U.S. Fixed Income Markets Weekly

Cross Sector P. White, L. Wash

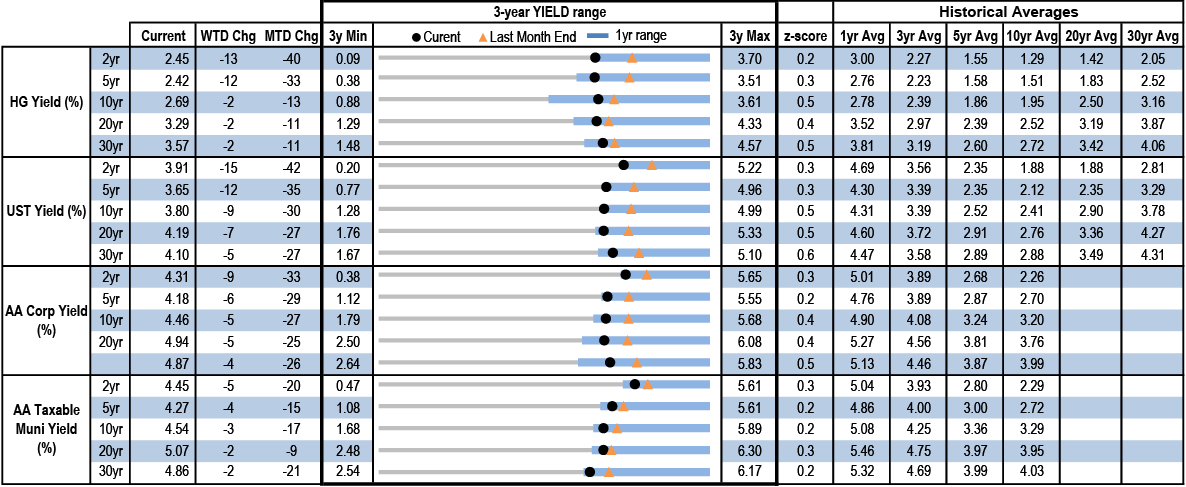

Treasury yields are lower and spreads stable as the economic data support a gradual economic cooling and as Fed communications confirm expectations of a near-term rate easing cycle. We continue to look for a 50bp cut at the next FOMC meeting and the August employment report will be key for determining the pace of easing. We modestly revise higher our HG gross issuance forecast to $1.5tn for 2024, leaving $400bn of issuance left this year.

Governments J. Barry, P. White, A. Borges, L. Wash

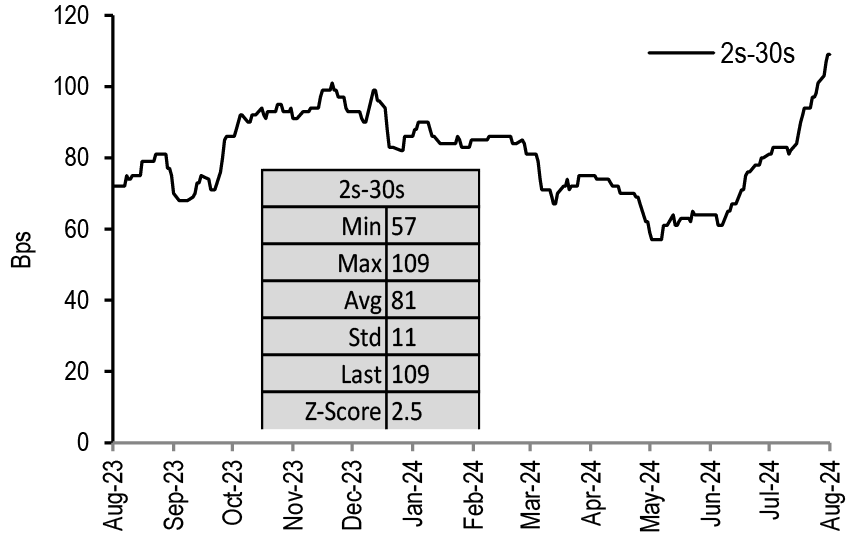

Chair Powell’s dovish tone supports our forecast of consecutive 50bp cuts at each of the next two meetings, but the August employment report is still two weeks away, valuations are no longer cheap, and dealer positioning is elevated, so we stay neutral duration for now. Powell’s comments support further long end steepening, and we recommend holding 5s/30s steepeners to express our core view. Most front-end curves appear too steep relative to their drivers, but 3s/7s offers value for those who want to position for a quicker and more aggressive easing cycle. We discuss the outlook for T-bill supply and valuations. Hold tactical 5y5y inflation swap longs.

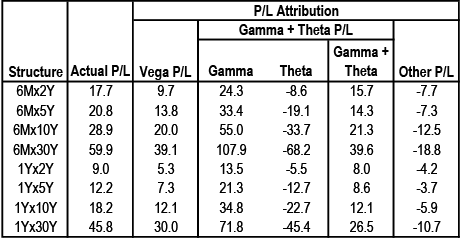

Interest Rate Derivatives S. Ramaswamy, I. Ozil, P. Michaelides, A. Parikh

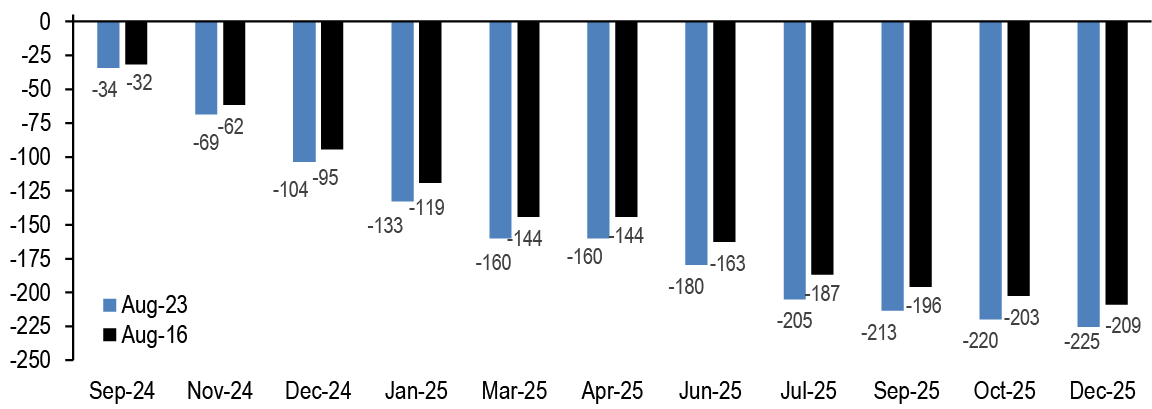

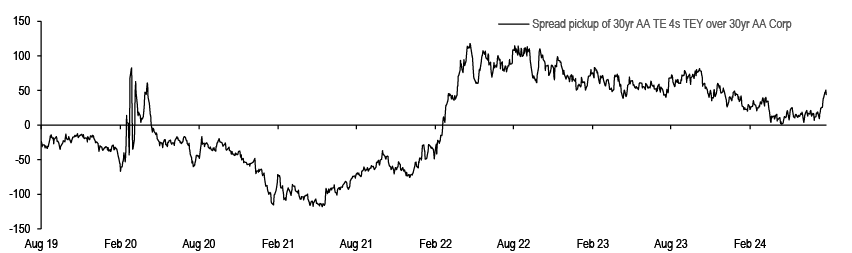

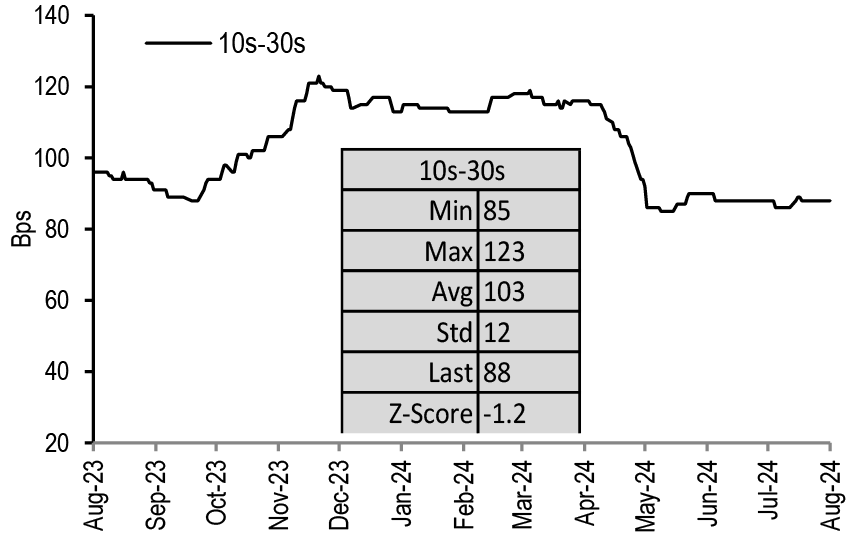

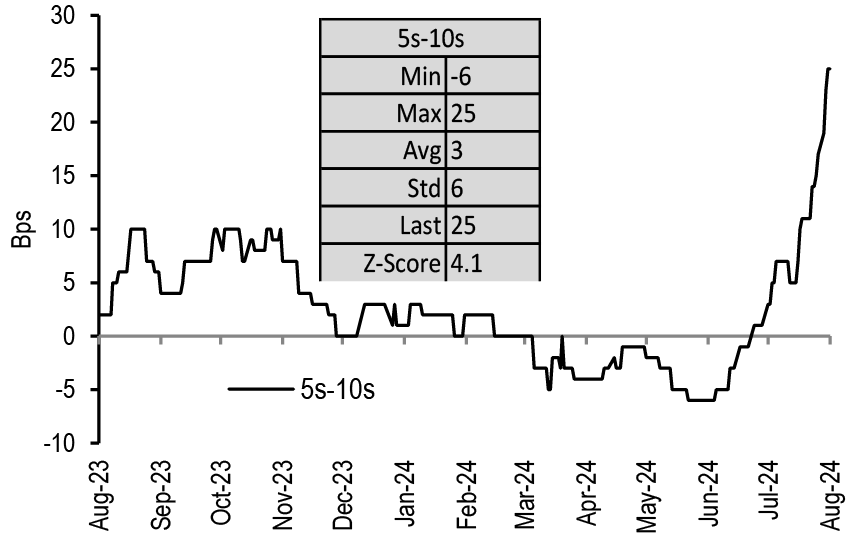

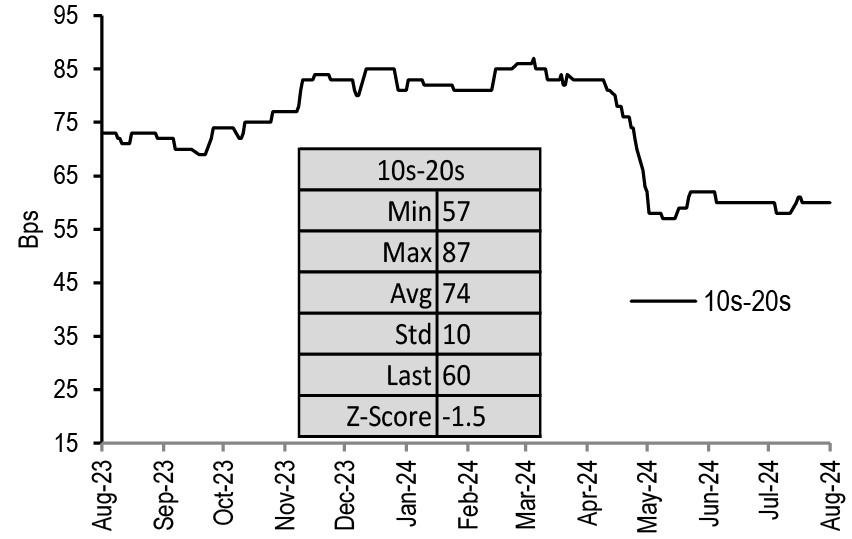

The first cut is all but certain at the Sep meeting, but pace and extent remain uncertain. Policy uncertainty amplifies delivered volatility - stay bullish on vol. Tbill net issuance should turn negative in coming weeks, and term funding premium appears too low - maintain front end spread wideners and position for a flatter 5s/30s spread curve. Initiate 7s/20s weighted spread curve steepeners to benefit from relative value. Forward curve steepeners are preferable to longs in the Reds.

Short-Term Fixed Income T. Ho, P. Vohra

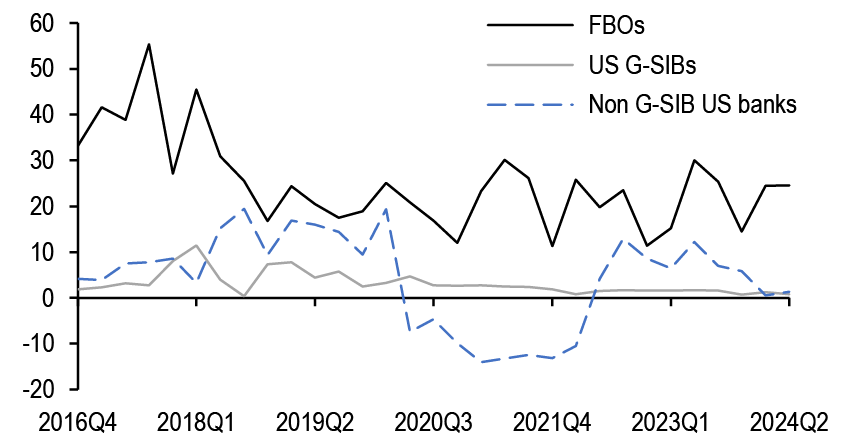

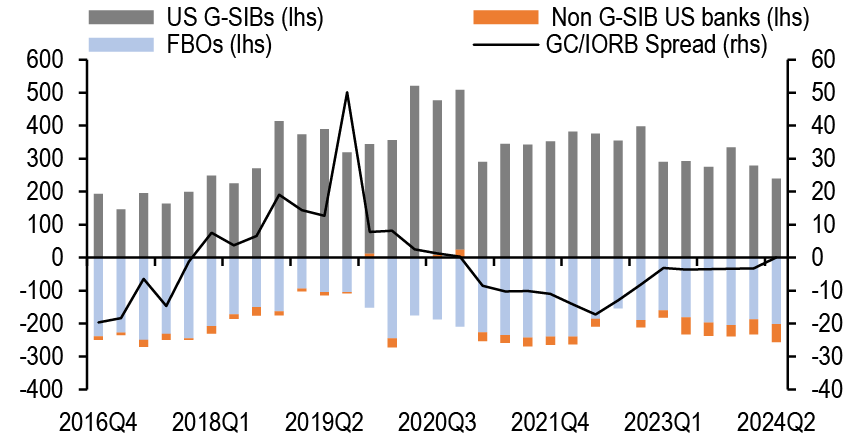

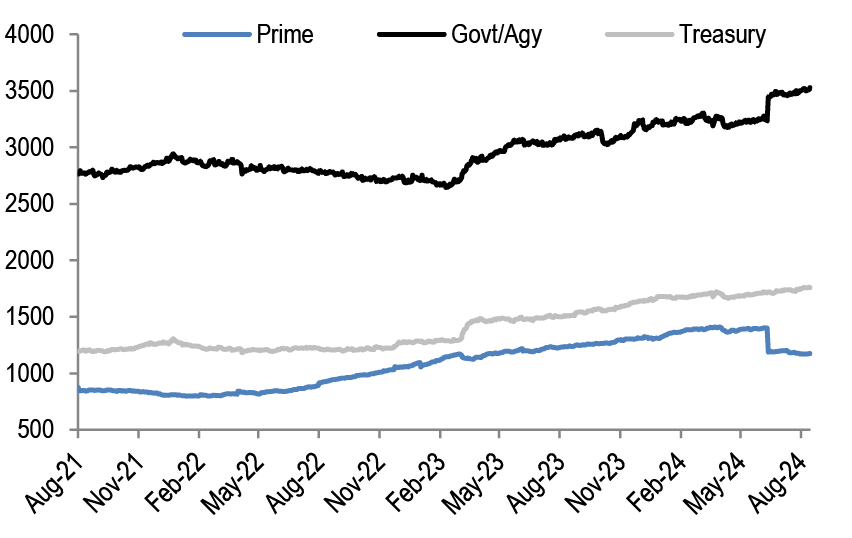

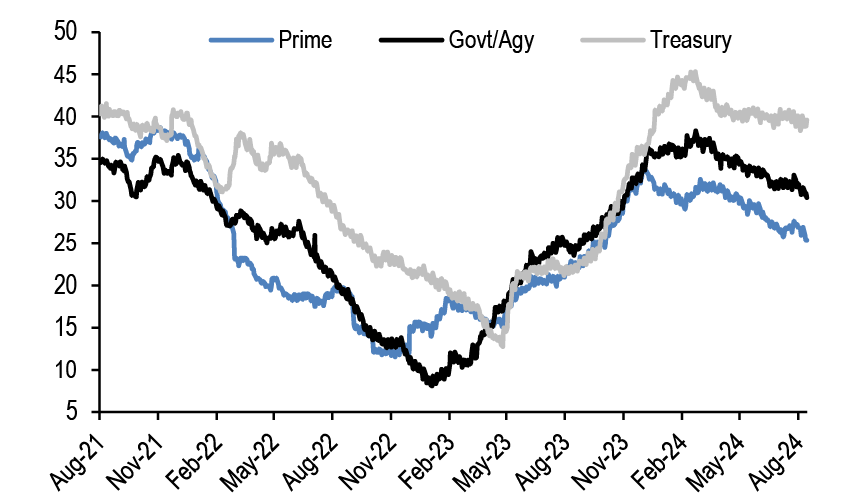

RRP balances have stabilized around $300bn, with limited room to decrease further. Both domestic bank borrowing in the O/N unsecured market and US banks’ participation in the repo market remain minimal, suggesting reserves have not transitioned from abundant to ample yet.

MBS and CMBS J. Sim

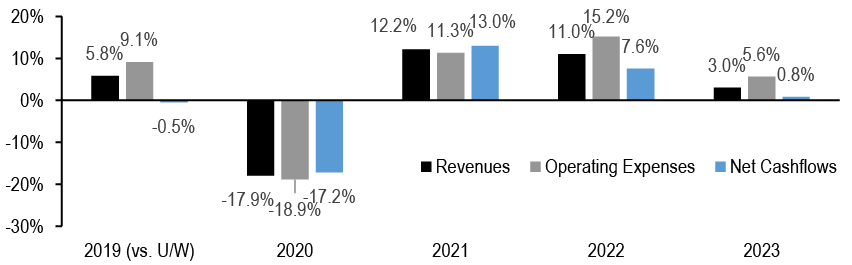

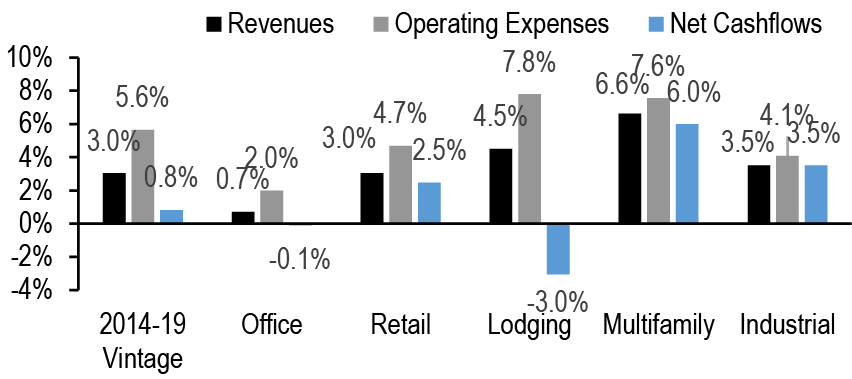

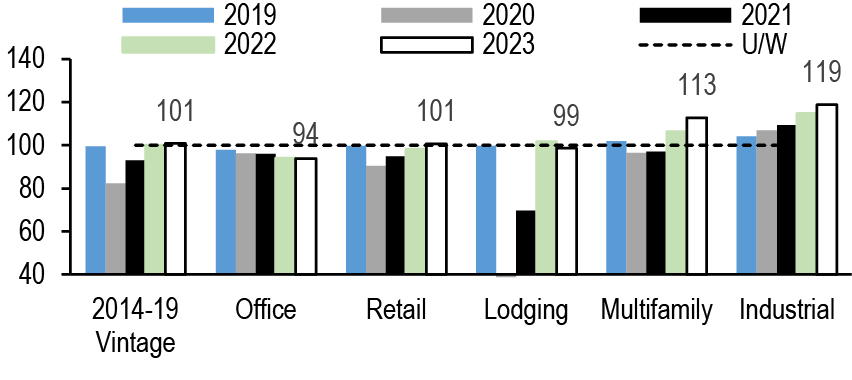

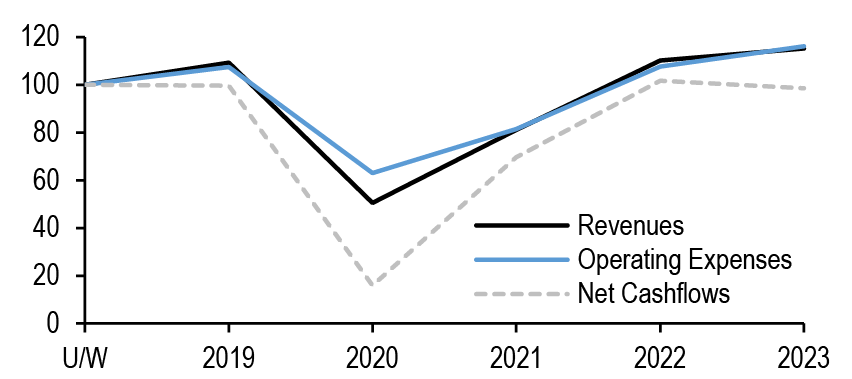

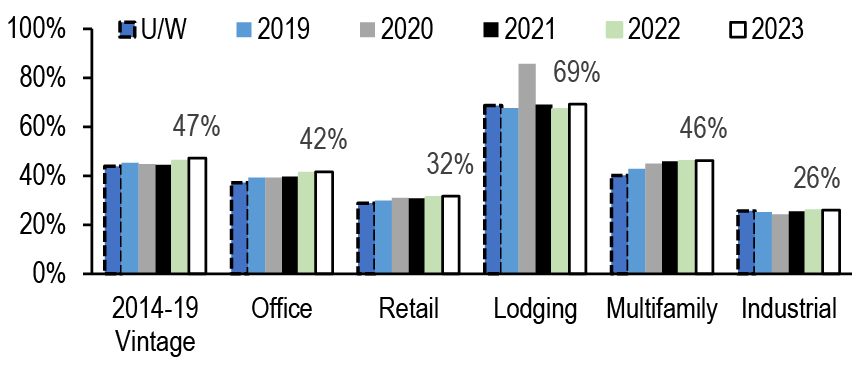

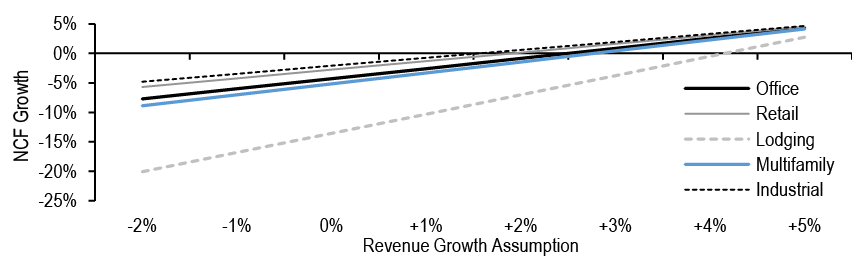

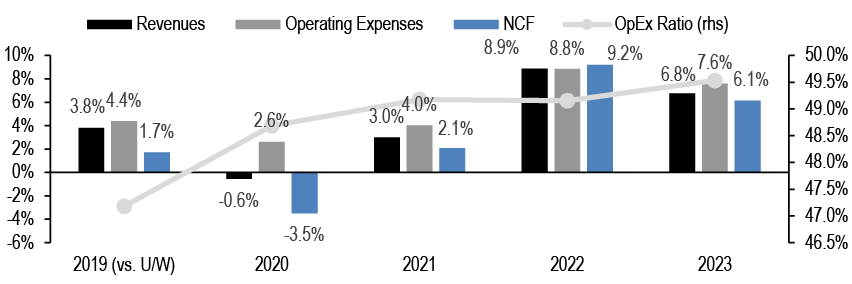

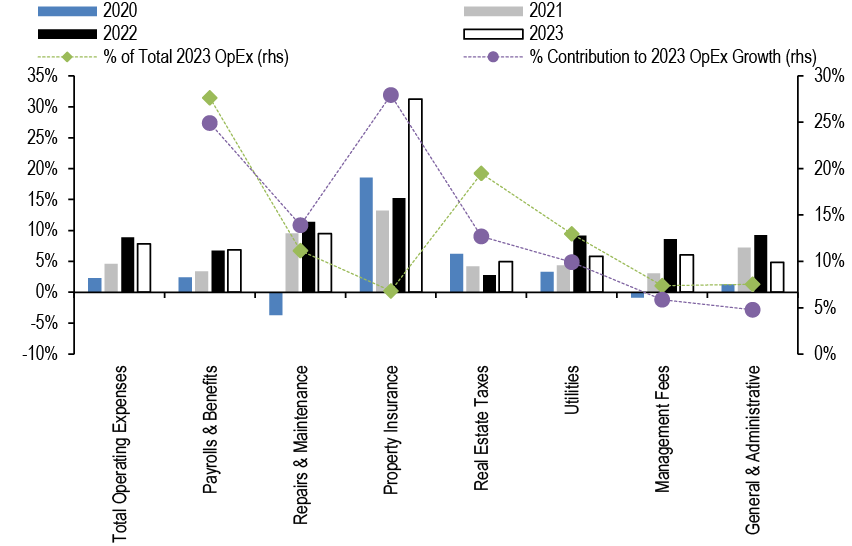

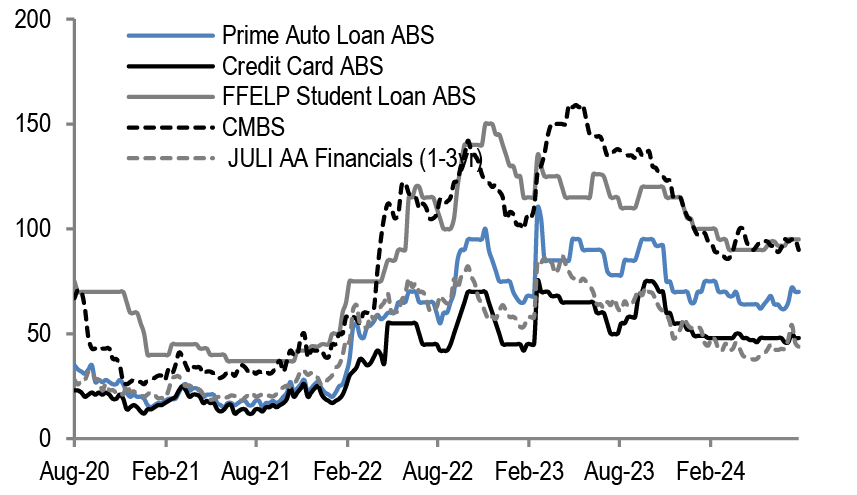

Mortgages had a relatively unexciting week, with lower coupons tightening modestly and the rest of the stack close to unchanged. We review 2023 CMBS property financial data, which indicates that net cashflow growth has slowed materially compared to prior years. Multifamily, in particular, has seen operating expenses increase significantly due largely to labor-related costs.

ABS and CLOs A. Sze, R. Ahluwalia

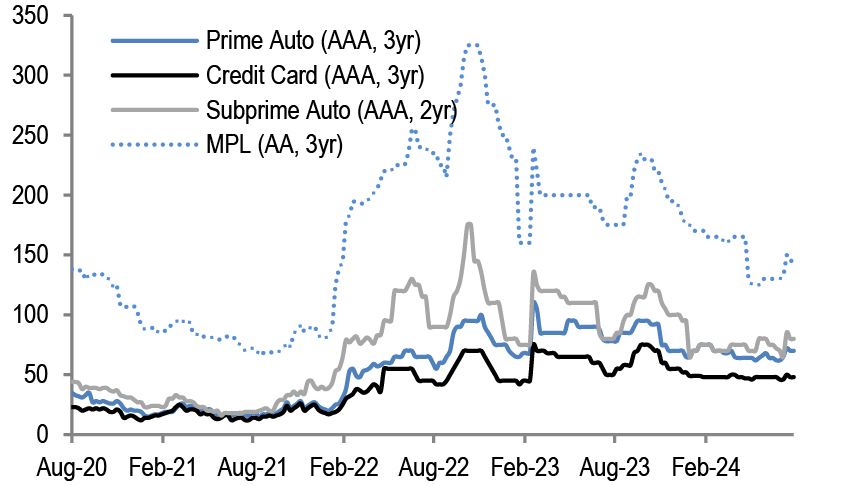

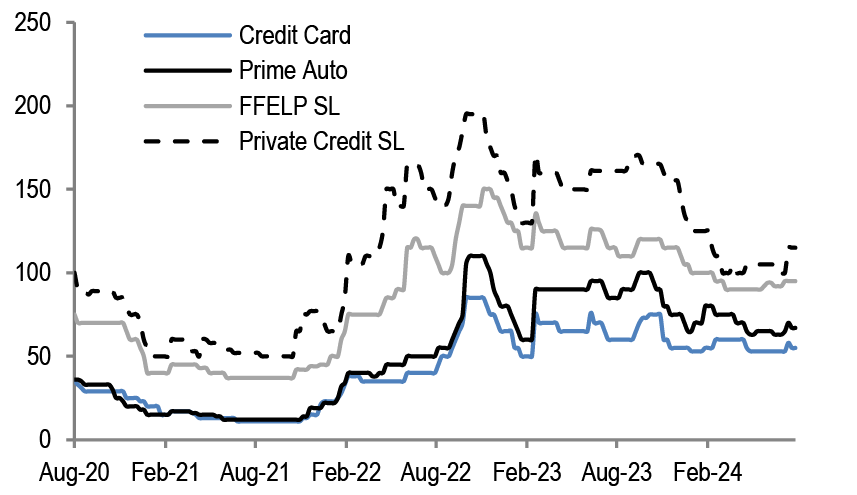

ABS spreads held firm on the week, but current strong technicals are scheduled to be tested in September due to a likely packed new issue ABS calendar, along with macroeconomic data and FOMC schedules.

Investment-Grade Corporates E. Beinstein, S. Doctor, N. Rosenbaum, S. Mantri

HG bond spreads were stable last week despite declining yields. August on track to be the 4th consecutive month of positive returns, supporting demand. We revise up our FY24 supply forecast to $1.5tr leaving $400bn to go in 2024.

High Yield N. Jantzen, T. Linares

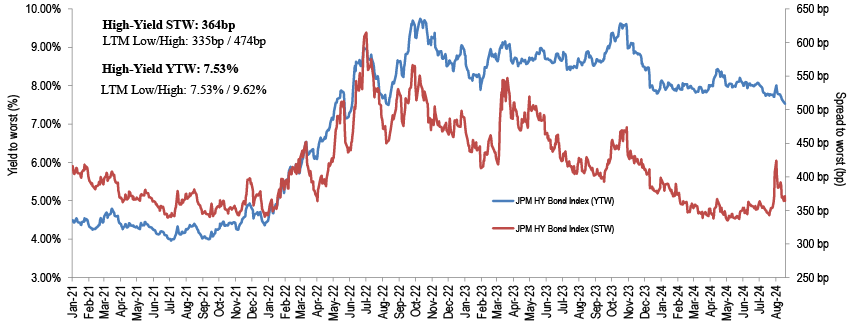

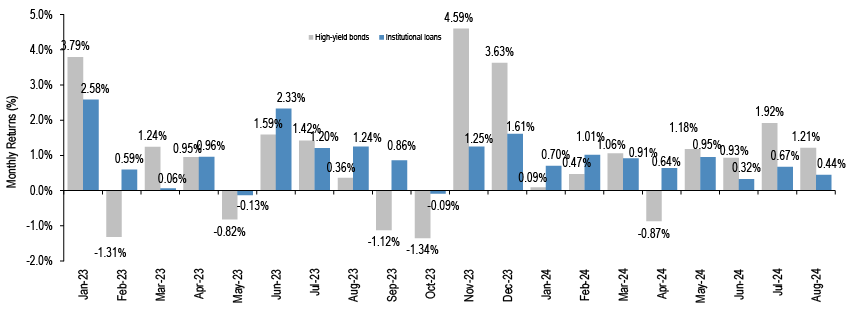

High-yield bond yields are at a low since August 2022 and spreads are 60bp inside early August’s high. High-yield bond yields and spreads decreased 12bp and 5bp over the past week to 7.53% and 364bp. And the HY index is up +1.21% in August which boosts 2024’s gain to +6.11%.

