U.S. Fixed Income Markets Weekly

Cross Sector P. White, L. Wash, H. Cunningham

Treasury yields and corporate spreads have largely retraced their post-payrolls move, supported by the relative strength of the data and normalization in risk sentiment. Next week we look for initial claims to remain rangebound and we think Chair Powell will provide little clarity at next week’s Jackson Hole symposium. RRP balances have declined to around $300bn and amid the tightening in liquidity conditions, we think QT has a few more months left.

Governments J. Barry, P. White, A. Borges, L. Wash

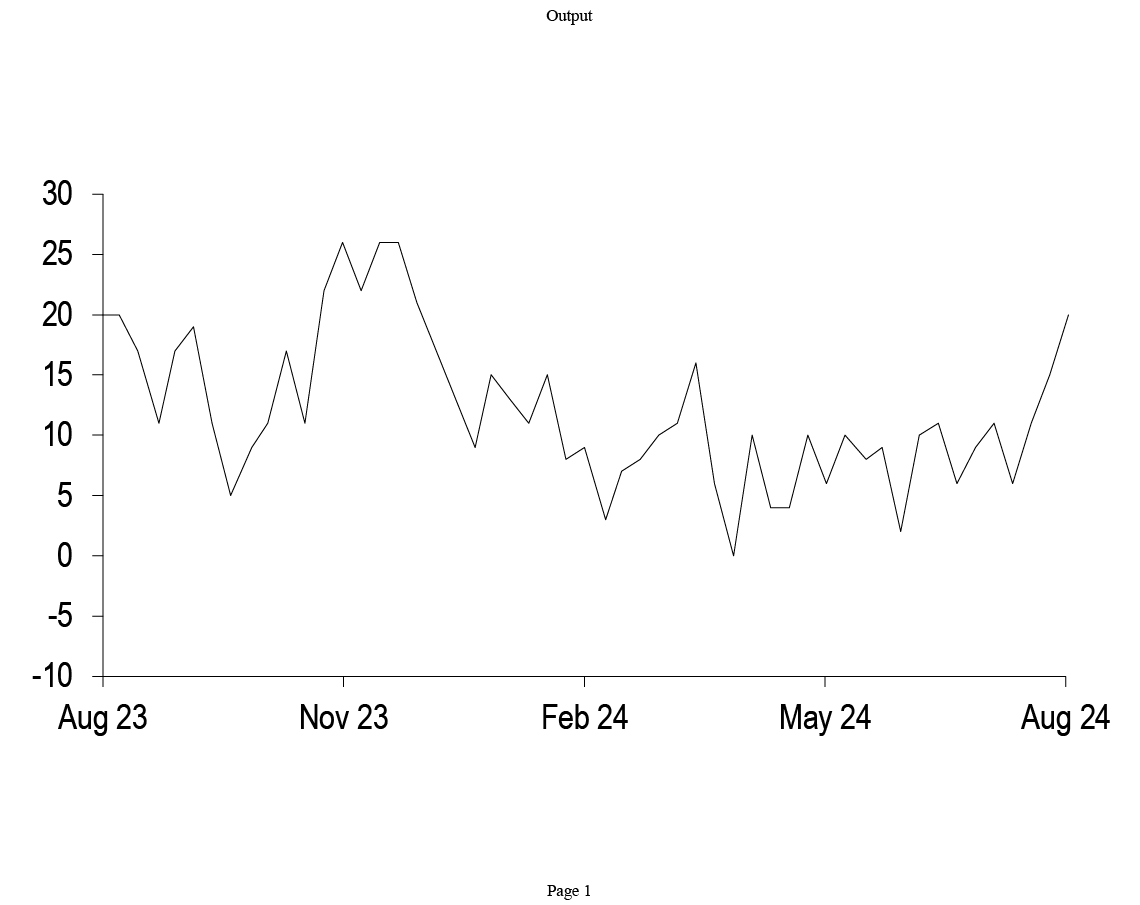

Markets are pricing in a less dovish path than our forecast, but we remain patient before adding duration given long investor positioning. Jackson Hole speeches have not traditionally led to large yield moves, except in 2020 and 2022; we do not expect clear guidance from Chair Powell next week. We contrast the upcoming easing cycle with other easing cycles: policy is more restrictive than at any point in the last 30 years, pointing toward a deeper easing cycle, but financial conditions are easy and financial stress is low, making the case for a slower pace of cuts. Hold 5s/30s steepeners as a low-beta long with a better carry profile ahead of the first cut. We review June TIC data. Initiate tactical 5yx5y inflation swap longs.

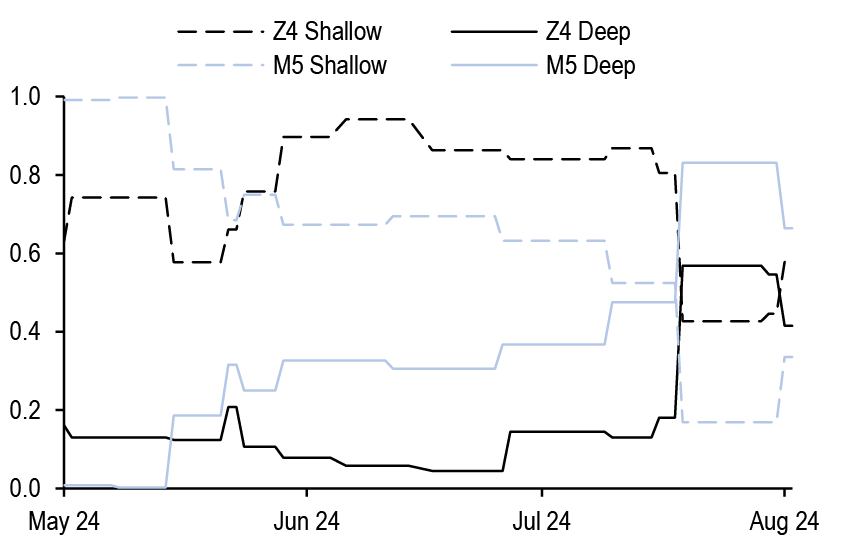

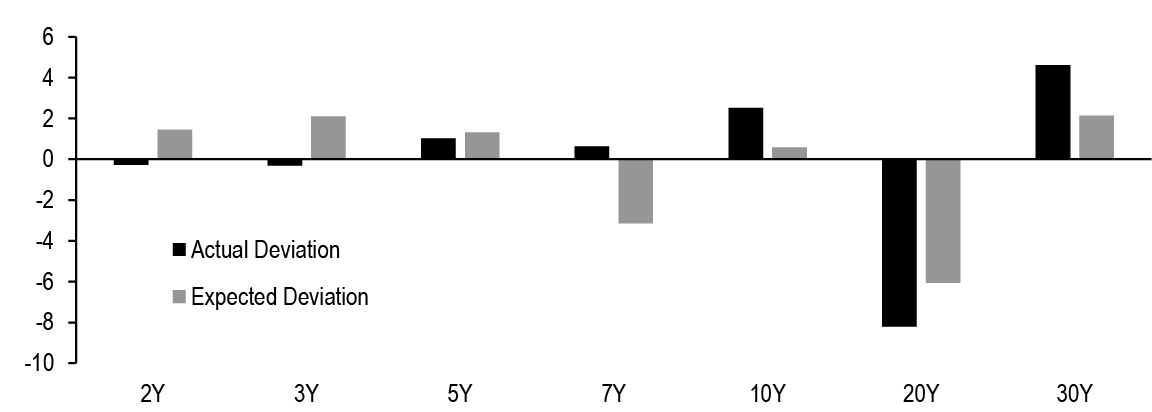

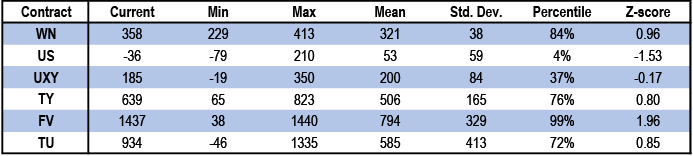

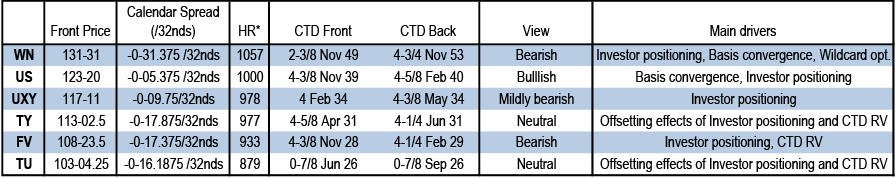

Interest Rate Derivatives S. Ramaswamy, I. Ozil, P. Michaelides, A. Parikh

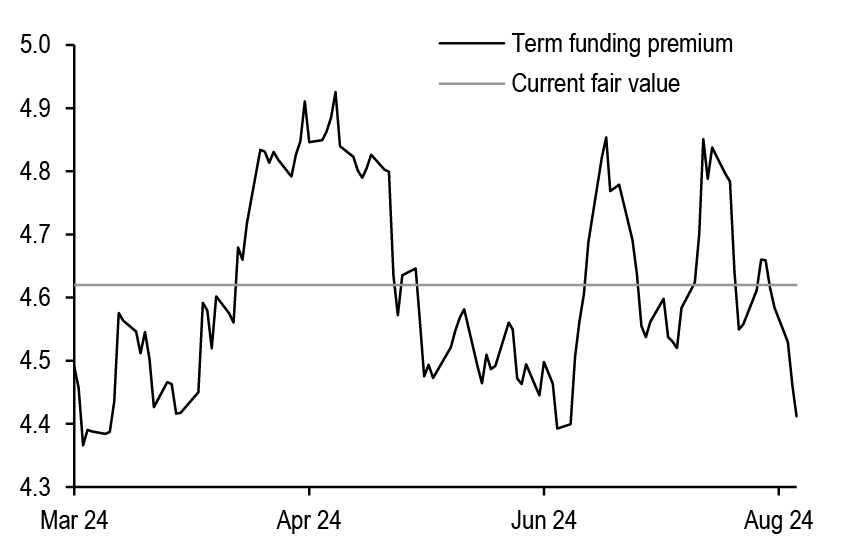

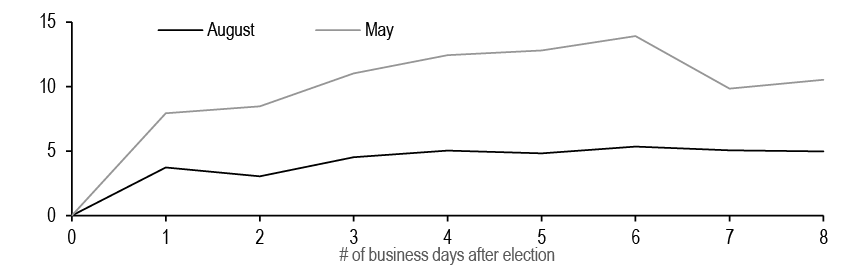

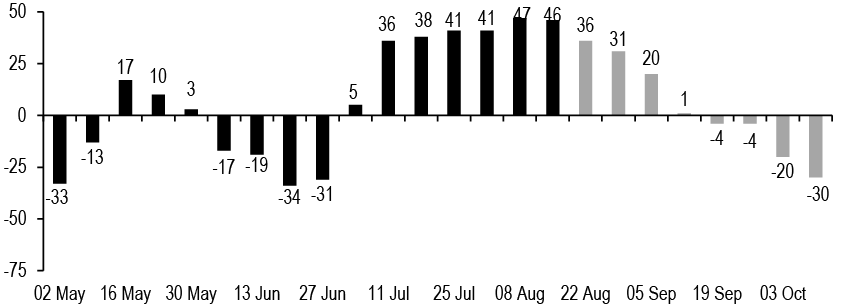

Policy uncertainty is back, and with it jump risk - stay bullish on short expiry volatility despite apparently rich valuations. Maintain front end swap spread wideners, and add exposure to narrower 10Y swap spreads and a flatter 3s/7s swap spread curve. Position for a flattening of the TU inter-CTD swap spread curve. Reserves and RRP are approaching levels where liquidity is less ample - QT is likely in its end game with a few more months of headroom. An analysis of 3M expiry implieds suggests that election premia being priced currently are lower than in May, and in a smaller post-election time window.

Short-Term Fixed Income T. Ho, P. Vohra

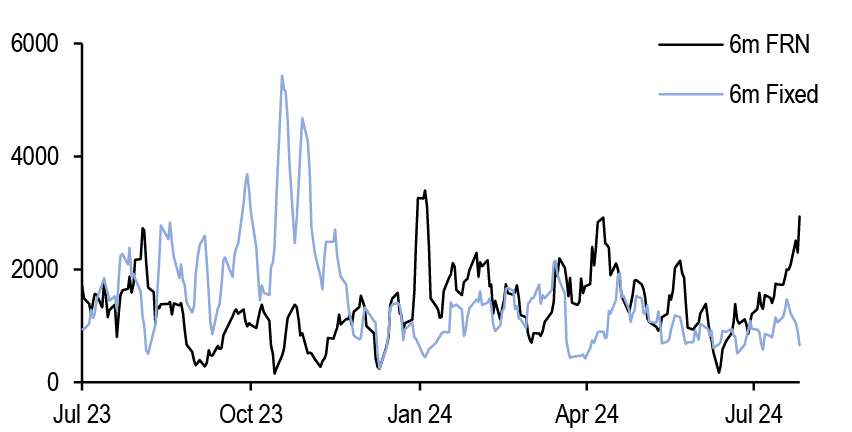

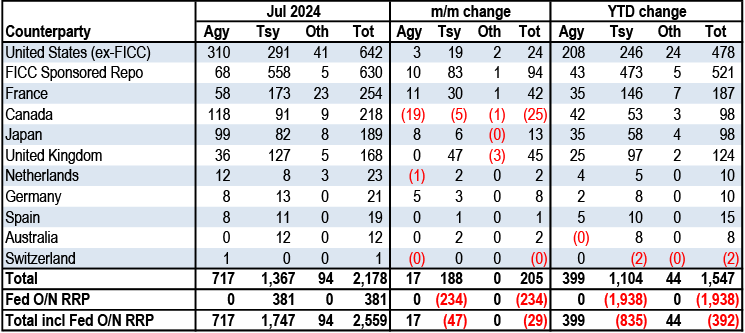

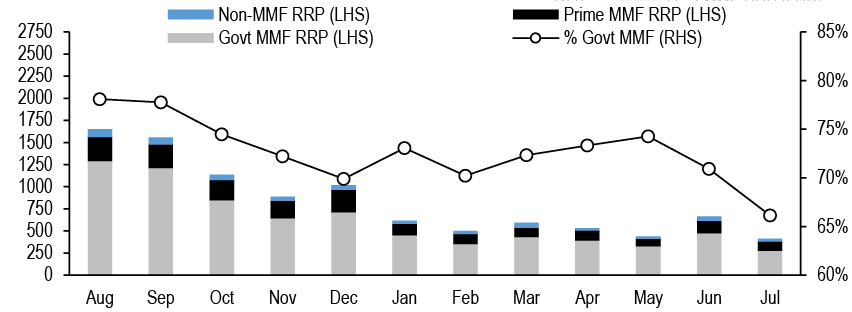

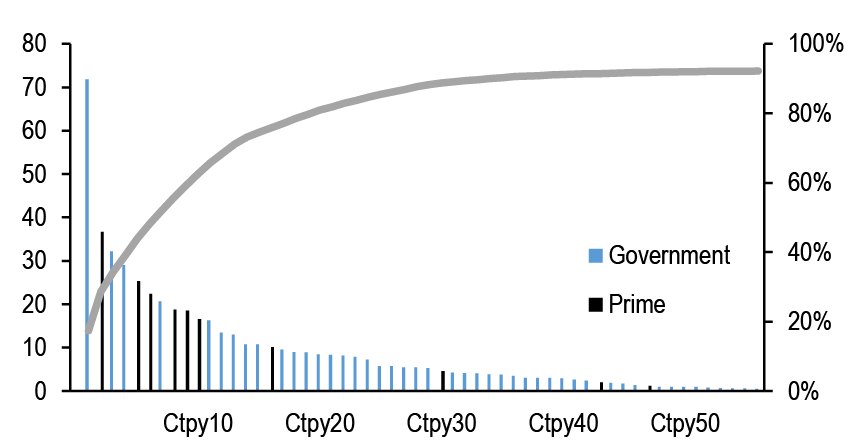

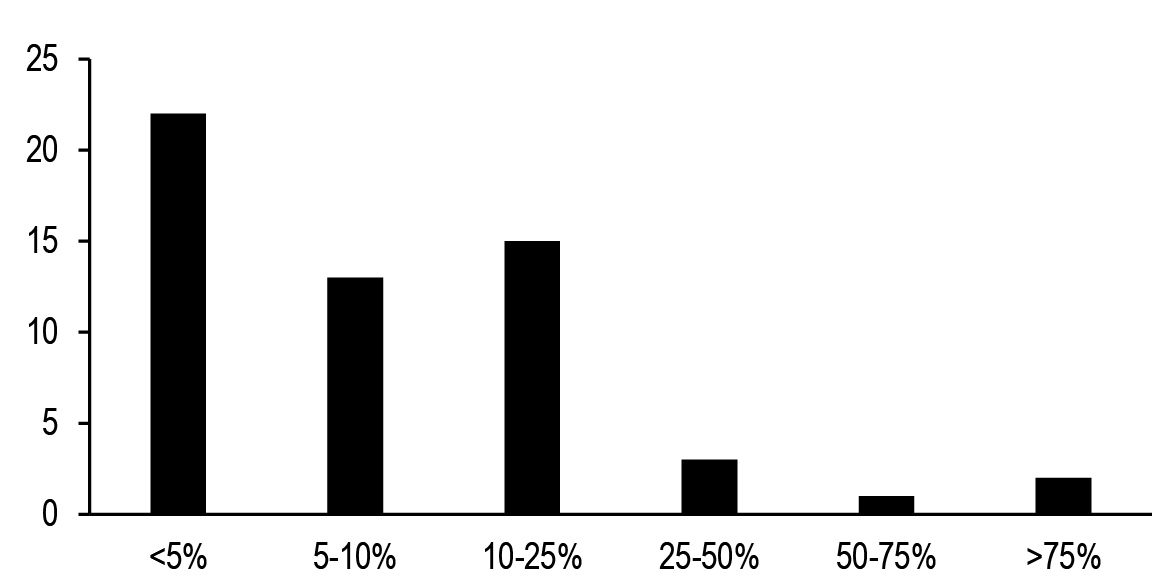

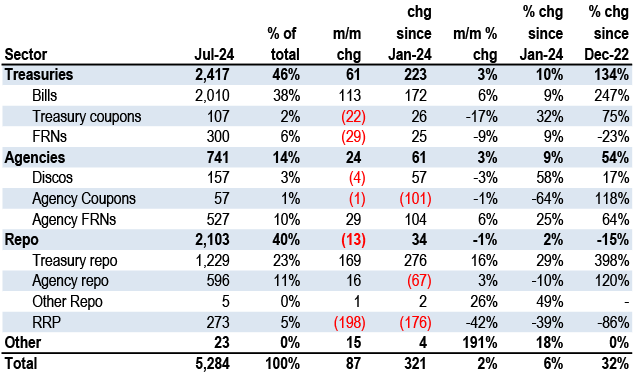

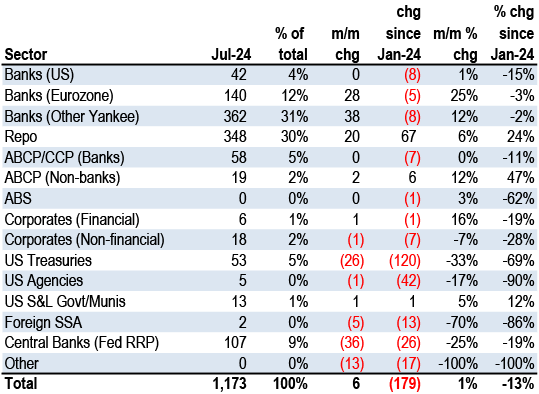

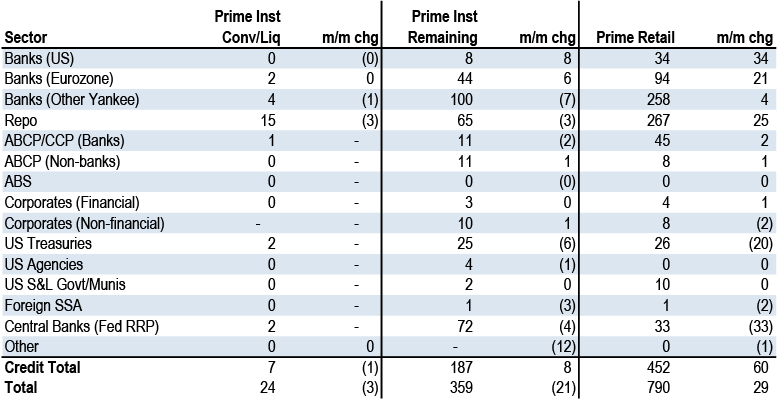

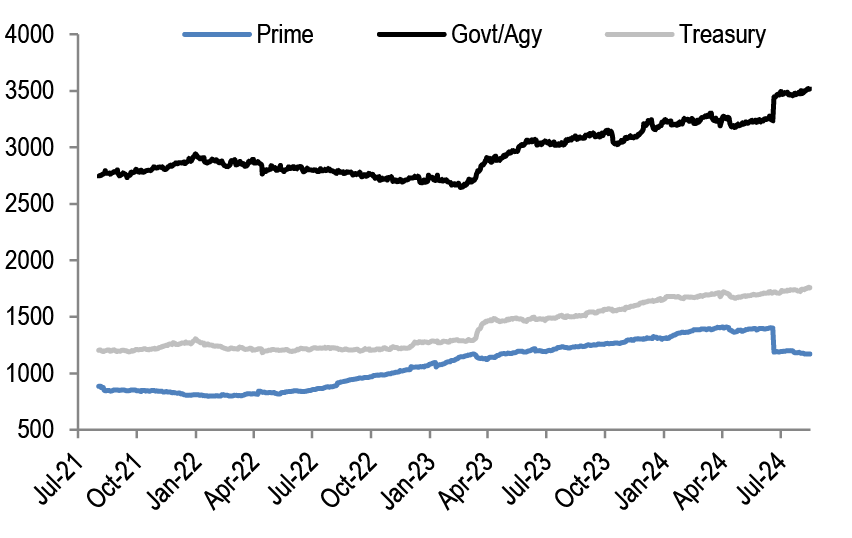

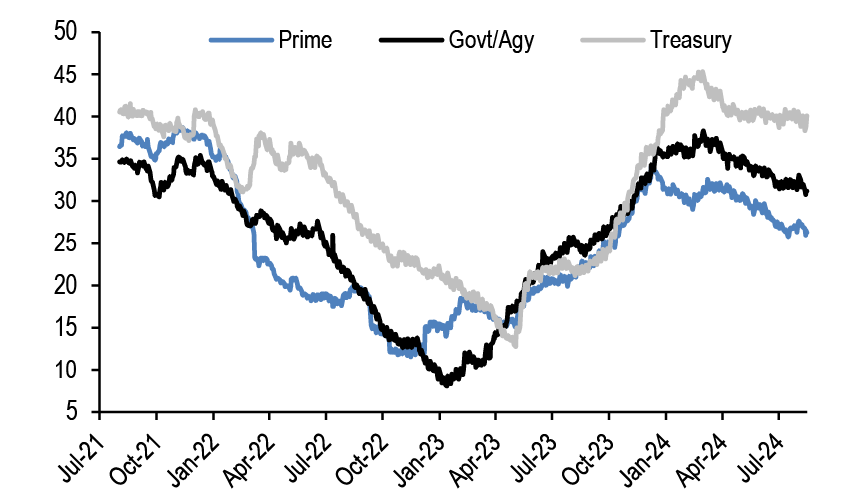

Short-term credit investors continue to favor bank CP/CD FRNs over fixed, with this trend likely to continue in the near term. RRP balances have decreased from their local peak but may be nearing a floor. We review July MMF holdings.

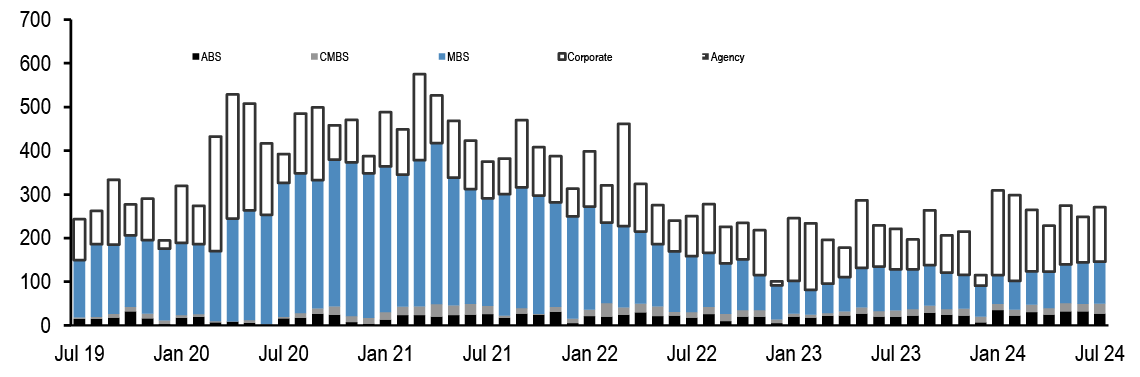

MBS and CMBS J. Sim

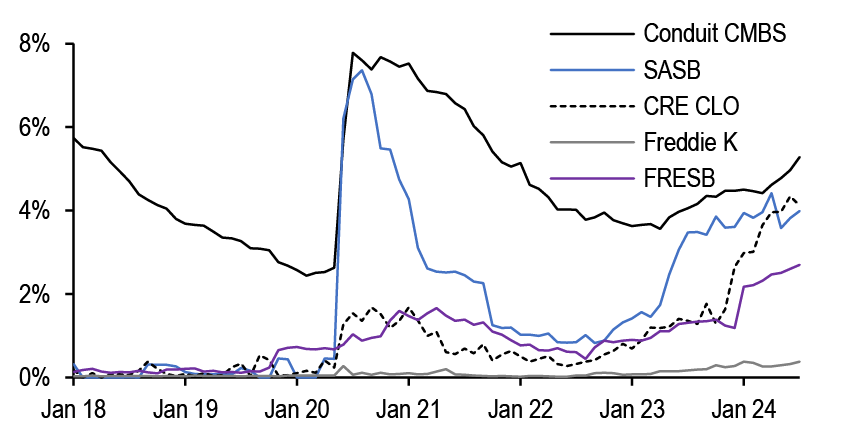

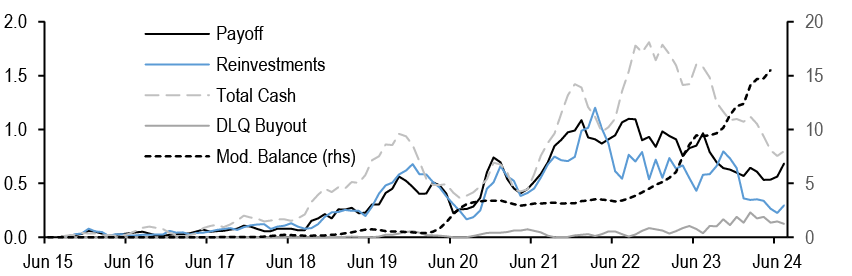

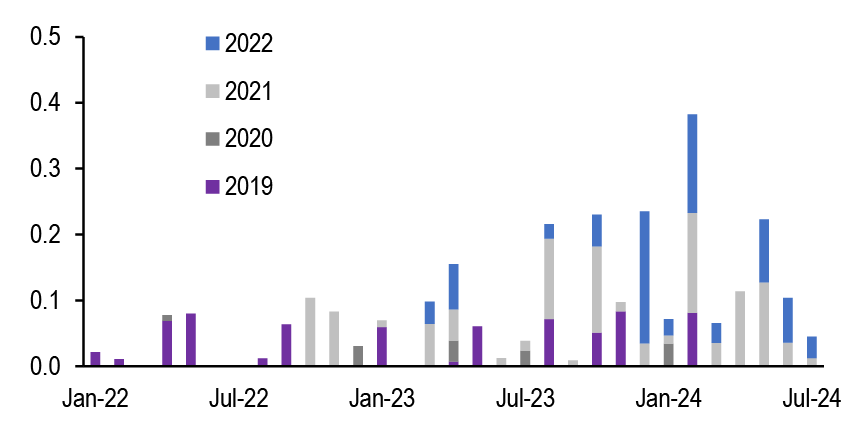

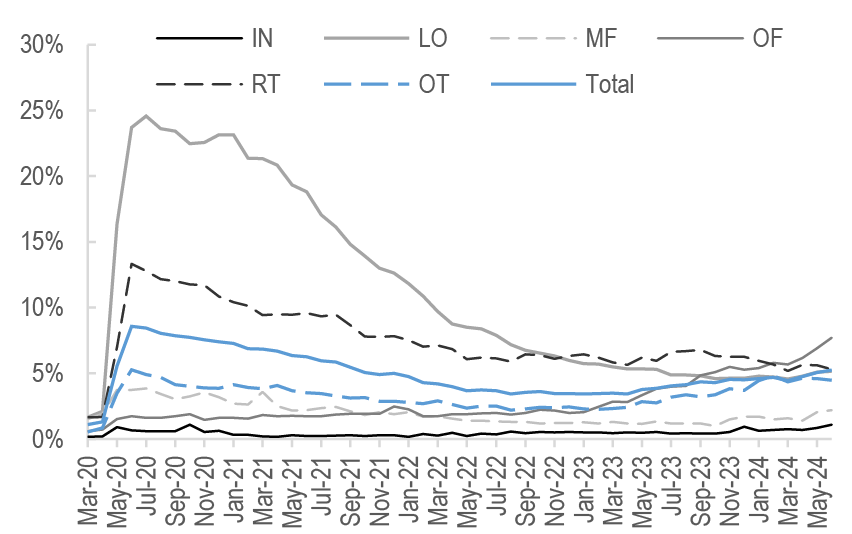

Continue to prefer UIC conventionals. The July remit data show that serious delinquency rate for private label CMBS increased to 4.74% and we continue to see elevated levels of DLQ buyouts and loan modifications in the CRE CLO market.

