Leverage enhanced execution from one of the largest liquidity pools in the market, combined with the latest trading technology.

Key Benefits

#1

J.P. Morgan is ranked #1 in trading by global market share*.

99%

Today, about 99% of stock and currencies trading at J.P. Morgan comes to the bank through electronic systems vs the telephone.

$44bn

On average, J.P. Morgan buys and sells $44 billion worth of stocks for clients every day across global markets.

$650bn

We deal in 122 currencies and settle about $650bn worth of foreign exchange transactions for clients every day.

| VIDEO

| VIDEO

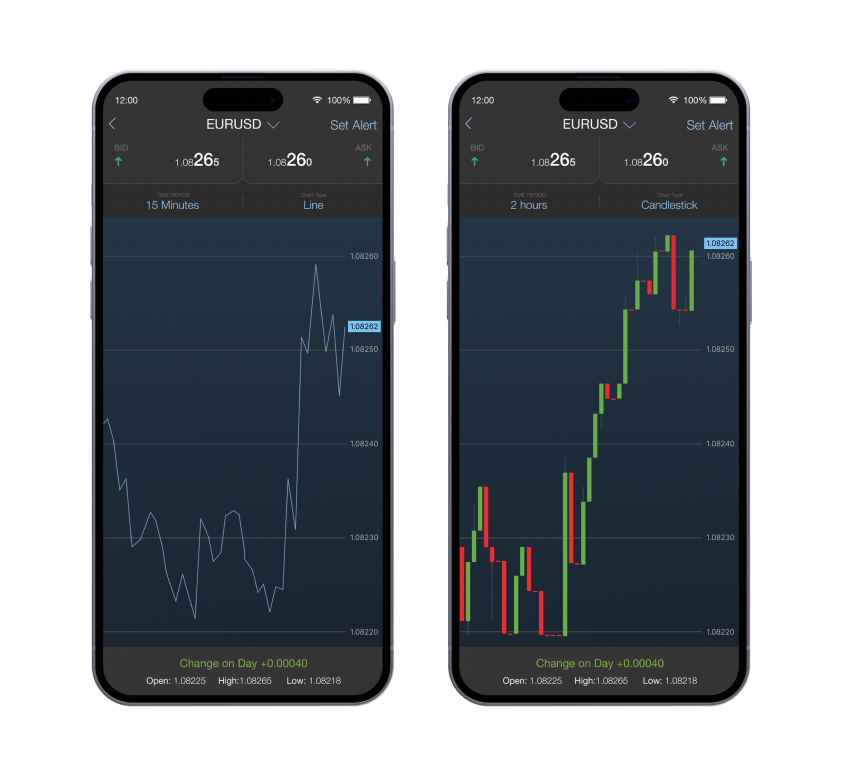

Enhance your trading strategies with J.P. Morgan Markets.

Spot opportunities across currencies and markets, with our complete platform - wherever you are.

Leverage cutting-edge technology, advanced algorithms, and one of the largest liquidity pools to maximize performance.

With reliable execution- ensuring you're always ready.

Enabling you to demand more and achieve more. So, you can stay ahead of market opportunities

Do More with Pricing and Execution on J.P. Morgan Markets.

Tools to serve different investor types

Optimize how you use and extract data with flexible channel connectivity

Institutional Investor

Pricing & Execution

Execute

Institutional Investor

PRICING & EXECUTION

Transact

Institutional Investor

PRICING & EXECUTION

Neovest

NON-INSTITUTIONAL INVESTOR

PRICING & EXECUTION

Execute for Private Bank

Broker Dealer

PRICING & EXECUTION

SI 360

PRICING & EXECUTION

Questions

J.P. Morgan aims for scalability by developing cross-asset solutions and leveraging existing technologies. They focus on reusing and enhancing current systems to meet future demands without adding complexity.

DLT is used to enhance data accuracy and efficiency, particularly in settlement processes. It enables precision in trading, such as intraday repo products, by providing a single source of truth and reducing the need for manual checks.

AI and machine learning can enhance DLT by improving data processing and settlement efficiency. These technologies can work together to create more sophisticated, automated trading and settlement processes.

J.P. Morgan focuses on continuous innovation by leveraging technology to meet client needs. They aim to provide seamless, efficient solutions across asset classes, using digital markets as a framework to integrate new technologies.

Digital bonds offer a single, shared ledger that enhances transparency and efficiency. This reduces the need for manual checks, speeds up processes, and opens opportunities for broader participation in capital markets.

