At J.P. Morgan, we leverage advanced data analysis to uncover insights that empower informed decision-making. While technology expands possibilities, our expert analysts bring real value by turning data into actionable strategies that drive results.

Setting a New Standard

"Data is the backbone of research. With advancements in technology, data storage, and computing, we are now able to use more data-driven analysis to enhance our content and reach conclusions that were previously unattainable."

Hussein Malik

Head of Global Research

| VIDEO

| VIDEO

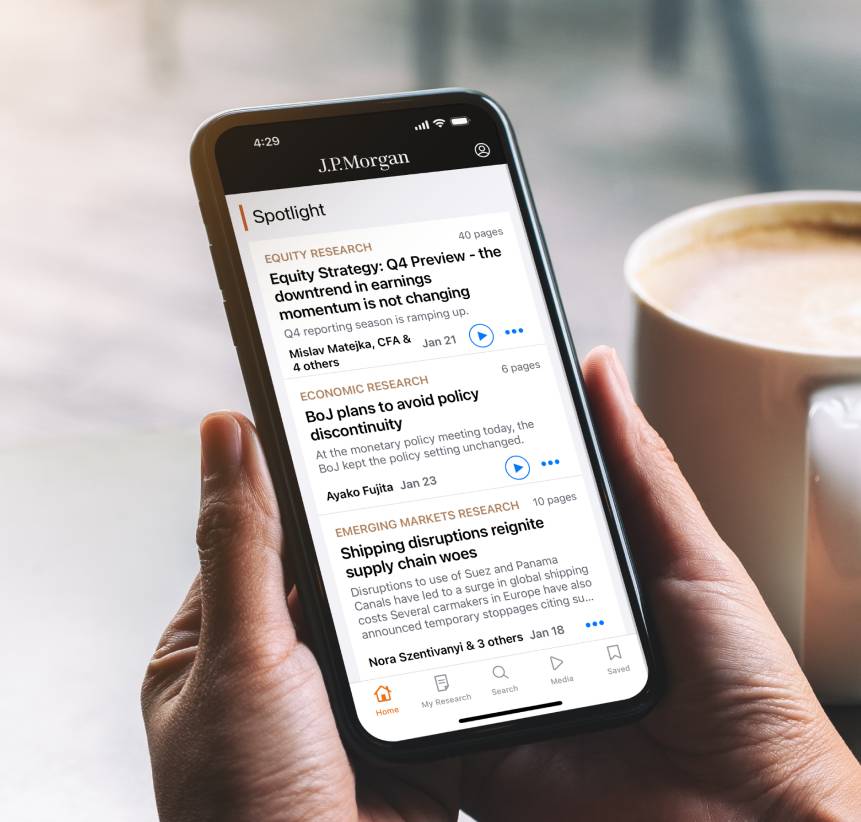

With J.P. Morgan Markets, focus on what truly matters.

Harness the expertise of more than 800 analysts, keeping you connected to market dynamics on the go.

Analyze trends in real-time and act on insights, gaining award-winning perspectives for a deeper understanding.

Enabling you to see more and know more. So, you can stay ahead of market opportunities.

Do More with Research and Insights on J.P. Morgan Markets.

Making Sense

Leaders across J.P. Morgan share their views on the events that are shaping companies, industries and markets around the world.

Navigating Asia’s bond and equity markets

[Music]

Meridy Cleary: Hi, you're listening to Market Matters, our market series here on J.P. Morgan's Making Sense podcast. I'm your host, Meridy Cleary from the FICC Market Structure team, and in today's episode, we're going to explore key themes in Asia across fixed income, FX, and equities markets. To do this, I'm joined by Clare Witts, head of Equity APAC Market Structure. Hi, Clare, thanks for being on here.

Clare Witts: Hi, Meridy. Thanks for having me.

Meridy: It's great to have you here, Clare. So when it comes to the evolving trading trends and regulatory initiatives in the APAC region, a lot of parallels can be drawn between market structure change in equities and FICC markets. We expect foreign investor access to some of the key emerging markets in the region to remain a top theme. We've seen central banks and markets regulators in the region ease certain controls on onshore FX and bond markets to drive further liquidity and investment. And Clare, what have you been focused on, on the equity side?

Clare: In equities, it's been a tale of two types of market. So for developed markets, particularly Japan, that's been where the majority of turnover is for our global clients. But similar to FICC, it's Asia's emerging markets where we see the most new interest, client questions, and also where some of the most significant market structure change is taking place. So for developed markets, the focus has really been on how to further improve efficiency of trading or reduced trading costs. Japan, Hong Kong, Australia are interesting from that perspective because the stock exchanges are making some quite significant changes to the market microstructure, like improving the auctions and trying to reduce the spread. But in emerging market equities, a lot of the focus is on improving access and attracting new investors. And although there's a lot of change across all of the Asia emerging markets right now, from a global investor perspective, the most interesting ones have been India and Korea, largely because of their relative size and opportunity compared to some of the other EM markets.

Meridy: Yes, I agree. Korea and India are key focus markets for us, too, particularly because of the addition of their government bonds into a growing list of global bond indices. India's fully accessible route, or FAR bonds, are being added to Bloomberg's EM local currency government index from January 31st of this year, and FTSE Russell's EM government bond index from September. And of course, we're approaching the final weight of 10% of India's FAR bonds in J.P. Morgan's GBI EM index in March. So amid these dynamics, we've seen an uptick in the share of FAR bonds held by foreign investors which has grown from around 2% pre-inclusion to now around 6%. So clearly the index inclusions are already having an impact. For India's bond markets, we expect continued focus on topics such as margin posting for India's government bonds, more flexible security settlement, and potentially regulatory change from the Reserve Bank of India or the securities regulators as well.

Clare: Yes, India's clearly been keeping us busy on the equity side, too. You also mentioned Korea, what's happening there?

Meridy: Yeah, definitely. I mean, Korea's had a lot of focus due to recent market structure reform spanning multiple asset classes. And after several initiatives by market authorities, for example, extending FX trading hours last year and allowing third-party FX transactions, Korea's government bonds are set to be added to FTSE's Wigby index starting November of this year. And we do see this as a significant development. The Ministry of Finance expects the inclusion to drive inflows into the local bond market and also increase liquidity in the FX market.