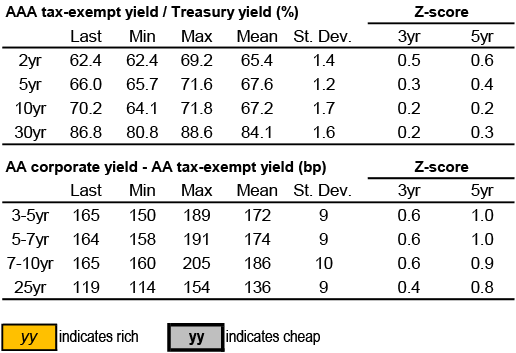

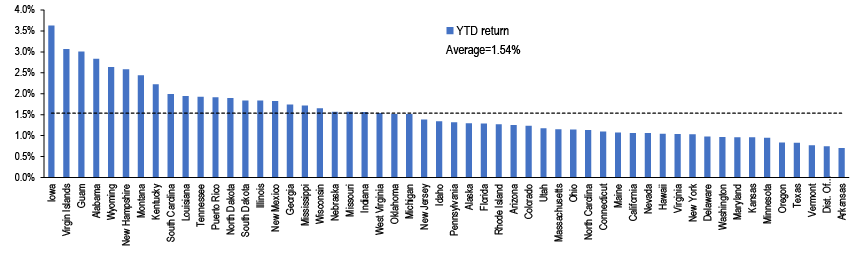

Municipals P. DeGroot, Y. Tian, R.Gargan

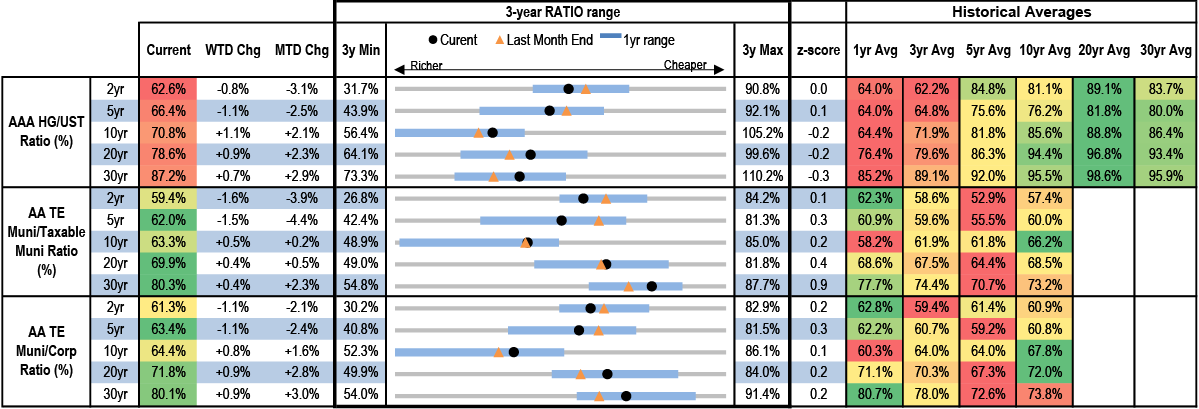

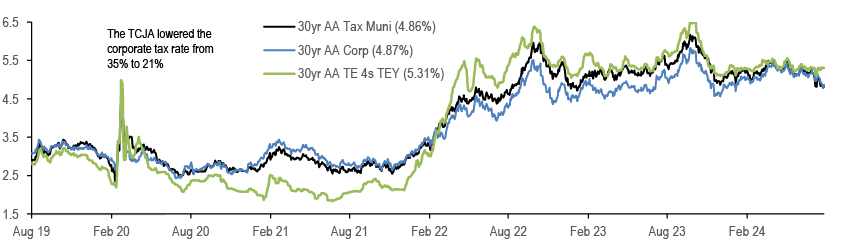

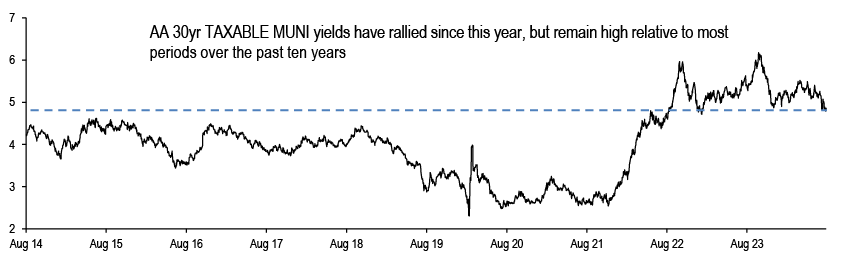

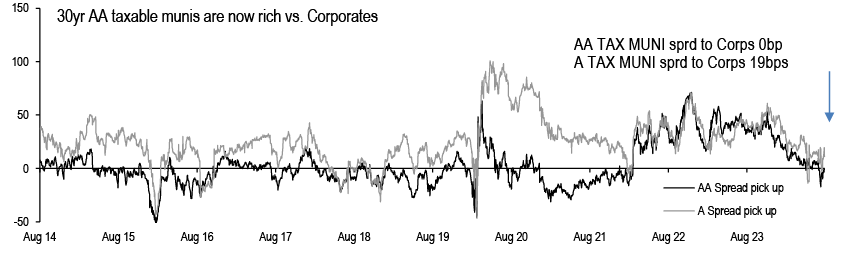

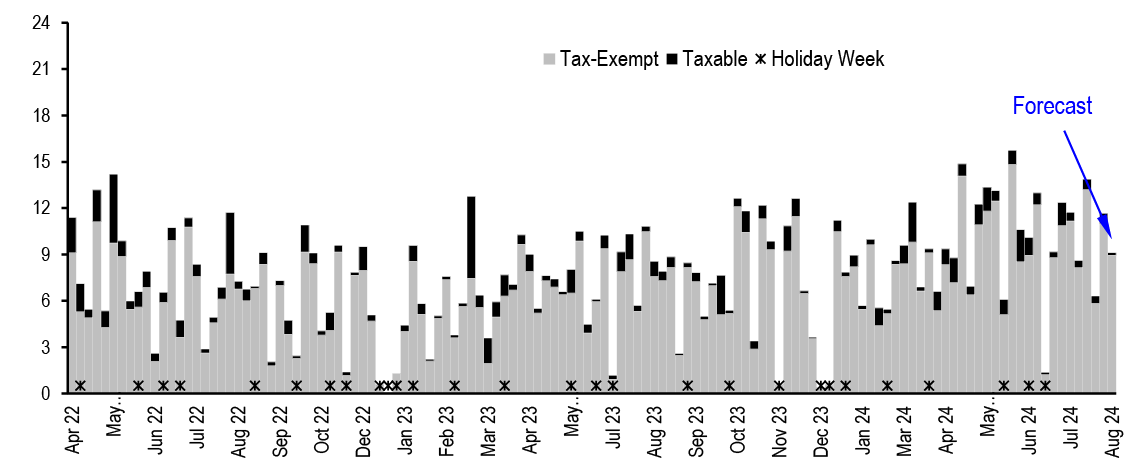

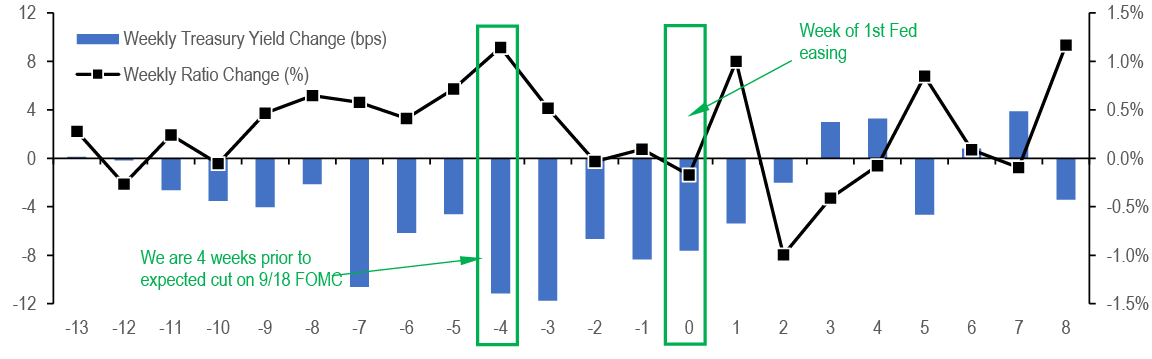

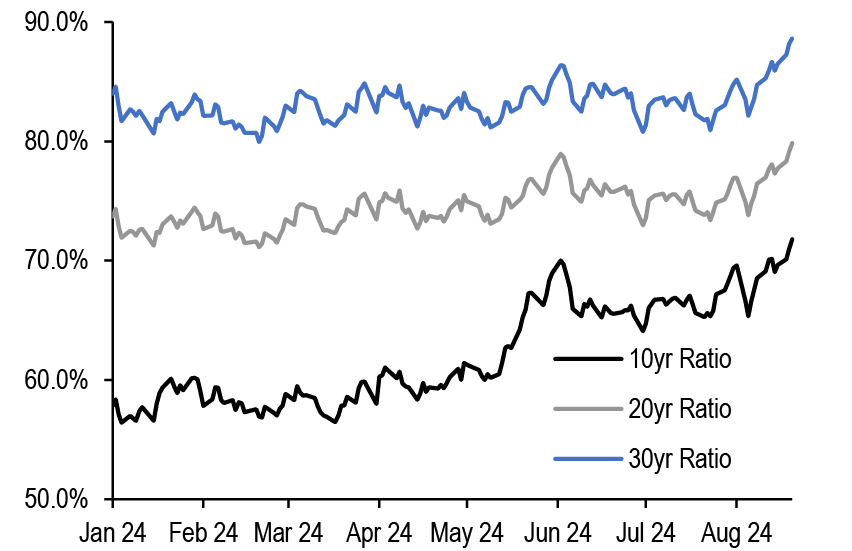

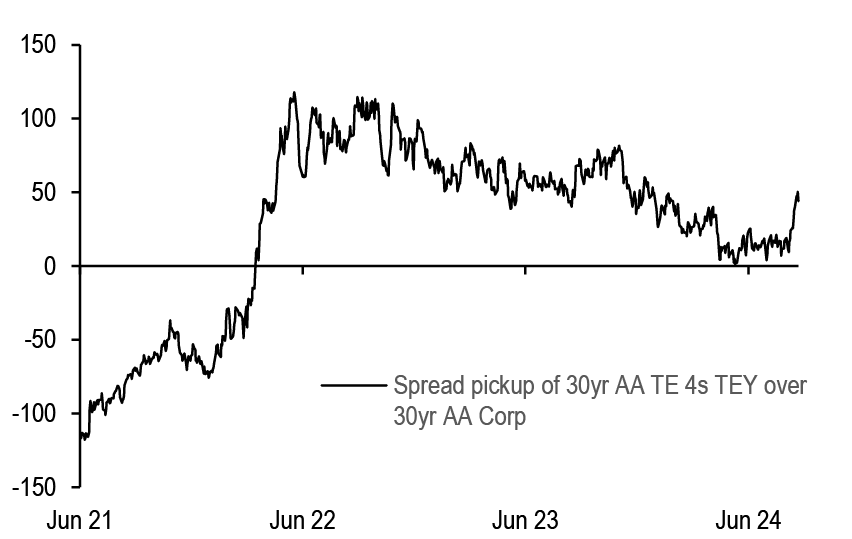

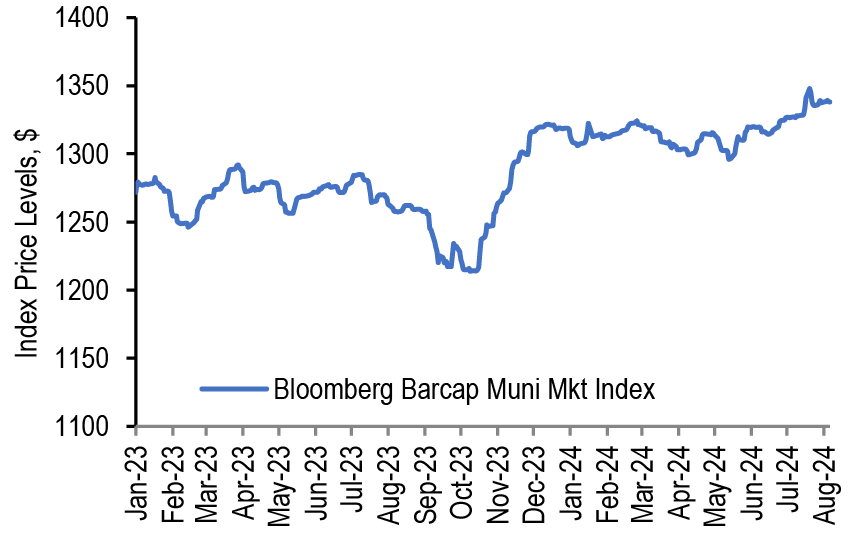

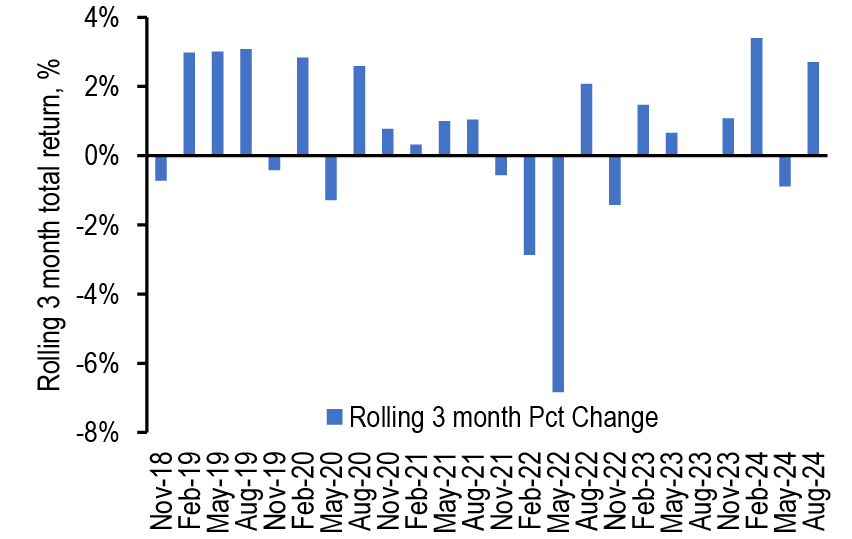

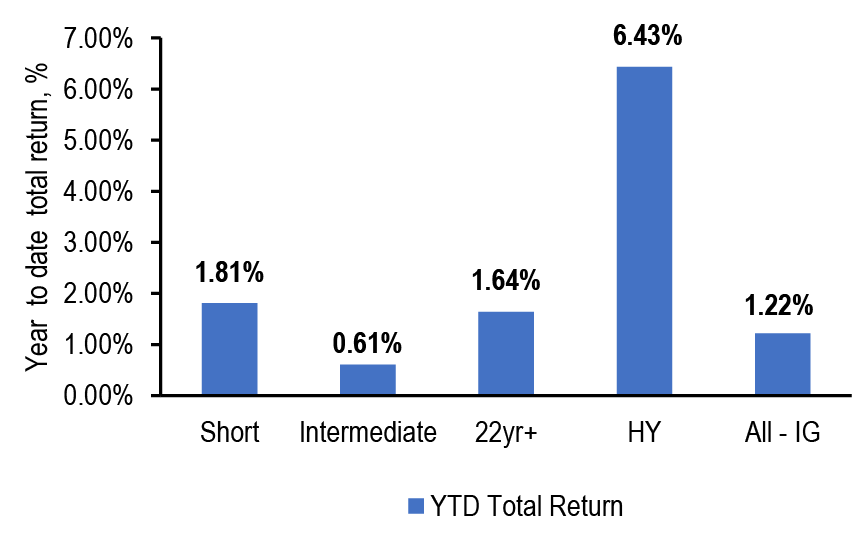

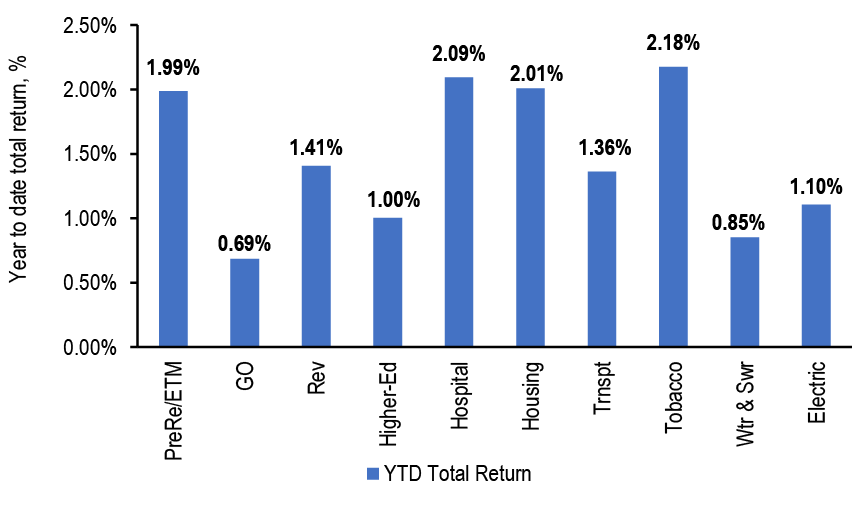

Cheaper municipal valuations and the expectation for lower absolute rates as the Fed’s easing cycle proceeds, could mean that the next couple of months offer the best opportunity to buy bonds of the year and possibly the rate cycle.

Emerging Markets L. Oganes

In EM fixed income, we are MW GBI-EM local rates, CEMBI and EMBIGD. EM bond flows were -$304mn (-0.08% of weekly AUM, up from -$1.4bn).

Summary of Views

| SECTOR | CURRENT LEVEL | YEAR END TARGET | COMMENT |

| Aug 23, 2024 | Dec 31, 2024 | ||

| Treasuries | |||

| 2-year yield (%) | 3.91 | 3.20 | Maintain 5s/30s steepeners and 75:6 weighted 5s/10s/30s belly-cheapening butterflies to position for higher term premium |

| 10-year yield (%) | 3.81 | 3.50 | |

| Technical Analysis | |||

| 5-year yield (%) | 3.65 | 3.10 | The rally has entered a more linear phase now |

| 5s/30s curve (bp) | 45 | 90 | The curve has broken out of its multi-year base pattern |

| TIPS | |||

| 10-year TIPS breakevens (bp) | 209 | 200 | Initiate tactical 5yx5y inflation swap longs |

| Interest Rate Derivatives | |||

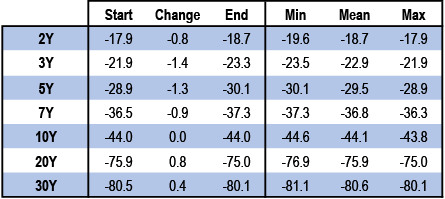

| 2-year SOFR swap spread (bp) | -19 | -6 | The first cut is all but certain at the Sep meeting, but pace and extent remain uncertain. Policy uncertainty amplifies delivered volatility - stay bullish on vol. Tbill net issuance should turn negative in coming weeks, and term funding premium appears too low - maintain front end spread wideners and position for a flatter 5s/30s spread curve. Initiate 7s/20s weighted spread curve steepeners to benefit from relative value. Forward curve steepeners are preferable to longs in the Reds. |

| 5-year SOFR swap spread (bp) | -30 | -22 | |

| 10-year SOFR swap spread (bp) | -44 | -37 | |

| 30-year SOFR swap spread (bp) | -80 | -79 | |

| Agency MBS | |||

| FNMA 30yr 5.5% Front Tsy OAS (bp) | 24 | 25 | Mortgages tightened on the back of weaker economic data |

| RMBS Credit | |||

| CRT M1B/M2 (DM@10CPR) | 1MS + 168bp | 1MS + 175bp | Non-QM and jumbo spreads have moved tighter vs. pre-August rate volatility, and we expect rangebound spreads through year end. |

| RMBS 2.0 PT (6s) | 1-08bk of TBA | 1-12bk of TBA | |

| AAA Non-QM | I + 130bp | I + 150-175bp | |

| ABS | |||

| 3-year AAA card ABS to Treasuries (bp) | 48 | 40 | ABS spreads mostly stable over the first two weeks of July, with strong bids for benchmark credit card and FFELP ABS |

| CMBS | |||

| 10yr conduit CMBS LCF AAA | 102 | 95 | Benchmark CMBS spreads look about fair to their corporate and mortgage comps. However, we see value in upper IG mezz conduit bonds. |

| 10yr Freddie K A2 | 52 | 48 | |

| Investment-grade corporates | |||

| JULI spread to Treasuries (bp) | 110 | 110 | Still attractive yields, a continuation of positive returns, relatively lighter supply in the coming months and the start of Fed cuts will be supportive of spreads, while slower growth and a trend towards lower yields limits meaningful further spread tightening. |

| High yield | |||

| Domestic HY Index spread to worst (bp) | 363 | 380 | We believe HY spreads will be supported in the near-term by resilient earnings, steady inflows, and lighter capital market activity in 3Q |

| Credit Derivatives | |||

| High Grade (bp) | 51 | 50 | Credit has outperformed relative to both equity and equity volatility in the recent selloff. Buying CDS index protection funded by selling VIX futures screens attractive at current levels |

| High Yield | $106.7/330bp | 350 | |

| Short-term fixed income | |||

| EFFR (%) | 5.33 | 4.10 | Funding conditions should remain benign, with liquidity remaining abundant, limiting any potential impacts to EFFR/SOFR, T-bills/OIS, and CP/OIS spreads. We do not expect MMF reform to have any outsized impact on money market credit spreads. Treasury repo clearing remains work in progress, though concerns about readiness are emerging. |

| SOFR (%) | 5.31 | 4.10 | |

| CLOs | |||

| US CLO Primary AAA (Tier 1, bp) | 135 | SOFR + 150 | We widened our base case CLO T1 AAA new issue spread forecast to 150bp (from 130bp prior) and introduced a 175-200bp risk case in the event of a hard landing. |

| Municipals | |||

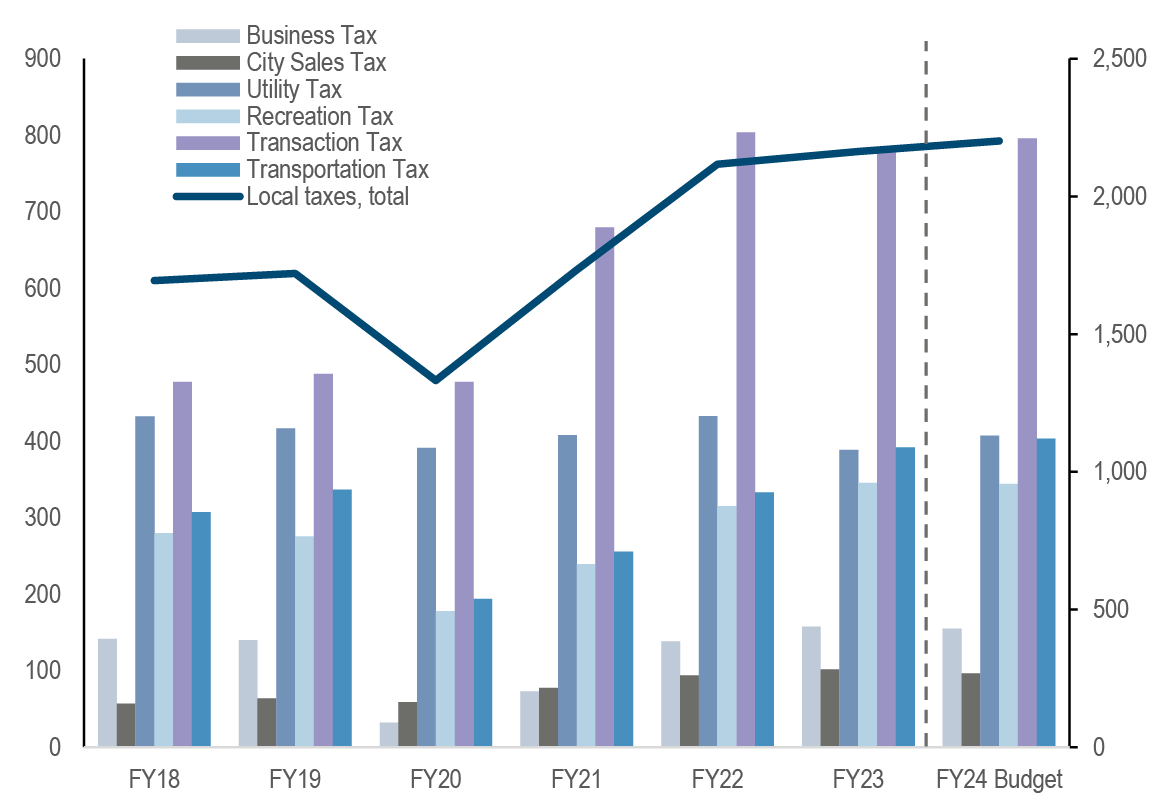

| 10-year muni yield (%) | 2.69 | 2.10 | Finding sustained market consensus while navigating transition to an easing cycle may be difficult, but we suggest playing the long game, and buying municipal bonds with a longer term perspective, particularly in periods where Treasuries sell-off. We suggest adding idiosyncratic municipal risk opportunistically on market weakness, and highlight potential market cheapening in the period before the election. |

| 30-year muni yield (%) | 3.57 | 3.10 | |

| Emerging Markets | |||

| Hard currency: EMBIG Div (bp) | 395 | 400 | MW EMBIGD |

| Hard currency: CEMBI Broad (bp) | 226 | 220 | MW CEMBI Br |

| Local currency: GBI-EM yield (%) | 6.27% | 5.58% | MW local rates |

Source: J.P. Morgan

US Fixed Income Overview

See you in September

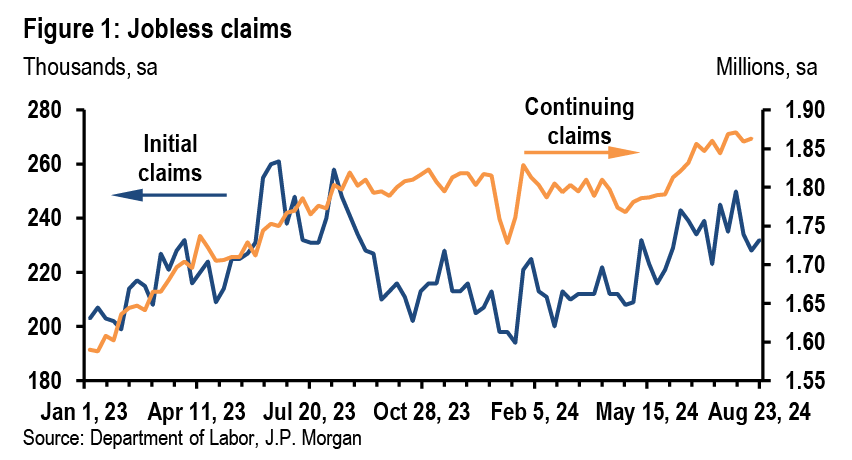

- Economics: The preliminary benchmark payroll revisions lowered total payroll growth for the year through March 2024 by 818k. Initial claims remained relatively unchanged at 232k for the August employment report reference week

- Treasuries: Chair Powell’s dovish tone supports our forecast of consecutive 50bp at each of the next two meetings, but the August employment report is still two weeks away, valuations are no longer cheap, and dealer positioning is elevated, so we stay neutral duration for now. Powell’s comments support further long end steepening, and we recommend holding 5s/30s steepeners to express our core view. Hold tactical 5y5y inflation swap longs

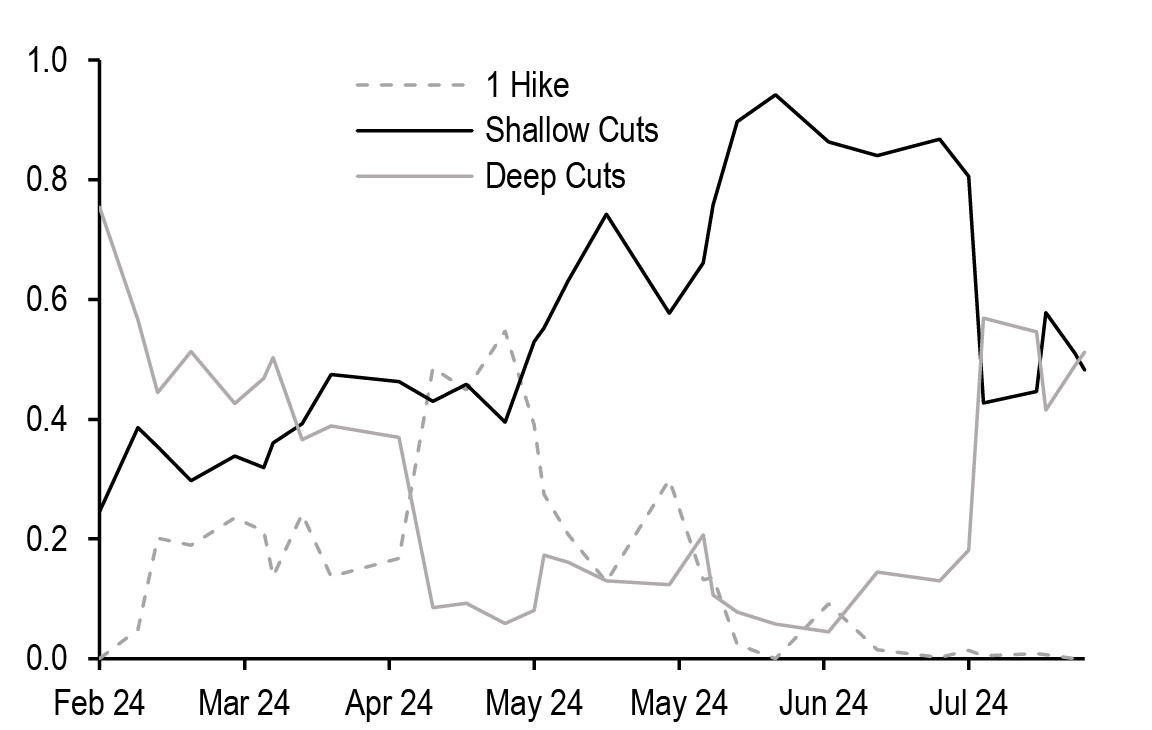

- Interest Rate Derivatives: Policy uncertainty remains elevated with OIS markets placing significant weight on both deep cutting and shallow cutting scenarios. Yields should remain sensitive to new economic and policy information which supports jump risk and elevated realized volatility. We remain bullish on volatility in short expiries. We remain positioned for swap spread curve flattening and we recommend initiating exposure to a flatter 5s/30s swap spread curve

- Short Duration: RRP balances have stabilized around $300bn, with limited room to decrease further. Both domestic bank borrowing in the O/N unsecured market and US banks’ participation in the repo market remain minimal, suggesting reserves have not transitioned from abundant to ample yet

- Securitized Products: Mortgages had a relatively unexciting week, with lower coupons tightening modestly and the rest of the stack close to unchanged. We think mortgage credit spreads can remain rangebound for the rest of the year. We see value in upper IG mezz CMBS and 5yr Agency CMBS bonds

- Corporates: HG bond spreads were stable last week despite declining yields. August on track to be the 4th consecutive month of positive returns, supporting demand. We revise up our FY24 supply forecast to $1.5tn leaving $400bn to go in 2024

- Near-term catalysts: July personal income (8/30), July JOLTS (9/4), Aug employment (9/6), Aug CPI (9/11), Aug PPI (9/12)

Must Read This Week

Cuts are coming, Michael Feroli, 8/23/24

Focus: Beryl and July jobs, Abiel Reinhart, 8/23/24

July FOMC minutes highlighted labor market risks, Abiel Reinhart, 8/21/24

US: Benchmark brings big downward revisions to (lagged) jobs, Abiel Reinhart, 8/21/24

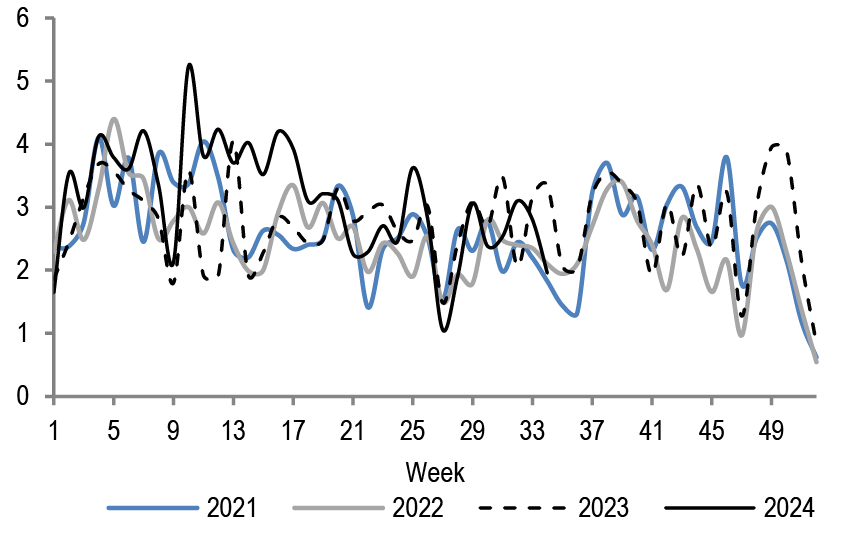

Over the past week Treasury yields are lower and spreads roughly stable across both corporate and mortgage markets as the economic data continue to reinforce only gradual cooling in the economy, the issuance calendar remains light, and Fed communications confirm expectations of a rate cutting cycle beginning in September. Indeed there was little fanfare from what sparse data was released this week. The preliminary benchmark revisions lowered total payroll employment growth for the year through March 2024 by 818k (0.5%), decreasing job growth by about 70k/month to a ~175k monthly run rate over the period. It is difficult to say exactly how the Fed will interpret this data, given that the revision cuts off in March 2024 and the implications for more recent months are not fully clear (see US: Benchmark brings big downward revision to (lagged) jobs, Abiel Reinhart, 8/21/24). At the same time initial jobless claims for the August employment reference week remained roughly unchanged over the week at 232k, but are 13k lower than the July reference week, and claims continue to follow a similar summer seasonal path as the last few years (see US: Good news from mostly stable jobless claims, Abiel Reinhart). The data support our view that the economy is slowing with low risks of a recession.