Video Interview

Get the real insights

Patrick Whelan:

Hi, I am Patrick Whelan, the Global Head of Fixed Income and Digital Markets at J.P. Morgan. I'm delighted to have Scott Lucas, the Markets DLT Head for J.P. Morgan. I've just mentioned three or four different acronyms in one sentence there. Scott, can you explain a little bit about what you do at J.P. Morgan and how you end up here?

Scott Lucas:

Sure, thanks Patrick. So Markets DLT, the market bit is easy, it sits across our trading businesses in the markets side of the house. DLT stands for distributed ledger technology, which is another word for blockchain. We really just use that as a way to build products for our clients that trade in a different way using a different technology and try and realize some of the benefits of that technology as we get into the next phase of how we think the markets are going to look.

We've been in that team for about three years. I think we built it in 2021, started to grow it through 22/23, which is a real reflection I guess, of how we've thought about what the opportunity set looks like in this space over the last few years. Before this, most of the team have come from other jobs in either markets or within J.P. Morgan. I sat in our treasury chief investment office and I spent about 12 or 13 years in that seat. Prior to J.P. Morgan, I was actually in the army, so I joined J.P. Morgan after a career in the army in 2010.

Patrick Whelan:

A natural progression then.

Scott Lucas:

Yeah, it's a pretty straightforward choice, one to the other.

Okay, Patrick, so digital markets, what does that mean for you?

Patrick Whelan:

I think markets have already digitized to a large degree. I think you look at equities, you look at FX, you look at parts and commodities and rates. So I don't think it's necessarily one thing. I think the way we envisage it is how do we integrate more of the technologies that we have already created across asset? How do we learn from the lessons of markets that have already been through the electronification journey, and how do we bring those solutions to bear in areas that are just starting out on that journey? So distribution and automation are themes that are not unique to digital markets. They exist across markets. I think we're all looking at ways to find the efficiencies within our relevant lines of business to be able to bring those themes to bear across each of our asset classes. I think the products themselves are on a northeasterly journey to towards more electronification.

If we're to look at J.P. Morgan five years from now, I think our goal within the digital markets organization is to try to find solutions that can scale to where we need to be. We always have that three to five year lens of where we want to be, not where we are today, but where we want to bring the company forward. I think the umbrella of digital markets allows us to navigate across assets a lot easier and a lot more seamlessly than we have in the past. To bring some horizontal solutions to bear, which is we look at our single dealer platform as a cross-asset solution for both equities and fixed income. We look at our API solutions directly to clients as being that broad tangible reach into all of those particular clients, EMSs and OMSs. Equally, I think the further electrification of our businesses can't happen with adding more people. We have to be able to reuse what we built and continue to provide the scale through that.

What is digital markets in the context of the broader J.P. Morgan ecosphere?

Scott Lucas:

That's a fair question. It's a bit hard because everything's digital anyway. There's very few things that have physically actually traded as far as an actual piece of something moving to another. We don't have bearer bonds in particular, in very many markets anymore. Not even much currency is physical anymore. So in that way it's a bit hard to narrow in what do we mean by digital?

The way I think about it is at the end of the spectrum that we're working at, which is really about bringing new technologies and a new type of digital to the market. So a different way of the constructing those different products, that to me has appropriated the word digital into that context. At the other end of the spectrum, the stuff that you are doing really I guess is around looking at your consolidation of data and a lot of the other newer technologies and speed of execution and that side of the house. I guess again, there's an appropriation of the fact it's digital and it's faster, newer, better, and I guess that's the work that's one of the reasons we put it in that box. That's certainly how I think about it. I don't know about you.

Patrick Whelan:

I think 100% encapsulates a lot of what we do. It's a brand that we developed over time. I think from our side, the key areas that we look at in terms of automation and digital distribution, it's not a one size fits all across the markets. Businesses, they've evolved in different ways at different times. FX has gotten to its stage of electronification a lot further and faster than let's say credit and rates and parts of rates and nonlinear rates and some of the other parts.

But they're all on the same journey and I think being able to put an umbrella term like digital markets around everything that we do helps us to build better products longer term for our clients as well as leverage the scale of J.P. Morgan and the franchise that we have to be able to deliver those capabilities to clients where they need them most, which is generally in their day-to-day workflow. Obviously we continue to evolve that space, little by little, but it's a journey for sure.

In terms of DLT, it means a lot of things to a lot of people, but from your perspective, you've highlighted a little bit about how you ended up where you did. How do you think that experience has helped you in this new role in the last couple of years?

Scott Lucas:

I think to be fair, I think it's relatively fundamental. When you look at what's happening in the broader DLT blockchain space when it comes to existing regulated products. So not crypto, separate to that. This is really about employing the technology in a way that we recognize against regulated products with sophisticated licensed participants in an existing market. A lot of the deployment of that technology in the short run is about providing efficiency and precision at the settlement end. We can do these trades today, but actually if you want to fund some of your positions and you need to have the cash available early tomorrow, you typically make that trade today and you carry that risk overnight in order to have their funds pre-positioned for tomorrow.

