Charles Schwab

Distribution of Alternative Products Is a Big Revenue Opportunity for Schwab — A Big Distribution Opportunity for Alternative Managers

Overweight

SCHW, SCHW US

Price (11 Oct 24):$67.68

We see the distribution of alternative products as potentially one of the biggest new revenue opportunities for Schwab. Because access to alternative products has been limited for wealth management investors and because the alternatives brand is for better returns often with lower volatility than available in public markets investing, we see substantial demand amongst Schwab’s $10tr of customer assets. Because alternatives are higher fee products, we see greater potential for Schwab to monetize its platform through the distribution of alternative products than it has been able to do with ETFs or institutional share class mutual funds. While Schwab seems poised to launch a curated alternatives product platform for its ultra-high net worth clients (likely within its Wealth Advisory platform) for customers with more than $5mn of assets at Schwab, we expect over time minimums would fall to $1mn and eventually lower. We expect over time alternatives will comprise 20% of HNW assets. If 8.75% of Schwab client assets were to migrate to alternatives within 10 years, assuming Schwab assets to continue to grow with the market and organically at a 9% annual pace, at a 40bps fee rate, Schwab would generate $8bn of annual alternative asset management fees annually within 10 years.

- Investor focus is NII, NIM and the shrinking balance sheet — However, Schwab is also looking to monetize its platform. Investors are focused on NII, NIM, the balance sheet and how a changing forward curve could impact earnings. Given management’s duration extension a few year back, recovery is a matter of time with management decisions likely having more limited impact at this point. However, we see management being able to better monetize the Schwab platform in coming years by building a platform for its clients to better access alternatives.

- We expect a supermarket type platform at some point. Brokerage and Advisory firms, including the US wirehouses are offering alternative products. This distribution is costly, but the opportunities for the alternative asset managers has been meaningful and rewarding. We see Schwab participating, but possibly in a different way. We understand that the brokerage model is generally charging upfront fees with some trailing charges. We would expect Schwab to charge asset based fees paid to Schwab monthly or quarterly. Schwab’s OneSource product comes to mind, with its one-stop-shop for retail and advisory customers to invest in mutual funds commission free. This was revolutionary when Schwab launched it 30ish years ago. Something similar for alternative products could be equally as revolutionary.

- $10tr x 10% penetration x 40bps fees = $4bn of high value fee revenue. The revenue implication could be meaningful to Schwab under the right scenarios. Schwab starts with a lot of customer assets — ~$10tr of which ~70% of Investor assets are in accounts with greater than $1mn. We assume the number is far greater on the Advisor side, where typically account minimums are $1mn. While different sources cite different estimates, McKinsey suggest institutional investors had a 30% allocation to alternative products in 2023 and wealth management client allocations to alternative products is just 1-2% in data cited by Apollo in its recent Investor Day. At a 10% allocation for Schwab’s current $10tr of assets at 40bps of annual fees, Schwab would generate an incremental $4bn of high margin and we believe high value revenue.

- Schwab alternatives could be a big deal for the alternative asset management industry. With $10tr in customer assets and with such a substantial portion in accounts with more than $1mn, we see an alternative platform as meaningful not just for Schwab, but for the alternative asset management industry. Hamilton Lane and StepStone are bringing in ~$1bn of wealth management assets per quarter and a relationship with Schwab could have a substantial positive impact on the growth of these firms. However, such a relationship could also move the needle for firms like Blackstone, Apollo, Blue Owl and Carlyle which also has invested in their wealth management operations. However, with existing Schwab relationships with the likes of T. Rowe Price, Janus and Franklin, there may be less obvious beneficiaries here too.

- Risk to our thesis is penetration — does suitability work for alternative products and Schwab’s client base. With so much in client assets, we see great potential for Schwab in offering an alternative distribution platform. Where we could be wrong is penetration. With 70% of retail assets in accounts with more than $1mn and with what we estimate is nearly all of its advisory assets in accounts with more than $1mn, we see Schwab as having a target rich customer base for alternative assets. But maybe there are more suitability issues than we see. If so, penetration could fall short of expectations.

Introduction — Schwab to Launch Alternatives Platform Is Big Profit Opportunity for Schwab

We believe that Schwab has a meaningful revenue opportunity in leveraging its platform through the offering of alternative products to its client base. We are particularly intrigued by the alternatives opportunity for Schwab because the numbers are big. Allocations to alternatives by institutional investors are large, which suggests over time that wealth management allocations to alternatives are going to be substantially larger than they are currently. Fees are high for alternative asset management products relative to the ETFs and Mutual Funds businesses, so more can be charged by firms like Schwab for their distribution. We see this currently at the wirehouses and independent/regional brokers. Schwab has a large percentage of its assets that are eligible for alternative products, given the average size of the Schwab account. We see alternative asset management distribution as being substantial for Schwab, but potentially transformational for a number of the alternative asset managers. We remind investors that Schwab custodies ~$10tr of assets for its clients, and it is setting up a distribution platform for alternative asset management products, an in-favor product with high fees and a substantial ability to pay for distribution. While Schwab and its new CEO/new CFO can’t control the rate environment and seem positioned to be reactive to changes in the yield curve, we do feel like Schwab has a substantial opportunity to monetize its platform through the distribution of alternative asset management product.