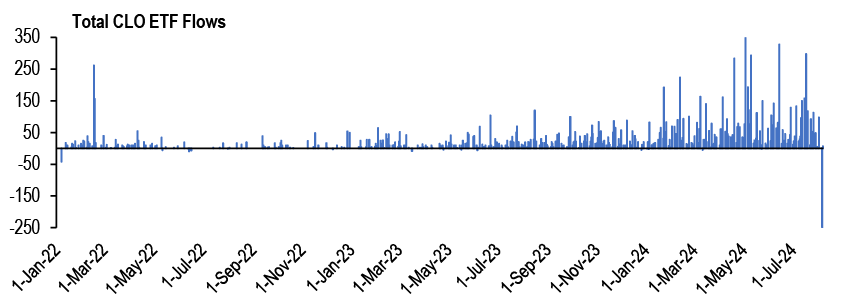

ABS and CLOs A. Sze, R. Ahluwalia

BB subprime auto ABS spreads have recovered, fully erasing the previous week’s widening. We widened our base case CLO T1 AAA new issue spread forecast to 150bp (from 130bp prior) and introduced a 175-200bp risk case in the event of a hard landing.

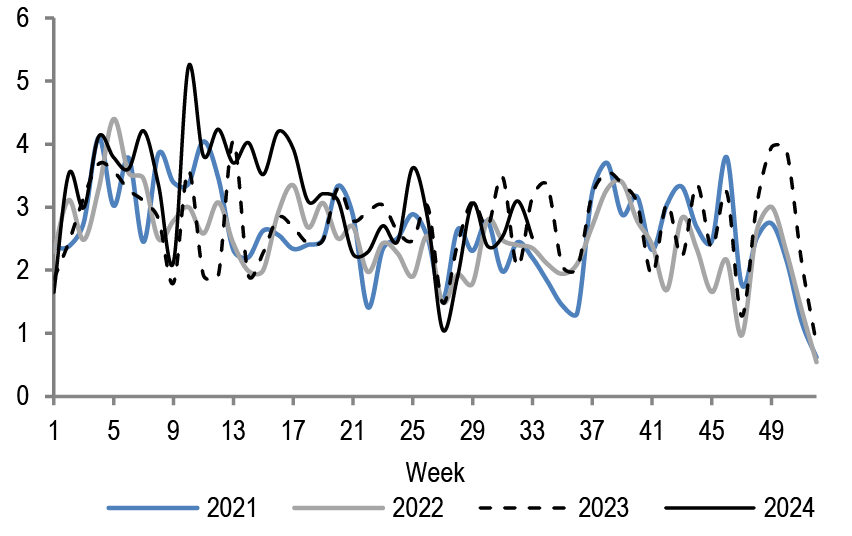

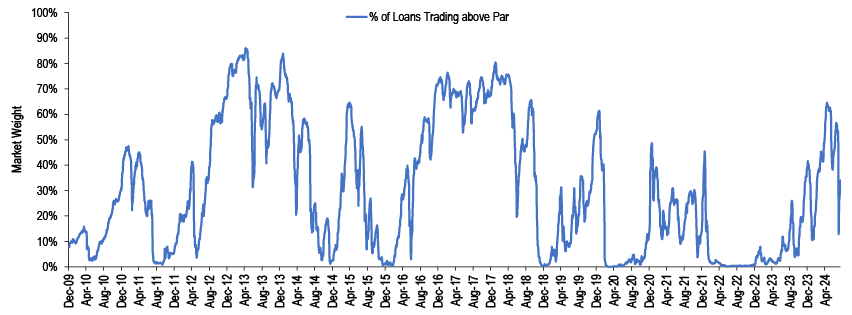

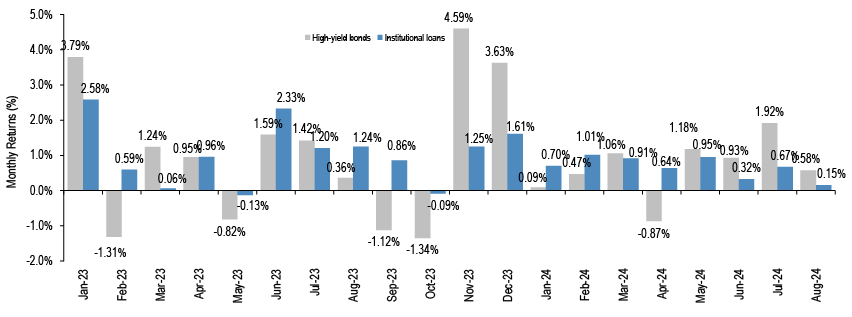

High Yield N. Jantzen, T. Linares

High-yield bond spreads of 369bp are well inside last week’s wide of 424bp, whereas yields (7.65%) too have fallen to a low since August 2022. And tightening 48bp, 52bp, 55bp off the wide, BB, B, and CCC spreads are now wider by 1bp, 16bp, and 42bp in August, respectively.

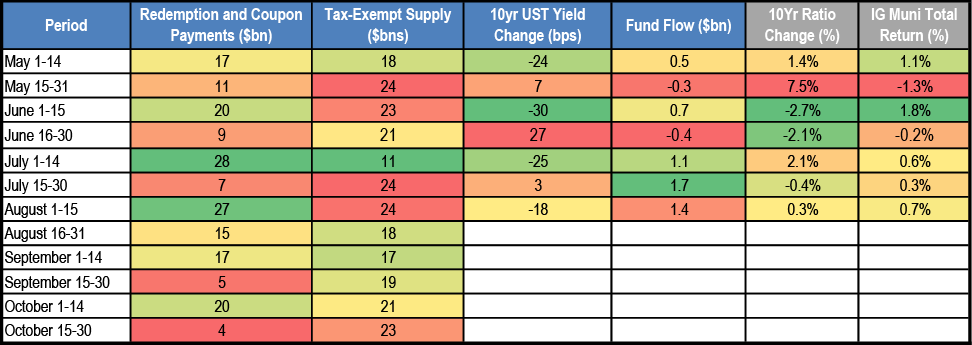

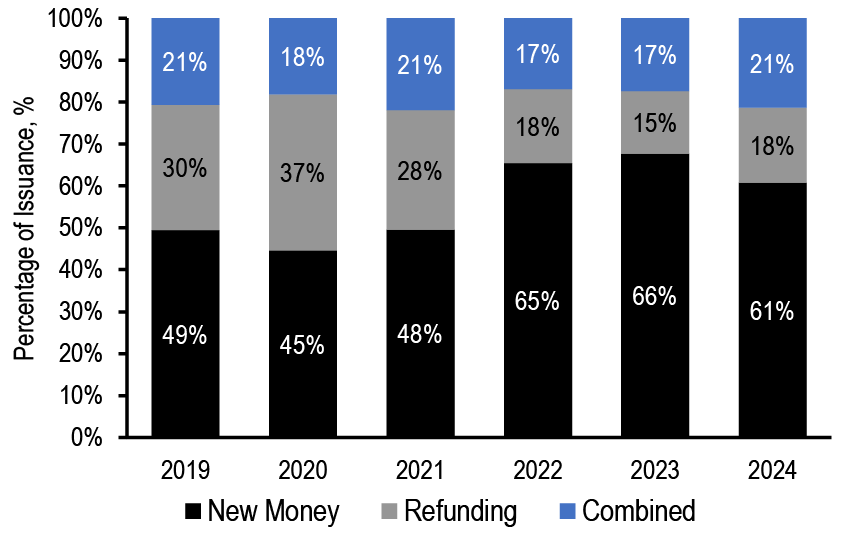

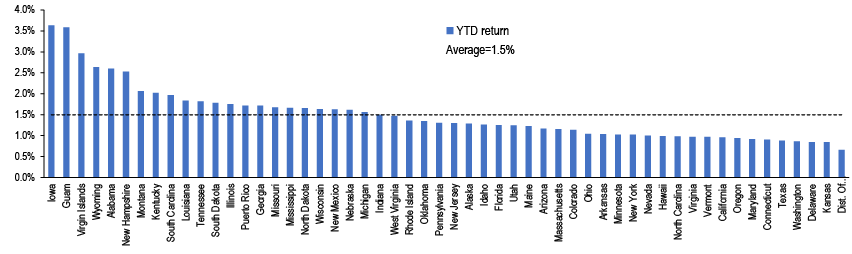

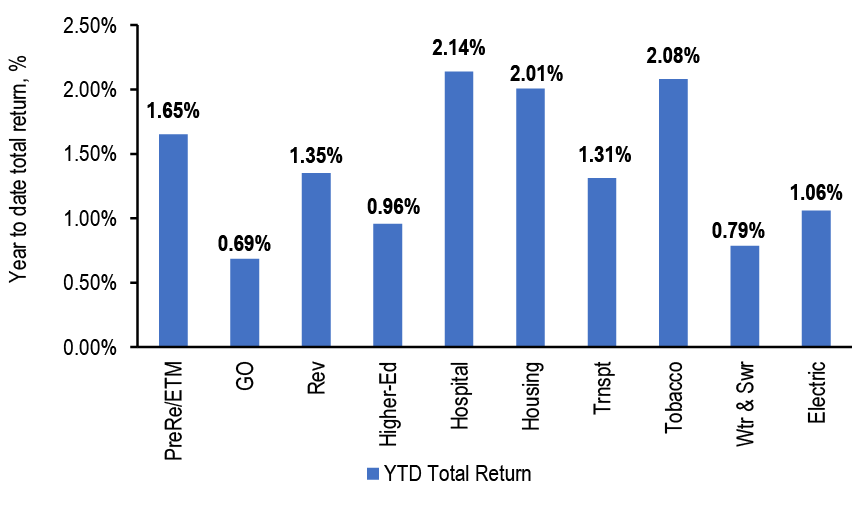

Municipals P. DeGroot, Y. Tian, R.Gargan

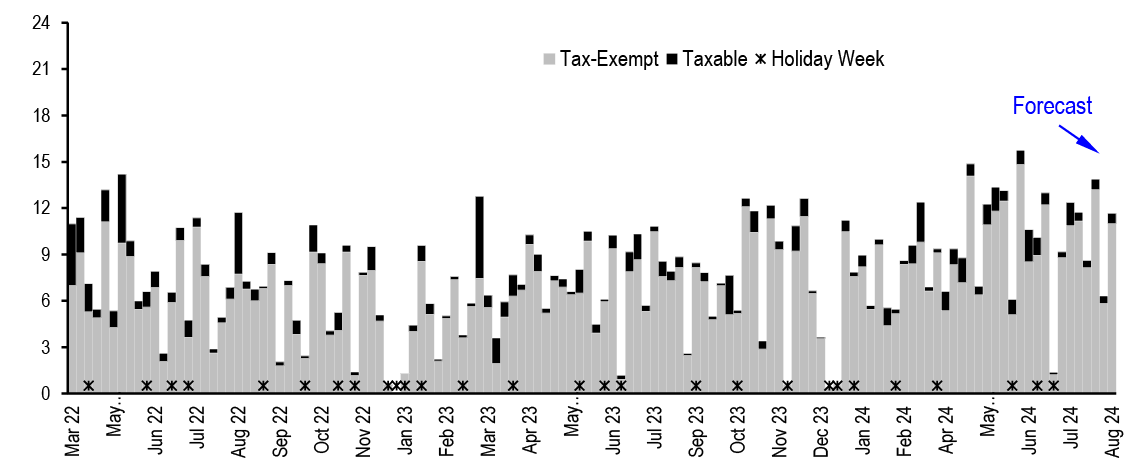

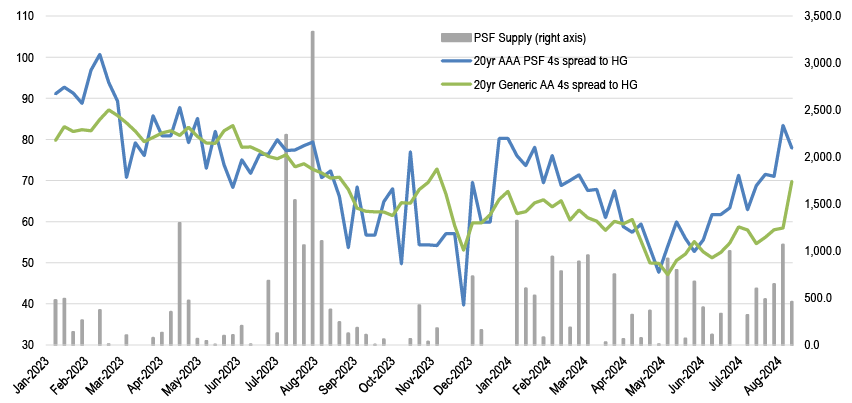

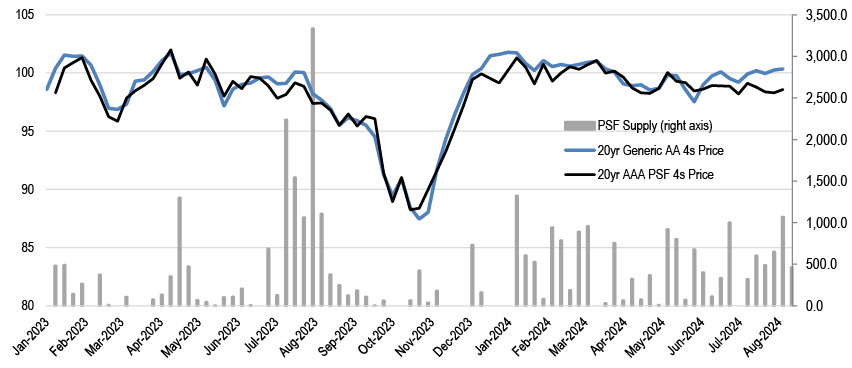

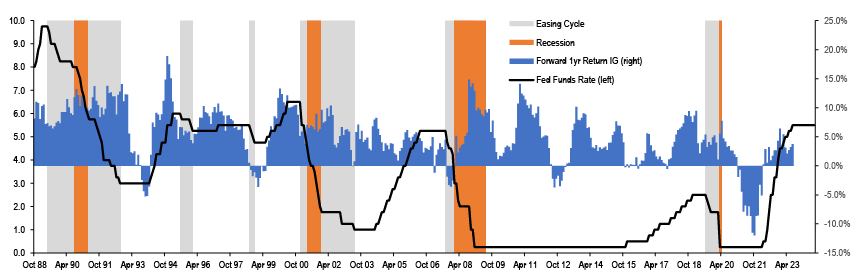

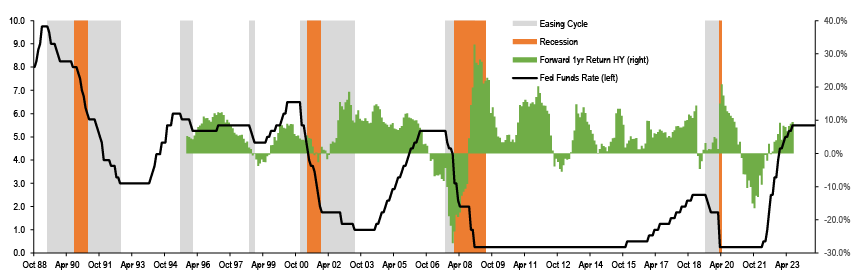

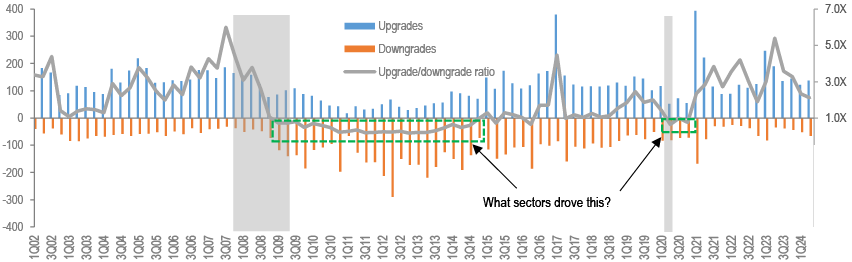

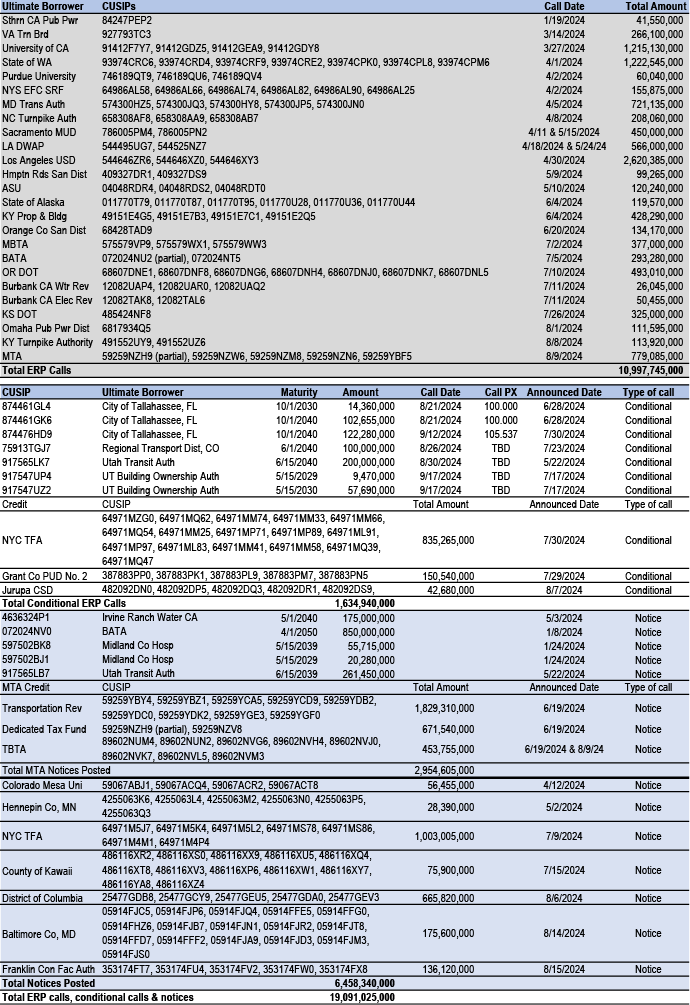

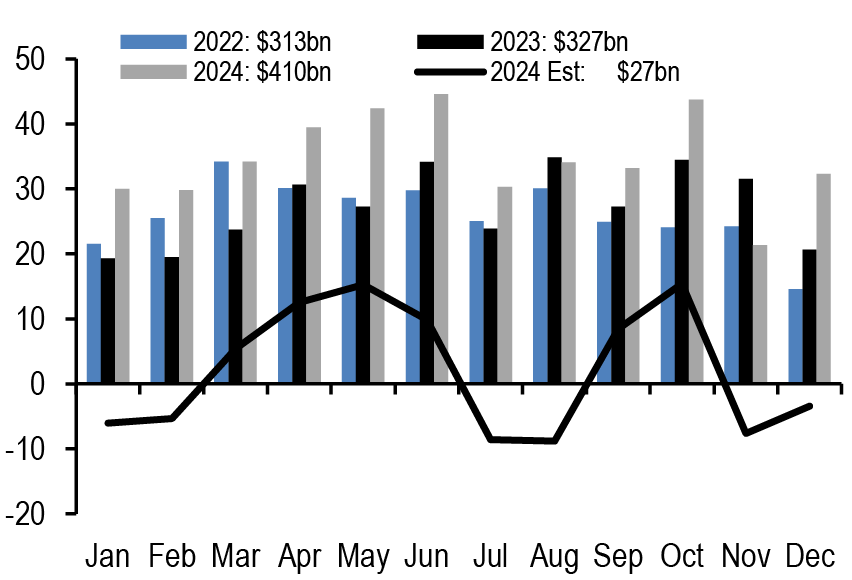

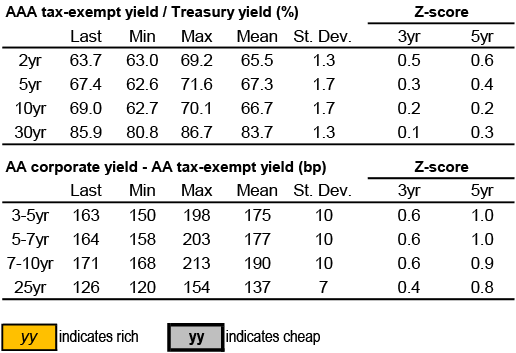

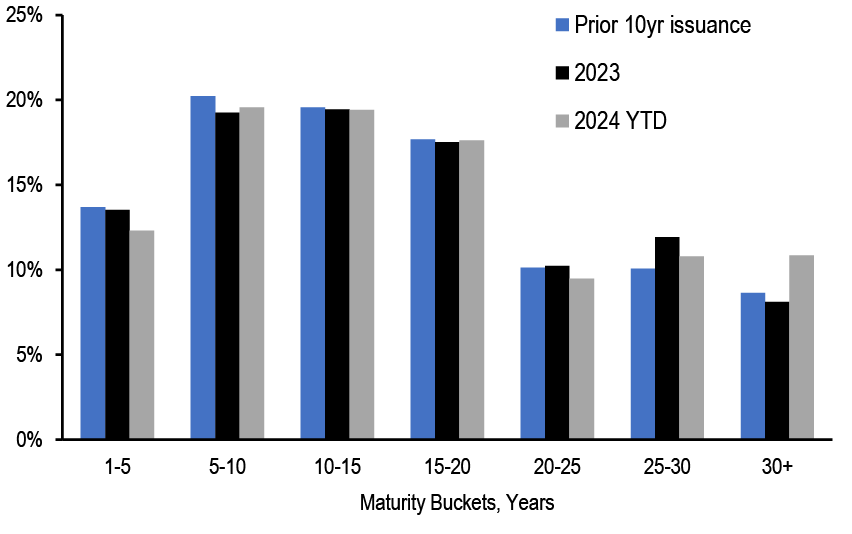

Elevated tax-exempt supply is expected to persist with market reception beholden to rate volatility. We find value in certain high-quality, high-vol structures and examine sector ratings change over economic cycles.

Emerging Markets L. Oganes

In EM fixed income, we are MW GBI-EM local rates, CEMBI and EMBIGD. EM bond flows were -$1.4bn (-0.36% of weekly AUM, down from -$1.0bn).

Summary of Views

| SECTOR | CURRENT LEVEL | YEAR END TARGET | COMMENT |

| Aug 16, 2024 | Dec 31, 2024 | ||

| Treasuries | |||

| 2-year yield (%) | 4.07 | 3.20 | Maintain 5s/30s steepeners and 75:6 weighted 5s/10s/30s belly-cheapening butterflies to position for higher term premium |

| 10-year yield (%) | 3.89 | 3.50 | |

| Technical Analysis | |||

| 5-year yield (%) | 3.77 | 3.10 | The rally has entered a more linear phase now |

| 5s/30s curve (bp) | 38 | 90 | The curve has broken out of its multi-year base pattern |

| TIPS | |||

| 10-year TIPS breakevens (bp) | 212 | 200 | Initiate tactical 5yx5y inflation swap longs |

| Interest Rate Derivatives | |||

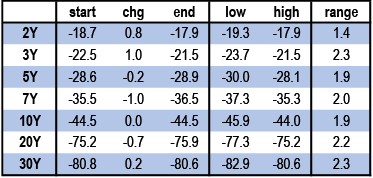

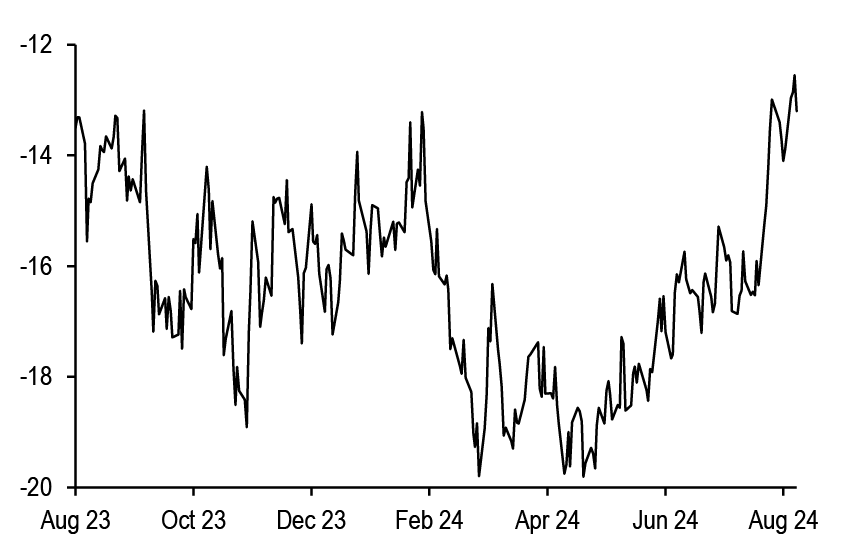

| 2-year SOFR swap spread (bp) | -18 | -6 | Policy uncertainty is back, and with it jump risk - stay bullish on short expiry volatility despite apparently rich valuations. Maintain front end swap spread wideners, and add exposure to narrower 10Y swap spreads and a flatter 3s/7s swap spread curve. Position for a flattening of the TU inter-CTD swap spread curve. An analysis of 3M expiry implieds suggests that election premia being priced currently are lower than in May, and in a smaller post-election time window. |

| 5-year SOFR swap spread (bp) | -29 | -22 | |

| 10-year SOFR swap spread (bp) | -44 | -37 | |

| 30-year SOFR swap spread (bp) | -80 | -79 | |

| Agency MBS | |||

| FNMA 30yr 5.5% Front Tsy OAS (bp) | 24 | 25 | Mortgages tightened on the back of weaker economic data |

| RMBS Credit | |||

| CRT M1B/M2 (DM@10CPR) | 1MS + 170bp | 1MS + 175bp | At the top of the capital structure, higher coupons (5.5-6.5s) do not have a ton of refinancing pressure in the near term. Spreads should hold firm. In credit, home prices remain supportive, but spreads are very tight. We look for more sideways moves in the second half. |

| RMBS 2.0 PT (6s) | 1-16bk of TBA | 1-12bk of TBA | |

| AAA Non-QM | I + 140bp | I + 150-175bp | |

| ABS | |||

| 3-year AAA card ABS to Treasuries (bp) | 50 | 40 | ABS spreads mostly stable over the first two weeks of July, with strong bids for benchmark credit card and FFELP ABS |

| CMBS | |||

| 10yr conduit CMBS LCF AAA | 103 | 95 | LCF AAAs look Freddie K A2 spreads look about fair to their corporate and mortgage comps. |

| 10yr Freddie K A2 | 53 | 48 | |

| Investment-grade corporates | |||

| JULI spread to Treasuries (bp) | 111 | 110 | HG spreads recovered from the sell-off and are back close to our YE target. Expecting a grind tighter into month-end so long as yields remain rangebound. |

| High yield | |||

| Domestic HY Index spread to worst (bp) | 368 | 380 | We believe HY spreads will be supported in the near-term by resilient earnings, steady inflows, and lighter capital market activity in 3Q |

| Credit Derivatives | |||

| High Grade (bp) | 52 | 50 | Credit has outperformed relative to both equity and equity volatility in the recent selloff. Buying CDS index protection funded by selling VIX futures screens attractive at current levels |

| High Yield | $106.5/337bp | 350 | |

| Short-term fixed income | |||

| EFFR (%) | 5.33 | 4.10 | Funding conditions should remain benign, with liquidity remaining abundant, limiting any potential impacts to EFFR/SOFR, T-bills/OIS, and CP/OIS spreads. We do not expect MMF reform to have any outsized impact on money market credit spreads. Treasury repo clearing remains work in progress, though concerns about readiness are emerging. |

| SOFR (%) | 5.35 | 4.10 | |

| CLOs | |||

| US CLO Primary AAA (Tier 1, bp) | 135 | SOFR + 150 | We widened our base case CLO T1 AAA new issue spread forecast to 150bp (from 130bp prior) and introduced a 175-200bp risk case in the event of a hard landing. |

| Municipals | |||

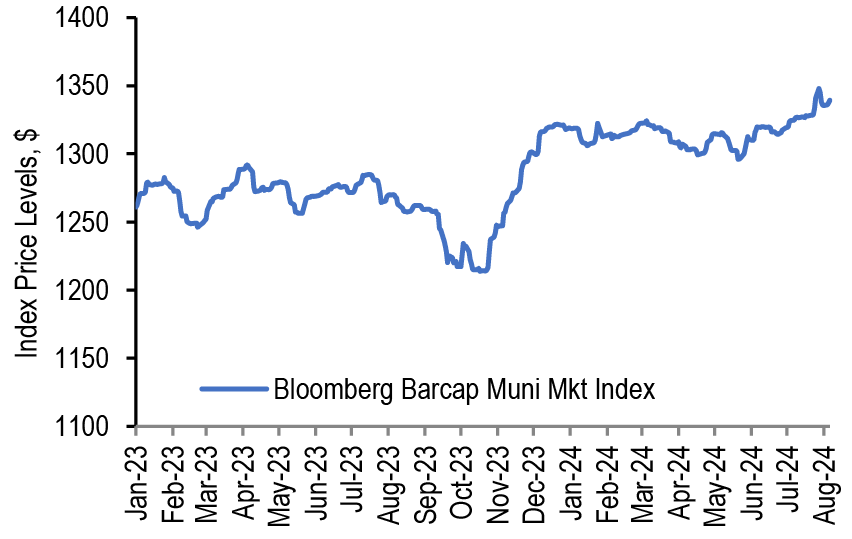

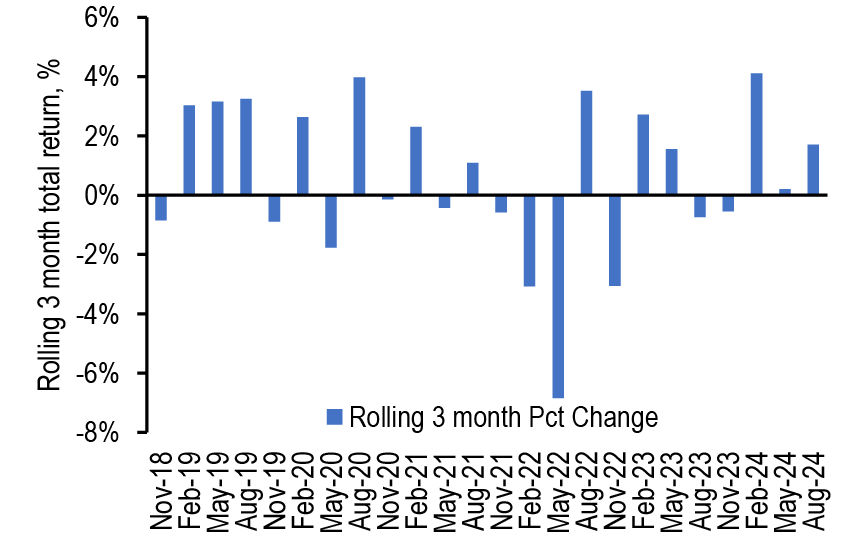

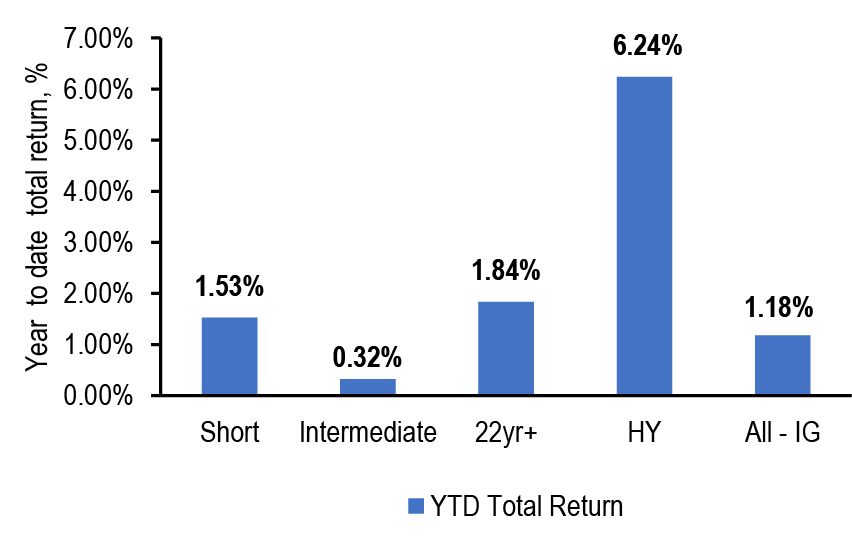

| 10-year muni yield (%) | 2.82 | 2.10 | Finding sustained market consensus while navigating transition to an easing cycle may be difficult, but we suggest playing the long game, and buying municipal bonds with a longer term perspective, particularly in periods where Treasuries sell-off. We suggest adding idiosyncratic municipal risk opportunistically on market weakness, and highlight potential market cheapening in the period before the election. |

| 30-year muni yield (%) | 3.57 | 3.10 | |

| Emerging Markets | |||

| Hard currency: EMBIG Div (bp) | 400 | 400 | MW EMBIGD |

| Hard currency: CEMBI Broad (bp) | 230 | 220 | MW CEMBI Br |

| Local currency: GBI-EM yield (%) | 6.25% | 5.58% | MW local rates |

Source: J.P. Morgan

US Fixed Income Overview

Roundtrip

- Economics: Headline CPI rose 0.2% last month while the core index increased 0.165%, leaving the year-ago rate to moderate to 3.2%. Meanwhile total retail sales increased 1.0% m/m while the control series rose 0.3% last month. Initial claims declined to 227k and we expect filings to remain roughly constant at 230k at the next print

- Treasuries: Markets are pricing in a less dovish path than our forecast, but we remain patient before adding duration given long investor positioning. Jackson Hole speeches have not traditionally led to large yield moves, except in 2020 and 2022; we do not expect clear guidance from Chair Powell next week. We contrast the upcoming easing cycle with other easing cycles: policy is more restrictive than at any point in the last 30 years, pointing toward a deeper easing cycle, but financial conditions are easy and financial stress is low, making the case for a slower pace of cuts. Hold 5s/30s steepeners as a low-beta long with a better carry profile ahead of the first cut.