Clare: Yes, and that's helped on the equity side, too. Korea's long been targeting an upgrade to develop market status from emerging market in the MSCI equity indices. Perhaps as part of that, in March, we expect to see the removal of the short-sell ban, which has been in place since 2023, and that's a key focus area for some of our clients. In other topics on our side, with index inclusion, Vietnam's been also pushing some major capital markets reform in order to be upgraded by FTSE from frontier to emerging markets. So that includes the removal of refunding, and there's much more work to be done there on trade and post-trade infrastructure as part of those plans.

Meredith: Yeah, that's really interesting. And what about some of the microstructure dynamics on your side?

Clare: Hong Kong's going to cut their tick size to reduce spreads, so that should be positive trading costs. And India regulators are consulting on introducing a closing auction. It's one of the few markets globally that doesn't have one. Another thing that we can't get through this podcast without talking about, I think, is the potential impact of geopolitics and Trump 2.0 on China and the other APAC markets. And that will undoubtedly have some effect on capital market policymaking and fund flows. So I'm going to be keeping a close eye on how different types of investors in APAC, from the retail through to the domestic institutions, and of course, the global investors, are changing what and how they trade.

Meredith: Yeah, I completely agree. This year is definitely going to be another busy one. And Clare, when it comes to market structure evolution, the topic of execution challenges remains front and center. In the APAC region, a combination of market fragmentation, regulatory change, and market idiosyncrasies add to the complexities around the trade execution process. On the FICC side, trade execution obstacles in certain EM markets are heightened by liquidity constraints, manual workflows, shorter trading windows, and also market access and euro clearability. This year, we expect the industry to focus on efficient workflows and trading infrastructure between liquidity providers and liquidity takers to smooth out some of these constraints. Another point to add is around the extraterritorial impacts of regulation and the potential impact on APAC markets. A good example, which also spans equities, is the move to T plus one in the U.S. that happened last year. And this required Asia-based traders to adapt funding and execution strategies to meet those timeframes.

Clare: Yes, that definitely had an impact on the equity side as well. And we see a number of markets in this region thinking about how they change their settlement cycles going forward, but that's a bit further out.

Meridy: Yes, T plus one is definitely a conversation we're having here in Europe as well. And Clare, I wonder what are some of the key execution challenges on the equity side?

Clare: Two big things. Number one, as you mentioned, there's just the complexity of all the different markets in this region. There's over 16 of them with different market idiosyncrasies and rules. And this drives a huge rate of change. We've got equity trading teams on the ground in almost all the APAC markets, and that local knowledge and access is really helpful, because almost every week we're reacting to a rule change somewhere or a unique trading situation in one market or another. Just to share some information about how big the rate of change is, I do a monthly market structure summary. And every month, there's never fewer than 20 new items on it.

Meridy: Wow.

Clare: So what we need to do then is build a lot of that into the electronic trading platform so that we can smooth out those idiosyncrasies for our clients and really create a somewhat consistent trading experience. Then the second thing that's a big challenge is managing trading costs for institutional sized orders. And this has two components to it. In small ASEAN markets, for example, the issue is often finding enough liquidity given the relatively small size of the market. Whereas in large liquid markets like Japan or India, the trading order book is really thin and even small trades can signal the market and move the price away. So the trading solutions also need to be different. That can be using block desks or facilitation to try and trade in one go or using algos that are designed to manage that signaling risk by breaking up orders and distributing them smartly. So in APAC, probably more than in other regions, there really is no one size fits all for trading. We need to have a lot of different trading tools and channels available.

Meridy: And I guess on the topic of trading tools and execution trends, of course, the rise of electronic trading is a theme that we've all witnessed. It's a trend that has taken off in APAC over the last decade, but particularly since 2020. Our team have been tracking the rise of e-trading in EM, interest rate swaps, government bonds and FX products across APAC markets. For example, we've seen a continued growth in Japanese government bond e-trading driven by enhancements to overall trading systems in the market, which allow brokers to have more capabilities of pricing electronically.

Clare: And Meridy, are algos becoming more popular in the FICC world?

Meridy: Yes, definitely. And we've seen a notable trend in the rise of algo usage in the region, given enhanced algo quoting capabilities and other developments. A good example of this is the significant increase in NDF algos in APAC currency pairs, up around 140% since 2023. And we expect this trend to continue as the depth of liquidity in APAC pairs grows further. Automation trading tools are also growing. For example, the launch of auto pricing and hedging tools. However, in FICC we still see gaps such as local currency markets and APAC high yield bond markets, which are predominantly voice traded. And we're definitely monitoring those developments there. Clare, I'm curious, how has the rise of e-trading in APAC equities grown?

Clare: Well, we're at a different phase in the cycle of electronification for equities in that almost all orders now are traded electronically on every exchange and the infrastructure is well established. But there are two big themes to watch in the year ahead. Firstly, is more choice of trading venues. So this year, we'll see new alternative trading venues launching in Japan and in Korea for the first time, there'll be a new venue as well. So we're going to see more competition to the traditional stock exchanges. The other big change that's coming into APAC electronic trading, and this is something that in Asia is really at a far more advanced stage than the rest of the world, is the scale of retail electronic trading. And I'm sure this is going to continue through 2025. We're seeing retail investors building their own algorithmic trading strategies, often trading from their phones, using APIs as day traders, semi-professional investors. And they're a very significant part of the market activity, particularly in China, Korea, India and Taiwan. And even now, the Indian regulator has a consultation out about how retail traders can build and use algos. So I think the impact of that electronic retail trading activity is a key focus for the year ahead.

Meredith: Well, thank you, Clare. I think we can agree there are a lot of dynamics in these fast moving markets, which is very exciting. And we've covered a lot today from key themes on our radar to execution dynamics. And there's so much more that we could discuss. I'm sure we could go on for another hour. Thank you so much for your time today, Clare.

Clare: Thanks, Meredith. I've really enjoyed it.

Meredith: To our listeners, please stay tuned for more FICC Market Structure and Liquidity Strategy content here on J.P. Morgan's Making Sense channel. If our clients have any questions or would like any further information on the topics in this episode, please reach out to your J.P. Morgan sales representative. I hope you have a great day.

