Equity Strategy

Closing the OW US vs Eurozone trade

Post the 30%+ outperformance in USD terms seen early last year, Eurozone has lagged the US since May ‘23

Eurozone is trading at sector neutral P/E discount to the US that is at past pre-COVID extremes

Eurozone outperformance a year ago coincided with better growth momentum, and underperformance with a weaker one… Eurozone activity momentum appears to be moving above the US again

Source: Datastream, IBES, J.P. Morgan.

- Eurozone had a big rebound vs the US around a year ago, of 30%+ in USD terms - see top chart, driven by our view at the time of easing in gas prices on ample supply, among other. We have cut Eurozone to UW vs the US in early May of 2023, and had a preference for the US since. We are now closing the US over Eurozone OW, for the following reasons:

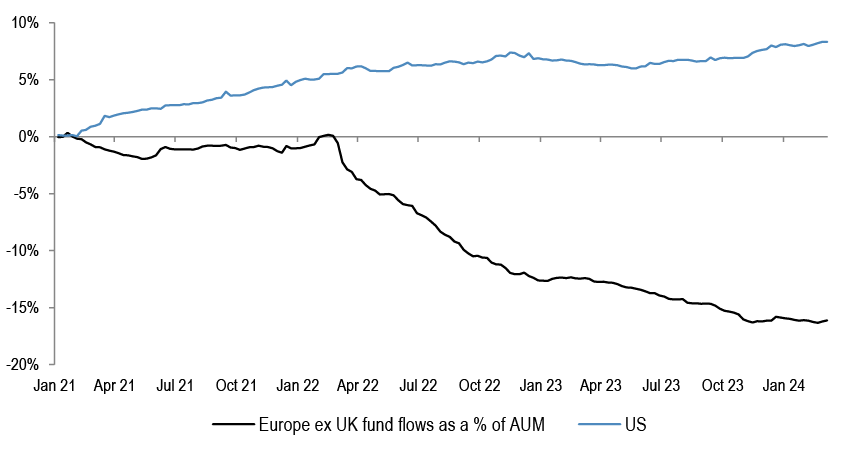

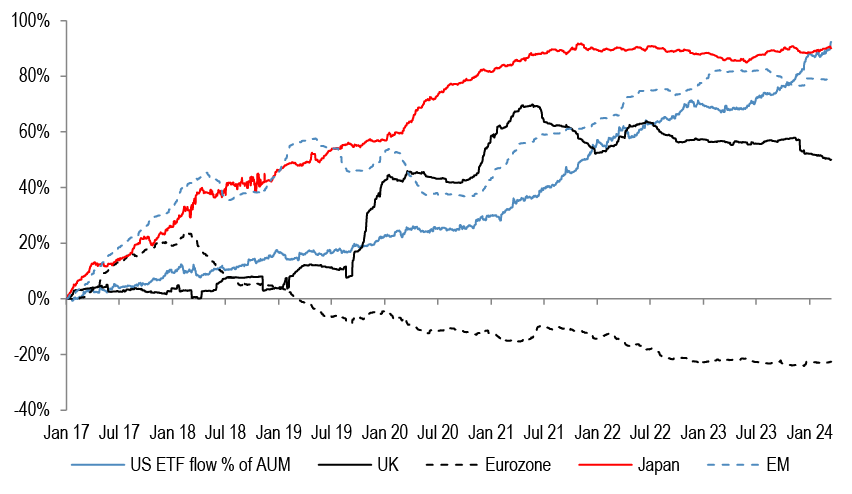

- 1. As per top chart, Eurozone has lagged in the past few quarters, losing 14% relative since May, and had relative outflows - in 41 out of the past 52 wks, and in 7 out of the past 10 wks ytd. At 13.3x forward, it is trading cheap vs the US, which is now on 21x. Even if one were to look at sector neutral P/E rating of Eurozone vs the US, it is trading the cheapest vs any time pre COVID. In absolute terms, Eurozone valuations are fair value vs historical median of 13x PE, and fair value vs fixed income. On both counts, US is more stretched.

- 2. We had a preference for Growth over Value style through 2023 and again this year. Even as we stay with this tilt, we note that Growth style has already performed exceptionally well, it is trading stretched and is at risk of a reversal, given the MOMO concentration. Of course, within Europe there is also an increasing risk of MOMO unwind, but the magnitude of the potential impact would always be greater for the US market.

- 3. In terms of activity momentum, Eurozone had a clear weakening through last year and especially relative to the US - see bottom chart. Even as we are skeptical with respect to the size and duration of the potential rebound, the relative growth disappointments of the region might have peaked, as seen in improving relative CESIs.

- 4. While ECB typically takes its cue from the Fed, there is a chance that it moves ahead of the US this time around.

- 5. We have been cautious on China over the past year from a global allocation perspective, but have a tactically more positive Chinacall, and if this continues tracking, it could indirectly help Eurozone.

- We are neutralizing the US vs Eurozone preference, but not reversing. This is because the potential for a market drawdown is elevated, in our view, with Goldilocks fully in the price. The risks are on both sides of this narrow path: either to growth disappointing, as seen in latest IFO, ISM, retail sales and US small business confidence, and also from inflation potentially staying too hot, as seen in the US 1-year inflation swaps approaching October highs. In addition, the earnings of Growth style keep beating Value, and US earnings likewise are so far delivering better vs Eurozone. Finally, US politics could potentially turn into a headwind for international markets later on in the year. If markets weaken from here, Eurozone is very unlikely to outperform, but equally the much more attractive P/E multiples in the region relative to clearly stretched US P/E multiples could offer some cushion, at least in relative terms.

- What is attractive in Euro Area? We note that every single Eurozone level 1 sector is trading at a greater than historical discount vs the US.

Closing the OW US vs Eurozone trade

Post the strong start to ‘23, Eurozone equities have lagged the US since May

Figure 1: MSCI Eurozone vs MSCI US

Source: Datastream

We held an upbeat view on Eurozone equities since Q4 ‘22, before downgrading the region to outright Underweight in our regional portfolio in May of last year. Our bullish view on Eurozone at the time was driven by the call that gas prices were set to fall, by China reopening, and by what was the extremely cautious positioning on the region at the end of 2022. We downgraded Eurozone in May ‘23, on the back of the view that activity momentum was set to weaken, with Eurozone equities underperforming US by 14% in dollar terms since.

We are now closing the US vs Eurozone preference: 1) Eurozone has lagged, it saw outflows, and is attractively priced vs the US

Figure 2: Cumulative fund flows into regional funds, as % of AUM

Source: EPFR

Apart from the renewed underperformance in the past few quarters, Eurozone equities have seen meaningful outflows, which contrasts to the US inflows.

Figure 3: Europe ex UK weekly flows

Source: EPFR

In the past 52 weeks, Eurozone saw outflows for 41 weeks, and ytd it saw 7 out of 10 weeks of outflows.

Figure 4: MSCI Eurozone 12m Fwd P/E rel to US

Source: Datastream

In terms of valuations, Eurozone equities are trading at a discount of almost 40% versus the US, a greater than 20% discount seen in the past.

Figure 5: Eurozone Sector Neutral P/E relative to US

Source: Datastream

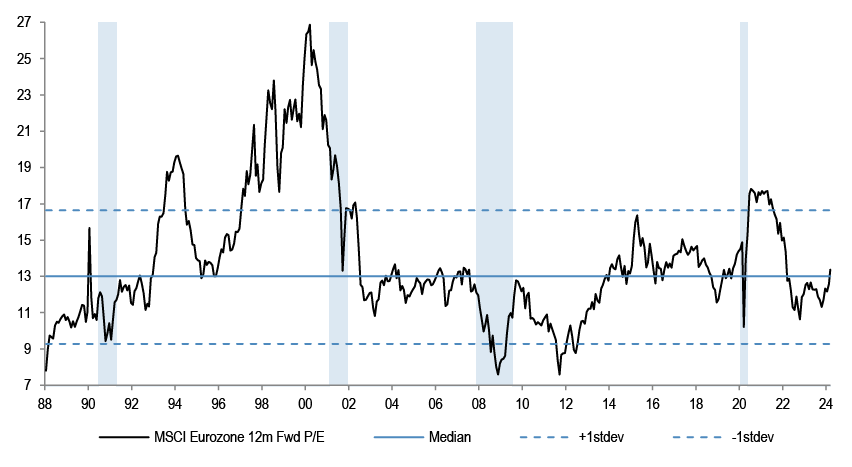

Even adjusted for sector biases, Eurozone screens attractive. On sector neutral P/E, it is trading at one of the cheapest P/E relatives seen in pre-COVID times.