The way we started this team and the product we launched was an intraday repo product. A repo has been around for a very long time and trades at scale and the trillions on a daily basis, but it's trade today, settle tomorrow. It's a rolling product with term. You couldn't really go to the market and say, I'd like to do a repo for X number of minutes because there isn't a way to agree the price, execute the transaction, settle the transaction, realize the proceeds of that, use them and then do the whole reverse the repurchase side of that, do the reverse on the same day.

That's what DLT has kind of found its way into the market as a precision way of settling things and being able to enable a different type of trading to achieve a similar outcome. The treasury background's really helpful with that because clearly we look at how we fund the entities, the pricing of that, the speed of that and where the risks sit. In my last job in treasury, which was around intraday liquidity and clearly the management and risk associated with that, finding something that offset some of the risks that we didn't like. Potentially gave us some economic benefits of balance sheet saves and capital liquidity is where we kind of landed with that product. I think that's a really helpful way to start thinking about how we can use the technology in the first context. There's extension opportunities, but for right now I think that's a useful start point for how we think about deploying the technology, certainly across a range of different markets. Interestingly, there's been a lot of other follow-on products around the market that are trying to do something similar to what we launched a few years ago.

Patrick Whelan:

It's definitely been a trend that has been around for a while in terms of blockchain DLT capabilities, that kind of scope. It does feel like it's found its feet in markets more broadly now and that the next five years are going to be where the rubber really hits the road. I think we see that trend not just in DLT but in the broader adoption of technology and a bunch of different places, especially with our clients. I suppose from your perspective, when you look at the kind of client's journey to where they are today, how do you pitch what you are doing and what benefits and capabilities it can bring to them and their workflow?

Scott Lucas:

Yeah, I think with all of this stuff, it is great to have a grand vision and so this is what the market could look like and here's what we're going to go and here's the benefits that we're going to realize. There's a lot of that opportunity marketing I think around some of the stuff that comes to DLT and blockchain. If you're a cynic, it was going to solve world hunger for five years. Anything and every problem that existed blockchain could do something about. Really it can't. It can solve specific problems in specific areas. I think having a vision that people can relate to is fine and we need to set that stall out, but along the way, in order to get traction, in order to get engagement, there needs to be economics. There needs to be a reason why an investor would see the value in investing in a digital bond versus a regular bond. There needs to be value in onboarding to a platform that gives you intraday trading capabilities rather than overnight and term capability.

So we try and have that longer term vision and along the way as we deploy the technology and we get feedback from the market and we try and tell the team it's the kick over as many rocks as we can and find where the money is because in that opportunity set, you then start to really explore where it could go. We might have a vision that it'll head in one particular direction, but the market could take it into completely other one. I think our job is to at least lay out a direction, work with the market to try and realize that and along the way the market will do what the market does. You do a lot of that with what you're doing now and electronification. You're right in the heart of the storm of where that goes at the more mature end of the market.

Patrick Whelan:

How does DLT actually differentiate what we have versus what potentially competitor offerings look like?

Scott Lucas:

When you look at distributed ledger technology, one of the things that's key about that is the word distributed. Rather nostro, vostro, mine and yours, it's ours. So there's a single record that entitled folks can look at, but there's one ledger that everyone is the single source of truth. So all of this debate around what's accurate and it becomes impossible to disagree. If we can get to a place where that becomes distributed across the market at scale, then the cleanliness of the data not just within a particular institution but across institutions becomes much easier to manage. That's when you start to realize not just the potential of some of the overlays that we want to put on the consolidation of that data, but actually the reality of that without debate of we'll take that model but with some caveats or we'll apply some assumptions here because of the nature of the data and where it's from.

It's actually just a clean record and you get what you need with it. I think we're a long way from there, but I do think at either end of that spectrum there's progress on getting to a point where you can have, whether it's on distributed ledger technology or others, a cleaner record of that data and then bringing out through the shop to the end that you are working at where you consolidate a lot of that process, use it as capabilities for our clients and ourselves to be able to make better decisions. I think that's something that sits under the digital markets umbrella as we're working at both ends. I think that's pretty interesting to explore where we can take that.

Patrick Whelan:

Yeah, I think blockchain has that effect on distributing data that way. I think when we look at AI and large language models, we see that coming back together again in terms of there's a centralization effect in tech companies that have the ability to be able to process that amount of data and obviously generate those models. How do you see blockchain and DLT and AI and machine learning and how they benefit each other and also how they can help each other grow?