Voiceover: Thanks for listening to Market Matters. If you’ve enjoyed this conversation, we hope you’ll review, rate, and subscribe to J.P. Morgan’s Making Sense to stay on top of the latest industry news and trends – available on Apple Podcasts, Spotify, and YouTube. The views expressed in this podcast may not necessarily reflect the views of JPMorgan Chase & Co, and its affiliates, together J.P. Morgan, and do not constitute research or recommendation advice or an offer or a solicitation to buy or sell any security or financial instrument. They are not issued by Research but are a solicitation under CFTC Rule 1.71. Referenced products and services in this podcast may not be suitable for you, and may not be available in all jurisdictions. J.P. Morgan may make markets and trade as principal in securities and other asset classes and financial products that may have been discussed. The FICC market structure publications, or to one, newsletters, mentioned in this podcast are available for J.P. Morgan clients. Please contact your J.P. Morgan sales representative should you wish to receive these. For additional disclaimers and regulatory disclosures, please visit www.jpmorgan.com/disclosures. © 2025 JPMorgan Chase & Company. All rights reserved.

[End of episode]

Trading insights: Risk and reward for European Equities post-YTD rally

[Music]

Eloise Goulder: Hi, I'm Eloise Goulder, head of the Data Assets and Alpha Group here at J.P. Morgan. And today I'm joined by my colleagues, Federico Manicardi and Victoria Campos, from our International Market Intelligence team to discuss European equities following quite a rally with the STOXX 600 up 6% from November lows and in fact hitting fresh all-time highs this week and marginally outperforming U.S. equities over the last two months. So, Fede, Victoria, thank you so much for joining us here today.

Federico Manicardi: Great to be here.

Victoria Campos: Thanks for having us.

Eloise Goulder: So, Fede, why do you think European equities have been so strong in recent months? I mean, on the face of it, the macro and the political narrative has continued to be one of U.S. exceptionalism. So, why do you think European equities have staged a bit of a comeback?

Federico Manicardi: So, yeah, with the main benchmarks finally breaking out of last year trading ranges, European equities are certainly in the spotlight. the rally started in mid-November, and it looks like there have been two phases in this. The first phase is from mid-November into year-end, and this was mostly a position-in-mid-reversion style move. European equities were oversold in absolute and relative terms, and the level of positioning were also quite low. The second phase of the price action is the year-to-date one, which looks to me more fundamental in nature. We have got some marginal positive in terms of political stability in France, we have seen ECB peak remaining consistently dovish, and the first part of the earning season has been positive in European luxury, as well as also for U.S. banks, which have clearly threw also in Europe. There is also a series of upside catalysts that investors have started to discount and have consistently come up in the conversation. The interesting bit is probably on the positioning side. On aggregate, investor surveys suggest long-goal is upcount and reverse that underweights and are still adding, while also CTAs and systematic accounts are buying. However, we have seen hedge fund investors adding to European ex-U.K. equities last year, but now they have started selling into this rally.

Eloise Goulder: That's fascinating. First of all, to hear about, in your mind, two phases of this European equity rally so far. The first one much more driven by the depressed positioning and technicals, but the second one driven more by tentative signs that fundamentals are improving. But hedge funds have not been buying into this second leg of the rally. So, Fede, as you look ahead, what's your view? Are you more bullish or bearish?

Federico Manicardi: Yeah, as we discussed in our previous podcast in mid-November, we've been constructing on Europe since late last year. Right now, however, we have neutralized our stance, but we do see some upside catalysts lined up. First of all, when we look at sell-side consensus expectation on European GDP growth, they look quite unassuming as effectively they project a flat line in growth extending to next year. This happens while we're getting healthy signs from the consumer in Europe from lower unemployment rate, rising disposable income, and significant excess savings. We are seeing a lending pickup as the ECB speak consistently remain dovish, and we are also seeing some improvement in the external environment, which is from China trying to revive its domestic demand via a mix of monetary and fiscal, and the U.S. growth keeps delivering. This is very important when you think that 60% of revenues exposure for Europe actually come from the external environment. A second catalyst could be a Russia-Ukraine peace or ceasefire deal. We think there would be a clear sentiment channel on the upside. However, we do think there is still uncertainty on energy flows resuming and also as to the final impact of reconstruction for European GDP. A third catalyst could be political stability as well as the prospect of a more business-minded government in Germany after election on February 23rd. And finally, when it comes to tariffs, we do recognize that uncertainty remains. However, it does seem like milder tariffs or more targeted tariffs is emerging, and there could seem to be room for negotiation via defense spending and/or energy imports for the European Union.

Eloise Goulder: So clearly several catalysts that could make you more bullish. But going back to my earlier point about U.S. exceptionalism, surely there is still a backdrop where Europe is facing structural headwinds. I mean, how do you think about the negatives here, Fede?

Federico Manicardi: Yeah, you're right.. I would start by mentioning the structural challenges to Europe, which remains. Energy prices remain high. Europe is relying a lot on manufacturing to create GDP growth, and this comes in an era where the U.S. is betting on reindustrialization. And finally, we see increasing competition from Asia on higher end sectors of the value chain. I would also mention that markets in our fair value framework effectively already discount an acceleration in business surveys, while the actual macro data that we have seen have only given limited and mixed signs of an inflection higher. I will also mention the earning season, which is coming next week. Our equity strategists do think that the earning season expectations for Europe can be a little bit punchy, especially considering that the pace of activity momentum last quarter was actually quite soft in Europe. And finally, markets are technically overbought with error size above 70s on pretty much all of the main European benchmark, and most of the positioning and mean reversion signals that have been firing in the last quarter have now neutralized.

Eloise Goulder: Thank you, Fede. Well, clearly a bit of a tug of war between some of the structural headwinds that remain here in Europe, but on the other hand, the incremental sources of upside across the macro political and geopolitical landscape. So, I understand you're holding this neutral stance on Europe as an index, but under the surface, are there pockets where you do have a bullish view right now?