What Monetization of the Schwab Platform Could Look Like for Alternatives

We expect Schwab will try to create a curated platform for alternative asset management products, that looks like or evolves into something more akin to its mutual fund supermarket. While we see Schwab implementing its offering with a more curated offering focused on its largest customers initially, we see this evolving over time to service more of its mainstream customers as product innovation evolves to include products that are available with smaller minimums and thus open to accounts of a smaller size.

An Alternatives Fund Supermarket?

We see the potential for Schwab to launch an alternatives supermarket. The characteristics we see for a Schwab model would be more likely to be based on annual recurring asset based fees, rather than fees based on commitments, transactions or sales. The industry (as we discuss further below) has evolved more into a distribution fee structure that charges an upfront fee on sales, although some also have a platform fee and/or some sort of trailing fees charged by intermediaries to the alternative managers. We see Schwab (and shareholders) likely more attracted to an asset-fee based model. This was Schwab’s approach when revolutionizing the mutual fund business and we would expect similar in alternatives. While we think Schwab could also charge a fee to the clients (except for Erisa based assets), we again think Schwab follows the fund supermarket model with fees only changed to the product managers.

Schwab’s Client Base — Lots of Assets in the Bigger Accounts

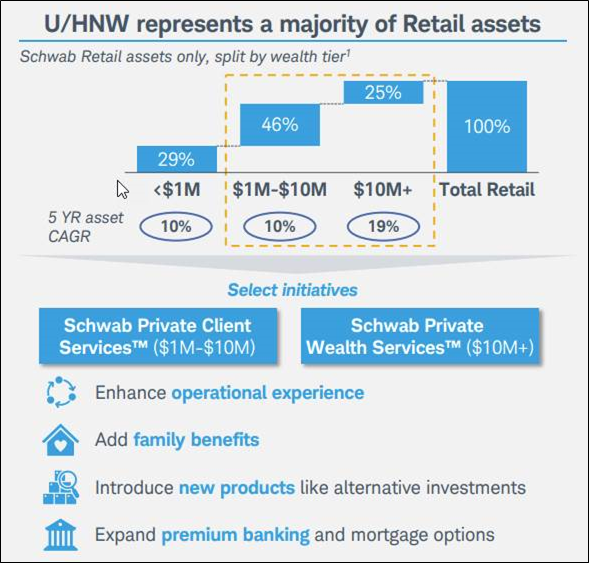

It looks like a disproportional large percentage of Schwab accounts will be eligible / appropriate for alternatives exposure. Schwab operates two divisions, Investor and Advisor services. Investor Services providing retail broker, banking and retirement plan services and some corporate brokerage with ~$5.1tr under custody as of 2Q24. Advisor Services provides trading, banking, retirement business and trust services to RIAs and recordkeepers with $4.4tr under custody. Our understanding is that advisors often have account minimums of $1mn. As such, we expect the majority of Schwab’s advisor assets to be eligible and appropriate for alternative products. As seen in the below Figure 1, Schwab’s Investor business is comprised of assets in larger accounts. Here, 25% of Investor Segment assets are in accounts with more than $10mn, and another ~50% are in accounts with $1mn-$10mn of assets. While Schwab has indicated a more curated offering for clients with more than $5mn, we see it evolving over time to clients with more than $1mn, and eventually we see account minimums falling further.

Figure 1: Sizable opportunity within Schwab’s current client base

Source: Company reports.

Schwab Emphasis on Win/Win Monetizations

We see Schwab having focused its strategy on monetizing the platform, enabling the firm to drive profitability even while driving $0 commissions. As part of this win/win monetization, Schwab has focused more on delivering advice solutions, but also on better monetizing access to its platform through such offerings as the Institutional No Transaction-Fee Fund (INTF) platform. We wrote extensively about the INTF Platform and acknowledge that it has fallen short of its potential. However, we see the potential for Schwab to monetize alternatives having much more potential. See our past research here and here on the Schwab Institutional No Transaction Fee program.

Monetizing Schwab’s Platform Through Alternatives — The Right Combination of Demand for Product, Demand for Access and High Product Fees

We see the potential for Schwab to monetize an alternatives initiative as being much greater than for the fund business over time. In alternatives, wealth management client allocations to alternative products are low. But with product innovation bringing more retail/high net worth friendly structures, we see much greater demand and much higher allocations over time. Furthermore, access has been limited and demand has not been met. We think a Schwab platform would be met with great demand.

Product Structure Makes Alternative Products More Attractive. We see alternative product structure having improved materially for retail and high-net-worth investors. Historic products requiring a minimum investment of $1mn made them out of reach for most retail investors and even many high net worth investors. In addition, many intermediaries didn’t have the capabilities to manage the capital calls required for drawdown funds. But product innovation has lead to funds that have lower minimums (as low as $2,500) and many report 1099s rather than K-1s. New products also offer limited liquidity, often quarterly.

Higher Fees Enable a Greater Opportunity to Pay for Distribution. Alternative products have a higher fee level, a combination of higher management fees and often performance fees. These allow for greater profitability for the managers of alternative assets, particularly compared to the mutual fund industry that has been under pressure with outflows and falling fee rates. As an example, LPL charges marketing support of up to 25bps for mutual fund assets, but up to 150bps on alternative product sales and/or up to 35bps on assets for alternative products.