Figure 6: MSCI Eurozone 12m Fwd. P/E

Source: Datastream

In absolute terms, Eurozone 12m Fwd P/E at 13.3x is broadly in line with its long-term history.

Table 1: DM Yield Gap for key regions

| Dividend yield | 10Y Bond yield | Dividend yield minus bond yield | Average since '00 | Current vs Average (bp) | |

| US | 1.4% | 4.3% | -2.9% | -1.4% | -152 |

| Japan | 2.0% | 0.8% | 1.2% | 0.9% | 30 |

| Eurozone | 3.1% | 2.9% | 0.1% | 0.4% | -29 |

| UK | 3.9% | 4.1% | -0.1% | 0.6% | -72 |

Source: IBES, Bloomberg Finance L.P., J.P.Morgan

Relative to the bond yields, Eurozone is not far from fair value. The US, in contrast, is outright expensive, in our view. At 3.1%, Eurozone dividend yield is meaningfully above the US.

Figure 7: Europe and US Buyback yield

Source: Bloomberg Finance L.P.

In addition, we note that the buyback yield in Europe is now not very different from the US. Adding dividend yield to buybacks, European total yield is at present meaningfully higher than in the US.

Table 2: Key regions P/E - Current vs Median

| 12m Fwd PE | |||

| Current | Median | Current vs Median | |

| US | 21.0 | 15.6 | 35% |

| Switzerland | 18.1 | 15.0 | 21% |

| World | 18.5 | 15.6 | 19% |

| France | 14.6 | 13.2 | 11% |

| Eurozone | 13.3 | 13.0 | 2% |

| EM | 12.2 | 12.1 | 1% |

| Germany | 12.1 | 13.0 | -7% |

| UK | 11.1 | 12.6 | -12% |

| Spain | 10.2 | 11.9 | -14% |

| Japan | 15.3 | 18.0 | -15% |

| Italy | 9.0 | 13.2 | -31% |

Source: IBES, median since 1988

US equities look stretched in a historical context on P/E metrics, while Eurozone is not.

2) We favoured Growth vs Value style, but the risk of a reversal is increasing

Figure 8: MSCI US and Europe Growth vs Value

Source: Datastream

We held a preference for Growth over Value style in 2023, and again ytd.

Figure 9: SXXP, SPX and TPX Momentum Index

Source: Bloomberg Finance L.P.

We fundamentally stay with the Growth over Value preference, but note the risk of a reversal is increasing, as the momentum trade has been very strong. The long momentum basket is outperforming the short leg by over 11% in the US, by 8.4% Eurozone, and by 8.9% in Japan.

Figure 10: Mag 7 share of S&P500 market cap

Source: Datastream

The market concentration is becoming very unhealthy, and could unwind.

Figure 11: GRANOLAS share of Stoxx 600 market cap

Source: Datastream

Concentration risk is high in Eurozone as well. A reversal in momentum factor performance, and a potential unwind in concentration, could be a problem for the Eurozone as well, but on a relative basis US equities will likely see a greater negative impact.

3) Relative growth momentum for Eurozone is starting to improve

Figure 12: Eurozone and US FRI

Source: Bloomberg Finance L.P.

The US economy enjoyed much stronger growth over the last year, while Eurozone growth projections were consistently downgraded.

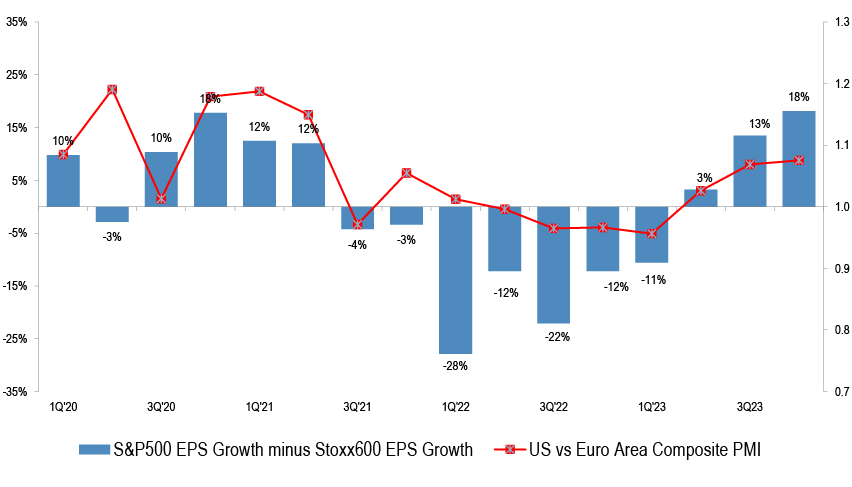

Figure 13: S&P500 vs Stoxx600 EPS Growth and relative PMI

Source: J.P. Morgan, Bloomberg Finance L.P., Datastream

This supported the better showing of US vs Eurozone earnings.

Figure 14: Eurozone and US CESI

Source: Bloomberg Finance L.P.

The rebound in Eurozone CESIs at the start of last year helped the equity market outperformance, while the weakness post May has been a drag. We note that Eurozone CESI appears to be moving above the US again.

4) There is a chance that ECB starts easing ahead of the Fed

Figure 15: ECB and Fed policy rate

Source: Bloomberg Finance L.P.

Typically, the ECB policy decisions would follow the Fed lead. That could change this time around.

Figure 16: ECB and Fed market expected change - Jan ’24 vs Current

Source: Bloomberg Finance L.P.

Relative to the peak dovishness point in early January, where the Fed was projected to ease by more than the ECB this year, now the ECB is expected to act more aggressively.

5) Any recovery in China could indirectly help Eurozone

Figure 17: MSCI China

Source: Datastream

Eurozone is more leveraged to China than is the US, and this has contributed to Eurozone’s weaker showing relative to the US. China could trade better in the near term given its nearly 40% underperformance and very light positioning. Our China strategists have a constructive view on the market. The key arguments they highlight in favour of China equities are the budget deficit having surprised to the upside, the Rmb 1trn special CGB scheme, and the lifting of the debt ceiling program.

Table 3: Chinese key macro-economic data

| Jan-23 | Feb-23 | Mar-23 | Apr-23 | May-23 | Jun-23 | Jul-23 | Aug-23 | Sep-23 | Oct-23 | Nov-23 | Dec-23 | Jan-24 | Feb-24 | |

| Manufacturing PMI | ||||||||||||||

| Caixan | 49.2 | 51.6 | 50.0 | 49.5 | 50.9 | 50.5 | 49.2 | 51.0 | 50.6 | 49.5 | 50.7 | 50.8 | 50.8 | 50.9 |

| NBS | 50.1 | 52.6 | 51.9 | 49.2 | 48.8 | 49.0 | 49.3 | 49.7 | 50.2 | 49.5 | 49.4 | 49.0 | 49.2 | 49.1 |

| Services PMI | ||||||||||||||

| Caixan | 52.9 | 55.0 | 57.8 | 56.4 | 57.1 | 53.9 | 54.1 | 51.8 | 50.2 | 50.4 | 51.5 | 52.9 | 52.7 | 52.5 |

| NBS | 54.4 | 56.3 | 58.2 | 56.4 | 54.5 | 53.2 | 51.5 | 51.0 | 51.7 | 50.6 | 50.2 | 50.4 | 50.7 | 51.4 |

| Composite PMI - Caixan | 51.1 | 54.2 | 54.5 | 53.6 | 55.6 | 52.5 | 51.9 | 51.7 | 50.9 | 50.0 | 51.6 | 52.6 | 52.5 | 52.5 |