Federico Manicardi: Yes, of course. So, the year has started with momentum strategy continuing to do well, which reflect the fact that some of the themes of last year, like banks, industrials, defence and software have remained quite strong. We don't want to fade these themes, but we do see more upside coming from sectors that have been challenged last year and are giving sign of an upside rotation. among luxury, we continue to see some upside following a slowdown in the second part of 2024. Our research team has also recently put out a comprehensive set of indicators in this space, which still points at fundamental headwinds, but it could also be pointing at some inflection higher. We also see some positive fundamentals here in the form of less uncertainty coming from elections, which are now behind, which is a positive for discretionary spending, as also rising consumer spending, which is effectively a determiner of luxury earnings. We also like broader European real estate, as valuations in the sector are quite low, and we also see a dislocation relative to where bond yields are trading, particularly in a situation where the ECB is giving a consistently dovish message, and we could see the BOE turning more dovish. Finally, in the European semi-space, the news flows continue to be positive in the AI supply chain, the entry point is attractive relative to the comparables in the U.S. and Asia, and also here, positioning is still quite low while our analysts think that the worst data point in the semi-equipment space are actually possibly behind.

Eloise Goulder: Thank you Fede, So Victoria, can we turn to you now? I mean, how much does the narrative that Fede has given across Europe also apply to the U.K.?

Victoria Campos: Yeah, so the U.K. has infamously been caught between the U.S. and Europe when it comes to macro weaknesses, firmer pricing and weaker activity. And the combination of this with challenges in the fiscal landscape have proved a tough pill to swallow for markets, with guilt sparing the brunt. 30-year yields reached levels last seen in the 90s, nearing 5.5% in early January this year. But last week's dovish CPI print did a lot to pair the sell-off, with record demand for Tuesday's guilt auction helping ease some of these fiscal concerns. I think it's also worth noting that guilt moves are often overemphasized in the context of fiscal impact, with our economists estimating that moves in rates by around 50 bps would push up deficit on average by 6 billion pounds, whereas a growth undershoot would be more pronounced, shaving off 17 billion pounds from fiscal headroom if near-term OBR forecasts are revised down half a percentage point. This number is a lot more material considering the treasury only has 9.9 billion of headroom. But the government has been quite quick to address this, with their pro-growth agenda picking up of late. Recent announcements have included boosting ties with China, a push on deregulation, an AI strategy statement, and new infrastructure projects.

Eloise Goulder: And when we think about U.K. equities, I mean, the FTSE 100 has also hit a fresh all-time high and is up around 5% year-to-date. So what's your view there?

Victoria Campos: Yeah, so we have some key catalysts coming up for U.K. equity markets in the coming weeks. PMIs this Friday should shed light on broader sentiment and growth outlook, and the Q4 GDP print, which is due in mid-Feb, will be a crucial data point and should help align expectations for the OBR's next forecast update at the end of March. Markets will also be closely watching the Bank of England's February meeting after the downside CPI surprise and increasingly dovish Bank of England comms. The most recent one being from Alan Taylor, who made the case for multiple cuts this year. markets are yet to price a more dovish path for the BOE, with only two whole cuts priced for 2025 currently. So a dovish surprise could catalyse further downside in yields and a subsequent boost to equities. Whilst improving domestic data and lower rates should benefit the FTSE 250, we remain more constructive on the FTSE 100 going forward, largely because of its exporter skew, which benefits from a weak sterling. We think additional downside on the currency is possible, given BOE carry can erode more quickly relative to market pricing if data continues to trend the right way. We like banks on strong earnings expectations, deregulation initiatives and a potential interference in the motor finance case. And we also see upside for homebuilders if yields continue to trend lower, with our basket down over 30% versus 2024 highs. Recent headlines on easing mortgage lending rules should also provide a boost to the sector. But I think it's worth emphasising that the U.K. still faces downside risks, given an uncertain domestic political environment as well as markets trading at a high beta to U.S. and global markets. So until we see more significant GDP prints it's hard to see how this narrative moves beyond a tactical take.

Eloise Goulder: Well, thank you so much, Federico and Victoria. It's been a really fascinating time to discuss Europe and U.K. equities in the context of these fresh all time highs that the indices have been making. And very helpful to understand that at the margin, you're holding a neutral view on the index levels, following your more bullish call back in November when we last recorded a podcast together. But that there are several sectors where you do have a more bullish view, whether Federico, it's across European luxury or real estate, or Victoria, it's across U.K. home builders or banks. Thank you both so much for taking the time to speak with us today.

Federico Manicardi: Thank you, Eloise.

Victoria Campos: Great to be here.

Eloise Goulder: Thank you also to our listeners for tuning into this biweekly podcast series from our group. If you have feedback, or if you'd like to get in touch, then please do go to our website at jpmorgan.com/market-data-intelligence, where you can reach out via the contact us form. And with that, we'll close. Thank you.

Voiceover: Thanks for listening to Market Matters. If you’ve enjoyed this conversation, we hope you’ll review, rate and subscribe to J.P. Morgan’s Making Sense to stay on top of the latest industry news and trends, available on Apple Podcasts, Spotify, Google Podcasts, and YouTube.

The views expressed in this podcast may not necessarily reflect the views of J.P. Morgan Chase & Co and its affiliates (together “J.P. Morgan”), they are not the product of J.P. Morgan’s Research Department and do not constitute a recommendation, advice, or an offer or a solicitation to buy or sell any security or financial instrument. This podcast is intended for institutional and professional investors only and is not intended for retail investor use, it is provided for information purposes only. Referenced products and services in this podcast may not be suitable for you and may not be available in all jurisdictions. J.P. Morgan may make markets and trade as principal in securities and other asset classes and financial products that may have been discussed. For additional disclaimers and regulatory disclosures, please visit: www.jpmorgan.com/disclosures/salesandtradingdisclaimer. For the avoidance of doubt, opinions expressed by any external speakers are the personal views of those speakers and do not represent the views of J.P. Morgan.

© 2025 JPMorgan Chase & Company. All rights reserved.

[End of episode]

How high is positioning in U.S. Equities?

[Music]

ELOISE GOULDER: Hi, I'm Eloise Goulder, head of the Data Assets and Alpha Group here at J.P. Morgan. And today, I'm really excited to be joined by my colleague John Schlegel, who's head of the Global Positioning Intelligence team here in New York to talk all things positioning post a stellar rally in US equities over the last few weeks and months. So, John, thank you so much for sitting down with us here today.

John Schlegel: It's great to be here.