Scott Lucas:

That's a really good question. I think to be fair that they're probably going to grow independently for a while and in a way I quite like the focus on AI at the moment. It takes the focus of blockchain, it means we can get on other jobs without so much, so much light shining on us, but I do think-

Patrick Whelan:

The light's coming back by the way.

Scott Lucas:

Yeah. But I do think the opportunity set, as long as we keep that aligned and we know that that exists and we know that in the longer run that there's a better opportunity by bringing both those things together. One of the things that always comes up around DLT and blockchain is like because of the way that it works, particularly when you come back to some of the funding trades, you might need to pre-fund some of these things. The on-rails, off-rails of different cash legs, et cetera, and that is one of the hurdles to being able to execute at scale because we get a lot of value out of netting your T plus whatever. You can do a lot of that. I think as it grows, bringing some of these models that already exist today, whether it be netting algorithms or whether they be some other algorithm that looks at how you bring a body of work together, settle those effectively and spit them back out into an execution platform.

They're the sorts of models that will be good to be able to transform into something that's available to deploy in DLT. So you still get that very precise and what I like to call atomic settlement. For me it's delivery versus payment, but whatever, I think you can get that in a way that relies on some of this more advanced models that are available today and getting better. Bring that into DLT, think the DLT settlement process will be a beneficiary of that first before there's a scalable set of data that then brings into a more advanced and developed set of models. The AIML side of the spectrum.

Patrick Whelan:

I heard a good quote which was today's science fiction is tomorrow's science fact, and one of the things they mentioned was smart contracts and how we look to tokenize more of our life. In an ideal world, we love the power that AI can bring to so many of our day-to-day tasks, the co-piloting from a developer perspective, even to helping with emails and various different forms of communication that we have to actually try and summarize large amounts of information quickly and it can just speed up your day so much more. Somebody just showed this view where essentially you were born with a smart contract, that smart contract was essentially yours when all your data and eventually it learns with you as you grow and it becomes like you are the one who ultimately has the power to say where or how your data gets used over time, but you have this co-pilot with you for life.

It's a bit dystopian in terms of where it goes after that, but it is an interesting point in terms of the benefits that DLT and blockchain can bring from a security perspective. When you have that amount of data that you want to train models on, you're able to do that in a way that can keep some of the data private while at the same time getting some of the benefits that large language models can give you in terms of being able to provide that efficiency and scale.

How do you look at it from your perspective in terms of where do you think it can go from here in terms of today's science fiction becoming tomorrow's science fact? I think that's a bit of a step too far, but I think in our world we see it in the loan market, we see it what you've done in munis today in terms of there is digital issuance, there is digitally native bonds already in existence. We're already seeing the issuance process changing in terms of where the debt capital markets, which are the envy of the world in the US are something that are evolving today. We see that both in Europe and in the US in terms of the embracing of these digitally native bonds. Where do you think it goes from here?

Scott Lucas:

First of all, we need scale and that will come through one route or another. It'll take time, but it'll come through one route or another. But scale will come because people start to see the benefit and it becomes a bit self-fulfilling. So if you can demonstrate through execution what that potential looks like, then I think people start buying into that model. So what do I mean by that? I think there's a bunch of different ways that this could develop. If you think about how a digital bond can be managed and serviced versus a regular way bond, that principle of it's a shared ledger, it's a single record rather than lots of different records. I mean the point I made before, it becomes impossible to disagree about what that data point is because there's only one record of that. That is the record that everyone sees.

That starts to remove the overhead of people checking. If you move the overhead of people checking everything along the way, then you can speed things up. So you think about an existing fixed income instrument that pays coupon on a semi-annual annual basis. We do that for a couple of reasons. One is because traditionally people used to tear strips off and post them away and then get their cash and then check that and reconcile it. That takes a while. Now it's because there's so many of these instruments out there and you've got to check them all. That overhead takes a reasonable amount of time. You don't want to be doing that a high frequency basis, but if you don't have that check because you've got the single record and you can calculate coupon to the second because it's just math. You can get your clean and dirty price, you can change the frequency of the coupon payments. You can pay daily, weekly, monthly type coupons. It starts to provide a different range of opportunities for those instruments look like. That's one set of opportunities.

You could start bringing the interest rate swap. You bring that in to the smart contract and say, well actually I'm going to issue a bond fixed. I'm going to put a swap in for floating. The issuer is going to step out of that. The bank can manage it. You have the same transparency, the same accuracy, the same reporting, but a fewer cash flows. Actually you take some operational risk out and you also open the door to a bunch of companies that are sophisticated enough today to have a well-trained high-cost finance department to manage the accrual accounting and the associated cost of doing business to issue a bond. They can now get into that space and it starts to do what capital markets are supposed to do, which is get wider and deeper and bring more capital to let companies grow in a different way. That's an opportunity.

