 2025 budget not showing credible tightening), we can see the residual even moving into cheap territory: for instance, Italy has always traded on the cheap side on this framework, which likely reflects lingering political and rating risks.

Figure 21: France has always traded quite dear on our sovereign risk framework, but the residual has almost fully after the recent widening

J.P. Morgan sovereign risk model residual evolution for 10Y France-Germany spread, bp

Source: See Euro Cash 2H24 Outlook for details on the sovereign risk index framework

Intra-EMU trading themes

We continue to hold OW 10Y Spain vs. Germany as benchmark OW intra-EMU exposure and also hold OW 10Y EU vs. swaps and OW 5-7Y KfW vs. Germany as medium-term OW €-SSA exposures. This week we enter 5s/10s France steepener vs. Germany as low-beta UW proxy. We also take profit on 10s/30s Italy flattener vs. Germany and long 5Y Italy CDS cash basis.

In France, as discussed above we maintain a cautious stance and stay neutral on spread until there is clarity on the budget delivery. Given the heightened uncertainty, we believe the market will likely overreact to negative news while underreact to a positive news, similar to the dynamics observed in recent days.

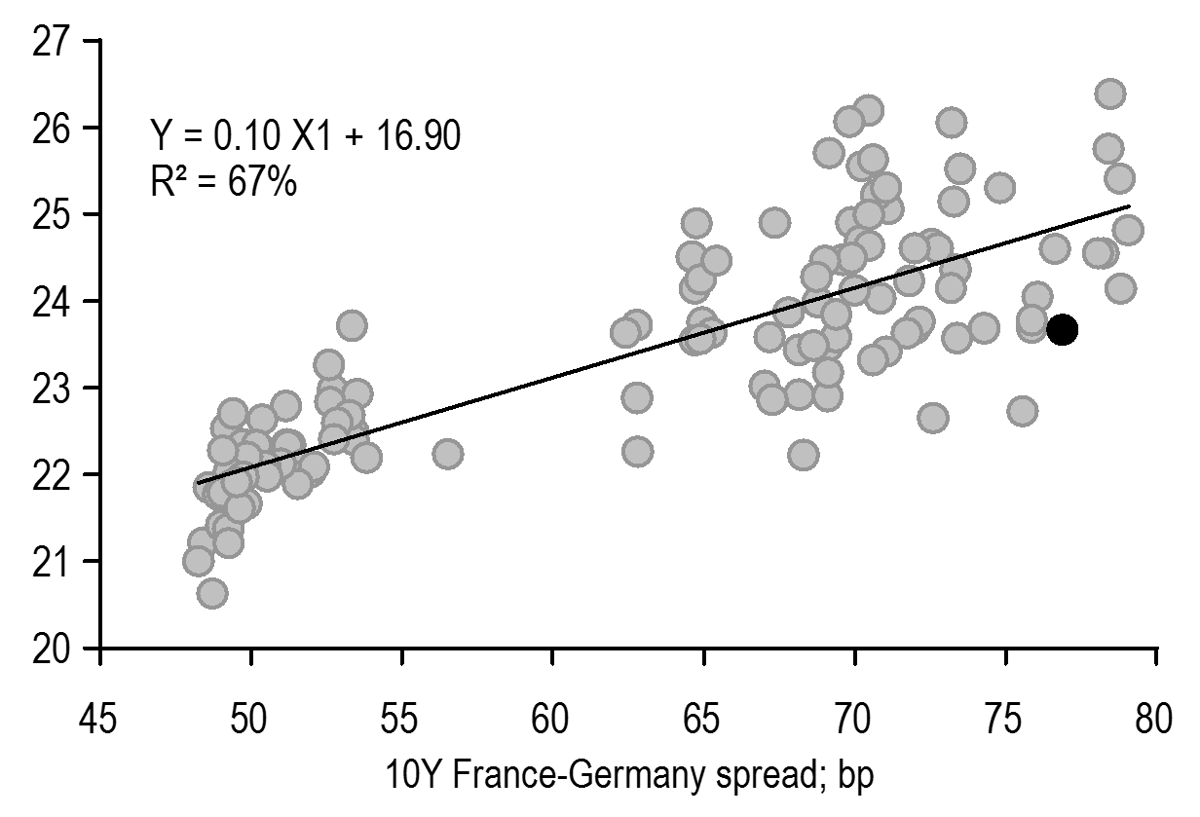

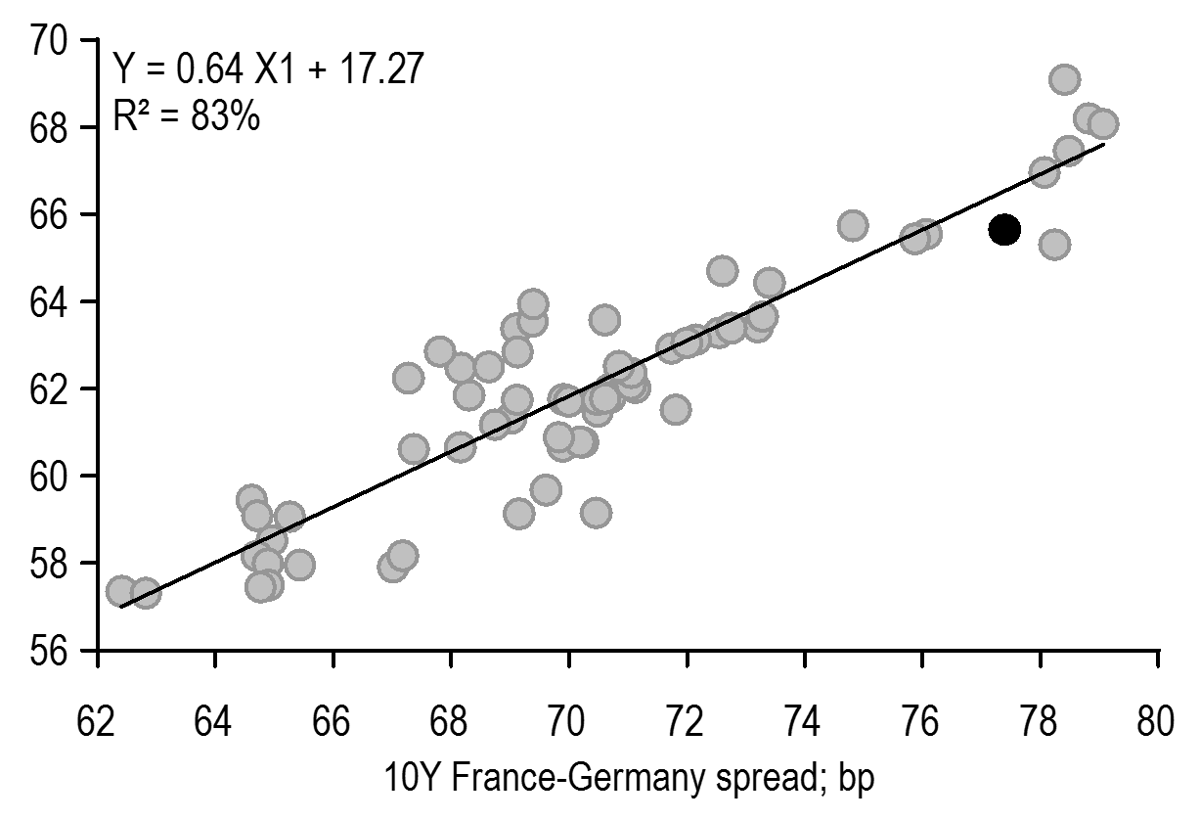

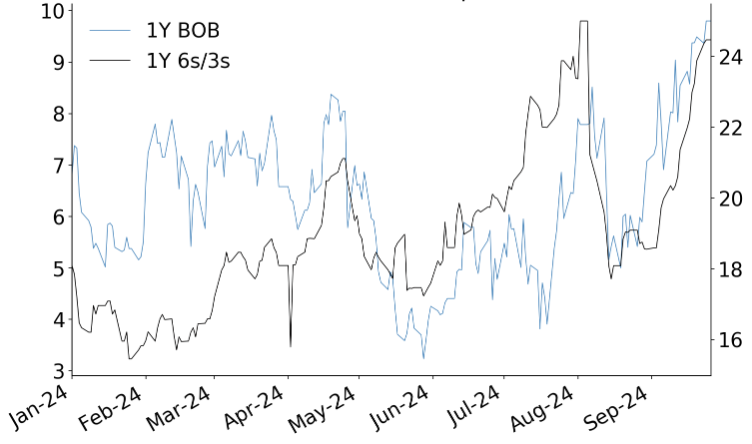

On French credit curve, we recommend 5s/10s France steepener vs. Germany as an attractive low-beta hedge against disruptive French budget tail risk scenarios and risks of potential rating downgrades. The 5s/10s box vs. Germany is trading more than 1bp too flat vs. level of spreads ( Figure 22). Also the box steepener has modest positive 3M carry (~1bp).

Figure 22: The 5s/10s France vs. Germany box is trading modestly flat vs. level of spreads: enter 5s/10s France steepener vs. Germany as low-beta France UW proxy

5s/10s France-Germany box regressed against 10Y France-Germany spread; bond specific; past 6M; bp

Source: J.P.Morgan

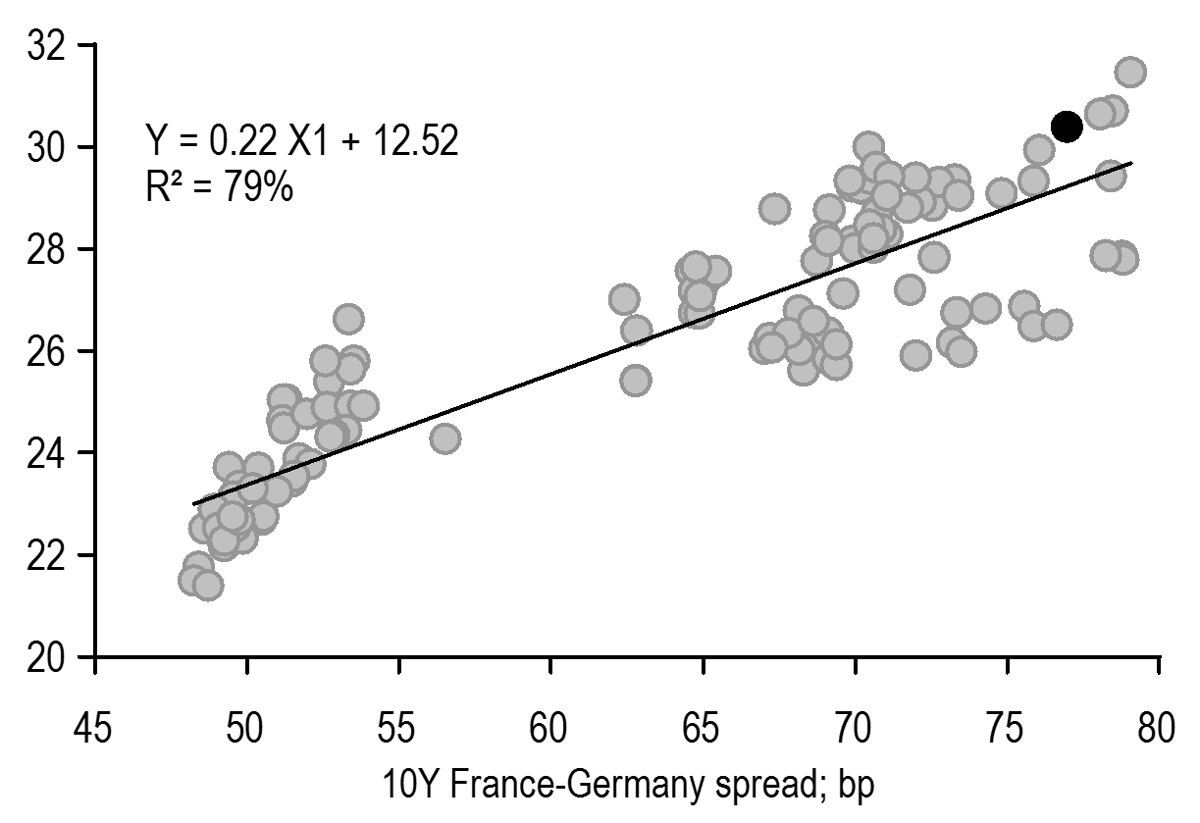

Also on French credit curve, the short-end spreads have outperformed in the recent widening move and we find the 3s/10s (3s/5s) boxes vs. Germany now trading on the steep side and are not attractive risk-off hedge any more ( Figure 23). Further out, the 10s/30s box has been negatively directional with level of 10Y yield and we find the box trading broadly fair ( Figure 24).

Figure 23: The 3s/10s (3s/5s) France vs. Germany box is now trading on the steep side and are not attractive risk-off hedge any more

3s/10s France-Germany box regressed against 10Y France-Germany spread; bond specific; past 6M; bp

Source: J.P.Morgan

Figure 24: 10s/30s France-Germany box is trading broadly fair vs. level of 10Y yield

10s/30s France-Germany box regressed against 10Y France yield; bond specific; past 6M; bp

Source: J.P.Morgan

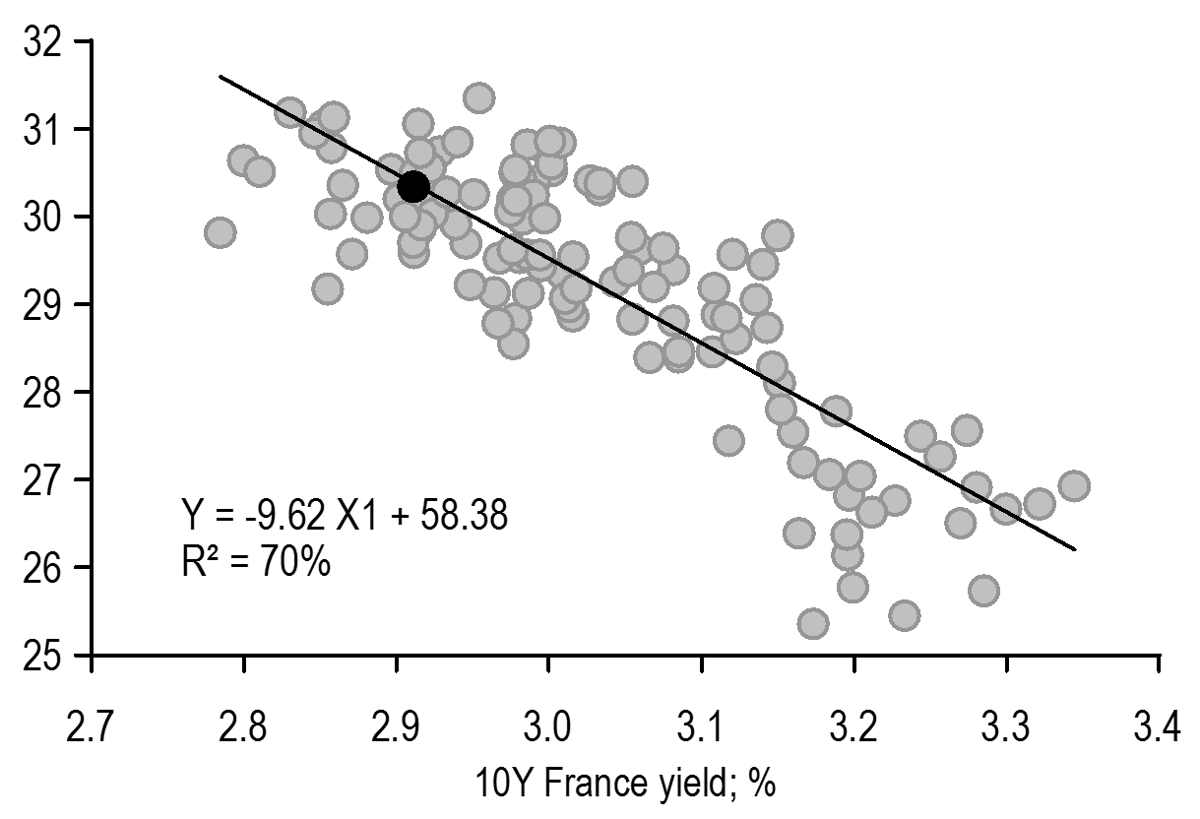

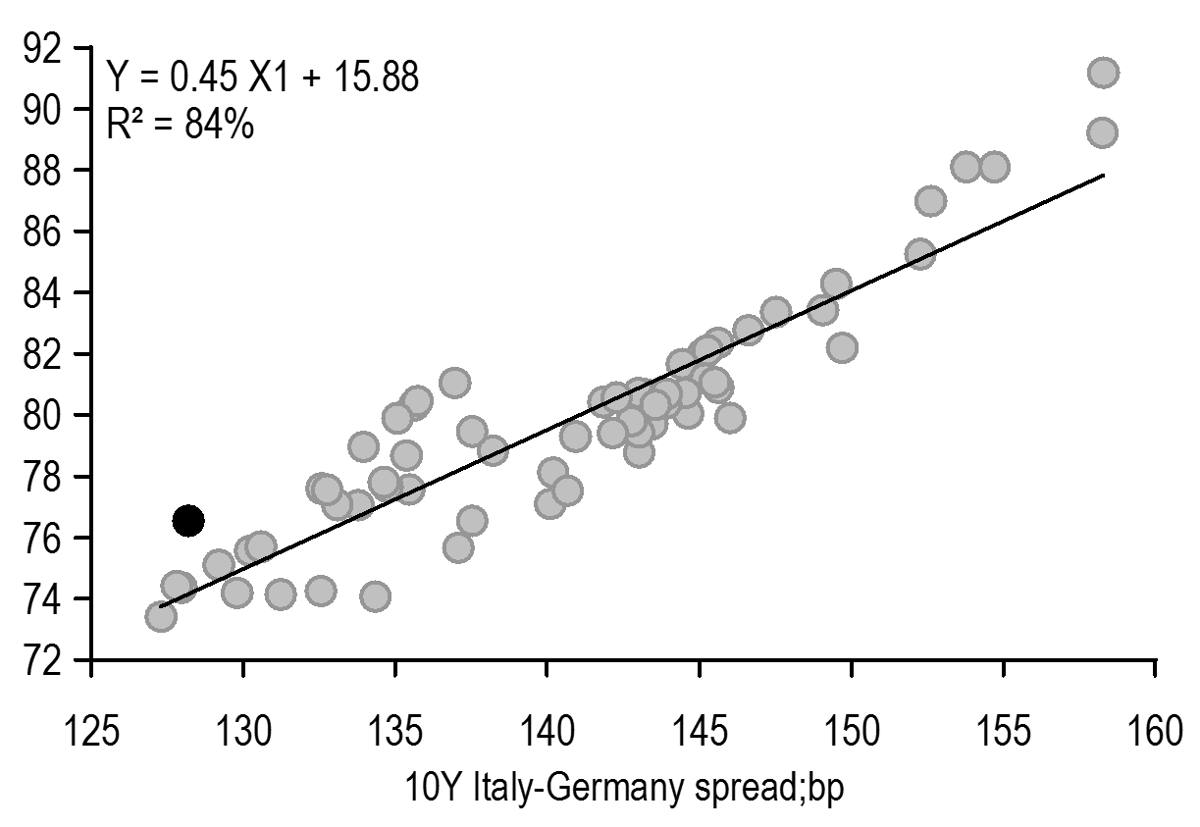

Italian spreads tightened sharply over the week on combination of better fiscal developments/news flow and broader risk-on tone in global markets. On fiscal side, the Italian Treasury this week highlighted that public finances are in more favourable situation than in government forecast in April. Also some sources media articles this week highlighted that 2024 budget deficit might come at 3.8% vs. previous target of 4.3%, and also that Italy will show an ongoing fiscal consolidation with deficit reaching below 3% by 2026. Given the positive news flow on fiscal side, we now see limited risk of noise around budget delivery. Also given the strong fiscal performance, we now shift lower our expected range of 10Y Italy-Germany spread to around 120-150bp vs. 130-155bp previously, to reflect lower fiscal noise risk and thus improvement in risk-adjusted carry. On a cross-market basis, Italian spreads are now screening more than 10bp too tight vs. other credit spreads ( Figure 25). Part of this relative expensiveness could be explained due to positive fiscal developments, but it is hard to explain the more than 10bp expensiveness fully.