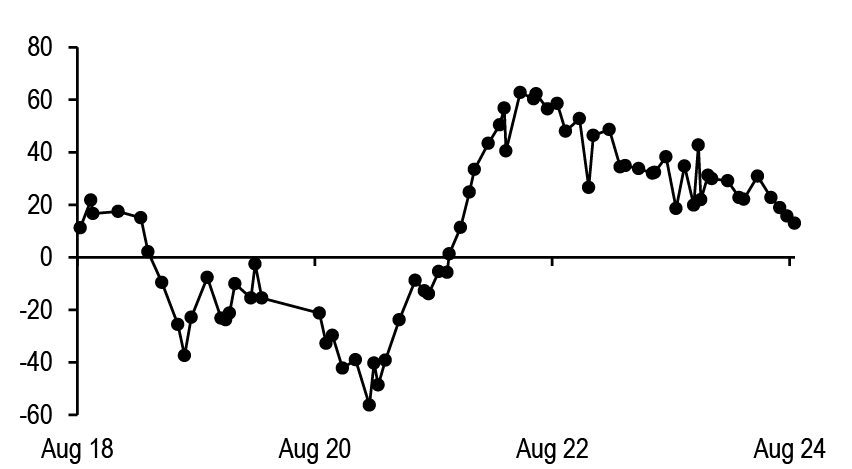

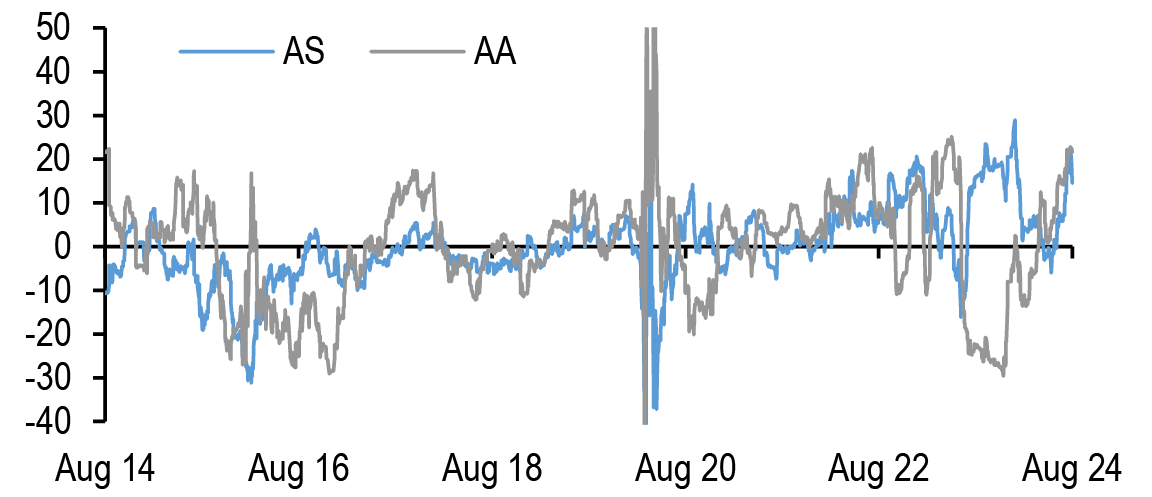

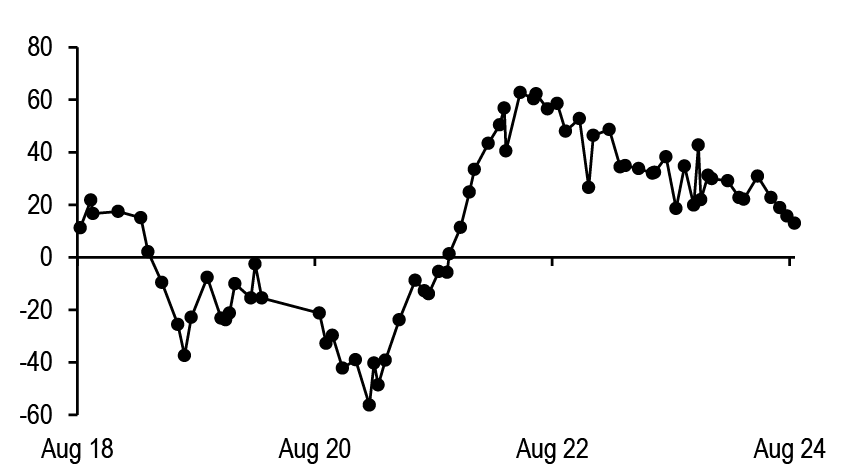

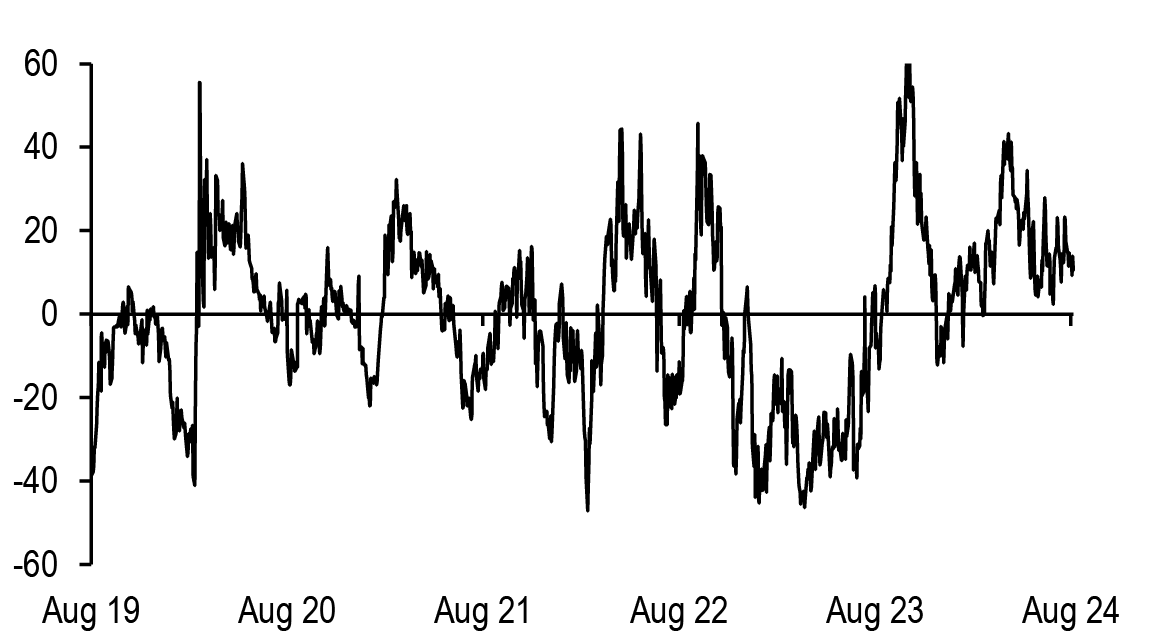

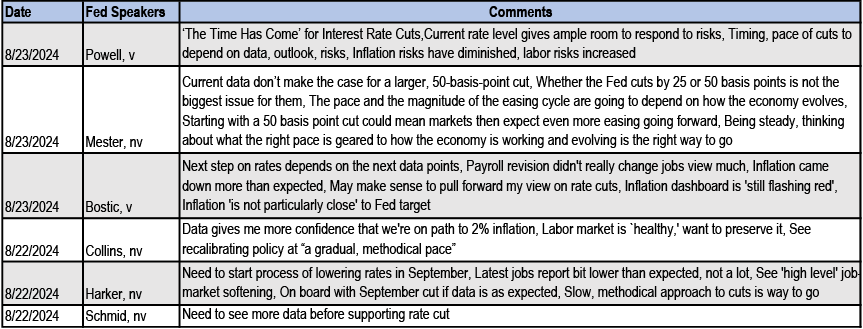

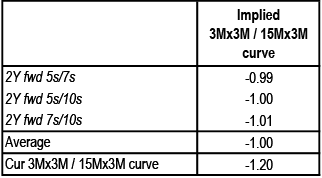

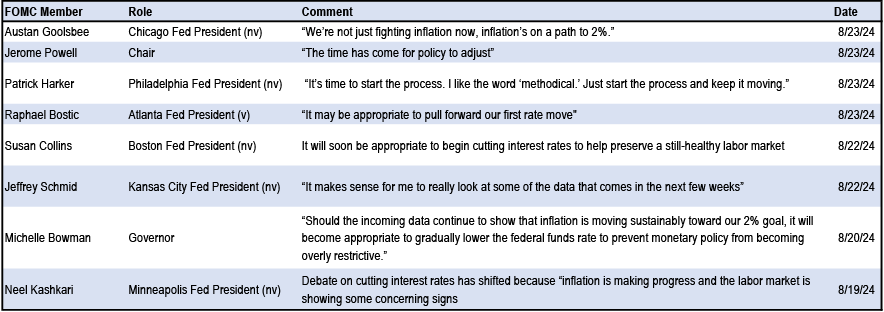

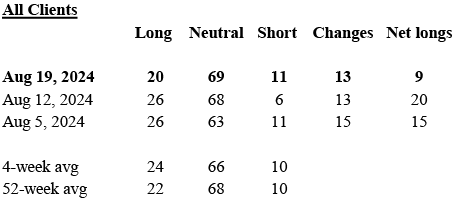

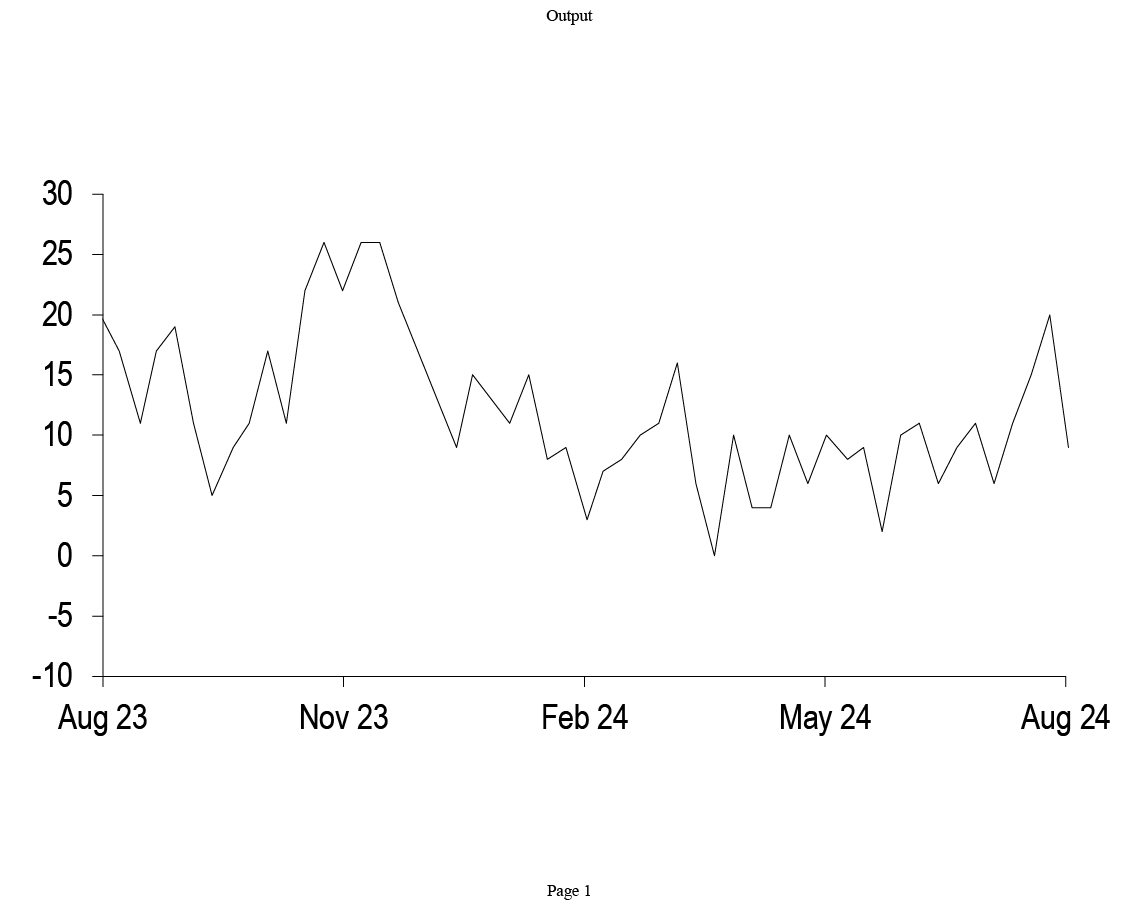

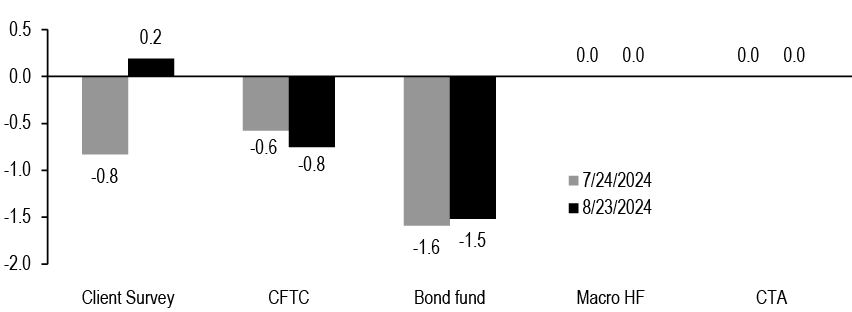

Instead, market participants were focused on Fed communications, which laid the ground work for an upcoming easing cycle. Even before the release of the July payrolls report, the July FOMC minutes revealed that “the vast majority” of the FOMC were ready to cut by the September meeting. Notably “many” participants noted the risks around cutting too little or too late while only “several” thought reducing rates too soon or too much could risk a resurgence in inflation (see July FOMC minutes highlighted labor market risks, Abiel Reinhart). Meanwhile this week Fed speak offered support for a “gradual” or “methodical” pace of cuts. However markets were most keen for Chair Powell’s Friday Jackson Hole speech where his comments skewed dovish. The Chair stated “the time has come” to adjust interest rates and that the Committee does “not seek or welcome further cooling in labor market conditions.” Unsurprisingly, our monetary policy NLP read Powell’s speech as more dovish than his press conference at the July FOMC meeting, and his most dovish speech since the fall of 2021 ( Figure 1, also see Fed, Powell: Review and Outlook, Joseph Lupton, 8/23/24). Whether the FOMC cuts 25bps or 50bps at the September meeting still hinges on the next monthly employment report, though Powell’s comments arguably lower the bar for the Fed to deliver a 50bp cut next month (see Cuts are coming, Michael Feroli, 8/23/24).

Figure 1: Chair Powell’s 2024 Jackson Hole speech scored as his most dovish in nearly 3 years

Jerome Powell Hawk-Dove history, using speeches, testimonies, and press conferences

Source: J.P. Morgan* For methodology, see Listen up: Upgrading J.P.Morgan’s central bank NLP machine, Joseph Lupton and Dan Weitzenfeld, 7/2/24

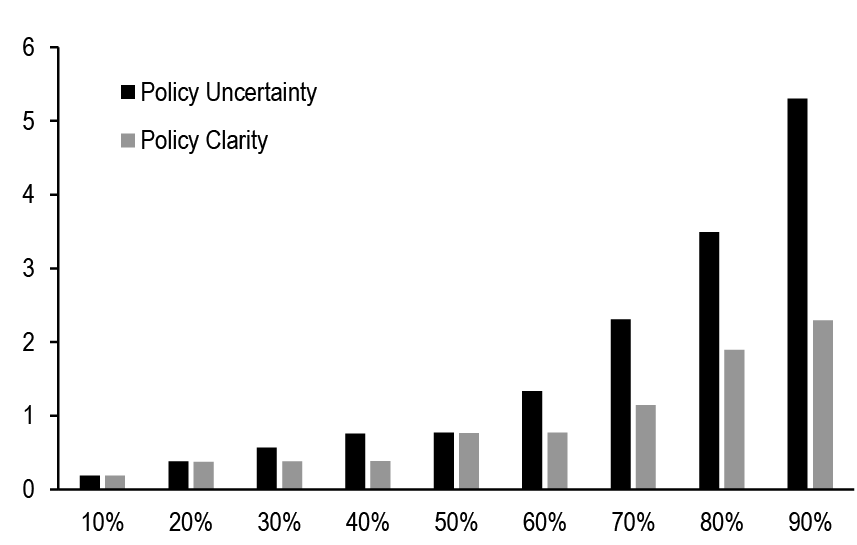

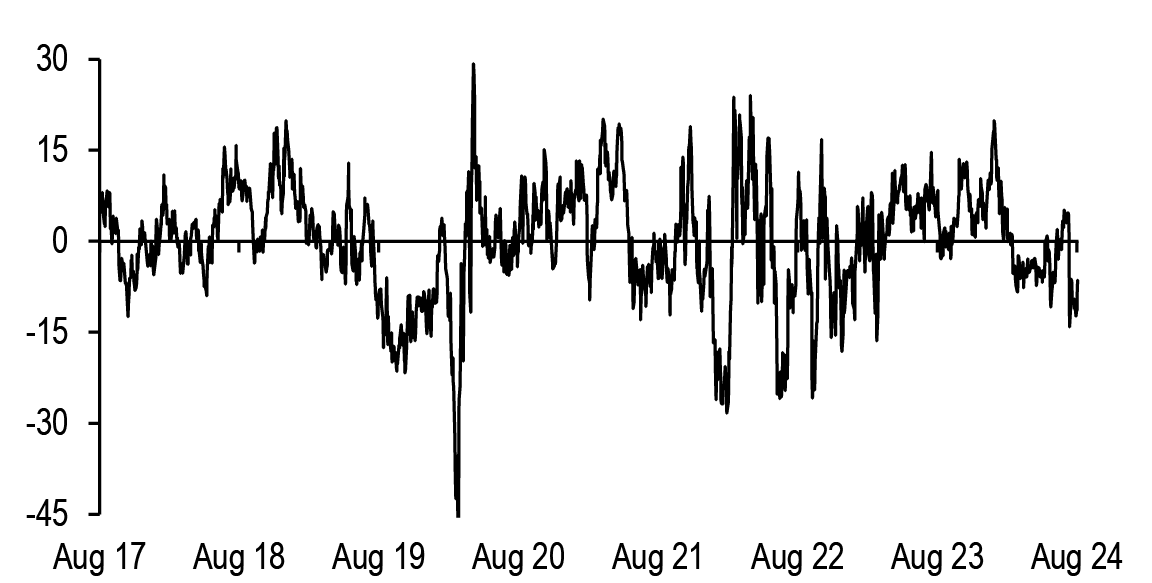

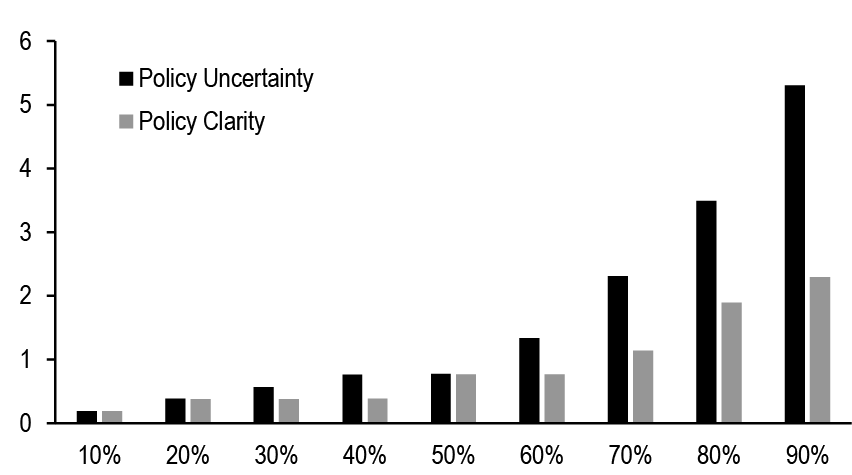

Figure 2: As one might expect, yields have tended to be much more sensitive to Fed-speak in periods of significant policy uncertainty

Size of the Nth percentile absolute change in the Fed sentiment index* on days with one or more Fed-speak events, grouped by policy clarity or uncertainty regime**, for various selected values of N from 10 to 90. Past 6 months; bp

Source: J.P. Morgan, Bloomberg Finance, L.P.

* The Fed sentiment index is computed as the cumulative sum of yield changes in 5-year note Treasury futures in the 15-minute period following the first Fedspeak headline on Bloomberg. Fedspeak is defined as any speech, FOMC meeting or FOMC minutes. ** Days on which the absolute difference between the total weight on deep cut scenarios and shallow cut scenarios was between 0.25 and 0.75 are classified as days characterized by Policy Uncertainty, while all other days are deemed to have Policy Clarity. For more details see Interest Rate Derivatives

As we look ahead, we continue to forecast 50bp cuts at the September and November meetings followed by 25bp per meeting thereafter. Our forecast is rooted in both the resumption of the disinflationary process which remains broad based across components, together with ongoing loosening in labor markets, which has reduced the risk prices remain sticky. With the beginning of the easing cycle less than a month away and OIS forwards pricing in 103bp of easing through YE24 compared to our own projection of 125bp, this would indicate there is value to being long duration. However we remain patient as growth data has turned more favorable in recent weeks and we do not think the debate surrounding the pace of easing will be settled before the August employment report. Moreover valuations look close to our fair value estimate, and in an environment in which term premium is biased higher, we think it’s unlikely that valuations overshoot to the rich side of fair value. Thus, we remain neutral on duration but continue to favor 5s/30s steepeners as a medium-term expression of our bullish view (see Treasuries).

Turning to inflation markets, intermediate breakevens remain cheap to our fair value framework, though the model residual narrowed on Friday, given a dovish shift from Fed Chair Powell. In recent months, the Fed’s wavering confidence in disinflation and thus a heightened focus on labor market data created a less supportive backdrop for TIPS, with real yields demonstrating lower sensitivity to nominal yields in rallies than in sell-offs. However, we argue that the backdrop is becoming more supportive for TIPS once again. Along the curve, the intermediate sector continues to offer value, and forward-starting swaps avoid the negative carry associated with spot breakeven positions. With the fundamental backdrop turning more supportive and valuations still cheap, albeit somewhat less cheap than a week ago, we maintain tactical long exposure in 5Yx5Y inflation swaps (see TIPS).

Despite the near certainty of a cut in September, the pace and extent of easing remain uncertain with OIS markets placing significant weight on both deep cut and shallow cut scenarios. In this period of elevated policy uncertainty, yields should remain highly sensitive to both new economic and policy information; Figure 2 shows the percentile moves in yields around Fedspeak events and indicates that markets are prone to greater sensitivity during periods of elevated policy uncertainty. Such a backdrop is conducive to jump risk and supportive of elevated realized volatility. Thus with significant jump risk going into August payrolls and beyond, we remain bullish on volatility in short expiries. We also remain positioned for a flattening in the swap spread curve. Front-end spreads should be biased wider as SOFR and GC rates normalize and net T-bill supply turns negative in September whereas long-end spreads should narrow against the backdrop of rising term premium. Therefore, we now recommend initiating exposure to a flatter 5s/30s swap spread curve (see Interest rate derivatives).

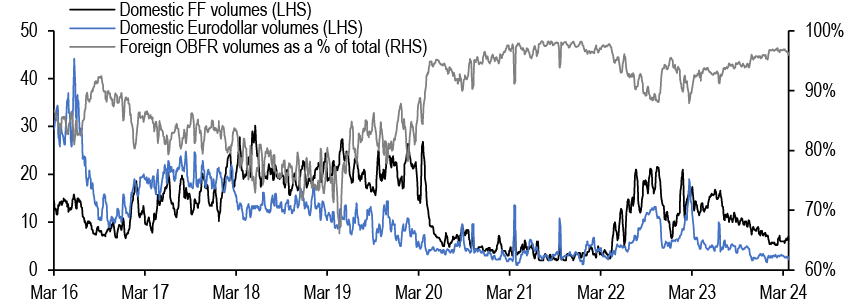

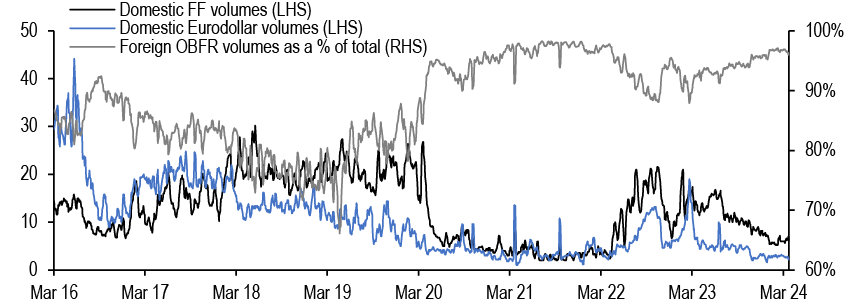

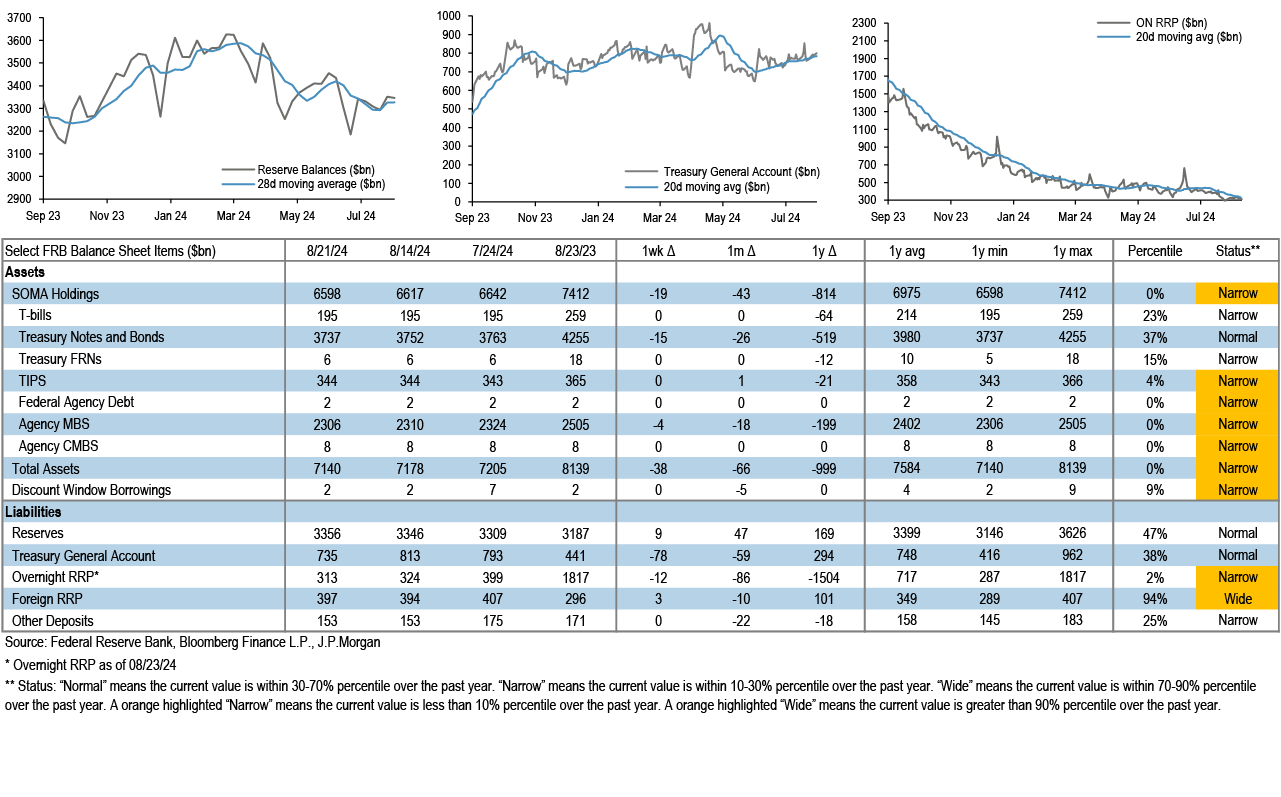

Turning to Fed’s balance sheet, the July FOMC minutes did not reveal much new information. The SOMA manager noted that repo rates had risen due to increased demand for financing Treasury securities and balance sheet normalization. Meanwhile, the manager concluded that reserves remained abundant but emphasized that the staff would continue to closely monitor developments in money markets. We agree, as we note domestic banks remain largely absent from overnight funding markets, whether in fed funds or Eurodollar deposits, while bank call reports show little increased net reverse repo activity YTD, as the GC/IORB spread remains subdued ( Figure 3). If we were to see increasing participation of banks within overnight markets or an increasing percentage of overnight Treasury repo transacted at or above IORB, this would signal reserve scarcity is approaching. To that end, bank reserves have been steady at ~$3.4tn while ON RRP balances have fallen by ~$700bn YTD as MMFs have shifted towards T-bills and non-Fed repo. We think there is limited room for ON RRP to move much below the current low $300 level, given operational considerations for MMFs to meet unexpected liquidity needs, and we think QT can continue through year-end (see Short term fixed income).

Figure 3: Domestic banks have remained largely absent from the overnight market, both in fed funds and Eurodollar deposits

Fed funds and Eurodollar deposits (OBFR-FF) volumes (LHS, $bn) versus Foreign OBFR volumes as a % of total (RHS,%)