Over time as we get more sophisticated in how they can be deployed, what the inputs for those are and how available they are, and there's a lot of streaming prices and streaming information which is about capturing the right stuff and the right way to feed into those contracts, then I think we get to start to really realize the value of that. But that will take time to get there because each one of those decisions takes people to take real risk. We talk about all these projects and you do a digital issuance or you do, we do this for a reason. The city of Quincy did a municipal issuance because it needed money for pavements and roads, not because they wanted to do a digital issuance, but they actually needed the money. All of these things have an outcome. That's real risk that the investors take on behalf of the issuer. It takes on behalf of actually putting it in the platform.

So to build that scale, you've got to do that incrementally to make sure people are comfortable with that risk and they can see it and agree it and feel good about doing that on behalf of their [inaudible 00:19:28] liquidity providers. We didn't leap from paper ticket trading to algos in a single muscle movement. That's a journey. This'll be the same.

Patrick Whelan:

Look, we've been on that journey for a while in our space and obviously it's one that we see the same footprint in terms of where we're headed, but at the same time, it's not that easy to necessarily disrupt and innovate traditional markets that have been that way for a long, long time. It was interesting to read about the Quincy bond in Massachusetts and the benefits that the legislators in the town felt they could get from the digitally native issuance. One, they could track where not only where the dollars were coming from but also where the dollars were going to go. So if you're a voter in that town, it's an easier and more complete way of tracking some of where that funds are actually going to get spent. It's going to be, as you said in your schools on your roads, you can actually feel like it's getting, you can track that value over time.

I do feel like it's an exciting time I think for digitally native bond issuance. It's not the only area I think that you're looking at in terms of it's the one that probably garners the most headlines at the moment, but it's probably not the only piece.

Scott Lucas:

We saw on Investor Day, Jamie spoke about all the interns coming in this summer are going to get AI training. We do a lot of that anyway. How do you deploy that? How do you think about that from your team training and people, et cetera?

Patrick Whelan:

Yeah, I think there's variations in terms of the forms of training that we're looking to give our analysts and associate populations as well as new interns. We've started to harness the skill sets that our analysts and associates have coming out of university. Most people have some form of Python training or some form of development skills that they've learned through courses in university. We want to make sure that they can harness those skills and put them into action once they join. So we've partnered them up with engineers in technology to help them get through some of the security and set up to get an actual piece of code up and running and actually working in production. I think if we don't start having more eyeballs on more data sets and continuing to clean it up, the points you've referenced before in terms of how do we actually get to a point where these large data sets are something we can train our models on, they'll never be clean enough and we'll always have issues.

We'll have the problems that are inherent in a lot of these large language models today in terms of bias and various other things. So we have to keep continuing to clean that data set, continue to deliver those insights, continue to find innovative ways of delivering those solutions to our clients and ultimately to harness our own data and actually use it better. So I don't think we've got it perfect yet, but I do feel like it has gotten better. As I said, more not just analysts and associates, I think we've seen more seasoned practitioners start to dust off some of their own developer skills from alongside the use of co-pilots like GitOps and LLM.

Scott Lucas:

It is complimentary. In order to ask good questions and build good models, they've got to know the products and feeds itself a little bit. When we talk about that, what are the sorts of things that we can see that we can deliver to when it comes to data analytics that are available for clients now that we've already built? Because it's not all future. We've got a lot of capability now.

Patrick Whelan:

Yeah. So on our single-dealer platform on Execute, we have our own Execute analytics product, which allows us to look at things like TCA reporting for clients on how our algo is performing, the heat map of market structure that we see across particular asset classes throughout the day. We see more volumes in the morning and into the close. We see it's aggregated and anonymized, so it's not necessarily client's data, but it does tell clients a little bit about the flows that we are seeing. We also have solutions that are a little bit more greenfield in terms of how we're developing them, where we're giving traders the ability to develop their own interfaces and UIs to be able to access some of that data and actually present better tools initially to salespeople so that they can actually see what the traders want them to see. They're actually producing the data sets themselves, but with a view that they can eventually deliver those to clients as well.

Scott Lucas:

We can't do it all ourselves. We've done some investments, we've looked at investments with you, we've looked at a range of different things. It is not just J.P. Morgan doing this, this is the market doing this. When you approach how we think about partnering or investing, how do you think about that and how do you think about bringing some of the stuff around our own approaches internally around data analytics, but also just workflow and bringing liquidity to the market into that conversation when you're looking at who we should invest in, who we should partner with, et cetera.