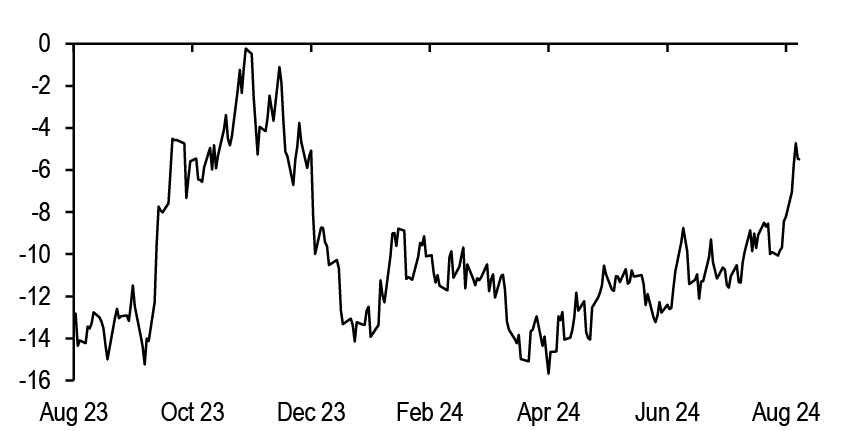

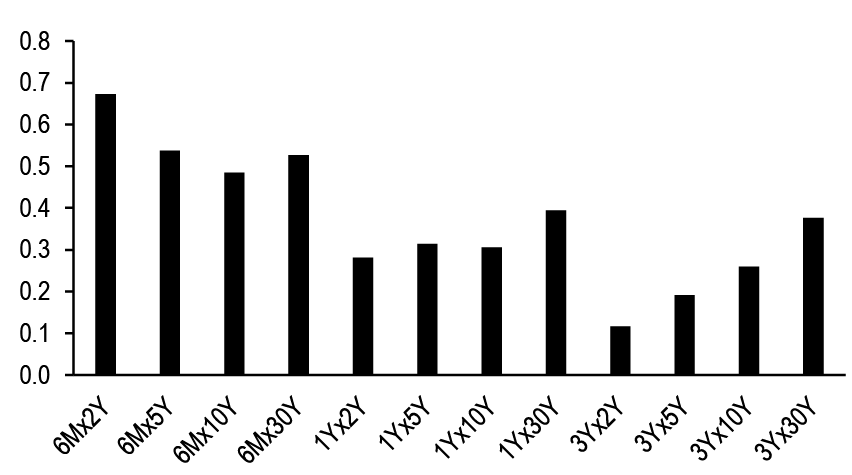

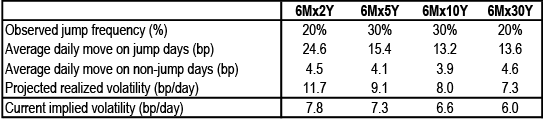

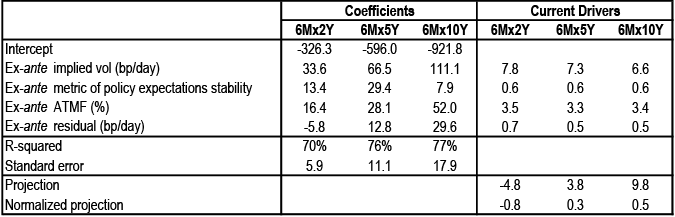

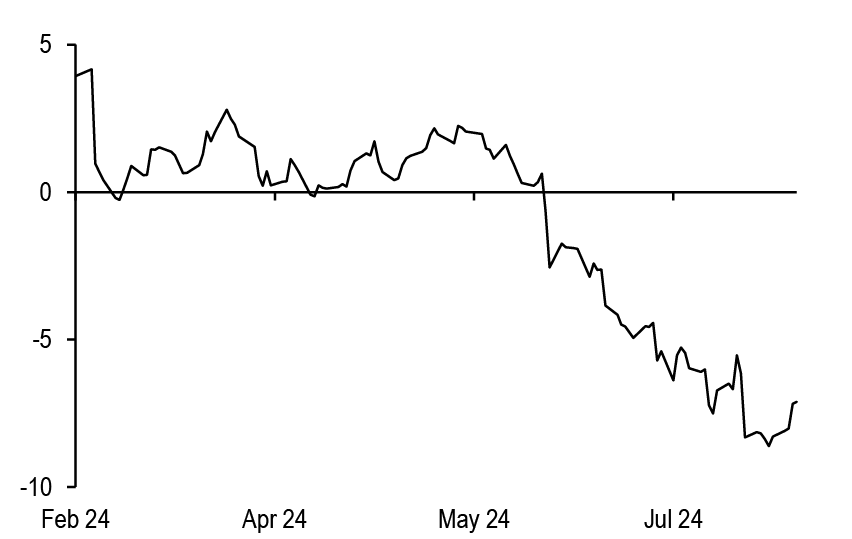

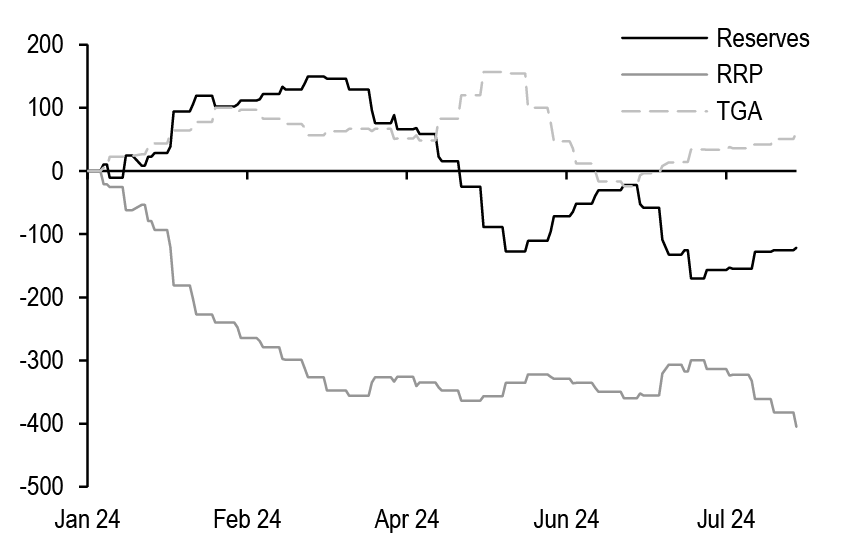

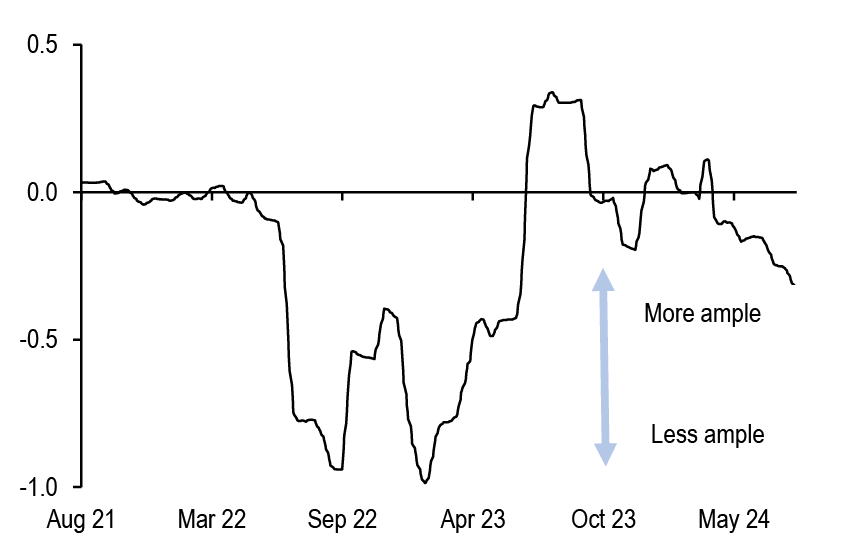

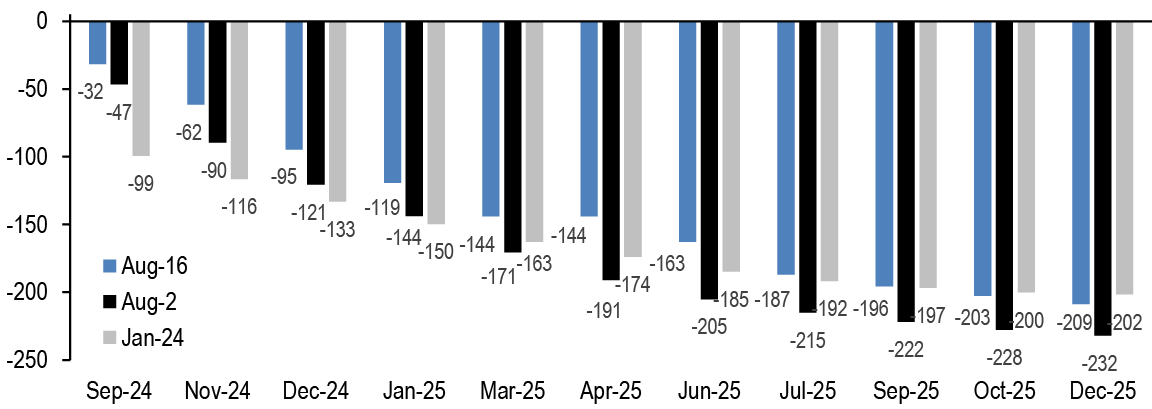

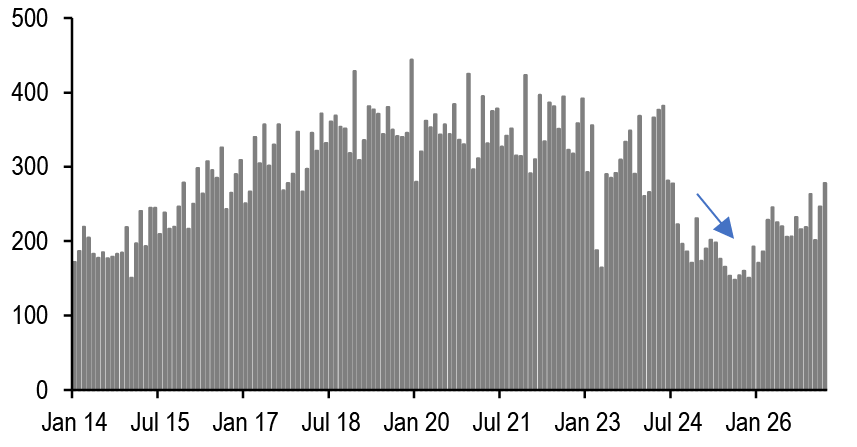

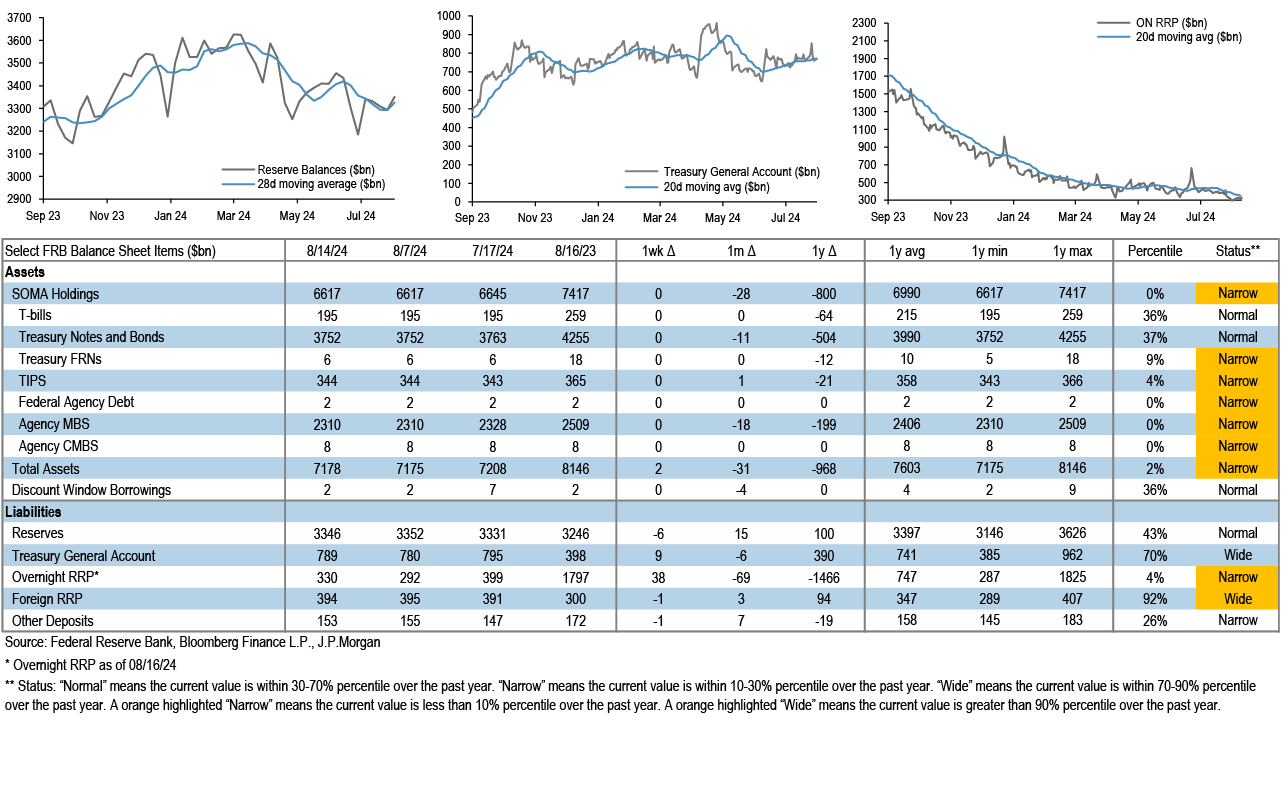

- Interest Rate Derivatives: We remain long volatility expressed in 5-year tails as elevated policy uncertainty leads to higher jump risk and more frequent jump days. Normalizing repo rates are likely to bias the front end of the swap spread curve wider while ongoing QT and elevated Treasury supply are likely to bias the long end narrower. We favor 3s/7s maturity matched swap spread curve flatteners. Liquidity conditions have tightened and we think QT is in its endgame, with reserves likely to reach $3tn and RRP balances slightly below $300bn by YE24

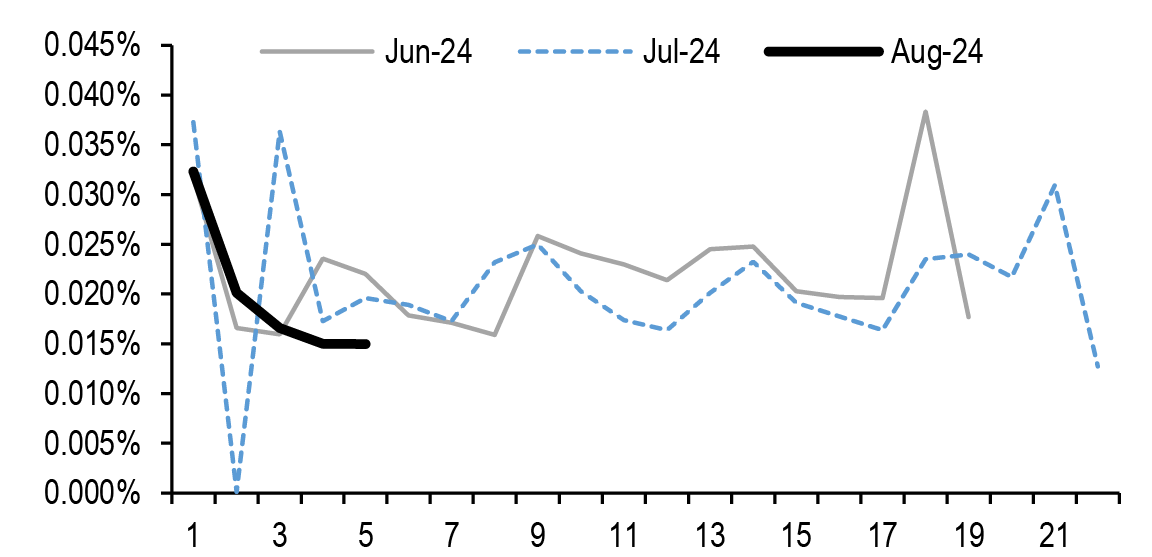

- Short Duration: RRP balances have trended lower, reaching $330bn on 8/16, and positive T-bill issuance over the past couple weeks has likely contributed to this trend. That said, we may be reaching a floor as net T-bill issuance stalls in early-September and as MMFs keep some amount of exposure meet liquidity needs. We expect RRP balances to hover near low to mid-$300bn range for the remainder of the month

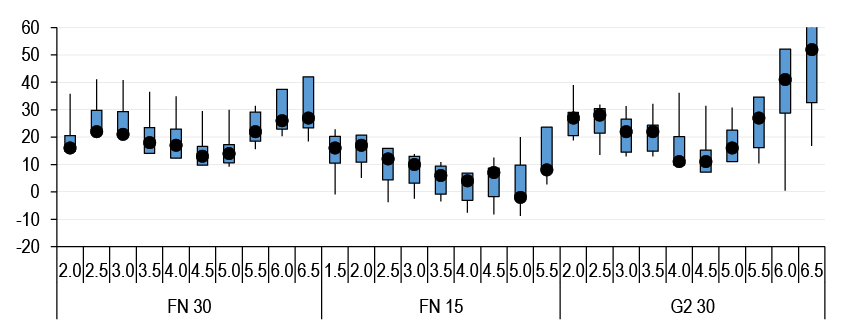

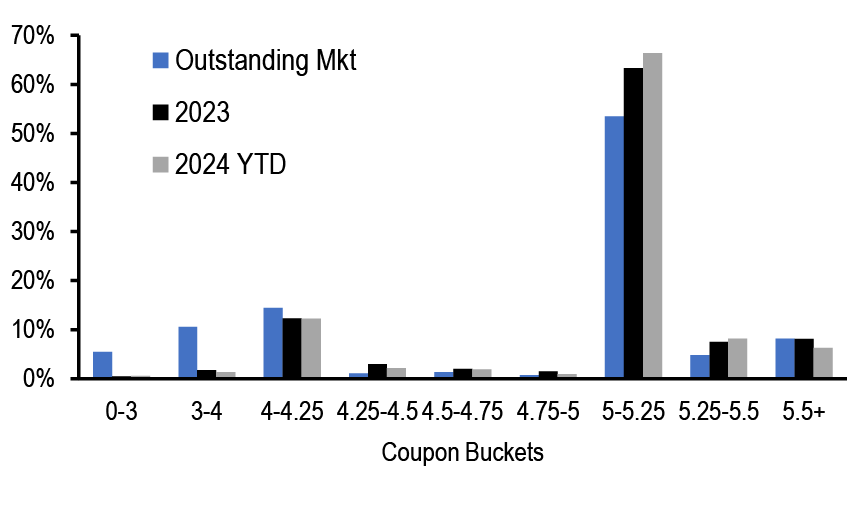

- Securitized Products: Higher coupons outperformed lower coupons, reflecting shifting demand and relative value up the stack. We prefer UIC conventionals and are underweight 4.5s and 5s. We think mortgage rates can fall to 6% by year-end, but this will have a limited impact on house prices. In CMBS, we think upper IG mezz bonds look cheap to similar duration single-A corporates

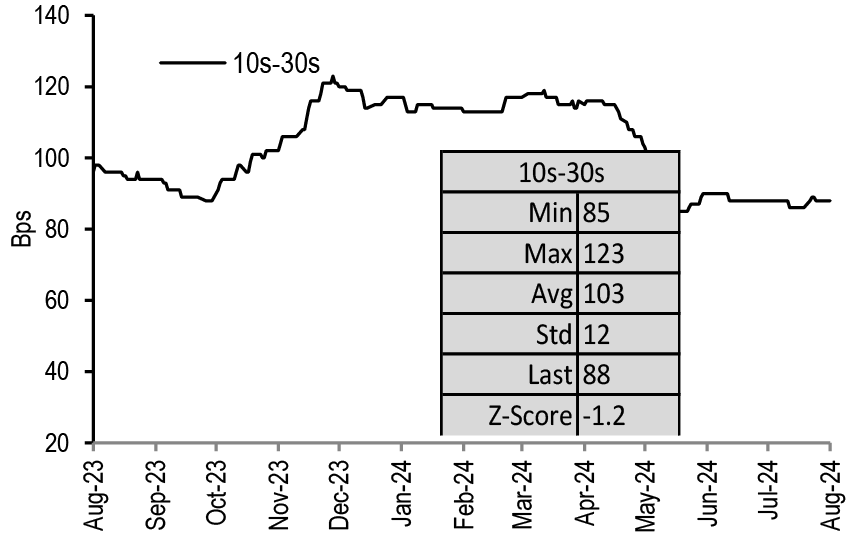

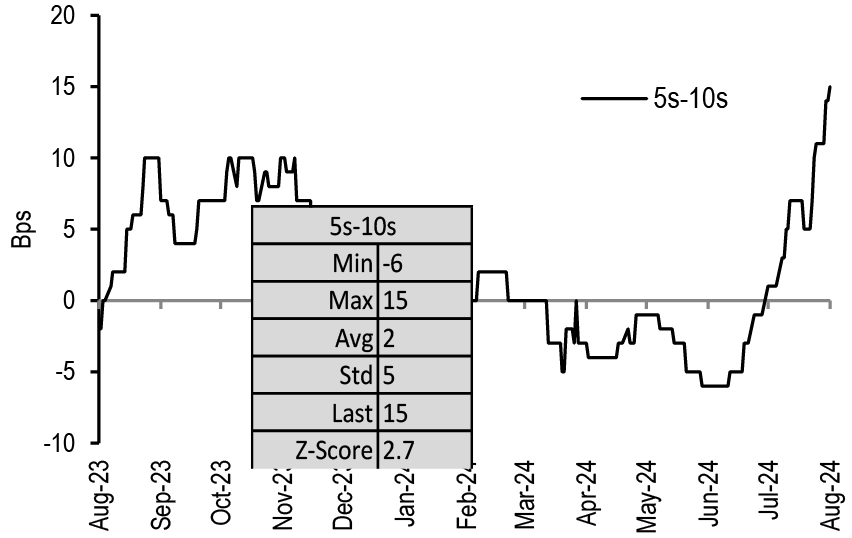

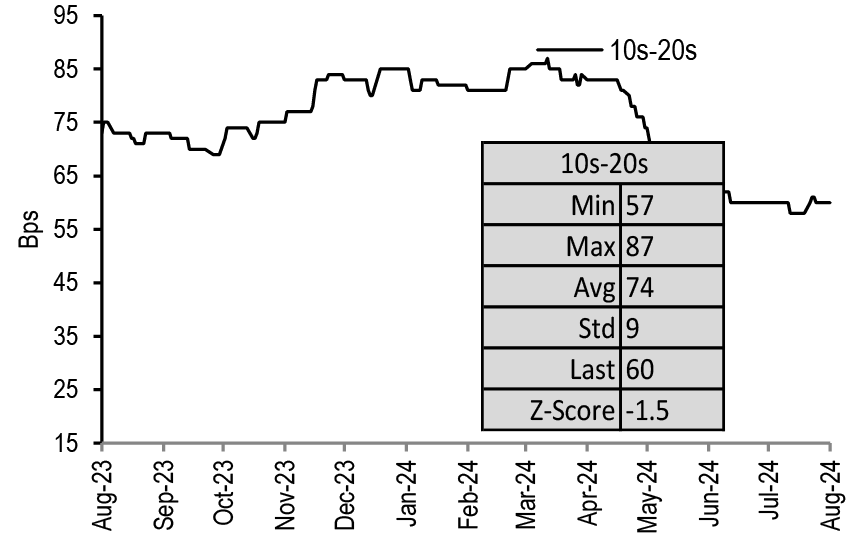

- Corporates: HG spreads have now nearly round tripped the most recent selloff. Demand remains solid, especially from overseas investors but the 10s30s spread curve has lagged as yields nudge lower and long-end supply picks up.We revise higher our CLO T1 AAA new issue spread YE24 forecast from 130bp to 150bp

- Near-term catalysts: Aug flash manufacturing PMI (8/22), Aug flash services PMI (8/22), Jackson Hole Symposium (Aug 22-24), Aug Employment (9/6)

Must Read This Week

Flows & Liquidity: How much liquidity deterioration?, Nikolaos Panigirtzoglou, 8/14/24

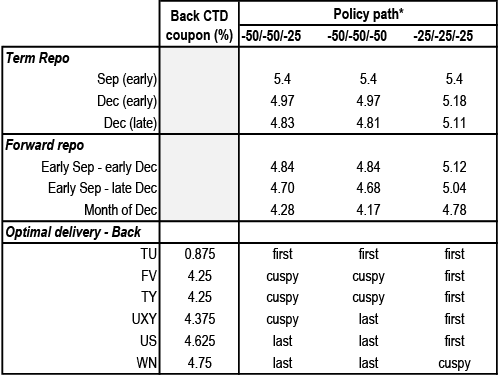

U.S. Bond Futures Rollover Outlook: September 2024 / December 2024, Srini Ramaswamy

US: The when and why of intermeeting Fed rate cuts, Michael Hanson and Michael Feroli, 8/9/24

US: Peering through the choppiness in claims, Abiel Reinhart, 8/9/24

Focus: Concerning signs as balance sheets normalize, Murat Tasci, 8/9/24

Gradualism under pressure, Bruce Kasman, Joseph Lupton, and Nora Szentivanyi, 8/7/24

‘Mission Accomplished’ on MBS vs HG Corps, Nathaniel Rosenbaum and Nick Maciunas, 8/6/24

And Now Hear This…

At Any Rate - July CPI, Jackson Hole, and Jittery markets, Phoebe White and Michael Hanson, 8/15/24

At Any Rate - Treasury futures roll, Srini Ramaswamy and Ipek Ozil, 8/14/24

At Any Rate - July Morning turns into Cruel Summer, Jay Barry and Srini Ramaswamy, 8/9/24