Schwab Starts from Scratch on Alternative Distribution. One of the key differences we see in terms of Schwab monetizing its alternatives platform is that it is starting from scratch and is introducing a fee structure as it introduces access to its platform. The challenge we think Schwab has had with its INTF platform is that it had given access for free and was trying to go in after the fact and charge the asset managers. While Schwab has given preferred data, access and ultimately shelf space, Schwab really couldn’t kick managers off the platform whose funds were widely owned by Schwab clients. The alternatives platform is different in that Schwab is offering access for the first time and has the opportunity to charge concurrently for that access.

Schwab’s Platform Potential from Alternative Asset Investment Distribution

Schwab’s current distribution platform

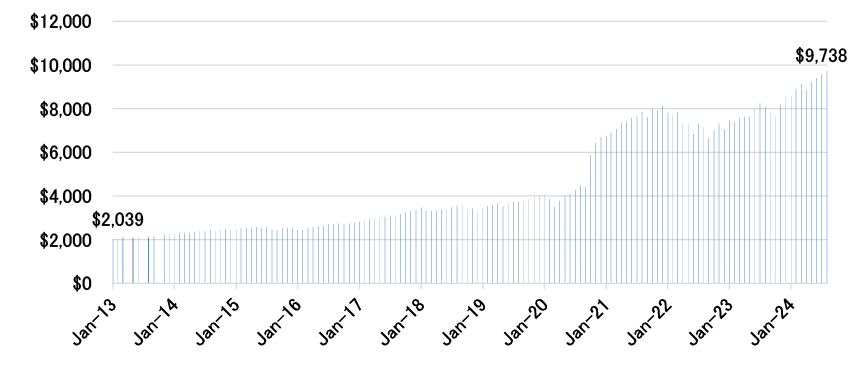

Schwab operates the largest retail distribution platform today with $10tn of client assets on its platform. Moreover, Schwab is also the largest RIA custodian in the US reaching ~15k independent investment advisors. It has been no secret that Schwab has been (and continues to be) a key partner for any asset manager looking penetrate retail distribution in the US.

Figure 2: Schwab’s client assets are nearing $10tn

$mn

Source: Company reports.

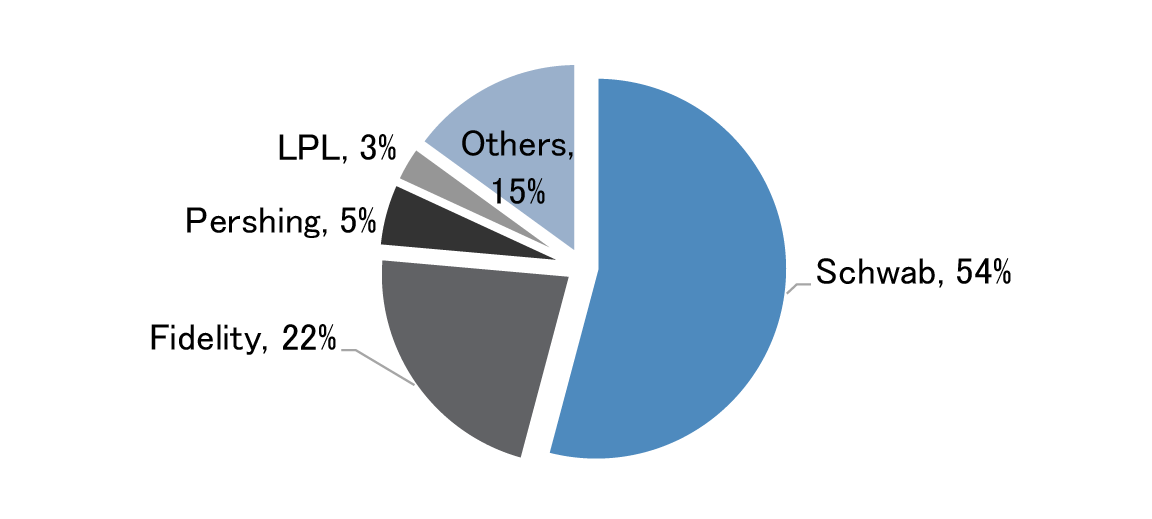

Clearly, there are notable peers in the industry such as Fidelity, Pershing, eTrade, LPL Financial among others. But we think Schwab’s scaled platform drives the monetization (and innovation) opportunity. Today, Schwab’s mutual fund marketplace oversees $1.8tn of assets with OneSource and no-transaction fee mutual funds accounting for $345bn. In the advisor/RIA segment, Schwab custodies $4.3tn of assets and we estimate that Schwab holds over 50% market share in that business.

Figure 3: Schwab maintains leading market share in the RIA custodian market

Estimated RIA custodian market share, 2022

Source: Company reports, Cerulli, and J.P. Morgan estimates.

Schwab has been taking advantage of its scale for years with the mutual fund industry, then the ETF industry, and now we think Schwab sets sights on alternatives.

Schwab’s continues to seek ways to monetize platform - INTF was most recent example but not a game-changer

We think Schwab’s industry-leading distribution platform delivers considerable value across the asset management value chain. Schwab has always been a pioneer in monetizing scale and we think this instance will be no different. We do not have to look far back for the most recent example in the INTF platform (Institutional No Transaction Fee) where mutual funds ultimately had to give up economics to Schwab to access certain services.

Recall, Schwab announced the launch of its Institutional No Transaction Fee platform in October 2022 with 15 managers (today at 25 managers). This is somewhat on the heels of Schwab’s mutual fund supermarket, OneSource, where the INTF platform would provide lower fee institutional share class funds geared toward Schwab’s RIA and advisor customers.