| Industry | ||||||||||||||

| Electricity Production, %oya | - | - | 5.1% | 6.1% | 5.6% | 2.8% | 3.6% | 1.1% | 7.7% | 5.2% | 8.4% | 8.0% | ||

| IP, %oya | - | - | 3.9% | 5.6% | 3.5% | 4.4% | 3.7% | 4.5% | 4.5% | 4.6% | 6.6% | 6.8% | ||

| FAI, %oya | - | 5.5% | 5.1% | 4.7% | 4.0% | 3.8% | 3.4% | 3.2% | 3.1% | 2.9% | 2.9% | 3.0% | ||

| Consumer Activity | ||||||||||||||

| Retail Sales, %oya | - | - | 10.6% | 18.4% | 12.7% | 3.1% | 2.5% | 4.6% | 5.5% | 7.6% | 10.1% | 7.4% | ||

| Passenger Car Sales, %yoy | -32.8% | 11.1% | 8.2% | 87.7% | 26.4% | 2.1% | -3.4% | 6.9% | 6.7% | 11.5% | 25.5% | |||

| 70-city house price index, %oya | -2.3% | -1.9% | -1.4% | -0.7% | -0.5% | -0.4% | 0.6% | -0.6% | -0.6% | -0.6% | -0.7% | |||

| Liquidity & Monetary Conditions | ||||||||||||||

| M2, %oya | 12.6% | 12.9% | 12.7% | 12.4% | 11.6% | 11.3% | 10.7% | 10.6% | 10.3% | 10.3% | 10.0% | 9.7% | 8.7% | |

| FX Reserves (bln yuan) | 3184 | 3133 | 3184 | 3205 | 3177 | 3193 | 3204 | 3160 | 3115 | 3101 | 3172 | 3238 | 3219 | 3226 |

| New Loan Creation (bln yuan) | 4900 | 1812 | 3890 | 719 | 1360 | 3050 | 346 | 1358 | 2312 | 738 | 1089 | 1171 | 4920 |

Source: Bloomberg Finance L.P.

China macro data has been disappointing over the past year, but could start to stabilize. PMI indicators are broadly back above the 50- pt threshold.

Figure 18: MSCI China 12m Fwd P/E relative

Source: Datastream

MSCI China screens attractive at 9x forward P/E, trading record cheap vs MSCI World. The longer-term issue is whether the current tactical bounce could turn into sustained outperformance, which we have reservations over.

Why not go OW Eurozone vs the US?

We are neutralizing the Eurozone vs US trade, but we are not recommending to go outright OW Eurozone vs the US. The reason for this is because the risk of a broader market drawdown is elevated, in our view.

Figure 19: Recession probability indicator

Source: J.P.Morgan

The Goldilocks narrative is fully consensus at present, with complacency with respect to the economic outlook among investors. Implied recession odds are at record lows, which might be too optimistic.

Figure 20: US ISM Manufacturing

Source: Bloomberg Finance L.P.

It is not clear to us that activity momentum is clearly bottoming. ISM manufacturing, for example, has turned back lower again.

Figure 21: US Retail sales control group

Source: Bloomberg Finance L.P.

US retail sales are softening.

Figure 22: NFIB small business optimism

Source: J.P.Morgan

US small business confidence is staying weak, too.

Figure 23: German IFO

Source: Bloomberg Finance L.P.

In Europe, German IFO has been struggling for direction in the last months.

Figure 24: : European Cyclicals vs Defensives 12m Fwd EPS vs IFO

Source: IBES, Bloomberg Finance L.P.

This is a risk for Cyclical sector earnings.

Figure 25: Regional correlation to Global Composite PMI

Source: Datastream, J.P. Morgan

While Eurozone could play catchup given its meaningful underperformance, the potential for a sustained rebound is likely to be capped if the macro backdrop underwhelms.

Figure 26: US Core Goods PPI

Source: Bloomberg Finance L.P.

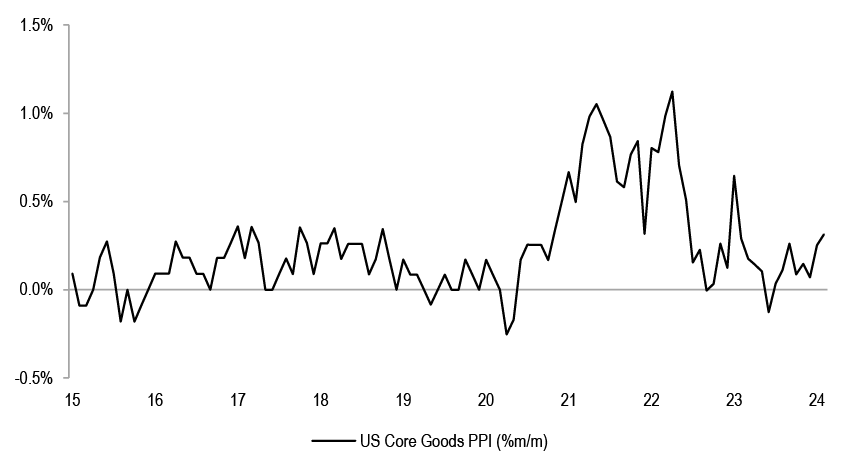

At the same time, inflation has been increasing again of late.

Figure 27: US 1-year inflation swap

Source: Bloomberg Finance L.P.

Indeed, US 1-year inflation swaps are closing in on the October 2023 highs.

Figure 28: Fed vs SPX

Source: Bloomberg Finance L.P.

Given the above, equity markets could have a drawdown over the next months both because of growth disappointments, and also due to continued sticky inflation prints and higher for longer Fed; ie, we might end up with the opposite from Goldilocks.

Figure 29: US Elections - for president - betting odds

Source: RedClearPolitics

As we approach the US elections in November of this year, a potential trade war uncertainty could weigh on markets generally and on International in particular.

Figure 30: MSCI World Growth vs Value 12m Fwd EPS

Source: IBES

Growth factor performance has thus far been supported by the strong earnings momentum, which has benefitted US over Europe trade. While we see the risks of this changing, especially given that the US large cap earnings could turn to be more cyclical than structural, so far the turn has not arrived. The improvement on any of the above would be a next step for us in considering to going outright OW Eurozone vs the US.

What is attractive within Eurozone?

Table 4: MSCI Eurozone vs US - L1 sectors 12m Fwd. P/E

| 12m Fwd PE | |||

| Eurozone | US | Eurozone vs US | |

| Real Estate | 11.4 | 36.2 | -69% |

| Discretionary | 12.4 | 25.7 | -52% |

| Financials | 8.3 | 15.3 | -46% |

| Energy | 7.2 | 12.6 | -42% |

| Market | 13.3 | 21.0 | -37% |

| Utilities | 11.7 | 15.4 | -24% |

| Healthcare | 14.3 | 18.9 | -24% |

| Telecoms | 14.8 | 18.9 | -22% |

| Industrials | 17.0 | 21.3 | -20% |

| Materials | 16.4 | 20.3 | -19% |

| Staples | 18.7 | 19.8 | -5% |

| IT | 29.4 | 28.5 | 3% |

Source: IBES

At index level, Eurozone equities are trading at close to a 40% discount relative to their US peers. Nearly every Eurozone sector is trading cheaper than its US counterpart, with the highest discount seen in Energy, Financials, Discretionary and Real Estate.