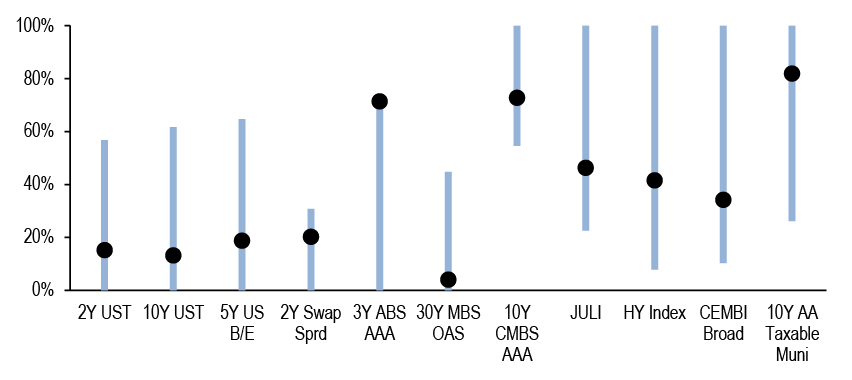

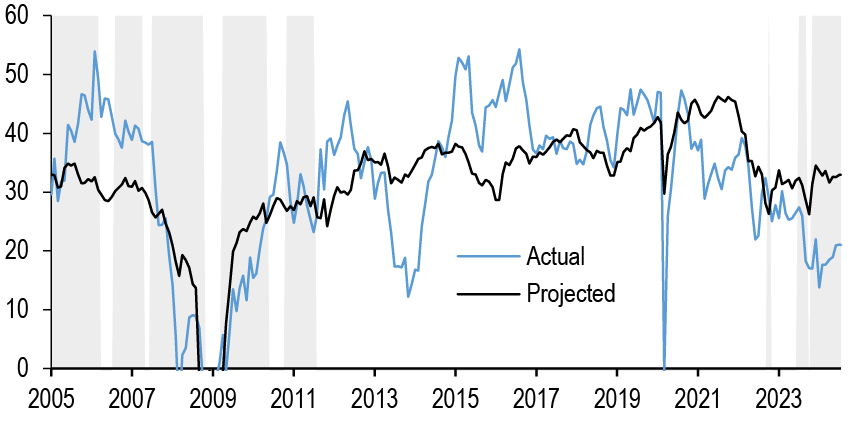

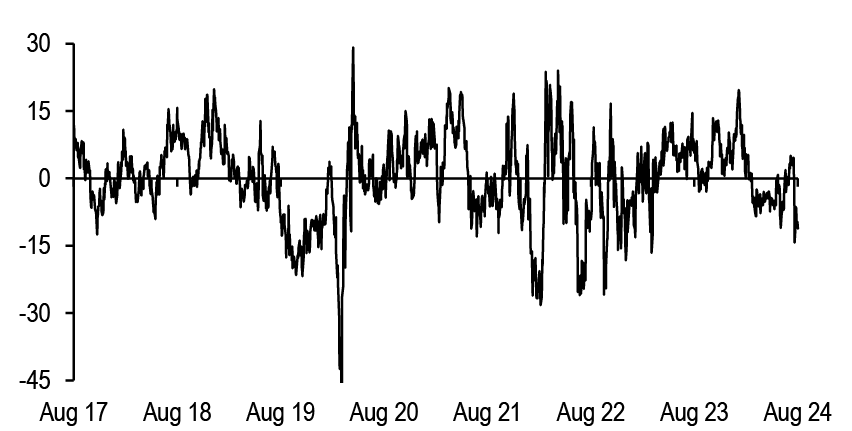

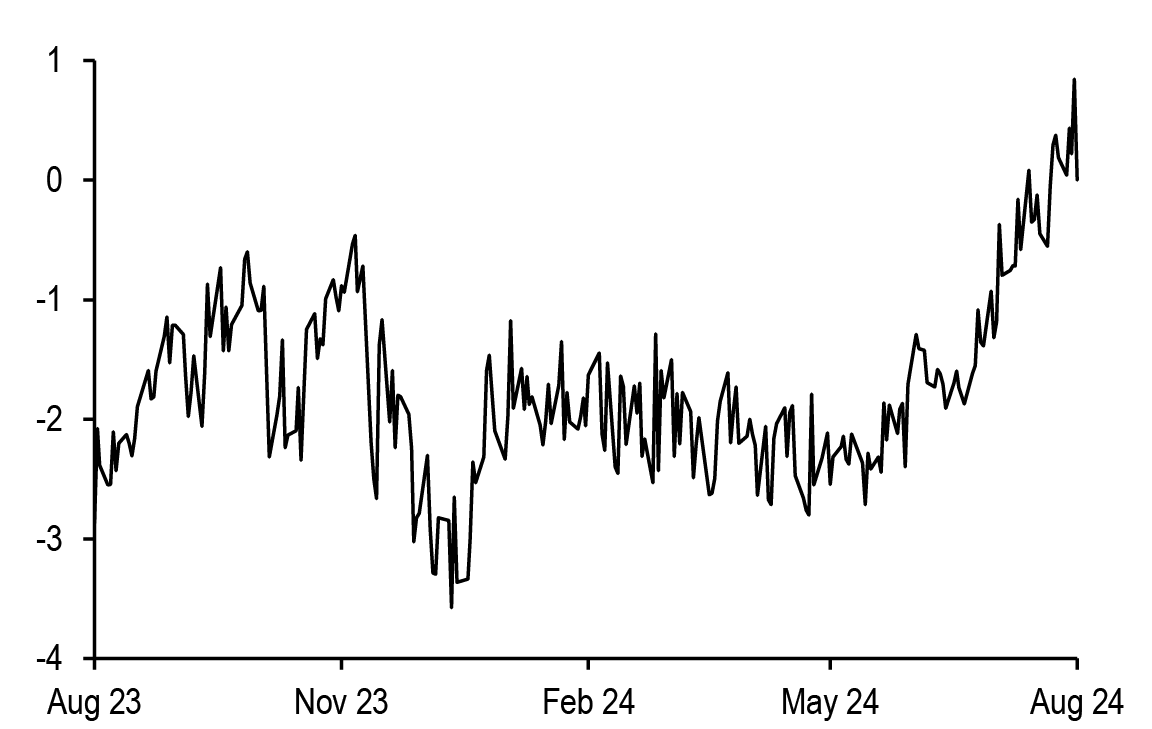

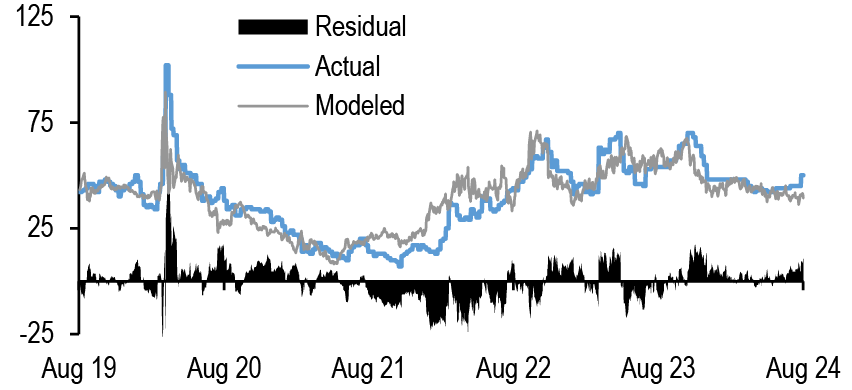

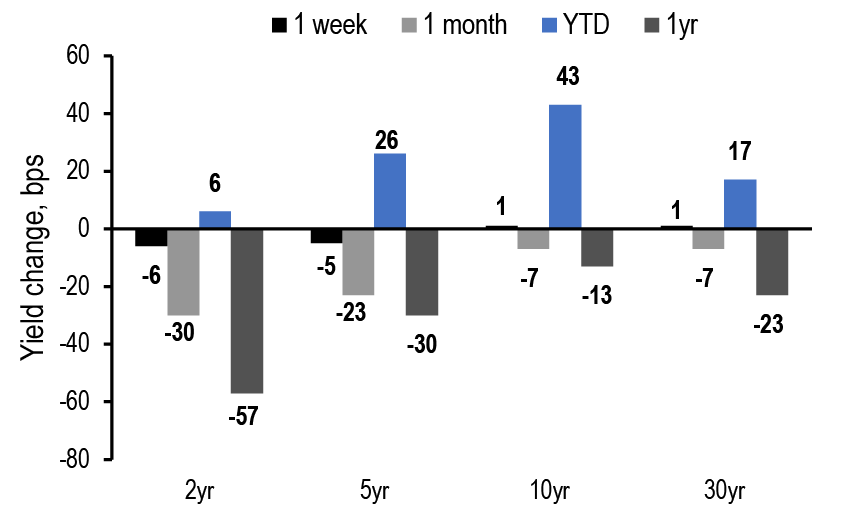

In the wake of the July employment report, Treasury yields initially plunged and corporate spreads widened before retracing these moves over the fortnight supported by the relative strength in the data and a normalization in risk sentiment ( Figure 1). Market liquidity conditions have also largely rebounded amid the decline in volatility. While limited, the data over the past two weeks has assuaged the worst fears surrounding an impending slowdown. The July CPI report delivered on expectations, as the core index rose 0.165% m/m last month to leave the year-ago rate to cool to 3.2% with most categories outside shelter flagging as soft, and we are currently tracking core PCE increased 0.122% in July (see US: Cooler July CPI, as expected, Michael Hanson, 8/14/24). Meanwhile the July retail sales report beat expectations, with the total index rising 1.0% m/m and the control group moving up by 0.3%, and strong consumer spending to start 3Q24 presents upside risk to our GDP tracking (see US: July retail sales suggest no slowing in 3Q real spending, Abiel Reinhart, 8/15/24). Most notably, initial jobless claims moved down from a peak 250k at the end of July to 227k, suggesting that after adjusting for one-off shocks emanating from recent weather events and auto-plant shutdowns, the level of claims are not significantly higher than in recent summers (see US: Jobless claims moved down, Murat Tasci, 8/15/24). As we look ahead, all eyes will be focused on initial claims next week, as it will overlap with the employment survey reference week, and we expect claims to remain roughly stable around 230k (see Economics). We also look forward to Powell’s comments at Jackson Hole, though it is unlikely the Chair will offer too much granularity on the magnitude or pace of easing given the importance of the upcoming August employment report.

Figure 1: Treasury yields have backed off their lows and credit spreads from their wides, as the relative strength in the data and risk sentiment has supported a normalization following the July payrolls report

Respective yields and spreads (black dots) within their 1-month range (blue section), normalized as a percentage of their 3-month histories; %

Source: J.P. Morgan

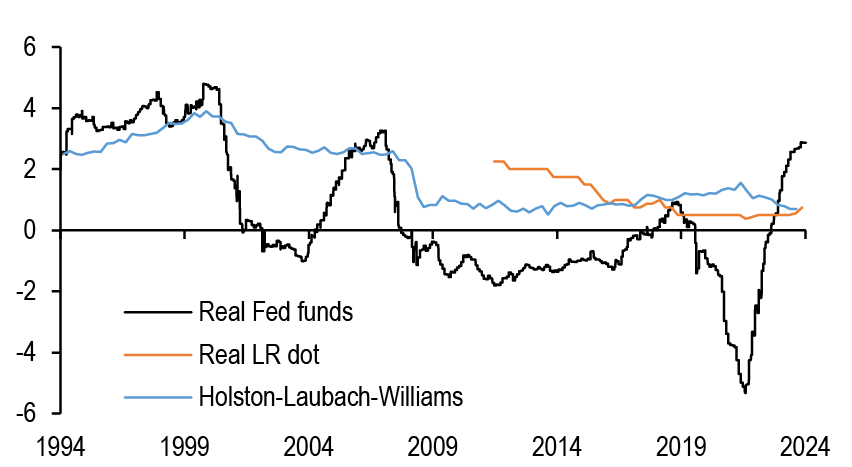

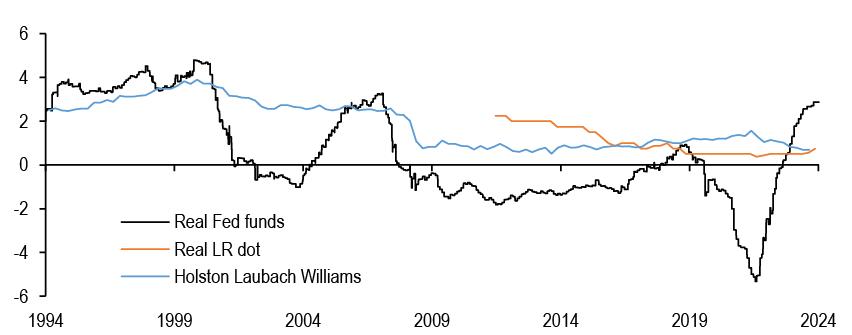

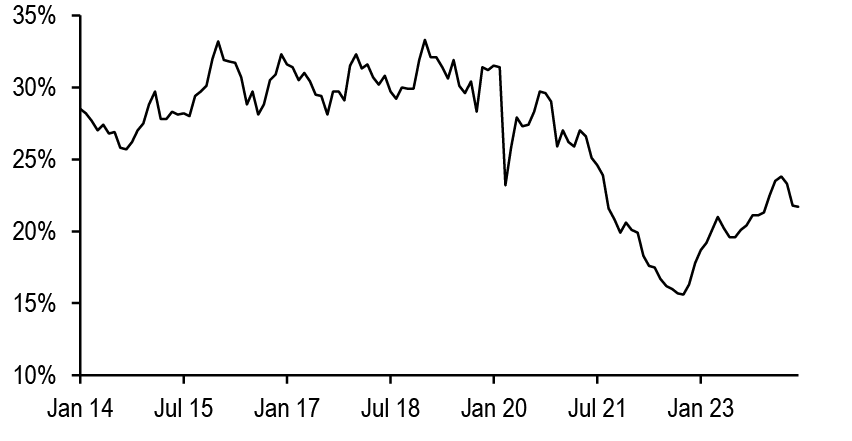

Against the backdrop of easing inflation pressures and above-trend growth, the real Fed funds rate is decidedly more restrictive than before prior easing cycles and it is notable that Fed speakers from across the spectrum have recently highlighted the need to moderate this stance ( Figure 2). Thus, with the disinflationary process resuming and labor markets significantly looser than they were a year ago, we think this makes the case for substantial Fed easing in the coming months, and we continue to project 50bp cuts in September and November before downshifting to 25bp through late-2025. However, markets have clearly moved in the opposite direction this week, pricing in just 30bp of easing by the September FOMC meeting, and 94bp for 2024. It’s tempting to add duration here, with markets pricing a slower and shallower path of cuts than our modal view, but we prefer to be patient, knowing that position technicals could be a drag over the near term. Specifically, our Treasury Client Survey index has extended significantly over the last few weeks to the longest levels since December. Should the conditions present themselves, we would look to add duration in the 3- to 5-year sector of the curve. Meanwhile, we maintain our 5s/30s steepener position as a lower-beta duration long with a better carry profile which is both supported by historical steepening pattern into Fed easing cycles and reinforced by higher term premium (see Treasuries).

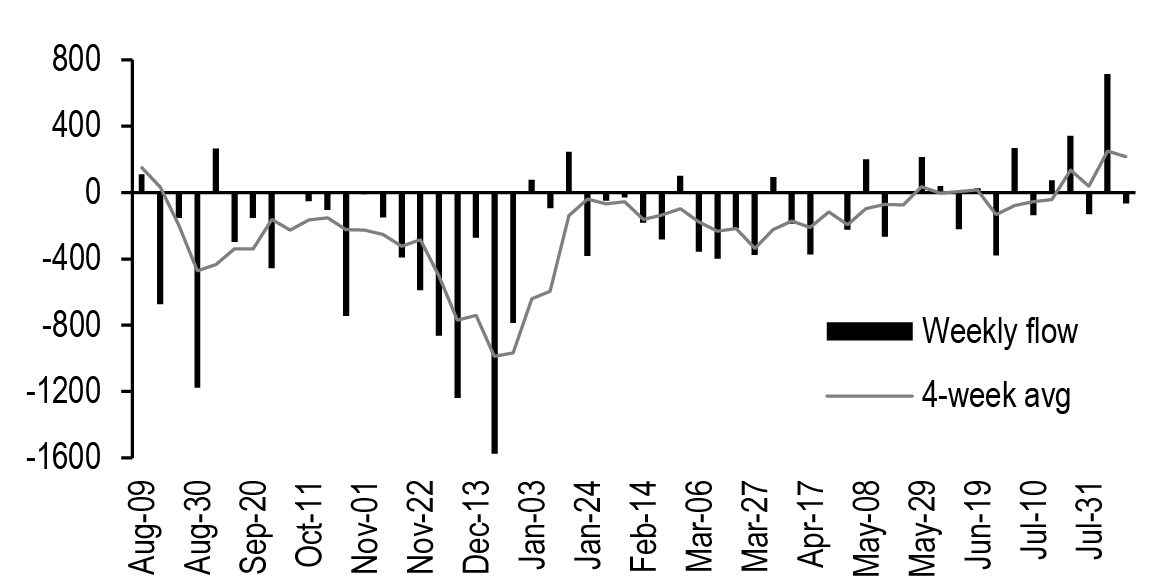

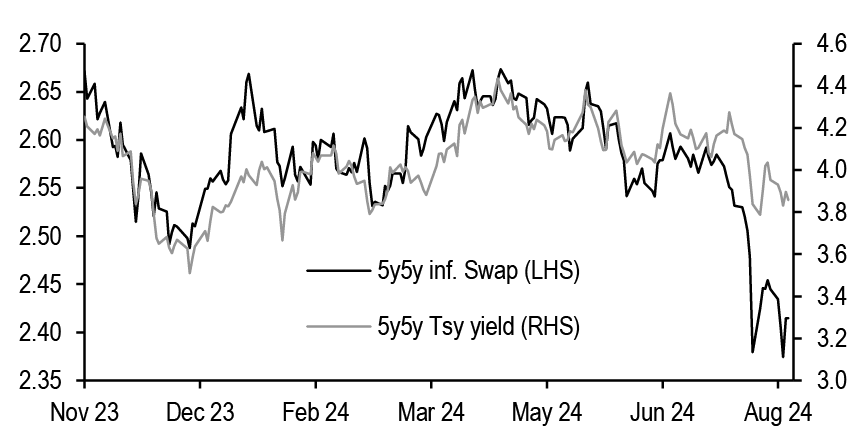

Turning to inflation markets, TIPS breakevens lagged the recovery in other markets and remain cheap versus our fair value estimates. With the Fed likely to begin cutting rates next month, we note that breakevens have not exhibited a consistent performance around the start of prior easing cycles. However, a Fed that is cutting due to risks coming into better balance and a desire to return policy rates quickly to neutral should be more supportive for breakevens than a Fed that is behind the curve. Meanwhile, technicals have turned more supportive as well. Demand for TIPS-focused funds has picked up alongside the decline in real yields and improvement in realized TIPS returns, driving the 4-week moving average of inflows to its highest level in more than 2 years. Along the curve, the intermediate sector offers value, and we prefer to express longs in inflation swaps rather than breakevens, given that IOTAs remain tight. Thus, we recommend tactical longs in 5Yx5Y inflation swaps (see TIPS).

Figure 2: The Fed funds rate is considerably more restrictive than at any point over the last 30 years

Real Fed funds rate*, real longer-run median Fed dot, and Holston-Labach-Williams natural rate of interest rate; %

Source: J.P. Morgan., Federal Reserve bank of New York, Bloomberg Finance L.P.

*Fed funds target less core PCE oya

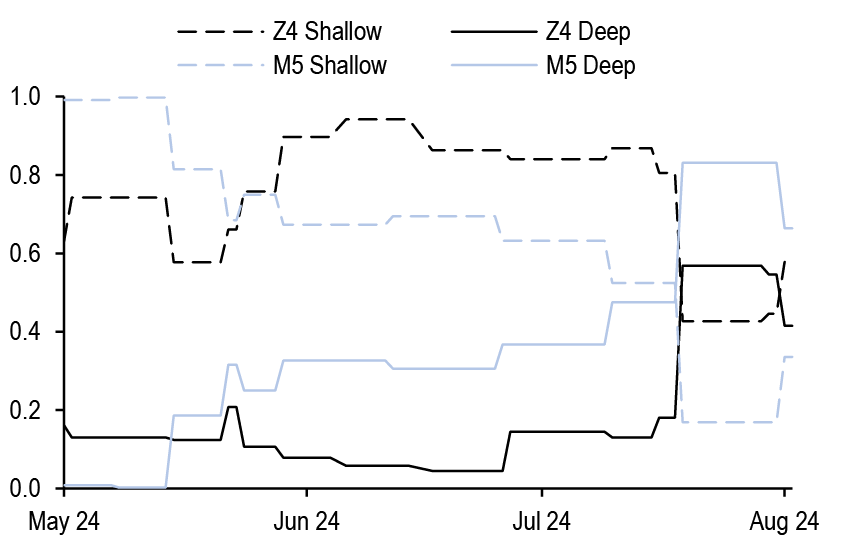

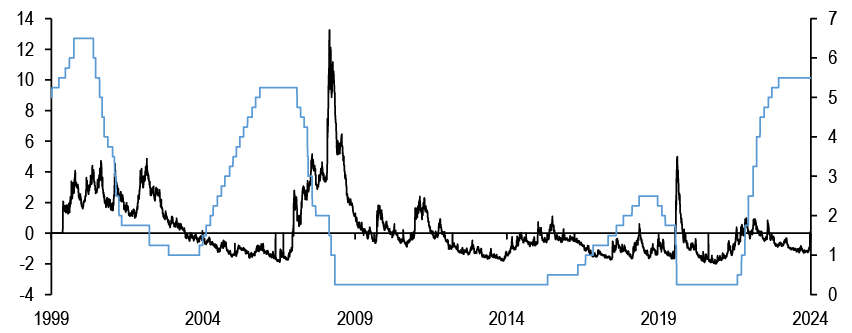

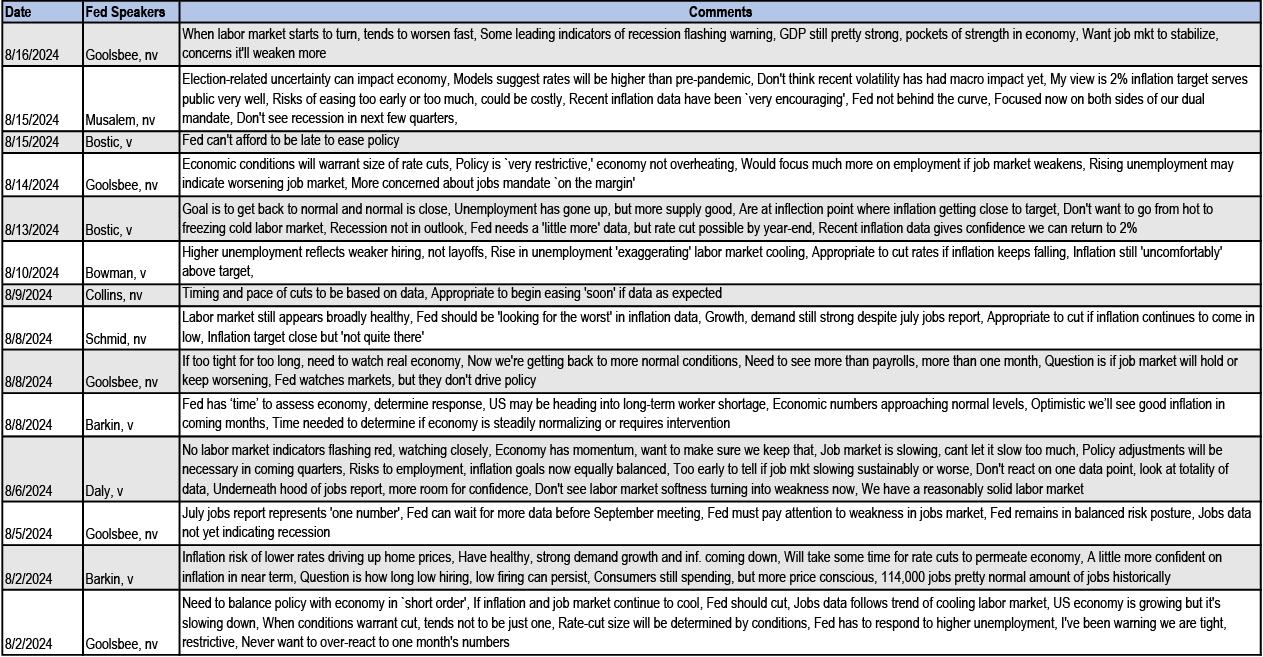

Figure 3: Policy uncertainty remains elevated and is also a feature in 2025, not just this year

Total weights on YE24 and 1H25 policy rate scenarios representing Shallow Cuts*, and Deep Cuts*, as calculated from a decomposition of the implied probability distribution associated with Dec 2024 and June 2025 SOFR futures; May 2024 – Current

Source: J.P. Morgan

* Shallow Cuts correspond to the total weights on the 0 Cut,1 Cut, 2 Cuts, and 3 Cuts scenarios for YE24, and 0 Cut,1 Cut, 2 Cuts, 3 Cuts, and 5 Cuts scenarios for 1H25 . Deep Cuts correspond to the total weights on the >3 Cuts scenarios for YE24, and 7 Cut and 9 Cut scenarios for 1H25. YE24 scenarios outlined in Figure 2 of What’s the rush?.

** We enumerate a list of scenario-specific Normal distributions with fixed standard deviations and means that are separated by 25bp, and then require the implied distribution to be a weighted combination of these individual distributions. The weights are then solved for, by fitting to the observed prices of calls and puts at various different strikes. For more details of our approach, see What’s the rush?.

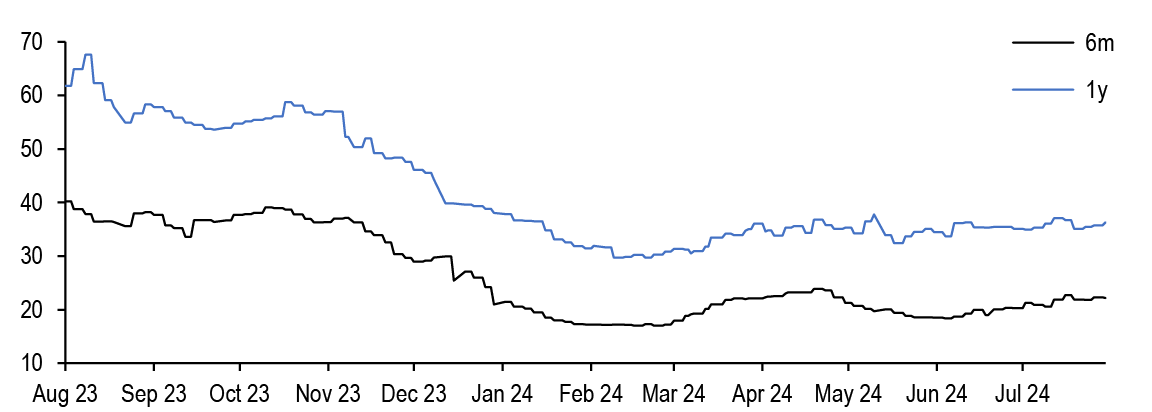

While it is highly likely the Fed will deliver a cut next month, the magnitude and subsequent pace of easing still remain highly uncertain and this leaves markets in a state of limbo as there is likely to be little clarity provided over the near-term. Indeed implied probability density functions inferred from call and put premia on Z4 SOFR futures indicate comparable weights between both shallow-cut and deep cut scenarios, leaving policy uncertainty elevated ( Figure 3). Against this backdrop high jump risk combined with more frequent jump days is manifesting in high delivered volatility and we think implieds look cheap considering these factors. Thus we maintain our long volatility bias and continue to express this in 5-year tails. We also maintain our swap spread curve flattening bias, as normalization in repo rates should bias front-end spreads wider whereas ongoing QT and elevated duration supply in Treasury markets should bias the long-end narrower. We like expressing this theme through a 3s/7s maturity matched swap spread curve flattener, which additionally is near the steep end of its one year range (see Interest Rate Derivatives).

Turning to the Fed’s balance sheet, RRP balances have trended lower, reaching $330bn on 8/16, and fell as low as $287bn on 8/7, a level not seen since May 2021. Positive net T-bill issuance over the past couple of weeks has likely contributed to the lower facility balance, though we might be approaching some sort of floor as the uptick in net T-bill issuance stalls in early-September. Furthermore, MMFs maintain some amount of exposure to the Fed’s ON RRP to help meet their liquidity needs that cannot be entirely met with repo or T-bills alone. For the remainder of the month, we expect RRP balances to hover in the low to mid-$300bn range (see Short-term fixed income).

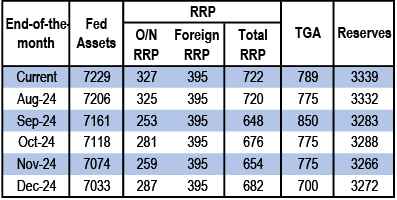

This is close to our $250-300bn guesstimate for the likely floor on O/N RRP balances that will be needed for well-functioning repo markets. This raises two important and related questions. First, is liquidity in the system (i.e., the combination of Reserves as well as RRP) still ample? Second, given the likely outlook for the Fed's major liabilities, how much further can QT continue? We argue the ampleness of liquidity is best estimated by examining the response of broader short rates (such as SOFR) to quantity shocks. Borrowing the essence of the idea in the recent note by Fed staff, we look at the empirical relationship between changes in the SOFR-versus-top-of-the-band differential and percentage changes in total liquidity (i.e., Reserves plus RRP balances). The rising magnitude of this rolling (negative) beta does indeed point to tightening liquidity conditions, and suggests that QT is in its endgame, with perhaps a few more months left. Overall, we project the Fed’s balance sheet to end the year at ~$7Tn, with Reserves flat at current levels, ON RRP balances slightly below $300bn, and a lower TGA ( Figure 4, see Interest Rate Derivatives).

Figure 4: We estimate that the Fed's balance sheet will end the year at ~$7Tn, with Reserves essentially flat to current levels, RRP balances ending slightly below $300bn, and with TGA lower from current levels

Current* and projected total Fed balance sheet assets, RRP, TGA, Reserves, and Commercial bank deposits** through 2024, $bn; 8/15/2024

| End-of-the-month | Fed Assets | RRP | TGA | Reserves | Commercial Bank Deposits | ||

| O/N RRP | Foreign RRP | Total RRP | |||||

| Current | 7229 | 327 | 395 | 722 | 789 | 3339 | 17564 |

| Aug-24 | 7206 | 325 | 395 | 720 | 775 | 3332 | 17609 |

| Sep-24 | 7161 | 253 | 395 | 648 | 850 | 3283 | 17620 |

| Oct-24 | 7118 | 281 | 395 | 676 | 775 | 3288 | 17673 |

| Nov-24 | 7074 | 259 | 395 | 654 | 775 | 3266 | 17706 |

| Dec-24 | 7033 | 287 | 395 | 682 | 700 | 3272 | 17760 |

Source: J.P. Morgan., FRED, Federal Reserve H.4.1, Federal Reserve H.8

*Current as of 8/15/2024 Fed H.4 release

**Deposits as of 8/16/2024 Fed H.8 release

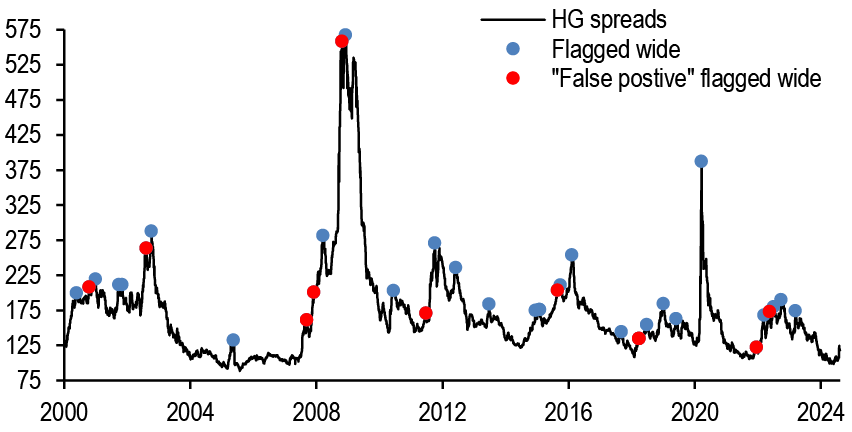

High grade credit spreads widened materially in the wake of the July employment report, reaching a YTD high of 125bp on the JULI, before retracing back to pre-payrolls levels in the following fortnight. As HG spreads have made a rapid retracement, some investors have expressed skepticism as to the durability of the ongoing spread rally. Time will tell if the current selloff will mark a local high or something more, but our analysis has shown that it has been, historically speaking, advantageous to buy the dip in HG, as 70% of the time when spreads widened materially, they subsequently rallied over the next three months ( Figure 5, see JPM Daily Credit Strategy & CDS/CDX am update, Eric Beinstein, 8/15/24). Turning to relative value, we note that the 10s/30s curve looks too flat when compared to 30-year Treasury yields, and we could expect this curve to steepen as yields decline into the Fed cutting cycle, especially as the recent dearth in long-end issuance has begun to reverse ( Figure 6, see JPM Daily Credit Strategy & CDS/CDX am update, Eric Beinstein, 8/14/24). We find little evidence that Japanese investors have pared down their cross-currency exposure to US credit amid the carry unwinds, as overnight net buying has been elevated and the relative value proposition of HG credit for Japanese buyers improved as volatility drove JGB yields lower (see JPM Daily Credit Strategy & CDS/CDX am update, Eric Beinstein, 8/13/24).