Source: Federal Reserve Bank of New York Fed, J.P. Morgan

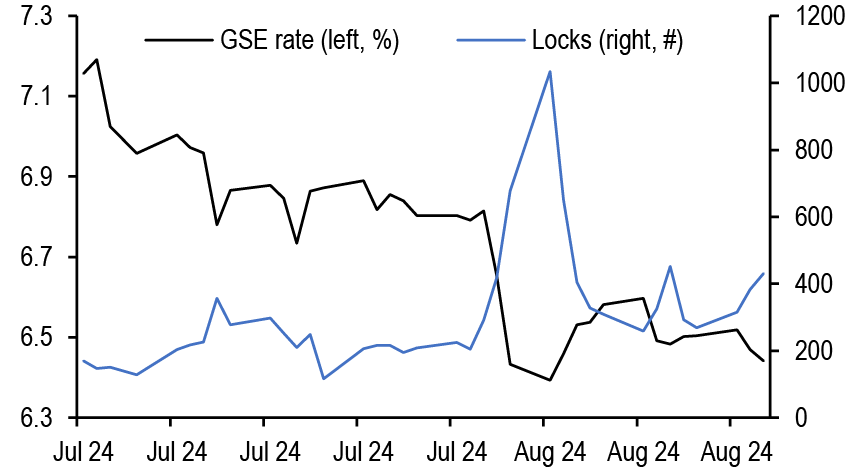

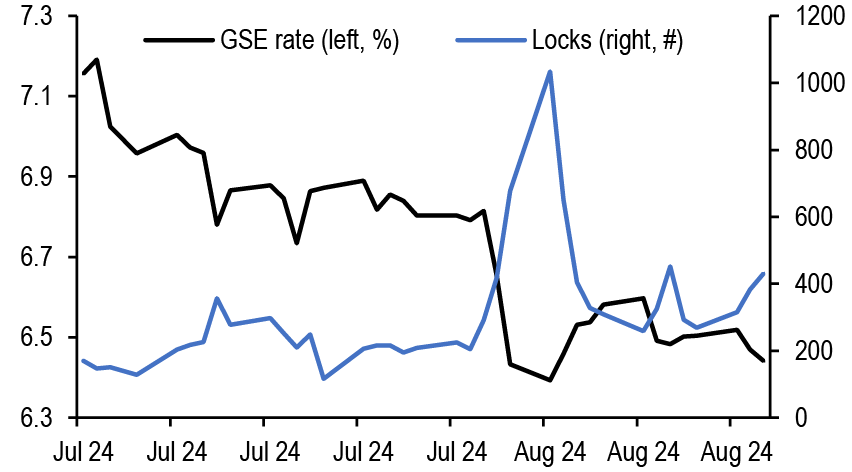

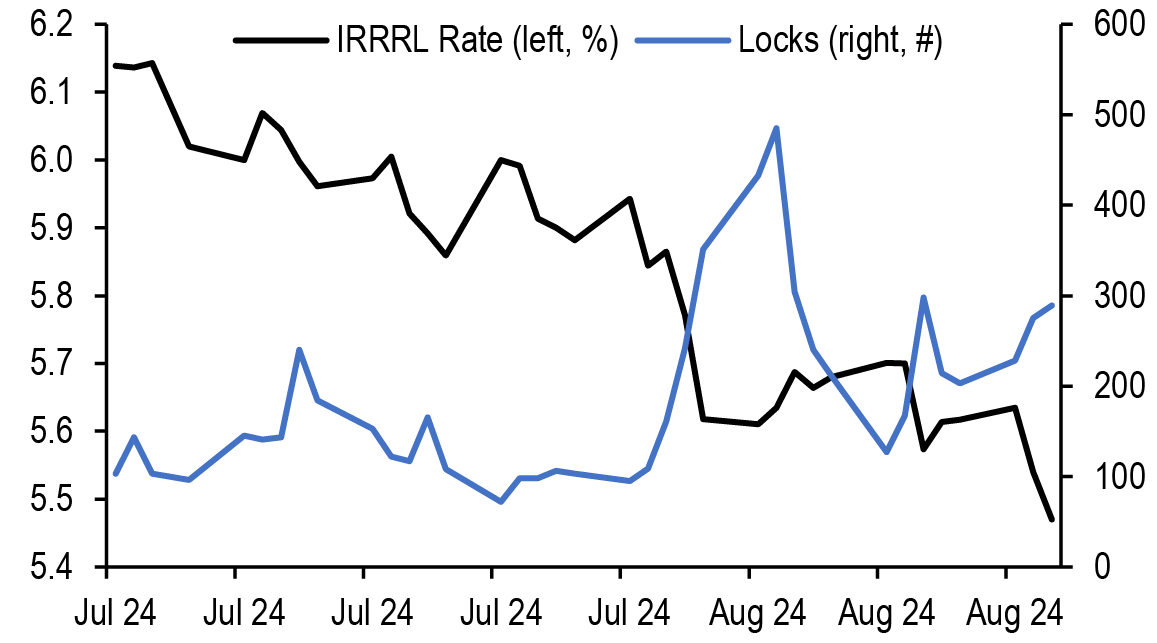

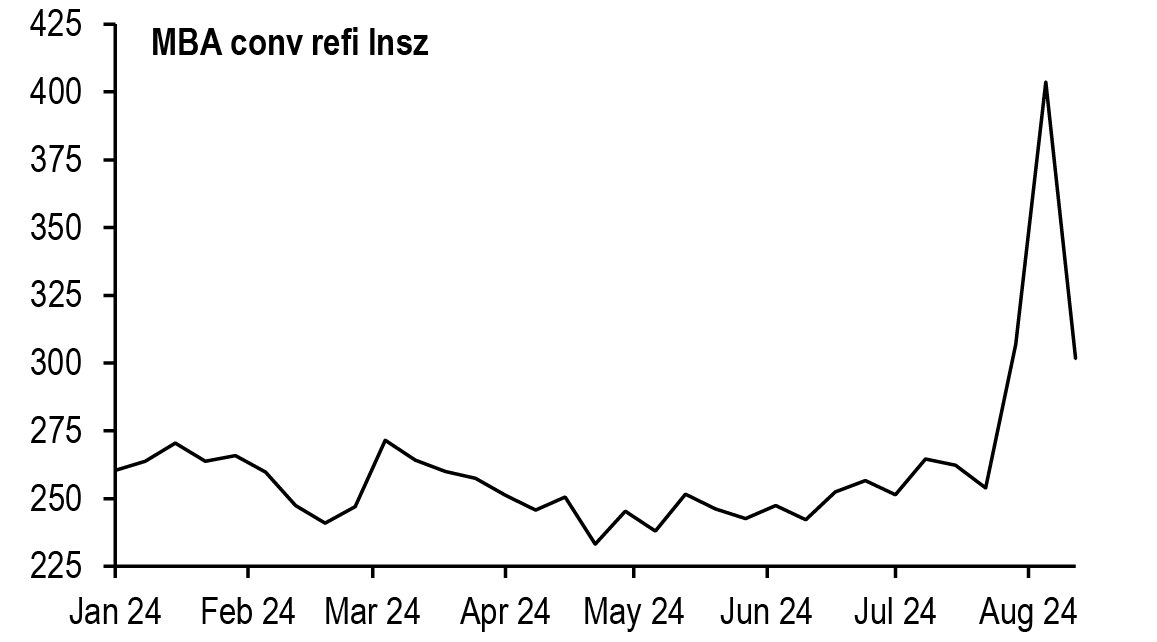

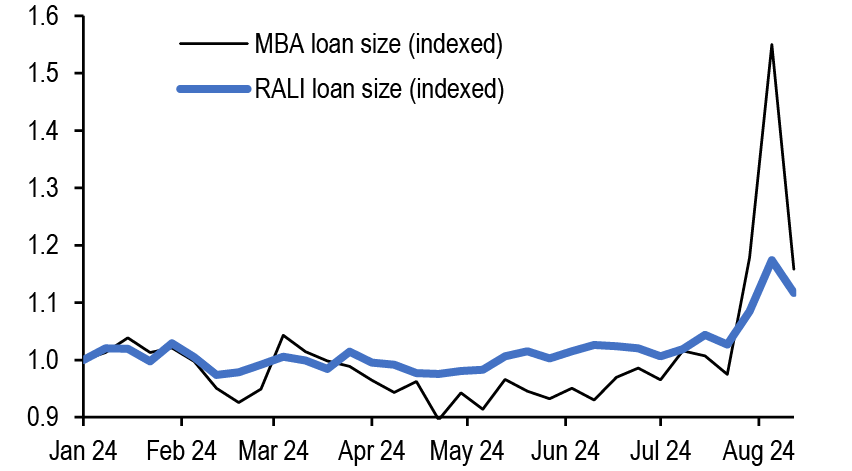

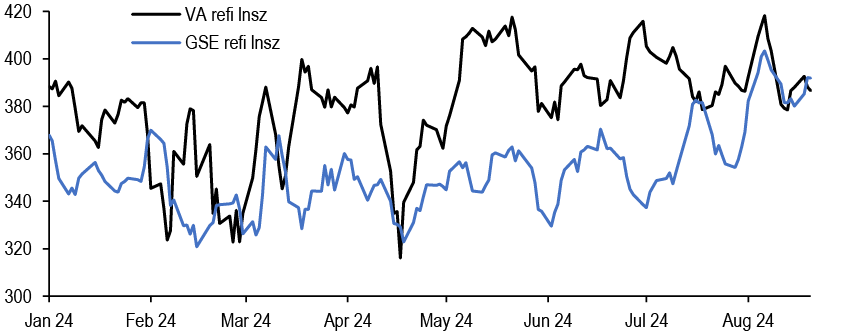

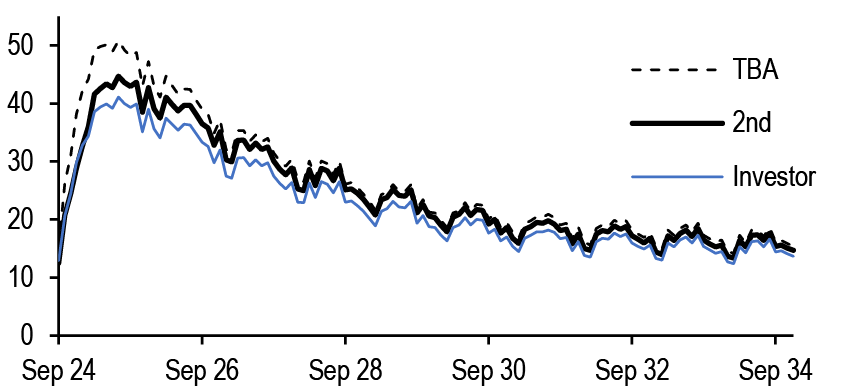

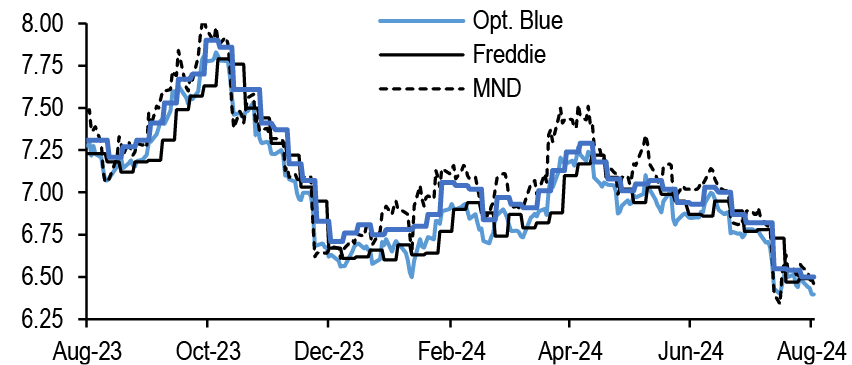

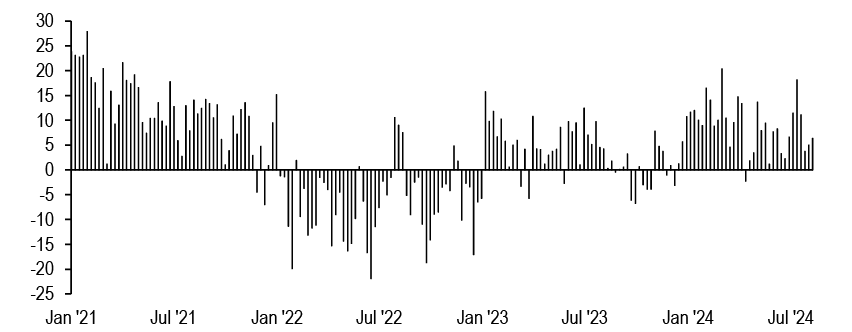

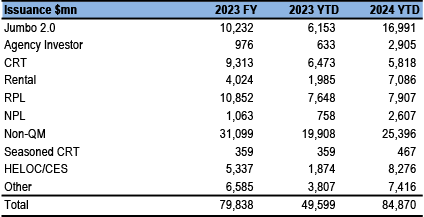

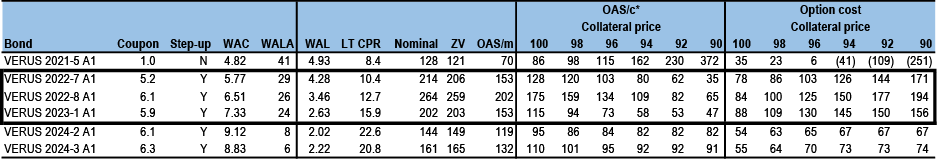

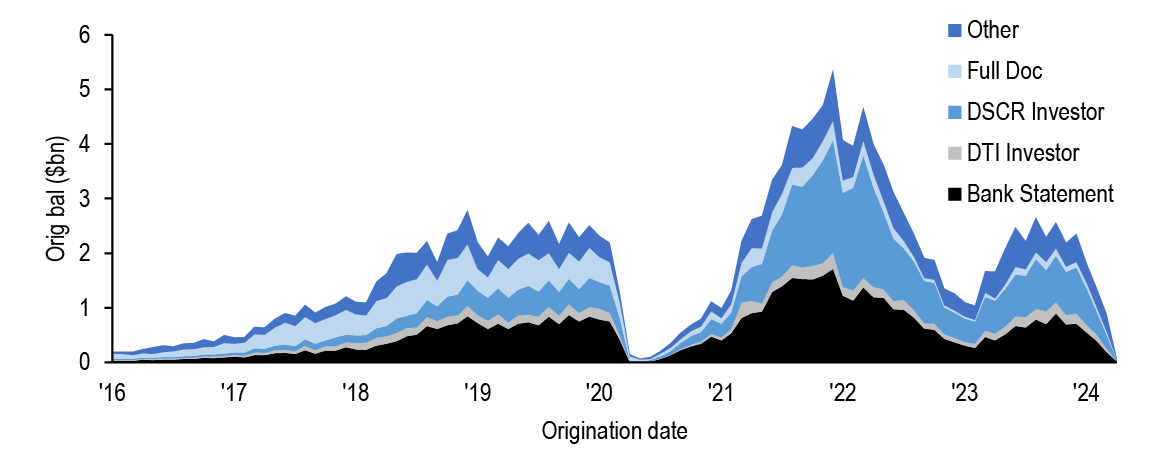

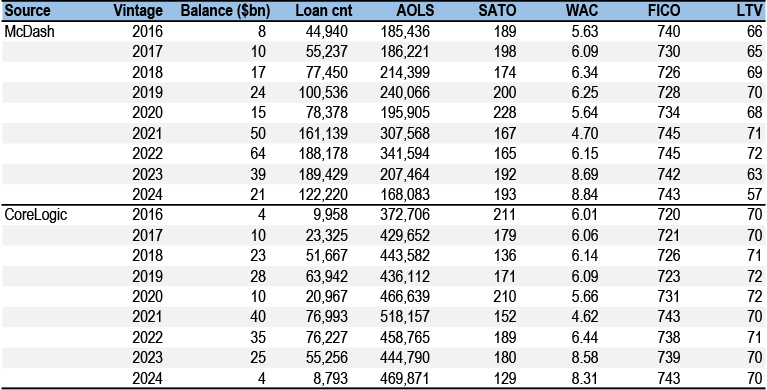

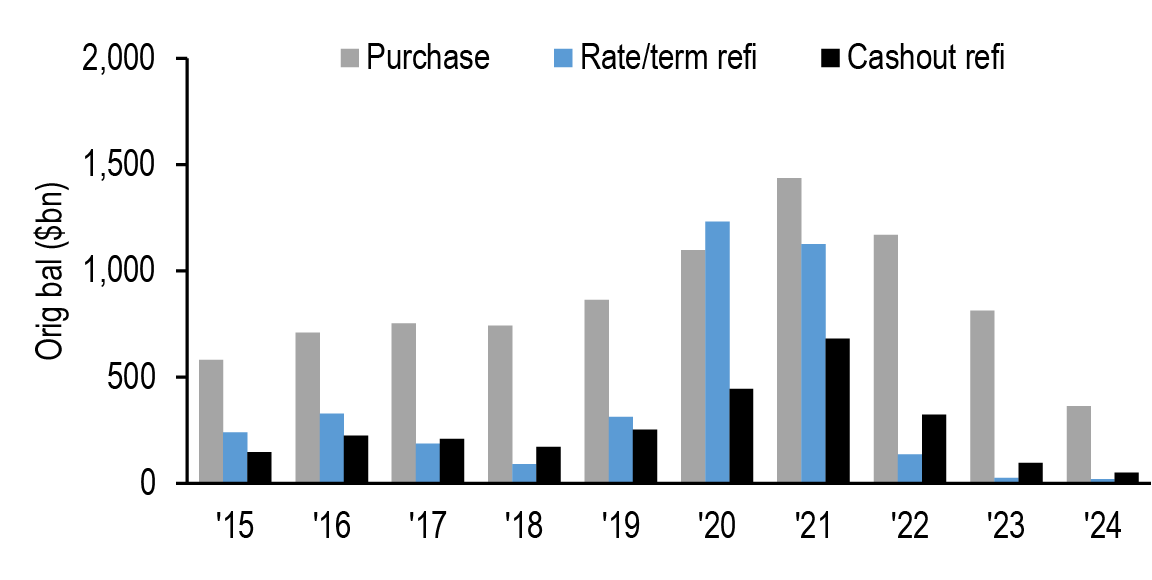

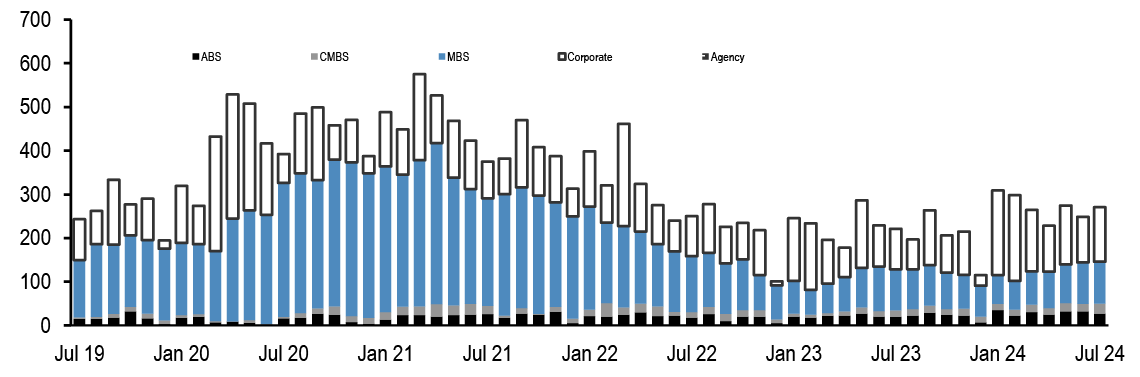

Mortgage rates are roughly unchanged across the stack, with lower coupons modestly tighter. Along with most spread products, valuations have recovered from the local wides seen early in the month; still, with mortgages continuing to offer historically compelling yields vs. corporates, we think the technical support for the product from money managers can be maintained. We continue to prefer UIC conventionals and are underweight 4.5s and 5s. Primary rates have fallen to roughly 6.44% on GSE loans and 5.47% for VA IRRRLs, but we have not seen a surge in refi applications, likely as originators picked up some low hanging fruit earlier this month ( Figure 4, see Mortgages). Mortgage credit spreads similarly retraced much of the widening seen earlier in the month with AAA non-QM back to 130bp in new issue. We expect spreads to remain rangebound over the rest of the year as the macro outlook remains challenging while the election season quickly approaches. Primary activity has been very active this summer, but stepped down over the month from $12bn to $7bn new issue RMBS in August, and we think primary markets will be light in the next week (see RMBS).

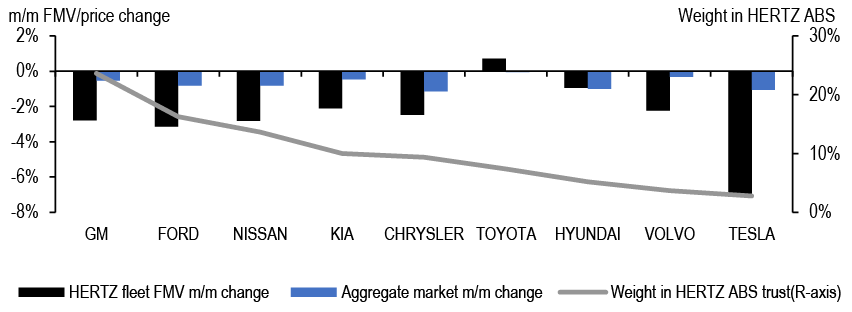

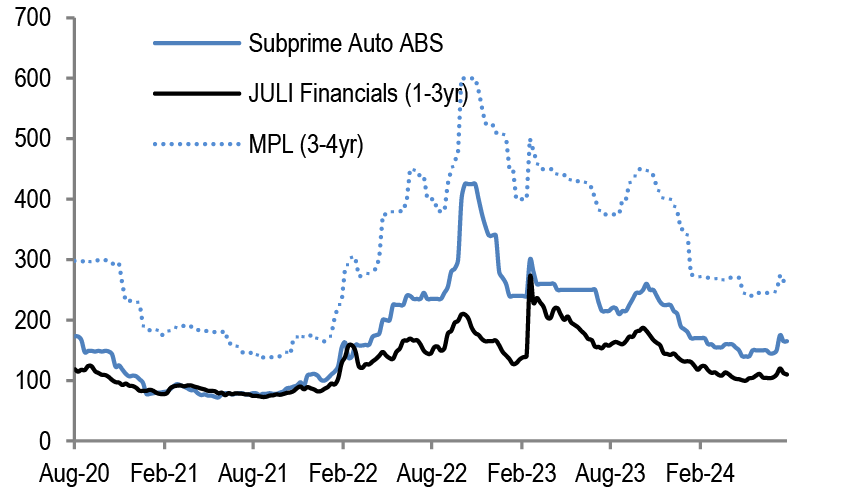

ABS spreads largely held firm over the month with relatively muted supply and as markets focused on opportunities in higher-yielding segments. Deals were marketed at wider initial price targets given the volatility this month, but final pricing was able to track within these margins given heightened oversubscriptions. Light primary dealer issue activity lent support to the secondary market this week, allowing dealers to off-load some inventory. Private credit student loan ABS tightened by 10-15bp across the capital stack. Meanwhile performance on our bankcard ABS index remains solid. Charge-offs have increased 6bp this year to 2.2% and these low losses coupled with high yields resulted in record high quarterly average excess spreads of 19.9%. Strong credit performance, robust demand, and the back-drop of a no-recession base case scenario should sustain spreads, though we note the potential for a likely heavy new issue ABS calendar alongside increased macro volatility come September (see ABS).

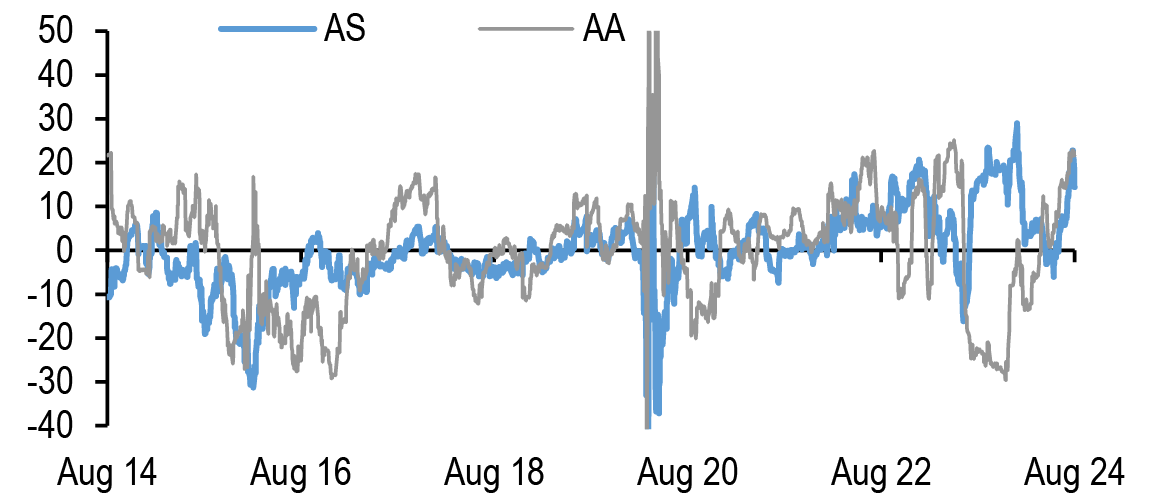

Issuance was similarly relatively light within CMBS markets over the past week. Benchmark CMBS spreads were slightly tighter, and valuations look fair relative to their corporate and mortgage comparables. Conduit IG mezz tightened more, with AS to single-As tighter 8-16bp over the week. We continue to see value in upper IG mezz bonds (AS and AA) which should be more insulated from near-term risks to the data but still look cheap relative to corporate comps and to the spread curve ( Figure 5). We also still see 5yr Agency CMBS as leaning cheap to current coupon Treasury OAS and ZVs. Our analysts review 2023 conduit CMBS property financial data, which indicates that net cashflow growth has slowed materially compared to recent years, with multifamily revenues in particular suffering from rising labor-related expenses and significantly rising insurance premiums (see CMBS).

Figure 4: Primary rates have edged lower, but lock volume is off the early August highs

GSE rate/term refi lock rates (%) and number of locks (#);

Source: Optimal Blue

Figure 5: Conduit CMBS upper IG mezz are cheap on the spread curve

Residuals from linear regressions* of 10yr conduit CMBS AS and AA Treasury spreads to those of adjacent tranches; bp

Source: J.P. Morgan

*Modeled spreads linearly regresses 10yr conduit CMBS AS spreads against 10yr conduit CMBS LCF AAA and 10yr conduit CMBS AA spreads over the last 10 years (R2 = 96%,SE = 8.8bp) and 10yr conduit CMBS AA spreads against 10yr conduit CMBS LCF AS and 10yr conduit CMBS A spreads over the last 10 years (R2 = 97%,SE = 12bp)