Table 5: MSCI Eurozone vs US - L2 sectors 12m Fwd. P/E

| 12m Fwd PE | |||

| Eurozone | US | Eurozone vs US | |

| Cons Mat | 8.2 | 29.1 | -72% |

| Automobile | 6.3 | 20.1 | -69% |

| Real Estate | 11.4 | 36.2 | -69% |

| Met&Min | 6.0 | 16.5 | -64% |

| Tech Hardware | 9.7 | 22.9 | -58% |

| Food Drug Ret | 10.5 | 24.2 | -56% |

| Retailing | 15.6 | 30.5 | -49% |

| Transport | 12.0 | 21.4 | -44% |

| Energy | 7.2 | 12.6 | -42% |

| Banks | 6.6 | 11.1 | -40% |

| Market | 13.3 | 21.0 | -37% |

| Div Fin | 12.4 | 19.2 | -36% |

| Prof. Services | 18.1 | 27.3 | -34% |

| Insurance | 9.9 | 13.4 | -26% |

| Utilities | 11.7 | 15.4 | -24% |

| Healthcare | 14.3 | 18.9 | -24% |

| Hotels,Rest&Leis | 21.6 | 27.1 | -20% |

| Cap Goods | 17.5 | 20.3 | -14% |

| Software | 29.6 | 32.5 | -9% |

| Chemicals | 20.4 | 21.5 | -5% |

| Food Bev&Tob | 17.4 | 16.5 | 5% |

| Semicon | 31.6 | 29.3 | 8% |

| HPC | 28.7 | 23.5 | 22% |

| Telecoms | 14.7 | 9.4 | 57% |

| Cons Durables | 28.8 | 17.1 | 69% |

Source: IBES

At level 2, the majority of Eurozone sectors are trading at a discount to the US.

Table 6: MSCI Eurozone vs US - current vs historical median

| 12m Fwd PE | |||

| Eurozone vs US | Current | Median | Current vs Median |

| IT | 1.03 | 1.06 | -2% |

| Staples | 0.95 | 1.00 | -5% |

| Materials | 0.81 | 0.86 | -6% |

| Industrials | 0.80 | 0.89 | -11% |

| Telecoms | 0.78 | 0.91 | -14% |

| Utilities | 0.76 | 0.89 | -15% |

| Healthcare | 0.76 | 0.94 | -19% |

| Market | 0.63 | 0.81 | -22% |

| Energy | 0.58 | 0.76 | -24% |

| Discretionary | 0.48 | 0.67 | -27% |

| Real Estate | 0.31 | 0.47 | -33% |

| Financials | 0.54 | 0.82 | -34% |

Source: IBES, Median since 1995

Relative to the historical discount, every single European sector is trading at least as much or more attractive.

Table 7: Eurozone vs US 12m Fwd PE: Current vs long term average

| 12m Fwd PE | |||

| Eurozone vs US | Current | Median | Current vs Median |

| Telecoms | 1.57 | 1.08 | 45% |

| Cons Durables | 1.69 | 1.25 | 35% |

| HPC | 1.23 | 1.14 | 8% |

| Food Bev&Tob | 1.06 | 1.01 | 4% |

| Chemicals | 0.95 | 0.92 | 4% |

| Cap Goods | 0.86 | 0.88 | -2% |

| Software | 0.91 | 1.00 | -9% |

| Semicon | 1.08 | 1.26 | -14% |

| Utilities | 0.76 | 0.89 | -15% |

| Hotels,Rest&Leis | 0.80 | 0.95 | -16% |

| Insurance | 0.74 | 0.89 | -16% |

| Healthcare | 0.76 | 0.94 | -19% |

| Prof. Services | 0.66 | 0.84 | -21% |

| Market | 0.63 | 0.81 | -22% |

| Energy | 0.58 | 0.76 | -24% |

| Div Fin | 0.64 | 0.86 | -25% |

| Banks | 0.60 | 0.89 | -33% |

| Real Estate | 0.31 | 0.47 | -33% |

| Transport | 0.56 | 0.94 | -40% |

| Food Drug Ret | 0.44 | 0.86 | -50% |

| Met&Min | 0.36 | 0.72 | -50% |

| Retailing | 0.51 | 1.04 | -51% |

| Cons Mat | 0.28 | 0.58 | -51% |

| Tech Hardware | 0.43 | 0.98 | -57% |

| Automobile | 0.31 | 0.81 | -61% |

Source: IBES, median since 1995

Table 7 shows the discount vs historical for level 2 subsectors.

Equity Strategy Key Calls and Drivers

So far this year, US and Japan are ahead of other markets, Growth is outperforming Value and large caps are again beating small in all key regions. We continue to believe that this, ultimately unhealthy, high concentration and narrow leadership is set to stay for a while longer. To buy Value and International stocks one needs to see a reflationary backdrop, in our view, but we could have the opposite. in terms of bond yields, we argued last October to go long duration, but also in January to look for a tactical bounce back in bond yields, as Fed easing became overdiscounted in markets. We now think that the counter-rally in yields might be running out of steam, and would advocate to go long duration again. The move back higher in Fed futures might be getting done – they round-tripped back to October levels, and activity momentum could soften from here. The question is, why didn’t equities weaken as US 10-year yields backed up 50bp during Jan-Feb? We think that this is because investors assumed that the yield upmove is reflective of economic acceleration, but we note that earnings projections for 2024 are not reacting positively – they keep coming down in most sectors. If the growth acceleration does not come through, this could act as a headwind. We close UW Eurozone vs US trade, as relative growth disappointments for the region are likely at their peak and growth style in US is at a risk of a reversal given it is already so stretched.

Table 8: J.P. Morgan Equity Strategy — Factors driving our medium-term views

| Driver | Impact | Our Core Working Assumptions | Recent Developments |

| Global Growth | Neutral | At risk of weakening as consumer strength wanes | Global composite PMI is at 52.1 |

| European Growth | Negative | Manufacturing and services are converging on the downside; industry data stays weak | |

| Monetary Policy | Neutral | Fed pivot could be accompanied by activity weakness | |

| Currency | Neutral | USD could strengthen again | |

| Earnings | Negative | Corporate pricing power is likely to weaken from here | 2024 EPS projections are continuing their downtrend |

| Valuations | Negative | At 21x, US forward P/E is still stretched, especially vs real yield | MSCI Europe on 13.8x Fwd P/E |

| Technicals | Negative | Sentiment and positioning are stretched post the Nov-Dec rally | RSIs are in overbought territory |

Source: J.P. Morgan estimates

Table 9: : Base Case and Risk

| Scenario | Assumption |

| Upside scenario | No further hawkish tilt by the Fed. No landing |

| Base-case scenario | Inflation to fall further, risk of downturn still elevated. Earnings downside from here |

| Downside scenario | Further Fed tightening and global recession to become a base case again |

Source: J.P. Morgan estimates.

Table 10: Index targets

| Dec '24 Target |

14-Mar-24 | % upside | |

| MSCI Eurozone | 256 | 293 | -13% |

| FTSE 100 | 7,700 | 7,743 | -1% |

| MSCI EUROPE | 1,850 | 2,034 | -9% |

| DJ EURO STOXX 50 | 4,250 | 4,993 | -15% |

| DJ STOXX 600 E | 460 | 506 | -9% |

Source: J.P. Morgan.

Table 11: Key Global sector calls

| Overweight | Neutral | Underweight |

| Healthcare | Technology | Capital Goods ex A&D |

| Telecoms | Discretionary | Food& Drug Retail |

| Food, Beverage & Tobacco | Mining | Autos |

| Real Estate | Transportation | Banks |

| Utilities |

Source: J.P. Morgan

Table 12: J.P. Morgan Equity Strategy — Key sector calls*

| Sector | Recommendations | Key Drivers |

| Healthcare | Overweight | Potential for lower yields and stronger dollar remain near term support, earnings are also holding up |

| Staples | Overweight | Sector is one of the best performers around the last Fed hike in the cycle, lower bond yields and better relative EPS momentum should further support |

| Banks | Underweight | Downgraded to UW in October after 3 years of strong performance. Bond yields and PMIs direction is the key for the potential P/E re-rating of the sector, we think both will move lower |

| Chemicals | Underweight | The sector trades at 70% premium to the market, well above historical norm. pricing continues to deteriorate, downside risks to current earnings and margin projections |

Source: J.P. Morgan estimates. * Please see the last page for the full list of our calls and sector allocation.