On the Italian credit curve, we close 10s/30s Italy flattener vs. Germany at a small profit as the excessive steepness of the credit curve has now fully corrected ( Figure 26). We also close long 5Y Italy CDS basis at profit as during the sharp BTP narrowing this week the CDS leg lagged and thus pushing the basis sharply wider.

Figure 25: Italian spreads are now screening more than 10bp too tight vs. other credit spreads

10Y Italy-Germany spread regressed against EUR IG spreads to Germany; par rates used; past 12M; bp

Source: J.P.Morgan

Figure 26: The excessive steepness of the 10s/30s Italian credit curve has now fully corrected: take profit on 10s/30s Italy flattener vs. Germany

Residual from regressing 10s/30s Italy-Germany box against 10Y Italy-Germany spread*; past 3M; bp

* 10s/30s = -0.17*10Y + 61.8; R-squared: 50%

Source: J.P.Morgan

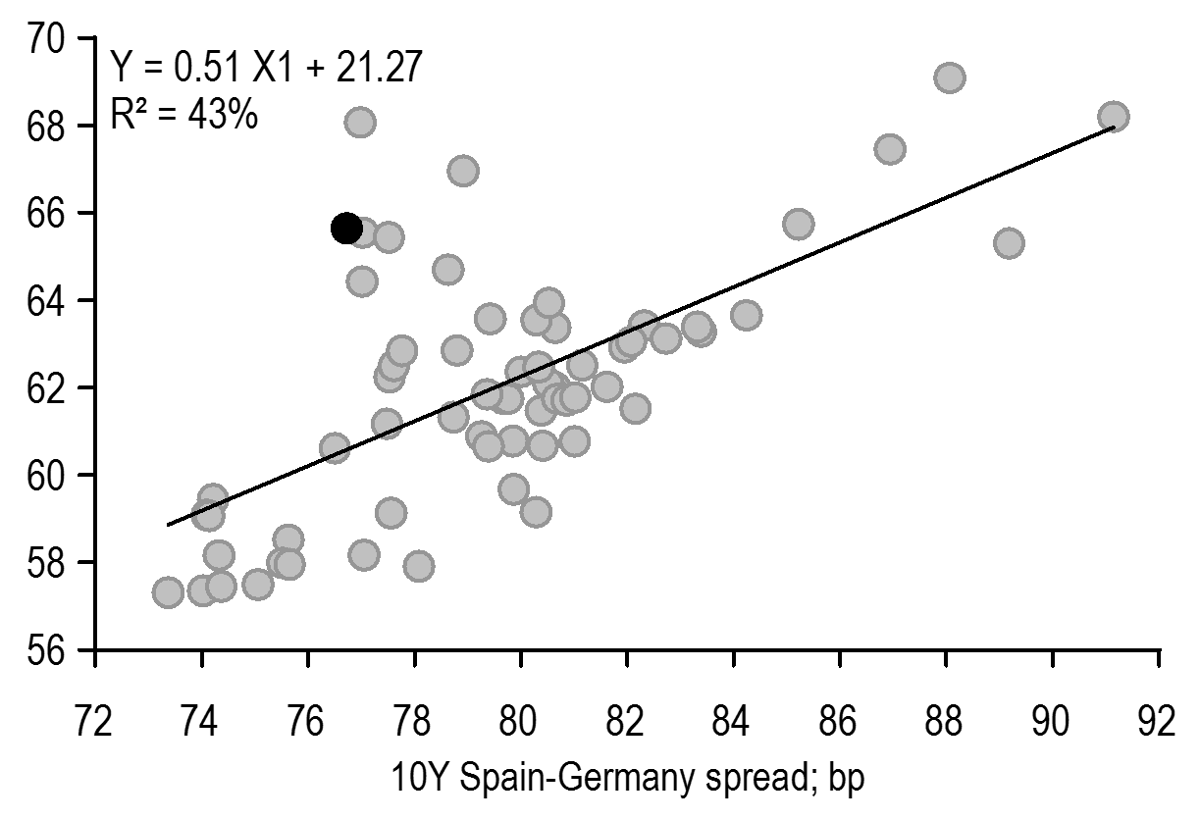

We hold OW 10Y Spain vs. Germany as our benchmark intra-EMU exposure. After the strong Italian tightening this week, Spanish spreads are now screening quite cheap relative to Italy ( Figure 27). Also, after the linker syndicate this year, Spain has covered more than 85% of 2024 issuance needs, based on our targets. We, therefore, would expect the auction sizes to gradually decline going forward, a supportive dynamic for our OW.

Figure 27: Spain is now screening quite cheap vs. Italy on recent relationship

10Y Spain-Germany spread regressed against 10Y Italy-Germany spread; par rates used; past 3M; bp

Source: J.P.Morgan

Belgian bonds tracked France with their recent ~60% beta and widened until Thursday before retracing partly on Friday ( Figure 28), whereas rest of the sovereign spreads, including other core, showed muted or even negative beta to France. This led to relative underperformance of Belgium vs. non-France peers and we now find Belgium cheap ( Figure 29). Given the idiosyncratic nature of the French uncertainty we find the recent high beta in a widening move excessive. We find OW 10Y Belgium vs. 10Y France (60%) and 10Y Germany (40%) attractive given our expectation of Belgium beta to France to decline in further France widening risk scenario.

Figure 28: Belgian bonds continued to track France with their recent ~60% beta and widened over the week…

10Y Belgium-Germany spread regressed against 10Y France-Germany spread; bond specific; bp

Source: J.P.Morgan

Figure 29: …thus leading to sharp relative underperformance vs. other peers

10Y Belgium-Germany spread regressed against 10Y Spain-Germany spread; bond specific; bp

Source: J.P.Morgan

Issuance

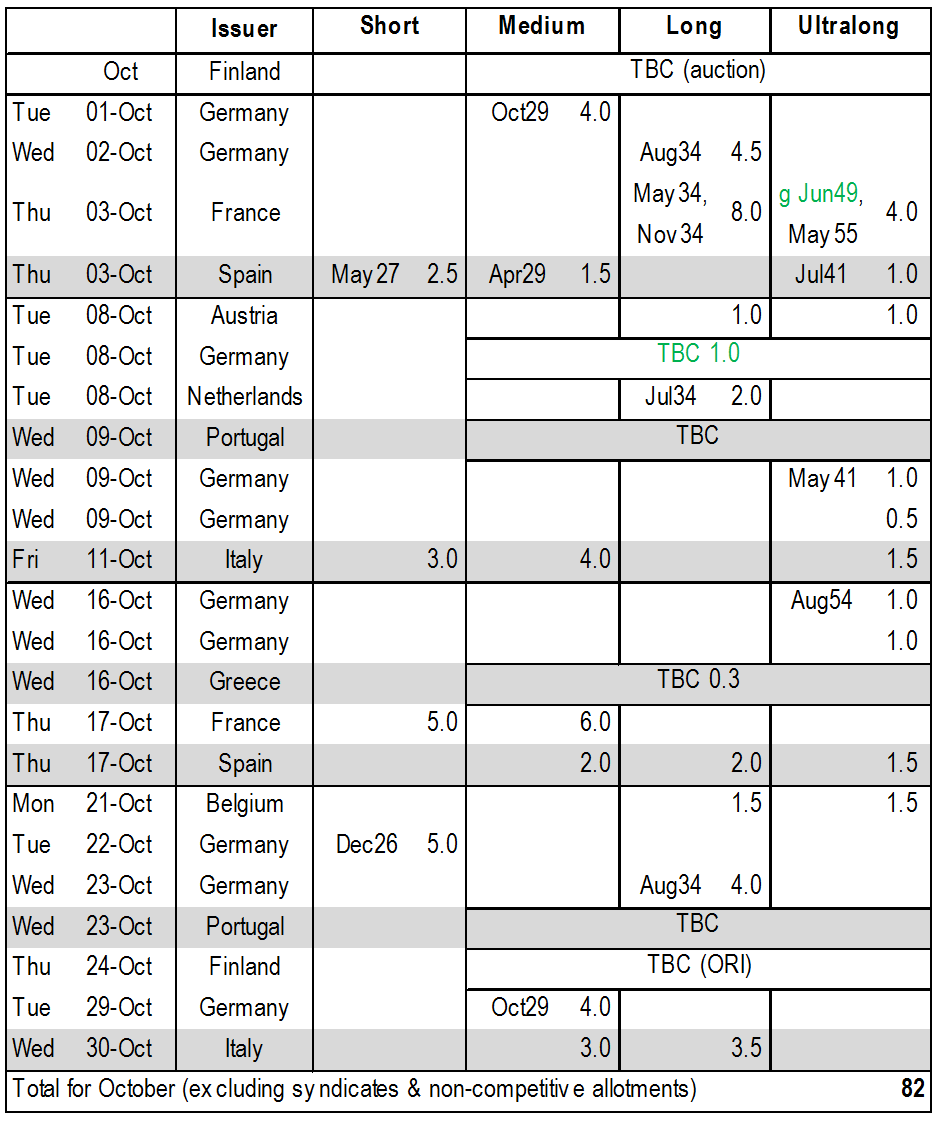

We expect around €26bn of conventional bond supply via scheduled auctions next week ( Figure 30). Conventional auctions are scheduled in Germany, France and Spain ( Figure 31).

Figure 30: We expect around €26bn of conventional bond supply via scheduled auctions next week

Total Euro area conventional bond issuance weekly volume on trade date basis; black indicating total conventionals issued only via auctions; grey indicating conventionals issued via syndicate, exchanges and private placements; light blue indicating next week expected issuance volume (auction only); weekly basis; €bn

Source: J.P. Morgan

Figure 31: Conventional auctions are scheduled in Germany, France and Spain next week

Euro area conventional bond issuance calendar until the end of October; official announcements and J.P. Morgan forecast; peripheral supply highlighted in grey, green bonds are marked in green; €bn

Source: Debt Management Offices, J.P. Morgan

Bobl Oct29: cheap

The current 5Y German benchmark is currently trading with a benchmark discount of around 5.8bp relative to surrounding bonds, on the cheap side as it continues to remain higher than the pre-2022 Bobl benchmark discount range of around 1-3bp ( Figure 32). Part of the Bobl relative cheapness comes from the expensiveness of old Bunds in this part of the curve. All the old Bunds in this sector are trading quite special in repo.

Figure 32: The current 5Y German benchmark is trading at around 5.8bp benchmark discount, higher than the pre-2022 Bobl benchmark discount range of around 1-3bp

Benchmark discount* on current 5Y Bobl; bp

* Benchmark discount is calculated as the difference between 5Y benchmark (Bobl) yield and interpolated yield calculated using surrounding

Source: J.P.Morgan

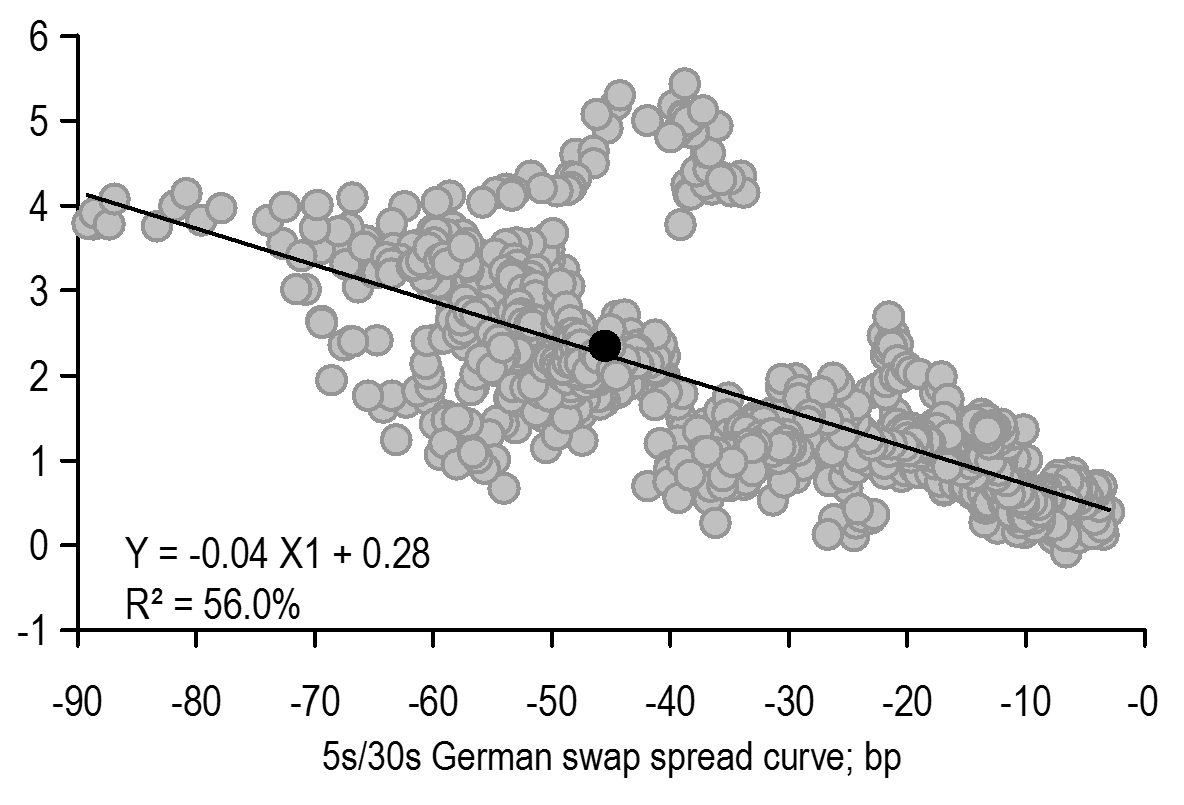

Bund Aug34: fair

The 10Y German benchmark is trading with a benchmark roll (z-spread pick-up over the off-the-run Bund Feb34) of 2.3bp, broadly in line with the average of the 10Y Bund benchmark roll over the past 12M (2.1bp). The 10Y German benchmark roll continues to show some modest negative directionality to 5s/30s German swap spread curve over long run history and the Bund Aug34 benchmark roll appears broadly fair based on that relationship ( Figure 33).

Figure 33: The 10Y German benchmark roll continues to show some modest negative directionality to 5s/30s German swap curve over long history and is currently trading broadly fair

10Y German benchmark roll (z-spread pick-up over off-the-run) regressed against 5s/30s Germany swap spread curve; past 5Y; bp

Source: J.P.Morgan

OAT May34: fair

The OAT May34 underperformed modestly relative to surrounding bonds after the auction announcement on Friday and is now screening broadly fair based on our par curve fair value framework.

OAT Nov34: fair

The 10Y benchmark is trading with a benchmark roll (z-spread over the off-the-run OAT Nov33) of around 5.6bp, close to the average of the 10Y benchmark roll over the past 12M.

OAT green Jun39: modestly cheap

The 25Y green bond has been cheapening over the past few weeks and has moved from pricing a greenium of 3.5bp to 1.5bp now, at the upper-end of its range since issuance in January.

OAT May55: modestly dear

The 30Y French benchmark is trading with a benchmark roll (z-spread pick-up over the off-the-run May54) of around 3.4bp, on the lower-half of the benchmark roll range (3.1bp to 4.1bp) since issuance in February.

Bono May27: modestly cheap

The 3Y benchmark is currently trading on the Spanish curve with a benchmark discount of around 3.0bp relative to surrounding bonds, modestly cheap in our view.

Bono Apr29: modestly cheap

Following the auction announcement on Friday, the Bono Apr29 underperformed relative to surrounding bonds and is now trading modestly cheap on the Spanish curve based on our par curve fair value framework.

Bono Jul41: fair

The Bono Jul41 is trading broadly fair on the Spanish curve based on our yield vs. modified duration framework.

Trade recommendations*

New trades

- Enter 5s/10s France steepener vs. Germany

Enter short €50mn OAT Nov34 vs. long €86.5mn OAT Feb30 and long €48.1mn Bund Aug34 vs. short €89.9mn Bund Oct29 @ 20.3bp. 3M carry: 1.2bp and 3M slide: 1.2bp.

Closed trades

- Close long 5Y Italy CDS basis

Close long €25.0mn of 5Y Italy CDS vs. long €25mn BTP Feb29 vs. maturity matched swap @ 18.8bp; 3M carry: -1.2bp. P&L since inception (19 Jan 2024): 3.5bp - Close 10s/30s Italy flattener vs. Germany

Close long €50mn BTP Oct53 vs. short €99.0mn BTP Feb35 and short €40.1mn Bund Aug54 vs. long €94.0mn Bund Aug34 @ 34.4bp. 3M carry: -1.6bp and 3M slide: -0.6bp. P&L since inception (06 Sep 2024): 0.8bp.

Country selection & RV trades

- Keep long 10Y Spain vs. Germany

Keep long €50mn Bono Oct34 vs. short €48.9mn Bund Aug34 @ 78.6bp. 3M carry: 2.2bp and 3M slide: 0.6bp; P&L since inception (06 Sep 2024): 2.9bp.

SSA trades

- Keep long 10Y EU vs. swap

Keep long €25.0mn EU Dec34 vs. maturity matched swaps @ 41.3bp; 3M carry: 0.7bp and 3M slide: 0.5bp. P&L since inception (02 May 2024): -16.2bp. - Keep long 5Y KfW vs. Germany

Keep long €25.0mn KfW Apr29 vs. short €25.01 Bobl Apr29 @ 36.6bp, 3M carry: 2.0bp and 3M slide: 0.5bp. P&L since inception (17 July 2024): -3.1bp.

*Unless specified, all trades are priced as of 1PM on non-payroll Fridays and 2PM on payroll Fridays.