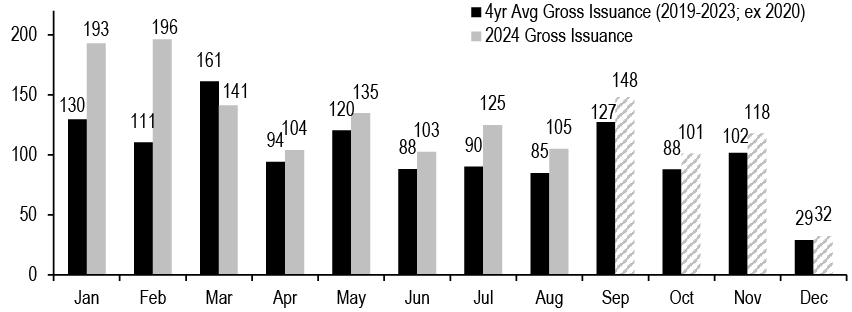

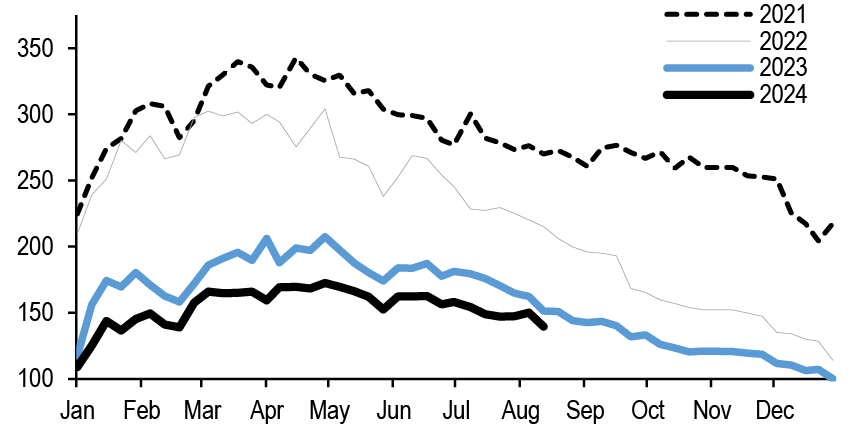

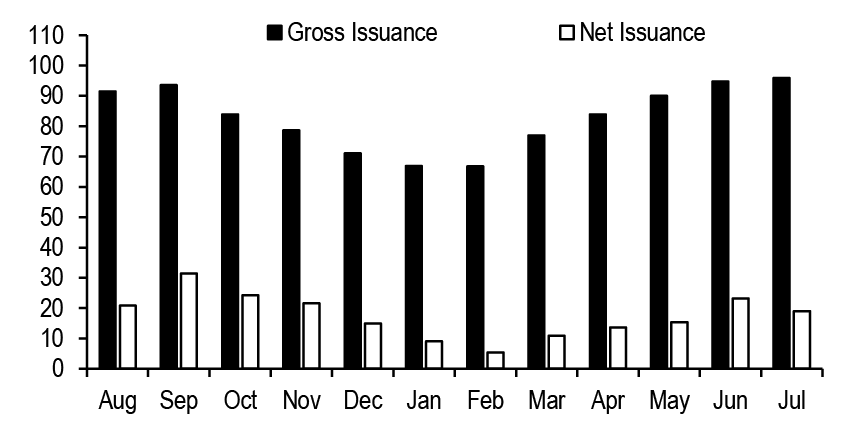

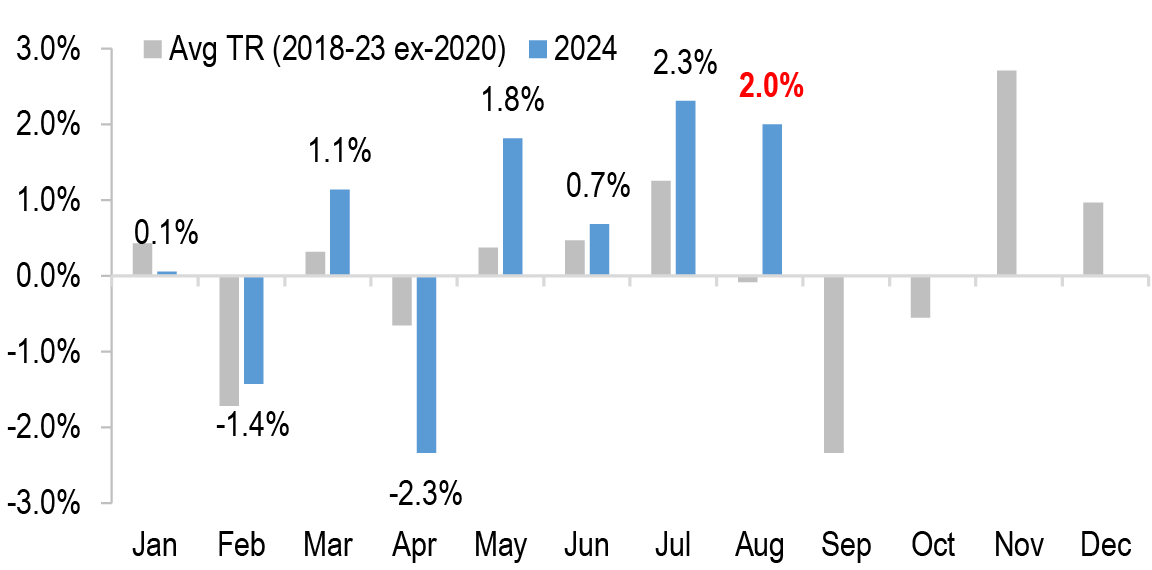

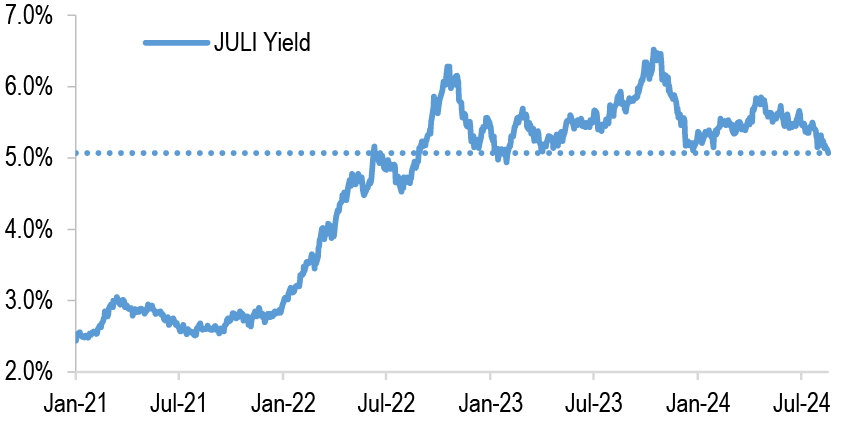

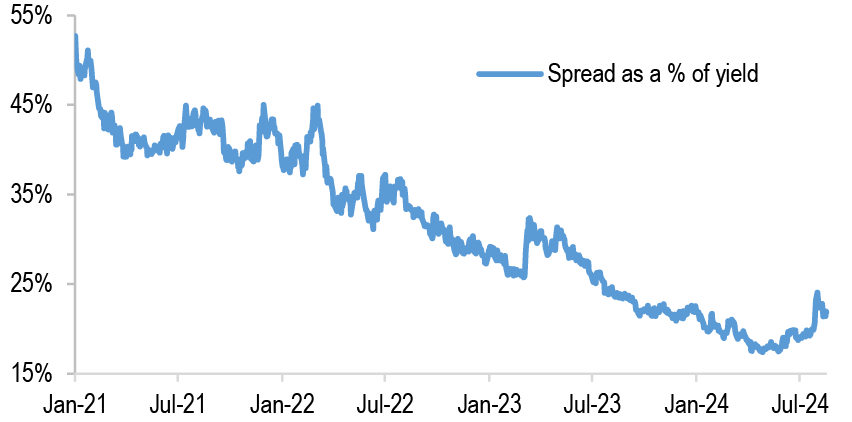

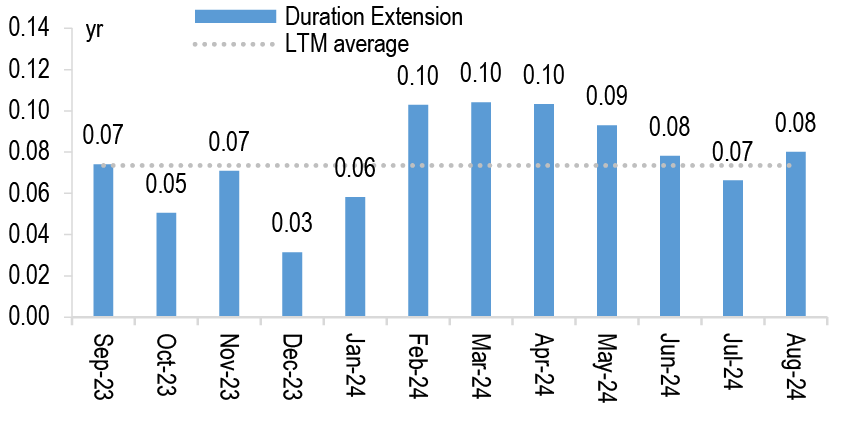

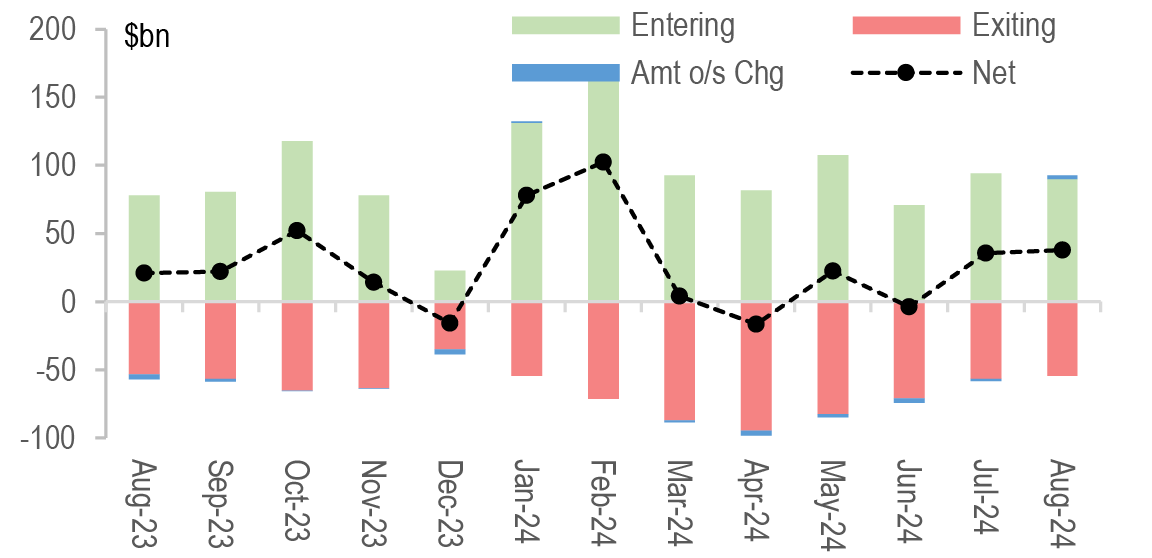

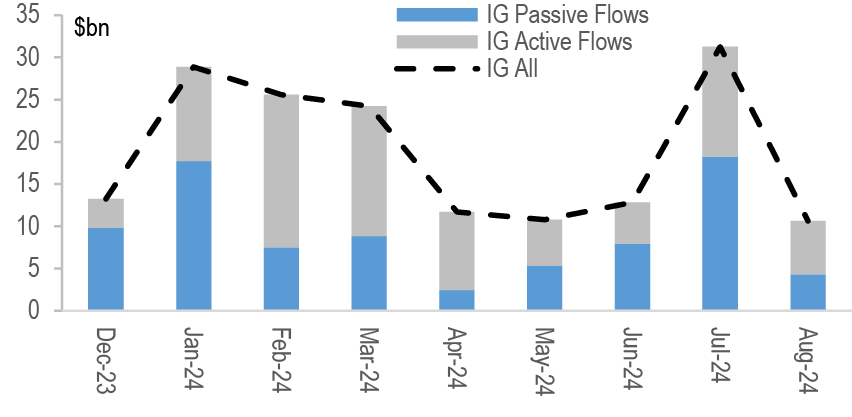

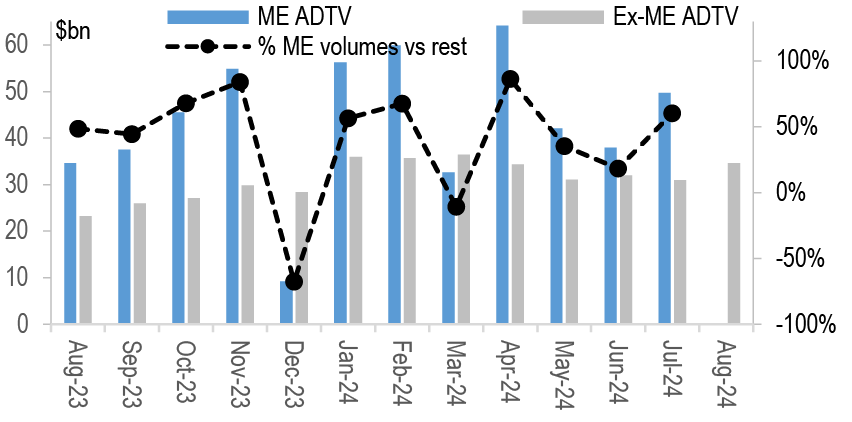

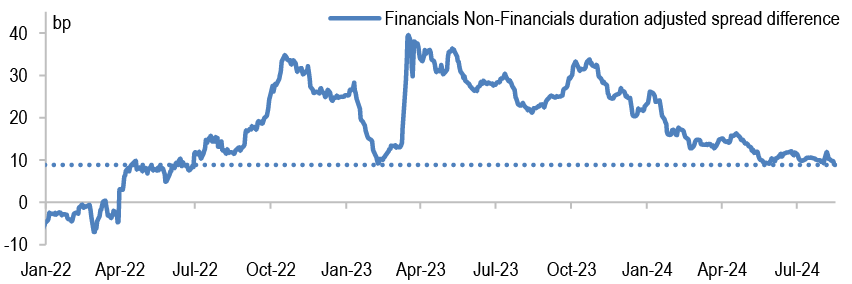

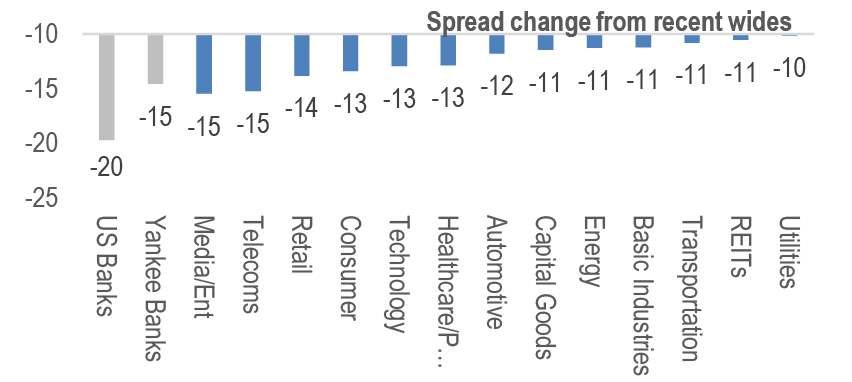

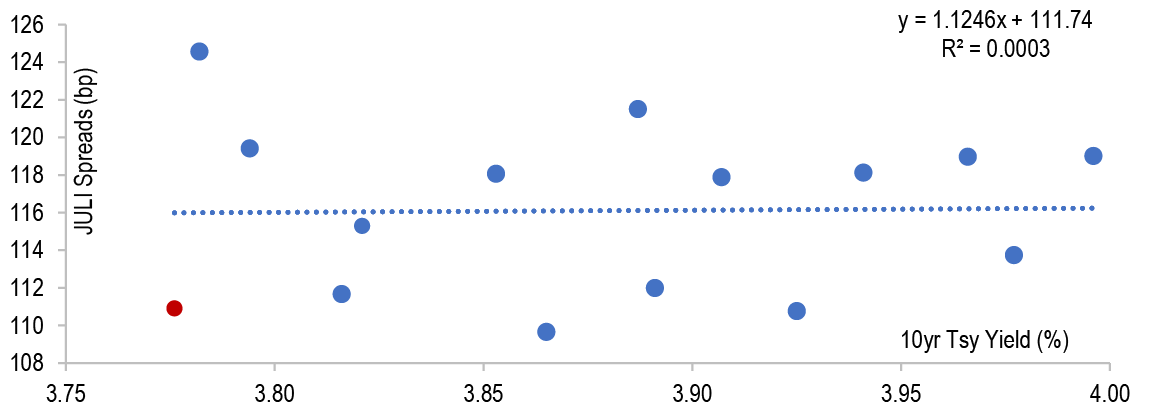

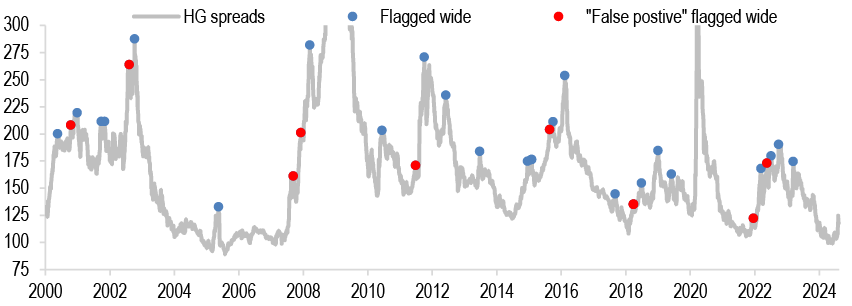

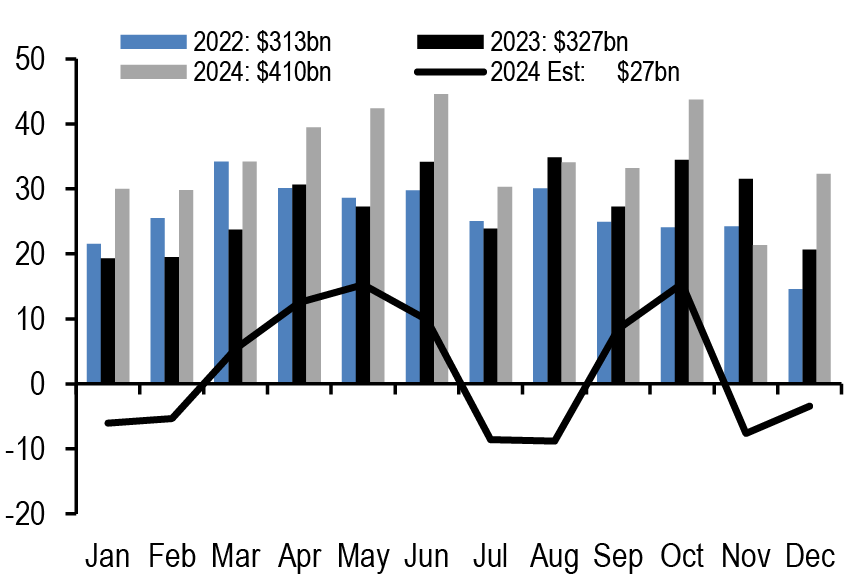

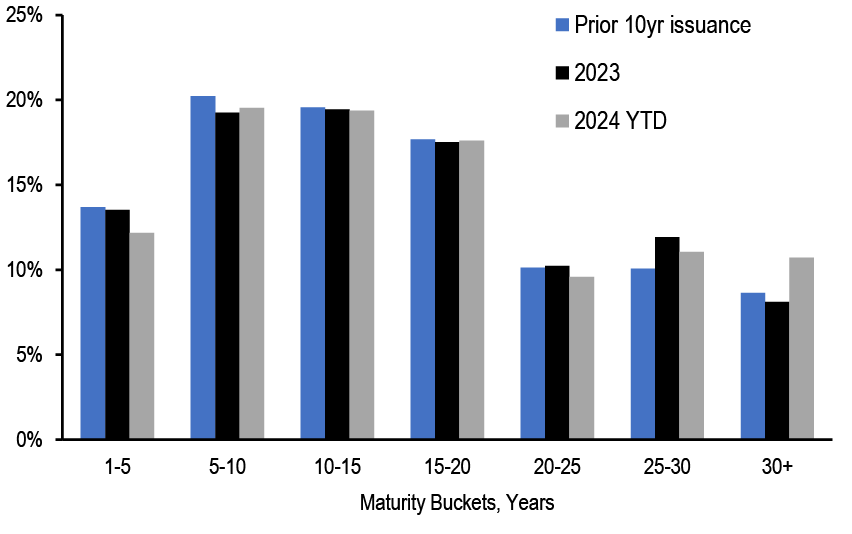

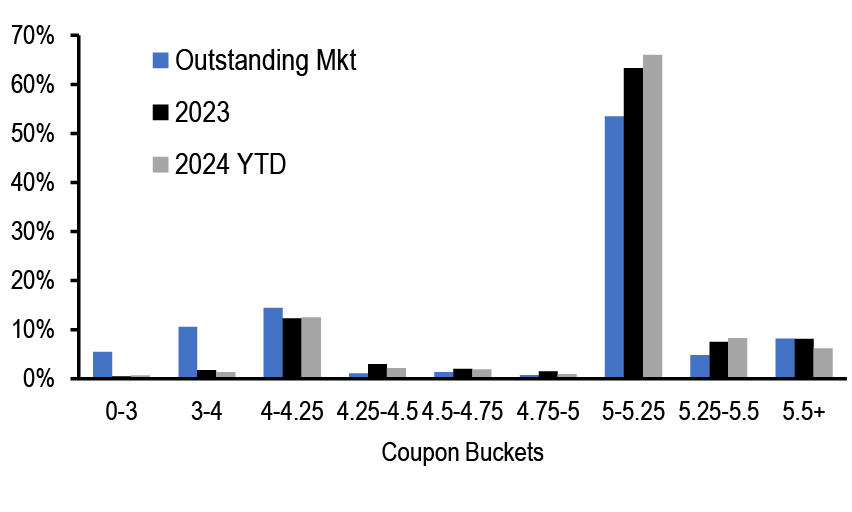

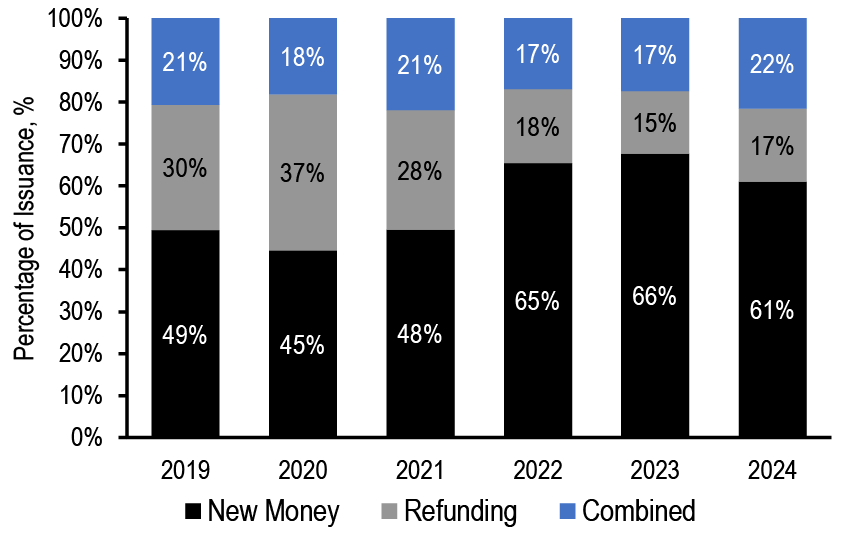

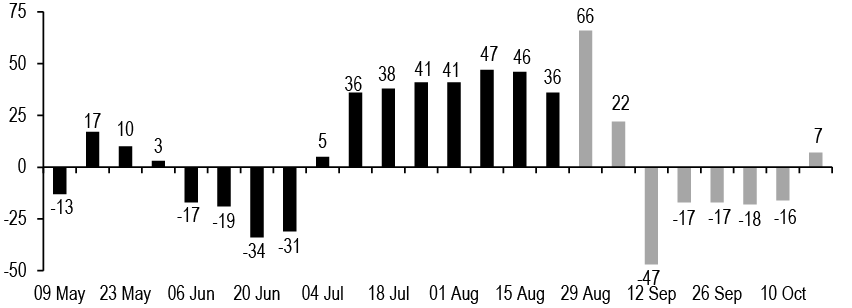

Turning to corporate credit, JULI spreads remained rangebound over the past week within a tight 109-112bp range and the stability of spreads in recent weeks comes despite declining yields and heavy corporate issuance. Supply has been active with $103bn priced in August, surpassing the historical average of $85bn. Instead we think spreads have benefited from the reversal of the equity sell-off following more encouraging economic data, seasonally unusually strong liquidity, and retail fund inflows. Indeed trading volumes averaging $35bn/day are 67% higher than the historical August pace, bucking the typical seasonal trend of late summer depressed liquidity, while fund flows have been robust averaging $5.3bn/week this month, likely driven by positive returns. Looking ahead, we recently revised higher our gross issuance forecast modestly to $1.5tn. Specifically, we expect $400bn in supply over the remainder of the year, a step down from the current pace, and this would leave roughly $150bn of supply come September according to historical seasonals ( Figure 6). In an environment where economic growth is slow but positive and the Fed lowers rates, we would expect spreads to remain near current levels. Meanwhile if the Fed does deliver on our projected easing forecast, we expect the percentage gap in yield between HG credit vs Treasuries to be near its widest YTD and this could spur the marginal duration buyer towards credit over rates (see Corporates).

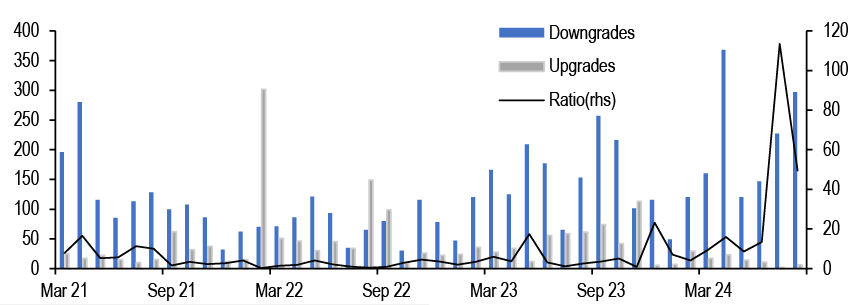

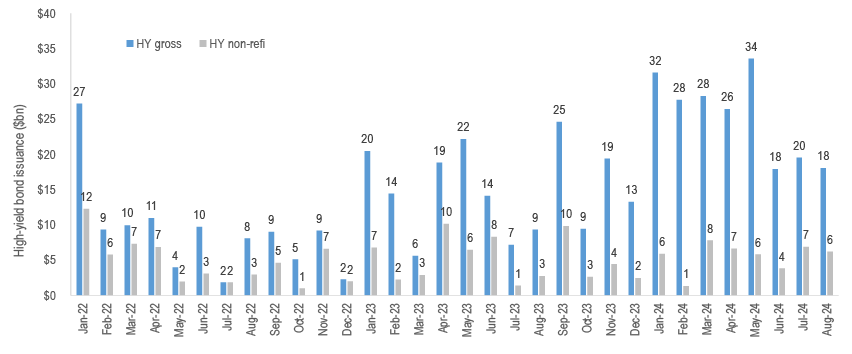

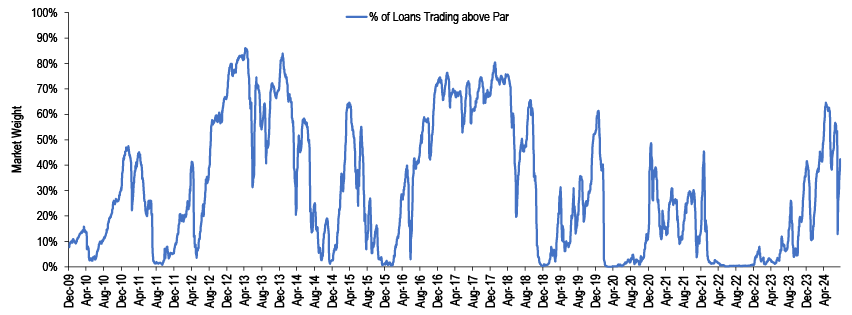

Down the capital stack, high yield spreads are 5bp tighter over the week while yields are at their lowest levels since August 2022 amid a Goldilocks narrative on growth without inflation. Month-to-date, BB spreads are tighter by 3bp while B and CCC spreads are now wider by 9bp and 33bp in August, respectively. Meanwhile the percentage of leveraged loans trading above par recovered to 42% amid improving growth sentiment, moderating retail outflows, robust CLO origination, and light capital activity. We note that the ratings profile for HY bonds is near its most benign on record, as the universe of single Bs contracted 440bp this year versus an expansion of 420bp for BBs and only a 20bp increase in CCCs. Conversely, the rating mix for loans is considerably weaker than bonds given the aggressive capital market activity earlier this year and a historic downgrade wave (see High Yield).

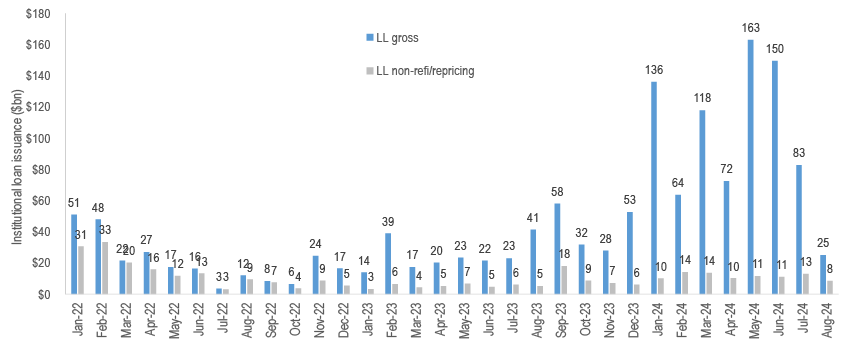

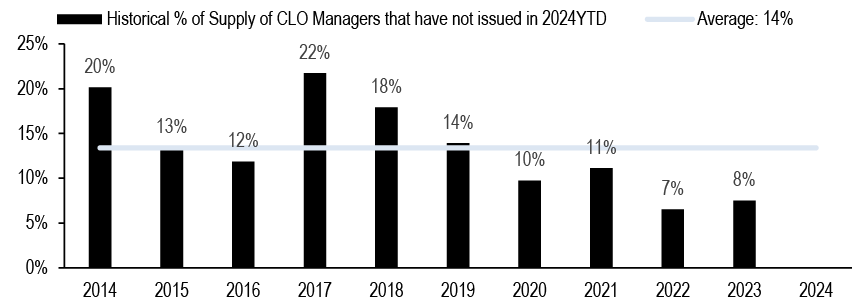

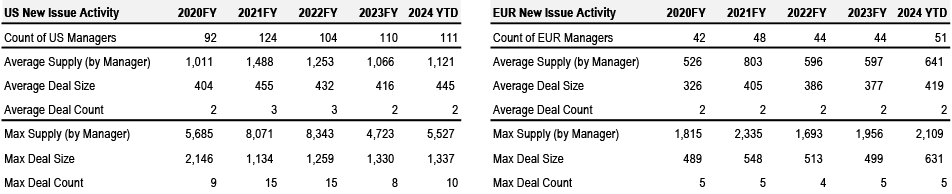

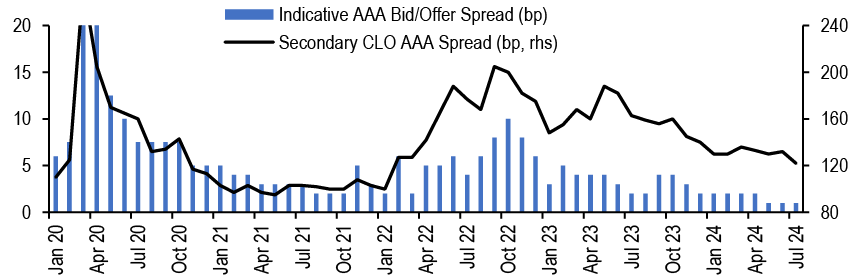

After a firm start to the year, US CLO supply has subsided in recent months with $12bn of new supply in August MTD compared to $24bn in May. We anticipate there will be a strain on new issuance over the coming months given challenging loan sourcing, rising recession risks, and Fed rate cuts. Spreads could soften as investors proceed with caution around market volatility. Meanwhile refi/reset activity has strong momentum with July the third heaviest month of all time at $27bn. Indeed there are 102 US managers that have refi’d/reset a deal this year compared to 42 last year as volumes have picked up (see CLOs).

Figure 6: We revise higher our gross issuance forecast to $1.5tn and expect $400bn for the remainder of the year. HG supply has exceeded the historical pattern in almost every month this year, and we expect this to continue through YE

4yr average gross issuance versus 2024 gross issuance*; bn

Source: J.P. Morgan

*The grey dashed bars are estimates based on historical pace and not our forecast

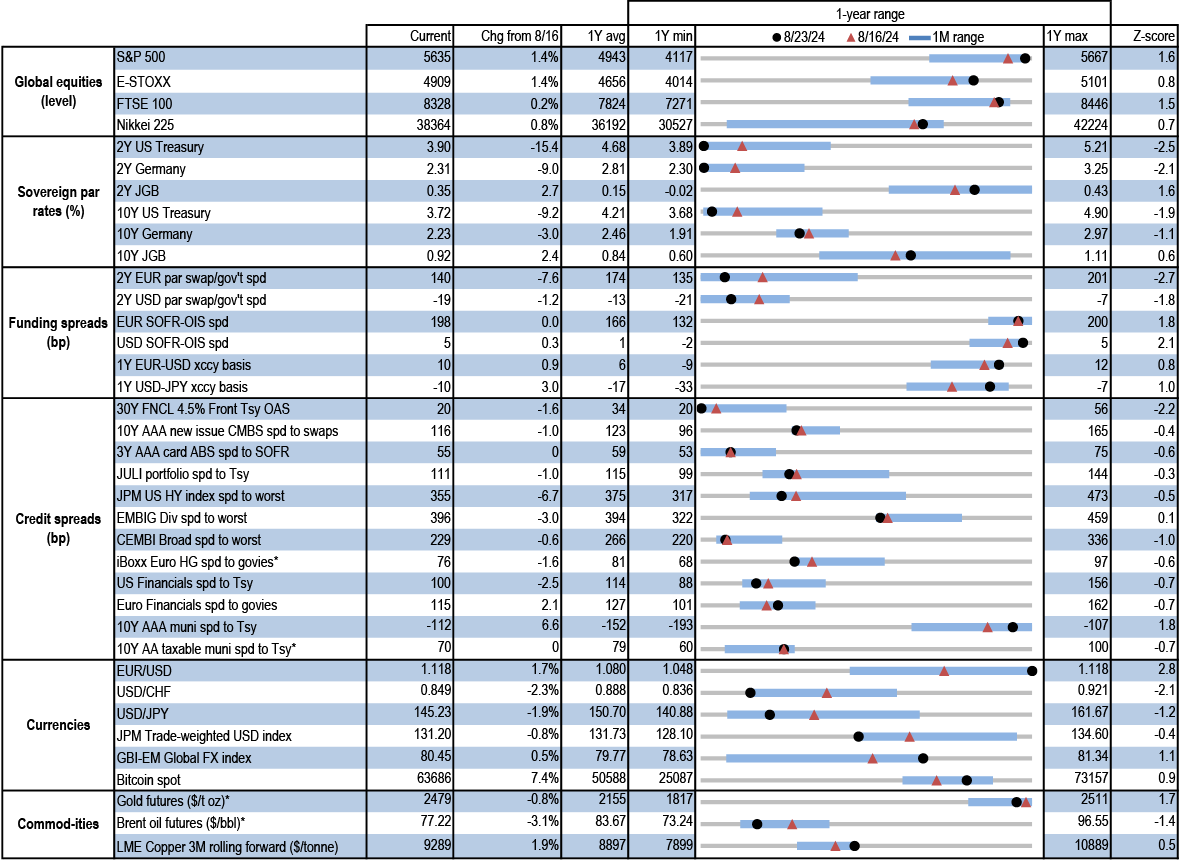

Figure 7: Cross sector monitor

Current levels, change since 8/16/24, 1-year average, minimum, maximum, and current z-score for various market variables; units as indicated

Source: J.P. Morgan, Bloomberg Finance L.P., ICE, IHS Markit

* 8/22/24 levels for iBoxx Euro HG, AA taxable munis, gold, and brent oil; 8/23/24 levels for all others

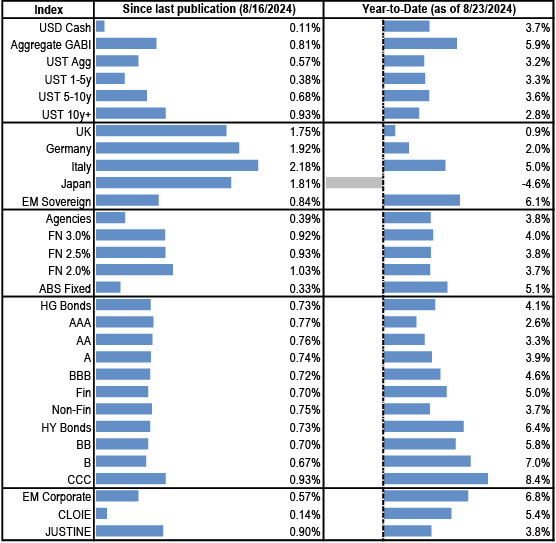

Figure 8: YTD returns on various fixed income indices; %

Source: J.P. Morgan

Economics

- Fed’s Powell: “The time has come for policy to adjust”

- Limited guidance leaves the debate over a 25bp or 50bp cut wide open; we continue to expect the latter...

- … but that will depend on the August jobs report after mixed labor market news this week

- Expected soft core PCE inflation in focus next

The path to rate cuts is now wide open. Fed communications this week—both the minutes to the late July FOMC meeting and Powell’s speech at the Jackson Hole conclave—were quite direct in signaling that policy rates will be reduced at the September meeting and presumably further in the fall and winter. Neither the minutes nor Powell shed light on the market’s current debate over a 25bp or 50bp cut next month, which makes sense given there’s almost a full monthly slate of data between now and the next meeting.

We still look for a 50bp cut in September. With risks to the inflation mandate ebbing and risks to the employment mandate growing, we think it makes sense for policy to be closer to neutral, which is likely at least 150bp below where rates are now. That said, the inconclusive nature of the Fed’s recent guidance with respect to pace suggests that the next employment report will dictate whether our forecast is realized or whether the Fed takes a more gradualist approach to easing.

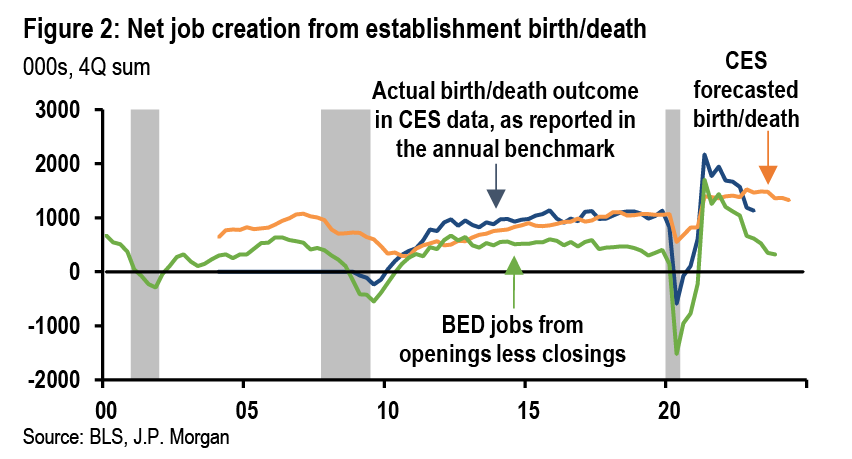

Staying on the topic of the labor market, the latest news has been mixed. Once again, weekly jobless claims remained tame, consistent with a healthy jobs market (Figure 1). However, the benchmark level of employment in March 2024 was revised down by a historically sizable 818,000 jobs. Data from the Business Employment Dynamics survey through December 2023 indicate that the BLS’s preliminary estimates of job growth attributable to the net of business births and deaths may have been overstated, and so it is possible that overstatement could extend beyond March 2024.

Next week promises to be relatively quiet before the fireworks of the data deluge after Labor Day. We expect next Friday’s core PCE figure will be up 0.12%m/m, which would leave the year-ago number unchanged at 2.6%.

Cuts are coming

Chair Powell’s remarks at the Jackson Hole forum left little room for doubt that the Fed will soon be cutting rates, as he frankly put it: “The time has come for policy to adjust.” He didn’t tip his hand on the expected size of that adjustment. Instead, he said “the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks.” While noncommittal on size, this was more open-ended guidance than what we’ve heard from some other Fed officials, who have recently spoken about “methodical” rate cuts. Overall, Powell’s remarks leaned dovish, as he stressed the FOMC’s attentiveness to labor market conditions. Powell did not express worry about the current state of the labor market, but also offered that the Fed does “not seek or welcome further cooling in the labor market.”

We continue to look for the Fed to start off the easing cycle with a 50bp cut next month, though that will depend in part on the August jobs report. As Powell noted, “The current level of our policy rate gives us ample room to respond to any risks we may face, including the risk of unwelcome further weakening in labor market conditions.” If the August jobs report validates the July weakness, then we believe they should quickly make use of that ample room.

While the labor market headlines stuck out, Powell also expressed growing confidence in inflation returning to 2 percent. In fact, much of the body of the speech was a retrospective on inflation developments over the past four years. In that, he attributed “much of the increase in inflation to an extraordinary collision between overheated and temporarily distorted demand and constrained supply.”

Earlier in the week, the minutes to the July 30-31 FOMC meeting (which occurred just before the release of the weak July labor report) similarly skewed dovish and showed a committee more focused on labor market risks than the possibility of a renewed jump in inflation—even if they still judged current inflation as somewhat elevated. While “several” had contemplated cutting 25bp at the last meeting, a “vast majority” were prepared to cut at the September meeting, and “many” saw policy as currently restrictive.

Like many others, participants were trying to understand how much of the unemployment rise reported at the time of the meeting was due to rising labor supply and how that rise should be weighed against less concerning news from new jobless claims and layoff rates. On balance, however, they did not appear to be discounting the increase. Moreover, the Committee was anticipating the possibility of downward payroll revisions, and “several assessed that payroll gains may be lower than those needed to keep the unemployment rate constant with a flat labor force participation rate.”

The labor market giveth, and taketh away

In an otherwise fairly quiet data week, jobless claims were comforting in their recent stability but the unexpectedly large preliminary benchmark revision to payrolls cast a broader pall over markets. Data on initial claims were collected during the reference week for the payroll survey, and do not point to another step down in job growth for August. It’s unclear how much signal for upcoming job growth one should take from the 818K preliminary downward revision to March 2024 payrolls—the final revision will take place early next year—but it helped narrow some of the unusually wide gap between the establishment and household measures of employment. The revisions suggest CES job growth likely averaged around 175K for the 12 months through March, rather than the 242K per month on average as reported, although history suggests a slightly smaller final revision is common. That said, the possibility that payrolls are still being overstated since March 2024 remains: the birth-death model looks to still be adding more jobs than recent (albeit lagged) data from the Business Employment Dynamics suggest is likely (Figure 2).

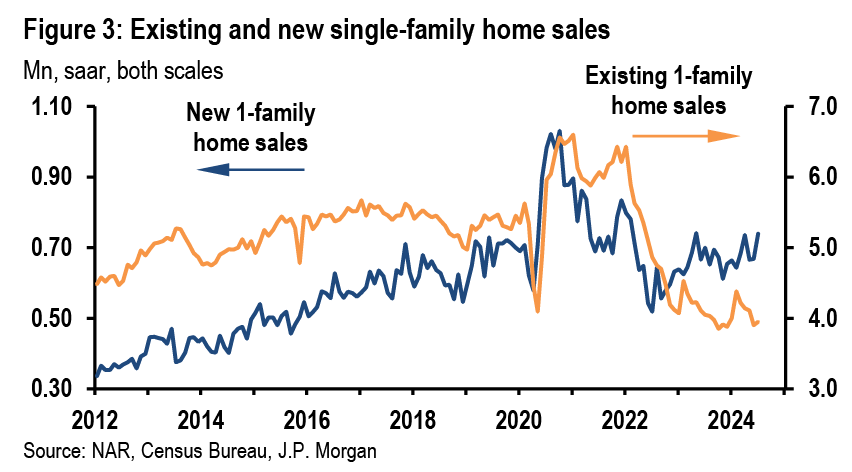

Mixed signals from home sales

After a pop near the start of the year, most housing market data have trended back down over the past several months. For July, new home sales surprised with a strong 10.6% pop, whereas existing home sales modestly disappointed with a more paltry 1.3% rise. Most importantly, the July single-family new home sales release came with substantial upward revisions to prior months that suggests a better trajectory for this year (Figure 3). New home sales tend to be volatile but they also tend to lead existing home sales (as the former reflects signed contracts while the latter are not recorded until a contract is closed). However, other leading indicators of existing home sales, such as mortgage purchases applications or pending home sales, continue to point to existing home sales remaining stuck at low levels. Inventories of existing homes remain low, although as interest rates come down that could stimulate sales later this year. By contrast, inventories of new homes remain quite elevated, which is restraining price growth and likely weighing on housing starts.

Divergent flash PMI details

In a sign of stability, the all-industry flash PMI for August (54.1) was nearly unchanged from July (54.3). But beneath the headline, the details offered divergent messages. First, looking across sectors, the manufacturing index fell to 48.0. This marks the second consecutive monthly decline, reversing much of its gradual improvement since early 2023 and taking the index to its lowest level since December. The weakness in the manufacturing PMI appears broad-based across survey components. By contrast, the business activity headline for services firmed marginally to 55.2 in August, with new business activity also well supported. While there has been some speculation that services activity would cool as the post-pandemic recovery normalized and the prospect of lower interest rates gave a lift to manufacturing, in reality the services sector remains the main impetus for the continued economic expansion.

Second, the employment flash PMI sent a concerning signal ahead of the August jobs report, with the all-industry measure sliding to its lowest reading in this cycle (outside of April) of 48.9. Weakness was evident in both the manufacturing and services PMIs, although the latter has been quite choppy of late. That said, we do not tend to take much of a signal from this report for the upcoming payroll print as monthly moves in the employment PMI are not particularly informative for the jobs report.

Next week we will get inflation readings in the monthly PCE report but not much labor market news other than the weekly claims. The most important piece of information will arrive after Labor Day with the August jobs report, which might incorporate a very modest post-Beryl addition to payrolls.