Table 13: J.P. Morgan Equity Strategy — Key regional calls

| Region | Recommendations | J.P. Morgan Views |

| EM | Neutral | China tactical chance for a bounce, but structural bearish call remains |

| DM | Neutral | |

| US | Neutral | Expensive, with earnings risk. Growth style at a risk of reversal. |

| Japan | Overweight | Japan is attractively priced; diverging policy path and TSE reforms are tailwinds |

| Eurozone | Neutral | Eurozone trading at a record discount vs the US; Growth differential to improve |

| UK | Overweight | Valuations still look very attractive, low beta with the highest regional dividend yield |

Source: J.P. Morgan estimates.

Top Picks

Table 14: J.P. Morgan European Strategy: Top European picks

Source: Datastream, MSCI, IBES, J.P. Morgan, Prices and Valuations as of COB 14th Mar, 2024. Past performance is not indicative of future returns.

Please see the most recent company-specific research published by J.P. Morgan for an analysis of valuation methodology and risks on companies recommended in this report. Research is available at http://www.jpmorganmarkets.com, or you can contact the cover

Equity Flows Snapshot

Table 15: DM Equity Fund Flows Summary

| Regional equity fund flows | ||||||||||

| $mn | % AUM | |||||||||

| 1w | 1m | 3m | ytd | 12m | 1w | 1m | 3m | ytd | 12m | |

| Europe ex UK | 372 | 157 | 84 | -973 | -12,929 | 0.1% | 0.1% | 0.0% | 0.3% | 0.6% |

| UK | -851 | -2,442 | -6,008 | -4,147 | -28,222 | 0.1% | 0.0% | 0.0% | -0.3% | -4.2% |

| US | -132 | 34,380 | 57,089 | 24,129 | 162,881 | -0.3% | -0.9% | -2.3% | -1.5% | -10.1% |

| Japan | 1,170 | 4,092 | 7,661 | 8,328 | 18,868 | 0.0% | 0.3% | 0.6% | 0.2% | 2.0% |

Source: EPFR, as of 6th Mar, 2024

Figure 31: DM Equity Fund flows – last month

Source: EPFR, Japan includes BoJ purchases.

Figure 32: DM Equity Fund flows – last 12 months

Source: EPFR, Japan includes BoJ purchases.

Figure 33: Cumulative fund flows into regional funds as a percentage of AUM

Source: EPFR, as of 6th Mar, 2024. Japan includes Non-ETF purchases only.

Figure 34: Cumulative fund flows into regional equity ETFs as a percentage of AUM

Source: Bloomberg Finance L.P. *Based on the 25 biggest ETF's with a mandate to invest in that particular region. Japan includes BoJ purchases.

Technical Indicators

Figure 35: S&P500 RSI

Source: Bloomberg Finance L.P.

Figure 36: EuroStoxx50 RSI

Source: Bloomberg Finance L.P.

Figure 37: AAII Bull-Bear

Source: Bloomberg Finance L.P

Figure 38: Put-call ratio

Source: Bloomberg Finance L.P.

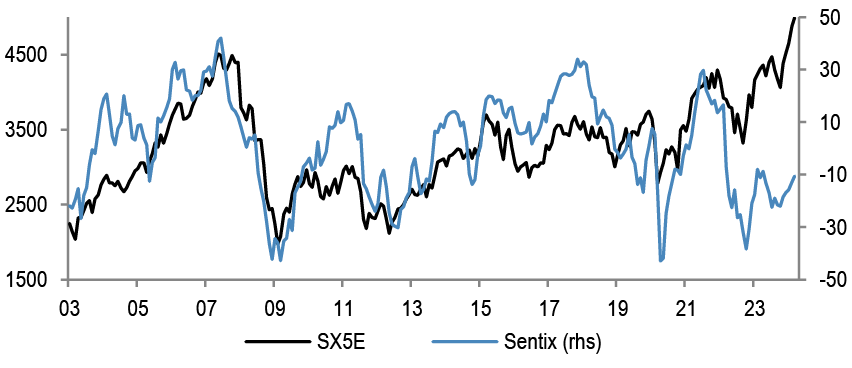

Figure 39: Sentix Sentiment Index vs SX5E

Source: Bloomberg Finance L.P.

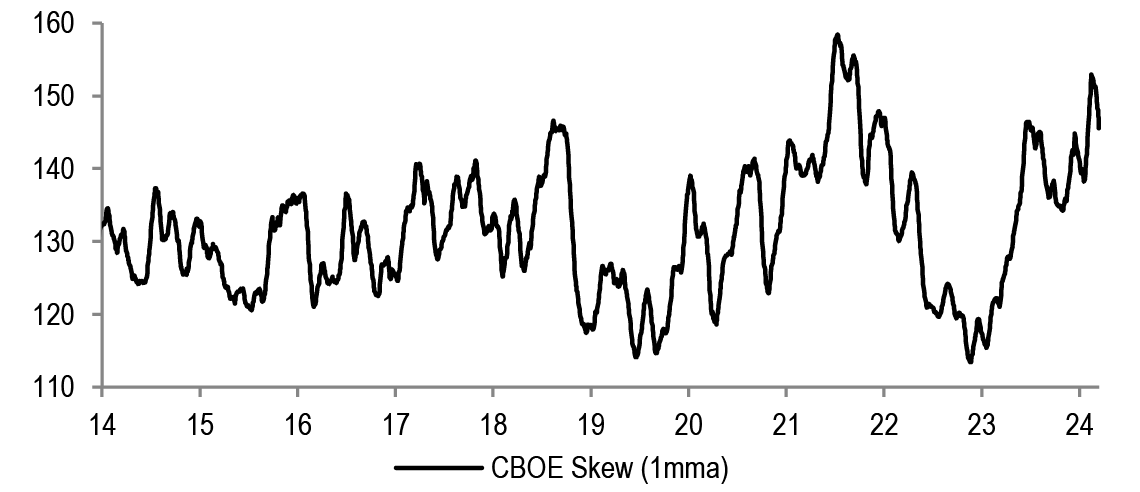

Figure 40: Equity Skew

Source: Bloomberg Finance L.P.

Figure 41: Speculative positions in S&P500 futures contracts

Source: Bloomberg Finance L.P.

Figure 42: VIX

Source: Bloomberg Finance L.P.

Performance

Table 16: Sector Index Performances — MSCI Europe

Source: MSCI, Datastream, as at COB 14th Mar, 2024.

Table 17: Country and Region Index Performances

| (%change) | Local Currency | US$ | |||||

| Country | Index | 4week | 12m | YTD | 4week | 12m | YTD |

| Austria | ATX | 0.7 | 1.0 | (1.2) | 1.8 | 2.6 | (2.6) |

| Belgium | BEL 20 | (0.1) | (1.0) | (0.4) | 1.1 | 0.5 | (1.9) |

| Denmark | KFX | 6.1 | 44.1 | 20.5 | 7.3 | 46.0 | 18.7 |

| Finland | HEX 20 | 0.2 | (10.2) | (3.2) | 1.3 | (8.8) | (4.6) |

| France | CAC 40 | 5.4 | 14.3 | 8.2 | 6.6 | 16.0 | 6.6 |

| Germany | DAX | 5.3 | 17.8 | 7.1 | 6.5 | 19.6 | 5.6 |

| Greece | ASE General | 1.0 | 32.0 | 9.6 | 2.2 | 34.0 | 8.1 |

| Ireland | ISEQ | 3.9 | 16.7 | 10.4 | 5.1 | 18.5 | 8.8 |

| Italy | FTSE MIB | 6.6 | 26.1 | 11.3 | 7.8 | 28.0 | 9.7 |

| Japan | Topix | 2.7 | 36.7 | 12.5 | 4.0 | 23.9 | 7.0 |

| Netherlands | AEX | 1.3 | 16.4 | 9.1 | 2.5 | 18.2 | 7.6 |

| Norway | OBX | 3.4 | 2.5 | (0.7) | 3.2 | 2.4 | (4.5) |

| Portugal | BVL GEN | (3.7) | (10.3) | (12.7) | (2.5) | (8.9) | (13.9) |

| Spain | IBEX 35 | 5.7 | 14.5 | 3.8 | 6.9 | 16.3 | 2.4 |

| Sweden | OMX | 6.0 | 15.6 | 5.5 | 7.2 | 17.2 | 2.9 |

| Switzerland | SMI | 3.9 | 9.4 | 5.2 | 3.5 | 13.1 | 0.3 |

| United States | S&P 500 | 2.4 | 31.4 | 8.0 | 2.4 | 31.4 | 8.0 |

| United States | NASDAQ | 1.4 | 41.1 | 7.4 | 1.4 | 41.1 | 7.4 |

| United Kingdom | FTSE 100 | 1.9 | 1.4 | 0.1 | 3.2 | 6.4 | 0.1 |

| EMU | MSCI EMU | 4.4 | 14.4 | 7.7 | 5.6 | 16.1 | 6.2 |

| Europe | MSCI Europe | 3.9 | 11.5 | 6.1 | 4.9 | 14.4 | 4.3 |

| Global | MSCI AC World | 2.6 | 26.7 | 7.5 | 2.8 | 26.5 | 6.7 |

Source: MSCI, Datastream, as at COB 14th Mar, 2024.