It is still early days for Schwab’s INTF platform but managers featured on INTF platform pay 17-19bps of asset based fees, ultimately providing an incremental, high margin revenue stream for Schwab. We think Schwab takes a similar approach in offering its scaled platform for alternative asset managers looking to access retail distribution.

Figure 4: Current managers on Schwab’s INTF platform

| Allspring | Cohen & Steers | First Eagle | Invesco | Nuveen |

| American Funds | Columbia | Franklin Templeton | Janus | PIMCO |

| BlackRock | Delaware Funds | Glenmede | Lord Abbett | Principal |

| BNY Mellon Funds | Diamond Hill | Goldman Sachs | MFS | Putnam |

| Calamos | DWS | Guggenheim | Neuberger Berman | T. Rowe Price |

Source: Company reports.

Schwab well-positioned as alternative asset managers look to expand into retail assets

Since Blackstone’s successful launch of BREIT into the retail channel in 2017, there has been a growing interest among alternative asset managers in accessing the large retail opportunity. We think this interest has been accelerating in recent years as we see new managers and new fund structures continue to be launched into the retail channel. With retail penetration levels close to 1% (vs. 15-20% for institutions), the AUM opportunity for alternative managers could be sizable. More recently, we have observed quarterly retail flows into alternatives reach into the double-digit $ billions.

Figure 5: Estimated retail flows into alternatives are becoming sizable

| $000s, unless otherwise stated | APO | ARES | BAM | BX | CG | HLNE | KKR | OWL | STEP | Total | Total (ex-BREIT) |

| Total PWM dedicated AUM ($bn) | $33.8 | $16.9 | $9.4 | $131.1 | $3.4 | $7.6 | $12.4 | $20.0 | $4.3 | $238.9 | $182.2 |

| 1Q22 | $1,549 | $1,060 | $114 | $12,252 | $305 | $423 | $369 | $1,216 | $135 | $17,422 | $10,285 |

| 2Q22 | $651 | $1,205 | $182 | $8,229 | $214 | $171 | $357 | $1,270 | $128 | $12,408 | $8,062 |

| 3Q22 | $1,193 | $1,167 | $278 | $3,057 | $90 | $43 | $274 | $795 | $179 | $7,075 | $5,580 |

| 4Q22 | $158 | $463 | $135 | ($258) | $86 | $131 | $159 | $763 | $138 | $1,775 | $2,345 |

| 1Q23 | $1,103 | $111 | $363 | $2,619 | $285 | $140 | $14 | $749 | $163 | $5,548 | $3,185 |

| 2Q23 | $793 | $920 | $404 | ($1,868) | $196 | $351 | $1,280 | $985 | $165 | $3,226 | $5,665 |

| 3Q23 | $979 | $406 | $404 | ($435) | $335 | $539 | $1,396 | $1,635 | $297 | $5,556 | $7,944 |

| 4Q23 | $1,165 | $753 | $2,013 | $543 | $395 | $583 | $1,219 | $1,819 | $299 | $8,788 | $10,874 |

| 1Q24 | $2,060 | $1,727 | $1,312 | $1,312 | $330 | $679 | $1,312 | $2,099 | $586 | $11,418 | $13,277 |

| 2Q24 | $1,946 | $2,465 | $697 | $2,606 | $338 | $868 | $2,266 | $2,794 | $624 | $14,604 | $16,825 |

Source: Company reports and J.P. Morgan estimates.

Moreover, we think the industry, particularly as it related to retail, moves toward more interval funds (vs. drawdown), which likely increases the pace of adoption ahead. While retail penetrations are still very low today, ultimately, we think the supply (more coming) and demand (increasing) dynamics will drive a clear secular trend for years to come. With the largest retail distribution platform in the market today, we think Schwab is well-positioned.

Platform economics

We think Schwab will begin to introduce a platform for alternative assets similar to OneSource, ultimately creating an alternative asset supermarket over time. Here, we think Schwab will implement a fee for alternative asset managers to participate on Schwab’s platform. The fee structure can come in the form of an upfront sales fee or annual asset based fee, both of which are utilized by different retail platforms today.

We observe that retail distribution platforms today (e.g., wirehouses, independent brokers, RIA, etc.) typically utilize either an upfront and/or annual asset based fee for alternative managers accessing their respective platforms. We appreciate that the fee ranges vary widely and each relationship comes with its own service levels and nuances. But we estimate that an upfront fee might look something close to ~100bps on new sales and an annual asset based fee might look like ~40-50bps for Schwab.

Figure 6: Estimated platform fees for alternative asset managers in today’s current market

| Firm | Upfront on Sales | Asset Based | ||||

| Wells Fargo | Unknown | 0 - 30bps | ||||

| LPL | 0 - 150bps | 0 - 35bps | ||||

| Ameriprise | 0 - 250bps | 0 - 80bps | ||||

| Cetera | 0 - 150bps | 0 - 25bps | ||||

| Merrill | Unknown | 0 - 100bps | ||||

Source: Company reports and J.P. Morgan estimates.

Moreover, many of the platforms also charge a one-time placement fee for end clients (0-200bps). While this would be another revenue stream, we do not think Schwab approaches its monetization strategy with an eye toward maximizing fee revenue from its end clients and advisors.