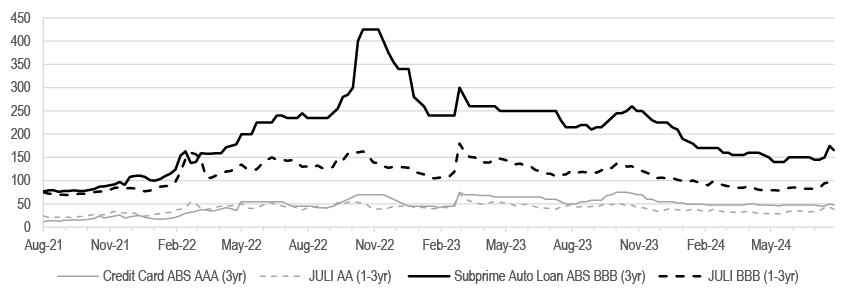

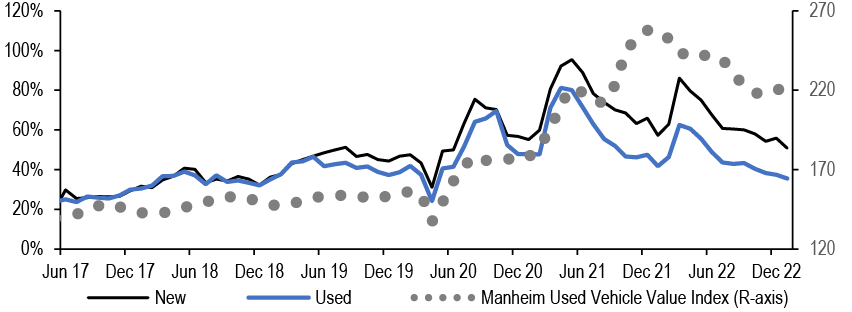

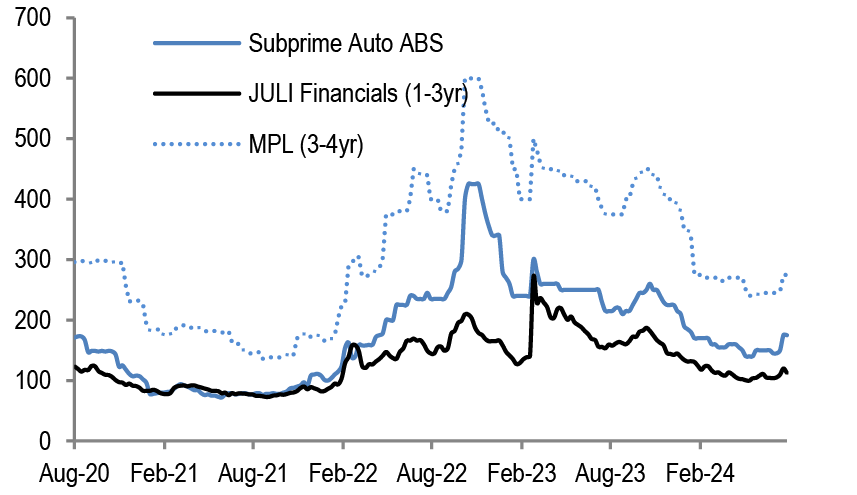

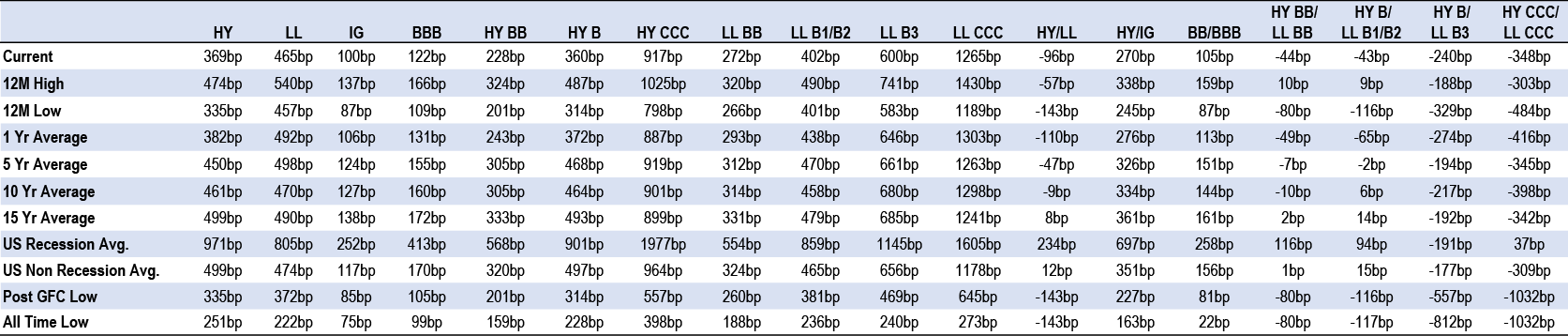

Down the capital structure, high yield bond spreads declined by 15bp to 369bp and yields collapsed to 7.65%, the lowest level since August 2022, as economic data have bolstered the Goldilocks narrative of positive growth with moderate inflation while 2Q earnings are meeting elevated consensus estimates. That said, concerns over future cooling are still present, as CCC spreads are 42bp wider on the month compared to BB and B spreads wider by 1bp and 16bp, respectively. Meanwhile leverage loan spreads have tightened by 4bp over the past week, amid moderating retail outflows and light capital market activity (see High Yield). We widen our CLO T1 AAA new issue spread YE24 forecast from 130bp to 150bp given the historical precedent for negative returns for risk assets once the Fed begins easing combined with the likely reduction in floater demand. This raises the risk that refi/reset activity may not remain quite as strong, especially as some 16% of the universe is coming out of non-call period in 2024, of which the majority is currently in-the-money (see CLOs).

Figure 5: There have been 37 moderate to major HG selloffs since 2000, and spreads rallied over the next 3 months in 26 of these episodes

JULI spread versus positive and false positive flagged wide during selloffs*; bp

Source: J.P. Morgan

*Selloff is defined as a point where spreads are at their widest in 3 months and remain the widest over next 1 month, and is further restricted to points where peak spread was at least 15bp wider than tightest over past 3 months. Positive flag is where the selloff corresponds to the peak in spreads over the subsequent 3 months, and false positive when spreads are wider over the next 3 months. See JPM Daily Credit Strategy & CDS/CDX am update, Eric Beinstein, 8/15/24

Figure 6: The 10s/30s HG spread curve appears too flat with respect to 30-year Treasury yields

10s/30s spread curve versus regression* model predicted 10s/30s spread curve; bp

Source: J.P. Morgan

* Regression model: 67.65 -5.27*30-year UST yield (%) -0.11*JULI spread (bp), R^2 = 48%, SE = 9.7bp

Shaded areas are where UST 30-year yields = 4 to 5%

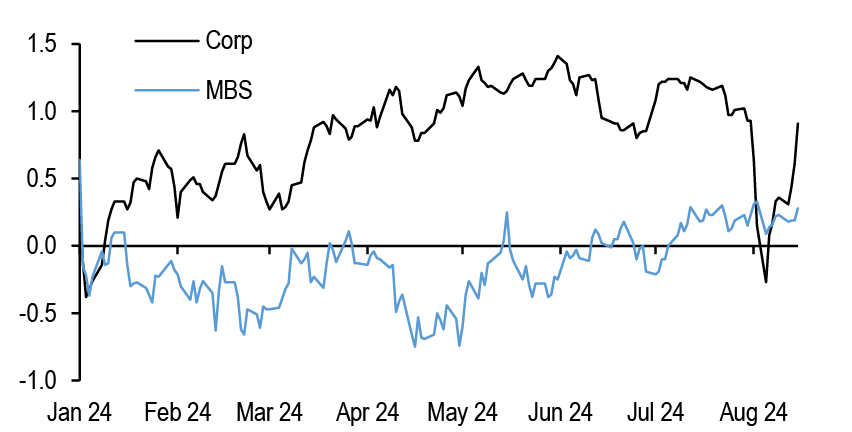

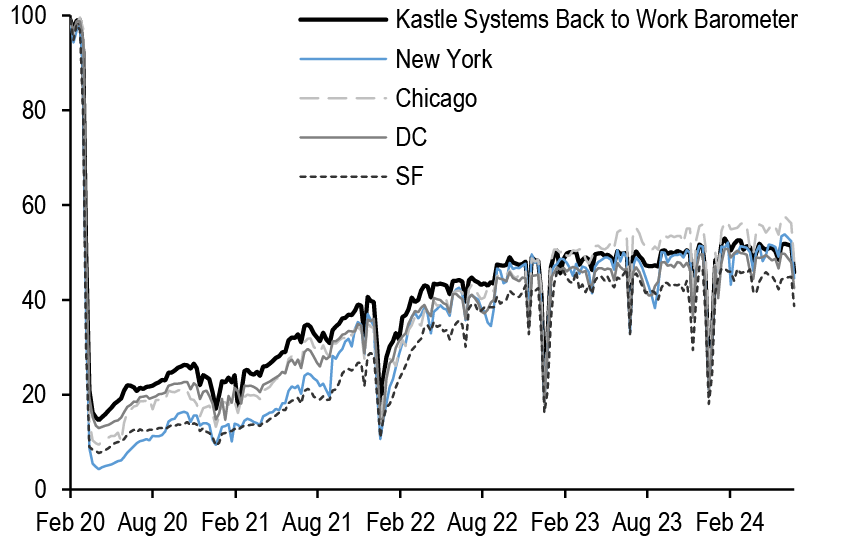

Turning to mortgages, higher coupon spreads continue to recover from their early August widening while lower coupons are a touch wider, perhaps on the margin reflecting concerns over bank and/or foreign portfolio reallocations or simply cheaper opportunities up the stack. Spreads remain on the snugger side of things, but the performance of mortgages in the flash rally reinforces the thesis among many mortgage-overweight money managers that mortgages offer comparable yields with less downside risk in sharp rallies to IG ( Figure 7). From this perspective, the recent retracement in corporate spreads may prove a headwind, but lower yields should be supportive of fund inflows and overall we would expect more neutral positioning going forward (see ‘Mission Accomplished’ on MBS vs. HG Corps, Nathaniel Rosenbaum and Nick Maciunas, 8/6/24). We continue to prefer UIC conventionals and are underweight 4.5s and 5s (see Agency MBS).

With a Fed easing cycle likely around the corner, we expect mortgage rates to fall marginally below 6% by the end of the year if our interest rate forecast is realized. This would improve affordability and potentially thaw a frozen housing market, but we do not expect this to be a massive driver of higher home prices as waiting sellers will likely be met by eager buyers, raising supply and demand commensurately. Indeed we look for only another 1.5% of HPI growth over the next 6months. What does this mean for relative value in the non-agency space? At the top of the capital structure, higher coupons (5.5 - 6.5s) should not face much refinancing pressure for the rest of the year and spreads should hold firm. Lower coupons meanwhile would benefit from even a modest pick-up in turnover. In credit, home prices remain supportive but spreads are tight and we look for a more sideways move in the second half. As such any spike in broader credit should be viewed as an opportunity to buy(see RMBS).

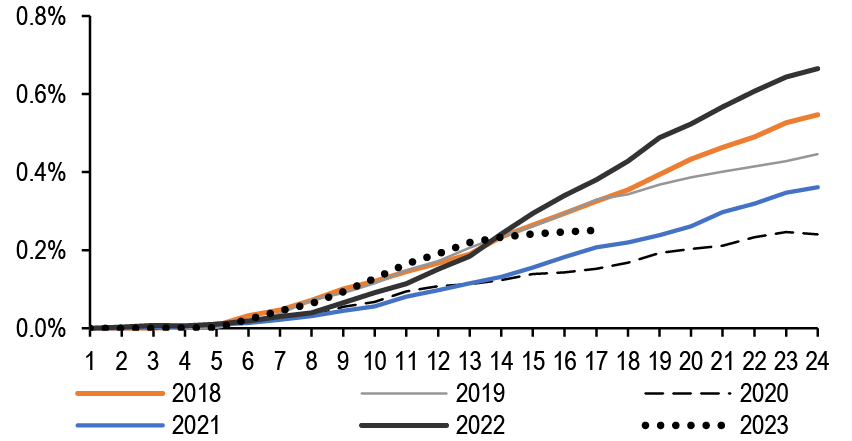

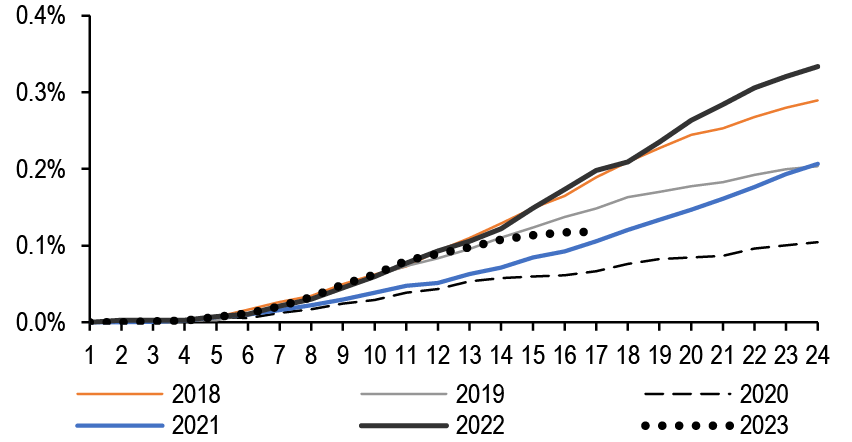

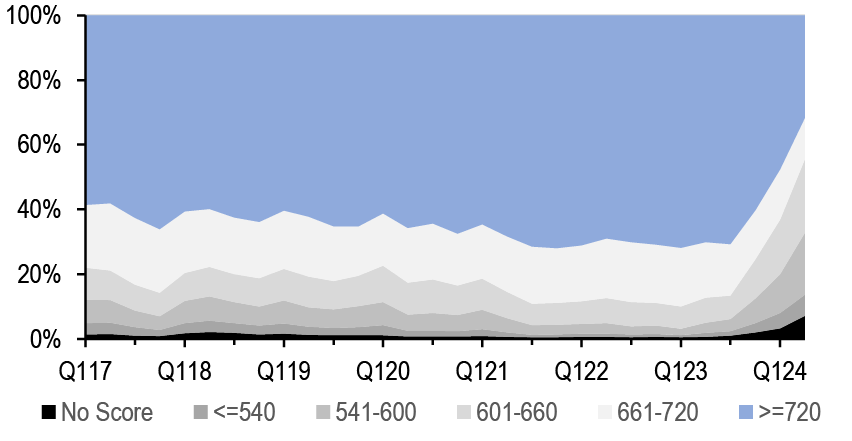

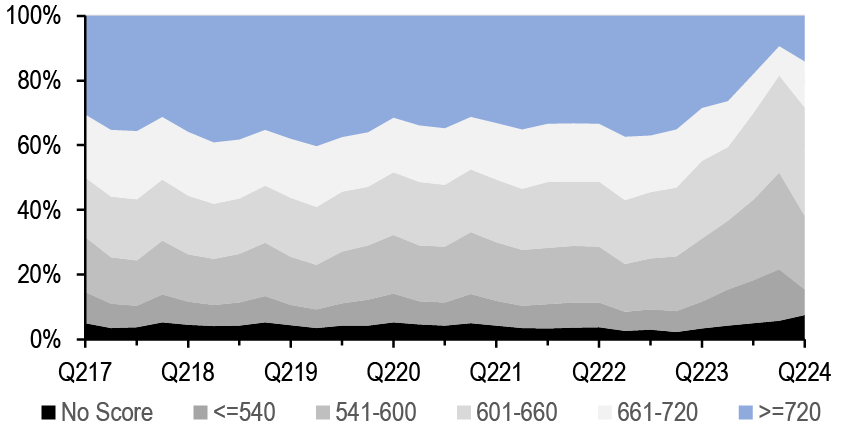

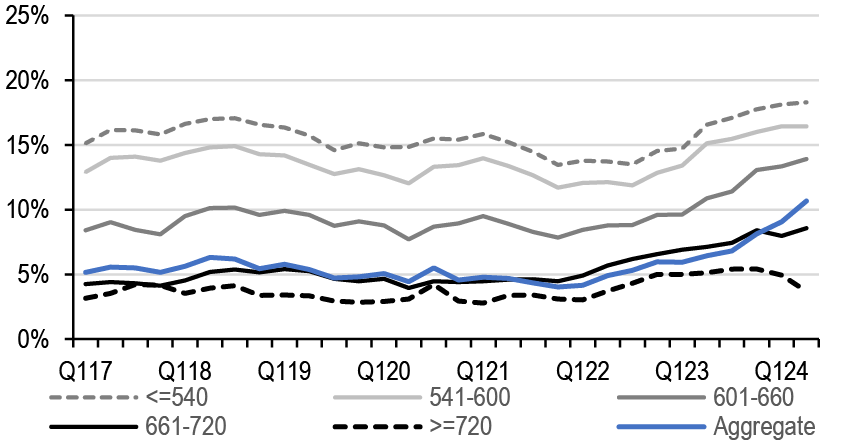

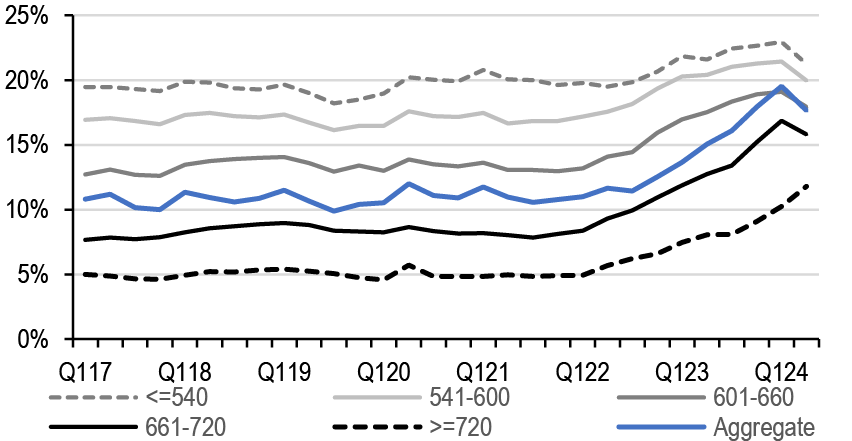

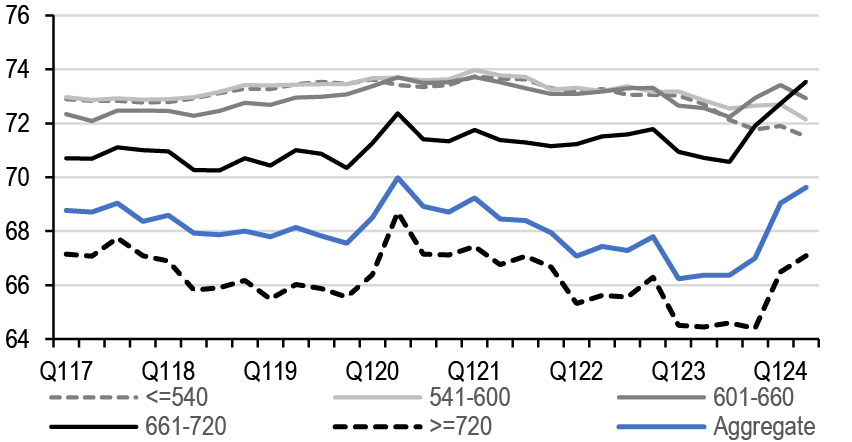

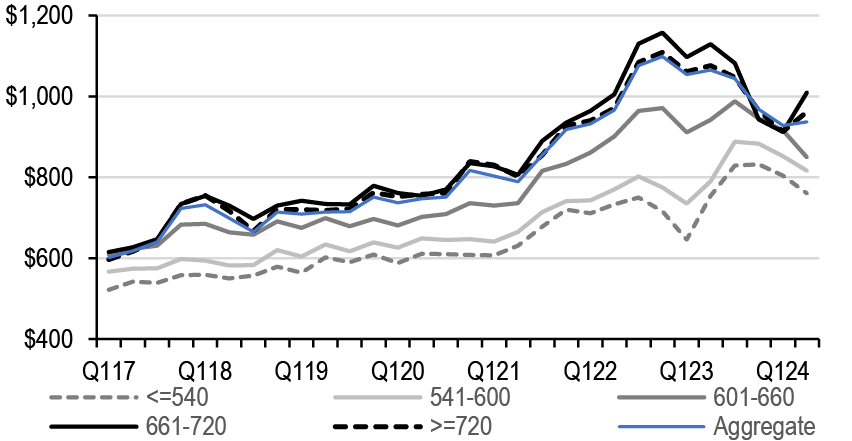

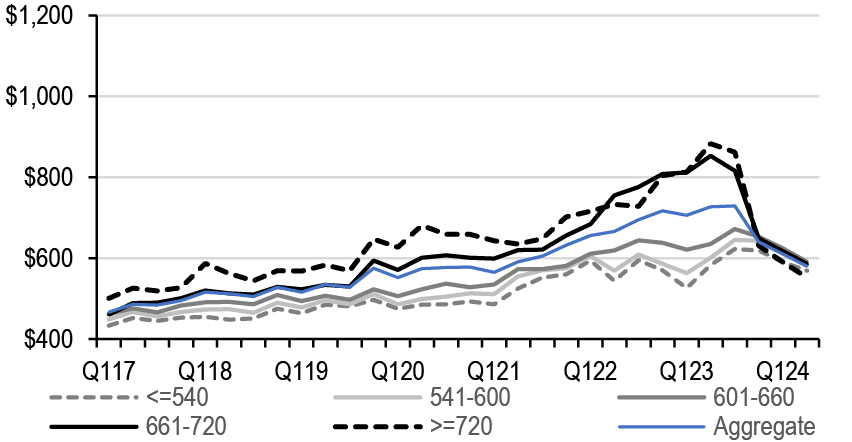

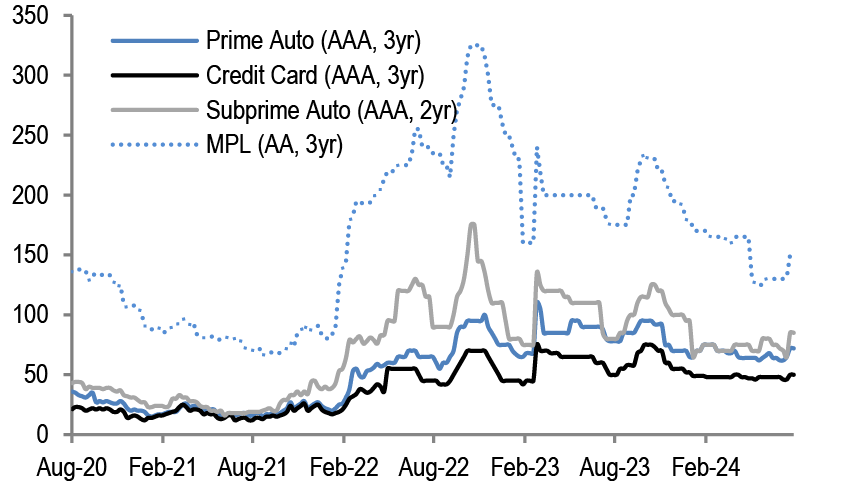

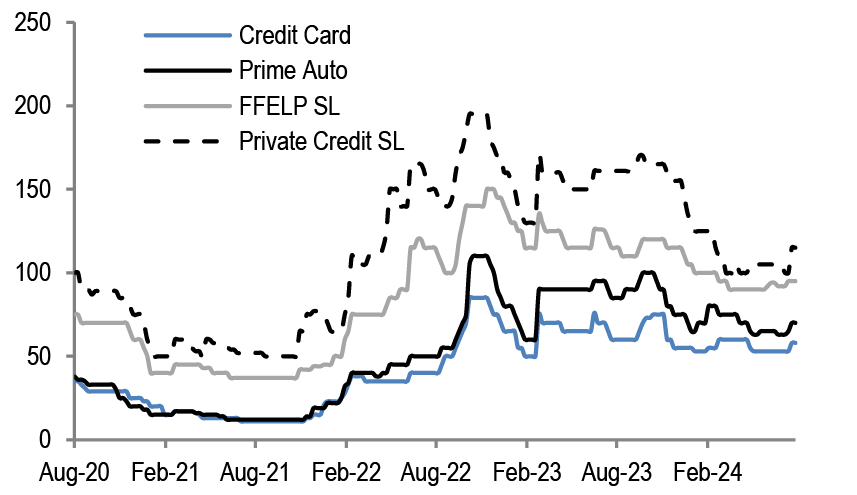

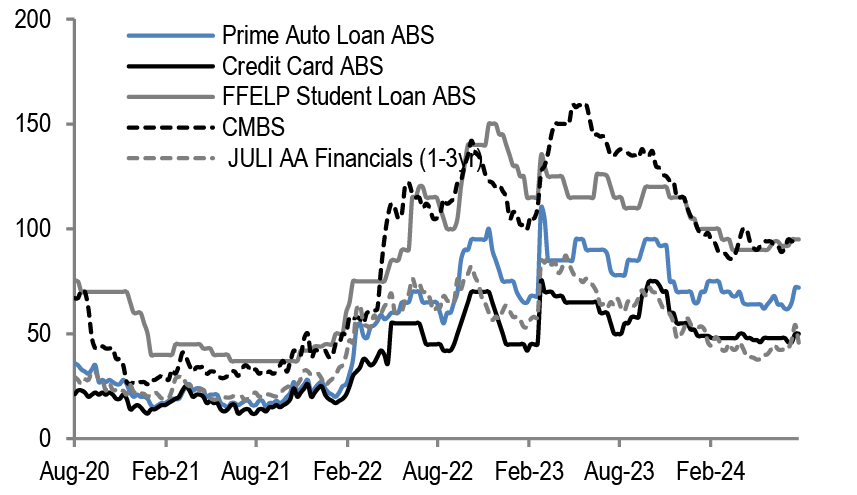

ABS spreads narrowed this week following the previous week’s volatility, with demand picking up in the higher yielding segments. Indeed the reaction function of ABS spreads to broader market volatility has been consistent in recent years with lower tier credit showing a higher beta than cash surrogate ABS versus comparable unsecured corporates. This offers a buying opportunity for ABS across the credit spectrum against the base case of no recession in the year ahead. Turning to auto loan ABS, we note that affordability appears to be returning to the market as collateral APRs have levelled off/started to decline this year, loan terms are extending, and monthly prepayments continue to fall. Delinquencies and losses have only modestly deteriorated on the prime side - likely due to the catch-up of compounding effects of inflation on household and consumer expenses among higher quality borrowers- and no worse on subprime in recent originations. Under our base unemployment forecasts, we do not expect significant deterioration in curing trends or an outsized uptick in loss ramps for prime vintages (see ABS).