ELOISE GOULDER: So, US equities have staged an impressive rally over the last couple of months with the S&P 500 now up over 10% since August lows and in fact, up 22% year-to-date. And it's been a very pro-cyclical rally with consumer cyclicals, industrials, financials, materials, and, of course, tech really leading the charge. And my interpretation is this has been a macro-driven rally, given that we've seen consistent upgrades to economic growth assumptions for the US over that period. In fact, our own economists upgraded their Q3 GDP forecasts from 1.5% to 2.5%. And, of course, we've seen very strong data points across the employment and the services sector in the US as well. And this is happening at the same time as the Fed cutting rates. So, this is driving further equity strength. John, do you agree with this narrative.

John Schlegel: Yes, I generally agree. But I would add that positioning-- if you look back to when this recent rally really kicked off in early August, had gotten to a fairly neutral level on a long-term basis. So there was ample room for clients to re-risk. And I think what has been a bit surprising compared to the expectations back then was just how strong the macro data had been even prior to the Fed starting to cut rates. So I think you've had a very strong US story from both an economic standpoint as well as a positioning standpoint. And then you've also had strong performance out of other regions, given some of the measures that are happening in China recently as well as other parts of Asia. So, globally, maybe excluding Europe, which is a bit more mixed, there's been ample room for markets to rally on the back of these drivers.

ELOISE GOULDER: That makes a lot of sense. Thank you, John. And you mentioned that back in July, August positioning was looking much more neutral in US markets. So who have been the main buyers of US equities since then?

John Schlegel: So I think if you go back to what drove the sell-off in late July to early August, a lot of that came more from hedges that were added or futures that were reduced, so think sort of broad-based instruments trying to reduce risk into the concerns around the potential economic growth slowdown. And if you think about what's driven positioning higher since then, a lot of that is the same things that were sold. So a lot of futures that are being bought back-- if you look at options in terms of the call-to-put ratios, those had turn more bearish into early August, have turned more bullish more recently. And then in the last few weeks, we've seen hedge funds even start to tick up their flows to be more positive. And this is after they had been selling from most of second half of July through middle to late September. So, in aggregate, there's a number of factors that are driving it, but I would say really macro products were the biggest drivers of the rally as we see it.

ELOISE GOULDER: And so where does that leave positioning today?

John Schlegel: So, in the US, we see positioning as fairly elevated, very similar to what we saw in early July. Our aggregate measure of US positioning is just over the 90th percentile. And over the last four weeks we've seen positioning turn positive. But we're not quite at those peak levels that we saw in July. So there's definitely some room for a bit more upside at this stage but not a whole lot from a positioning standpoint.

ELOISE GOULDER: That's really helpful. So positioning has risen quite a lot and is now looking relatively elevated, as you say. But, on the other hand, the macro data, the micro data, and, of course, the global data, including from Asia, is looking more positive. So where does this leave overall risk-reward for markets at this stage?

John Schlegel: I think at this stage, the economic data and the fundamental data arguably could trump positioning. By this, I mean, if you think about seasonality into year end tends to be very strong. For US election years, it's typically strongest after the election-- so November, December. And given positioning is pretty high, I'm a bit more concerned about what markets could do over the next few weeks because there can be some choppiness. Even if you look at the last three US elections, there's been a little bit of downside in the three weeks leading into the election. And just given where markets are at all-time highs and positioning having risen a bit in the last month, I think there is room for that to come off a little bit. But, overall, I think into year end, there's seasonality, strong economic growth, Fed cutting rates, China trying to stimulate their economy-- all of this suggests that we could continue to rally into year end.

ELOISE GOULDER: Yep. So there's a lot of positives on the macro front. If we turn to thematics, arguably, we've seen some quite hawkish data points recently. We've seen higher payrolls data, we've seen a slightly higher CPI versus expectations. And so there's this risk that bond yields really widen from here. John, do you see that as a risk for market levels and in particular for certain pockets and themes within the markets?

John Schlegel: Yeah, so I think certain pockets and themes could be at risk. I think for the wider market, our view would be there is room for rates to rise from a position standpoint simply because by the mid-September period, as markets were expecting the Fed to cut but debating 25 versus 50 basis points, we had seen positioning in bonds get more long. So CTA net risk and a bunch of the different tenors were at the most net long we'd seen in a few years. And there's room for this to come down-- that net length towards the long end to be reduced a bit. So US rates could rise a bit further. But if you look at how the S&P 500 as a whole has acted, it usually hasn't taken on a more negative stance unless rates rise significantly. And if you look at the past couple of times when equities have sold off, it's been when rates have risen above about 4.3% in the US 10-year. And so I think there is a little bit more room before we get there given where rates are today. But I think, more specifically on the rotational side, there are some areas that could be under pressure. I think some of the defensives-- especially rate-sensitive ones like utilities, which rallied a lot-- could come under pressure because of their sensitivity to rates also because positioning has gotten a lot higher for a sector like that in the third quarter. So I'd be a little bit more specific around which sectors could be hurt due to higher rates. But I think more generically, the market could be OK as long as we don't really keep accelerating higher in US rates from these levels.

ELOISE GOULDER: And, of course, we have seen a very pro-cyclical skew to market strength over the last month or so with our cyclicals baskets outperforming our defensive baskets.

John Schlegel: that's correct.

ELOISE GOULDER: Thank you so much, John. So the fundamental and the macro drivers of the market are looking very robust. But, as you say, positioning in the aggregate has got that much more elevated. So are there pockets where you see more upside risk perhaps because the fundamentals are so strong or perhaps because positioning is lighter in those pockets?

John Schlegel: So I think there are three areas I point out that all are on the more cyclical end of the spectrum that could do better if the macro backdrop remains robust. But positioning in these areas are still somewhat light from our view. So the three I would call out would be, one, energy, partly because of what we see for oil positioning as well as what's happening in China. If the economy continues to re-accelerate globally, energy could be a beneficiary. I think financials in the US are another beneficiary. As long as rates don't rise too rapidly, rates stabilizing at high or levels than they were a few years back generally could be a positive for the sector and positioning overall has been reduced quite a bit. One of the key areas that we think positioning could arise is in ETFs. So ETF flows were the most negative financials in September versus other sectors and that could return more positively. And then the last one would be semis in the US. Now, this might be a little more controversial in terms of whether or not positioning is actually light. But as we see it in the aggregate, we think a lot of positioning did come out in the second half of July into early September period when semis and broader tech stocks generally underperformed the market. And we don't think it's come back that strongly yet. I think one of the most interesting data points to us is that hedge funds, which were starting to sell into the semis peak in June, have actually been buying over the last few weeks. So it suggests that more fundamental investors who saw, sort of, the top toppiness of the market back in the second quarter are now a little bit more confident in adding some risk in that sector.