The additional economic nuance for Schwab (and others in the industry) revolves around the involvement of firms such as iCapital, CAIS, etc. We think firms like iCapital provide a considerable solution when it comes to managing capital calls, end client flows, and client management/dashboards. We do not think Schwab is equipped to handle this level of service today and find it appropriate if they partner with another firm to deliver its alternatives platform.

Looking ahead, we recognize that the development and penetration of the client asset base for alternatives will take years to realize but the economics of the ecosystem point to sizable upside for Schwab’s revenue profile.

Penetration and the Pace of Adoption for Schwab in Alternatives

We expect the rollout and penetration of alternative asset management product will take plenty of time, but that the pace of adoption will be far faster than what we have seen in other financial products over time. Here, we see demand as particularly robust for alternative product and we see alternative managers particularly focused on product development and innovation to attract more assets here. Our base case for Schwab is 15% penetration in 15 years, with the pace of adoption accelerating over time.

Institutional Allocation to Alternative Assets Today

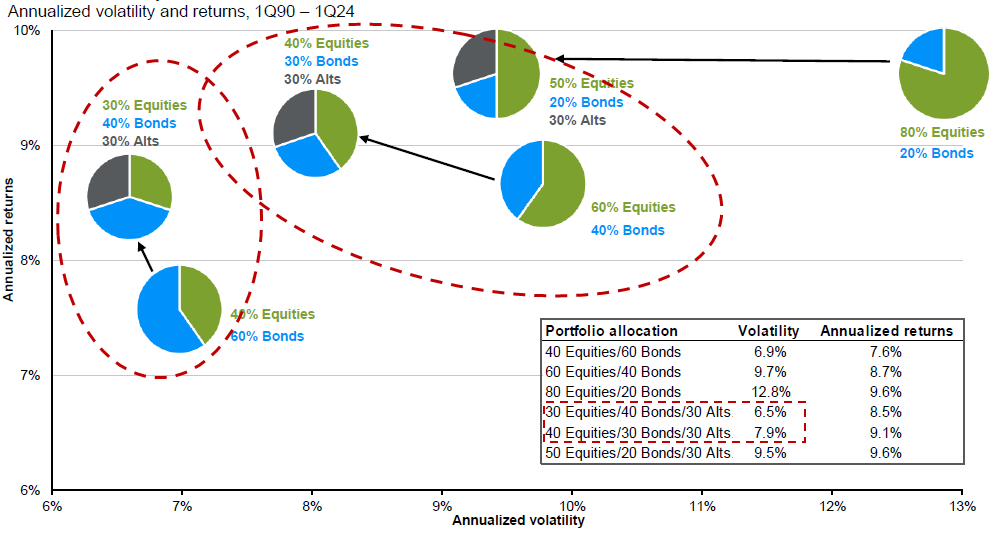

Data varies by provider, but McKinsey estimates in 2023 that institutional investors have ~30% allocation to alternative asset management products. This is largely private equity (~10%) and Real Estate (~8%), but private credit, infrastructure and multi-asset investments are growing quickly off the smaller base. This allocation is up from 20% a decade ago. Our view is that retail and high net worth managers chase institutional allocations, and we expect to see high-net-worth allocations rise meaningfully from current levels.

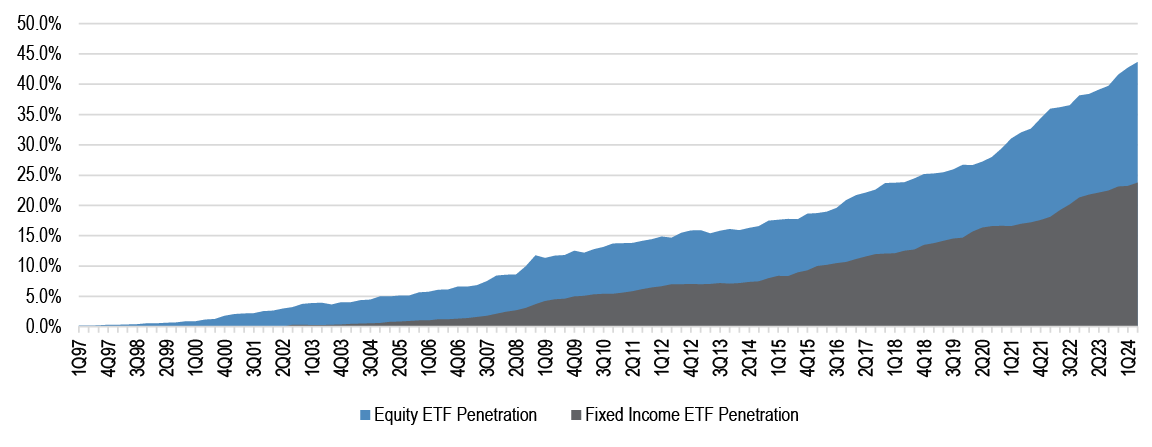

Penetration of Newer Products for Retail

We look to the ETF business to see how new products are adopted by the mutual fund industry. While Schwab currently breaks out ETF assets (currently 22% of AUM), it only began doing so in 2013 when ETFs were already 8% of assets. Thus we look to the mutual fund industry to get a picture of adoption. ETFs have been a success story in investment management, allowing the masses to get access to index funds at rock bottom fees. Adoption levels for both equity and fixed income ETFs went from ~1% to ~10% in about ten years.