Trades closed over the past 12 months

European Derivatives

Long Duration Bias: Navigating ECB’s Disinflation and Rate Cut Trajectory

- Lower than expected inflation in France and Spain has increased our conviction on the overall disinflation journey. Along with a weak growth back drop, we now expect the ECB to deliver back-to-back cuts starting in October until we reach 2% by June. We see risk of a lower terminal rate even in absence of a recession

- The €STR curve is now pricing around 20bp and 52bp of cumulative cuts by October and December meetings and a cumulative 172bp of cuts by end-2025, in addition to the two 25bp cuts already delivered

- We favour receiving Dec24 ECB €STR on market pricing some risk of a jumbo cut if inflation next week disappoints as well

- We increase our conviction on medium term long duration bias. With a view that the risk of a large back-up in reds yield remains limited, we recommend buying 1Yx1Y A/A-37.5bp receiver versus selling A+25bp OTM payer at a net credit. Take profit in 1Yx1Y A/A-50bp receiver spread versus OTM payer

- Keep conditional bull steepeners in Mar25/Mar26 but take profit in 2s/5s

- Take profit and re-strike 2s/5s/10s conditional bull belly cheapener via 3M receivers

- 10s/30s swap curve is marginally too flat in our long-term model but is too steep in our short-term model versus 1Yx1Y €STR; keep 10s/30s swap curve flatteners hedged with long in reds as pure RV trade. Concerns around Dutch pension fund indexation flow could support some temporary flattening of the curve

- Bearish hedges: hold 3Mx(1Yx1Y) A/A+20 1x2 payer spread

- German Eurex swap spreads continue to trade narrow vs. historical levels, to show weak directionality to yield levels, with a broad modest drift narrower on further easing of financial conditions

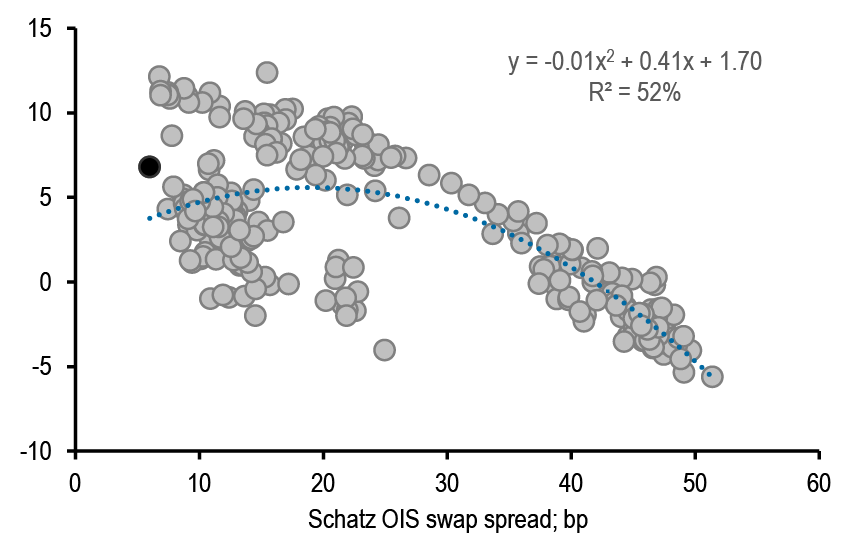

- Schatz €STR swap spread continues to trade cheap vs. fundamental variables with investors’ positioning biased for narrowers on carry considerations, given declining beta to intra-EMU peripheral spreads to OAT/Bund spreads

- We hold Dec24 Schatz €STR swap spread widener as convex tactical risk-off hedge to our long carry/short vol portfolio, with directionality to intra-EMU expected to increase in a risk-off move driven by macro or geopolitical concerns

- Bund swap spread fair to a touch rich vs. fundamental drivers; medium term narrowing bias

- Initiate Dec24 Schatz/Bund €STR swap spread curve flattener

- Sell 3Mx30Y gamma with infrequent delta-hedging; hold shorts in 6Mx10Y unhedged straddles; bias towards 2s/10s volatility curve flatteners across tails

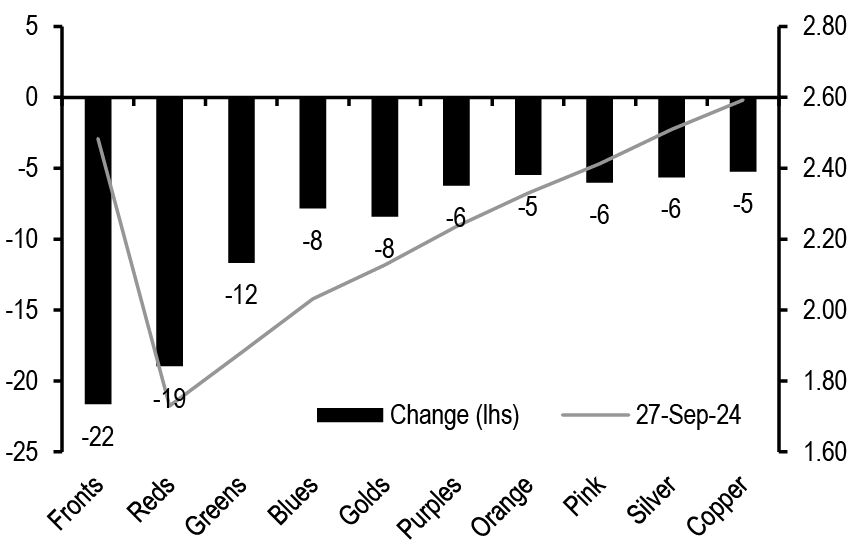

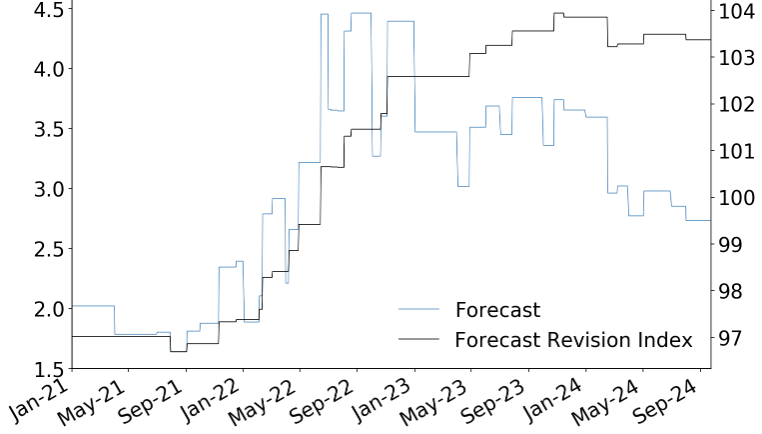

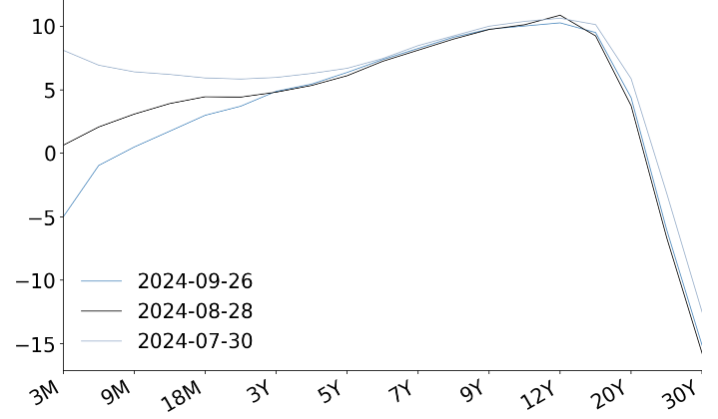

€STR 1Y forward yield curve bull-steepened sharply over the week; weak PMIs and German IFO followed by downside surprise in France and Spain inflation drove a large repricing of ECB easing expectations for the October meeting and fuelled the large rally at the front-end of the curve and consequent bull-steepening of the curve ( Figure 34). Anecdotal evidence suggests some profit taking in steepeners and bank related paying flows in the intermediate sector of the curve.

Figure 34: €STR forward yield overall increased with a decent bull-steepening of the curve

1W changes of various 1Y forward €STR yield (lhs, bp) versus 1Y fwd €STR curve (rhs,%)

Source: J.P. Morgan.

Figure 35: ECB commentary has been fairly neutral towards an October cut with broad consensus appearing for a December cut, in line with a “gradual” easing cycle

ECB hawk/dove score; since 1 Jan 2020; unitless

Source: J.P. Morgan.

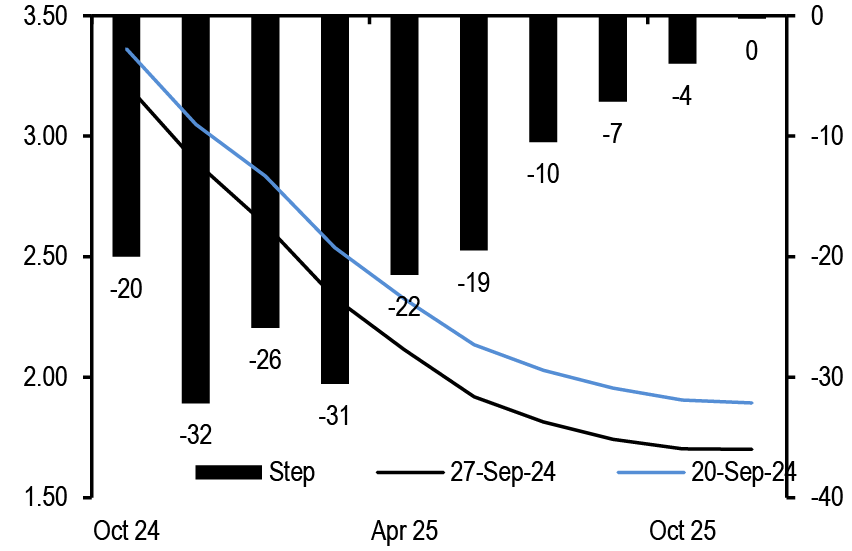

Euro area HICP (flash) for September and US payroll report are the highlights of next week and will go a long way in crystallizing the easing for the ECB and the Fed for their respective next meetings. HICP inflation is expected to fall in September due to favourable base effects whereas core and especially services are expected to remain sticky. However, a downward surprise, in line with that seen in France and Spain this week will tilt the scale towards an October cut from the ECB. ECB commentary has been initially broadly neutral towards an October cut with guidance towards gradualism and supporting next cut only in December (see Overview); our ECB hawk/dove score has been hovering close to 0 which indicates close to neutral stance from the speakers ( Figure 35). However, weak Euro area PMIs along with any negative inflation surprise could bolster the ECB’s confidence towards the disinflation process and shift towards weakening growth backdrop. Indeed, our revised call is now for the next cut in October with ECB delivering back-to-back cuts until we reach 2% in June 2025 with risk of still lower terminal rate, even in absence of a recession.

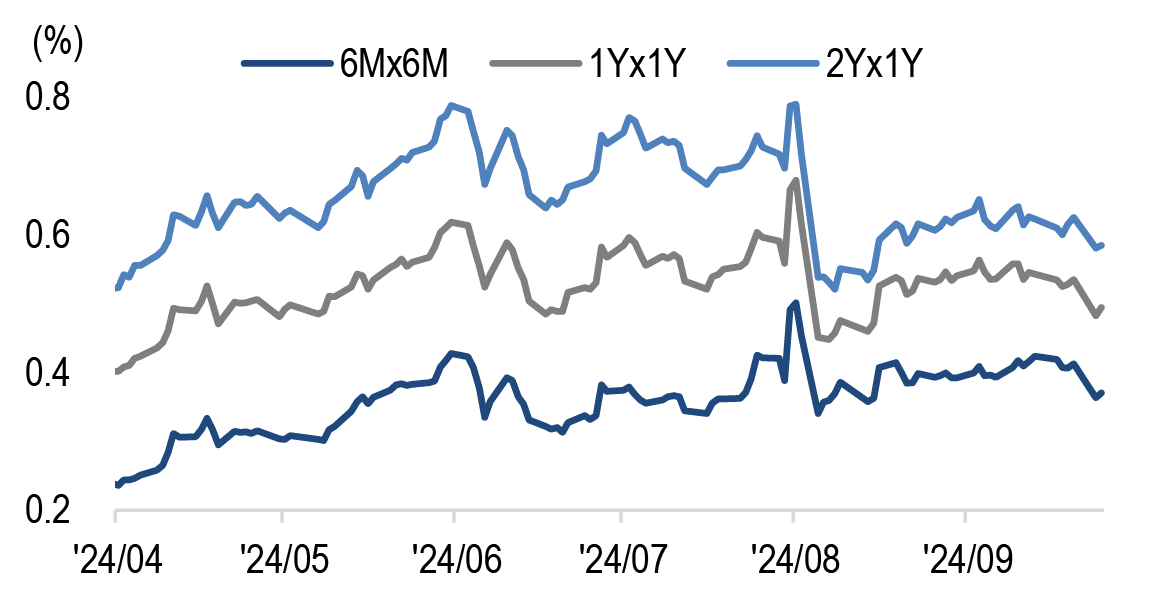

The €STR curve is currently pricing around 20bp and 52bp of cumulative cuts for the October and December ECB meetings and a cumulative 172bp of cuts by year-end 2025 ( Figure 36). We highlight the following. First, we favour receiving Dec24 ECB €STR as a tactical trade which is currently pricing 52bp of cut as we see risk of market pricing some probability of a jumbo cut from the ECB if inflation in Germany and consequently the Euro area disappoints further next week. We would consider outright longs in Dec24 ECB €STR if the pricing retraces back to 50bp, for example.

Figure 36: The €STR curve is pricing around 20bp and 52bp of cumulative cuts for the October and December meeting. We favour receiving Dec24 ECB €STR

ECB meeting steps for the €STR curve (rhs, bp) and current €STR curve (lhs, %);

Source: J.P. Morgan.

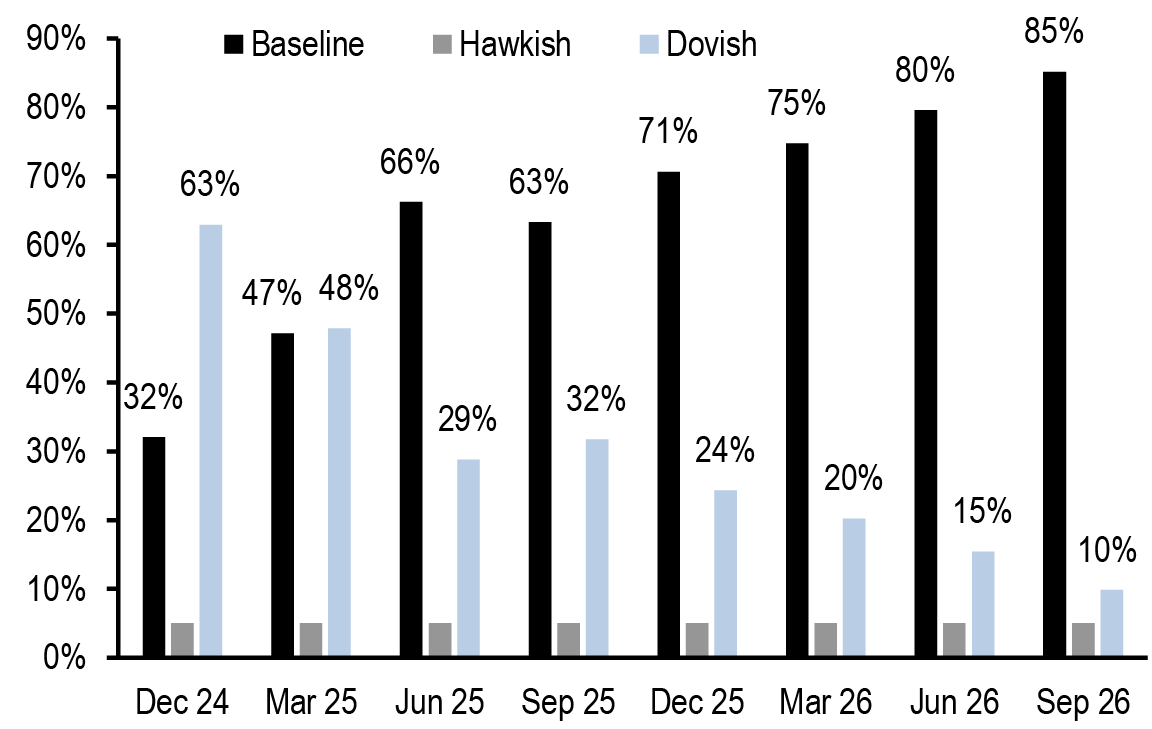

Figure 37: The €STR curve is priced closer to our dovish scenario over the next few meetings but then switches towards our baseline scenario further out

Estimated probability of the baseline/dovish scenario as implied by current €STR curve; %

Source: J.P. Morgan.

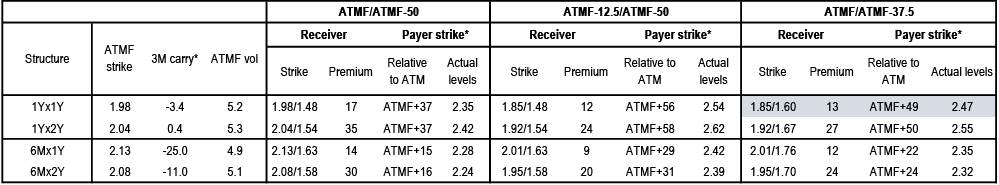

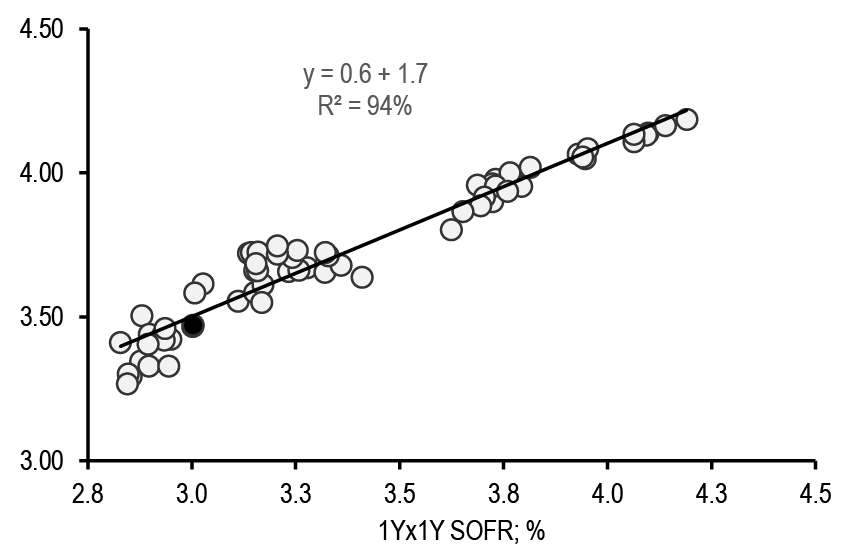

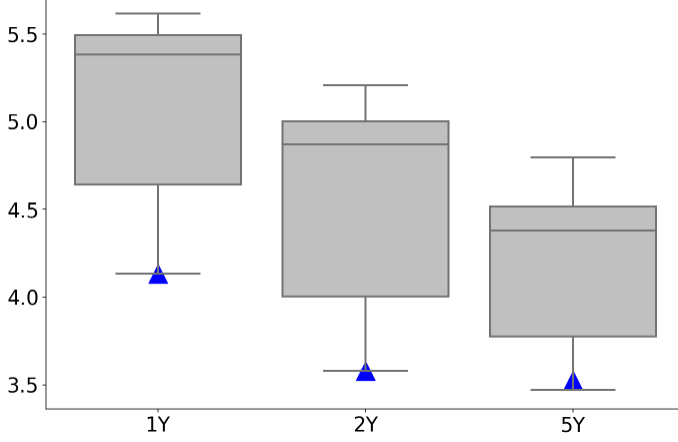

Second, the terminal rate (average over 2026 ECB meetings) priced in the curve is around 1.85%, with reds (1Yx1Y) €STR around 1.75%. The easing priced over the next few months is broadly in line with our revised call. With the risk profile in Euro area changing, both due to weaker growth backdrop and ongoing disinflationary trend with the potential of decline in services and core inflation as well, we see risks biased towards lower terminal rates. This should support a bullish duration bias. In other words, the terminal rate currently prices in some risk of a hard-landing scenario ( Figure 37). We believe that this is fair but cannot discount the risk of this increasing further as Euro area economy falters and/or there is heightened risk of an inflation undershoot the ECB is forced to take policy rates well below neutral level of rates. We keep our medium term bullish duration but keep these only via proxies ( Figure 38). To this effect, we take profit and re-strike our 1Yx1Y A/A-50bp receiver spread versus OTM payer ( Figure 39). As a new trade, we recommend buying 1Yx1Y A/A-37.5bp versus paying OTM payer. In the past, we have fully funded these receiver spreads via selling an equivalent OTM payer. A similar strategy would call for selling A+50bp payer for the package to be premium neutral. However, we superimpose our view that the risk of a 50bp backup in reds is now rather limited given macro backdrop and thus we reduce the moneyness of the payer to say A+25bp to enable us to express this bullish exposure at a net credit (see Trade Recommendations).

Figure 38: We keep medium term bullish duration exposure but only via proxies – receiver spread at the front-end funded via OTM payer offer attractive risk reward

ATMF strike, 3M carry, ATMF implied volatility, and OTM payer strike that would offset the cost of receiver spread; %

Data as of COB 26th Sep 2024.

Source: J.P. Morgan.