Excerpted from, United States Data Watch , Michael Feroli, August 23, 2024

Treasuries

Your time has come

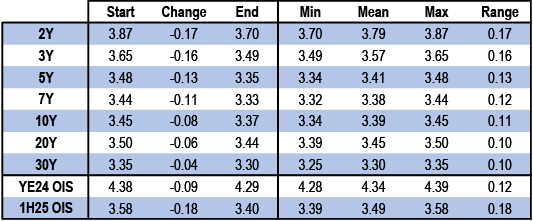

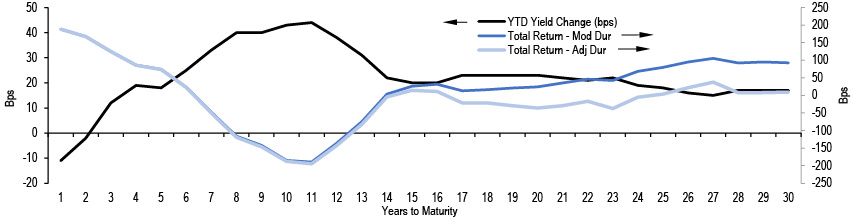

- The Treasury curve bullishly steepened this week supported by the July FOMC meeting minutes and Chair Powell’s speech at Jackson Hole, as both indicated a step in the dovish direction

- Given Powell’s concerns over further cooling in labor markets and his acknowledgement that there is significant room to lower policy rates, we think this supports our forecast of 50bp cuts in September and November, before downshifting to 25bp thereafter

- At face value, with money markets pricing a slower pace of cuts than our forecast, this suggests we should be overweight duration. However, we think it will require a weak August employment report to price a more dovish path for the Fed. With valuations no longer cheap and dealer balance sheets somewhat bloated, we prefer to be patient before adding duration

- In the meantime, this also supports a steeper curve at the long end, as the first cut approaches and the Fed begins to ease consistently. At the long end, steepeners with shorts anchored in 30s offer more value than those anchored in 20s, and we continue to favor 5s/30s to express our core view

- Front-end steepeners should outperform if the Fed eases aggressively, but 2s/5s appears too steep in our framework and incurs significantly negative carry. On margin, 3s/7s looks more attractive for those who want to position for the risk of a quicker and more aggressive easing cycle

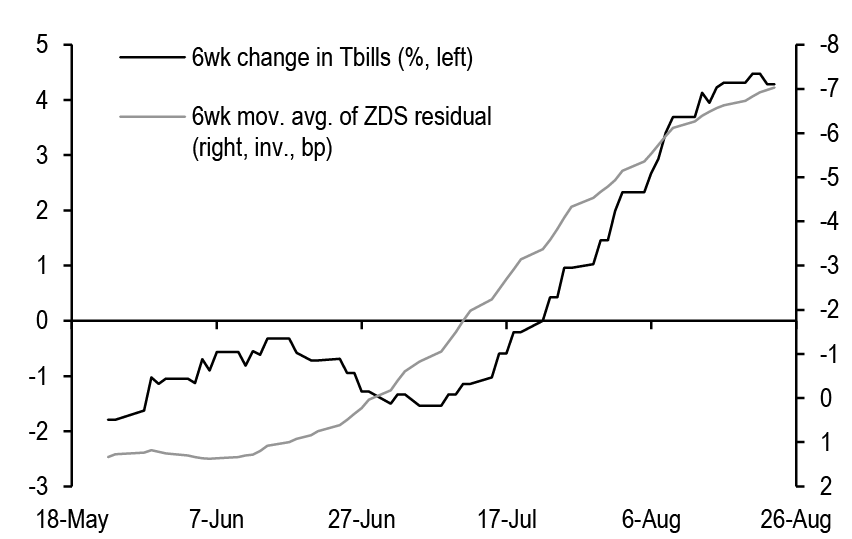

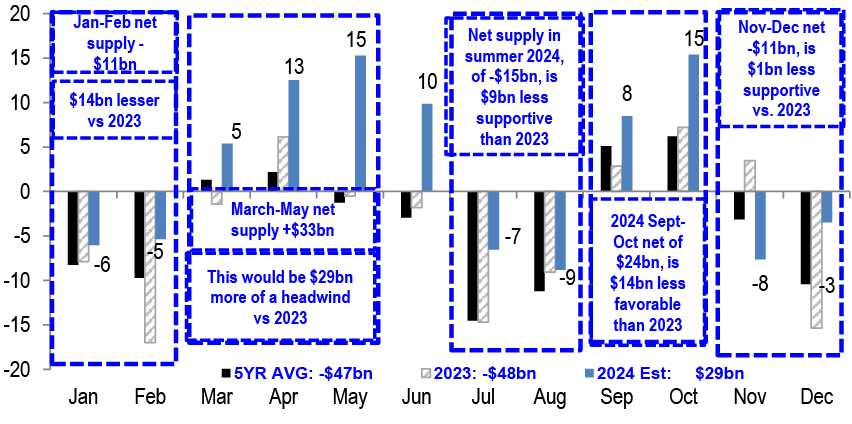

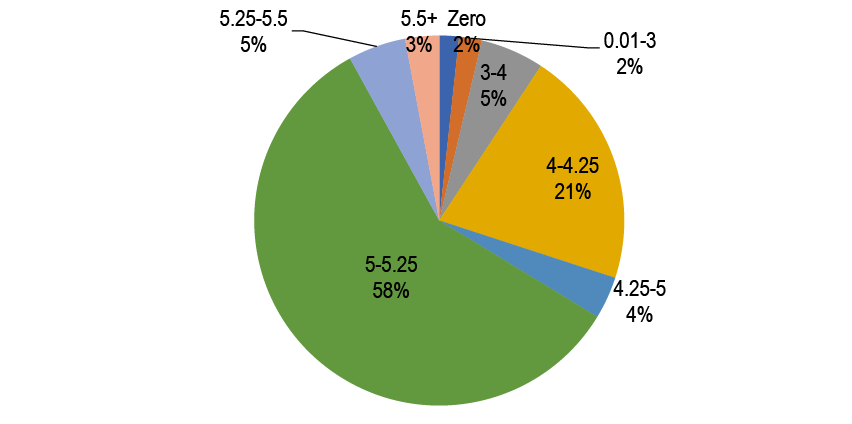

- The period of positive net T-bill issuance is set to come to a seasonal close in early-September as we approach the corporate tax date. Longer-dated T-bills are trading at the cheap end of their recent range, but with issuance set to turn negative, dealer positions at average levels and our derivative colleagues biased toward wider swap spreads, we see scope for richening over the near term

Market views

The Treasury curve bullishly steepened this week, supported by the July FOMC minutes and Chair Powell’s speech at Jackson Hole, both of which read dovishly. The July minutes indicated the Committee’s confidence in inflation returning to 2% had increased, while in June, participants had emphasized the need to see more data. There was also heightened focus on the risk that continued easing in labor market conditions could transition to a more serious deterioration, and it’s no surprise in this context that participants saw the upside risks to the inflation outlook as moderating, while the downside risks to labor market weakening were increasing. Finally, “the vast majority observed that, if the data continued to come in about as expected, it would likely be appropriate to ease policy at the next meeting” (see July FOMC minutes highlighted labor market risks, Abiel Reinhart, 8/21/24).

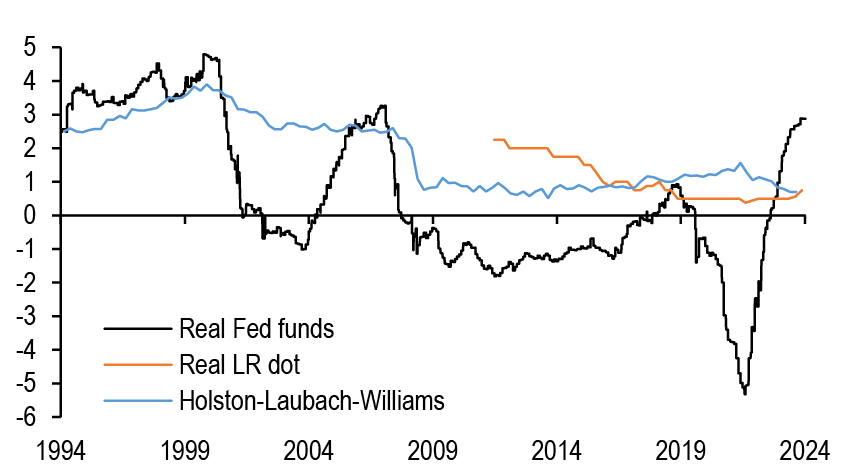

Chair Powell advanced the discussion further at Jackson Hole on Friday, saying “The time has come for policy to adjust. The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks.” This was a bit of a departure from speakers earlier this week who framed the expected pace of cuts as either “gradual” or “methodical.” What’s more, the balance of risks has shifted to the labor markets, as Powell offered, “We do not seek or welcome further cooling in labor market conditions.” Finally, the Chair stated, “The current level of our policy rate gives us ample room to respond to any risks we may face.” As we discussed last week, the real Fed funds rate is approximately 2.75%, a full 200bp above the Fed’s real longer-run dot. Using either the Fed’s longer-run dot (with data back to 2012) or the Holston-Laubach-Williams r* estimate, policy rates were negligibly restrictive in 2019, and only about 100bp restrictive in mid-1995 before the first cut, suggesting policy rates are highly restrictive ( Figure 9). Unsurprisingly, our monetary policy NLP read Powell’s speech as more dovish than his press conference at the July FOMC meeting, and his most dovish speech since the fall of 2021 ( Figure 10, also see Fed, Powell: Review and Outlook, Joseph Lupton, 8/23/24).

Figure 9: Policy is highly restrictive right now, underscoring Chair Powell’s point that there is “ample room to respond”...

Real Fed funds rate*, real longer-run median Fed dot, and Holston-Labach-Williams natural rate of interest rate; %

Source: J.P. Morgan, Federal Reserve bank of New York, Bloomberg Finance L.P

* Fed funds target less core PCE oya

Figure 10: ...and today scores as his most dovish speech in nearly 3 years

Jerome Powell Hawk-Dove history, using speeches, testimonies, and press conferences

Source: J.P. Morgan* For methodology, see Listen up: Upgrading J.P.Morgan’s central bank NLP machine, Joseph Lupton and Dan Weitzenfeld, 7/2/24

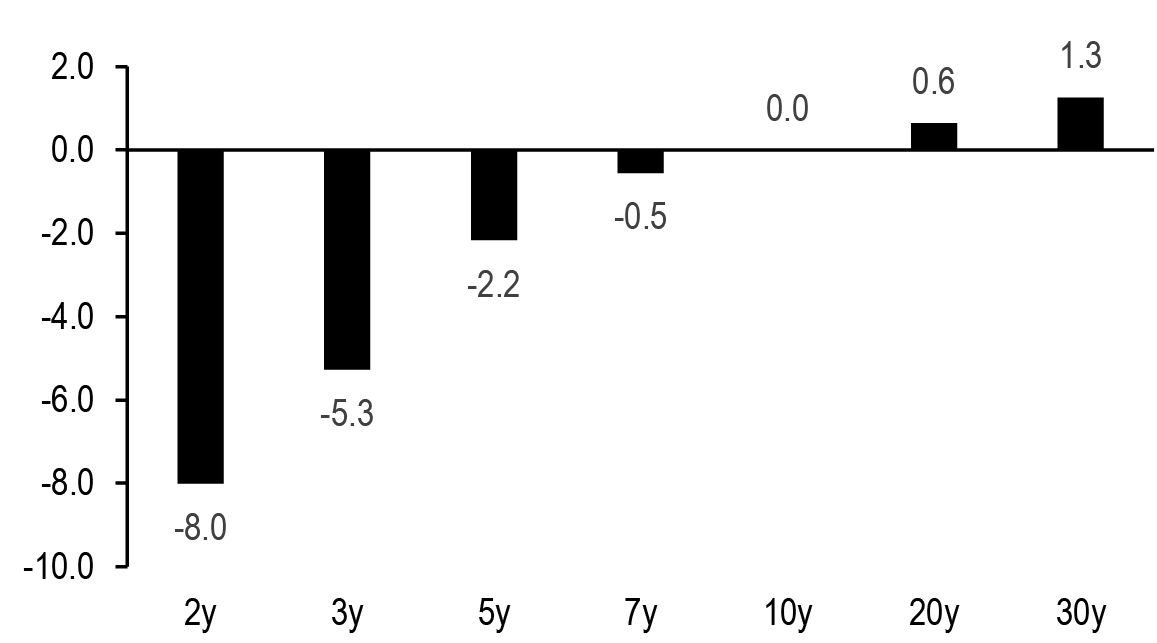

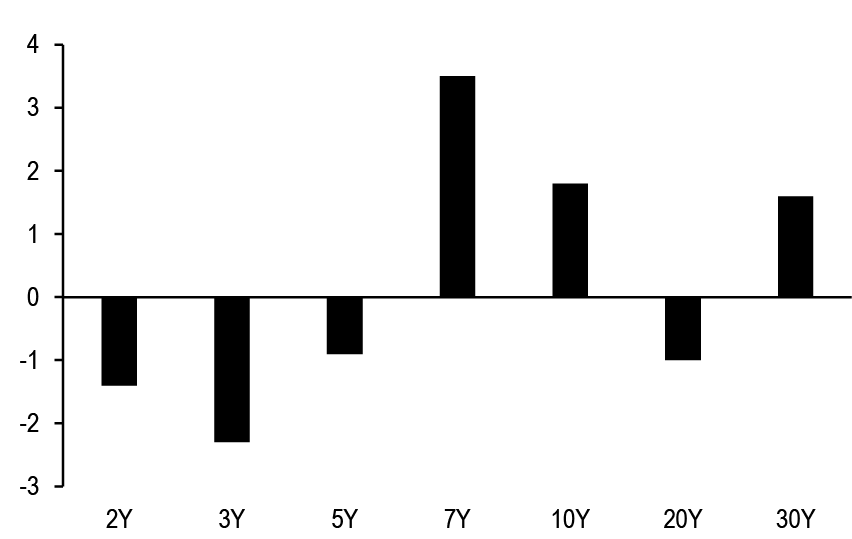

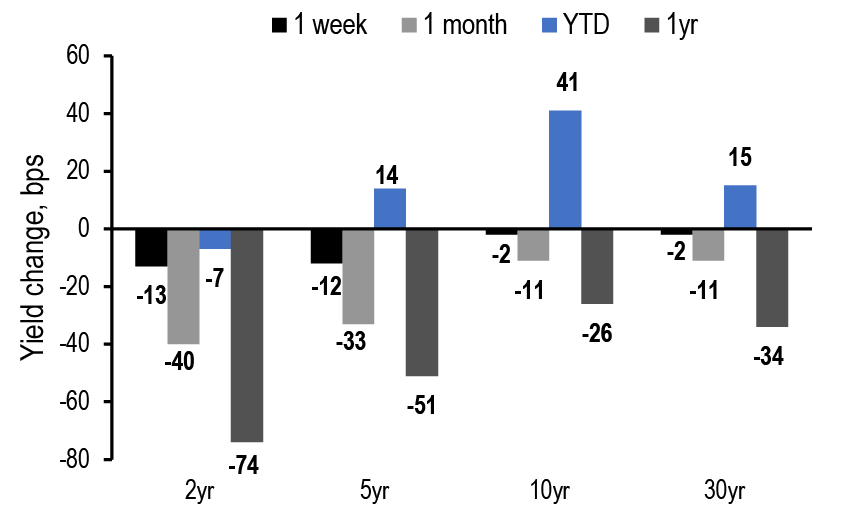

On the week, 2-, 5-, 10-, and 30-year yields declined 15bp, 12bp, 9bp, and 5bp, respectively. Considering the recent sensitivities of most points along the curve, the steepening is more pronounced than would be expected by the decline in front-end yields. Figure 11 shows that adjusting for the 3-month beta to changes in 10-year yields, the short- to intermediate sector strongly outperformed this week. However, we think some mean reversion is at work here. The primary driver of most curve slopes is the market’s medium-term Fed policy expectations, and late last week, the curve had flattened more than would be implied by the move in 2-year yields. With these moves, the curve appears more appropriately priced after adjusting for the level of 2-year yields ( Figure 12).

Figure 11: The front-end outperformed on a beta-adjusted basis this week...

Actual change in yields by sector over the past week minus the change implied by the 3-month beta with 10-year yields; bp

Source: J.P. Morgan

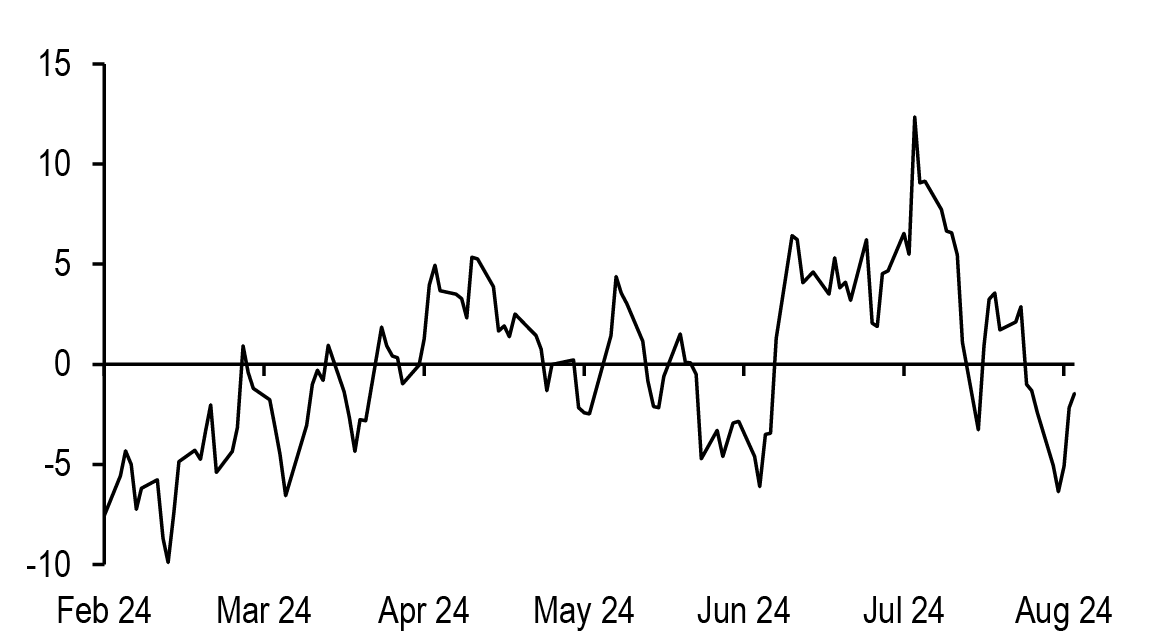

Figure 12: ...but we think this reflects mean reversion from flat levels

Residual of 5s/30s Treasury curve regressed on 2-year Treasury yields*; bp

Source: J.P. Morgan

*6-month regression. R-squared = 87.2%, SE = 4.2bp

Looking ahead, we continue to forecast 50bp cuts in September and November and think Chair Powell’s comments today leave the door open to this outcome. Our forecast is driven by two different factors. First, the disinflationary process has resumed in a more broad-based fashion than observed in 2H23, considering there has been disinflation in core goods, services ex-shelter, and shelter. Second, the ongoing loosening of the labor markets has reduced the risk that services prices remain sticky to the upside. OIS forwards are pricing in approximately 103bp of easing over the balance of this year, versus our 125bp forecast, and this would indicate there is value to being long duration at current levels. However, the August employment report is still two weeks away, and validation of the weak July data will be needed to price in more aggressive easing this year. This is particularly important, as final demand remains strong, and our US FRI has moved higher, as we’ve recently revised up growth forecasts for the current quarter ( Figure 13). Thus, we do not think the debate about pace will be settled until the release of the August employment report on September 6.

Figure 13: Labor markets will be key in determining the pace of cuts, as our growth forecasts have been revised higher in recent weeks

J.P. Morgan US growth Forecast Revision Index;

Source: J.P. Morgan

Figure 14: 10-year Treasuries are no longer cheap after adjusting for their fundamental drivers, and we think an overshoot to the downside is unlikely in an environment in which term premium is biased higher...

Residual of J.P. Morgan 10-year Treasury fair value model*; bp

Source: J.P. Morgan, Federal Reserve, US Treasury

* Regression of 10-year Treasury yields on 5Yx5Y seasonally-adjusted TIPS breakevens (%), 3m3m OIS rates (%), Fed policy guidance (months), J.P. Morgan US Forecast Revision Index (%), and SOMA share of outstanding marketable US Treasury debt, excluding T-bills (%). Regression over the last 5-years. R-squared = 97.8%, SE = 20.1bp

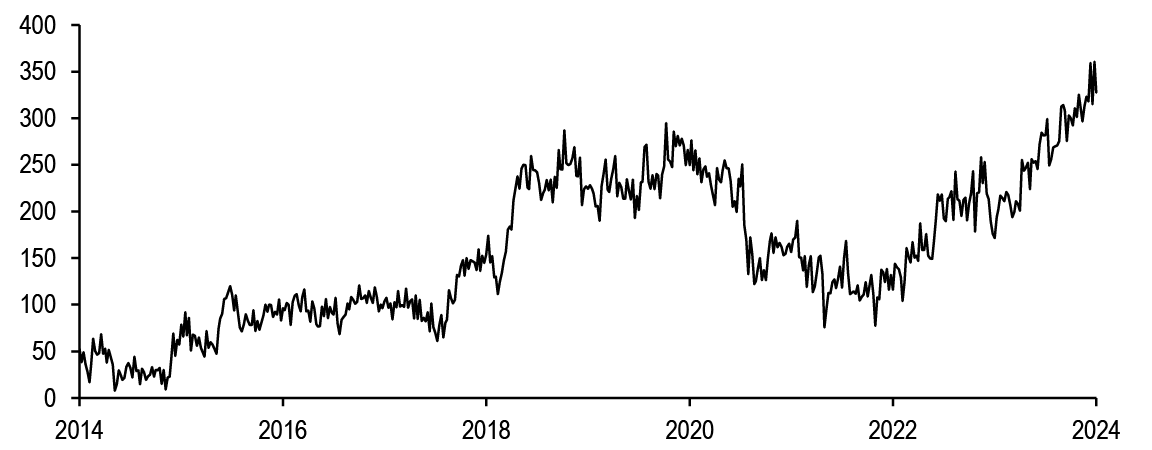

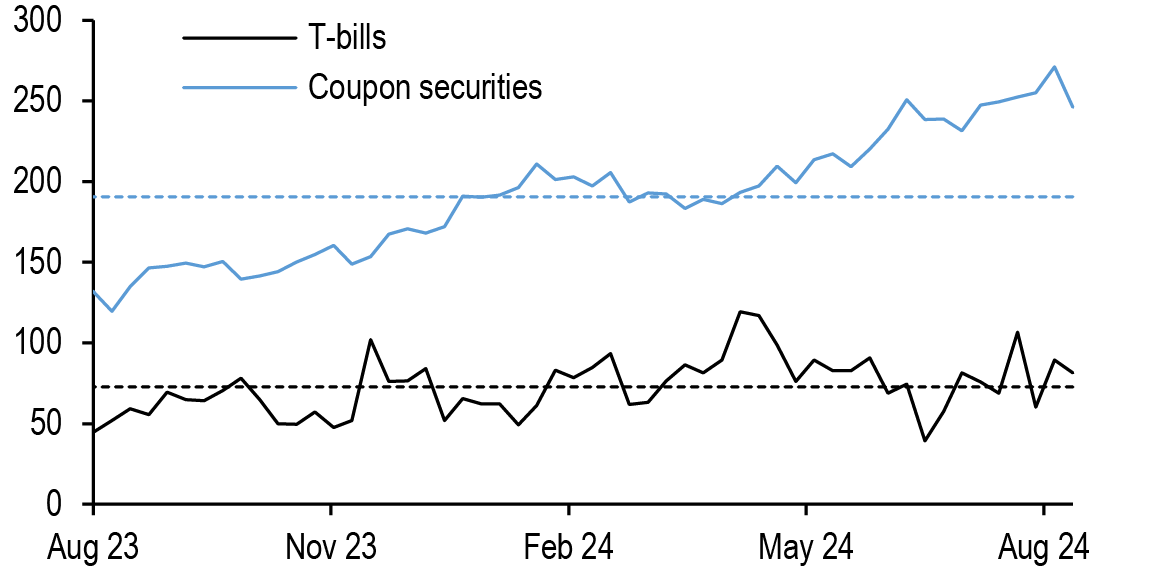

Valuations are relatively neutral as well, as yields in the intermediate sector no longer appear cheap to their fundamental drivers: Figure 14 shows 10-year Treasuries are fairly valued when controlling for their market’s medium-term Fed policy, inflation, and growth expectations. Given that the first expected cut is now less than a month away, one could argue there is room for yields to overshoot to the downside, but as the figure shows, Treasuries have not traded significantly rich relative to their drivers since “immaculate disinflation” was the market’s narrative in late 2023. Moreover, the current environment, in which the Treasury market continues to grow more rapidly than its traditional constituents of demand, term premium is biased higher, which should make it hard for valuations to overshoot the rich side of fair value (see In the eye of the beholder, 9/12/23). We can observe this dynamic to a certain extent in the evolution of primary dealer positions, which have increased nearly 30% in coupons this year, as more price sensitive demand has yet to appear ( Figure 15). Given this backdrop, we continue to recommend patience before adding duration, but given the sensitivity of the Fed’s reaction function to the labor markets, we will reevaluate as we get closer to the release of the August employment data.

Figure 15: ...which we think is reflected in the considerable rise in dealer positions over the last year

Primary dealer positions in Treasuries (excluding T-bills); $bn

Source: Federal Reserve Bank of New York

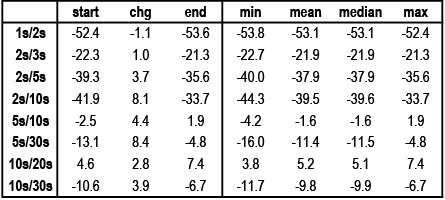

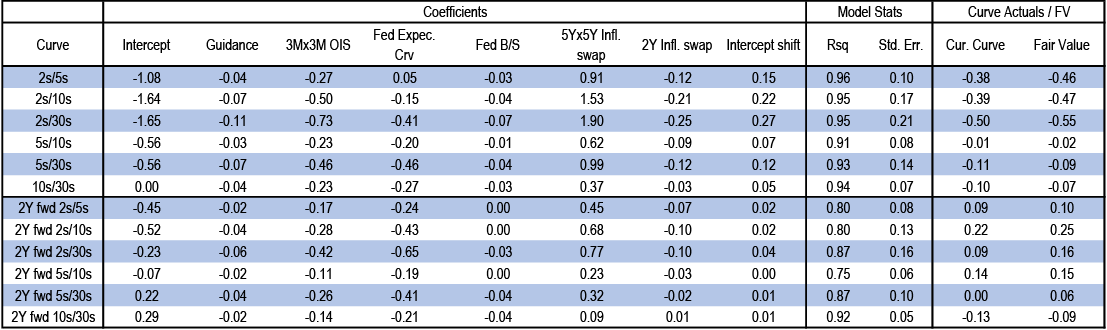

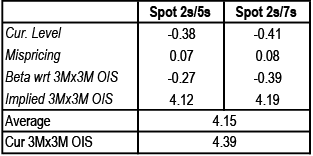

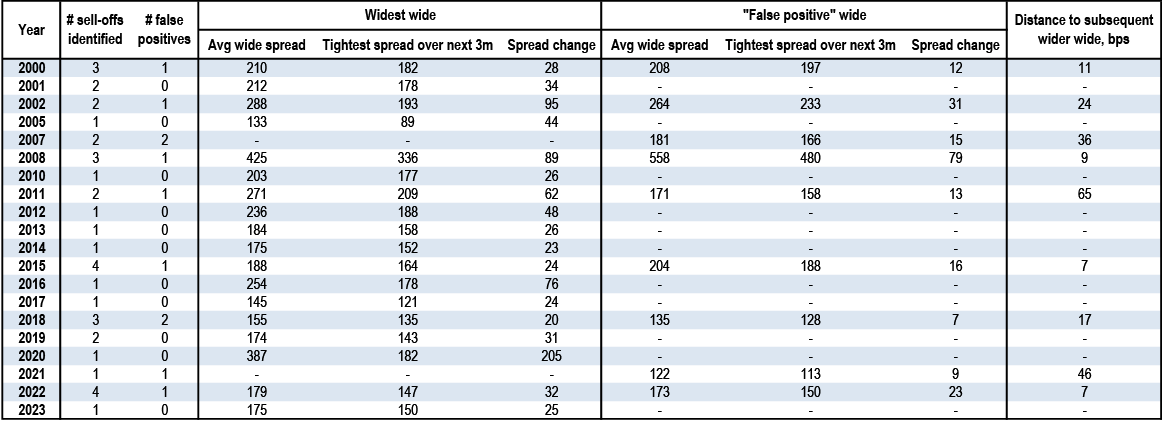

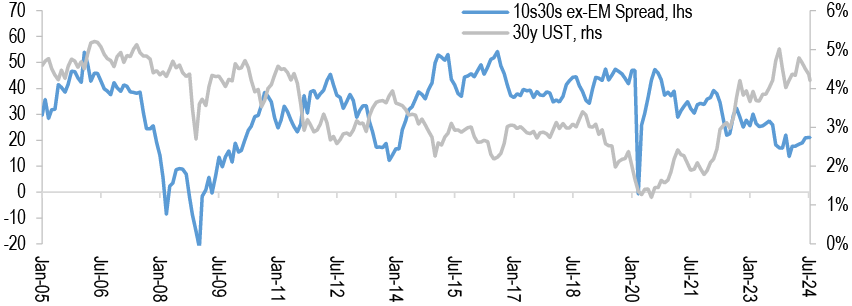

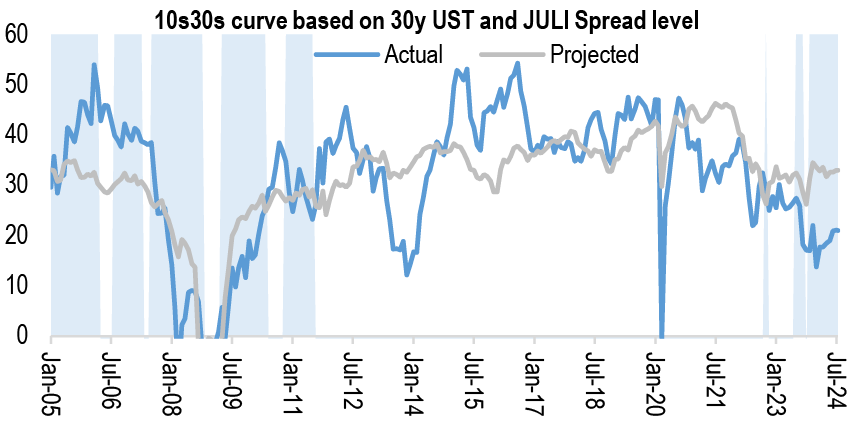

Powell’s comments and his implicit acknowledgment that policy is significantly restrictive validate the view that there is significant room to normalize policy rates from current levels, which should support further broad steepening. The periods just prior to and around the beginning of an easing cycle are supportive of long-end led steepening, and we believe this leaves further room for the long end to steepen from current levels. Moreover, our medium-term valuation framework also suggests there is value in steepeners at current levels as well: Figure 16 shows that the market’s medium-term Fed policy and inflation expectations, as well as the Fed’s ownership share of the Treasury market have been highly significant in explaining the variation in most Treasury curve pairs over the last three years. 5s/30s is flagging as fairly valued after controlling for these drivers, while curve pairs with the long leg anchored in 20s appearing too steep, reflecting the recent cheapening of this sector. Thus, we continue to recommend 5s/30s steepeners as the medium-term expression of our bullish view as we move into an easing cycle.

Figure 16: Our curve models indicate long-end steepeners with shorts anchored in 30s are fairly valued, while most front-end pairs appear too steep relative to their drivers, with the exception of 3s/7s

Statistics for various Treasury curves over the last 3 years, with statistics from 3-year regressions on 1y1y OIS (%), 5Yx5Y TIPS breakevens (%), and Fed share of the Treasury market (%); bp unless otherwise indicated

| Curve | Last | Min | Max | Avg | % | R^2 | Partial betas | Residual | Z-score | ||

| 1y1y OIS | 5y5y BE | Fed share | |||||||||

| 2s/5s | -26 | -78 | 78 | -17 | 59% | 73% | -0.30 | 0.65 | 0.02 | 3.6 | 0.2 |

| 2s/7s | -21 | -91 | 108 | -15 | 65% | 74% | -0.39 | 0.74 | 0.01 | 0.6 | 0.0 |

| 2s/10s | -11 | -109 | 129 | -17 | 70% | 75% | -0.47 | 0.82 | -0.01 | 2.6 | 0.1 |

| 2s/20s | 28 | -96 | 179 | 16 | 70% | 77% | -0.52 | 0.71 | -0.01 | 6.9 | 0.3 |

| 2s/30s | 19 | -119 | 184 | 2 | 73% | 81% | -0.59 | 0.82 | -0.03 | 3.0 | 0.1 |

| 3s/7s | -2 | -55 | 81 | -6 | 70% | 77% | -0.27 | 0.40 | -0.02 | -4.1 | -0.3 |

| 3s/10s | 8 | -76 | 103 | -8 | 77% | 79% | -0.35 | 0.47 | -0.03 | -2.1 | -0.2 |

| 3s/20s | 46 | -63 | 153 | 25 | 78% | 81% | -0.39 | 0.36 | -0.03 | 2.1 | 0.1 |

| 3s/30s | 38 | -86 | 158 | 11 | 81% | 86% | -0.47 | 0.47 | -0.05 | -1.8 | -0.1 |

| 5s/10s | 16 | -36 | 56 | 0 | 84% | 82% | -0.17 | 0.17 | -0.03 | -1.0 | -0.2 |

| 5s/20s | 54 | -23 | 109 | 34 | 84% | 77% | -0.21 | 0.06 | -0.03 | 3.3 | 0.4 |

| 5s/30s | 45 | -46 | 116 | 20 | 83% | 86% | -0.29 | 0.17 | -0.05 | -0.7 | -0.1 |

| 7s/10s | 10 | -21 | 23 | -2 | 90% | 83% | -0.08 | 0.08 | -0.02 | 2.0 | 0.7 |

| 7s/20s | 48 | -8 | 77 | 31 | 87% | 65% | -0.13 | -0.04 | -0.02 | 6.3 | 0.9 |

| 7s/30s | 40 | -37 | 85 | 17 | 86% | 83% | -0.20 | 0.08 | -0.03 | 2.4 | 0.3 |

| 10s/20s | 38 | 13 | 57 | 33 | 73% | 45% | -0.05 | -0.11 | 0.00 | 4.3 | 0.8 |

| 10s/30s | 30 | -18 | 63 | 19 | 79% | 76% | -0.12 | 0.00 | -0.02 | 0.4 | 0.1 |

Source: J.P. Morgan

Finally, most front-end pairs appear too steep and incur significantly negative carry as well. Thus, though steepeners like 2s/5s do outperform in more aggressive easing cycles, both valuations and the carry implications make these trades less attractive locally. However, among front-end pairs, 3s/7s looks too flat in this framework, and offers value for those who want to position for a quick and aggressive easing cycle.

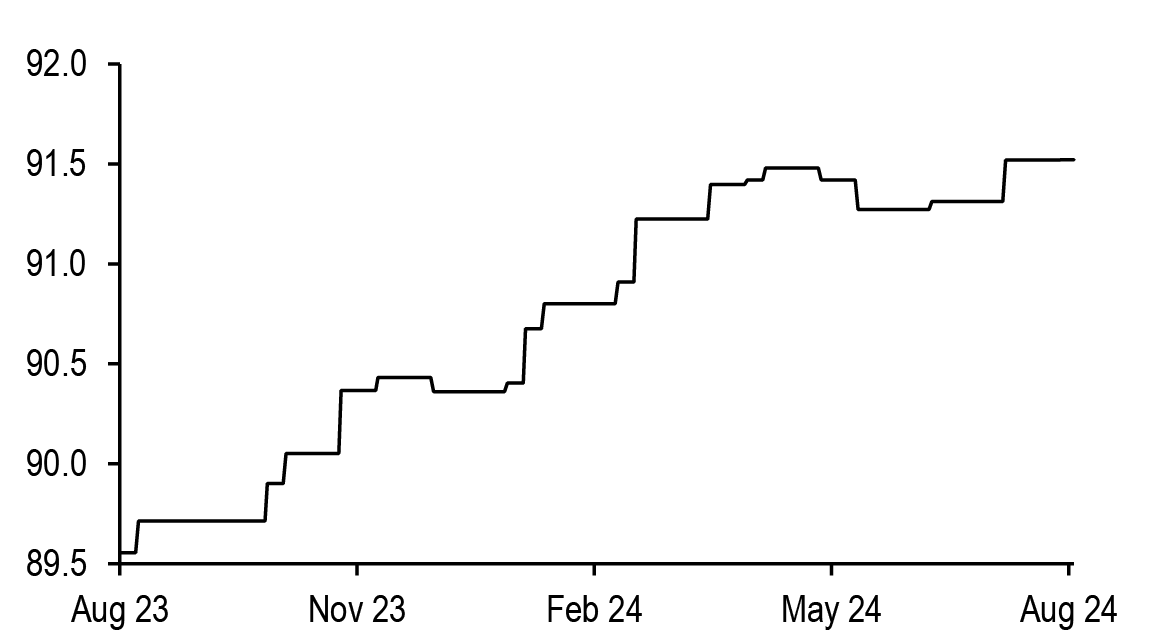

T-bill update

Turning to the front end, T-bill net issuance has been positive for the last 7 weeks, and the stock of outstanding T-bills has risen by $290bn over the period. However, this period is coming to an end, and we forecast net T-bill issuance will turn negative in two weeks, in line with traditional seasonals ahead of the corporate and estimated tax deadline on September 16th. Figure 17 shows our weekly T-bill net issuance and TGA projections for the coming months, assuming Treasury hits the $5bn cap at each of the four cash management buyback operations scheduled for the September 5-25 period. Looking at the details, we expect one more week of outsized net issuance, as the $35bn CMB maturing September 12 settles next week, and look for 5 weeks of negative T-bill issuance into early October. Following this period, we project more than $125bn in net issuance between mid-October and mid-November.