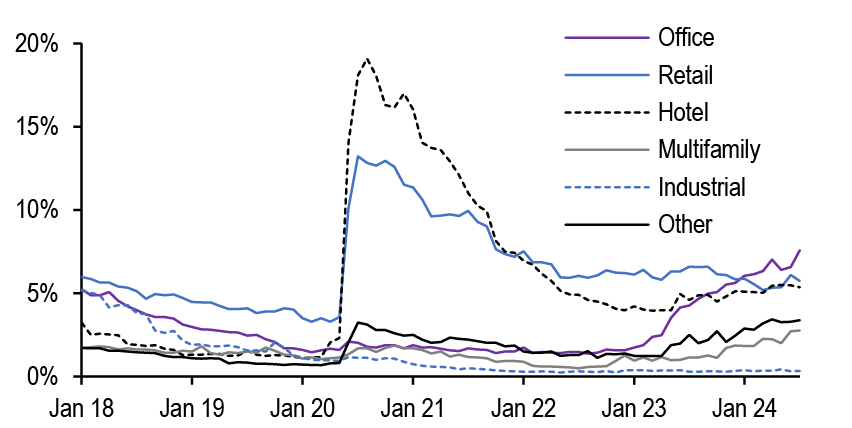

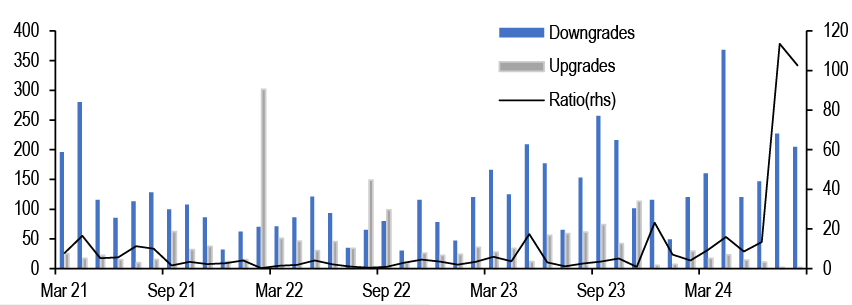

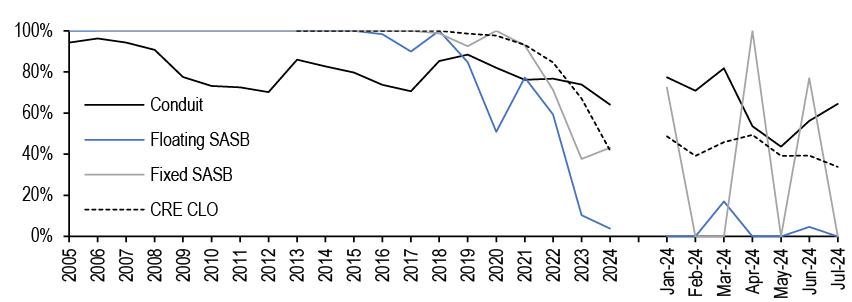

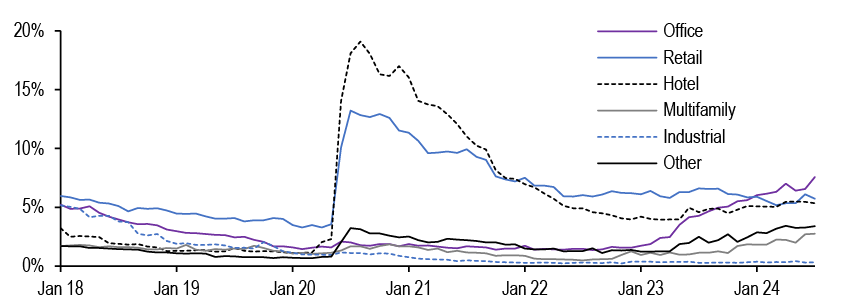

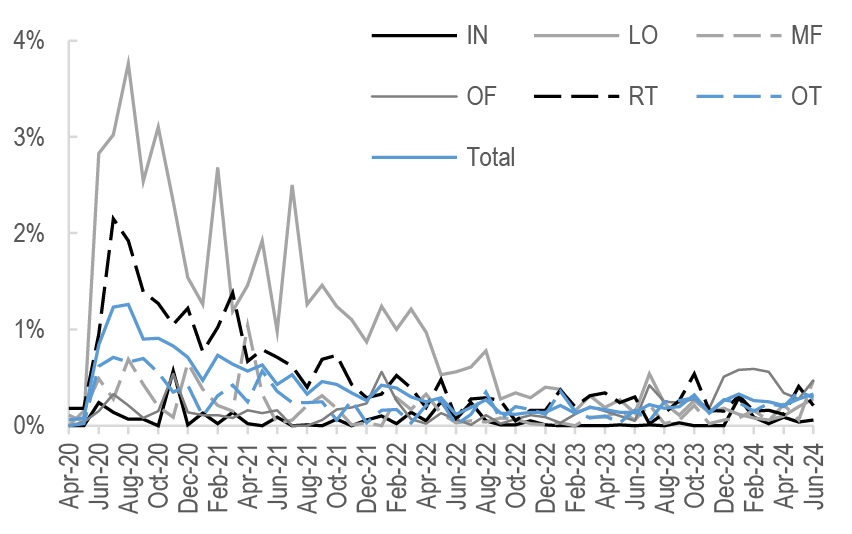

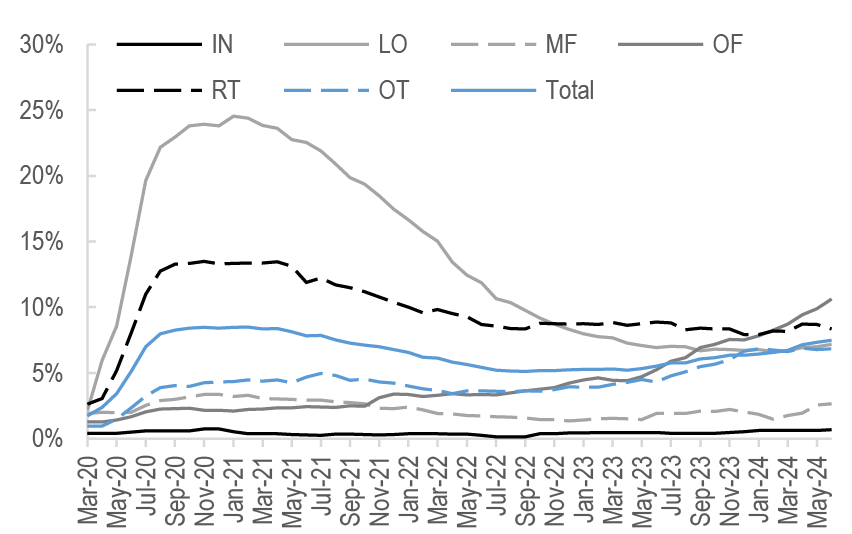

In the CRE space, on-the-run conduit CMBS spreads widened 4-11bp across the stack, with AS bonds underperforming both within the stack and relative to similar duration single-A corporates. With expectations of a slowing but not breaking economy, we believe upper IG mezz bonds have sold off too much and appear cheap compared to similar duration single-A corporates. Agency CMBS spreads also widened over the past two weeks and Fannie DUS 5/4.5s appear cheap to 30-year FN 5s on both an OAS and ZV comparison. The July remit data show that serious delinquency rate for private label CMBS reached 4.74%, representing a 20bp increase from the prior month, with office loans the marginal driver of the increase ( Figure 8). Finally,we continue to see elevated levels of DLQ buyouts and loan modifications in the CRE CLO market, with $527mn in reinvestments through the entire CRE CLO market in July representing the highest volumes since October 2023 (see CMBS).

Figure 7: YTD excess returns flipped in favor of MBS during the flash rally for the first time since January

YTD Cumulative excess returns on the Bloomberg Corporate and MBS indices, %

Source: J.P. Morgan, Bloomberg L.P.

Figure 8: Within CMBS, office loans were the marginal driver of the increase in serious delinquencies last month

60d+ delinquency rate (including NP matured and FC/REO) by property type, as of July 2024; 5

Source: J.P. Morgan, Trepp

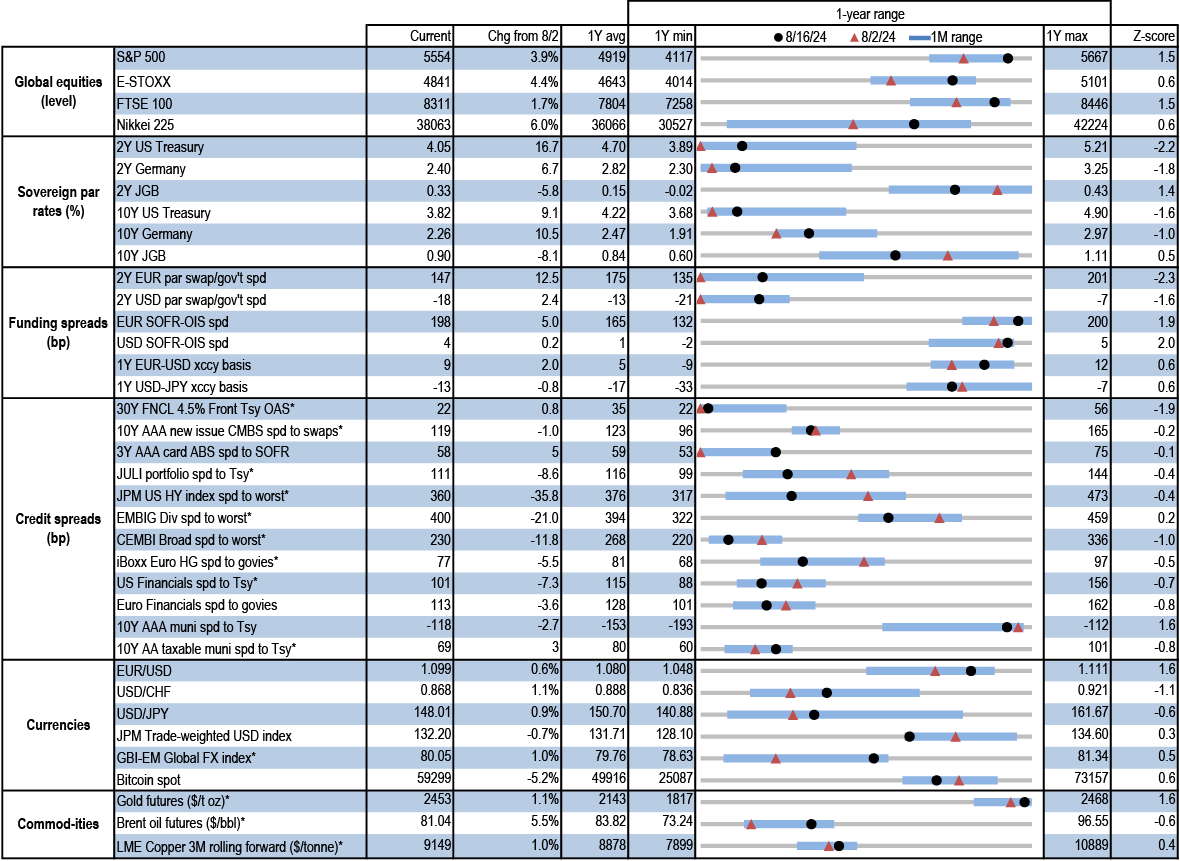

Figure 9: Cross sector monitor

Current levels, change since 8/02/24, 1-year average, minimum, maximum, and current z-score for various market variables; units as indicated

Source: J.P. Morgan, Bloomberg Finance L.P., ICE, IHS Markit

* 8/15/24 levels for 30Y FNCL, AAA CMBS, JULI, US HY, EMBIG, CEMBI, iBoxx Euro HG, US financials, AA taxable munis, GBI-EM Global FX, gold, and brent oil; 8/16/24 levels for all others

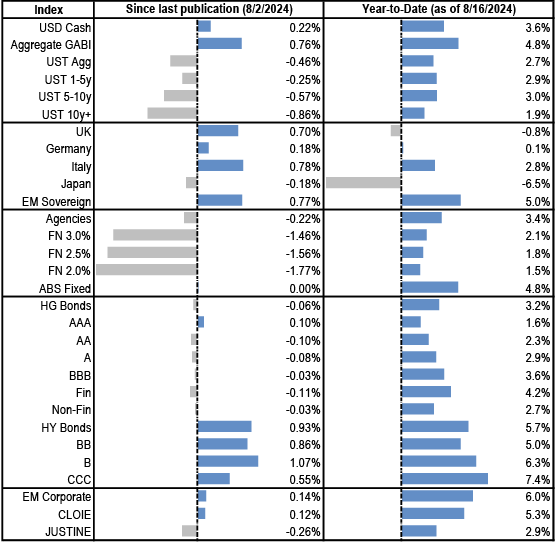

Figure 10: YTD returns on various fixed income indices; %

Source: J.P. Morgan

Economics

- The July CPI report was tame, as the core measure increased only 0.17%

- Firm retail sales trend led us to revise up 3Q GDP growth to 1.25%

- Initial jobless claims move lower as automaker-related distortions fade

- Powell’s Jackson Hole remarks next week unlikely to tip hand for September FOMC

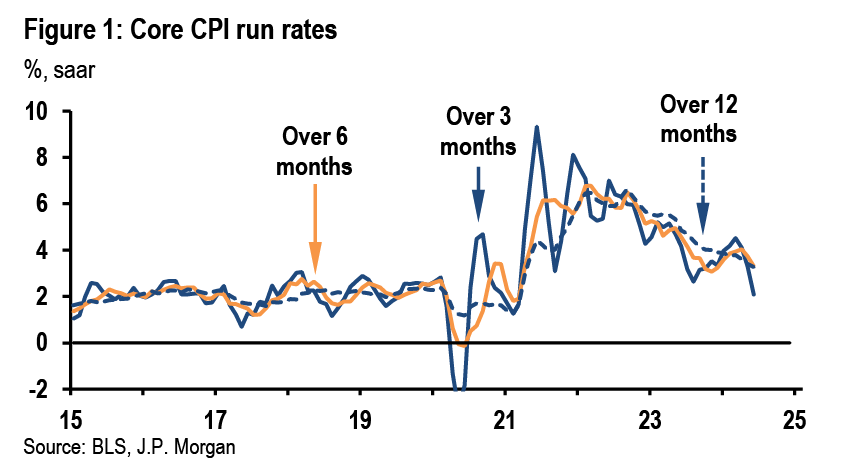

The immaculate disinflation thesis received more support this week, as inflation continues to moderate against a backdrop of healthy growth in economic activity. The CPI report for July was benign as the ex-food and energy core measure increased only 0.17%, and over the last year is up 3.2%. After a few unwelcome upside surprises at the beginning of the year, core inflation has been well behaved more recently, increasing at only a 1.6% annual rate over the last three months. The lagging rental measures are still slow to moderate, but excluding shelter costs core inflation was up 1.7% in the 12 months through July.

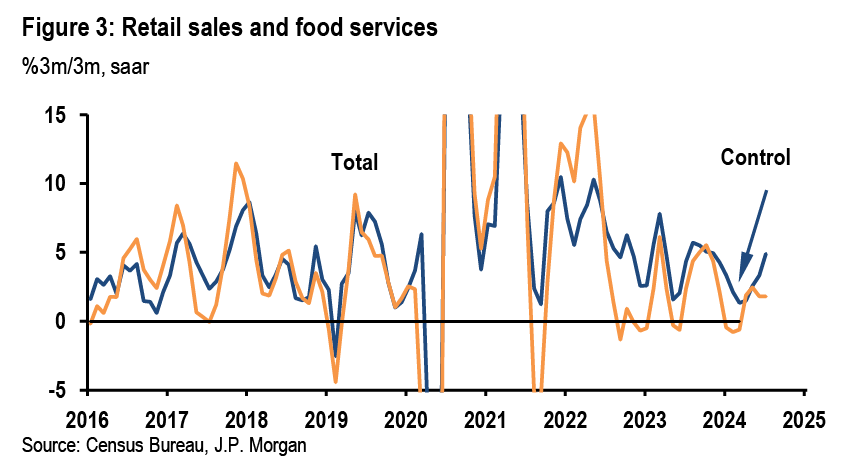

Meanwhile, most indicators of growth were generally favorable this week. Most notably, retail sales rose 1.0% in July and the core “control” measure increased 0.3%. These figures suggest real consumer spending is off to a good start in 3Q and accordingly we revised up our estimate of current-quarter GDP growth to 1.25%. We also separately rejiggered the contour of real GDP growth for 2025, effectively swapping the first-half and second-half growth profiles to reflect more modest growth in 1H25 followed by a moderately stronger rebound in 2H25 as the impact of the front-loaded Fed easing cycle starting next month percolates through the economy. This revision leaves 4Q/4Q and year-on-year growth for 2025 unchanged.

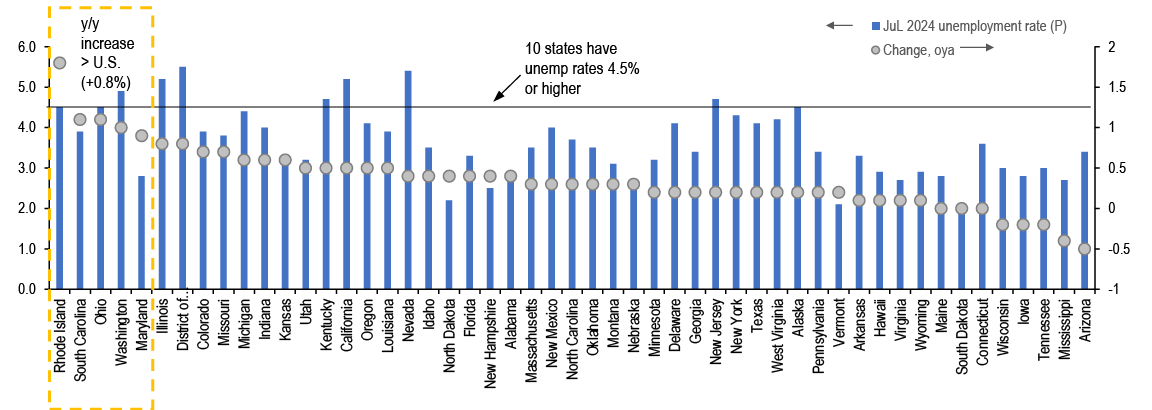

The latest jobless claims data also peeled back some of the recent increase, suggesting the deterioration in labor market conditions seen in the July employment report is not building on itself. Some of the prior rise in claims may owe to extended automaker shutdowns, a factor that also weighed on the July industrial production report released this week. State-level data suggest some drag on payrolls in Texas that might be attributed in part to Hurricane Beryl; impacted sectors showed an earlier rise in jobless claims as well, so we could see a modest bounce-back in August nonfarm payrolls. Beryl does not appear to have distorted the national unemployment rate, however, although the automaker shutdowns might have led to temporary layoffs in the Midwest.

The data flow next week slows to a trickle. Instead, the most notable development will likely be Fed chair Powell’s remarks at the annual Jackson Hole symposium. There has been only limited Fed-speak since the disappointing July jobs report. Of those who have spoken most have asserted that risks to the employment and inflation mandates are close to balanced. They generally have also judged that policy is currently restrictive. In this setting we think it makes sense to get policy back to neutral quickly and believe a 50bp reduction in the funds rate at the September FOMC meeting is warranted. That said, we doubt Chair Powell will pre-judge the outcome of that meeting, given almost a full month of data releases between now and then.

Inflation genie gets back in the bottle

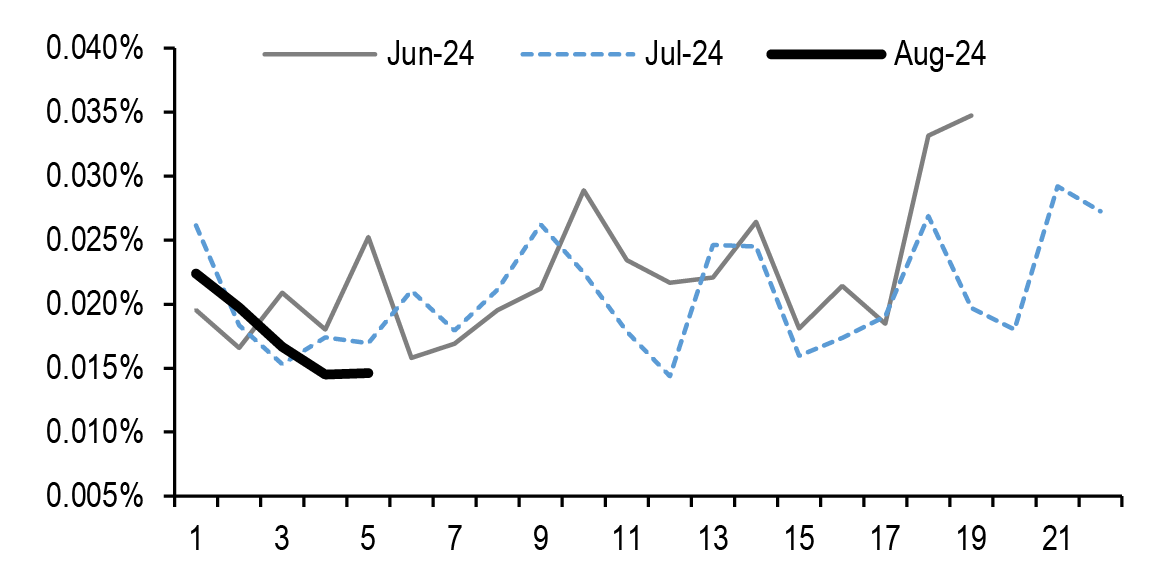

This week saw the release of the full suite of July inflation data—CPI, PPI, and import prices—and the net result is that we expect only a modest 0.12% increase in the core PCE price gauge last month. Both headline and core CPI rose 0.2% on the month, with core very close to our expectations (a realized 0.165% unrounded print versus our forecast of 0.170%) but headline slightly softer. As a result, the year-ago pace of headline CPI inflation eased a tenth to 2.9%, while core slid a tenth to 3.2% as expected (Figure 1).

Both of these readings mark the slowest annual pace of inflation since 2021. The unexpected softness in headline can largely be traced to a flat contribution from energy on the month, while food prices rose 0.2% as expected. Away from food and energy, the details on the core were more varied but broadly aligned with our expectations. Core services firmed 0.3% while core goods declined 0.3% for July. The former was the strongest in three months while the latter was the softest reading for core goods prices in a year.

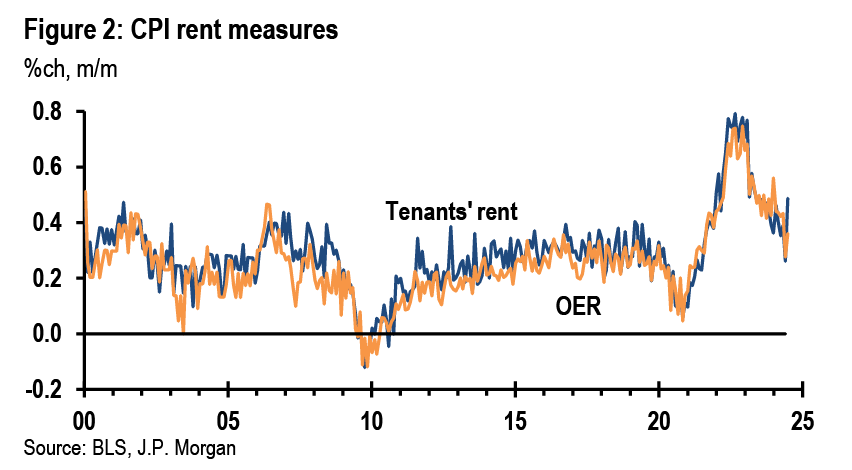

As we forecasted, shelter prices firmed on the month—albeit a bit more than anticipated, with owners’ equivalent rent (OER) up 0.4% and tenants’ rent up 0.5% on the month (Figure 2).

New and used vehicle prices eased broadly as forecast as well, with the latter accelerating their recent monthly pace of decline to 2.3%. Industry data point to a reversal of this drag in coming months. Airfares (down 1.6%) and postage (up 0.8%) also provided offsetting but broadly anticipated swings last month. Motor vehicle insurance costs appear to have resumed their upward trend after a brief interruption in May; they rose 1.2% in July. More surprising was the 0.3% drop in medical care services, which appears to have been nearly entirely due to an unexpected 1.9% decline in outpatient hospital services. The rest of the subcomponents for medical services rose last month, and several accelerated.

The July producer price index (PPI) report was generally softer than expected, re-establishing a disinflationary trend for producers’ prices after some firming earlier this year. The headline final demand measure rose 0.1% on the month, while the core PPI index (excluding food and energy) was unchanged. With revisions to prior months, year-ago headline PPI inflation has cooled to 2.2% from an upwardly-revised 2.7% in June, while core eased to 2.4%oya from 3.0% in June. Although the pass-through from producer into consumer prices is incomplete and of variable length, the July reading is well within the range that allows the Fed to continue to place its primary focus on the labor market at upcoming policy decisions.

Consumer spending stays firm

The July retail sales report came in strong and points to another solid gain in real consumer spending in 3Q. Based on the retail data as well as a reported decline in utilities in the IP report, our expectation is that real PCE rose 0.2%-0.3%m/m in July. Even if there were no further gains in spending in August and September, real PCE for the quarter would still increase a solid 2.1%q/q, saar.

Total retail sales increased 1.0%m/m in July, supported by a 3.6%m/m increase in sales at motor vehicle and parts dealers. These data are consistent with a 4.2%m/m rebound in unit vehicle sales reported for July. Excluding autos and gas, total sales rose 0.4%. The control category, which further excludes food services and building materials, rose a high-side 0.3%, which comes after a large 0.9% increase the prior month. The control category rose 4.9%3m/3m, saar, reversing a slowdown earlier in the year (Figure 3).

We had expected food services to be a drag on sales given the signal from Chase card data, but in fact that category rose 0.3%m/m. That said, the 2% annualized increase over the last three months is still a slow pace. Results for housing-related components were also decent, as sales at building material stores rose 0.9% while furniture, electronic, and appliance store sales increased 1.0% in July. Sales at both of these store types have trended upward from earlier in the year after being weak last year. Sales in some of the other larger categories, including grocery stores, general merchandise stores, and e-commerce, were all up on the month as well.

Stronger than expected retail sales data for July paint a relatively upbeat picture for consumers, but the preliminary August print of the University of Michigan’s consumer sentiment index showed only a mild improvement that was driven by the expectations component while current conditions index slid a bit. Inflation expectations remained unchanged both at the one-year (2.9%) and five-year (3.0%) horizons.

Housing starts slide

Housing starts and permits declined substantially in July, with starts down 7%m/m to 1.238mn saar, and permits down 4% to 1.396mn saar. Moreover, there were net downward revisions to starts in prior months. The decline in total starts was driven by a 14% plunge in the single-family segment, which left them near their cycle lows from early 2022. Despite modest declines in mortgage interest rates that are likely to continue as the Fed easing cycle commences, we think residential investment growth in the GDP accounts should be soft in 2H given the past declines and given that units under construction are still falling from elevated levels. In addition, builders have been giving a lot of rate incentives to buyers, which they may withdraw as mortgage rates decline.

Excerpted from, United States Data Watch , Michael Feroli, August 16, 2024

Treasuries

Just keep starin’ at the sun, pray for summer’s end

- With the disinflationary process resuming and labor markets looser, the path for substantial Fed easing in the coming months is becoming clearer. We continue to forecast 50bp cuts in September and November, followed by 25bp cuts through summer 2025. Though markets are pricing in a less dovish path than our own forecasts, we think we can be patient before adding duration...

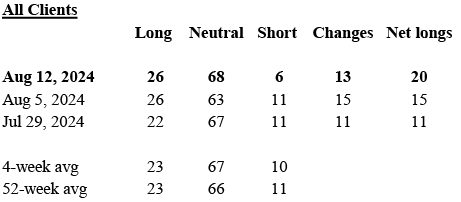

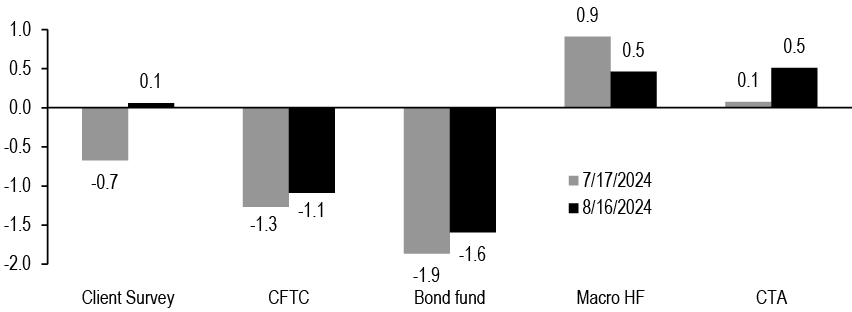

- ...We think investor positioning has had a role in the recent move to higher yields: our Treasury Client Survey Index has reached its highest level since December. This level of the survey index has historically preceded rising yields in subsequent weeks, indicating potential near-term bearish risks

- Chair Powell’s Jackson Hole speech will be closely watched. Historically, these events have not driven significant volatility in Treasuries, except in 2020 and 2022. We do not expect the Chair to give granular policy guidance, as the magnitude of easing will depend on labor market data, particularly the August employment report

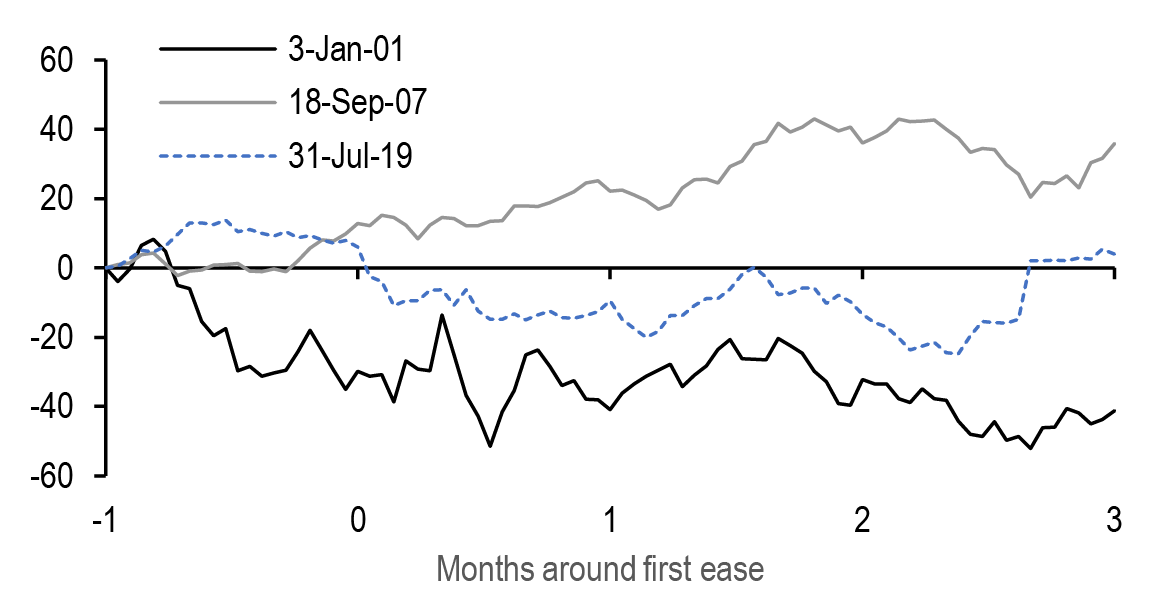

- The current environment does not closely resemble the periods prior to the last 4 easing cycles. Policy is more restrictive than at any other point in in the last quarter-century, suggesting more significant easing than in 1995 and 2019, but financial conditions are easier and displaying less stress than prior to the 2001 and 2007 cycles

- We continue to favor 5s/30s steepeners as a representation of our strategic view, as the curve tends to steepen ahead of the first rate cut. This trade behaves like a lower-beta duration long with a better carry profile. The rapid growth of the Treasury market and reliance on price-sensitive investors warrant higher term premiums and steeper curves

- 2s/5s steepeners are becoming more attractive, but a weak employment report is needed to shift steepening exposure further in the curve

- Foreign investors purchased $17bn of long-term Treasuries in June, the least since December 2023, with demand concentrated among Euro-area investors while net selling pressure emanated from Japan

Market views

It’s been a wild two weeks since our last US-FIMS publication, with yields plunging first in the aftermath of the weak July employment report and later following weakness in risk assets due to the unwind of the Yen carry trade. However, yields have risen off their lows, supported by a rebound in risk assets and relative strength in data: with these moves, markets have normalized strongly from their most extreme levels on August 5 ( Figure 11). Initial claims have fallen more than 20k from their local peak just two weeks ago and are firmly back in the range they’ve held since early summer, and the 4-week average has retreated back as well. With the rises in July concentrated in Texas and Michigan now fading, it appears these were indeed technical, related to Hurricane Beryl and auto plant shutdowns, respectively (see US: Jobless claims moved down, Murat Tasci, 8/15/14). Separately, the July retail sales report came in strong, pointing to upside risk to growth early in 3Q24: control group sales rose 0.3% over the month (consensus: 0.1%), and early in the quarter, this indicates consumption has not stepped down materially from the 2.3% pace in 2Q24 (see US: July retail sales suggest no slowing in 3Q real spending, Abiel Reinhart, 8/15/24). Since our last weekly publication on August 2, 2-, 5-, 10- and 30-year yields have risen by 20bp, 15bp, 10bp, and 4bp, respectively.