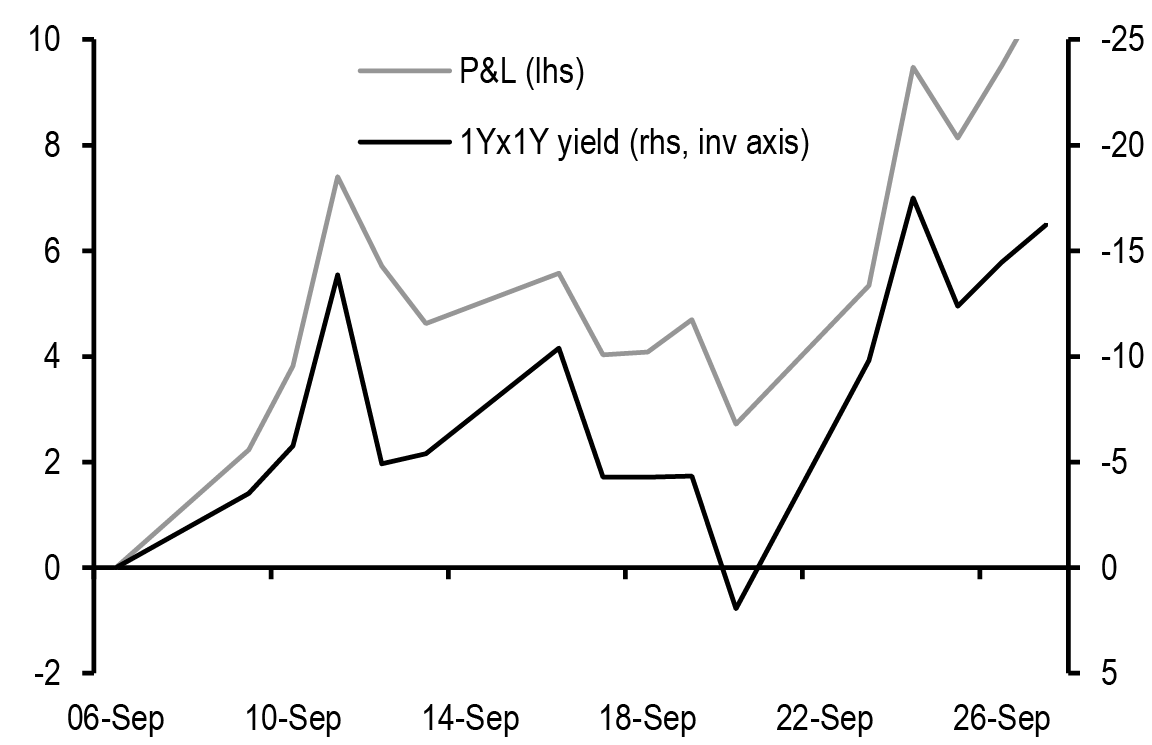

Figure 39: Take profit and re-strike 1Yx1Y receiver spread versus OTM payer

Cumulative P&L (lhs, bp of notional) versus change in underlying yield (rhs, bp, inverted axis)

Source: J.P. Morgan.

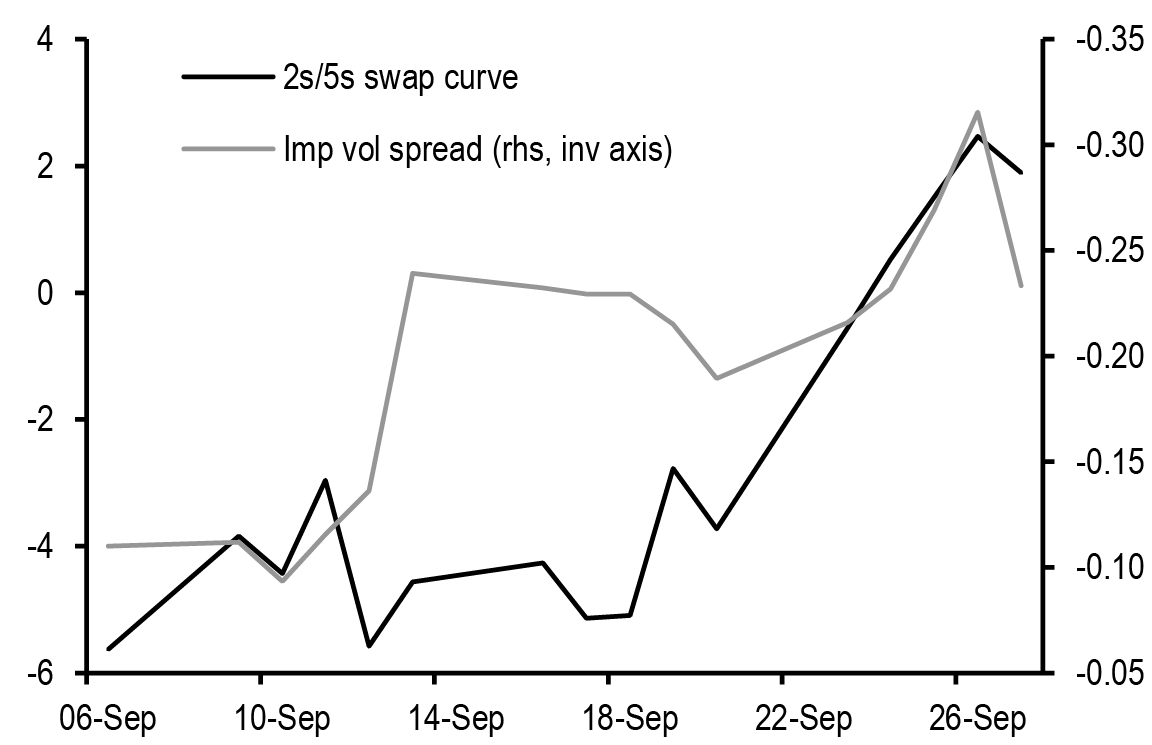

Figure 40: Take profit in 2s/5s conditional bull steepeners

Evolution of fixed dated 2s/5s swap curve (lhs, bp) and (3Mx5Y – 3Mx2Y) implied vol spread (rhs, inverted axis, bp/day); since 6thSep 2024

Source: J.P. Morgan.

Third, we continue to hold Mar25/Mar26 conditional bull steepeners via Euribor calls and midcurve calls. This reflects our view that market pricing of accelerated ECB easing is likely to be front-loaded.

For investors, who wish to position for some retracement in the current pricing, we find buying 97.125/97 1x2 Dec24 Euribor 1x2 put spread at close to flat attractive. Dec24 Euribor futures are currently around 97.15 and we see minimal risk of them rising 25bp higher to push through the upper barrier even if the ECB decides to skip an October cut. We also keep 3Mx(1Yx1Y) payer spread 1x2 as a bearish hedge that we had recommended a few weeks ago.

Further out, on the swap curve we have expressed a strategic steepening bias but have refrained from outright steepeners and instead focused on conditional bull steepeners via 2s/5s bull steepeners. The trade has benefitted from an overall bull-steepening of the swap curve and a relative richening of the 2Y volatility versus 5Y ( Figure 40). While the curve continues to exhibit a strong negative directionality versus yield, we also believe that the risk of a lower-for-longer dynamic is also increasing (not our baseline view and the probability for such an outcome is low at present) which could limit the extent of further steepening of the 2s/5s curve. Thus, we take tactical profit in our conditional 2s/5s bull-steepeners (see Trade Recommendations).

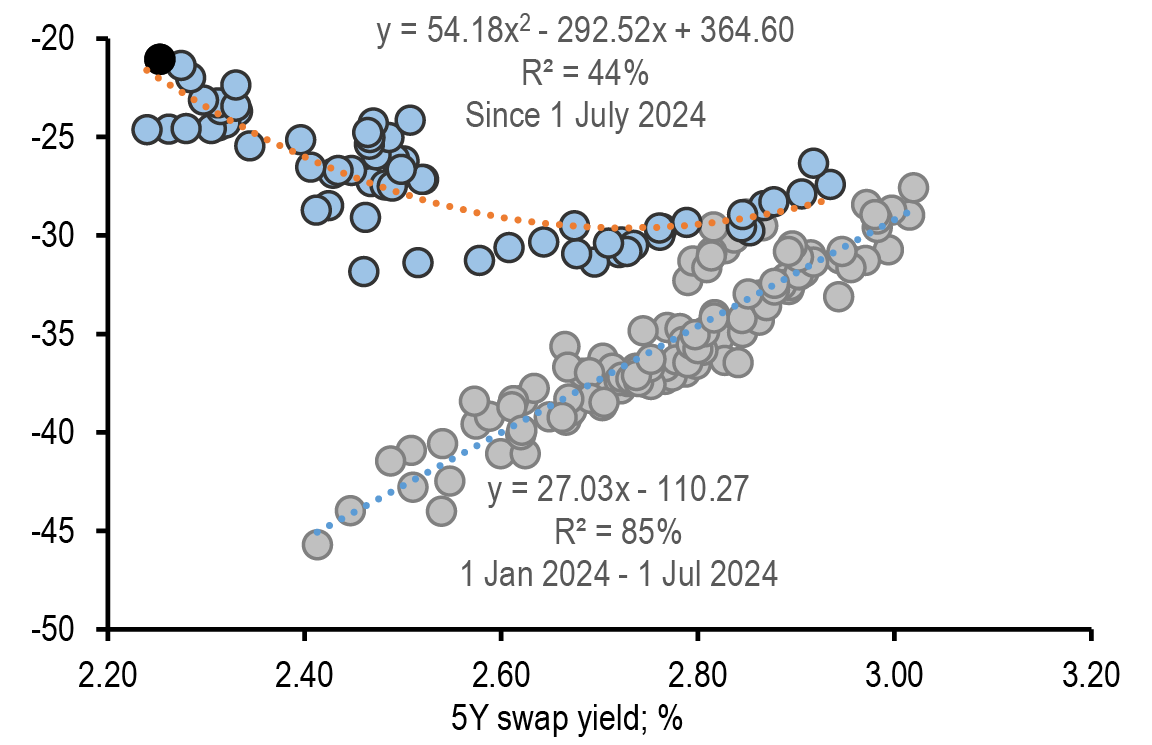

The 2s/5s/10s 50:50 swap fly has continued to gradually cheapen in the recent rally, broadly in line with our expectations; the spot 2s/5s/10s fly has cheapened around 10bp since inception (2ndAugust 2024) as 5Y swap yields are overall 20bp lower. We have conviction in this bull-belly cheapening dynamic and take profit and re-strike our 2s/5s/10s 50:50 conditional bull-belly cheapener via 3M receivers (see Trade Recommendations). Implied directionality is currently around 9% (pricing a belly richening dynamic in a rally) versus delivered directionality over the last 2M around -10% (measured using a linear regression of the 2s/5s/10s 50:50 fly versus 5Y over the last 2M) ( Figure 41).

Figure 41: The negative directionality of the 2s/5s/10s 50:50 swap fly is continuing to assert. Take profit and re-strike conditional bull-belly cheapeners via 3M receivers

2s/5s/10s 50:50 swap fly regressed against 5Y swap yield; since 1 Jan 2024; bp

Source: J.P. Morgan.

2s/5s/10s 50:50 swap fly regressed against 5Y swap yield; past 2M; bp

Source: J.P. Morgan.

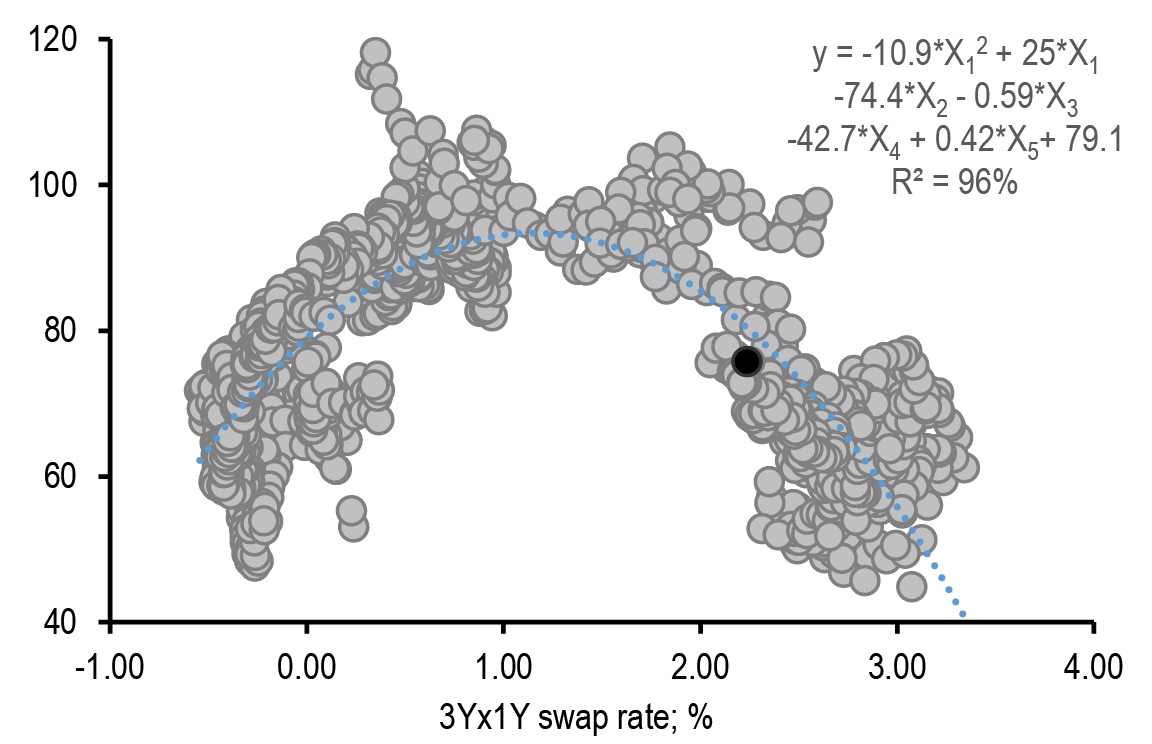

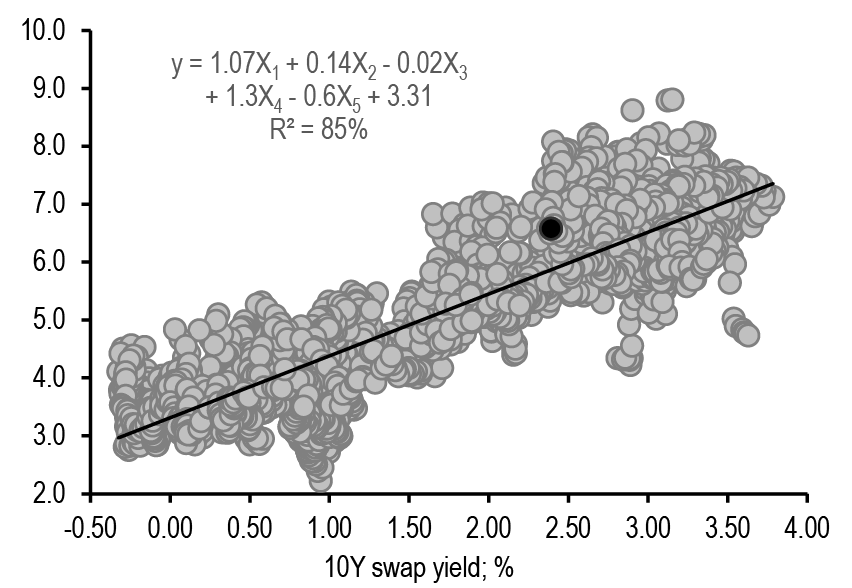

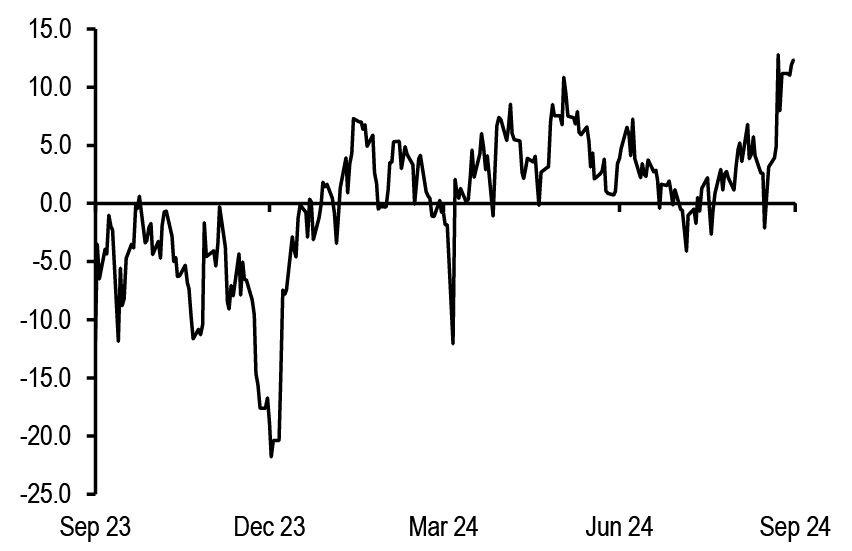

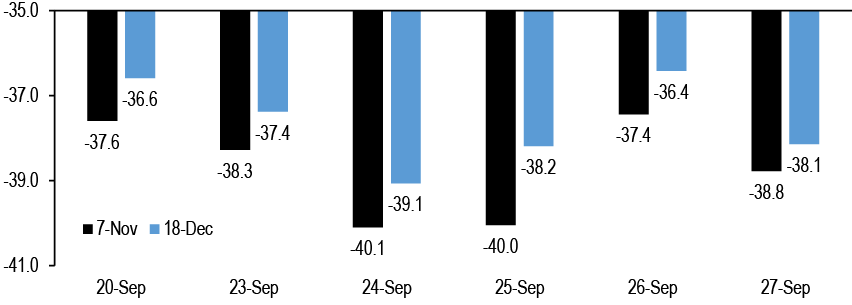

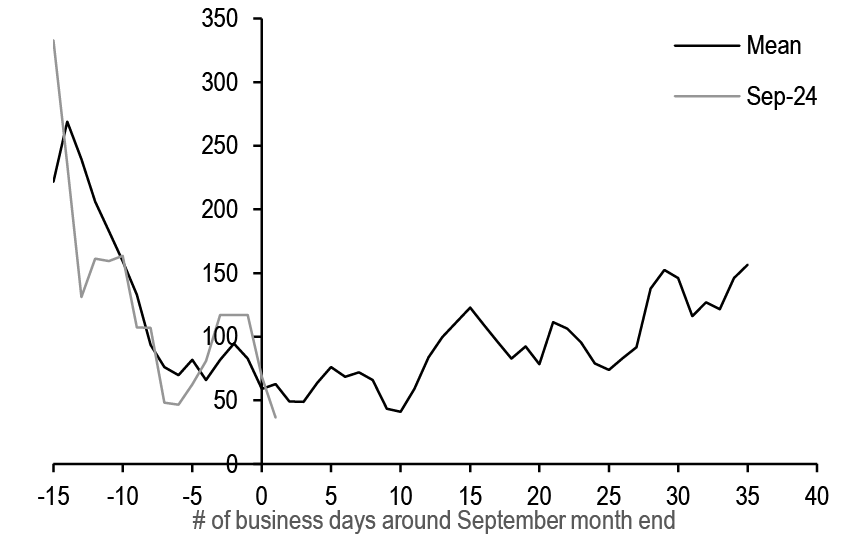

The 10s/30s swap curve has steepened around 2-3bp over the week and is now hovering close to its steepest levels seen since the ECB started it hiking cycle in July 2022. On a fair value framework, the curve appears marginally too flat (around 4bp) ( Figure 42). As we have discussed last week, our medium-term view remains that of further steepening primarily driven by decline in front-end yields and a potentially steeper USD curve as well. However, over the short-term concerns around Dutch Pension flow indexation related receiving flows (curve flatteners) could modestly temper the overall expected steepening. In Figure 43, we show the indexation announced by top few funds in 2023 along with their funding ratios. To the best of our knowledge, none of these funds have announced the indexation for 2025 and are likely to do so over the course of 4Q24. However, we make the following considerations. First, given the sharp decline in inflation this year, we expect only modest indexation than the last two years. This should translate into limited receiving flows from these funds. Second, anecdotally these funds execute the corresponding hedging flows opportunistically and thus this time around could be spread out over the course of next few weeks. We recall than in the past these flows continue well beyond year end as well.

Figure 42: The 10s/30s swap curve appears marginally too flat in our long-term fair value model and we keep our medium-term steepening bias on the curve

10s/30s swap curve regressed against 1) 3Yx1Y swap yield (X1, quadratic fit); 2) ECB b/s as a % of GDP (X2);3) VIX (X3); 4) ECB hawkish pivot dummy (X4); and 5) 10s/30s USD swap curve (X5); since 1 Jan 2017; bp

Source: J.P. Morgan.