ELOISE GOULDER: Fascinating. Thank you. So three sectors there to be watching the energy, the financials, and the semis-- all of them more pro-cyclical beneficiaries, presumably, of stronger macro data as we're seeing at the moment but also, as you're arguing, all with lighter positioning, at least versus their own histories.

John Schlegel: That's correct. Yeah.

ELOISE GOULDER: And then, finally, if we can turn to the other regions, you mentioned at the outset that pockets of Asia have been stronger recently, perhaps less so in Europe. Can you contextualize what you're seeing from a fundamental and a positioning angle in the other regions?

John Schlegel: So I think China is probably the most interesting and most topical at this point. We've seen, obviously, the markets there rally quite strongly over the past few weeks given the stimulus measures that have been announced and the expectation for more to come. In terms of positioning changes, at this stage, we think a lot has changed from a few weeks ago. So whether it's the flows that we see in our prime brokerage book across hedge funds, we've seen a lot of buying of local China shares. If we think about what we're seeing in futures, there's been quite a bit of directionality added and even CTAs in the Hang Seng index are now the most net long they've been since early 2021, so a 3 and 1/2 year high. I think the overall skew from a positioning lens has shifted much, much more positive in China. And there will be a lot more emphasis needed on the continuation of the stimulus measures to keep this rally going. But, clearly, if the government continues to come out with strong measures, there's a lot of potential for the retail investor in China, as I see it in particular to continue to be supportive of that market. If I think about Europe, it's a lot more mixed is the way I view it. There's not been a whole lot of performance in the absolute sense in the past few months. It's also been an underperformer versus the US. But from a positioning standpoint, we've seen it right around the two-year average and so, therefore, not really striking me as something that is either wildly underpositioned or overpositioned and in line-- with a market that's been middling for the last few months.

ELOISE GOULDER: That makes sense. And I guess we're going to have to watch macro data from here in Europe because it's certainly not been strong in the way that it has in the US recently.

John Schlegel: Yes. And I think there's a tug of war between some of the stimulus measures in China and what that could mean for certain sectors in Europe versus the more domestic economy and some of the slowdown that we're seeing there. And so it's a bit trickier market than maybe others.

ELOISE GOULDER: So to summarize, then, John, you remain relatively optimistic that US equities can rally further into year end, albeit they may be somewhat constrained in the near term by more elevated positioning levels. So which events and data points will you be watching from here to confirm or to refute your views? We, obviously, have US elections in a few weeks, but beyond that, what will you be watching?

John Schlegel: So I think the key things will continue to be the macro data. What do we see for payrolls? What do we see for inflation? Does that continue to move in a more Goldilocks fashion and allow the Fed to continue to lower rates at a modest pace? I think, also, earnings, which are kicking off right now in the US, will be key. If earnings continue to beat and expectations can rise from here, I think that will support the market. And then arguably, from a global standpoint, do we continue to see some of the measures out of China remain positive for that market and help to drive a broader global growth story into year end.

Eloise Goulder: Brilliant. Well, those are very clear views, John, so thank you so much. We really appreciate all of your time and your thoughts today.

John Schlegel: It's been great having this conversation with you.

ELOISE GOULDER: Thank you also to our listeners for tuning in to this bi-weekly podcast series from our group. If you have feedback or if you'd like to get in touch, then please do go to our website at jpmorgan.com/market data intelligence where you can send us a message via the Contact Us form. And with that, we'll close. Thank you.

Voiceover: Thanks for listening to “Market Matters?” If you’ve enjoyed this conversation, we hope you’ll review, rate, and subscribe to J.P. Morgan’s “Making Sense” to stay on top of the latest industry news and trends – available on Apple Podcasts, Spotify, and YouTube. The views expressed in this podcast may not necessarily reflect the views of J.P. Morgan Chase & Co and its affiliates (together “J.P. Morgan”), they are not the product of J.P. Morgan’s Research Department and do not constitute a recommendation, advice, or an offer or a solicitation to buy or sell any security or financial instrument. This podcast is intended for institutional and professional investors only and is not intended for retail investor use, it is provided for information purposes only. Referenced products and services in this podcast may not be suitable for you and may not be available in all jurisdictions. J.P. Morgan may make markets and trade as principal in securities and other asset classes and financial products that may have been discussed. For additional disclaimers and regulatory disclosures, please visit: www.jpmorgan.com/disclosures/salesandtradingdisclaimer. For the avoidance of doubt, opinions expressed by any external speakers are the personal views of those speakers and do not represent the views of J.P. Morgan.

[End of episode]

RESEARCH & INSIGHTS

Questions

J.P. Morgan's research is renowned for its depth, breadth, and quality. With coverage across six continents and 55 countries, they actively cover about 5,000 companies, making them a leading franchise in research.

Most clients receive research via email, with over a million emails sent daily. Clients also access research through the J.P. Morgan Markets portal, mobile platforms, and popular industry aggregators.

J.P. Morgan uses advanced technologies to deliver content, allowing clients to discover and personalize their subscriptions. They employ AI and NLP to curate content, making it easier for clients to find relevant insights.

J.P. Morgan uses AI, particularly NLP, to analyze large data sets quickly. This includes tools like Smart Buzz, which assesses themes and sentiment from news and reports, providing actionable insights for clients.

The team is focused on exploring new opportunities, such as expanding research efforts in India. They aim to continue offering industry-leading advice and integrating their offerings to meet evolving client needs.

Video Interview

Get the real insights

Hussein Malik:

Hi, my name is Hussein Malik and I'm Co-Head of Global Research at J.P.Morgan. I'm glad to be joined here today with my colleague, Asif Mohamed, who's head of Digital Product for Research.

Asif Mohamed:

Great to be here, Hussein. Thank you. Research is ranked number one. We're ranked number one in research. What does that really mean for our clients in the market?