Figure 11: Most asset classes have retraced significantly from their extremes on August 5, supported by stronger labor market and consumption data

Current values for various asset classes, 1-week change, distance from August 5th extremes, with 1-month statistics; units as indicated

| Asset | Last | 1wk chg | Dist from Aug 5 low | 1m min | 1m max | 1m range |

| 2y UST; % | 4.07 | 5.1 | 18.3 | 3.87 | 4.52 | 65 |

| 10y UST; % | 3.89 | -1.6 | 10.9 | 3.78 | 4.28 | 50 |

| 5s/30s UST curve; bp | 38.4 | -6.5 | -6.1 | 28.5 | 49.3 | 21 |

| 10y TIPS breakevens; bp | 209.8 | -2.3 | 3.5 | 203.4 | 229.9 | 26 |

| 3mx10y vol; bp/day | 6.99 | -0.05 | 0.11 | 5.91 | 7.12 | 1.2 |

| S&P 500; | 5554.3 | 210 | 367.9 | 5186.3 | 5667.2 | 480.9 |

| JULI; bp | 110 | -8 | -14.6 | 104.7 | 124.6 | 20 |

| USD/JPY; | 147.7 | -0.2 | 5.1 | 142.6 | 158.6 | 16.0 |

| Brent oil; $/bbl | 79.58 | -2.72 | 3.28 | 76.3 | 85.11 | 8.8 |

Source: J.P. Morgan

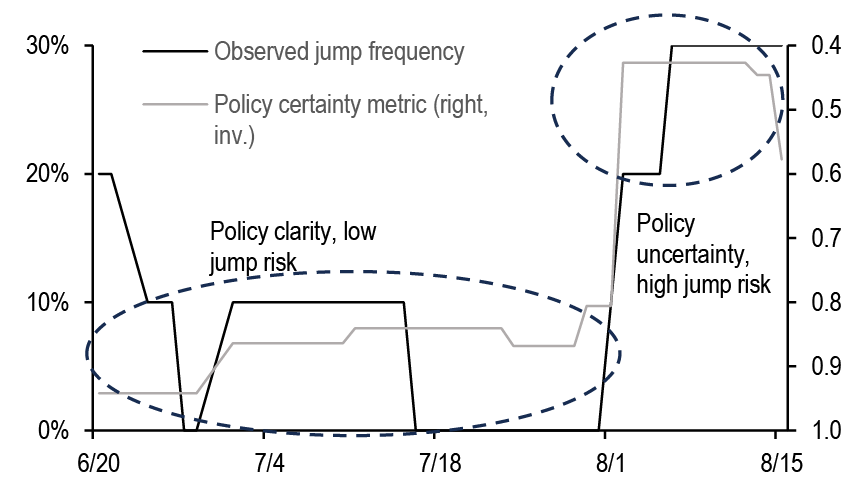

Though there was normalization in markets this week, it can’t be ignored that inflation data was benign once again. Headline CPI rose 0.2%, allowing the year-ago rate to tick lower to 2.9%, while core CPI also rose 0.2% (0.165% unrounded), leaving the year-ago rate at 3.2%. With CPI and PPI data in hand, we estimate a 0.12% rise in core PCE in July, with the year-ago rate holding steady at 2.6% (see US: Cooler July CPI, as expected, Michael Hanson, 8/14/24). Given three consecutive months of cooler inflation prints and the ongoing cooling in labor markets, this ratifies the market’s expectation the Fed will ease next month. It’s notable that the CPI data seemed to contribute to a tone shift from Fed speakers this week: Bostic’s (Atlanta, nv) comments shifted markedly in two days, hinting at support for a September ease. Separately, Goolsbee (Chicago, nv) and Musalem (St. Louis, nv) both discussed the restrictive stance of monetary policy and seemed comfortable with easing in the near future ( Figure 12). While the Fed is focused on the totality of the data in determining when to lower rates, it seems that this week’s CPI data was the proverbial “nail in the coffin,” though markets have clearly been in this camp for weeks.

Figure 12: The tone from Fed officials seemed to shift following the July CPI report, as various speakers hinted at a September cut and highlighted the restrictive stance of policy

Selected comments from this week’s Fedspeak

| Date | Speaker | Comments |

| 10-Aug | Bowman (v) | "I will remain cautious in my approach to considering adjustments to the current stance of policy." (…) "It will become appropriate to gradually lower the federal funds rate to prevent monetary policy from becoming overly restrictive." |

| 13-Aug | Bostic (Atl, v) | "We want to be absolutely sure," (…) “It would be really bad if we started cutting rates and then had to turn around and raise them again.” |

| 14-Aug | Goolsbee (Chi, nv) | "It feels like, on the margin, I’m getting more concerned about the employment side of the mandate." (…) "[interest rates are] very restrictibe" (...) "If you were going into a recession or you believe that you were going into recession, that would affect the rate at which you’d be doing the cuts” (...) “Conditions are what will warrant the size of the cuts" |

| 15-Aug | Bostic (Atl, v) | "[Fed can't] afford to be late" (…) "I'm open to something happening in terms of us moving before the fourth quarter" |

| 15-Aug | Musalem (St. L, nv) | "Monetary policy is moderately restrictive" (...) "From my perspective, the risk to both sides of the mandate seem more balanced" (…) "Accordingly, the time may be nearing when an adjustment to moderately restrictive policy may be appropriate as we approach future meetings" (…) "There are risks of cutting too early or too much" (...) " |

| 16-Aug | Goolsbee (Chi, nv) | “There are some various leading indicators of recession, and some of those are giving warning lights, but there’s cross currents” (…) "You don't want to tighten any longer than you have to" (…) "[size of September ease] Everything is always on the table" |

Source: Federal Reserve, Bloomberg Finance L.P.

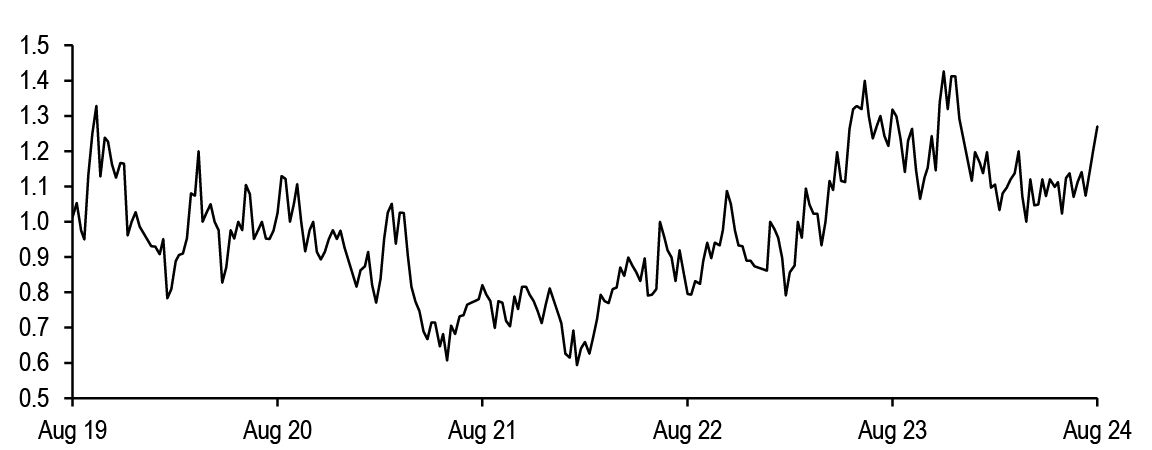

From a high-level perspective, it may seem strange that yields rose this week in the face of inflation data that gives the FOMC confidence inflation is trending back toward 2%, but fleeting expectations of an intermeeting or larger-sized cuts were being driven by fears of a more severe slowing in growth and weakening in labor markets, and this week’s data helped to ease those fears for now. What’s more, we think investor positioning has played a role as well : our Treasury Client Survey Index extended significantly over the last few weeks, to the longest levels since December ( Figure 13). Thus, it could be that this week’s moves were somewhat exaggerated by investor positioning as well, as the index had risen to 1.27, nearly 1.5 standard deviations above its 1-year average. Historically, when the Treasury Client Survey Index has moved to this level, yields have consistently risen over the ensuing weeks (see Survey says Using the Treasury Client Survey to predict rates moves, 7/21/23). We will be interested to see next week’s survey, as this technical factor leaves the risks skewed more bearishly over the very near term.

Figure 13: Our Treasury Client Survey Index rose to its highest levels since December, a move that has been traditionally consistent with yields rising over the following weeks

J.P. Morgan Treasury Client Survey Index*;

Source: J.P. Morgan*(Longs +Neutrals)/(Shorts+Neutrals)

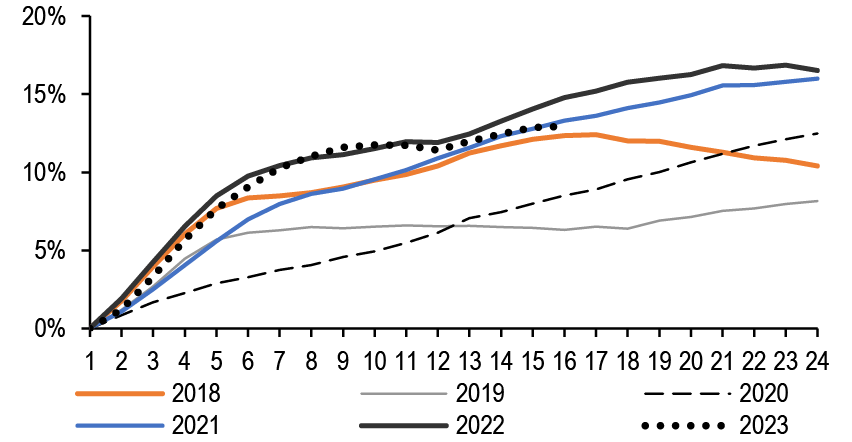

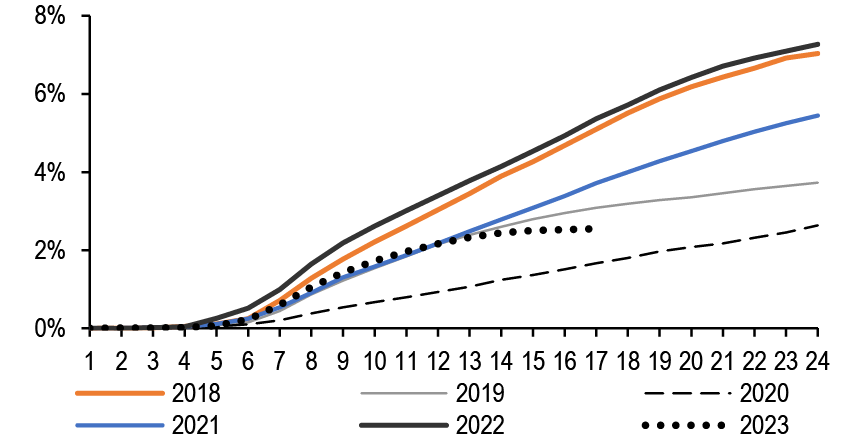

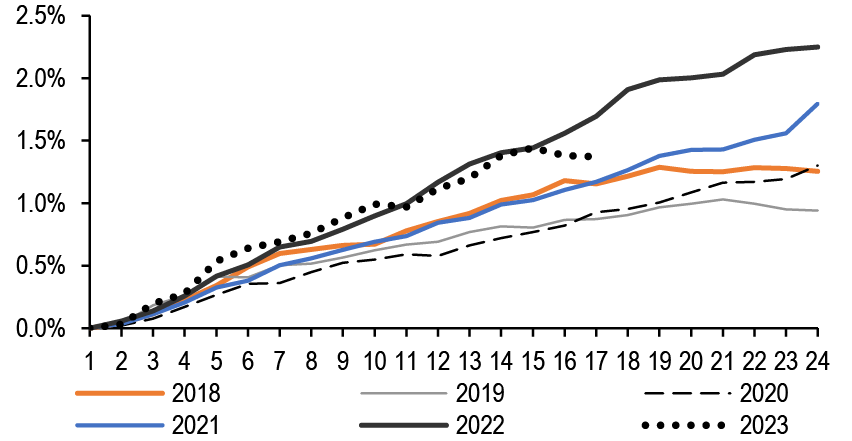

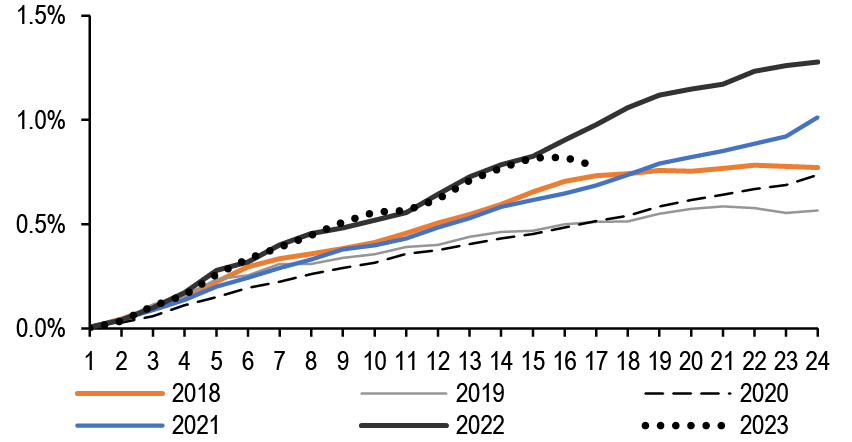

As we look ahead, policymakers and academics will descend on Jackson Hole late next week for the Kansas City Fed’s annual monetary policy symposium, and Chair Powell will speak on the economy at 10am ET next Friday morning. Given this backdrop, we think it’s worthwhile to go back and look at the behavior of the Treasury market in the day and week after the Chair’s appearance at Jackson Hole. These events have not frequently corresponded with large moves in Treasury yields, either on the day of the speech or in the week following the Chair’s remarks, as Jackson Hole has not typically been a forum for discussing the near-term path of Fed policy ( Figure 14). 2020 and 2022 were exceptions: in 2022, Chair Powell used this forum to push back on expectations for easing in the following year, and this event represented a turning point for policy expectations, with long-term yields rising more than 100bp over the next two months (see Short but not sweet, Michael Feroli, 8/26/22). Separately, in 2020, Chair Powell formally announced the adoption of flexible average inflation targeting (see We know what they want but we just don’t know how they go about getting it, Michael Feroli, 8/27/20). However, we think it’s unlikely Chair Powell offers too much granular policy guidance, as the expected magnitude of eases in September and beyond will probably depend highly on the evolution of labor market data, and the August employment report will be key in that regard.

Figure 14: Fed Chair speeches at Jackson Hole drove significant Treasury moves in only 2020 and 2022

Jackson Hole Symposium agendas, Fed Chair speeches, and changes in 10-year Treasury yields on the day of the Chair speech as well as in the following 5 days; bp

| Year | Symposium agenda | Chair remarks | Date | 10-year UST chg | |

| Day of | Next 5d | ||||

| 2016 | Designing Resilient Monetary Policy Frameworks for the Future | The Federal Reserve’s Monetary Policy Toolkit: Past, Present and Future | 26-Aug-16 | 5.7 | -3.6 |

| 2017 | Fostering a Dynamic Global Economy | Financial Stability a Decade after the Onset of the Crisis | 25-Aug-17 | -2.2 | -1.4 |

| 2018 | Changing Market Structures and Implications for Monetary Policy | Monetary Policy in a Changing Economy | 24-Aug-18 | 0.5 | 2.7 |

| 2019 | Challenges for Monetary Policy | Challenges for Monetary Policy | 23-Aug-19 | -8.3 | -2.1 |

| 2020 | Navigating the Decade Ahead: Implications for Monetary Policy | New Economic Challenges and the Fed’s Monetary Policy Review | 27-Aug-20 | 5.9 | -12.4 |

| 2021 | Macroeconomic Policy in an Uneven Economy | Monetary Policy in the Time of COVID | 27-Aug-21 | -3.1 | 1.0 |

| 2022 | Reassessing Constraints on the Economy and Policy | Monetary Policy and Price Stability | 26-Aug-22 | 1.1 | 15.5 |

| 2023 | Structural Shifts in the Global Economy | Inflation: Progress and the Path Ahead | 25-Aug-23 | 0.4 | -6.6 |

| Avg | 0.0 | -0.9 | |||

| St. dev. | 4.4 | 7.6 | |||

Source: Federal Reserve, J.P. Morgan

Away from the near-term event risks, we’ve often debated whether the coming easing cycle will look more like the shallow maintenance cutting cycles of 1995 or 2019, or the full-blown easing cycles of 2001 or 2007. With the data we have in hand now, we do not think the current cycle resembles any of these cycles in the modern monetary policymaking era since the Fed began releasing policy statements in 1994. On one hand, the easing in inflation pressure against the backdrop of above-trend growth has this cycle somewhat reminiscent of the mini 75bp cycles of 1995 or 2019, but the similarities end here.

The current stance of monetary policy is decidedly more restrictive than it was in these other episodes: the real Fed funds rate is approximately 2.75%, a full 200bp above the Fed’s real longer-run dot. Using either the Fed’s longer-run dot (with data back to 2012) or the Holston-Laubach-Williams r* estimate, policy rates were negligibly restrictive in 2019, and only about 100bp restrictive in mid-1995 before the first cut ( Figure 15). To be fair, in 1995, the Fed had the luxury of shallow cuts because the neutral rate of interest was rising thanks to the IT-driven productivity boom, and it’s hard to say whether we are at the early stages of another productivity boom now. However, even if we adjust these measures of neutral policy rates higher by 50bp, there would still be more than 150bp of easing to bring policy rates back to more neutral levels, or twice the magnitude of shallower cycles.

Figure 15: The Fed funds rate is considerably more restrictive than at any point over the last 30 years...

Real Fed funds rate*, real longer-run median Fed dot, and Holston-Labach-Williams natural rate of interest rate; %

Source: Federal Reserve, J.P. Morgan

Source: J.P. Morgan., Federal Reserve bank of New York, Bloomberg Finance L.P.* Fed funds target less core PCE oya

Thus, could this cycle more closely resemble the 2001 and 2007 easing cycles, when the Fed eased aggressively for more than a year in each instance? We think it’s hard to make these comparisons, as financial conditions are clearly easier and showing fewer signs of stress than they did prior to these other major easing cycles. Figure 16 shows the OFR’s Financial Stress Index, and this series began in 1999. The index indicates financial stress is well below its longer-term averages, while this index demonstrated financial stress was more acute before the Fed began easing in 2001 or 2007. Certainly, were financial conditions to tighten more aggressively, the analog could tip in favor of these more aggressive easing cycles, but this is not apparent right now.

Figure 16: ...but as of now there are few signs of financial stress to motivate a deeper easing cycle like 2001 or 2007

OFR US Financial Stress Index (lhs) versus Fed funds target rate (rhs; %)

Source: OFR, J.P. Morgan

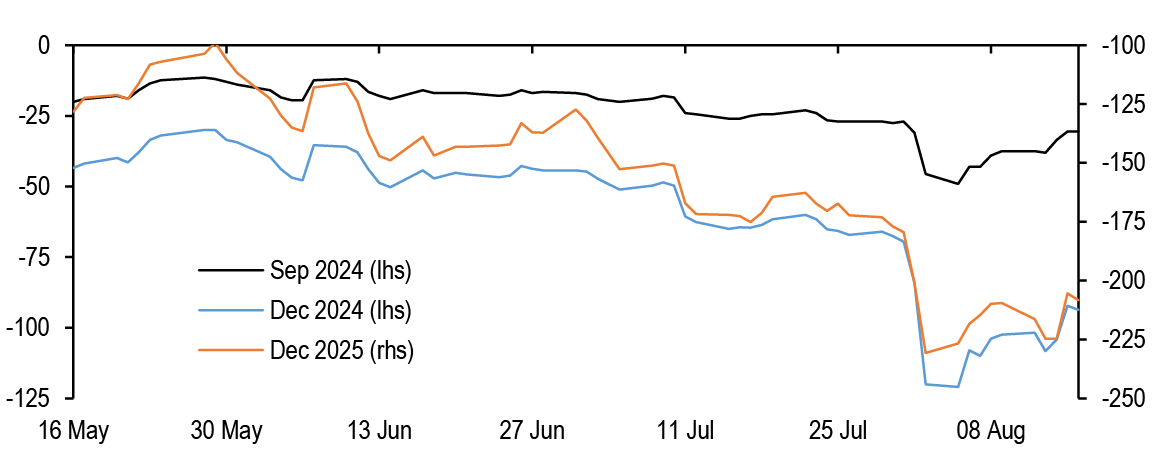

Overall, with the disinflationary process resuming and labor markets substantially looser than they were a year ago, we think this makes the case for substantial Fed easing in the coming months, and we continue to project 50bp cuts in September and November before downshifting to 25bp through late 2025. However, markets have clearly moved in the opposite direction this week, pricing in just 30bp of easing by the September FOMC meeting and 94bp for 2024 ( Figure 17). It’s tempting to add duration here, with markets pricing a slower and shallower path of cuts than our modal view, but we prefer to be patient, knowing that the position technicals we described above could be a drag over the near term. Should the conditions present themselves, we would look to add duration in the 3- to 5-year sector of the curve.

Figure 17: Markets are pricing in a less dovish path, but we do not yet recommend fading this

Easing priced by September and December 2024 (lhs), and December 2025 FOMC meetings (rhs); bp for both axes

Source: J.P. Morgan

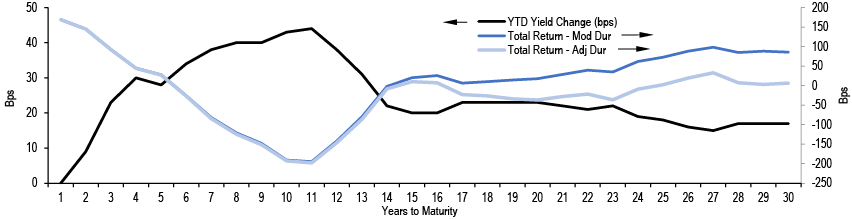

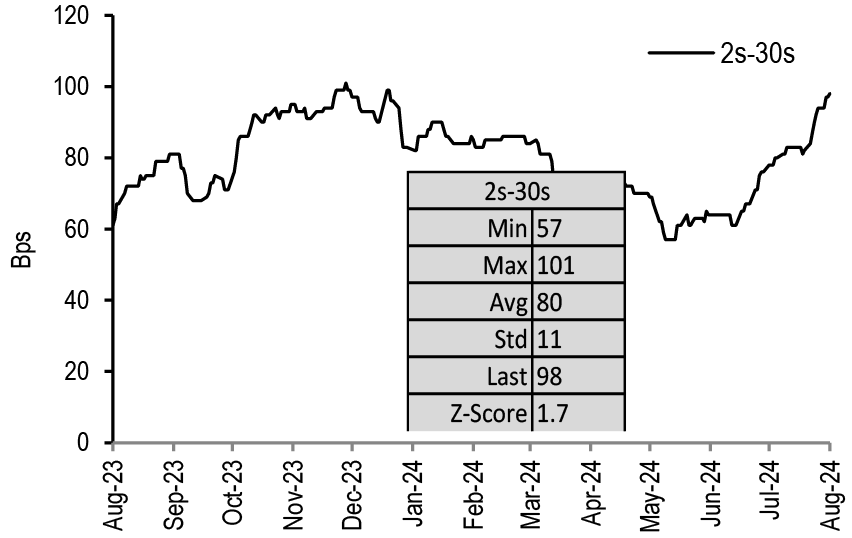

Turning to the curve our views are unchanged, and we continue to favor 5s/30s steepeners for multiple reasons. First, as we’ve written in this piece multiple times over the last 8 to 9 months, the curve tends to steepen outside in, with the long end steepening ahead of the first cut, as medium-term monetary policy expectations ease. This steepening tends to occur consistently as the time to the first cut draws near, suggesting this is no time to pare back on steepening exposure. Second, this trade tends to behave like a lower-beta duration long with a better carry profile than an outright long position. Third, as the rapid growth of the Treasury market outstrips demand from its traditional base of less price-sensitive investors like the Fed, foreign official investors, and US commercial banks, and relies more heavily on price-sensitive investors, this warrants higher term premium and steeper curves (see In the eye of the beholder, 9/12/23). Now it’s clear our choice of steepener biases us toward a more normalizing Fed cutting cycle: our recent work has found that the behavior of the front end varies greatly, traditionally trading in a range around shallower easing cycles, and steepening sharply in more aggressive easing cycles. In this vein, 2s/5s is beginning to look more attractive, as the risks point toward quicker and deeper cuts, but we think it will require another weak employment report to have us shift our steepening exposure further in the curve.

June TIC update

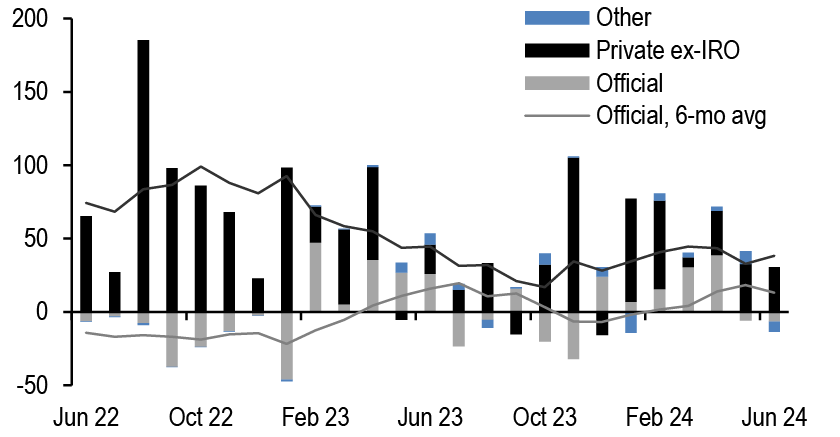

Turning to the monthly TIC data, foreign investors purchased $17bn long-term Treasuries over the month of June, below the six-month average, and the weakest month of net purchases since December 2023. Private investors added $23bn, a step down from the $41bn of purchases in May, which includes $7bn of net selling from International and Regional Organizations (IROs), the first month of net selling from this community since January. Meanwhile foreign official investors sold $6bn for the second consecutive month ( Figure 18).

Figure 18: Foreign investors on net purchased $17bn of long-term Treasuries in June, the least since December 2023...

Total net sales of long-term Treasuries by US residents by sector and 6-mo. moving average; $bn

Source: Treasury International Capital System

Figure 19: ...and geographically, demand was concentrated in Europe while net selling flows emanated from Japan

Net sales of long-term Treasuries by US residents from April- June 2024 by region as well as cumulative net sales year-to-date; $bn

| Region | Jun-24 | May-24 | Apr-24 | YTD 2024 |

| Euro Area† | 20.6 | 10.0 | 8.1 | 83.1 |

| China | 5.9 | -23.9 | 23.9 | -38.8 |

| Ireland | 0.2 | 5.7 | 0.3 | 13.3 |

| Oil Exporters* | -2.2 | 2.1 | 0.3 | 10.4 |

| EM ex-China** | -2.3 | 13.1 | 15.5 | 51.6 |

| UK | -5.1 | 15.2 | -3.7 | 25.9 |

| Cayman Islands | -10.7 | 3.7 | 18.0 | 2.0 |

| Japan | -30.1 | -5.8 | -4.6 | 8.8 |

Source: Treasury International Capital System

*Oil exporters include all OPEC members (excluding Equatorial Guinea & Angola) and also include Bahrain, Indonesia & Oman

**EM ex-China includes Russia, Brazil, African countries, Taiwan (China), South Korea and Mexico

† Euro area include Austria, Belgium, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Latvia, Luxembourg, Malta, Netherlands, Portugal, Slovakia, Slovenia, Spain

Turning to the geographical composition, Figure 19 shows that flows were rather muted across the domiciles we monitor. That said, demand in June was concentrated among European investors, who net purchased $20.6bn of long-term Treasuries over the period. Indeed, European investors have comprised the largest source of demand for US Treasuries this year, as buying US bonds on both a rolling and matched-maturity FX hedged basis remains attractive (see Global Fixed Income Markets Weekly, 8/2/24). Within this group, French investors purchased $18bn over the month, accounting for the lion’s share of this demand. Meanwhile Japan investors sold $30bn of long-term Treasuries, the largest monthly sale since September 2022. This should not come as a surprise as more granular data from the MoF showed that Japanese investors net sold $4.26bn JPY of foreign bonds in June, of which roughly 60% were USD-denominated, with the majority of this selling pressure emanating from banks. Selling continued at a more moderate $2.11bn JPY pace in July (see Japan Flows in Pictures, Takafumi Yamawaki, 8/8/24).