Patrick Whelan:

Yeah, look, I mean all the data analytics in the world, if it's only built up on our data set, is only going to be so useful to a client. They want real-time streams from us. They want pre-trade data.r They want the analytics from us, but they also want to see aggregate data from our competitors. They want to be able to harness what our competitors are sending them at the same time. So some of that obviously leads to discussions around how can we bring better solutions to bear in the market that ultimately solve client's problems better? I think that's something that has required us to work with our competitor firms to create solutions ultimately that either we can strategically invest in, that we can partner with an existing FinTech to help scale what they've already built so that ultimately we can provide that type of solution across assets or across the markets to a larger population of clients than we can necessarily get through our own single-dealer offering or through our own individual efforts.

So when we look at it, we generally look at it from, there are a number of principles whenever we get involved in strategic investments. I think every firm makes their own decision, but every one of us is trying to increase competition. We're trying to improve the transparency, improve the digitalization of workflows so that there's more automation, it's easier to do that. The scale that we need for the future is something that we can bring to bear with our clients. A lot of times you need a partner.

Scott Lucas:

The bit that I do find interesting is, and it's a bit of a privilege, I think working in digital markets and in J.P. Morgan because the strength of the crossover and knowledge coming back to the training around data analytics, markets, products, AI, ML, there's a very strong fin and tech component that works together. Whereas outside the firm, I think there's quite often pretty small fin, big tech in some of these and you need those complementary skills. But I think that's something we can also help as we make some of those investments evolve and bring some of those companies into a way that they can be more market useful.

Patrick Whelan:

I do feel like it's one of those areas you got to try and try and try, and then every now and then you'll find one that works. Not all of them will work, but as you said, and you're right, in terms of J.P. Morgan, we have the luxury of being in this seat to be able to navigate across so many different parts of that potential investment criteria that we would look to want to invest in a company. We're able to do the diligence, we're able to bring the power of the firm to bear by having lawyers, accountants, technologists, everybody look at potentially why this one might make sense. It isn't just one person's decision a lot of times. It's not something that happens overnight and it takes. We did one recently, it took two and a half years to get to market in the end, and it'll take four to five, six years to fully bear fruit.

But as you said, if we weren't in that position continually challenging ourselves as well as our clients and our partners across the market to continue to push, to innovate, to disrupt, to change things, I don't think we'd necessarily see the outcomes that we have in the past. I think being involved in electrification, the e-trading journey has lent itself to, as you said, the crossover of fin and tech in that sense. Ultimately we've helped accelerate a lot of these platforms' growth over time, and they've all helped broaden that network, increase that network-centric effect, but we continue to have to create competition otherwise it will stagnate.

So I think that is something that we continue to focus on. I don't think it's necessarily a one size fits all. I think some of the smaller ones have actually worked out better in a lot of cases because they're more targeted in particular areas. We've seen it in loans in both Octaura and Versana, even in the primary site in direct books, these kinds of consortium-led ventures can lead to improved digitization, improved workflows over time, but they take time and money to get going. But as you said, hopefully over the next few years we'll start to see some of the benefits of those. If I was to parachute into your team tomorrow, what would be the common conversations? What are people talking about the most? What are they excited about?

Scott Lucas:

I think, what next? It's a similar thing to across, and actually I was chatting to one of the associations this morning. They was saying, okay, so we've done Quincy, what next? He was talking about the fact that there's this a bit of almost a post-execution, oh god, now what are we going to do? Kind of feeling around it. There are other people across digital markets have thought when they've launched products, it's the same feeling. That I think is the next question. Okay, so we've done one thing, we want to do another thing. Where do we take it? How do we get there? I like that because it's very much a forward-looking appetite rather than the rear vision mirror. It wasn't that great. I think that's very much the conversation in the team at the moment. They're thinking about, okay, that's a baby step.

How do we turn into a bigger step and a bigger step and to the point you ready for, it's called work for reason. It's tough. There's a lot of things you've got to work through in order to execute and for good reason. It comes back to everybody asking people money on the table. They've got to have confidence in us and the team, the technology and the legal rules, et cetera. So I think they enjoy that challenge and they're looking forward to the next one. Certainly I am, and I think that's certainly where our focus is, but that's just brand new stuff. I mean, when you come back to the broader fixed space, there's a lot of different products in your area. If you're going to pick one, which is your favorite?

Patrick Whelan:

I came from credits, I would definitely lean on that one probably more than anything else, but it has been the one that's had a lot of focus in the last few years as well. It's gone through probably the most significant change. The disruption that you talk about, that entrepreneurial spirit is not just unique to digital market. We see it in salespeople, we see it in trading, we see it in our technology teams, in our QR teams across the board. That spirit is there, it's about harnessing it and actually giving people that outlet to continue to try and change the business.