Figure 43: Concerns around Dutch pension fund related indexation flow could temper the steepening over the short term although we believe that these flows are likely to be muted relative to last two years

Current funding ratios and indexation details for 2023 for top Dutch pension funds; %

| Dutch Pension Fund | 2024Q2 | 2023 | |||

| Policy funding ratio | Indexation | Announcement | Start date | Policy funding ratio | |

| ABP | 114% | 3.0% | 30-Nov-23 | 01-Jan-24 | 114% |

| PFZW | 111% | 4.8% | 10-Nov-23 | 01-Jan-24 | 112% |

| PMT | 110% | 3.2% | 05-Dec-23 | 01-Jun-24 | 110% |

| PME | 114% | 3.3% | 28-Nov-23 | 01-Jan-24 | 113% |

| Pensioenfonds Vervoer | 114% | 7.6% | 05-Dec-23 | 01-Jan-24 | 114% |

| BpfBouw | 126% | 0.0% | 24-Nov-23 | 01-Jan-24 | 125% |

| Detailhandel | 123% | 3.3% | 29-Nov-23 | 01-Jan-24 | 122% |

| PGB | 117% | 5.2% | 16-Nov-23 | 01-Jan-24 | 117% |

| BPL | 119% | 4.2% | 14-Dec-23 | 01-Jan-24 | 118% |

| Rabobank | 118% | 2.6% | 22-Jun-23 | 01-Jul-23 | 119% |

| Rail & OV | 132% | 0.0% | 01-Dec-23 | 01-Jan-24 | 130% |

| StiPP | 112% | 0.0% | N/A | 01-Jan-24 | 112% |

| ABN AMRO | 129% | 7.6% | N/A | 01-Jan-24 | 131% |

| ING CDC | 133% | 0.0% | 28-Aug-23 | 01-Jan-24 | 131% |

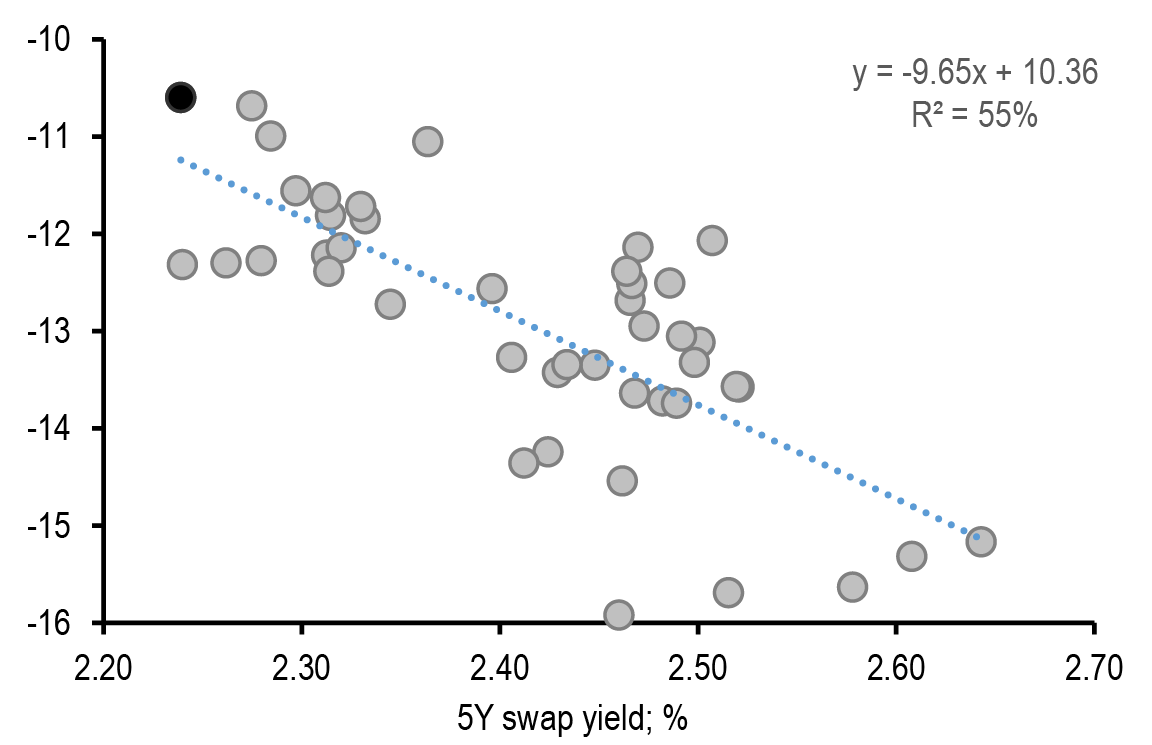

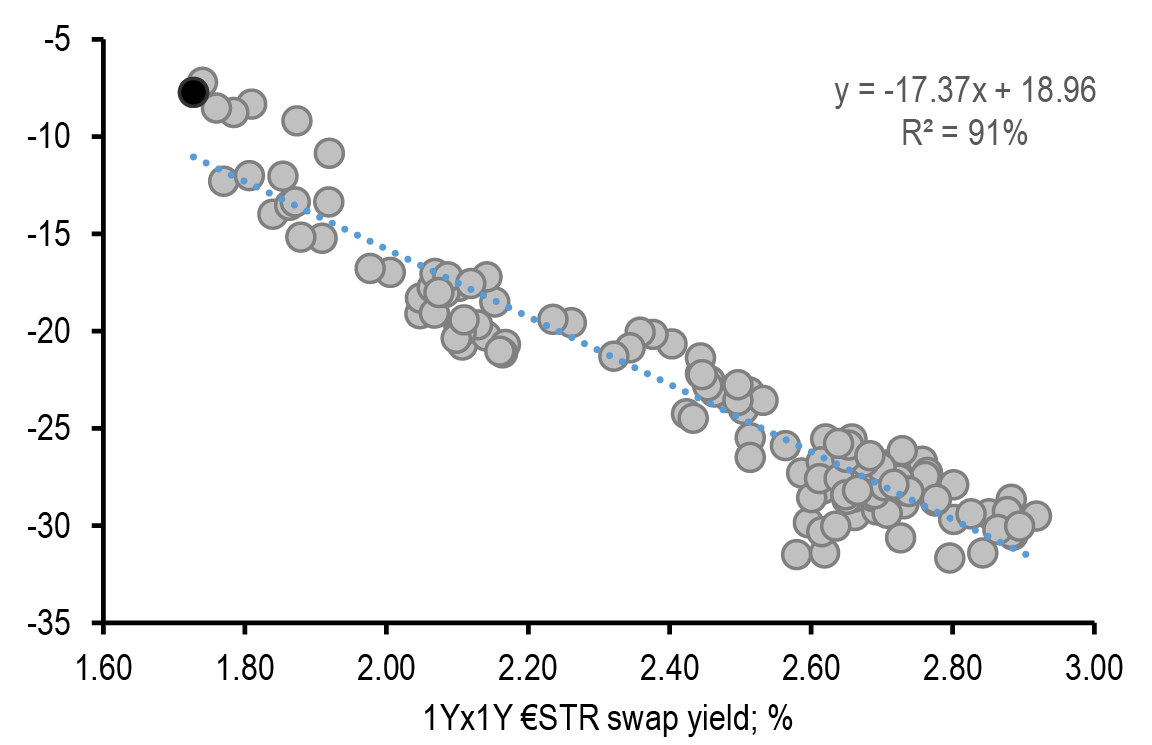

Last week, we had recommended tactical 10s/30s swap curve flatteners beta-hedged with longs in reds (16% risk) on RV considerations. The relative value has partially corrected but the curve still appears marginally too steep on a short-term regression basis ( Figure 44). Thus, we hold this as RV trade.

Figure 44: Hold 10s/30s swap curve flatteners beta hedged with longs in reds on RV considerations

3Mx(10s/30s) swap curve regressed against 1Yx1Y €STR; past 6M; bp

Source: J.P. Morgan.

Swap spreads

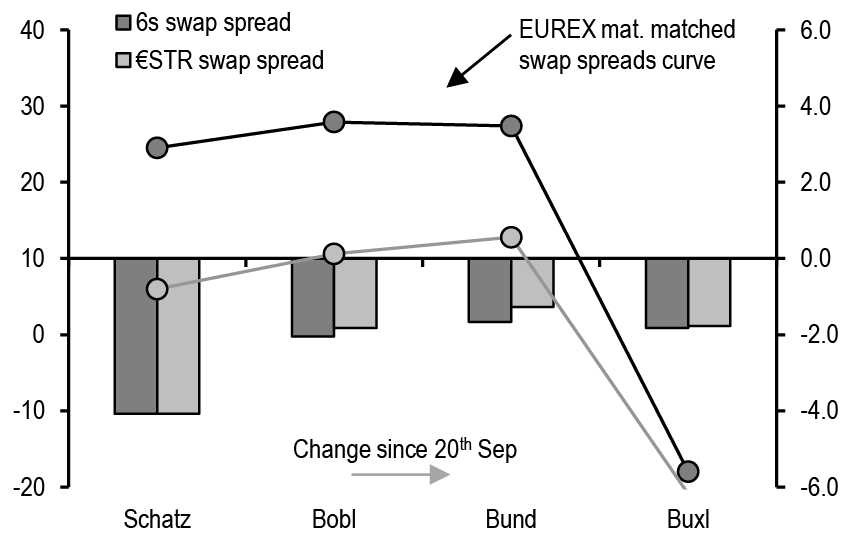

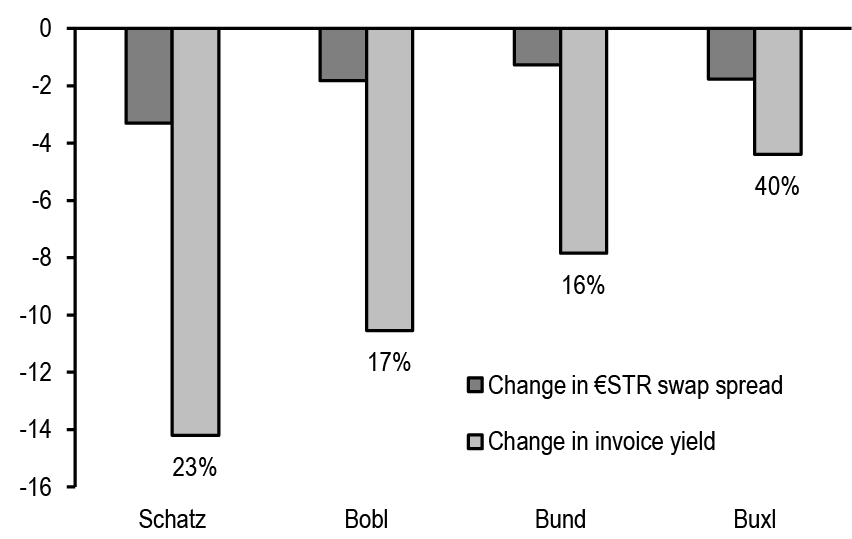

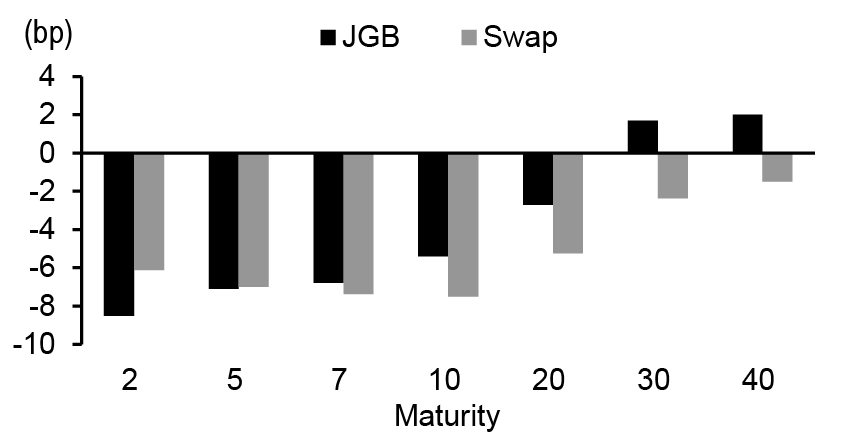

Over the past week German Eurex swap spreads were narrower across the curve with an underperformance of Schatz swap spread and a steepening of the swap spread curve ( Figure 45). Macro data over the week tilted decisively to the downside with weak flash PMI reading on Monday and significant downside surprise on inflation in France and Spain on Friday. These surprises triggered a large rally in €STR at the short end of the curve with market pricing a lower trough and a faster easing cycle (see Overview) and a significant bull steepening of the German curve, turning directionality of swap spreads to yield levels unusually positive ( Figure 46).

Figure 45: German Eurex swap spreads were narrower across the curve with an underperformance of Schatz swap spread and a steepening of the swap spread curve

Current level of Dec24 Schatz, Bobl, Bund, and Buxl maturity matched 6s and OIS (€STR) swap spreads and change since 20th September; bp

Source: J.P. Morgan.

Figure 46: Directionality of swap spreads has turned unusually positive across the curve with the German curve delivering a pronounced bull steepening primarily driven by sharp drop in Euro area PMI and downside inflation surprises

Changes since 20th September of Dec24 Schatz, Bobl and Bund €STR swap spreads and changes in respective invoice yields with ratio shown as percentage; bp

Source: J.P. Morgan.

Valuation considerations remain broadly unchanged for German swap spreads. The narrowing dynamic has been a feature for most of 2024 and at current levels across the curve we are now hovering close to the YTD narrowest levels ( Figure 47). Long term technical and macro factors such as collateral availability and easing of financial conditions have contributed to most of the narrowing in 2024, with additional contribution from NIM hedging receiving flows from financial institutions. The directionality of swap spreads have been strongly negative in 1H24, as yield declined from the sharp rally into late 2023 as market was repricing the unwinding of the QE/scarcity story. In the last quarter the directionality of swap spreads to yield levels has been much weaker and more mixed ( Figure 48), with idiosyncratic bouts of flight to quality and risk aversion on one side (negative directionality with widening in a rally), and narrower swap spreads on easier financial conditions as market prices in a lower terminal rate (positive directionality with narrowing in a rally).

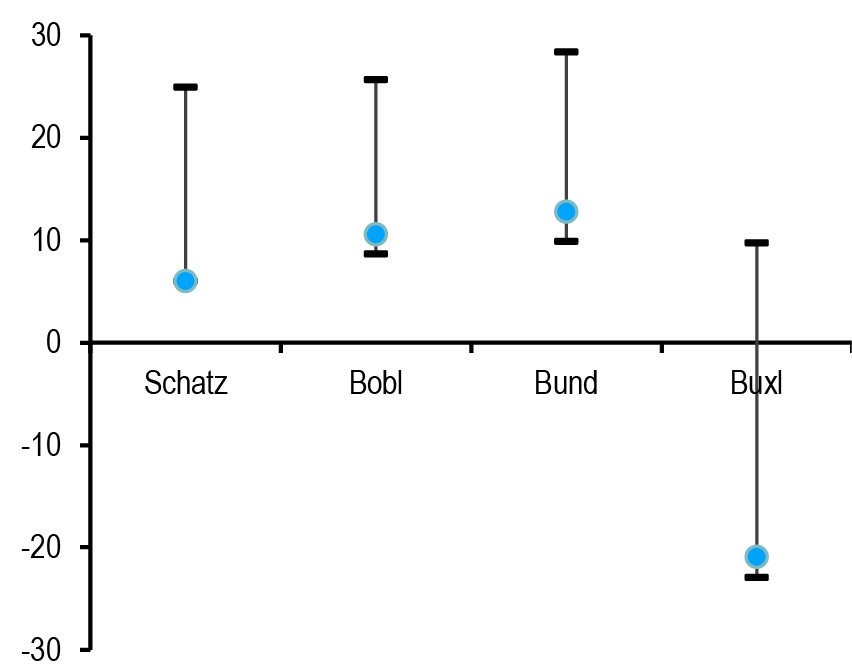

Figure 47: German swap spreads have been narrowing for most of 2024 and are now hovering close to their YTD narrowest levels

Current values of Schatz, Bobl, Bund and Buxl €STR swap spreads and range since 1 Jan; bp

Source: J.P. Morgan.

Figure 48: As highlighted in the past few weeks the directionality of swap spreads to respective German yields has been much weaker in 3Q24, as idiosyncratic flight to quality flows amidst a broad repricing of ECB easing expectations became more relevant drivers

Beta and r-squared of 2Y, 5Y, 10Y, 15Y and 30Y German b/m, Schatz, Bobl, Bund and Buxl swap spreads against respective benchmark and invoice yields since July 2024 and between late December 2023 and early June 2024; %

| Swap spread vs 6s | Since 01 Jul 2024 | Dec23 to Jun24 | ||

| Beta | R-Sqr | Beta | R-Sqr | |

| Schatz | 3 | 20% | -17 | 59% |

| 2Y | 6 | 41% | -16 | 55% |

| Bobl | 4 | 10% | -22 | 64% |

| 5Y | 4 | 12% | -22 | 67% |

| Bund | -1 | 1% | -33 | 63% |

| 10Y | 0 | 0% | -35 | 66% |

| 15Y | 1 | 0% | -53 | 77% |

| Buxl | -8 | 18% | -56 | 50% |

| 30Y | -8 | 17% | -51 | 62% |

Source: J.P. Morgan.