Earnings

Table 18: IBES Consensus EPS Sector Forecasts — MSCI Europe

| EPS Growth (%yoy) | |||||

| 2023 | 2024E | 2025E | 2026E | ||

| Europe | (3.3) | 3.4 | 10.0 | 9.2 | |

| Energy | (31.6) | (4.4) | 4.3 | 8.9 | |

| Materials | (39.8) | 8.5 | 11.1 | 6.8 | |

| Chemicals | (38.7) | 25.1 | 18.5 | 11.8 | |

| Construction Materials | 12.2 | 10.2 | 8.9 | 9.1 | |

| Metals & Mining | (46.2) | (5.1) | 3.6 | 0.7 | |

| Industrials | 1.3 | 7.4 | 13.5 | 11.8 | |

| Capital Goods | 22.4 | 10.9 | 13.5 | 11.8 | |

| Transport | (54.7) | (19.5) | 16.6 | 12.8 | |

| Business Svs | 3.2 | 9.4 | 11.0 | 11.4 | |

| Discretionary | 7.8 | 2.3 | 10.7 | 9.5 | |

| Automobile | 2.6 | (3.5) | 5.8 | 6.3 | |

| Consumer Durables | (5.4) | 5.8 | 14.2 | 13.4 | |

| Media | (0.5) | 9.6 | 9.7 | 11.5 | |

| Retailing | 50.7 | 14.5 | 17.1 | 6.5 | |

| Hotels,Restaurants&Leisure | 91.5 | 17.3 | 21.4 | 17.3 | |

| Staples | 2.5 | 3.0 | 8.7 | 7.7 | |

| Food & Drug Retailing | 5.3 | 4.1 | 11.5 | 7.8 | |

| Food Beverage & Tobacco | 2.0 | 2.0 | 8.5 | 7.9 | |

| Household Products | 3.0 | 5.5 | 8.0 | 7.3 | |

| Healthcare | 3.1 | 4.3 | 13.9 | 10.9 | |

| Financials | 15.6 | 5.4 | 7.9 | 8.6 | |

| Banks | 28.5 | 0.6 | 4.6 | 5.9 | |

| Diversified Financials | (22.6) | 19.7 | 22.8 | 24.3 | |

| Insurance | 13.9 | 10.5 | 7.8 | 5.8 | |

| Real Estate | 11.0 | (2.1) | 4.2 | 6.5 | |

| IT | 13.9 | (4.6) | 28.6 | 15.9 | |

| Software and Services | 18.5 | (0.1) | 20.4 | 14.0 | |

| Technology Hardware | (20.8) | 11.5 | 8.5 | 8.9 | |

| Semicon & Semicon Equip | 28.0 | (12.2) | 41.8 | 19.0 | |

| Telecoms | (8.7) | 10.6 | 10.0 | 8.1 | |

| Utilities | 0.3 | (0.2) | 1.0 | 1.8 | |

Source: IBES, MSCI, Datastream. As at COB 14th Mar, 2024.

Table 19: IBES Consensus EPS Country Forecasts

| EPS growth (%change) | |||||

| Country | Index | 2023 | 2024E | 2025E | 2026E |

| Austria | ATX | (15.3) | (5.9) | 5.1 | 1.8 |

| Belgium | BEL 20 | 20.7 | (2.2) | 11.6 | 12.9 |

| Denmark | Denmark KFX | (14.4) | 26.6 | 20.9 | 16.8 |

| Finland | MSCI Finland | (25.1) | 4.7 | 11.3 | 9.2 |

| France | CAC 40 | (2.2) | 2.8 | 9.0 | 8.3 |

| Germany | DAX | 1.6 | 0.4 | 11.8 | 10.6 |

| Greece | MSCI Greece | 8.5 | 0.5 | 4.4 | 22.2 |

| Ireland | MSCI Ireland | 32.5 | (2.2) | 2.5 | 7.2 |

| Italy | MSCI Italy | 9.9 | 0.8 | 3.0 | 2.5 |

| Netherlands | AEX | (0.9) | (0.5) | 13.2 | 11.7 |

| Norway | MSCI Norway | (40.1) | 3.8 | 6.5 | 3.1 |

| Portugal | MSCI Portugal | 21.6 | 11.4 | 6.4 | 7.9 |

| Spain | IBEX 35 | 8.3 | 1.1 | 4.4 | 5.4 |

| Sweden | OMX | 31.6 | 0.4 | 8.3 | 7.1 |

| Switzerland | SMI | (4.2) | 9.4 | 13.8 | 10.0 |

| United Kingdom | FTSE 100 | (11.2) | 1.4 | 7.9 | 9.2 |

| EMU | MSCI EMU | 4.1 | 2.8 | 10.1 | 8.7 |

| Europe ex UK | MSCI Europe ex UK | 0.9 | 4.1 | 11.0 | 9.1 |

| Europe | MSCI Europe | (3.3) | 3.4 | 10.0 | 9.2 |

| United States | S&P 500 | 2.2 | 9.8 | 13.5 | 11.7 |

| Japan | Topix | 2.9 | 15.2 | 8.9 | 9.3 |

| Emerging Market | MSCI EM | (5.0) | 17.3 | 15.7 | 12.7 |

| Global | MSCI AC World | 0.2 | 8.9 | 12.7 | 11.0 |

Source: IBES, MSCI, Datastream. As at COB 14th Mar, 2024** Japan refers to the period from March in the year stated to March in the following year – EPS post-goodwill

Valuations

Table 20: IBES Consensus European Sector Valuations

| P/E | Dividend Yield | EV/EBITDA | Price to Book | |||||||||

| 2024e | 2025e | 2026e | 2024e | 2025e | 2026e | 2024e | 2025e | 2026e | 2024e | 2025e | 2026e | |

| Europe | 14.1 | 12.8 | 11.8 | 3.4% | 3.6% | 3.8% | 8.1 | 7.5 | 7.0 | 1.9 | 1.8 | 1.7 |

| Energy | 7.6 | 7.2 | 6.7 | 5.6% | 5.5% | 5.7% | 3.3 | 3.3 | 3.2 | 1.2 | 1.1 | 1.0 |

| Materials | 15.6 | 14.0 | 13.2 | 3.3% | 3.5% | 3.7% | 7.4 | 6.7 | 6.4 | 1.7 | 1.6 | 1.5 |

| Chemicals | 23.9 | 20.2 | 18.0 | 2.7% | 2.9% | 3.1% | 11.3 | 10.1 | 9.4 | 2.4 | 2.3 | 2.2 |

| Construction Materials | 13.9 | 12.7 | 11.7 | 2.8% | 2.9% | 3.1% | 7.4 | 7.0 | 6.5 | 1.7 | 1.6 | 1.5 |

| Metals & Mining | 9.7 | 9.4 | 9.3 | 4.4% | 4.6% | 5.0% | 4.7 | 4.2 | 4.2 | 1.1 | 1.1 | 1.0 |

| Industrials | 19.6 | 17.3 | 15.4 | 2.4% | 2.6% | 2.8% | 10.1 | 9.0 | 8.3 | 3.3 | 3.1 | 2.9 |