Hussein Malik:

What that really means is that we have incredible depth, breadth, and quality of research. Research is the first leg of the trade cycle, and what we are really trying to do is give great insights to our clients about economies, markets, and companies. We have research coverage over six continents. There's 55 countries where we do economics, markets, or company coverage, and we have about 5,000 companies that we cover on an active basis. So really putting all of that together makes us the number one franchise in research.

Asif Mohamed:

That is amazing. In terms of coverage, tell me more about what you mean by the scope of coverage and why that's so important.

Hussein Malik:

I think it's really important to think about the scale of research. Every day we produce between 400 and 500 pieces of content that we send out to our clients. In an average year, we attend or join or lead about 80 to 90 conferences per year. We do hundreds of road shows, we produce a lot of content, and we make sure that that's delivered to our clients in the best possible way.

Asif Mohamed:

So there's a vast amount of research that's being produced every day. How are clients finding and actioning those research pieces? I presume there's lots of research out there. We're a leader in the industry, and so how are clients actually finding and receiving that research?

Hussein Malik:

Well, most clients still receive research in email. We send a lot of emails every day. That number is well over a million emails that we send out every day, and clients ultimately do need to search through that content to find what they want. So what we're trying to do is help them find it faster. And I do think that with the great increase in the amount of content available to clients, they are and will continue to use machines to do that first level of filtering to help them find the content that they're really looking for. But let me talk about delivery because this is really in your wheelhouse. We obviously produce the content and we get it to our clients. How do you think technology is changing that path? How does that come into play?

Asif Mohamed:

Yeah, that's absolutely right. We're using lots of different technologies in the delivery of our content, the large volumes of content that's created across various markets, as you described, and with our various asset classes, we have a tremendous amount of technology in play to deliver that content to clients. And so we've created this capability that allows them to discover and select their subscriptions effectively. And so as the content's being written, it's contextually mapped to their interest and they're able to receive that content over email. You mentioned 1.5 million emails, but there are also other channels that clients are consuming our research insights on, such as the web. We have the J.P. Morgan Markets portal, mobile, and they also use some of the popular aggregators in the industry to consume content. Now, content's also being integrated into their workflow and their processes, and so we are delivering content via electronic formats. You speak to clients every day. What are you picking up? What is the insight about the client consumption of research insights? How is that changing over time?

Hussein Malik:

I think today it's still, as I mentioned, a fair amount of email, but podcasts have become more popular in certain parts of the world. Videos have become more popular. We are doing more multi-analyst conferences or conference calls where people are listening in very large numbers. So they're using different channels to consume content. Where I think they are going is using tools like LLM to curate content, broadly speaking, faster and easier for them, to be able to hone in on what they really need to focus on.

Asif Mohamed:

Yeah, that's right. It's more than email, obviously, and we create subscription systems similar to some of the modern media companies have done for allowing clients to subscribe and personalize their content. So they're able to go into a subscription system on a real-time basis and make adjustments to the content that they'd like to receive. So they're able to search, discover, subscribe, change those interests on a regular basis for their needs, as their needs change.

Hussein Malik:

And what about things beyond email?

Asif Mohamed:

We have the J.P. Morgan Markets portal, which is a large platform, and we provide content on the web. We provide content in mobile form factor, as well as through aggregators. And the search, as clients are able to come and search, we do quite a bit of curation of that content. And so all these technologies are being employed to deliver content to the client the way that the client wants it, with all of the modern capabilities and expectations, and the expectations are changing. And so we are changing the technologies, we're moving to the cloud in many ways and using the latest and greatest capabilities to deliver content to clients. So Hussein, how do you change the content creation process, or how does the content creation process change to address these user expectations?

Hussein Malik:

Well, content creation when I started my career was really printing out copies of research and distributing the hard copies. And obviously, that's changed. It's moving to a digital world and it needs to get more digital as we go along. And it's all very important to do that in order to be able to componentize the content, that we have to enrich it with better metadata to make sure we can tag it correctly, and then we can deliver it in more automated fashions and curate it much more than we are able to do with that today.

Asif Mohamed:

So Hussein, tell me a little bit about how data is being consumed in research.

Hussein Malik:

Well, data is the backbone of research. So research has always been about data, and with better technology, data storage, and computer available to us, when we think about it, we are using more data-driven analysis to drive our content and to make sure that we are getting to those conclusions that we couldn't get to earlier in the time that we could. What that does mean is that we need to deliver this data to our clients better than we were ever able to. And we need to make sure in a way that data is coming out from behind the curtain and it becomes a form of content that we are delivering. What that doesn't change really is still the importance of the person who's coming up with the data, the analysis, talking about it and explaining the importance of that when we talk to our clients.

Asif Mohamed:

And how does artificial intelligence influence the way that we're creating content?

Hussein Malik:

There's a lot of hype and there's some reality, and I think there'll be more reality as we go along. But we have been using AI, or broadly speaking, AI, specifically NLP in our research for a long time, but with the greater availability of GenAI and LLM tools, there's a lot of focus on this, and we are able to do things today that we were not able to do in the past. So we are able to process a large amount of data very, very quickly and produce an output that at times can be quite auto-generated in terms of the analysis in a short period of time.

One example of that is what we're doing with Central Banks Speak, where we have managed to train our system to understand what central banks are communicating, doing it at a very granular level, and we are able to get that output to our clients in a matter of minutes. In addition to that, we have put a lot of these tools out and made our tools available to clients, and I think you know probably more about that than I do, so maybe I'll turn this over to you to talk about that.

Asif Mohamed:

Yeah, we're using AI in a number of places, and we've used natural language processing technologies for a number of years now to deliver investable AI, a portfolio of products that use natural language processing to analyze the news, earnings call statements, and analyst reports to deliver thematic information and sentiment information for actionable investment insights. And so that's one of the areas, we're also using it to deliver dashboards for our clients on economic indicators that are almost real time and now casters and those kinds of things. So we've deployed natural language processing technology in developing data products for our clients, whether it's in equities or economics, and we're moving towards the use of large language model capabilities to enrich those data products. We've developed a number of data products using natural language technology, and we have developed a page on our portal that has all of those capabilities. So for example, we've got a product called SmartBuzz, which looks at themes and sentiment across a vast amount of news, earnings, call transcripts, as well as analyst reports.

Hussein Malik:

And clients can use it?