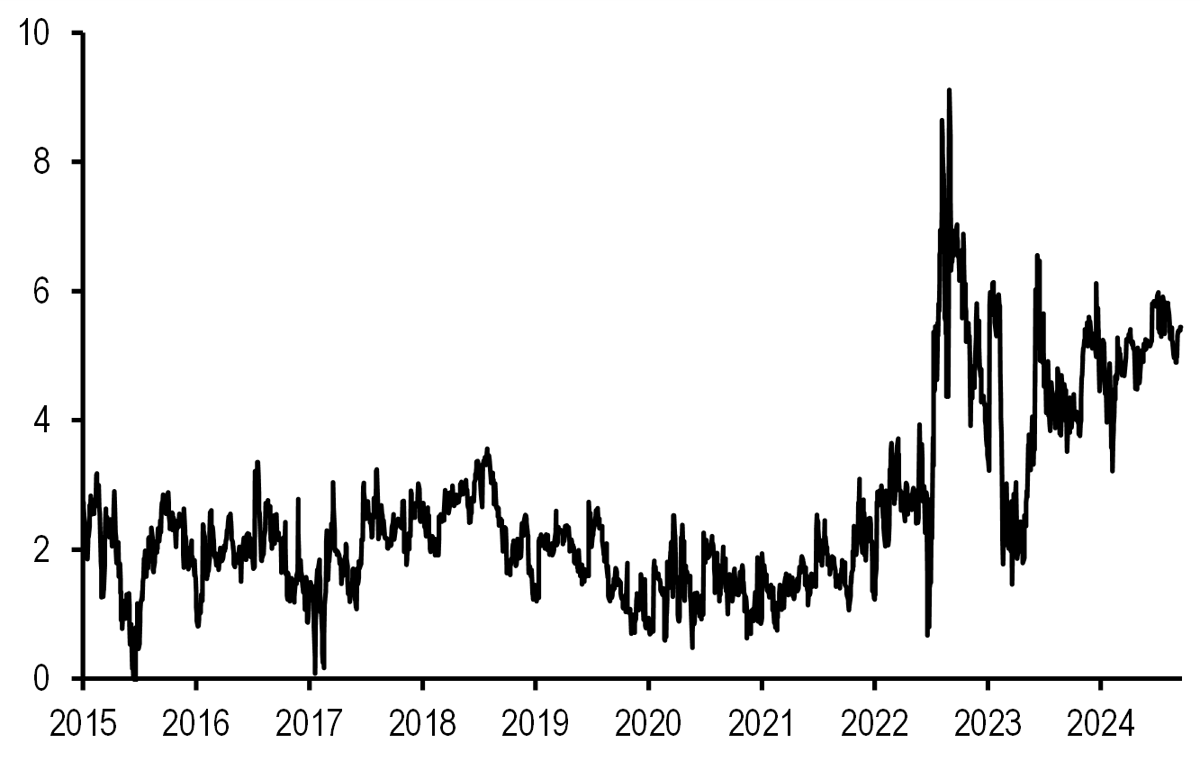

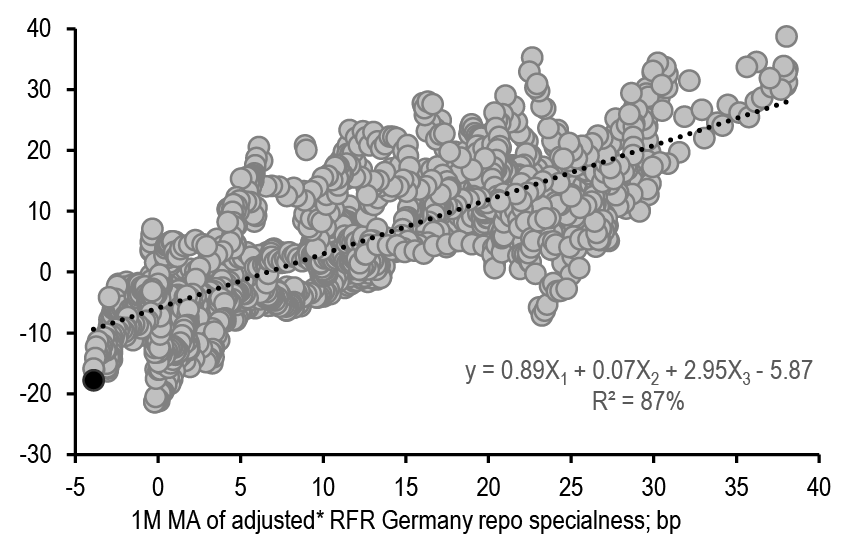

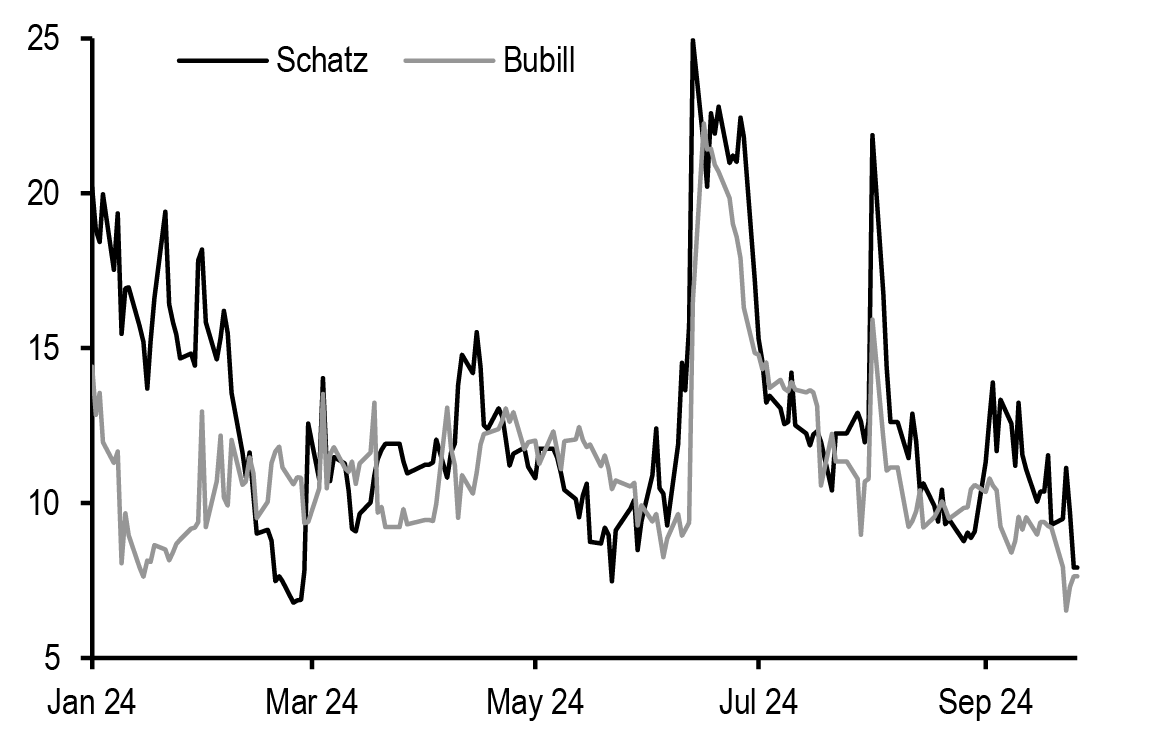

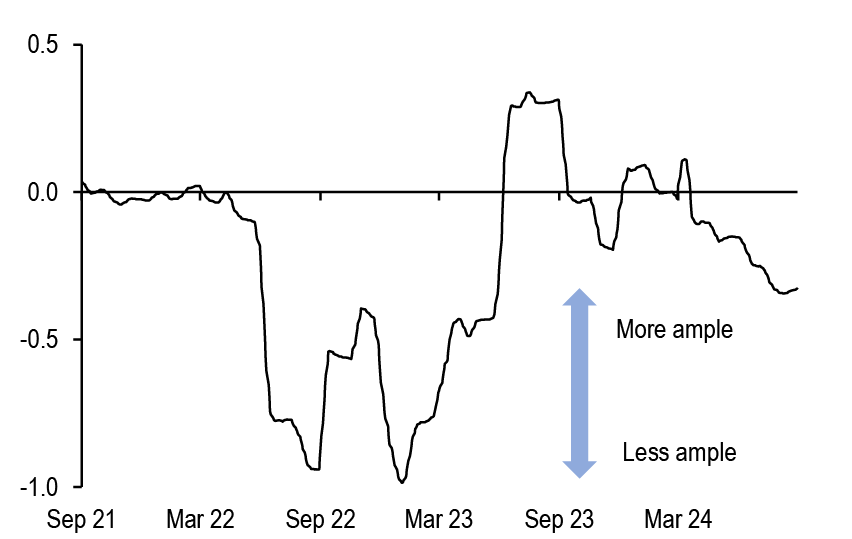

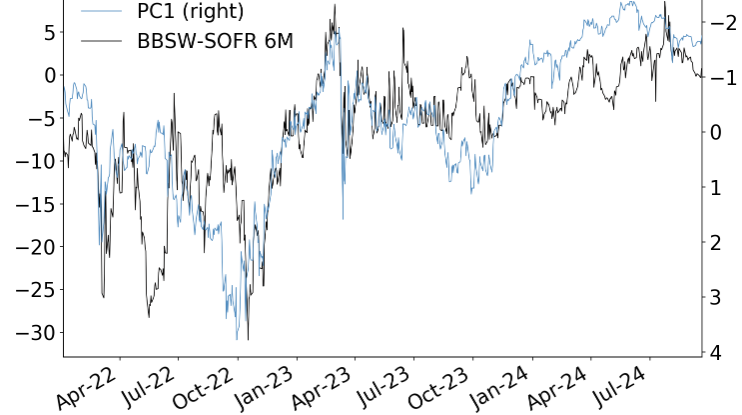

Schatz €STR swap spread continues to trade on the narrow side vs. fundamental drivers in our long-term revised fair value framework ( Figure 49). We discussed over the past few weeks the challenges in including OAT/Bund spread as regressor in our model. The repricing of French sovereign spreads on fiscal concerns has structurally changed in our view the empirical beta of Schatz swap spread. Investors’ positioning appears skewed towards narrower on carry and roll down considerations, although at current levels it appears quite limited ( Figure 50).

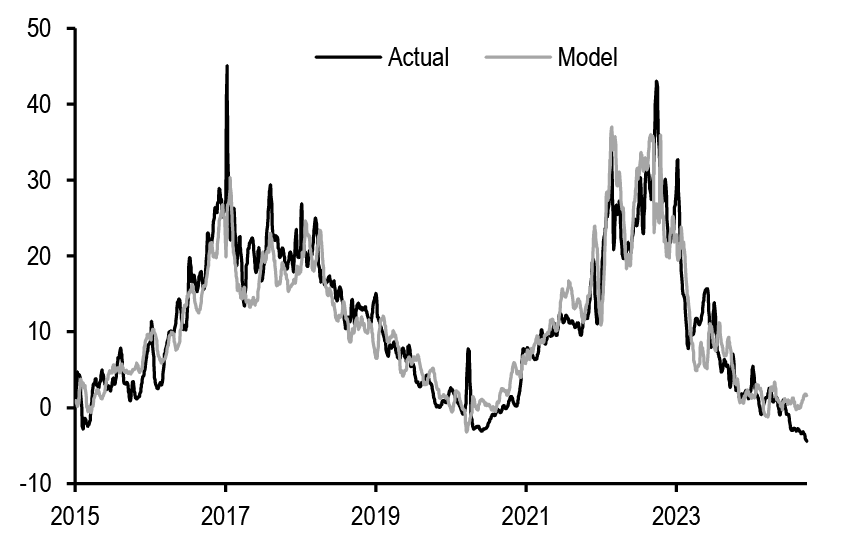

Figure 49: Schatz €STR swap spread continues to trade on the narrow side vs. fundamental drivers in our long-term revised fair value framework

Schatz invoice OIS swap spread (vs. €STR rolling 1st of delivery month) and model levels implied by regression against: 1) 1M MA of adjusted* RFR Germany repo specialness (X1); 2) 10Y BTP/Bund since the 2016 US Presidential election (X2); 3) 3Mx2Y EUR swaption volatility (X3); since 1 Jan 2015; bp

Source: * Excluding year-end effect from 23 December 2016 to 6 January 2017 and the year-end and quarter-end effect over the last business days of the quarters. Repo Funds Rate Germany (RFR Germany) is a daily euro repo index calculated from trades executed on the BrokerTec and MTS electronic platforms. All eligible repo trades are centrally cleared and RFR Germany is calculated and published by ICAP Information Services. RFR Germany is calculated with repo trades that use German sovereign government bonds. RFR Index source: Broker Tec and MTS trading.BrokerTec, MTS trading, and J.P.Morgan.

Figure 50: Investors’ positioning appears skewed towards narrower on carry and roll down considerations

Schatz €STR and Bubill 6M €STR swap spread; since 1 Jan 2024; bp

Source: J.P. Morgan.