| Capital Goods | 19.6 | 17.3 | 15.5 | 2.2% | 2.5% | 2.7% | 10.4 | 9.3 | 8.5 | 3.5 | 3.2 | 3.0 |

| Transport | 16.3 | 14.0 | 12.4 | 3.6% | 3.7% | 3.7% | 6.9 | 6.5 | 6.1 | 1.6 | 1.5 | 1.5 |

| Business Svs | 21.9 | 19.8 | 17.7 | 2.4% | 2.6% | 2.7% | 13.1 | 11.9 | 11.1 | 6.1 | 5.6 | 5.0 |

| Discretionary | 14.0 | 12.6 | 11.8 | 2.6% | 2.9% | 3.0% | 5.5 | 5.1 | 4.7 | 2.0 | 1.8 | 1.8 |

| Automobile | 6.4 | 6.0 | 5.9 | 4.9% | 5.3% | 5.3% | 1.8 | 1.7 | 1.7 | 0.8 | 0.7 | 0.7 |

| Consumer Durables | 25.7 | 22.5 | 19.8 | 1.7% | 1.9% | 2.1% | 14.4 | 13.1 | 11.7 | 4.6 | 4.1 | 3.7 |

| Media & Entertainment | 16.7 | 15.2 | 13.3 | 2.3% | 2.5% | 2.9% | 11.1 | 9.6 | 8.9 | 1.9 | 1.6 | 2.1 |

| Retailing | 14.9 | 12.8 | 12.0 | 2.5% | 2.7% | 3.0% | 10.1 | 9.2 | 8.0 | 2.9 | 2.7 | 2.2 |

| Hotels,Restaurants&Leisure | 23.8 | 19.6 | 16.7 | 2.1% | 2.4% | 2.8% | 12.4 | 10.6 | 9.7 | 4.2 | 3.8 | 3.5 |

| Staples | 17.1 | 15.7 | 14.6 | 3.1% | 3.3% | 3.6% | 10.8 | 10.1 | 9.3 | 2.9 | 2.7 | 2.6 |

| Food & Drug Retailing | 11.9 | 10.7 | 9.9 | 4.1% | 4.5% | 4.8% | 6.0 | 5.6 | 5.4 | 1.5 | 1.5 | 1.4 |

| Food Beverage & Tobacco | 16.7 | 15.3 | 14.2 | 3.5% | 3.7% | 4.0% | 10.6 | 9.9 | 9.1 | 2.6 | 2.5 | 2.3 |

| Household Products | 20.2 | 18.7 | 17.4 | 2.4% | 2.5% | 2.7% | 14.0 | 13.0 | 12.6 | 4.3 | 4.1 | 4.1 |

| Healthcare | 18.1 | 15.9 | 14.3 | 2.3% | 2.5% | 2.8% | 12.6 | 11.1 | 10.2 | 3.5 | 3.2 | 3.0 |

| Financials | 9.0 | 8.4 | 7.7 | 5.6% | 5.7% | 6.2% | - | - | - | 1.1 | 1.0 | 0.9 |

| Banks | 6.8 | 6.5 | 6.2 | 7.5% | 7.5% | 8.0% | - | - | - | 0.8 | 0.7 | 0.7 |

| Diversified Financials | 15.1 | 12.3 | 10.0 | 2.4% | 2.6% | 2.9% | - | - | - | 1.4 | 1.5 | 1.4 |

| Insurance | 10.9 | 10.1 | 9.5 | 5.4% | 5.8% | 6.2% | - | - | - | 1.7 | 1.6 | 1.5 |

| Real Estate | 13.9 | 13.3 | 12.5 | 4.2% | 4.5% | 4.8% | - | - | - | 0.8 | 0.8 | 0.8 |

| IT | 30.3 | 23.6 | 20.4 | 1.1% | 1.3% | 1.4% | 18.9 | 15.0 | 12.9 | 5.1 | 4.6 | 4.1 |

| Software and Services | 31.1 | 25.8 | 22.7 | 1.2% | 1.4% | 1.5% | 20.0 | 16.3 | 14.3 | 4.6 | 4.3 | 3.8 |

| Technology Hardware | 15.8 | 14.6 | 13.4 | 2.6% | 2.6% | 2.9% | 9.2 | 8.3 | 7.1 | 1.9 | 1.8 | 1.7 |

| Semicon & Semicon Equip | 35.4 | 25.0 | 21.0 | 0.8% | 1.0% | 1.1% | 22.5 | 16.5 | 14.0 | 8.4 | 7.1 | 6.0 |

| Communication Services | 13.9 | 12.6 | 11.6 | 4.3% | 4.5% | 4.8% | 6.5 | 6.1 | 5.7 | 1.4 | 1.3 | 1.3 |

| Utilities | 11.9 | 11.8 | 11.6 | 5.4% | 5.6% | 5.6% | 7.8 | 8.0 | 8.2 | 1.5 | 1.4 | 1.4 |

Source: IBES, MSCI, Datastream. As at COB 14th Mar, 2024.

Table 21: IBES Consensus P/E and 12-Month Forward Dividend Yields — Country Forecasts

| P/E | Dividend Yield | |||||

| Country | Index | 12mth Fwd | 2024E | 2025E | 2026E | 12mth Fwd |

| Austria | ATX | 7.4 | 7.5 | 7.1 | 6.8 | 6.2% |

| Belgium | BEL 20 | 15.2 | 15.6 | 14.0 | 12.1 | 3.1% |

| Denmark | Denmark KFX | 28.7 | 30.3 | 25.0 | 21.4 | 1.6% |

| Finland | MSCI Finland | 14.2 | 14.6 | 13.1 | 12.0 | 4.6% |

| France | CAC 40 | 13.4 | 13.7 | 12.6 | 11.6 | 3.2% |

| Germany | DAX | 12.2 | 12.6 | 11.3 | 10.4 | 3.4% |

| Greece | MSCI Greece | 29.4 | 29.8 | 28.5 | 20.3 | 1.7% |

| Ireland | MSCI Ireland | 10.9 | 11.0 | 10.7 | 10.0 | 3.6% |

| Italy | MSCI Italy | 9.0 | 9.1 | 8.8 | 8.6 | 5.5% |

| Netherlands | AEX | 15.0 | 15.4 | 13.6 | 12.4 | 2.5% |

| Norway | MSCI Norway | 10.4 | 10.6 | 9.9 | 9.6 | 6.7% |

| Portugal | MSCI Portugal | 13.5 | 13.7 | 12.9 | 11.9 | 4.2% |

| Spain | IBEX 35 | 10.7 | 10.9 | 10.4 | 9.9 | 4.9% |

| Sweden | OMX | 15.6 | 15.9 | 14.7 | 13.8 | 3.7% |

| Switzerland | SMI | 17.3 | 17.9 | 15.7 | 14.3 | 3.3% |

| United Kingdom | FTSE 100 | 11.0 | 11.2 | 10.4 | 9.5 | 4.2% |

| EMU | MSCI EMU | 13.3 | 13.6 | 12.4 | 11.4 | 3.4% |

| Europe ex UK | MSCI Europe ex UK | 14.8 | 15.2 | 13.7 | 12.6 | 3.2% |

| Europe | MSCI Europe | 13.8 | 14.1 | 12.8 | 11.8 | 3.4% |

| United States | S&P 500 | 20.7 | 21.6 | 19.0 | 17.0 | 1.5% |

| Japan | Topix | 14.8 | 16.1 | 14.8 | 13.6 | 2.2% |

| Emerging Market | MSCI EM | 11.9 | 12.3 | 10.9 | 9.6 | 3.0% |

| Global | MSCI AC World | 17.4 | 18.0 | 16.2 | 14.6 | 2.1% |

Source: IBES, MSCI, Datastream. As at COB 14th Mar, 2024; ** Japan refers to the period from March in the year stated to March in the following year – P/E post goodwill.