Asif Mohamed:

Clients can use it on a daily basis to understand and make investment decisions on those capabilities. And so a vast amount of data, alternative data, we have a number of macroeconomic type of indicators on that page as well. So it's a portfolio of products that uses natural language processing technology to consume large amounts of data and generate insightful signals for clients to consume. So Hussein, what are your views on how J.P.Morgan research is differentiated in the industry?

Hussein Malik:

Research is obviously about content and delivering content, but the content has to be there and the content is driven by first and foremost, people. And we have great people, we have a complete organization. And I think what makes us really powerful is that we work together as one research group to deliver the insights to our clients in ways that a siloed organization really cannot. And that's what I think is really the power of our research franchise.

Asif Mohamed:

That's great. And in terms of innovation, build versus buy?

Hussein Malik:

Historically, research has tended to have a bias, and I think generally Wall Street has had a bias towards building things themselves, and I think many times that's still the right answer. But with the great expansion in the number of capabilities available, what we used to call FinTech more than we do now, it at times makes more sense to buy technology, partner with technology to create the products that you have. And in some cases, we've even built some partnerships to create the content that we are producing that tends to be a little bit more data type content, but we are exploring all of those options to make sure that we remain cutting edge in what we deliver to our clients.

Asif Mohamed:

So these are a very comprehensive set of capabilities that the firm has with the injection or infusion of technology, innovative technologies and modern evolving technologies. What haven't I asked you about, that you'd like our clients to know?

Hussein Malik:

Well, the research is for them. So I think the number one thing I'd like our clients to know is that we are listening to them, we are producing this content for them, and we want to know what we are not doing for them. How can we do that more? How can we integrate our offering more? And that's one of the reasons we built the markets client portal, for example, to bring together what we're doing in research with what we're doing in sales and trading and make sure we can deliver that in an integrated fashion to our clients.

Asif Mohamed:

So Hussein, what are we focused on for our clients and the market?

Hussein Malik:

Well, we're constantly looking to see where the new opportunities for our clients lie. So I think if you go back a few years, we really have built a top notch effort of research in China, for example, where we cover a number of companies locally, and then we do it a little bit with a greater China focus in Hong Kong and Taiwan as well. Currently, India is a big focus for us. We definitely think that there's an opportunity for our clients to invest in India with the growth with the friendshoring and some of these dynamics. So it's another area in which we are quite focused, and we continue to do that, both in terms of countries opportunities, asset classes, and make sure that we are there where our clients are going to go, and continue to offer them the same level of advice that we would in the developed or established markets.

Asif Mohamed:

So Hussein, how has research evolved over the years since you've been involved in research?

Hussein Malik:

At the beginning of my career, I used to spend some time typing numbers into Excel because that's how the market data used to come in. That's obviously changed a lot. We wrote research and we published it and we distributed it in hard copy. That's changed to electronic distribution, but I think as we look ahead, it's going to become more and more digital distribution of content, and that's really the evolution. And then ultimately, it'll be data feeds and to a certain extent, machine to machine. But what won't change, in my view is really the people behind the content, the people delivering and explaining and talking about the content.

Asif Mohamed:

So the machines are going to be more prevalent in the consumption of content going forward, you think.

Hussein Malik:

As a first level of filtering, I do believe so.

Asif Mohamed:

Thinking back about your younger self, is this where you imagined you would be today?

Hussein Malik:

Imagined, no. I did hope, maybe, yes. I did start in research. I worked in research for 12 years. I left research for 13 or 14 years and then came back. So for me, it's been a roundabout journey to come back to research. That journey's all been around the investor clients, so I think that's been the common thread through all of it. But I don't think I would've imagined being here if you had asked me, and maybe I would've said, "I hope to be there." But I think it's a long road and a lot of things you learn along the way. What about you?

Asif Mohamed:

Yeah, no, I would not have imagined it. I started out in a very different discipline. I was an engineer and then I transitioned into the capital markets, and so I'm obviously very interested in innovation and transformation and those kinds of things, and so I've kind of found my way here, but it's not something that I imagined from early days. I certainly enjoy what I'm doing and it's challenging, but really love that.

Hussein Malik:

I do remember calling you one day about five years ago, Asif, and saying, "I have an idea."

Asif Mohamed:

Yeah, and you actually had to convince me, right, of that idea?

Hussein Malik:

Yeah, I really felt that your ability to understand what the FinTechs were doing and what people were doing and applying it to a different space and being able to articulate and deliver a vision was something that we could really use in research. And frankly, what we have accomplished in research in terms of the digital journey has a lot to do with you.

Asif Mohamed:

Well, thank you. So things fall into place, I think over a long career. Opportunities present themselves, and you take the things that you find are going to be fulfilling and you're going to be happy with. So if you were to have lunch with someone at J.P.Morgan, who would that be and why?

Hussein Malik:

Jamie. I've had lunch with Jamie before, so it wouldn't be the first time, but it's always insightful. You learn, you get challenged, you get asked a few questions. You have to be on your toes, but you always learn a lot. And it's been a few years, so I think that would be great. How about you?

Asif Mohamed:

I think Claudia Jury, who is the co-head of sales and research would be an interesting lunch session. I think that Claudia comes from a trading background and she's made that transition into heading sales and research. And so the combination of skill sets and challenges, I think would be interesting to understand how she's navigated those waters.

Hussein Malik:

I can try to make that happen.

Hussein Malik, Head of Global Research, and Asif Mohamed, Head of Digital Product for Research, discuss the depth and quality of J.P. Morgan's research capabilities.

language processing is discussed, showcasing how it helps analyze vast data sets to generate actionable insights.

More products in Research & Insights

See. More. Know. More.

Research & Insights

Global Research

Research & Insights

Market Insights

Available on the J.P. Morgan Markets Platform and through a multitude of additional channels to suit your needs.

The complete markets platform. Get around-the-clock access to an advanced portfolio of digitized services, designed to put you in control.

FOR INSTITUTIONAL & PROFESSIONAL CLIENTS ONLY

SOME PRODUCT AND SERVICES LIKE SI360 & PRIVATE BANK EXECUTE ARE AVAILABLE TO NON-INSTITUTIONAL CLIENTS

© 2026 JPMorgan Chase & Co. All rights reserved.