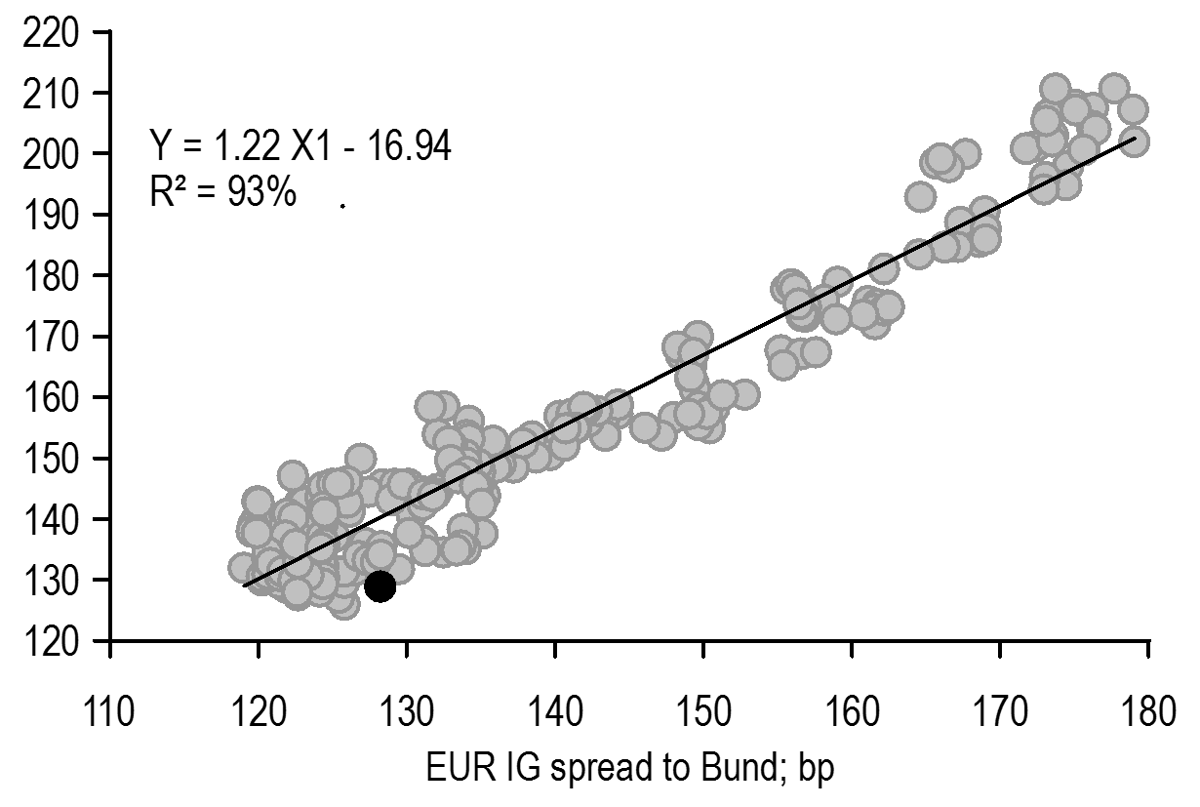

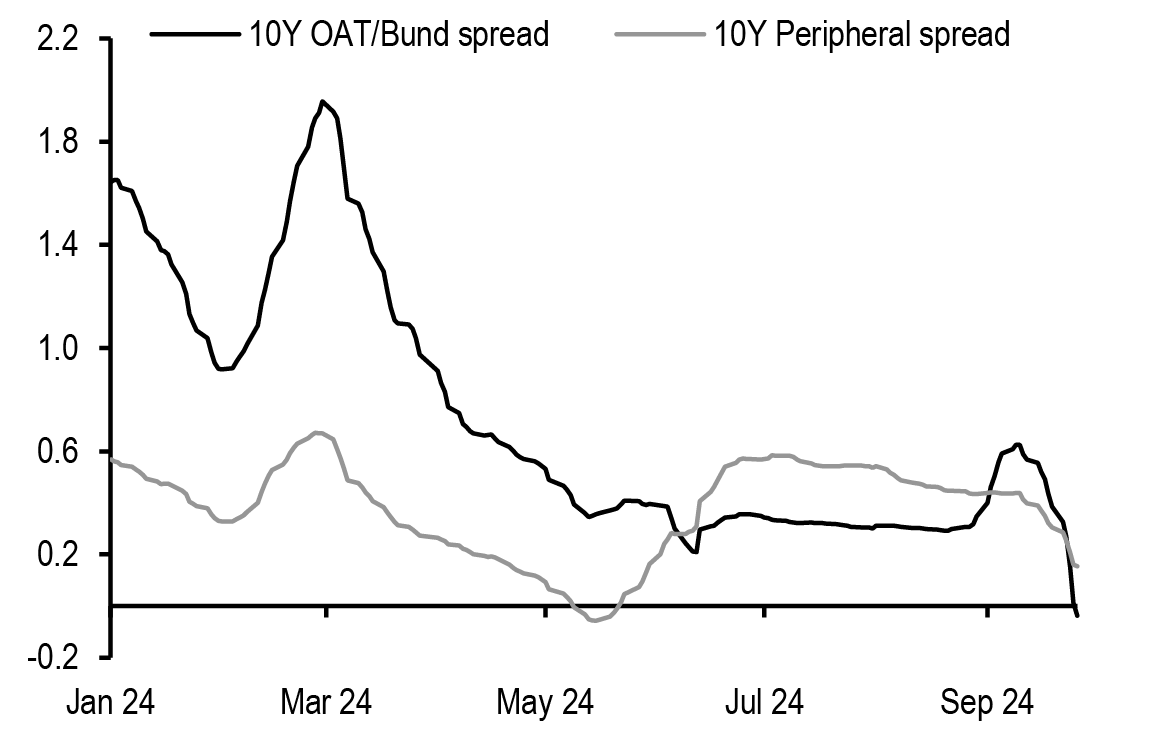

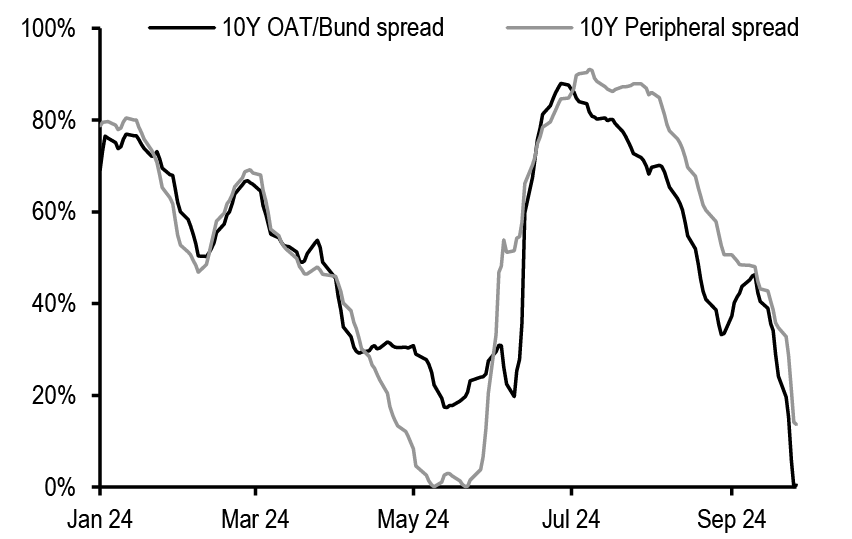

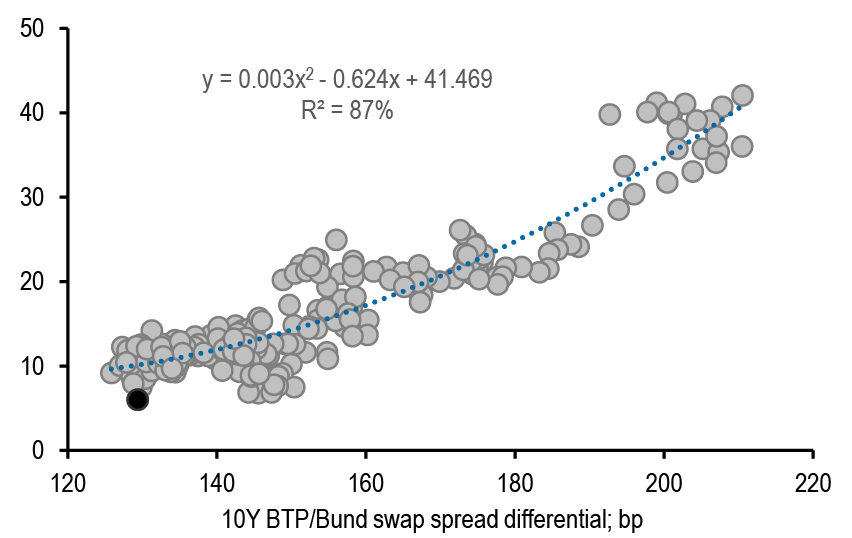

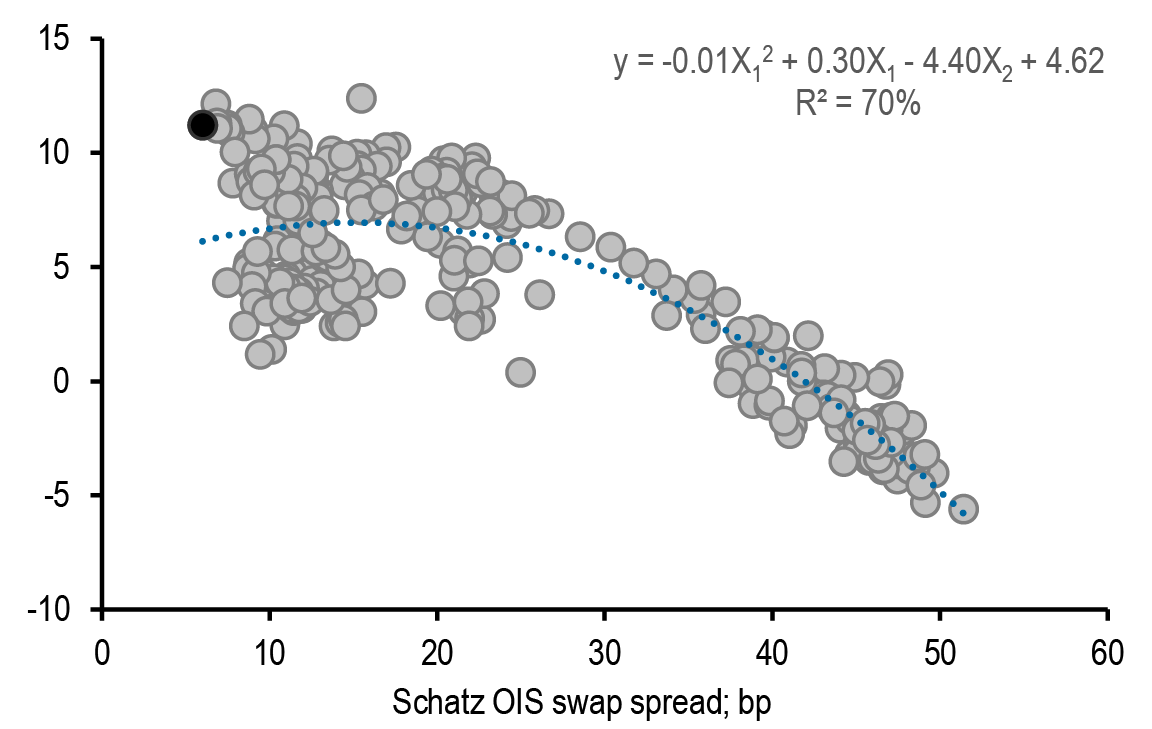

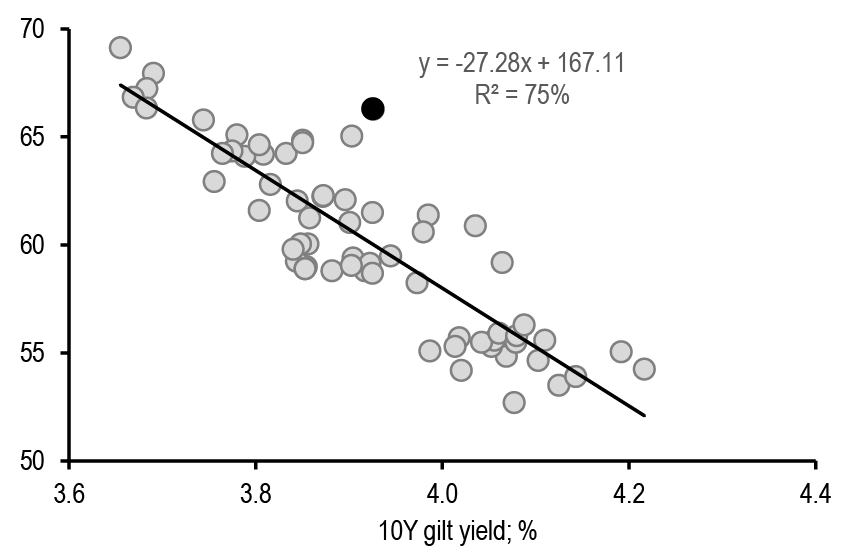

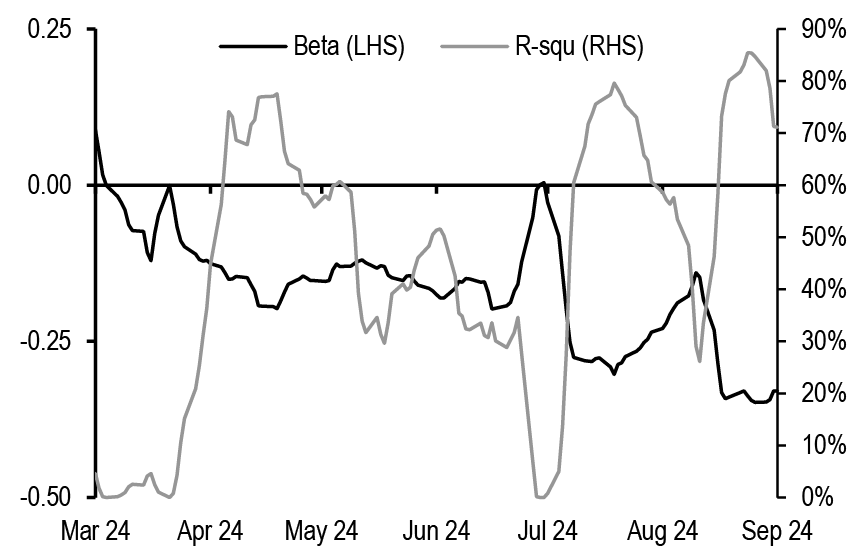

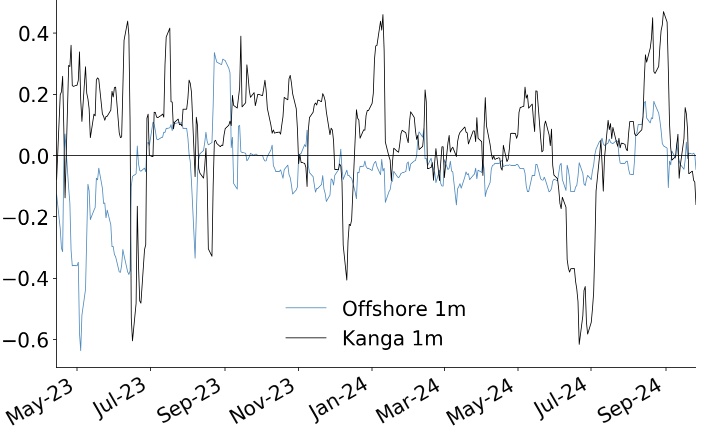

Looking at the directionality of swap spreads to OAT/Bund and peripheral spreads we note that the beta to OAT/Bund spread increased locally around the French elections but declined sharply recently along with similar but more modest decline of beta vs. peripheral spreads ( Figure 51). We acknowledge that the post QE period will deliver on average a lower sensitivity to intra-EMU spreads but nevertheless we continue to believe that Schatz €STR swap spread widener offer a convex hedge to intra-EMU tightener. This week we revised the expected trading range for 10Y BTP/Bund to 120-150bp and believe that the room from further narrowing in Schatz €STR appears limited around current levels ( Figure 52). In our portfolio of broad long intra-EMU spreads (see Euro Cash) we find Schatz €STR swap spread widener an attractive risk off hedge and continue to hold the trade, despite recent underperformance.

Figure 51: The beta to OAT/Bund spreads increased locally around the elections but declined sharply recently along with similar but more modest decline of beta vs. peripheral spreads

3M beta (lhs) and R2 (rhs) of Schatz OIS swap spread versus 10Y OAT/Bund spread and 10Y weighted peripheral spread; since Jan 2024;

Source: J.P. Morgan.

Source: J.P. Morgan.

Figure 52: We expect a 120-150bp trading range for 10Y BTP/Bund which would suggest limited narrowing in Schatz €STR swap spread from current levels

Schatz €STR swap spread regressed against 10Y BTP/Bund swap spread differential; since 1 Oct 2023; bp

Source: J.P. Morgan.

Looking into more details at the drivers, we find that funding rates continues to stay cheap on the German curve and they appear too cheap vs. underlying drivers such as flows of QE purchases, distortion on the German curve and proxy for international investors’ demand ( Figure 53). The residual vs. the model has increased over the past few weeks and is mostly explained by an increase in the distortion of the German curve, as measured by our Root-Mean-Squared-Error of the par curve ( Figure 54). This distortion has not triggered broad richening of German funding rates, with more selective idiosyncratic richening (most in short dated off-the-run Bund). However we believe it should limit further richening of funding rates from here.

Figure 53: Funding rates continues to stay cheap on the German curve and they appear too cheap vs. underlying drivers such as flows of QE purchases, distortion on the German curve and proxy for international investors’ demand

2W MA of German RFR richness to EONIA and model regressed against 1) average monthly ECB asset purchases (X1), 2) 1M MA of RMSE of German par fitted curve (X2), 3) dummy variable since they started buying bonds below the deposit rate (X3), 4) spread between RFR German repo rate and GC (X4) and 5) pick up of German repo by USD based account (X5); since Jan 2015; bp

* Excluding year-end effect from 23 December 2016 to 6 January 2017 and the year-end and quarter-end effect over the last business days of the quarters. Repo Funds Rate Germany (RFR Germany) is a daily euro repo index calculated from trades executed on the BrokerTec and MTS electronic platforms. All eligible repo trades are centrally cleared and RFR Germany is calculated and published by ICAP Information Services. RFR Germany is calculated with repo trades that use German sovereign government bonds.

Source: BrokerTec, MTS trading, and J.P.Morgan.

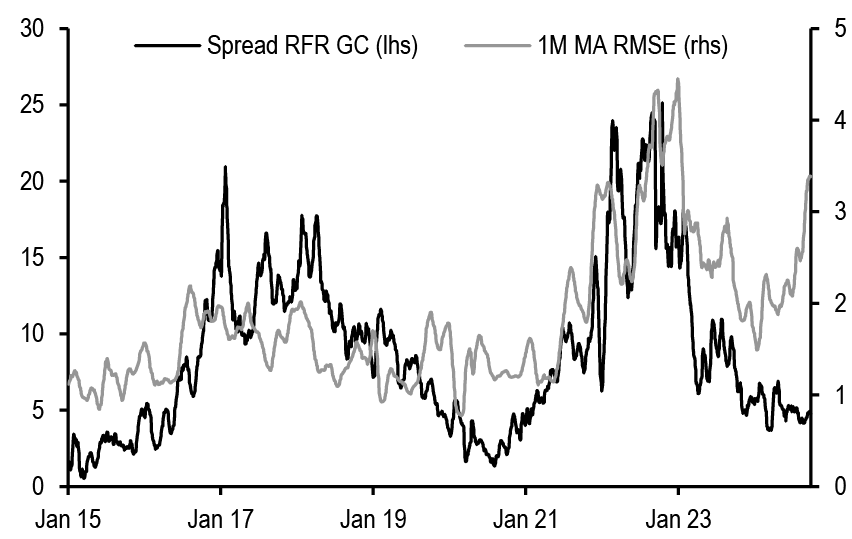

Figure 54: The distortion on the German par curve has not resulted in a broad richening of German Repo Funds Rates, but should leave room for limited richening from here

2W MA of German RFR richness to EONIA (lhs) and 1M MA of RMSE of German par fitted curve (rhs); since Jan 2015; bp

Source: J.P. Morgan.

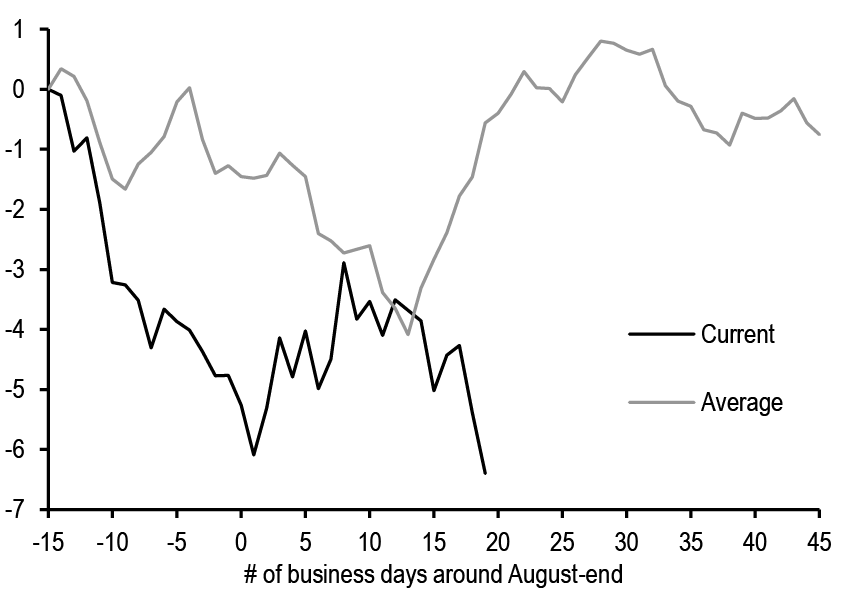

Further out the curve, Bund swap spread is trading fair to a touch too wide in our fair value model, with the value of the residual turning positive for the first time since early August ( Figure 55). The value of the residual is not large enough to warrant outright positioning in our view. Our bias in unchanged and would like to fade a widening move from current levels. We highlighted over the past few weeks how an earlier than usual seasonal pattern could actually trigger a modest rewidening when swapped issuance activity slows down after the seasonal September pick-up. Looking in details, we note that the seasonality of German swap spread around the typical issuance activity in September took place earlier with trough of swap spreads in late August rather than in mid-September, with mixed performance thereafter ( Figure 56).

With Bund swap spread marginally on the wide side in our fair-value framework, and given our widening bias in Schatz €STR swap spread as risk-off hedge we expect a flattening of the swap spread curve and initiate Dec24 Schatz/Bund €STR swap spread curve flattener ( Figure 57) (see Trade Recommendations).

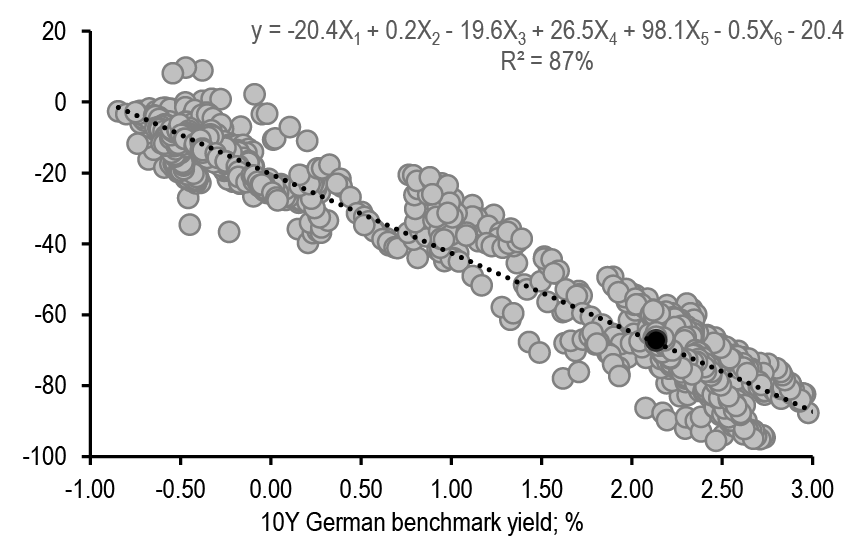

Figure 55: Bund swap spread is trading fair to a touch too wide in our fair value model, with the value of the residual turning positive for the first time since since early August

Front Bund invoice swap spreads vs. 6s regressed against 1) 10Y German benchmark yield (X1), 2) 10Y weighted peripheral spread (X2), 3) a dummy variable to include the PEPP announcements in March 2020 (X3), 4) 1M OIS rate 2Y forward (X4), 5) ECB balance sheet as % of GDP (X5), 6) 1M moving average of fixed rate swapped issuance (X6); since 1 Jan 2019; bp

Source: ECB, Dealogic, and J.P.Morgan.

Figure 56: The seasonality of German swap spread around the typical issuance activity in September took place earlier with trough of swap spreads in late August rather than in mid-September, with mixed performance thereafter

10Y German benchmark swap spread vs. 6s around end of August; since 2015; bp

Source: J.P. Morgan.

Figure 57: Our widening bias in Schatz €STR swap spread as risk-off hedge should drive a flattening of the swap spread curve: initiate Dec24 Schatz/Bund €STR swap spread curve flattener

Schatz/Bund €STR swap spread curve regressed against a) Schatz €STR swap spread only (lhs) and b) Schatz €STR swap spread and dummy variable on European elections (rhs); since mid-Jun 2023; bp

Source: J.P. Morgan.

Source: J.P. Morgan.

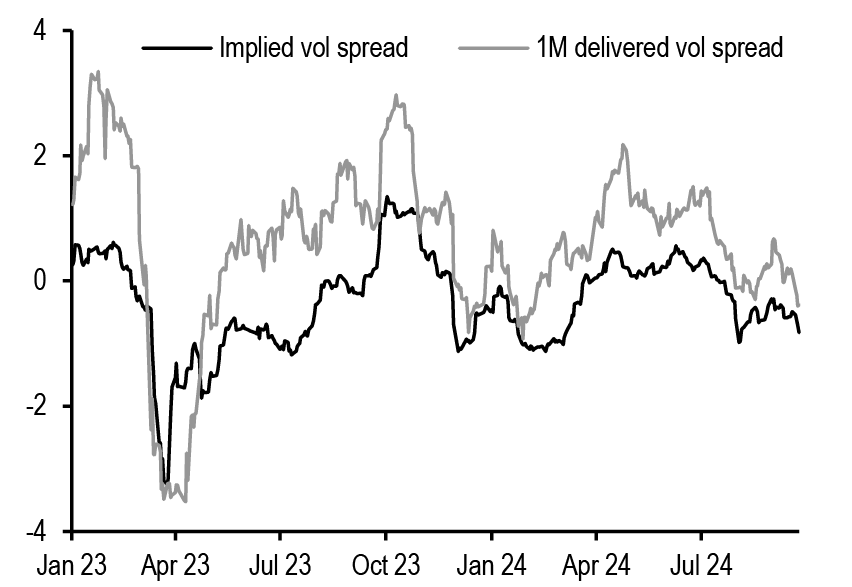

Volatility

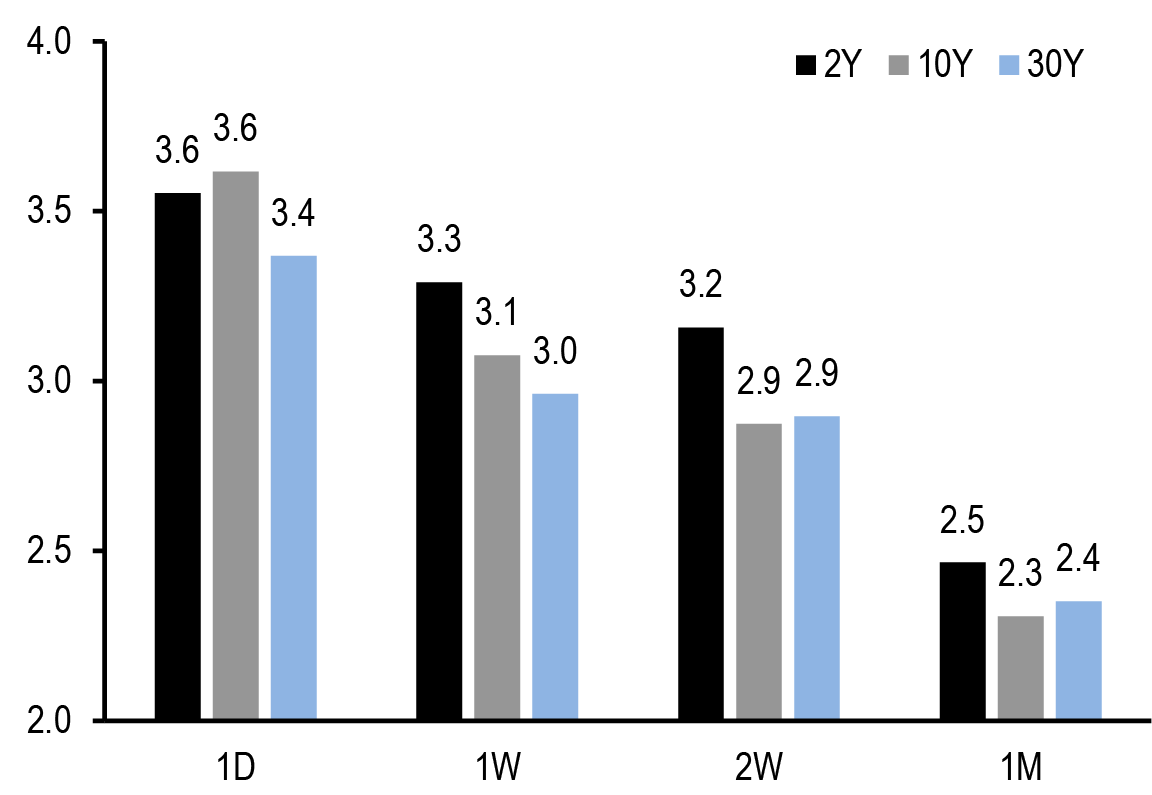

Implied volatility increased across the curve with a decent flattening of the volatility curve across tails ( Figure 58). The increase in volatility was driven primarily by weak PMIs and benign inflation print which has resulted market now pricing high probability of an October cut. The flattening of the volatility curve was in line with our expectations that we have been discussing over the past few weeks – any further increase in the easing priced in the curve is likely to be associated with a flatter volatility curve across tails. Delivered volatility on 1M lookback was mixed, increasing around 0.1-0.3bp/day in sub 10Y while declining around 0.3bp/day at the long-end of the curve.