In the Figure 7 below, we show ETF penetration by asset class. For equities, ETFs had a 1% market share in 2Q00, which grew to 12.9% ten years later. Fixed Income ETFs reached a 1% market share in 4Q05 and reached a penetration of fixed income funds of 9.0% ten years later. Currently, equity ETFs are ~30% of the equity fund industry, and fixed income ETFs are ~23% of fixed income fund industry assets.

Figure 7: Equity and fixed income ETF penetration have continued to grow over time

Source: Strategic Insight, J.P. Morgan estimates.

Experience for Schwab when Introducing Newer Products

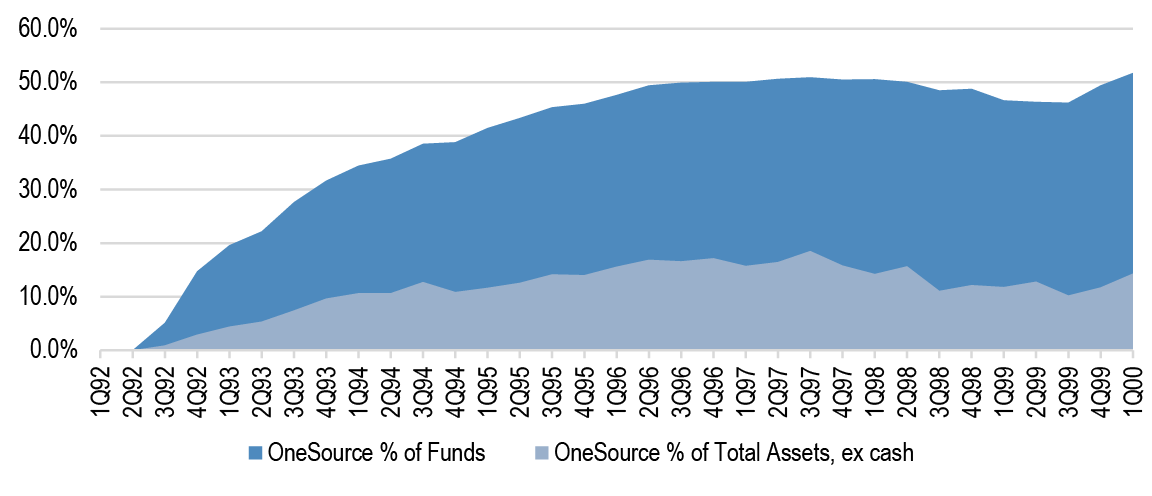

Schwab has introduced a number of innovative and differentiated products and services over the decades. When demand and supply intersect, we have seen rapid adoption. Here, we highlight the launch of Schwab mutual fund supermarket OneSource. Given we think that an alternatives supermarket could be as innovative today as the mutual fund supermarket was back in the early 1990s, we highlight adoption as a baseline to think about what could be for alternatives.

As we see in Figure 8 below, the adoption curve was pretty rapid for OneSource. OneSource went from a concept to about 50% market share of Schwab’s funds assets (excluding money market funds) within five years, when including both third-party funds and Schwab’s nascent proprietary funds business. Even as a percent of total assets, penetration of total assets (excluding cash and mutual fund clearing assets) grew and peaked at 17% within five years in 1996.

Figure 8: Schwab’s OneSource Reaches 50% of Fund Assets, 17% of Total Assets within Five Years of Launch

Source: Company reports.

Alternative Investment Distribution - A Multi-Billion Revenue Opportunity for Schwab

We see the revenue opportunity from building out an alternatives distribution platform as substantial. This potential is so significant because Schwab has so many assets eligible for alternative products and because alternative managers can pay so much for distribution because their fees are high. The ultimate revenue potential for Schwab will be based on the fee structure Schwab chooses to pursue, the ultimate quantum of assets that migrates to alternative products and the time it takes to get there. The back of the envelope is enough to warrant a further look at what Schwab can generate in terms of transactional or recurring revenue — one snapshot - $10tr of customer assets with a 10% allocation to alternatives at a 40bps fee rate suggest $4bn of incremental revenue.

The Right Structure — We Think a Fee-Based, Supermarket Type Structure

We start with the likely structure that Schwab will adopt over time for its alternatives platform. Here we think that the supermarket model is that one the Schwab would like to pursue. While other distributors have largely an large upfront selling charge and a lower trailer, we see Schwab gravitating towards no upfront fee, but with an asset based fee charged annually and collected monthly or quarterly. Schwab has moved away from transaction based fees over time and currently largely charges asset based, rather than transaction based fees. Also, the supermarket model has worked well for Schwab over time and we thus would expect Schwab to explore the supermarket model which has always utilized asset based fees.

The Right Fee Rate — We Think 40-50bps

We expect Schwab will look to charge something between 40-50bps. We see other brokers as referenced earlier in this research charging an upfront fee of 100-250bps AND/OR a trailing annual fee of up to 25-100bps. We would expect Schwab to target something around the average of the peers. To benchmark other fees that Schwab currently charges in aggregate ~8bps on third party mutual fund for administrative and other services. Schwab charges 19bps on the institutional share classes on mutual funds part of of the INTF platform. Mutual Fund OneSource charges a rack rate of 40bps on assets, although the average was closer to 30-32bps over time. Schwab averages 40bps on fee based advice. Given that competitors are charging 20-40bps for mutual fund distribution, we would expect Schwab to be able to charge a premium to that for alternative products. With such a large pool of assets and given that fee rates and margins are so high for alternative asset managers, we would expect fees to be in a range of 40-50bps. Could we see a fee as low as 30bps? That is possible although we see that as unlikely given that’s what Schwab charges for higher fee retail share classes of mutual funds, that are meaningfully lower fee than what alternative products charge. Could it be 20bps? We find that highly unlikely given that is essentially what Schwab charges on lower fee mutual funds.