Figure 17: T-bill issuance should turn negative in early-September, ahead of the corporate tax date

Net T-bill issuance* (lhs; $bn) versus TGA balance (rhs; $bn)

Source: US Treasury, J.P. Morgan

*Grey bars are J.P. Morgan forecasts

Figure 18: Longer-dated T-bills are near the cheaper end of their recent ranges…

T-bill/SOFR matched maturity spreads, current levels with 3-month statistics; bp unless otherwise indicated

| Maturity | Current | 3m chg | 3m high | 3m low | 3m avg | Percentile |

| 4-week | -7.1 | -3.6 | -3.2 | -13.3 | -6.6 | 37% |

| 8-week | -4.5 | -2.4 | 2.0 | -8.8 | -4.1 | 52% |

| 13-week | -1.7 | 0.6 | 2.3 | -6.5 | -2.8 | 75% |

| 17-week | 1.0 | 2.1 | 6.8 | -2.9 | -0.2 | 84% |

| 26-week | 5.2 | 6.5 | 8.0 | -7.1 | -0.1 | 87% |

| 52-week | 7.6 | 10.4 | 11.2 | -3.3 | 3.0 | 84% |

Source: J.P. Morgan

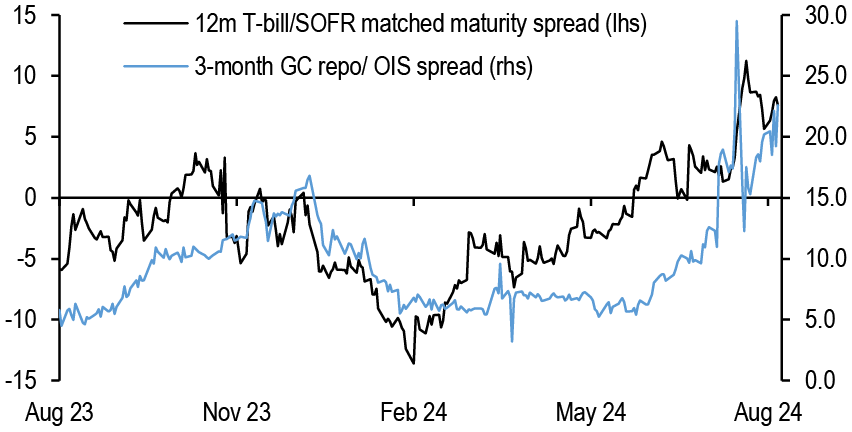

This issuance pattern should be marginally supportive for valuations in the weeks ahead. However, we would note the upcoming reductions should be concentrated in shorter-maturity T-bills. This is important because while 3- to 12-month T-bills are now trading near the cheaper end of their 3-month ranges, this is not the case for 1- and 2-month bills, which remain closer to the middle of the ranges that have persisted over the last three months ( Figure 18). Taking a step back, the cheapening in longer-dated bills should not be surprising given the recent widening in GC/OIS spreads, which we tend to view as a proxy for dealer financing costs ( Figure 19). As discussed earlier, primary dealer positions in Treasuries have risen sharply YTD, which helps explain the cheapening of Treasuries on spread to SOFR, but T-bill inventories have remained relatively stable, and most of this accumulation has occurred in coupon securities ( Figure 20). Moreover, our colleagues in derivatives strategy continue to recommend swap spread wideners at the front end. Given these dynamics, we see some room for longer-dated bills to richen from current levels over the coming weeks.

Figure 19: ...and have cheapened alongside the widening of GC/OIS spreads

12-month T-bill/ SOFR matched-maturity spread (lhs) versus 3-month GC repo/ OIS spread; bp

Source: J.P. Morgan

Figure 20: Primary dealer Treasury holdings have risen over the last year, but not in T-bills

Primary dealer positions in Treasuries*; $bn

Source: Federal Reserve Board of New York *Latest data as of as of 8/14/2024

Dashed lines represent 1-year averages

Trade recommendations

- Maintain 5s/30s steepeners

- Stay long 100% risk, or $112mn notional of T 4.875% Oct-28s

- 100% risk, or $29.9mn notional of T 4.75% Nov-53s

- (US Treasury Market Daily, 11/22/23: P/L since inception: 17.4bp)

- Maintain 75%/6% weighted 5s/10s/30s belly-cheapening butterflies

- Stay long 75% risk, or $43mn notional of T 4.625% Sep-28s

- Stay short 100% risk, or $33.3mn notional of T 3.875% Aug-33s

- Stay long 6% risk, or $1mn notional of T 4.125% Aug-53s

- (US Fixed Income Markets Weekly, 9/29/23: P/L since inception: -6.7bp)

- Maintain 23:84 weighted 2s/7s/10s belly-richening butterflies

- Stay short 23% risk, or $28mn notional of T 4.375% Jul-26s

- Stay long 100% risk, or $40.2mn notional of T 4.125% Jul-31s

- Stay short 84% risk, or $23mn notional of T 3.875% Aug-34s

- (US Treasury Market Daily, 8/21/24: P/L since inception: -0.4bp)

Figure 21: Closed trades in last 12 months

P/L reported in bp of yield unless otherwise indicated

| TRADE | ENTRY | EXIT | P/L |

| Duration | |||

| 5-year duration longs | 08/04/23 | 09/08/23 | -27.6 |

| 5-year duration longs | 10/03/23 | 11/02/23 | 14.9 |

| 7-year duration shorts | 11/03/23 | 11/22/23 | -7.9 |

| 30-year duration shorts | 12/15/23 | 01/04/24 | 10.9 |

| 5-year duration longs | 01/19/24 | 02/01/24 | 25.3 |

| 5-year duration longs | 02/09/24 | 03/07/24 | 3.3 |

| Equi-notional 2s/5s flatteners | 05/31/24 | 06/06/24 | 16.0 |

| 5-year duration shorts | 06/14/24 | 07/01/24 | 21.9 |

| 30% 2-year duration short | 07/12/24 | 07/31/24 | -1.8 |

| Curve | |||

| 10s/30s steepener | 12/16/22 | 09/29/23 | 3.0 |

| 10s/30s steepener | 11/03/23 | 11/22/23 | -7.3 |

| 2s/5s flatteners | 12/08/24 | 05/17/24 | 6.0 |

| Relative value | |||

| 100:96 weighted 3.5% Feb-39 / 3.75% Nov-43 flatteners | 07/28/23 | 08/16/23 | 3.2 |

| 2.75% Aug-32/ 3.5% Feb-39 steepeners | 01/10/24 | 01/26/24 | 5.2 |

| 20s/ old 30s flatteners | 02/15/24 | 05/10/24 | -2.6 |

| 100:97 weighted 3.75% Apr-26/ 4.625% Sep-26 flatteners | 04/12/24 | 05/17/24 | 2.2 |

| 100:95 weighted 4% Feb-28 / 4% Feb-30 steepeners | 02/23/24 | 05/31/24 | -6.6 |

| 50:50 weighted 3s/5s/7s belly-richening buterflies | 03/15/24 | 06/14/24 | 2.1 |

| 100:98 weighted 4.75% Feb 37s / 4.5% Aug 39s steepeners | 06/14/24 | 07/12/24 | 2.6 |

| 100:95 weighted 0.625% Jul-26s / 1.25% Dec-26s steepeners | 07/12/24 | 08/14/24 | 1.5 |

| Number of positive trades | 14 | ||

| Number of negative trades | 6 | ||

| Hit rate | 70% | ||

| Aggregate P/L | 64.3 |

Source: J.P. Morgan

Technical Analysis

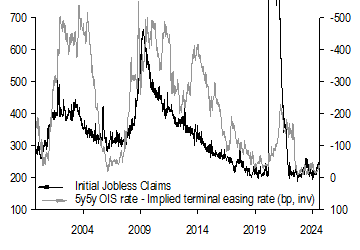

- The spread between market-implied terminal easing rate and market-implied neutral has traded in a range over the past 24-months, where the market has been unwilling to price the policy rate more than 30-50bp through implied neutral. In the past three cycles, the front-end pricing breakouts coincided with trends to higher jobless claims...

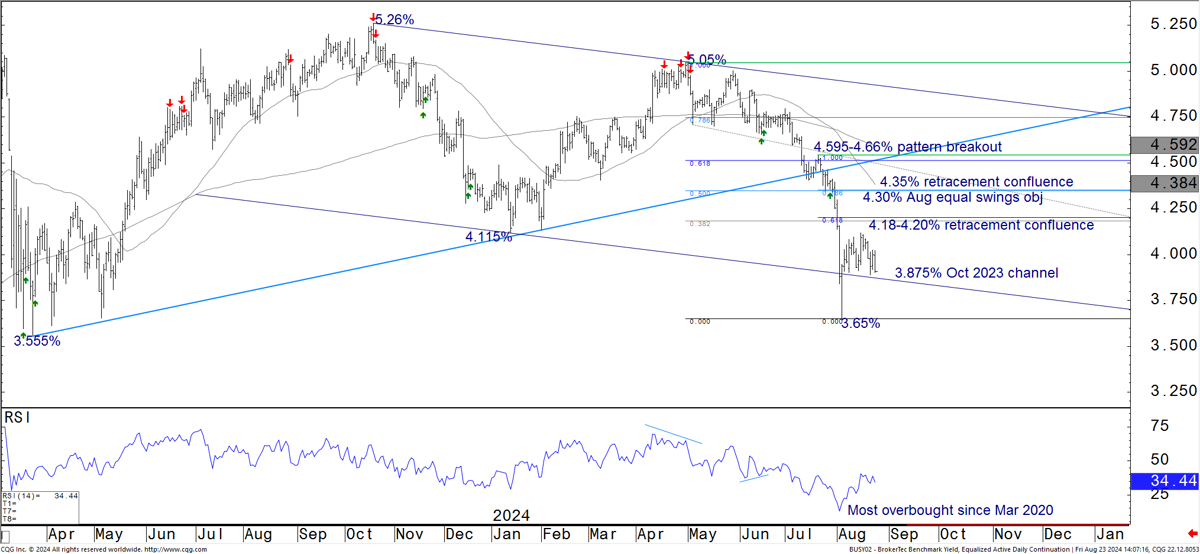

- ...Regardless of the macro-fundamental driver, the bullish consolidation richer than the 4.115-4.20% initial support zone continues to favor a positive bias and technical view that looks for an eventual breakout in late-2024 or early-2025….

- Along with the shape of the OIS curve and 2-year note pattern neckline at 3.555-3.65%, we are also focused on the -20bp through -15bp area on the 2s/5s curve chart. That has marked a barrier for multiple quarters to what we believe to be a cycle bottom pattern. We see a asymmetric risk-reward setup heading into the latter months of the year and early-2025 in favor of a breakout and transition to an aggressive steepening trend.

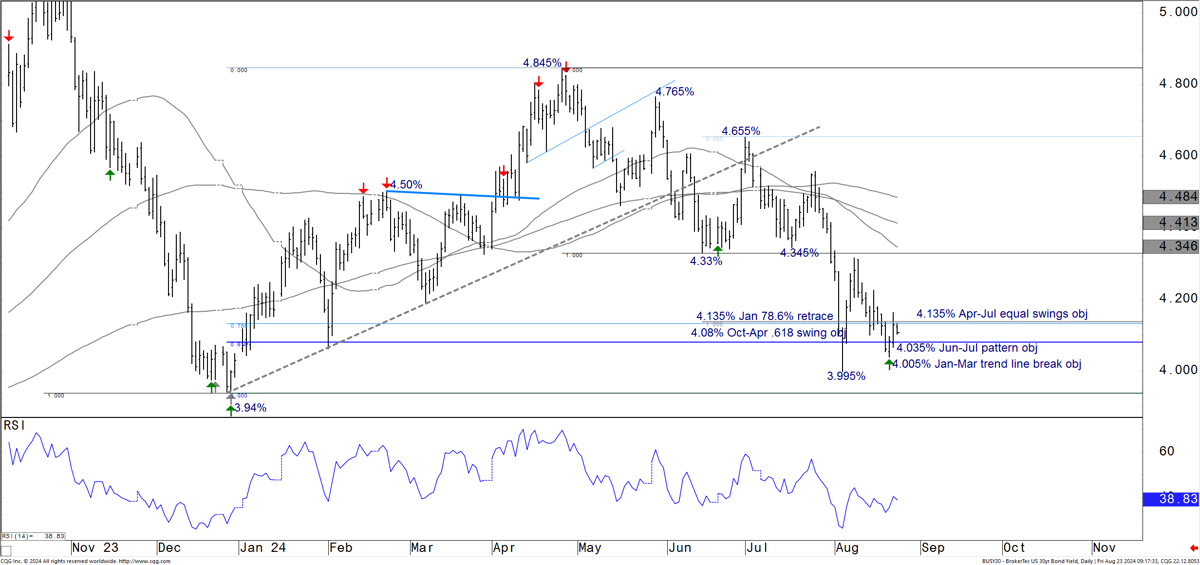

- The 5-year note continues to bullishly consolidate after the mid-summer acceleration to lower yields. We expect the 3.885-4.02% support zone to cap yields through late summer. A break through 4.15-4.20% is needed to derail the bullish pattern structure at this point. The rally stalled near the 3.50% Oct-Apr equal swings objective and the associated channel trend line, now at 3.475. We suspect that area will act as resistance for a few weeks but give way later in the year or into 2025.

- The 10-year note yield bullishly consolidates behind the 3.625% Apr 2023 78.6% retrace and in front of key support at 4.02-4.14%. We expect those two zones to define the trading range into the early fall. The next zone of chart resistance sits at 3.22-3.248%, targets for later this year or early 2025.

- Look for continued 5s/30s curve range trading below the 59bp Mar 2021 50% retrace and above the 28-32bp support zone in the weeks ahead. We think that range will consolidate the breakout from the 2022-2024 base pattern and give way to a more aggressive steepening trend in the months ahead.

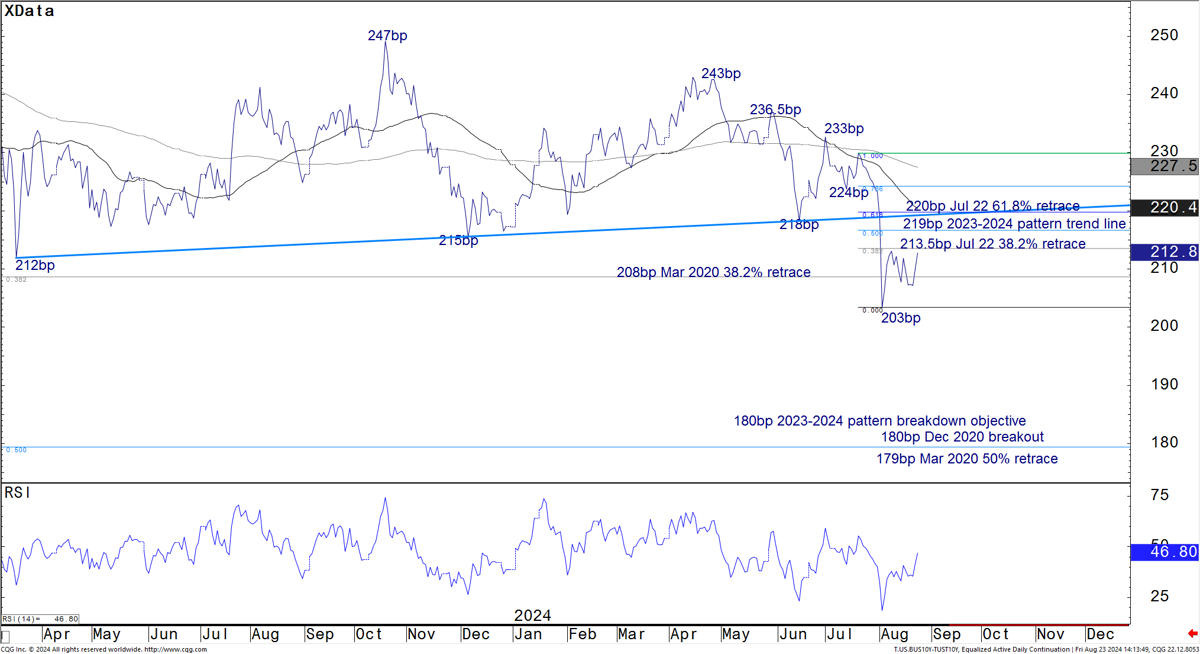

- 10-year TIPS breakevens widen back into the 212-220bp resistance zone following the dovish Fed messaging. We are looking for breakevens to falter in that area again and for that reversal to set the market up for renewed tightening pressure into the Sep-Oct period of seasonal weakness for risky markets. Look for a retest of the 200bp area over that period.

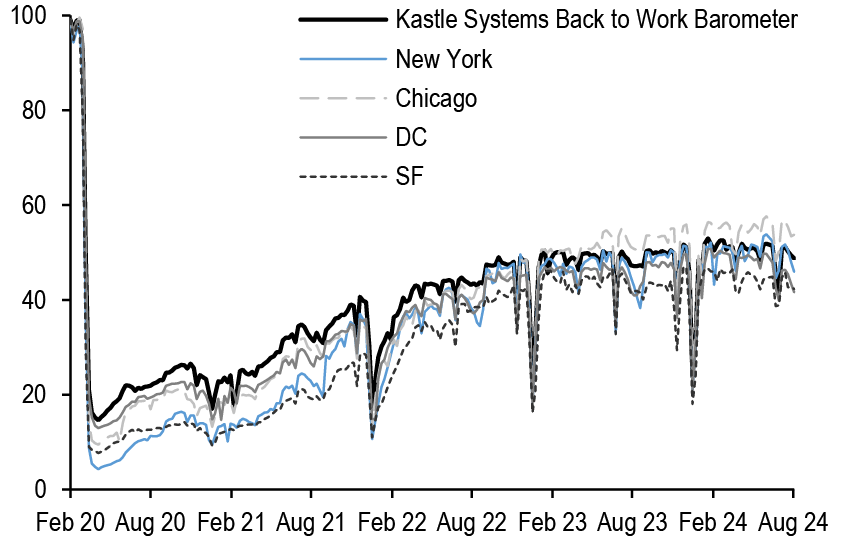

US

Treasuries continue to trade in what look like bullish consolidation patterns across the entire duration spectrum as the Fed validates the recent dovish repricing. The Aug flight-to-quality rotation helped propel the 2-year note back toward the low yields realized early last year in the aftermath of two bank failures. Likewise, that as the money market curve adjust to nearly match the dovish extremes achieved over the past two years, with more than 230bp of total eases priced for the cycle, and the terminal easing rate priced more than 30bp through market-implied neutral. Across the board, front-end pricing tagged chart levels that now define the necklines of multi-quarter reversal patterns. Beyond the importance those key thresholds represent on the charts from a pattern perspective, the threshold on money market curve charts also represented key bifurcation zones during the cycles since the mid-1990s and when we have OIS markets to analyze. The spread between 5y5y OIS rate levels (market-implied neutral) and the forwards priced terminal easing rate has a loose inverse correlation with initial jobless claims historically ( Figure 22). While claims have been well-anchored below 260K during most of the post-COVID recovery and expansion, the spread between market implied neutral and the expected terminal easing rate has also been range bound. In each of the three slowdowns over the observed period, the money market curve not only tracked claims higher, but the market transitioned to an aggressive trending regime once it broke out.

Figure 22: The spread between market-implied terminal easing rate and market-implied neutral has traded in a range over the past 24-months, where the market has been unwilling to price the policy rate more than 30-50bp through implied neutral. In the past three cycles, the front-end pricing breakouts coincided with trends to higher jobless claims...

Initial jobless claims (sa, 1000s, left scale), spread between 5y5y OIS rate and OIS implied terminal easing rate (bp, inverted, right scale)

Source: J.P. Morgan

Regardless of the driver, the bullish consolidation on duration and yield curve charts favor an eventual release to lower yields and bull steepening breakouts in the months ahead. For the 2-year note, that bullish consolidation has unfolded richer than the 4.115% Jan yield low and 4.18-4.20% Fibonacci retracement confluence ( Figure 23). Another group of levels rests at 4.30-4.35%. The more mixed data in recent weeks leaves a backup to that second zone as a possibility, especially if the u-rate retraces some of the recent rise with the early-Sep data. The market would need to back up through the 4.595-4.66% breakout area to completely nullify the bullish trend dynamics, levels we do not see getting tested going forward. To lower yields, tactical bulls would regain traction with a break through 3.88% for another run at the 3.65% Aug extreme.

Figure 23: Regardless of the macro-fundamental driver, the bullish consolidation richer than the 4.115-4.20% initial support zone continues to favor a positive bias and technical view that looks for an eventual breakout in late-2024 or early-2025...

2-year note yield, daily bars with momentum divergence signals; %

Source: J.P. Morgan, CQG

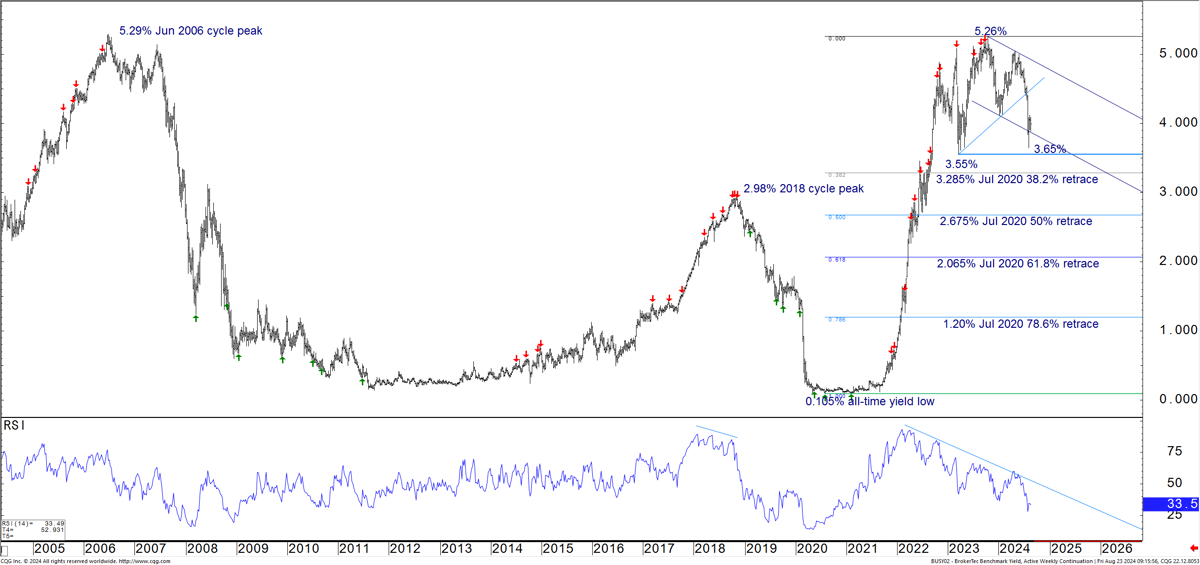

Bigger picture, the weekly and monthly time-frame momentum divergence buy signals that triggered in 2022-2023, the yield curve breakouts, late-cycle signals across other markets like USD/JPY, and recent bullish impulses to lower yield levels leave us viewing the entire 2023-2024 price action as large bullish reversal patterns ( Figure 24). We expect the front-end to pressure those levels into the fall and eventual break richer into early-2025. Initial breakout resistance rests at the 3.285% Jul 2020 38.2% retrace and 2.98% 2018 cycle cheap.

Figure 24: … The lower-frequency bullish momentum divergence signals that triggered through late-2022 and 2023, the recent impulsive bullish price action, and steepening breakouts on yield curve charts all suggest the entire late-2022 through 2024 2-year note pattern represents a large bullish trend reversal.

2-year note yield, weekly bars with momentum divergence signals; %

Source: J.P. Morgan, CQG

Similar to the key thresholds noted above, the 2s/5s curve has kept the area between -25bp and -12bp under steepening pressure this summer. That not only marks the upper-end of the 2023-2024 base pattern, but was also the 1989, 2000, 2006, and 2019 cycle troughs ( Figure 25). Given the dynamics identified in the money market curve pricing in prior cycles, we suspect a 2s/5s curve breakout above that area will mark the transition to an aggressive steepening trend, so we’ve added a stop-in strategy to our list of long duration proxies in the trade strategy section. On the downside, the recent corrective flattening held above support at the -33.5bp Jun 50% retrace, -34bp 50-day moving average, -36.5bp Jun 61.8% retrace, and -37.5bp 200-day moving average. We see the -41.5bp Jul 2023 38.2% retrace as a likely floor going forward.

Figure 25: Along with the shape of the OIS curve and 2-year note pattern neckline at 3.555-3.65%, we are also focused on the -20bp through -15bp area on the 2s/5s curve chart. That has marked a barrier for multiple quarters to a what we believe to be a cycle bottom pattern. We see a asymmetric risk-reward setup heading into the latter months of the year and early-2025 in favor of a breakout and transition to an aggressive steepening trend.

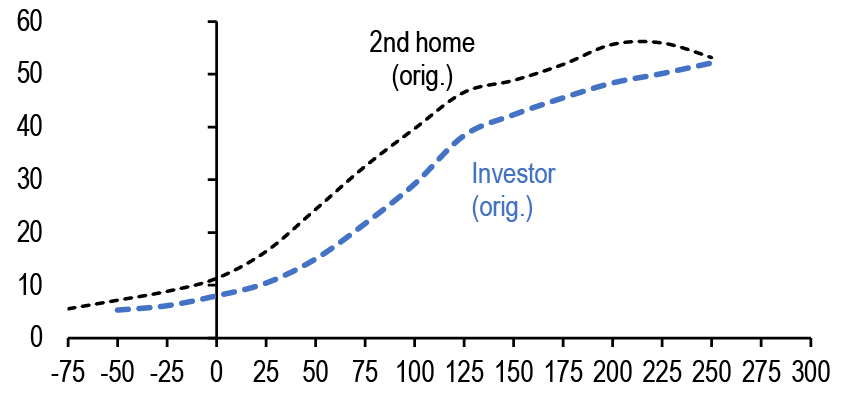

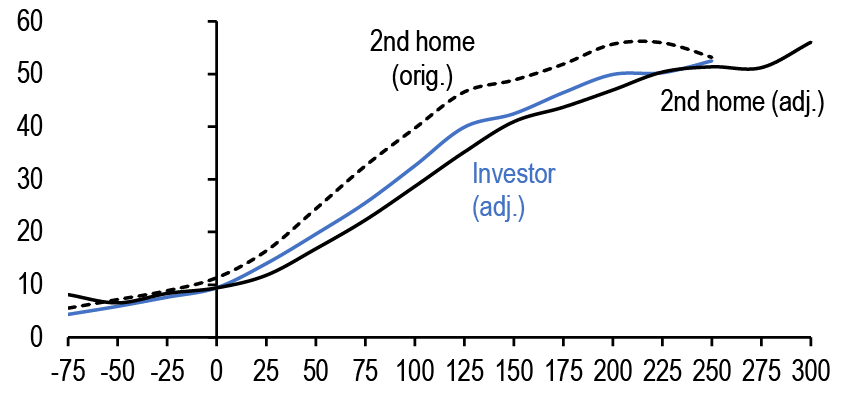

2s/5s curve, daily closes; bp

Source: J.P. Morgan, CQG

Figure 26: The 5-year note continues to bullishly consolidate after the mid-summer acceleration to lower yields. We expect the 3.885-4.02% support zone to cap yields through late summer. A break through 4.15-4.20% is needed to derail the bullish pattern structure at this point. The rally stalled near the 3.50% Oct-Apr equal swings objective and the associated channel trend line, now at 3.475. We suspect that area will act as resistance for a few weeks but give way later in the year or into 2025.

5-year note, daily bars with momentum divergence signals; %

Source: J.P. Morgan, CQG

Figure 27: The 10-year note yield bullishly consolidates behind the 3.625% Apr 2023 78.6% retrace and in front of key support at 4.02-4.14%. We expect those two zones to define the trading range into the early fall. The next zone of chart resistance sits at 3.22-3.248%, targets for later this year or early 2025.

10-year note yield, daily bars with momentum divergence and TY premium-weighted Put/Call z-score signals; %

Source: J.P. Morgan, CQG, CME

Figure 28: The 30-year bond bullishly consolidates richer than the 4.33-4.345% Jun-Jul pattern riches and in front of the 4.40-4.50% confluence of moving averages. Look for further coiling around the 4.00% area in the weeks ahead.

30-year bond yield, daily bars with momentum divergence signals; %

Source: J.P. Morgan, CQG

Figure 29: Look for continued 5s/30s curve range trading below the 59bp Mar 2021 50% retrace and above the 28-32bp support zone in the weeks ahead. We think that range will consolidate the breakout from the 2022-2024 base pattern and give way to a more aggressive steepening trend in the months ahead.

5s/30s curve, daily closes; bp

Source: J.P. Morgan, CQG

Figure 30: 10-year TIPS breakevens widen back into the 212-220bp resistance zone following the dovish Fed messaging. We are looking for breakevens to falter in that area again and for that reversal to set the market up for renewed tightening pressure into the Sep-Oct period of seasonal weakness for risky markets. Look for a retest of the 200bp area over that period.

10-year TIPS breakevens, daily closes; bp

Source: J.P. Morgan, CQG

This report was excerpted from Global Fixed Income Technical, Jason Hunter, August 23, 2024

TIPS Strategy

Fed shift sets more supportive foundation for TIPS

- Intermediate breakevens remain cheap to our fair value framework, though the model residual narrowed on Friday, given a dovish shift from Fed Chair Powell

- In recent months, the Fed’s wavering confidence in disinflation and thus a heightened focus on labor market data created a less supportive backdrop for TIPS, with real yields demonstrating lower sensitivity to nominal yields in rallies than in sell-offs. However, we argue that the backdrop is becoming more supportive for TIPS once again...

- ...Chair Powell stated that his “confidence has grown” on the inflation front, while the Committee is now committed to dialing back policy restriction to support strong labor markets

- Along the curve, the intermediate sector continues to offer value, and forward-starting swaps avoid the negative carry associated with spot breakeven positions. IOTAs broadly remain tight across the curve, although we acknowledge this is particularly so at the front end, and we think there’s room for the IOTA curve to flatten

- With the fundamental backdrop turning more supportive and valuations still cheap, albeit somewhat less cheap than a week ago, we maintain tactical long exposure in 5Yx5Y inflation swaps

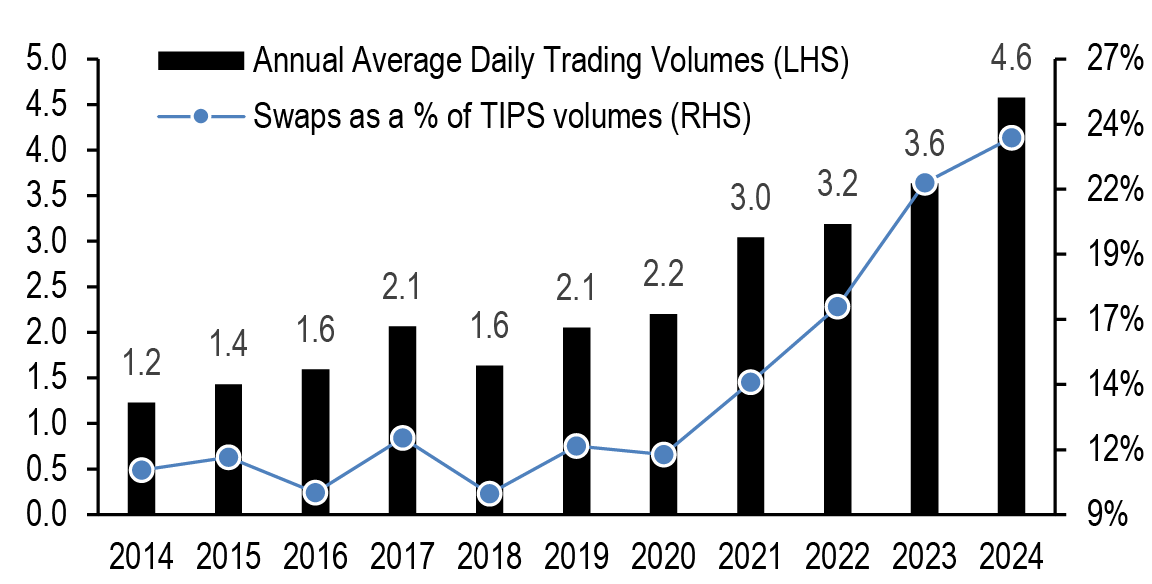

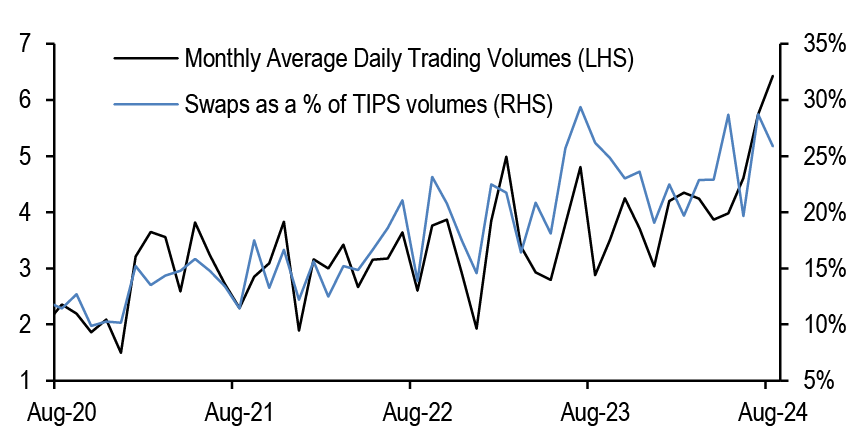

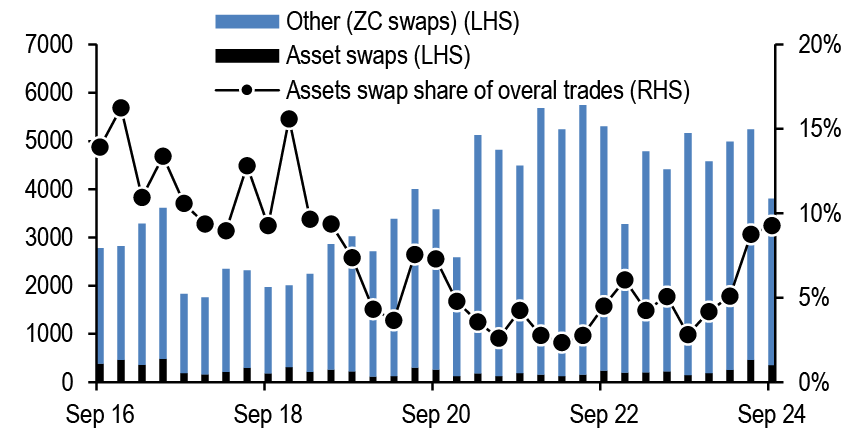

- Inflation swap daily average trading volumes have risen 25% to $4.6bn YTD, now comprising 23.5% of TIPS trading volumes. Much of this rise has occurred in recent months and coincides with a significant increase in the asset swap share of overall inflation swap transaction volumes, to 9% in the current quarter

Market views

Over the past week, TIPS initially underperformed, but more than recovered over the second half of the week, leaving breakevens 3bp wider across the curve, as jobless claims were stable, Thursday’s 30-year TIPS reopening auction was well-received, and Chair Powell delivered dovish remarks at Jackson Hole. Specifically, the supply cleared just 0.8bp cheap to pre-auction levels, and end-user demand rose to 93.1%, the second highest takedown on record ( Figure 31). With little in the way of inflation news this week, focus was squarely on the labor market data and commentary from Fed officials, including the minutes from the July FOMC meeting. Though the preliminary estimate of the 2024 benchmark for the establishment survey showed total payroll employment was 818K lower than previously thought, a larger revision than we estimated, it is difficult to say exactly how the Fed will interpret it, given that the revision cuts off in March 2024 and the implications for more recent months are not fully clear (see US: Benchmark brings big downward revision to (lagged) jobs, Abiel Reinhart, 8/21/24). Meanwhile, jobless claims rose only slightly in the week ending Aug 17, which is the payroll survey week. Relative to the July survey week, initial claims are down 13k and the four-week average is essentially unchanged, so claims at least aren’t suggesting another step down in job growth for August (see US: Good news from mostly stable jobless claims, Abiel Reinhart, 8/23/24). Overall, the economic data leave us comfortable with the view that data is softening only slowly, with recession risks still relatively low.