Figure 58: Implieds increased across the curve with a decent flattening of the volatility curve across tails

3M expiry implied volatility on various tails, current and 1W ago (lhs) versus 1W change in implieds (rhs); bp/day

Source: J.P. Morgan.

Figure 59: Mean reversion in yields is strong at the long-end of the curve

3M delivered volatility for various swaps using different change frequencies; bp/day

Source: J.P. Morgan.

We have been recommending short volatility positions at the long-end of the curve and reiterate our strong conviction on this view, even though implieds have increased modestly over the past week and the upcoming US payrolls next week could impart locally some temporary volatility. Our conviction on short volatility positions, especially at the long-end of the curve, is primarily driven by the fact that delivered volatility is low and more importantly expected to stay muted over the near term. This reflects our view that long-end rates are expected to remain rangebound and exhibit strong degree of mean reversion ( Figure 59). It will require significant repricing of ECB policy rate expectations in either direction for terminal rate pricing and consequently the long-end of the curve to move one way or another. In other words, macro volatility remains low which should support limited risk premium on the curve. This expectation of rangebound yield is the cornerstone of our conviction on short volatility positions at the long-end of the curve.

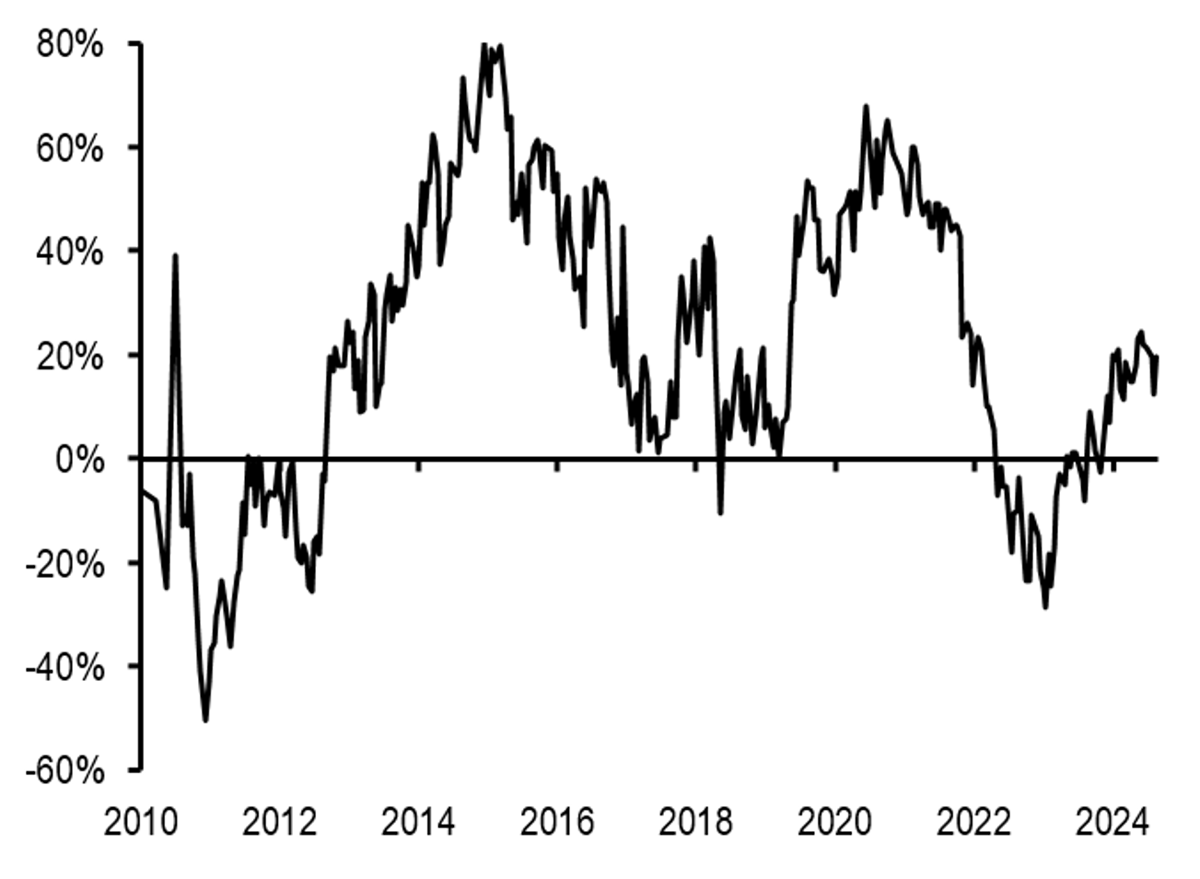

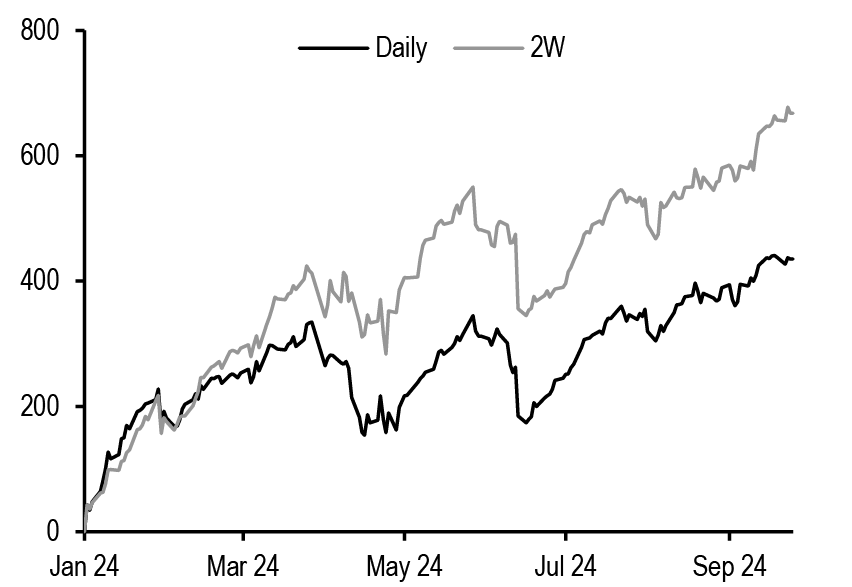

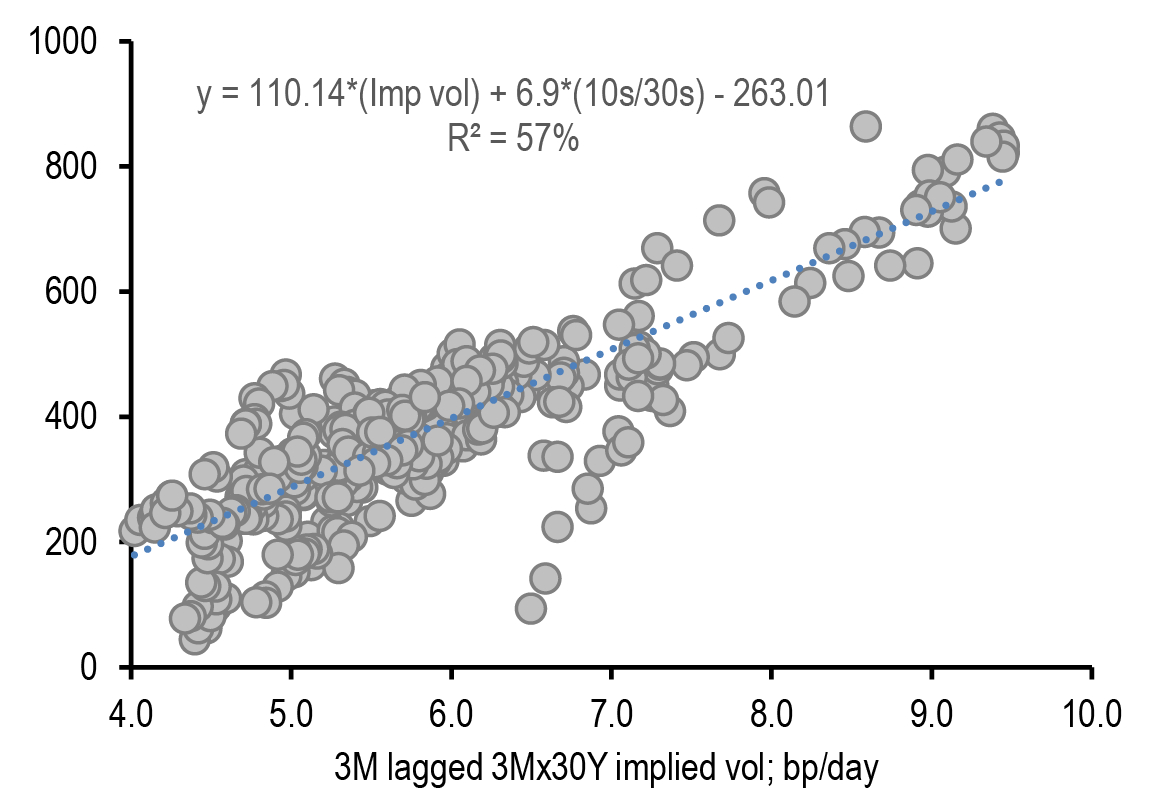

On valuations, long-end implieds appear too rich versus fundamental drivers in our long-term fair value model which uses swap rate, Euro area HICP inflation, GDP volatility, and ECB balance sheet (% of GDP) as regressors and run since 2010 ( Figure 60). An expected further decline in swap yield (see above) and lowering of inflation should put downward pressure on implied, as per this model. Support to short volatility positions also come from muted delivered volatility, which reduces further if we measure using low-frequency changes – an indication of strong mean reversion. Indeed, short gamma positions with infrequent delta-hedging would have yielded significantly higher returns on a YTD basis ( Figure 61).

Figure 60: Long-end implieds appear too rich versus fundamental drivers

3Mx10Y implied vol regressed against 1) 10Y swap yield (X1), 2) Euro area HICP inflation (X2),3) 1W MA of Bund market depth (X3), 4) ECB balance sheet as % of GDP (X4), and 5) ECB Dec22 dummy (X5, defined as 1 for dates after 16 Dec2022 and 0 before that); since 1 Jan 2010; bp/day

Source: J.P. Morgan.

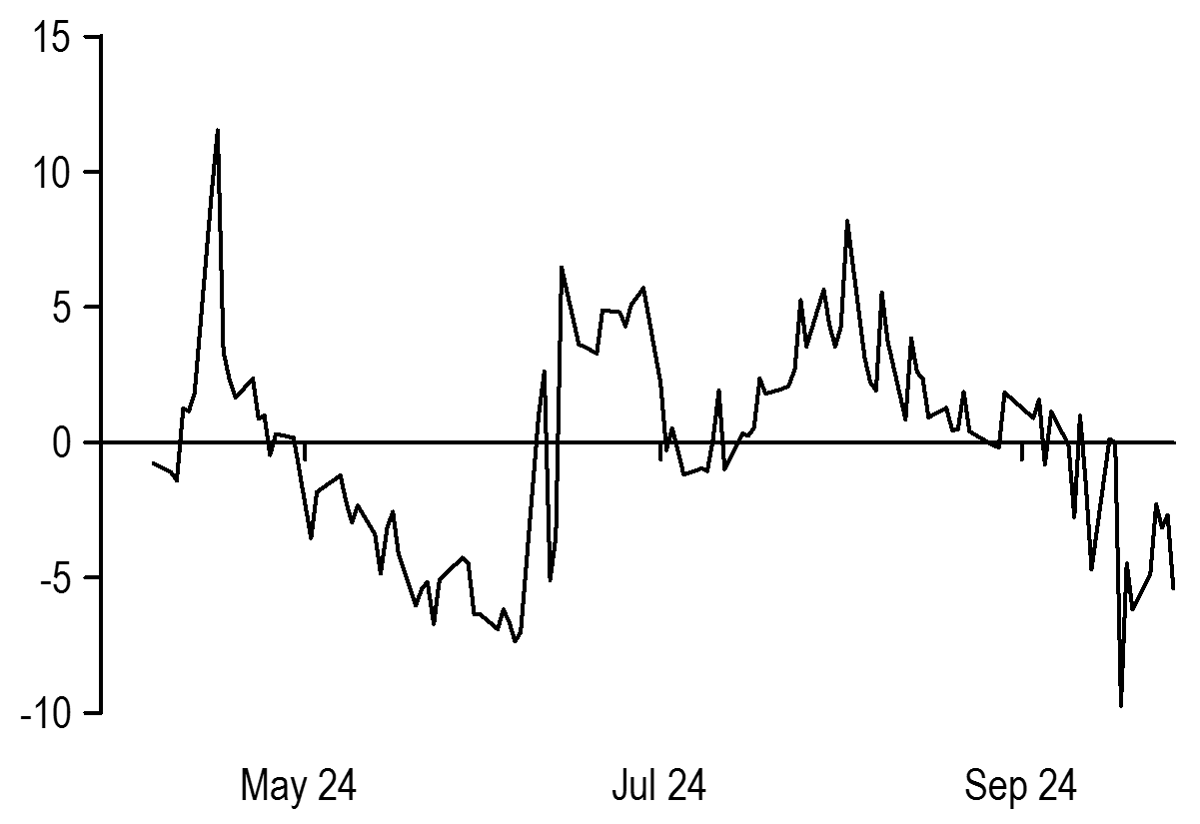

Figure 61: Short gamma positions with infrequent delta-hedging have yielded significantly higher returns relative to daily delta-hedging on a YTD basis

Cumulative return from short 3Mx30Y gamma (daily and 10D delta-hedging rule); since 1 Jan 2024; bp of notional

Source: J.P. Morgan.

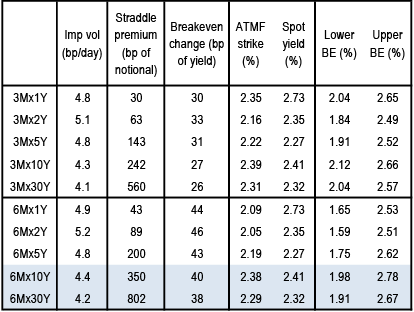

We keep our short volatility position in unhedged 6Mx10Y straddle that we had recommended a few weeks ago. These positions offer wide breakevens of (2.0%, 2.8%) at expiry to which we ascribe a low probability of breaching ( Figure 62). Assuming 10Y swap spread of around 25bp, this implies 10Y Bund yield is within (1.75%, 2.55%) versus current level of around 2.10%. Our baseline forecast for 10Y Bund yield is to be around 1.95% by end 1Q25 (6M expiry) and we anticipate Bund yields to potentially breach the lower barrier only if market starts to price elevated risk of a “hard-landing” scenario and an aggressive easing cycle – not our baseline view.

Figure 62: We stay short 6Mx10Y unhedged straddles on expectation of range bound yields and low probability of breaching the breakevens

Current implied volatility (bp/day), premium (bp of notional), breakeven change at expiry(bp of yield) and upper/lower breakeven range at option expiry (%);

Source: J.P. Morgan.

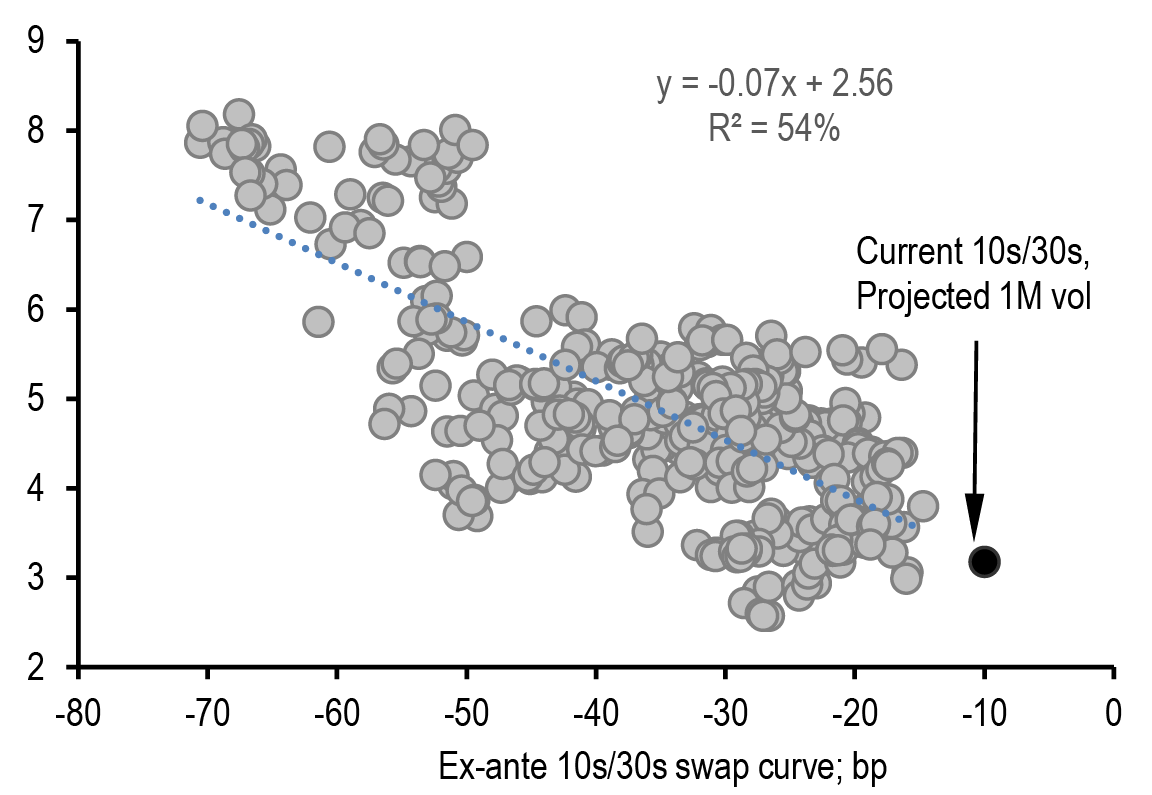

Figure 63: We expect delivered volatility of 30Y swaps to remain well below current implieds based on a relationship of delivered volatility versus ex-ante level of the 10s/30s swap curve

Rolling 1M delivered volatility of the 30Y swaps regressed against ex-ante level of 10s/30s swap curve; since 1 Jan 2023; bp/day

Source: J.P. Morgan.

We add to our short volatility bias by selling 3Mx30Y gamma with infrequent delta hedging (every two weeks or if the delta changes by 10%) (see Trade Recommendations). We expect implieds to remain sticky over the next week going into US payroll and then decline modestly from there. Our conviction on short gamma positions comes from an expectation of low delivered volatility. 1M delivered volatility of 30Y swaps has exhibited a strong negative correlation with ex-ante levels of the 10s/30s swaps ( Figure 63); a flatter curve has been associated with high risk premium and thus elevated volatility. Assuming this relationship holds, current level of 10s/30s swap curve suggests that delivered volatility over the next month is projected to be around 3.2bp/day versus current level of implieds at 4.3bp/day.

Similarly, we model returns from short 3Mx30Y straddles (daily delta-hedging) using ex-ante levels of implieds and 10s/30s swap curve ( Figure 64). On average, selling gamma at higher level of implieds has been profitable which suggests mean reversion of implieds. Similarly, selling gamma at flatter levels of the 10s/30s curve (large negative value) has yielded negative returns to short gamma positions as these are associated with higher level of delivered volatility (see above). Current level of implieds and 10s/30s swap curve suggest that short 3Mx30Y gamma (using daily delta-hedging) is expected to result in around 130bp of notional of profit over the next 3M. Superimposing our view of mean reversion and infrequent delta hedging biases this upside even higher.