So I do feel like if I was going to pick one, it would be that. But I feel like the bit that probably the fixed income lens has given me more than anything else is the ability to look across the businesses and see, as you said, some of the synergies that exist to be able to say, okay, we were looking at a direct connectivity with clients and we have this ongoing target of a path to 25% whereby we're trying to get 25% of our electronic volume being done directly with clients via our API in both credit and rates and commodities. So we've started to see the effects of being able to do things on a standardized basis, giving people targets and objectives that work across asset.

They are addressed differently from the business problems underneath. But ultimately we're trying to meet clients where they want to be met. They don't want to talk to 10 different people about the same thing. They just want to get access to our pre-trade data as efficiently as possible. They want to execute with us and they want to be able to do that as efficiently as possible. So we have to make that as seamless and frictionless as possible. I think that piece in terms of providing that scale horizontally, when I look to my broader team, we keep asking them for ways to not just do the first thing in a greenfield site, but how do we create reuse? How do we get to use it again and again and again and be able to scale that across the various products within fixed income and still provide the solutions the client wants?

So that one I think is one that's probably most common. I think the second one is metrics. How do we measure success? How do we look at our success through that lens and say, okay, can we quantify what it is we've done? Obviously something like the path to 25%, it's pretty clear. It becomes a catchphrase for a lot of people to say, okay, it starts to become something that we can all get behind and start to help people achieve. I think people like those objectives. They like clear targets, they know what it means, they know the benefits that it can bring. If we do our job well and execute well, yeah, we can bring that to bear across a number of different asset classes. I suppose turning it back on you, what are the things that are most likely to drive people in terms of their objectives?

Scott Lucas:

We've got long-range and short-range. The long-range vision of how we think things might play out. I think people are comfortable with, and it's been pretty well articulated across the market by most people that are in the market. They've all got a very similar landing point. The question really is how we navigate to get there. For us that's about being able to work in both of those gears. The short-term stuff is really about just kicking those rocks over and finding the trades that make money in the short run that demonstrate both the value and the investment we're making. We should continue to make that investment. But actually continue to reinforce the longer term value of why the technology and the capabilities we're bringing to bear than the market have even bigger value across a range of different use cases.

So Patrick, let's pretend we don't know each other for a few minutes. So give me a bit of background, like your first memory of the trading floor.

Patrick Whelan:

That's a good one. It's been a while. I've been at J.P. Morgan for 18 years now, but my first day at J.P. Morgan was getting a tour of the trading floor and just being hit with this wall of sound that ultimately just invades your senses from so many different angles. There's hoots and phones and back then there was a lot more hoots and phones. I think these days it's a bit quieter, but it's still fairly loud. There's still an energy about it that when you first encounter it, I was talking to one of our analysts that has recently joined, and they're still buzzed by it. They're just excited by the fact that it's 6:15 in the morning. This place is one of the busiest places you're going to come across. There's floors galore that are empty, but the trade floor, there's people there, people are going. It quietens down a little bit later on in the day, but it is definitely one of those places that does have an impact, I suppose. How about you? What's your earliest memory?

Scott Lucas:

It was a bit weird for me. So I joined from the army. It was a very different experience. Left outdoors all the time wearing uniform. Everyone looked pretty much the same.

Patrick Whelan:

Just the same, then.

Scott Lucas:

Yeah. It's pretty much the same. Instead of gillets and like a long sleeve shirts, it was camouflage. But I think one of the earliest memories I saw, I joined the chief investment office. Very early on in the canteen on that floor, one of the traders had a KitKat Chunky and a regular KitKat. He was doing a quick calculation of the price versus the weight of those chocolate bars. I was like, this guy makes a pretty good living and he's figuring out the value of something that's worth 75p. So it was a pretty interesting insight into the mind of someone who's making those risk decisions on a daily basis. But it was very different to the sort of, I guess, risk decisions I used to make in my previous career.

Patrick Whelan:

How did you make the transition from the army to a financial company?

Scott Lucas:

So I took a year to do an MBA. It was helpful. I grew up in Australia. I was in the British Army, so a few years in the Australian Army, a few years in the British Army. I didn't have a network in the UK outside the army. All those people that caught the training into London and sat in front of the computer screen, I didn't know what they did for a living. I didn't know what a salesperson did, I didn't know what a marketer did, I didn't know what an accountant did. So I took the year to figure out what do people do for a living and what do I want to do?

Patrick Whelan:

I'd still like to know what they do for a living.