At the same time, Fedspeak this week confirmed the Committee is ready to begin cutting at the next meeting, even if the pace of cuts is likely to depend on the incoming data. The July FOMC meeting minutes skewed dovish and showed a Committee more focused on labor market risks than the possibility of a renewed jump in inflation. Importantly, “several” participants had contemplated cutting 25bps at the last meeting, and it was already the case that a “vast majority” were ready to cut at the September meeting, even before the July employment report. Over much of the week, more timely commentary from Fed speakers were perceived as somewhat more hawkish, offering support for a “gradual” or “methodical” pace of cuts. However, Powell's remarks at the Jackson Hole Symposium were the main event of the week, as the Chair stated “the time has come” to adjust interest rates and that the Committee does “not seek or welcome further cooling in labor market conditions.” Whether the FOMC cuts 25bps or 50bps at the September meeting still hinges on the next monthly employment report, though Powell’s comments arguably lower the bar for the Fed to deliver a 50bp cut next month (see Cuts are coming, Michael Feroli, 8/23/24).

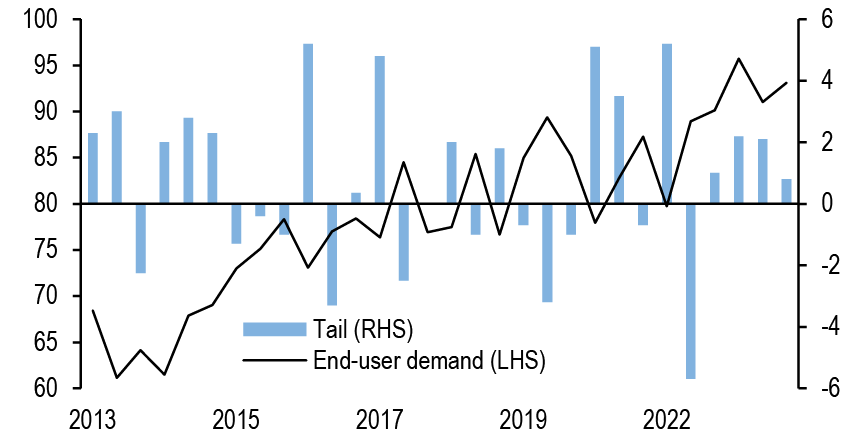

Figure 31: End-user demand at Thursday’s TIPS auction was the second highest on record

End-user demand* at 30-year TIPS auctions (%, LHS) versus tail (bp, RHS)

Source: J.P. Morgan

*Reflects direct and indirect bidder participation

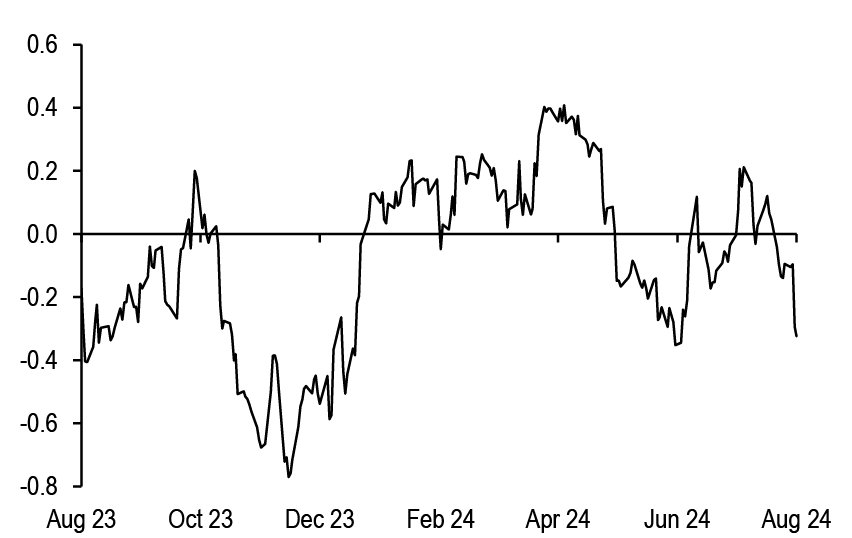

Figure 32: Breakevens remain cheap to our fair value estimate, though the residual narrowed late in the week

Residual on J.P. Morgan 10-year breakeven fair value model*; bp

Source: J.P. Morgan

*1m-forward, seasonally-adjusted breakevens are regressed on the J.P. Morgan Commodity Curve Index (JPMCCI) as well as its square and the 3mx3m/15mx3m OIS curve; regression over the last 7years; R2=93%, SE=9bp

Against this backdrop, breakevens outperformed versus our fair value framework over the week: Figure 32 shows 10-year breakevens now appear roughly 7bp too narrow on this basis, with the residual nearly cut in half over recent sessions. As we look ahead, we think there is room for inflation to outperform further versus other macro markets, particularly given the shift in Fed reaction function articulated by Chair Powell on Friday. As we argued last week, the performance of TIPS as we approach the upcoming easing cycle is likely to depend crucially on the context in which the Fed is lowering policy rates (see TIPS Strategy, 8/16/24).

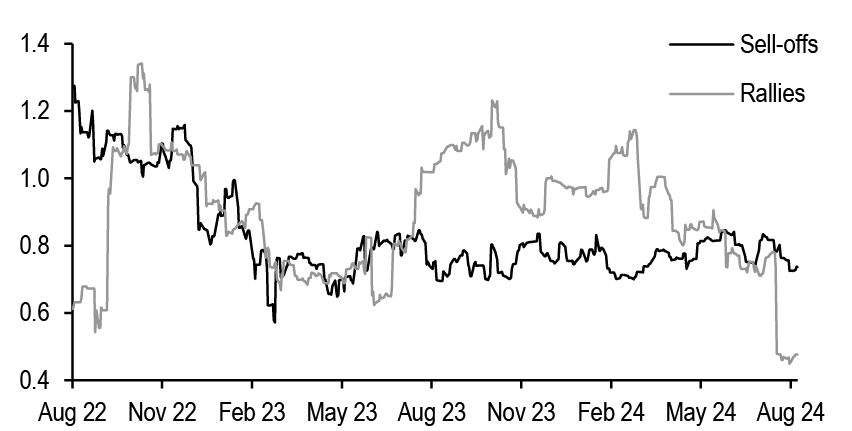

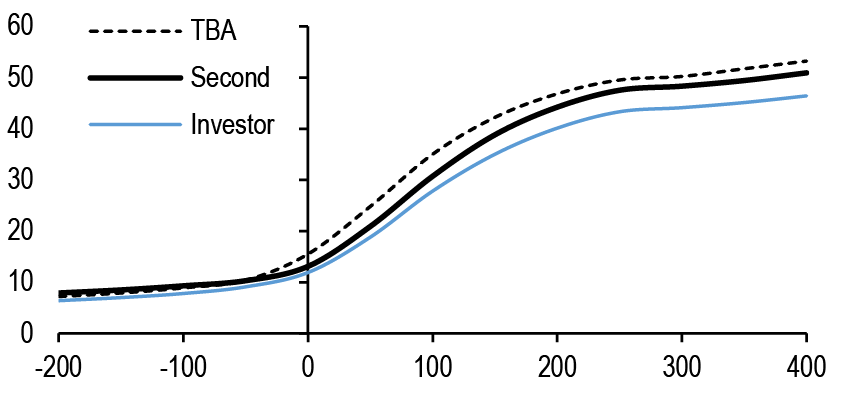

Taking a step back, recall that the Fed reaction function earlier this year made TIPS an attractive way to position long duration, given asymmetric risk/reward. Indeed, for much of the past year the primary risk to Fed expectations was further unanticipated stickiness in inflation, while on the flip side, “immaculate disinflation” suggested the Fed could ease more quickly, even without significant weakening in economic growth. In this environment, real yields exhibited a higher beta to nominal yields in rallies than in sell-offs ( Figure 33). However, this relationship shifted into the summer, as the Fed’s confidence in disinflation waned, which put greater emphasis on evidence of cooling labor markets ( see TIPS Strategy, 6/14/24). Thus, unsurprisingly, Figure 34 shows that the asymmetry of nominal yield betas shifted in the other direction in recent months, punctuated by the sharp underperformance of TIPS as yields fell in the aftermath of the July employment report. Similarly, with uncertainty on labor market and growth back in the driver’s seat, this shift also corresponded with a negative stock-bond correlations reasserting itself. At this juncture, however, with Chair Powell stating that his “confidence has grown that inflation is on a sustainable path back to 2%” and the Committee intending to dial back policy restraint “to support a strong labor market,” TIPS are likely once again to be a more attractive instrument for investors looking to add duration.

Figure 33: In contrast to the dynamic observed for much of the last year, when real yields were more sensitive to nominal yields in rallies...

Rolling 3-month betas of changes in 5-year real yields with respect to changes in nominal yields in nominal rallies versus sell-offs;

Source: J.P. Morgan

Figure 34: ....real yields have exhibited reduced sensitivity to nominal yields in rallies in recent months

Statistics for daily changes in breakevens and real yields regressed on daily changes in nominal yields, run separately for rallies and sell-offs in nominal Treasuries, for the last 3 months

| Sell-offs | Rallies | ||||

| Tenor | Beta | R-sqr | Beta | R-sqr | |

| Breakevens | 5 | 0.26 | 25% | 0.52 | 54% |

| 10 | 0.31 | 40% | 0.52 | 51% | |

| 30 | 0.33 | 47% | 0.46 | 46% | |

| Real yields | 5 | 0.74 | 73% | 0.48 | 49% |

| 10 | 0.69 | 76% | 0.48 | 48% | |

| 30 | 0.67 | 78% | 0.54 | 54% | |

Source: J.P. Morgan

With the fundamental backdrop turning more supportive and valuations still cheap, albeit somewhat less cheap than a week ago, we maintain tactical long exposure in 5Yx5Y inflation swaps. Along the curve, the intermediate sector continues to offer value versus the wings, and forward-starting swaps avoid the negative carry associated with spot breakeven positions in the current environment. Meanwhile, IOTAs broadly remain tight across the curve, although we acknowledge this is particularly so at the front end, and we think there’s room for the IOTA curve to flatten from current levels.

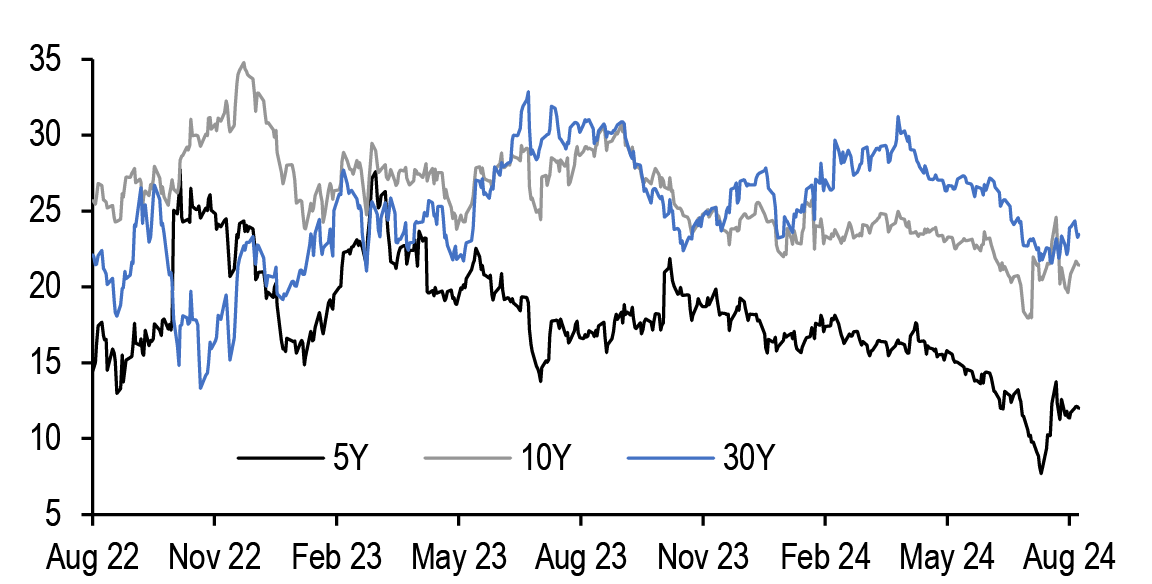

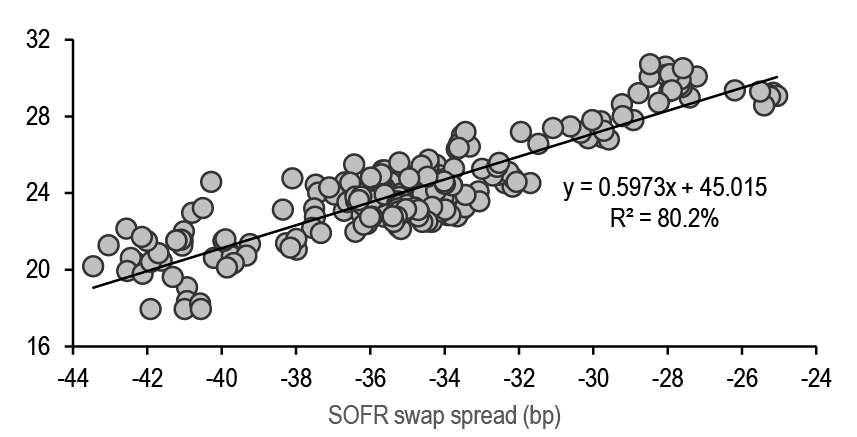

Figure 35 shows that though IOTAs widened in the aftermath of the July payrolls release, they have partially retraced narrower over the last couple of weeks, with the exception of the long end. While the front end through intermediate sectors have likely been supported by ongoing TIPS asset swap demand (discussed further below), the imminent end of the Fed-on-hold period suggests an environment that will be less ripe for carry trading. Additionally, Figure 36 shows that IOTAs have demonstrated an increased sensitivity to SOFR swap spreads over the past year, with swap spreads explaining more than 80% of the variability in 10-year IOTAs over the period. Our interest rate derivative strategists continue to argue for a flatter SOFR swap spread curve, given that ongoing QT and heavy net Treasury supply suggest higher term funding premium (TFP), and front-end spreads continue to appear substantially tight versus fair value (see Interest Rate Derivatives, Srini Ramaswamy, 8/16/24). While these considerations suggest there is more room for IOTA widening at the front end of the curve, we prefer to hold long exposure in inflation swaps relative to cash breakevens. Overall, we maintain longs in 5Yx5Y inflation swaps.

Figure 35: Following a brief widening earlier this month, IOTAs are back to pre-payrolls levels

IOTAs (derived from z-spread differentials) for hot run TIPS; bp

Source: J.P. Morgan

Figure 36: Over the past year, IOTAs have demonstrated a strong relationship with nominal swap spreads

10-year IOTAs regressed on 10-year SOFR swap spreads (bp); regression over the past year; bp

Source: J.P. Morgan

Inflation swap trading activity update

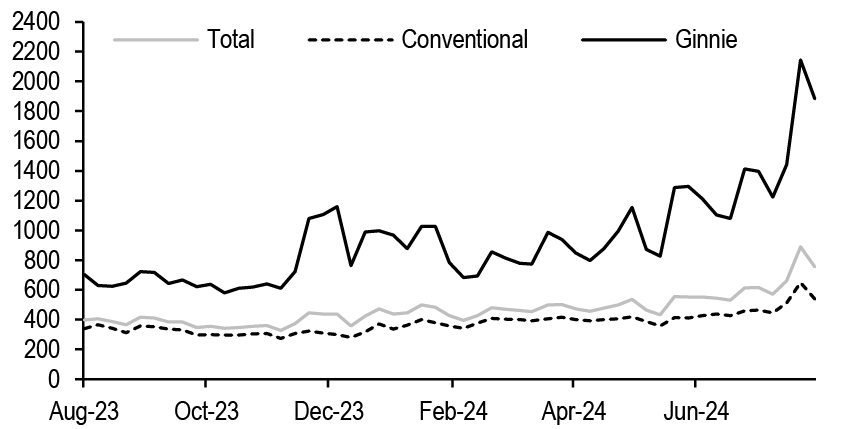

Turning to inflation swap volumes, we can see that trading activity continues to grow at a robust pace thus far this year. Using data from the DTCC swap data repository (SDR) through the middle of August, inflation swap daily trading volumes increased 25% from an average $3.6bn last year to $4.6bn YTD ( Figure 37). Moreover, the growth in the swap market continues to outstrip that of the cash market, with inflation swap daily trading volumes comprising 23.5% of TIPS volumes over the year. Turning to a more granular frequency, Figure 38 illustrates that much of this uptick has occurred over the last few months; while monthly data are quite volatile, it is notable that average daily trading volumes have increased 60% over the past three months since May to $6.4bn MTD.

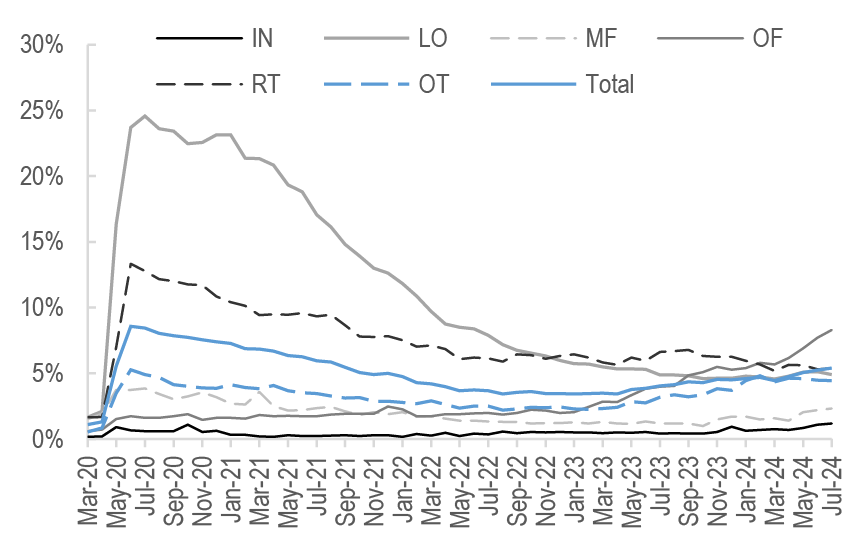

Figure 37: Inflation swap volumes continue to rise on both outright and relative to the TIPS market YTD

Annual average daily trading volumes of US CPI inflation swaps (LHS; $bn) versus inflation swaps as a percentage of TIPS volumes (RHS; %)

Source: DTCC SDR, J.P. Morgan

Figure 38: More granularly, we observed a notable uptick in volumes in recent months

Monthly average daily trading volumes of US CPI inflation swaps (LHS; $bn) versus inflation swaps as a percentage of TIPS volumes (RHS; %)

Source: DTCC SDR, J.P. Morgan

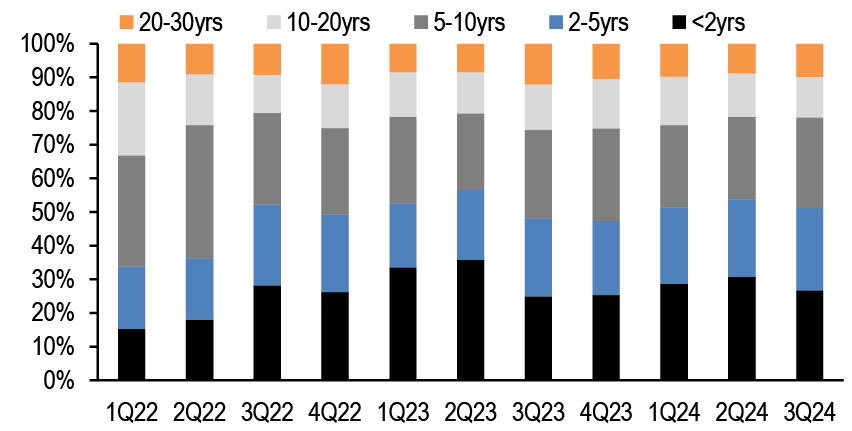

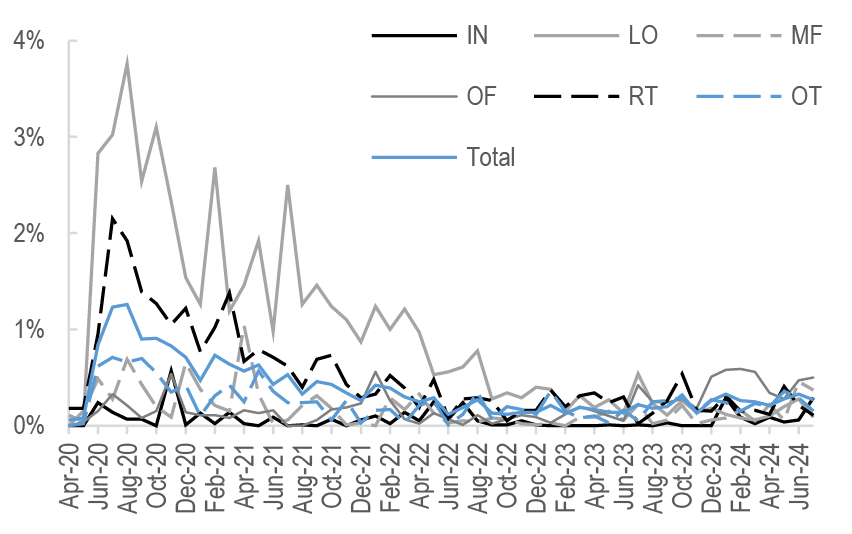

Quarter-to-date, we estimate that TIPS asset swaps continue to grow as a share of overall transaction volumes, assuming that transactions with maturity dates that match outstanding TIPS reflect asset swap transactions. Figure 39 shows that, while ZC structures continue to comprise the vast majority of overall inflation swap transactions, asset swaps currently constitute 9% of overall transactions, up from 2% during 3Q23. Meanwhile asset swap transaction sizes have also expanded recently, rising 58% over the past two years to $73mn, while ZC inflation swap sizes have only increased 32% to $48mn over the same period. At the same time the maturity structure of the inflation swap market remains roughly consistent over the period, as over half of all transactions have been concentrated in the 0-5 year bucket ( Figure 40).

Figure 39: TIPS asset swaps continue to grow as a share of overall inflation swap transactions

Quarterly inflation swap trade count split by asset swaps and other (LHS, count) and asset swaps share of overall trade count (RHS, %)

Source: DTCC SDR, J.P. Morgan

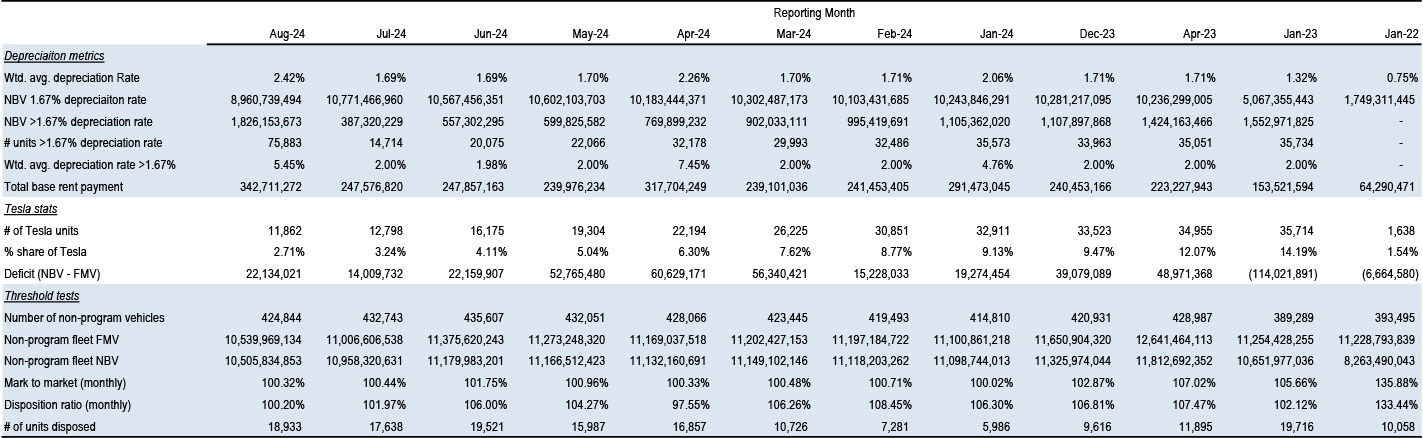

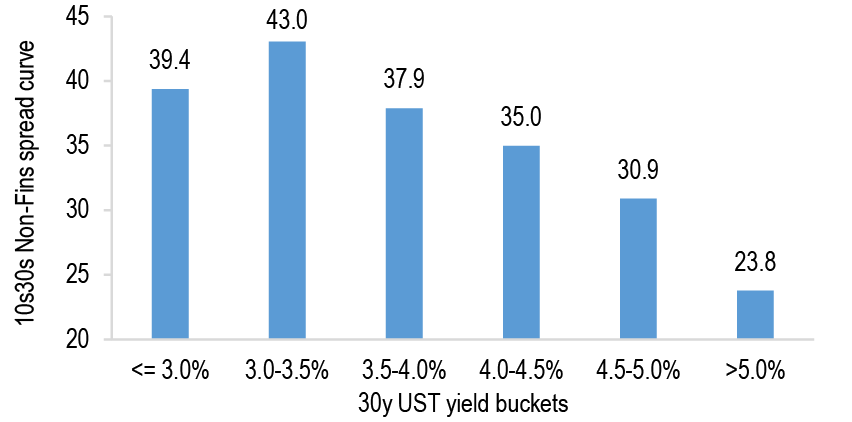

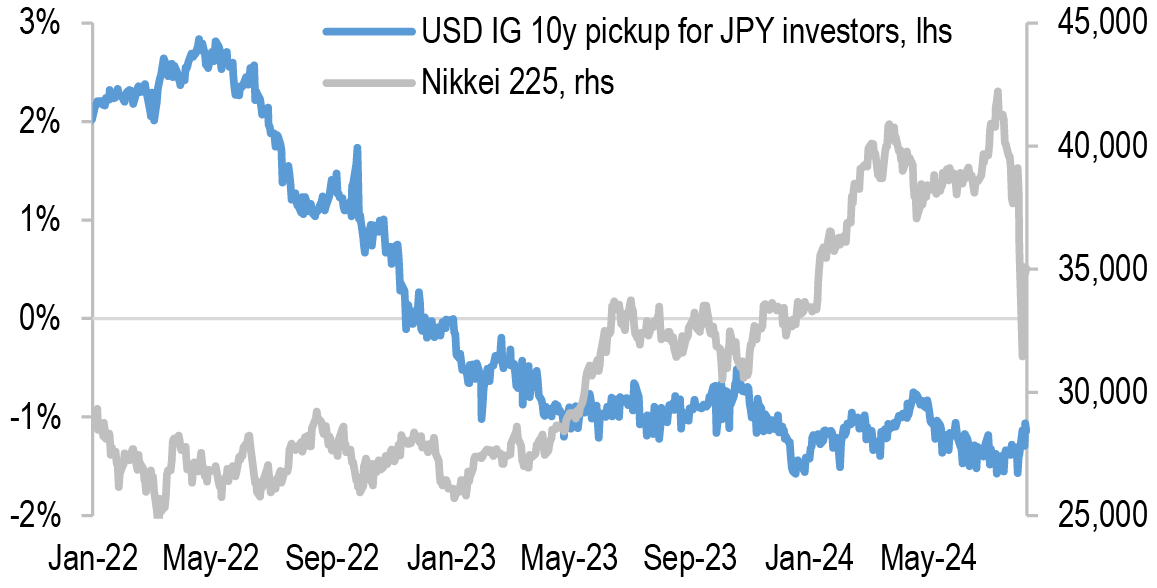

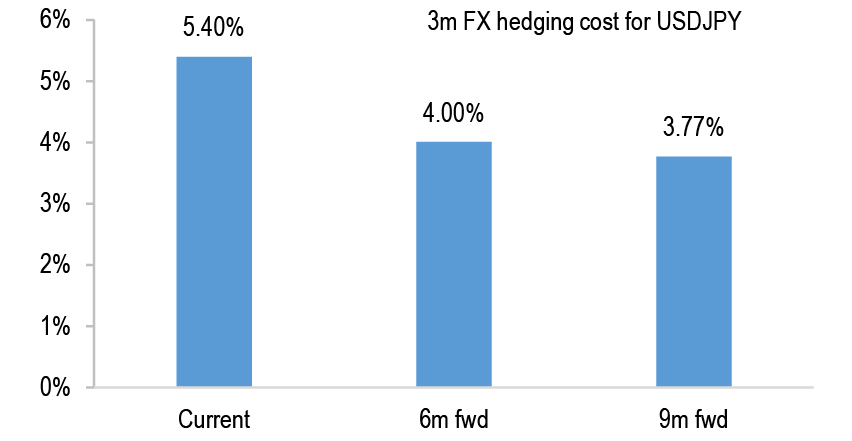

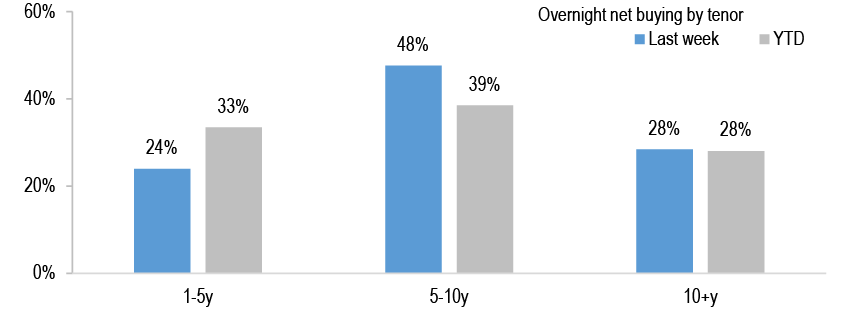

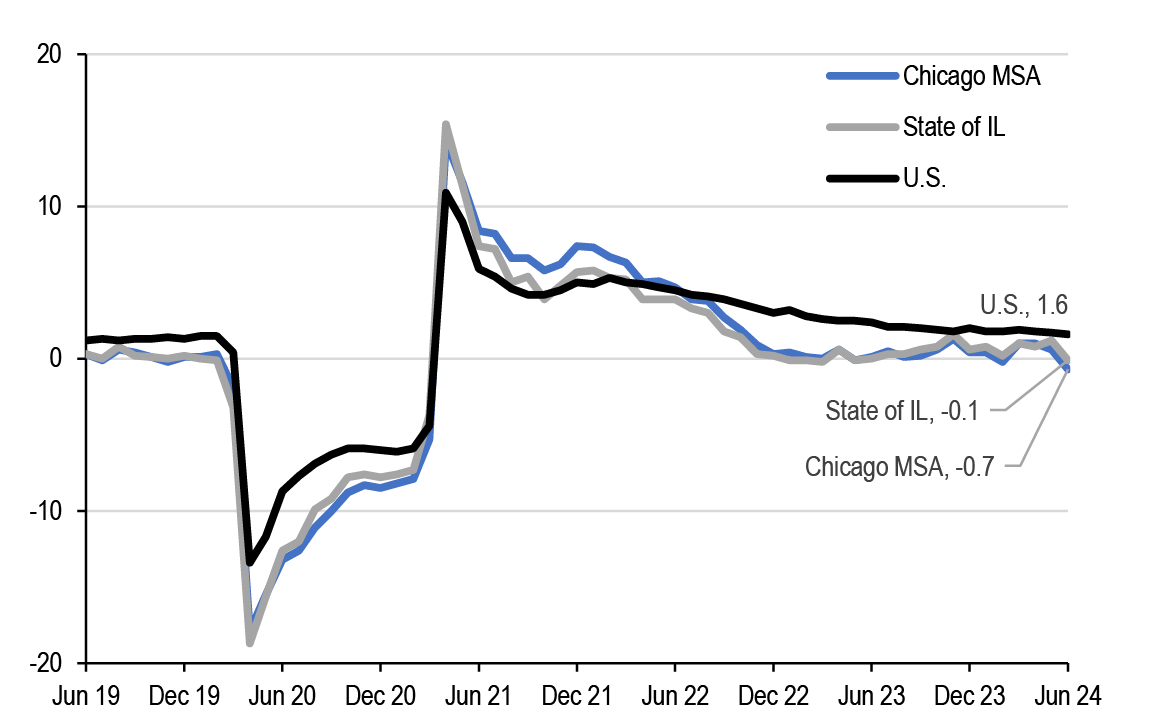

Figure 40: More than half of all inflation swap transactions are concentrated in the 0-5 year sector