Trade recommendations

- Maintain 5s/30s steepeners

- Stay long 100% risk, or $112mn notional of T 4.875% Oct-28s

- 100% risk, or $29.9mn notional of T 4.75% Nov-53s

- (US Treasury Market Daily, 11/22/23: P/L since inception: 10.3bp)

- Maintain 75%/6% weighted 5s/10s/30s belly-cheapening butterflies

- Stay long 75% risk, or $43mn notional of T 4.625% Sep-28s

- Stay short 100% risk, or $33.3mn notional of T 3.875% Aug-33s

- Stay long 6% risk, or $1mn notional of T 4.125% Aug-53s

- (US Fixed Income Markets Weekly, 9/29/23: P/L since inception: -6.5bp)

Figure 20: Closed trades in last 12 months

P/L reported in bp of yield unless otherwise indicated

| TRADE | ENTRY | EXIT | P/L |

| Duration | |||

| 5-year duration longs | 08/04/23 | 09/08/23 | -27.6 |

| 5-year duration longs | 10/03/23 | 11/02/23 | 14.9 |

| 7-year duration shorts | 11/03/23 | 11/22/23 | -7.9 |

| 30-year duration shorts | 12/15/23 | 01/04/24 | 10.9 |

| 5-year duration longs | 01/19/24 | 02/01/24 | 25.3 |

| 5-year duration longs | 02/09/24 | 03/07/24 | 3.3 |

| Equi-notional 2s/5s flatteners | 05/31/24 | 06/06/24 | 16.0 |

| 5-year duration shorts | 06/14/24 | 07/01/24 | 21.9 |

| 30% 2-year duration short | 07/12/24 | 07/31/24 | -1.8 |

| Curve | |||

| 10s/30s steepener | 12/16/22 | 09/29/23 | 3.0 |

| 10s/30s steepener | 11/03/23 | 11/22/23 | -7.3 |

| 2s/5s flatteners | 12/08/24 | 05/17/24 | 6.0 |

| Relative value | |||

| 100:96 weighted 3.5% Feb-39 / 3.75% Nov-43 flatteners | 07/28/23 | 08/16/23 | 3.2 |

| 2.75% Aug-32/ 3.5% Feb-39 steepeners | 01/10/24 | 01/26/24 | 5.2 |

| 20s/ old 30s flatteners | 02/15/24 | 05/10/24 | -2.6 |

| 100:97 weighted 3.75% Apr-26/ 4.625% Sep-26 flatteners | 04/12/24 | 05/17/24 | 2.2 |

| 100:95 weighted 4% Feb-28 / 4% Feb-30 steepeners | 02/23/24 | 05/31/24 | -6.6 |

| 50:50 weighted 3s/5s/7s belly-richening buterflies | 03/15/24 | 06/14/24 | 2.1 |

| 100:98 weighted 4.75% Feb 37s / 4.5% Aug 39s steepeners | 06/14/24 | 07/12/24 | 2.6 |

| 100:95 weighted 0.625% Jul-26s / 1.25% Dec-26s steepeners | 07/12/24 | 08/14/24 | 1.5 |

| Number of positive trades | 14 | ||

| Number of negative trades | 6 | ||

| Hit rate | 70% | ||

| Aggregate P/L | 64.3 |

Source: J.P. Morgan

Technical Analysis

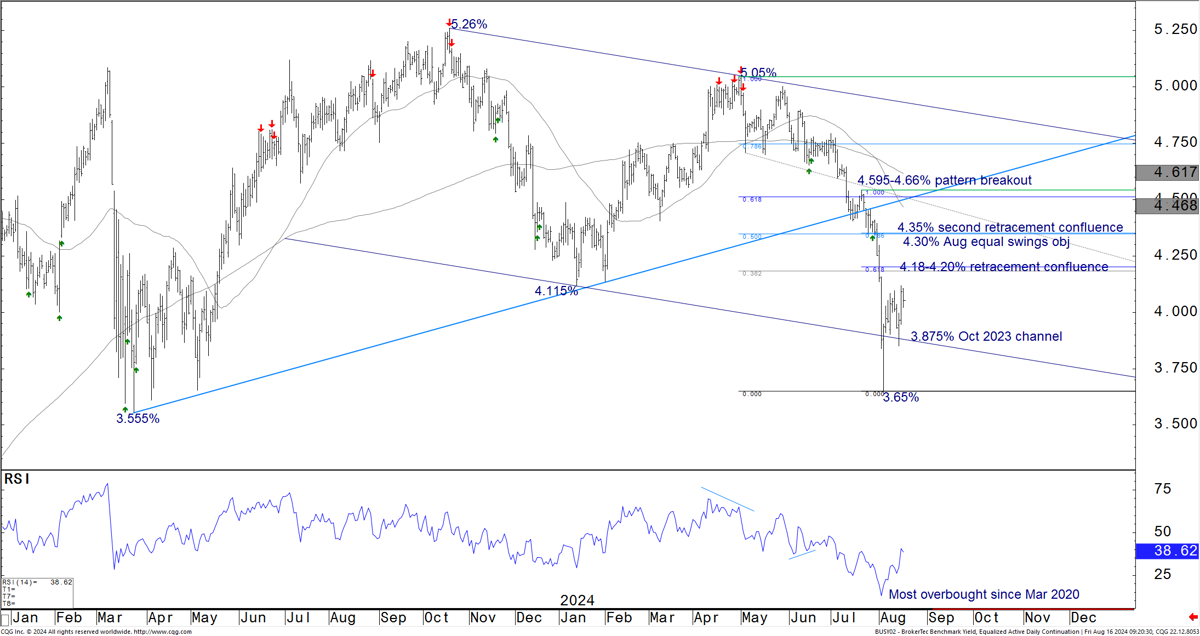

- The 2-year note backup from 3.65% approaches the first zone of potential support at 4.115-4.20%. We expect the market to find its footing near that support or the 4.30-4.35% second confluence of levels over the near term. Bigger picture, what appears to be a multi-year yield top pattern developing behind the 3.55% Mar 2022 yield low and other signals across markets that point to the potential transition to an end-of-cycle dynamic leave us looking for late-summer consolidation to give way to an impulsive break to lower yield levels into 2025 as a bull market enters its acceleration phase.

- The 5-year note consolidates after the mid-summer acceleration to lower yields. We expect the 3.91-4.02% support zone to cap yields through late summer. A break through 4.15-4.20% is needed to derail the bullish pattern structure at this point. The rally stalled near the 3.50% Oct-Apr equal swings objective and the associated channel trend line. We suspect that area will act as resistance for a few weeks.

- The 10-year note yield bullishly consolidates behind the 3.625% Apr 2023 78.6% retrace and in front of key support at 4.02-4.14%. We expect those two zones to define the trading range into the early fall. The next zone of chart resistance sits at 3.22-3.248%, targets for later this year or early 2025.

- The 30-year bond bullishly consolidates richer than the 4.33-4.345% Jun-Jul pattern riches and in front of the 4.40-4.50% confluence of moving averages. Look for further coiling around the 4.00% area in the weeks ahead.

- Look for continued 5s/30s curve range trading below the 59bp Mar 2021 50% retrace and above the 28-32bp support zone in the weeks ahead. We think that range will consolidate the breakout from the 2022-2024 base pattern and give way to a more aggressive steepening trend in the months ahead.

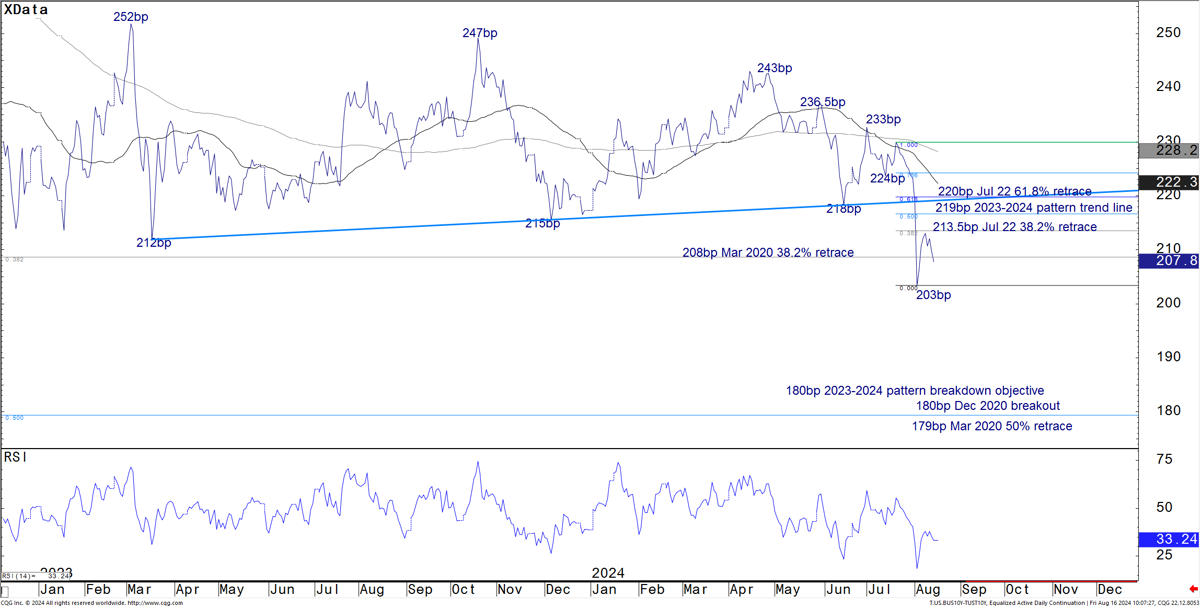

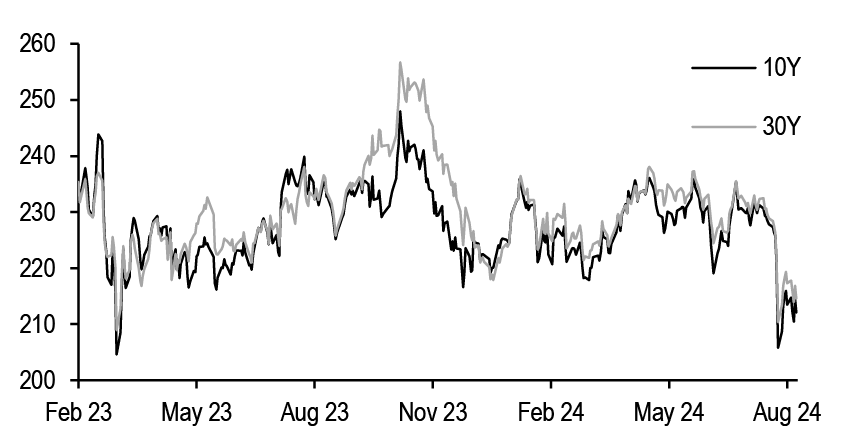

- The 10-year TIPS breakevens rebound from the 203bp Aug low stalled at the key 215-219bp breakdown resistance zone. We used the test of that resistance as an opportunity to initiate a tightening trade. While the market can see more backing and filling over the near term, we expect additional tightening pressure to build later this year and into 2025. We see the 180bp area as a base-case target for that period.

US

While we believe the Apr-Aug moves kicked off powerful trend dynamics that will lead to further bond market rally impulses into 2025, we suspect the rest of the month will give market participants the opportunity to enjoy what are usually heavy vacation weeks. We are looking for further consolidation after the early-Aug cascade to lower global bond yields. That same consolidation is likely to play out on curve and TIPS breakevens charts. The speed at which some equity indexes retook ground over the past week lowers our conviction that trends have entered a more acute phase of an end-of-cycle transition to some degree. However, the majority of those markets are still trading below Jun-Jul breakdown levels and thus still look vulnerable into risk-off seasonals that take hold into Sep provided they respect that resistance over the near term. For now, we suggest carrying a full 5s/30s curve steepening trade and a newly added 10-year TIPS breakevens tightening trade that we entered as the market tested expected resistance levels. We will look for opportunities to enter outright duration longs if the markets respect support as we anticipate in late Aug.

At the front end, the 2-year note has nearby support at the 4.115% Jan yield low, 4.18-4.20% Apr-Jul Fibonacci retracement confluence and payrolls bull gap ( Figure 21). We are looking for material buying interest to contain Aug-Sep backups near there, or at the 4.30-4.35% second zone of levels. As we get increased confidence in which of those two it will be, we will look to start entering a bullish trade. The medium-term bullish chart structure stays in gear as long as the market does not cheapen back thorugh the 4.595-4.66% pattern breakout levels and moving averages.

Figure 21: The 2-year note backup from 3.65% approaches the first zone of potential support at 4.115-4.20%. We expect the market to find its footing near that support or the 4.30-4.35% second confluence of levels over the near-term...

2-year note yield, daily bars with momentum divergence signals; %

Source: J.P. Morgan, CQG

Bigger picture, we view the late-2022 through 2024 price action that has developed cheaper than 3.50% as a large bullish reversal pattern ( Figure 22). We suspect bullish consolidation to continue behind the 3.55% Mar 2022 yield low through the fall, but see the prospects for a release richer growing as the months roll by. Next resistance rests at the 3.285% Jul 2022 38.2% retrace and then 2.98% 2018 bear cycle cheap. We think the market will challenge those levels later this year or into early 2025.

Figure 22: … Bigger picture, what appears to be a multi-year yield top pattern developing behind the 3.55% Mar 2022 yield low and other signals across markets that point to the potential transition to an end-of-cycle dynamic leave us looking for late-summer consolidation to give way to an impulsive break to lower yield levels into 2025 as a bull market enters its acceleration phase.

2-year note yield, weekly bars with momentum divergence signals; %

Source: J.P. Morgan, CQG

The 5-year note has a similar short-, medium-, and longer-term pattern setup. Nearby support rests at the 3.915% Jul 22 61.8% retrace and 3.935% May internal trend line ( Figure 23). Medium-term bulls keep the agenda as long as backups respect the 4.02% Aug equal swings objective, 4.15% Aug 2022 trend line, and 4.195% Jun 14 yield low. While the recent data have reduced some angst regarding US growth, we do not envision a retest of those cheaper levels going forward. The Aug rally satalled near the 3.50% Oct-Apr equal swings objective and 3.485% Oct 2023 channel. Look for that area to keep a floor under yields for a few weeks. Next resistance rests at the 3.205% May 2023 yield low.

Figure 23: The 5-year note consolidates after the mid-summer acceleration to lower yields. We expect the 3.91-4.02% support zone to cap yields through late summer. A break through 4.15-4.20% is needed to derail the bullish pattern structure at this point. The rally stalled near the 3.50% Oct-Apr equal swings objective and the associated channel trend line. We suspect that area will act as resistance for a few weeks.

5-year note, daily bars with momentum divergence signals; %

Source: J.P. Morgan, CQG

The 10-year note backup from near the 3.625% Apr 2023 78.6% retrace has stalled in front of key support at the 4.02% Apr internal trend line, 4.05% Jul 24 61.8% retrace, and 4.14% Jul 17 yield low ( Figure 24). The market is currently working off the most extreme overbought reading on our TY premium-weighted Put/Call ratio z-score indicator since 2021, but the absence of the momentum divergence signaling that normally accompanies a more lasting trend reversal points to bull market consolidation and not a protracted retracement to higher yield levels. We suspect the intermediate sector will spend a few weeks in a 3.65% to 4.15% range and pressure to lower yields in the months ahead. Next resistance rests at the 3.50% Oct-Apr equal swings objective, with longer-term levels at the 3.248% Apr 2023 yield low and 3.22% Mar 2020 38.2% retrace.

Figure 24: The 10-year note yield bullishly consolidates behind the 3.625% Apr 2023 78.6% retrace and in front of key support at 4.02-4.14%. We expect those two zones to define the trading range into the early fall. The next zone of chart resistance sits at 3.22-3.248%, targets for later this year or early 2025.

10-year note yield, daily bars with momentum divergence and TY premium-weighted Put/Call z-score signals; %

Source: J.P. Morgan, CQG, CME

Figure 25: The 30-year bond bullishly consolidates richer than the 4.33-4.345% Jun-Jul pattern riches and in front of the 4.40-4.50% confluence of moving averages. Look for further coiling around the 4.00% area in the weeks ahead.

30-year bond yield, daily bars with momentum divergence signals; %

Source: J.P. Morgan, CQG

Figure 26: Look for continued 5s/30s curve range trading below the 59bp Mar 2021 50% retrace and above the 28-32bp support zone in the weeks ahead. We think that range will consolidate the breakout from the 2022-2024 base pattern and give way to a more aggressive steepening trend in the months ahead.

5s/30s curve, daily closes; bp

Source: J.P. Morgan, CQG

Figure 27: The 10-year TIPS breakevens rebound from the 203bp Aug low stalled at the key 215-219bp breakdown resistance zone. We used the test of that resistance as an opportunity to initiate a tightening trade. While the market can see more backing and filling over the near term, we expect additional tightening pressure to build later this year and into 2025. We see the 180bp area as a base-case target for that period.

10-year TIPS breakevens, daily closes; bp

Source: J.P. Morgan, CQG

This report was excerpted from Global Fixed Income Technical, Jason Hunter, August 16, 2024

TIPS Strategy

Initiate 5Yx5Y inflation swap longs

- Core CPI came in close to expectations, with some offsetting surprises within the details, and does little to change our medium -term inflation outlook. The fixings continue to imply a softer core CPI inflation over the balance of the year relative to our forecast

- Despite a partial rebound in breakevens over the last two weeks, the product has lagged the recovery in other markets and breakevens remain cheap versus our fair value estimates. Given the recent improvement in economic data, we now recommend initiating long exposure

- With the Fed likely to begin cutting rates next month, we note that breakevens have not exhibited a consistent performance around the start of prior easing cycles. However, a Fed that is cutting due to risks coming into better balance and a desire to return policy rates quickly to neutral should be more supportive for breakevens than a Fed that is behind the curve

- Demand for TIPS-focused funds has picked up alongside the decline in real yields and improvement in realized TIPS returns, driving the 4-week moving average of inflows to its highest level in more than 2 years

- Along the curve, the intermediate sector offers value, and we prefer to express longs in inflation swaps rather than breakevens, given that IOTAs remain tight. 5Yx5Y inflation swaps also avoid the seasonally negative carry of spot breakeven positions

Market views

Over the last two weeks, 5-, 10-, and 30-year breakevens widened 8bp, 8bp, and 6bp, respectively, alongside an improvement in economic data. Specifically, the ISM employment index rose from 46.1 to 51.1, and initial jobless claims moved back down to 227K, after rising to 250K two weeks ago. The July retail sales data came in stronger than expected, leading our economists to revise up their 3Q real consumption growth estimate to 2.0% from 1.1% previously (see US: July retail sales suggest no slowing in 3Q real spending, Abiel Reinhart, 8/15/24). Inflation news was relatively benign. Though core PPI was softer than expected, with the index unchanged in July, core CPI came in line with expectations, rising 0.17% m/m and leaving the year-ago rate unchanged at 3.2%. With CPI and PPI data in hand, we estimate a 0.12% rise in core PCE in July, with the year-ago rate holding steady at 2.6% (see US: Cooler July CPI, as expected, Michael Hanson, 8/14/24).

Turning to the details of the CPI report, the headline CPI-U NSA printed at 314.54 in July, below the market fixing of 314.63. Energy prices were flat on the month, while food prices rose 0.2% as expected. Meanwhile, core goods prices fell 0.32%, the softest reading since January, held down by a 2.3% decline in used vehicle prices ( Figure 28). Though industry data imply another decline in used car prices in August, more recent data have shown an increase in prices, and we generally look for greater stability in vehicle prices over the remainder of the year relative to what we’ve observed YTD (see Focus: Vehicle Prices, Michael Feroli, 7/19/24). Core services also came in line with our forecast, rising 0.31%, though with some offsetting surprises within the details. Rent and OER firmed somewhat more than anticipated, rising 0.49% and 0.36%, respectively, with both components rising faster in larger cities. Overall, this does not derail our view that we should see softer rent inflation readings over the balance of the year, particularly on a seasonally-adjusted basis. However, we note that fundamentals in the rental market remain strong, which could make it difficult for rent inflation to return to its pre-pandemic pace, absent more significant economic weakening (see CMBS Weekly, Chong Sin, 8/2/24). Away from rents, medical care services came in softer than expected, driven by an outsized 1.9% decline in outpatient hospital services, which is unlikely to be repeated going forward. Other components were generally in line with expectations.

Figure 28: Core CPI rose 0.17% m/m in July, with strength in rent components offset by unexpected weakness in medical care services

Select categories of core CPI; units as indicated

| Category | Weight | % m/m | % 3m saar |

| Core Goods | 23.68% | -0.32% | -1.9% |

| New vehicles | 4.62% | -0.2% | -3.3% |

| Used cars and trucks | 2.52% | -2.3% | -12.3% |

| Other core goods | 16.54% | 0.0% | 0.1% |

| Core Services | 76.32% | 0.31% | 2.7% |

| Rent of primary residence | 9.61% | 0.49% | 4.7% |

| OER | 33.55% | 0.36% | 4.4% |

| Core services ex-rent & OER | 33.16% | 0.21% | 0.4% |

| Lodging away from home | 1.68% | 0.2% | -7.4% |

| Health insurance | 1.01% | -0.4% | 0.8% |

| Airline fares | 0.94% | -1.6% | -34.0% |

| Auto insurance | 3.50% | 1.2% | 8.2% |

| Other core services | 27.71% | 0.2% | 1.4% |

| Core CPI | 100.00% | 0.17% | 2.1% |

Source: J.P. Morgan, BLS

Figure 29: The fixings imply very soft core CPI inflation over coming months

CPI fixings and implied inflation rates*; units as indicated

| Month | Fixing | Implied headline % m/m sa | Implied headline % oya | Implied core % m/m sa | Implied core % oya |

| Aug-24 | 314.700 | 0.10% | 2.50% | 0.09% | 3.07% |

| Sep-24 | 314.840 | 0.16% | 2.29% | 0.15% | 2.90% |

| Oct-24 | 314.660 | 0.06% | 2.27% | 0.21% | 2.87% |

| Nov-24 | 314.070 | 0.17% | 2.29% | 0.12% | 2.67% |

| Dec-24 | 313.850 | 0.26% | 2.32% | 0.12% | 2.51% |

| Jan-25 | 315.210 | 0.19% | 2.20% | 0.28% | 2.40% |

| Feb-25 | 316.370 | 0.19% | 1.95% | 0.22% | 2.26% |

| Mar-25 | 317.880 | 0.21% | 1.78% | 0.43% | 2.33% |

| Apr-25 | 318.820 | 0.22% | 1.68% | 0.21% | 2.25% |

| May-25 | 319.560 | 0.07% | 1.75% | 0.02% | 2.10% |

| Jun-25 | 320.210 | 0.11% | 1.92% | 0.02% | 2.06% |

Source: J.P. Morgan

* To derive market-implied core inflation rates, J.P. Morgan forecasts for food and energy CPI are used

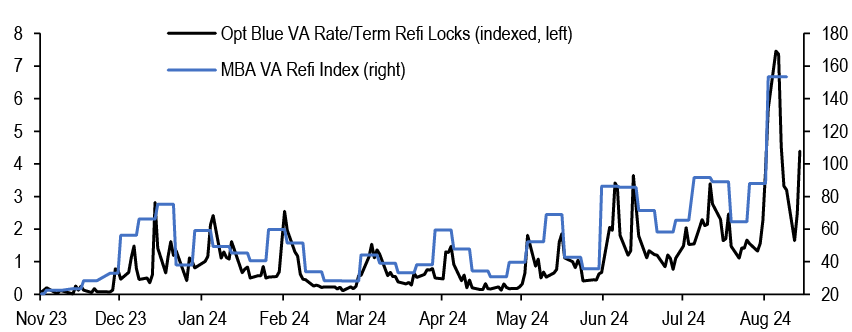

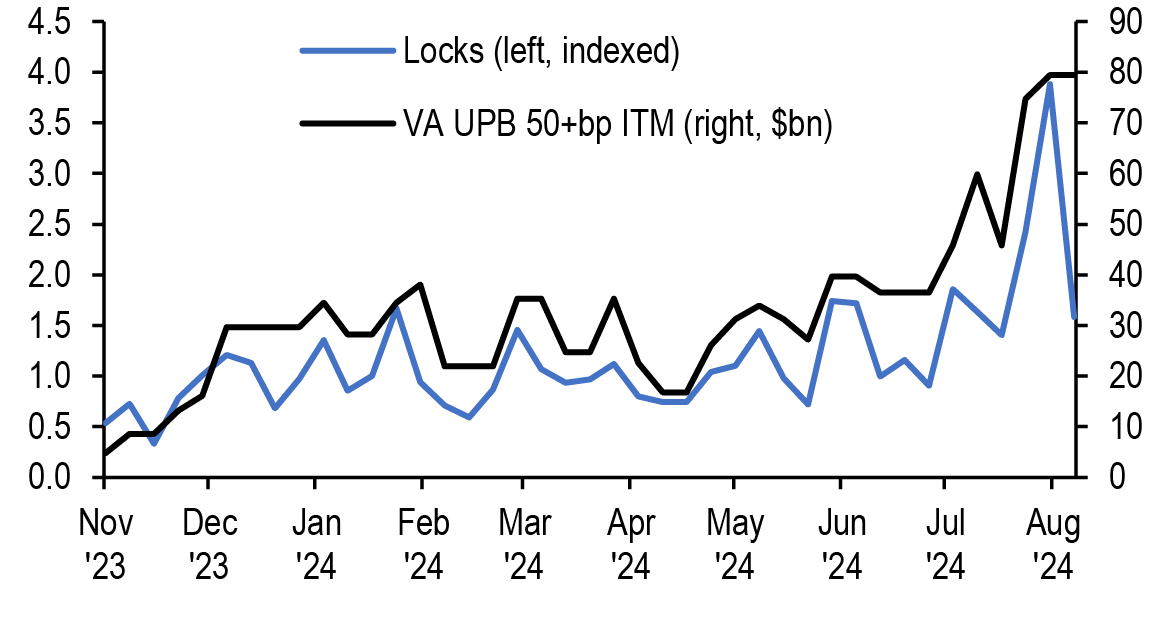

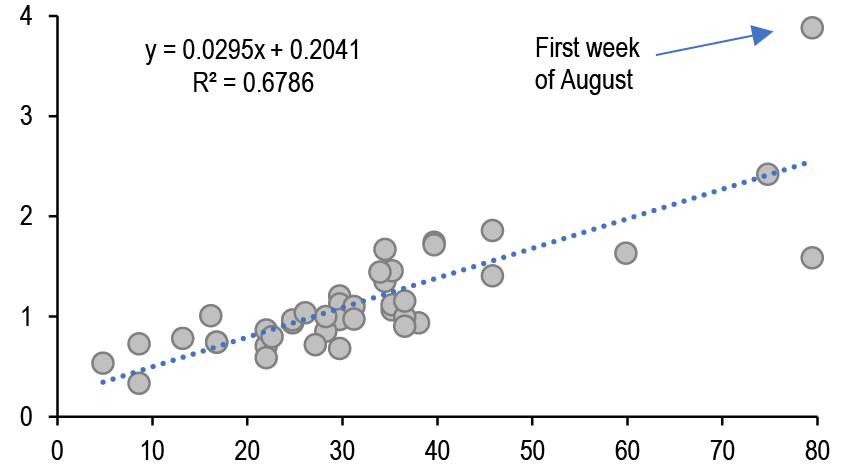

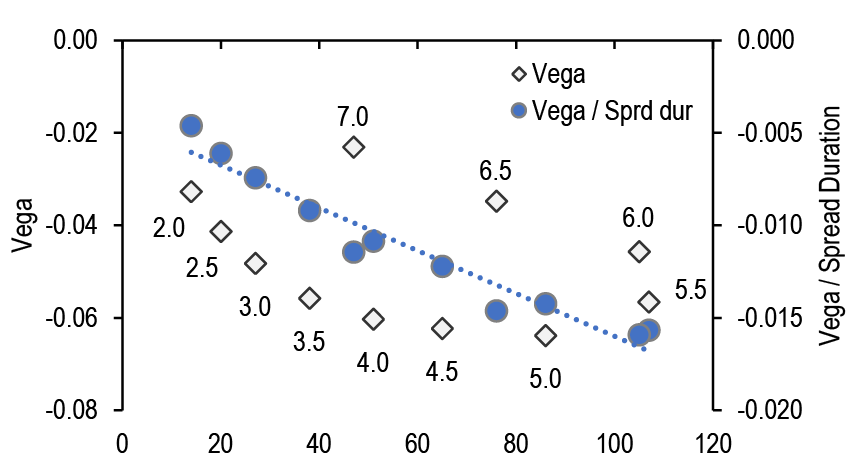

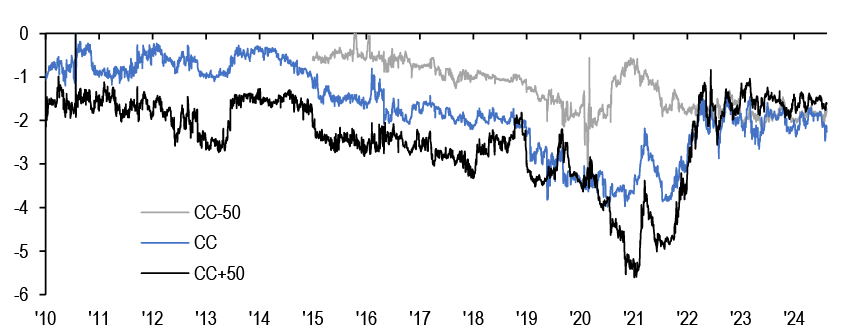

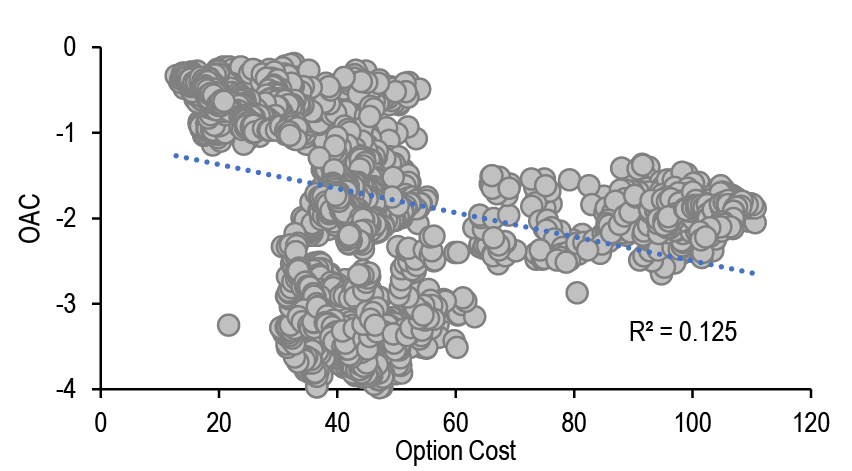

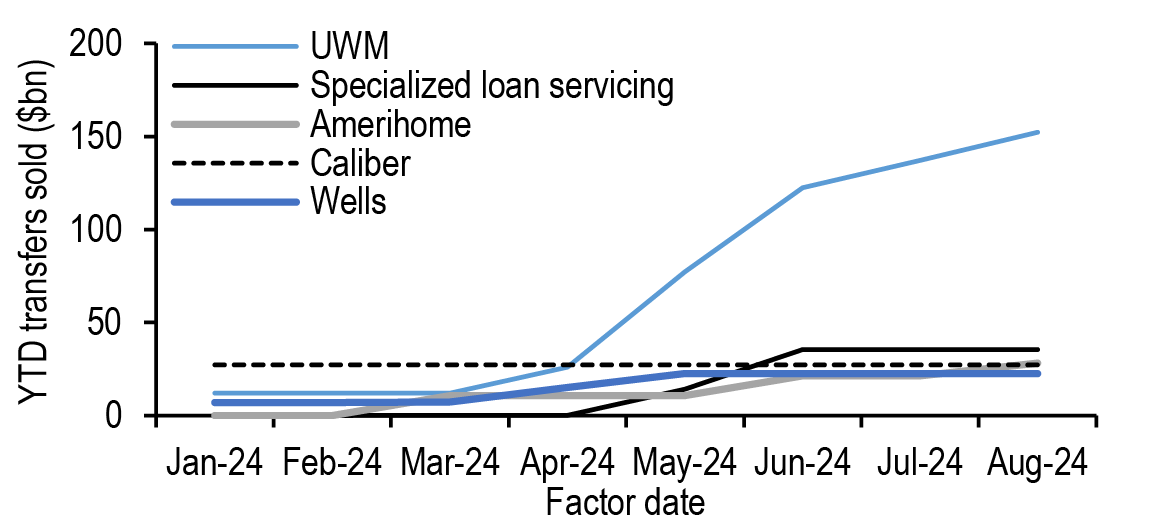

Over the past month or so, we have recommended a neutral stance on breakevens and had noted in late July that we would look for cheaper valuations to add bullish exposure. Though that cheapening came in the wake of the July employment report, we were patient to initiate wideners given that the details of the report, combined with the large move up in initial jobless claims, suggested a greater risk of a more significant deterioration in labor markets than we had expected (see TIPS Strategy, 8/2/24). However, the improvement in data over the last two weeks, including the full reversal lower in claims, leaves us more comfortable with fading the cheapening. Indeed, we think there’s room for breakevens and inflation swaps to richen in the near term for a number of reasons.