The Right Eligible Assets to Consider

We expect that, eventually, Schwab will deliver alternative products to nearly all of its customer assets. We look at the potential for Schwab both from an Advisor and an Investor vantage point. We see potential for both customer segments to hold meaningful potential to drive distribution fees for Schwab.

- Investor Assets — Schwab Investor Services Segment custodies ~$5tr of assets. Initially, Schwab has indicated a curated portfolio of alternatives products, including private equity, private credit, hedge funds and other alternative products, for those investors with $5mn+ of assets. It’s unclear whether all $5mn has to be custodied at Schwab, but it would be an incentive to get HNW customers to migrate more assets to the Schwab platform to get access to these product. Initially, we see Schwab targeting alternatives to its Schwab Wealth Advisory business with its ~$200bn of AUM, but we see Schwab widening alternative access to those with more than $1mn over time. As mentioned above, ~70% of Schwab retail assets are in households with more than $1mn at Schwab. As such, we see the addressable market in Schwab’s Investor business at $3.5tr of the $5tr of total customer assets here.

- Advisor Assets — Schwab Advisor Services custodies ~$4.4tr of customer assets. Although Schwab’s advisor network likely has access to alternative assets, we see Schwab offering something similar to what it has with institutional share classes of funds. Here we would expect greater support for its advisors looking for alternative exposure to alternative, seamlessly integrated with its other custody and bank services. Here, we see near 100% of the $4.4tr of customer assets eligible for exposure to alternative assets over time, given the majority of advisors have account minimums that exceed $1mn/account.

The Right Cadence of Adoption

We would expect that cadence of adoption to be faster than the adoption of other new financial products. We would start out by saying that we expect the pace of product innovation to be robust and expect over time for alternative product to be accessible to smaller accounts. While Schwab seems initially to be targeting accounts with $5mn+ of investible assets, we would expect that target to be $1mn+ accounts in the not so distant future and then to be $500k+ and eventually $250k+ (which is the approximate average size of a Schwab customer account). As mentioned above, we saw equity ETFs go from a 1% penetration to a 12.2% penetration rate within 10 years. For fixed income ETFs it was to 9% within ten years. Our base model for how a Schwab alternatives platform could grow suggest an 8.5% penetration of total Schwab customer assets within 10 years and a 15% penetration rate within 15 years.

The Economics for Schwab

We think the economics for Schwab could be substantial. Again, we are only guessing at the inputs, but our best guess suggests that the economics could be significant. Here, once Schwab exits the experimental phase targeting Schwab Wealth Advisory, we see meaningful potential for incremental revenue.

Here we see that an asset based fee generates substantially higher revenue over time than a distribution based fee. Initially however, a distribution fee nets more, but as seen below, the cross over point is year-3. We note that in year 5 of the model below, we migrate from Schwab just targeting accounts with over $1mn to targeting all clients. This assumes continued product innovation that we highlighted above.

Figure 9: Potential for significant value accrual to Schwab over time

| Revenue opportunity | ||||||||||||||||||

| Upfront sales fee only | 1.00% | |||||||||||||||||

| Annual fee only | 0.40% | |||||||||||||||||

| Penetration pace yr 1-4 | 0.75% | |||||||||||||||||

| Penetration pace yr 5-10 | 1.25% | |||||||||||||||||

| Assumes all client capital gets recycled into new funds | ||||||||||||||||||

| Year | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 | |||

| Addressable client assets ($bn) | 8,152 | 8,885 | 9,685 | 10,556 | 14,983 | 16,331 | 17,801 | 19,403 | 21,149 | 23,053 | 25,127 | 27,389 | 29,854 | 32,541 | 35,469 | |||

| growth % y/y (mkt + NNA) | 9.0% | 9.0% | 9.0% | 9.0% | 9.0% | 9.0% | 9.0% | 9.0% | 9.0% | 9.0% | 9.0% | 9.0% | 9.0% | 9.0% | ||||

| Alts penetration @ Schwab | 0.25% | 1.00% | 1.75% | 2.50% | 2.50% | 3.75% | 5.00% | 6.25% | 7.50% | 8.75% | 10.00% | 11.25% | 12.50% | 13.75% | 15.00% | |||

| Total alternative assets ($bn) | 20 | 89 | 169 | 264 | 375 | 612 | 890 | 1,213 | 1,586 | 2,017 | 2,513 | 3,081 | 3,732 | 4,474 | 5,320 | |||

| New Alts sales ($bn), annual | 20 | 67 | 73 | 79 | 87 | 204 | 223 | 243 | 264 | 288 | 314 | 342 | 373 | 407 | 443 | |||

| Upfront revenue ($bn), annual | 0.2 | 0.7 | 0.7 | 0.8 | 0.9 | 2.0 | 2.2 | 2.4 | 2.6 | 2.9 | 3.1 | 3.4 | 3.7 | 4.1 | 4.4 | |||

| Asset based revenue ($bn), annual | 0.1 | 0.4 | 0.7 | 1.1 | 1.5 | 2.4 | 3.6 | 4.9 | 6.3 | 8.1 | 10.1 | 12.3 | 14.9 | 17.9 | 21.3 | |||

Source: Company reports and J.P. Morgan estimates.