Economic, Interest Rate and Exchange Rate Outlook

Table 22: Economic Outlook in Summary

| Real GDP | Real GDP | Consumer prices | |||||||||||

| % oya | % over previous period, saar | % oya | |||||||||||

| 2023E | 2024E | 2025E | 3Q23 | 4Q23 | 1Q24E | 2Q24E | 3Q24E | 4Q24E | 3Q23 | 1Q24E | 3Q24E | 1Q25E | |

| United States | 2.5 | 2.3 | 1.6 | 4.9 | 3.2 | 2.3 | 1.5 | 0.7 | 0.7 | 3.6 | 3.1 | 2.9 | 2.5 |

| Eurozone | 0.5 | 0.4 | 1.0 | -0.2 | -0.2 | 0.5 | 0.7 | 0.7 | 0.7 | 5.0 | 2.6 | 2.2 | 1.9 |

| United Kingdom | 0.1 | 0.0 | 0.1 | -0.5 | -1.4 | 1.0 | 0.8 | 0.0 | -0.5 | 6.7 | 3.6 | 1.7 | 2.3 |

| Japan | 1.9 | 0.5 | 0.8 | -3.3 | -0.4 | 1.0 | 1.7 | 1.0 | 0.8 | 3.1 | 2.8 | 3.6 | 2.8 |

| Emerging markets | 4.2 | 3.9 | 3.6 | 5.8 | 3.9 | 4.2 | 3.6 | 3.7 | 3.6 | 3.8 | 3.8 | 3.5 | 3.5 |

| Global | 2.7 | 2.4 | 2.3 | 3.6 | 2.5 | 2.6 | 2.2 | 2.0 | 2.0 | 4.0 | 3.3 | 3.0 | 2.8 |

Source: J.P. Morgan economic research J.P. Morgan estimates, as of COB 15th Mar, 2024

Table 23: Official Rates Outlook

| Forecast for | ||||||||

| Official interest rate | Current | Last change (bp) | Forecast next change (bp) | Mar 24 | Jun 24 | Sep 24 | Dec 24 | |

| United States | Federal funds rate | 5.50 | 26 Jul 23 (+25bp) | Jun 24 (-25bp) | 5.50 | 5.25 | 5.00 | 4.75 |

| Eurozone | Depo rate | 4.00 | 14 Sep 23 (+25bp) | Jun 24 (-25bp) | 4.00 | 3.75 | 3.50 | 3.00 |

| United Kingdom | Bank Rate | 5.25 | 03 Aug 23 (+25bp) | Aug 24 (-25bp) | 5.25 | 5.25 | 5.00 | 4.50 |

| Japan | Pol rate IOER | -0.10 | Jan 16 (-20bp) | 3Q24 (+10bp) | -0.10 | -0.10 | 0.00 | 0.25 |

Source: J.P. Morgan estimates, Datastream, as of COB 15th Mar, 2024

Table 24: 10-Year Government Bond Yield Forecasts

| 10 Yr Govt BY | Forecast for end of | ||||

| 18-Mar-24 | Jun 24 | Sep 24 | Dec 24 | Mar 25 | |

| US | 4.31 | 4.15 | 4.05 | 4.00 | 3.90 |

| Euro Area | 2.44 | 2.20 | 2.05 | 1.90 | 1.80 |

| United Kingdom | 4.10 | 4.05 | 3.95 | 3.80 | 3.65 |

| Japan | 0.79 | 0.75 | 0.85 | 1.05 | 1.05 |

Source: J.P. Morgan estimates, Datastream, forecasts as of COB 15th Mar, 2024

Table 25: Exchange Rate Forecasts vs. US Dollar

| Exchange rates vs US$ | Forecast for end of | ||||

| 15-Mar-24 | Jun 24 | Sep 24 | Dec 24 | Mar 25 | |

| EUR | 1.09 | 1.05 | 1.05 | 1.09 | 1.12 |

| GBP | 1.27 | 1.22 | 1.22 | 1.25 | 1.29 |

| CHF | 0.88 | 0.92 | 0.91 | 0.89 | 0.87 |

| JPY | 149 | 148 | 146 | 144 | 142 |

| DXY | 103.4 | 106.3 | 106.0 | 102.8 | 100.2 |

Source: J.P. Morgan estimates, Datastream, forecasts as of COB 15th Mar, 2024

Sector, Regional and Asset Class Allocations

Table 26: J.P. Morgan Equity Strategy — European Sector Allocation

| MSCI Europe Weights | Allocation | Deviation | Recommendation | ||

| Energy | 6.1% | 8.0% | 1.9% | OW | |

| Materials | 7.1% | 6.0% | -1.1% | N | |

| Chemicals | UW | ||||

| Construction Materials | N | ||||

| Metals & Mining | N | ||||

| Industrials | 15.3% | 14.0% | -1.3% | N | |

| Capital Goods ex Aerospace & Defence | UW | ||||

| Aerospace & Defence | OW | ||||

| Transport | N | ||||

| Business Services | N | ||||

| Consumer Discretionary | 9.4% | 7.0% | -2.4% | UW | |

| Automobile | UW | ||||

| Consumer Durables | N | ||||

| Consumer Srvcs | UW | ||||

| Speciality Retail | UW | ||||

| Internet Retail | UW | ||||

| Consumer Staples | 11.9% | 13.0% | 1.1% | OW | |

| Food & Drug Retailing | UW | ||||

| Beverages | OW | ||||

| Food & Tobacco | OW | ||||

| Household Products | OW | ||||

| Healthcare | 15.5% | 18.0% | 2.5% | OW | |

| Financials | 17.9% | 14.0% | -3.9% | UW | |

| Banks | UW | ||||

| Insurance | N | ||||

| Real Estate | 0.8% | 2.0% | 1.2% | OW | |

| Information Technology | 7.2% | 7.0% | -0.2% | N | |

| Software and Services | N | ||||

| Technology Hardware | N | ||||

| Semicon & Semicon Equip | UW | ||||

| Communication Services | 4.5% | 5.0% | 0.5% | OW | |

| Telecommunication Services | OW | ||||

| Media | N | ||||

| Utilities | 4.3% | 6.0% | 1.7% | OW | |

| 100.0% | 100.0% | 0.0% | Balanced |

Source: MSCI, Datastream, J.P. Morgan.

Table 27: J.P. Morgan Equity Strategy — Global Regional Allocation

| MSCI Weight | Allocation | Deviation | Recommendation | |

| EM | 10.0% | 10.0% | 0.0% | Neutral |

| DM | 90.0% | 90.0% | 0.0% | Neutral |

| US | 70.9% | 68.0% | -2.9% | Neutral |

| Japan | 6.2% | 8.0% | 1.8% | Overweight |

| Eurozone | 8.6% | 8.0% | -0.6% | Neutral |

| UK | 3.8% | 6.0% | 2.2% | Overweight |

| Others* | 10.5% | 10.0% | -0.5% | Neutral |

| 100.0% | 100.0% | 0.0% | Balanced |

Source: MSCI, J.P. Morgan *Other includes Denmark, Switzerland, Australia, Canada, Hong Kong SAR, Sweden, Singapore, New Zealand, Israel and Norway

Table 28: J.P. Morgan Equity Strategy — European Regional Allocation

| MSCI Weight | Allocation | Deviation | Recommendation | |

| Eurozone | 51.0% | 48.0% | -3.0% | Neutral |

| United Kingdom | 22.6% | 25.0% | 2.4% | Overweight |

| Others** | 26.5% | 27.0% | 0.5% | Overweight |

| 100.0% | 100.0% | Balanced |

Source: MSCI, J.P. Morgan **Other includes Denmark, Switzerland, Sweden and Norway

Table 29: J.P. Morgan Equity Strategy — Asset Class Allocation

| Benchmark weighting | Allocation | Deviation | Recommendation | |

| Equities | 60% | 55% | -5% | Underweight |

| Bonds | 30% | 35% | 5% | Overweight |

| Cash | 10% | 10% | 0% | Neutral |

| 100% | 100% | 0% | Balanced |

Source: MSCI, J.P. Morgan

Click here for our weekly podcast

Anamil Kochar (anamil.kochar@jpmchase.com) of J.P. Morgan India Private Limited is a co-author of this report.