Scott Lucas:

It's a fair point. But it was interesting to get a bit of context around that. Then through that process, met some people who'd been in different financial services firms, some people from J.P. Morgan came up and did a few different briefings. Just met a few folks and thought it sounded like an interesting area, interesting company, and eventually navigated my way into the firm in 2010.

Patrick Whelan:

It's quite the journey. Mine was slightly different. I joined in technology and technology has always formed a backbone to my career. I started out in production management and got a broader view of all of the different systems that traders used on a day-to-day basis. It was a good foundational growing area because whenever anything went wrong, you were the first person people called.

I transitioned later towards, and somebody once told me that you'll have 10 different careers in a 20-year career because each one will be different. I think that is the thing that J.P. Morgan gives you is that opportunity to continue to change your career path even within. So I spent two years in production management, I then became a developer, business analyst, the risk and analytics side, moved into the credit trading space and kind of credit exotics and hybrids pre-crisis. It also still had a strong technology lens through it because we had to continue to evolve the tools that we had available to us and then continue to move through to today where basically I wanted to find out more about, I felt like I knew enough about technology at that point that I developed a network that was broad and deep enough to want to find out more about how exactly the credit business operated.

I moved into our business management COO function and started to figure out a little bit more about the broader businesses that underpin that particular asset class, but always with a technology lens again. Technology was a driving force to what credit wanted to do, what we wanted to do in credit over time, which was we just started to see ETFs come into the space. We were just starting to embrace e-trading and that's where I moved into e-commerce and digital markets and started to develop a stronger lean towards how do we automate more of what we're doing within credit? How do we leverage what we've done in FX and rates and bring it to bear in an asset class like credit?

I think ETFs has been an area of focus for the firm more broadly and is one of the areas that we're probably most proud of in terms of what we've done in the last few years. It's not just one asset class. It is commodities, rates, credit as well as equities. It is about bringing all of those underlying asset classes onto a similar technology framework to be able to price them efficiently, to be able to not necessarily break them down into their individual business lines and treat them differently, but to be able to service our client base in the ETF space more broadly. They want the complete package. They don't want only a partial solution from rates or a partial solution from equities. They want to be able to look at ETFs across the board and trade whatever they want.

So we had to develop in partnership across the firm, a solution that worked in every area. Then obviously that was with a view to obviously our market share at the time was not where we would've liked it to be. There were gaps in terms of our offering to clients and we try to close those as quickly as we can. I'm glad to say we have managed to close a lot of those gaps. We're not done. We're a lot closer to where we wanted to be and we're closer to being the top bank in this space more consistently across asset, which is where we want to be. Obviously we want to move into the top two consistently going forward.

Scott Lucas:

You don't need to move on to business to do that. You don't need to move seats or teams to do that, but it's certainly something that seems to come up a lot in the conversations. Do you hear the same thing? There's appetite from mobility.

Patrick Whelan:

There definitely is. I think it's something that I think we embrace as well in terms of not just in digital markets, but in J.P. Morgan. A lot of people start their careers in sales and trading. We talked a little bit about more people wanting to leverage the data analytics skills that they've had in university and want to put them into practice.

Traditionally, that wasn't something that could have happened, right? So they would've had to move roles or move technology or move firms. I think what we're trying to do more often is, to your point, create those challenges, give people the opportunity to own their career and the direction they want to take it and continue to provide choice in that journey. I don't think any of us want to lose people. It's probably the thing that we love about the company the most. It is one of the questions that was going to put back on you in terms of what motivates you. I know for me it is the people, it is the network, it is the teams. It's the ability to work with so many extraordinary people all the time and continue to challenge our own ideas to disrupt within as well as to look to disrupt the broader market structure and industry as well. So I do feel like it's the people more than anything else that gets me out of bed in the morning.

Patrick Whelan, Global Head of Fixed Income Digital Markets and Scott Lucas, Market DLT Head, discuss their roles and the integration of digital technologies in financial markets.

They explore the benefits of DLT for data accuracy and efficiency, and the potential of AI and machine learning to enhance these technologies. Both emphasize the need for continuous innovation and client-centric solutions.

Available on the J.P. Morgan Markets Platform and through a multitude of additional channels to suit your needs.

The complete markets platform. Get around-the-clock access to an advanced portfolio of digitized services, designed to put you in control.

FOR INSTITUTIONAL & PROFESSIONAL CLIENTS ONLY

SOME PRODUCT AND SERVICES LIKE SI360 & PRIVATE BANK EXECUTE ARE AVAILABLE TO NON-INSTITUTIONAL CLIENTS

© 2026 JPMorgan Chase & Co. All rights reserved.