When we think about a sensitivity to the fees charges, we show two tables below that look at the above analysis with higher and lower fees as well as differing paces of client penetration of alternative products.

Figure 10: Schwab’s annual upfront fee potential in 15 years

| Schwab revs in 15 years ($bn) - Upfront only | ||||

| Penetration pace, annual Yr 1-4 | ||||

| 4.4 | 0.50% | 1.00% | 1.50% | |

| Upfront | 0.75% | $2.7 | $4.0 | $5.3 |

| fee | 1.00% | $3.5 | $5.3 | $7.1 |

| 1.25% | $4.4 | $6.7 | $8.9 | |

| 1.50% | $5.3 | $8.0 | $10.6 | |

Source: Company reports and J.P. Morgan estimates.

Figure 11: Schwab’s annual asset based fee potential in 15 years

| Schwab revs in 15 years ($bn) - Asset based only | ||||

| Penetration pace, annual Yr 1-4 | ||||

| 21.3 | 0.50% | 1.00% | 1.50% | |

| Annual | 0.30% | $12.5 | $19.4 | $26.3 |

| fee | 0.40% | $16.7 | $25.9 | $35.1 |

| 0.50% | $20.8 | $32.4 | $43.9 | |

| 0.60% | $25.0 | $38.8 | $52.7 | |

Source: Company reports and J.P. Morgan estimates.

Valuating This Earnings Stream — Highly Stable, Highly Growing, Highly Valuable

We think the alternative asset platform will ultimately generate a highly valuable earnings stream for Schwab. The earnings profile will encapsulate a stable and high growth asset base with considerable economics that flow through Schwab. The revenue growth trajectory behind secular tailwinds and competitive positioning present at high value opportunity for Schwab. Unlike public markets, private assets do not get marked as frequently and price movements are typically less volatile.

Figure 12: Alternative assets introduce less volatility for investors, thus benefitting Schwab

Source: J.P. Morgan Asset Management, Bloomberg Finance L.P., Burgiss, HFRI, NCREIF, S&P, Factset. Note: alternatives include private equity, real estate, hedge funds.

Without debating the validity of private asset marks in any given time, we can appreciate that both asset managers and end clients prefer less volatile assets/investments. Moreover, we think the lower perceived volatility in this asset base stands to benefit Schwab’s annual asset based fee structure with a much more stable asset base, and recurring revenue stream.

While revenue stream is of high value, we also like the significant earnings potential from Schwab’s platform. Clearly, there will be some start-up costs and various investments to get the platform off the ground. But Schwab’s operating leverage potential from this platform is meaningful. Here, we believe Schwab’s margins from this endeavor should be well-north of 50%, once scaled, and incremental margins could likely be 75%+ on an ongoing basis. The margin potential is not dissimilar to Schwab’s net interest income earnings stream but with a much more stable, and recurring revenue base.

If we consider revenue growth that continues to compound at a double-digit+ rate well-after a decade, generating 50%+ margins, we do not expect this segment to be overlooked by investors. We recognize that proposing a sum of the parts for a business that has not even launched is somewhat premature. That said, when we look at the ecosystem surrounding this platform, we note that alternative asset managers have FRE valuation multiples that average 30x+ and recurring fee, wealth platforms valued at 20x+ EBITDA in the private markets.

Figure 13: Alternative asset managers command notable FRE multiples given the solid business models and secular tailwinds supporting the business

| 2024 DE Multiple |

2025 DE Multiple |

2024 FRE Multiple (incl SBC incl tax) | 2025 FRE Multiple (incl SBC incl tax) | |

| Traditional Alts | ||||

| Apollo | 19.2x | 16.0x | 41.2x | 34.5x |

| Ares Management | 37.9x | 25.8x | 56.8x | 41.3x |

| Blackstone | 34.5x | 22.7x | 62.5x | 53.8x |

| Blue Owl | 26.1x | 20.8x | - | - |

| Bridge Investment Group | 12.4x | 9.6x | 16.3x | 11.8x |

| Brookfield Asset Management | 33.4x | 28.6x | 36.0x | 30.4x |

| Brookfield Corporation | 13.6x | 12.2x | 52.6x | 43.7x |

| Carlyle | 12.2x | 11.0x | 39.1x | 24.1x |

| TPG | 29.9x | 21.7x | 32.2x | 27.9x |

| Solutions Providers | ||||

| P10 | 12.8x | 12.6x | - | - |

| Hamilton Lane | 33.4x | 35.5x | 55.9x | 48.7x |

| Stepstone | 34.0x | 28.9x | 37.2x | 34.2x |

| GCM Grosvenor | 16.1x | 14.1x | 30.7x | 23.3x |

| Average (total) | 24.3x | 19.7x | 41.9x | 34.0x |

| Average (alts) | 24.3x | 18.2x | 42.1x | 33.4x |

| Average (solns) | 24.1x | 22.8x | 41.3x | 35.4x |

As of 10/8/24

Source: Company reports, J.P. Morgan estimates, Bloomberg Finance L.P.

Keep in mind, much of the growth of FPAUM for the alternative asset managers will be coming from the retail/wealth channel, where Schwab is one of the leading distribution platforms. We think Schwab’s alternative asset platform presents scarcity value in the ecosystem that Schwab will be able to monetize.