Key Beta One Benefits

Design

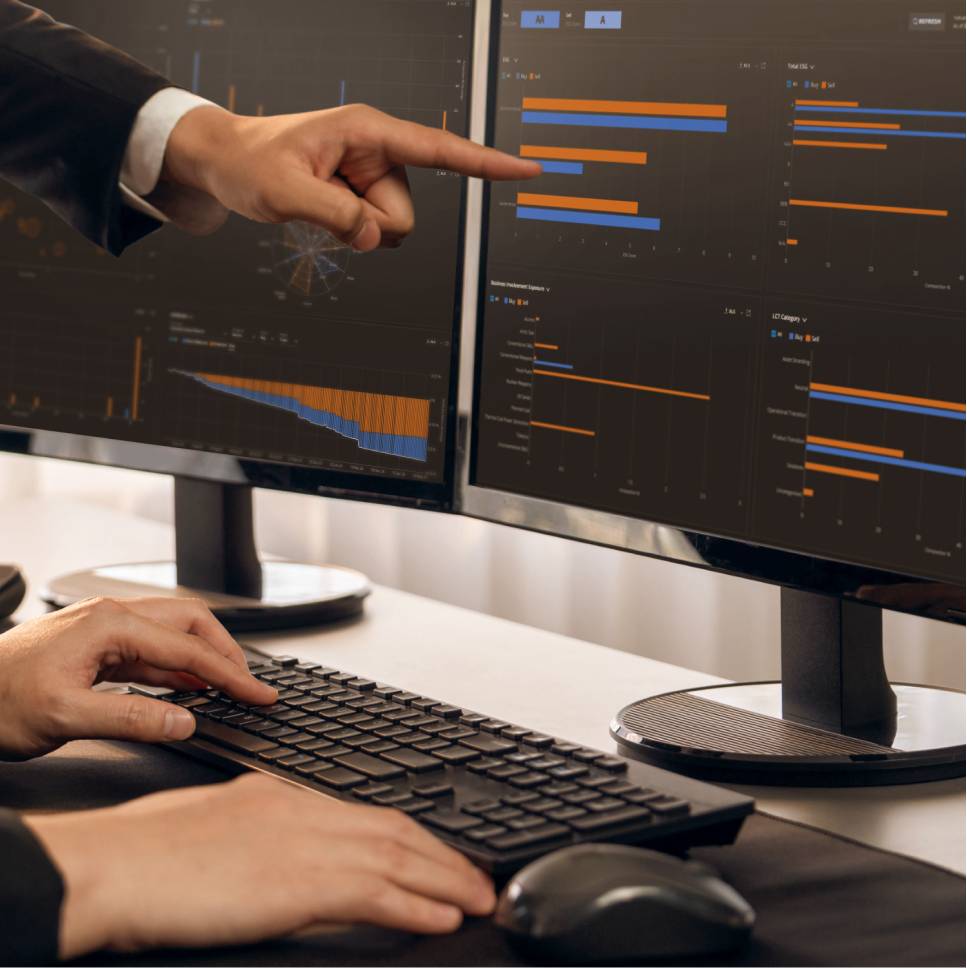

Access optimized portfolio selection to match the profile you provide as well as achieve quality execution, pricing and liquidity. J.P. Morgan can also optimize your entire portfolio and propose alternatives designed to maximize yield, liquidity, ESG objectives and more

Pricing

Receive a single portfolio price, based on analysis of liquidity sources, giving you quality execution

Execution

J.P. Morgan provides quality execution and facilitates physical delivery of each bond in the portfolio

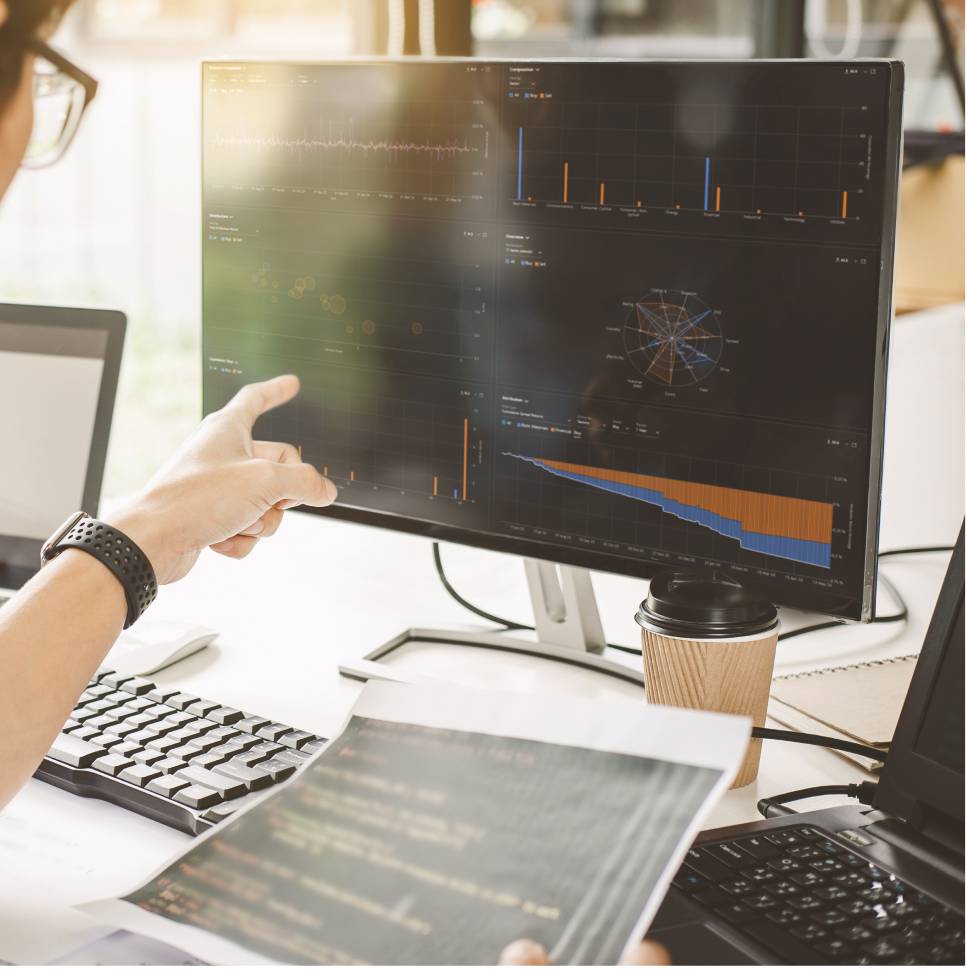

Beta One Capabilities

Available on the J.P. Morgan Markets Platform.