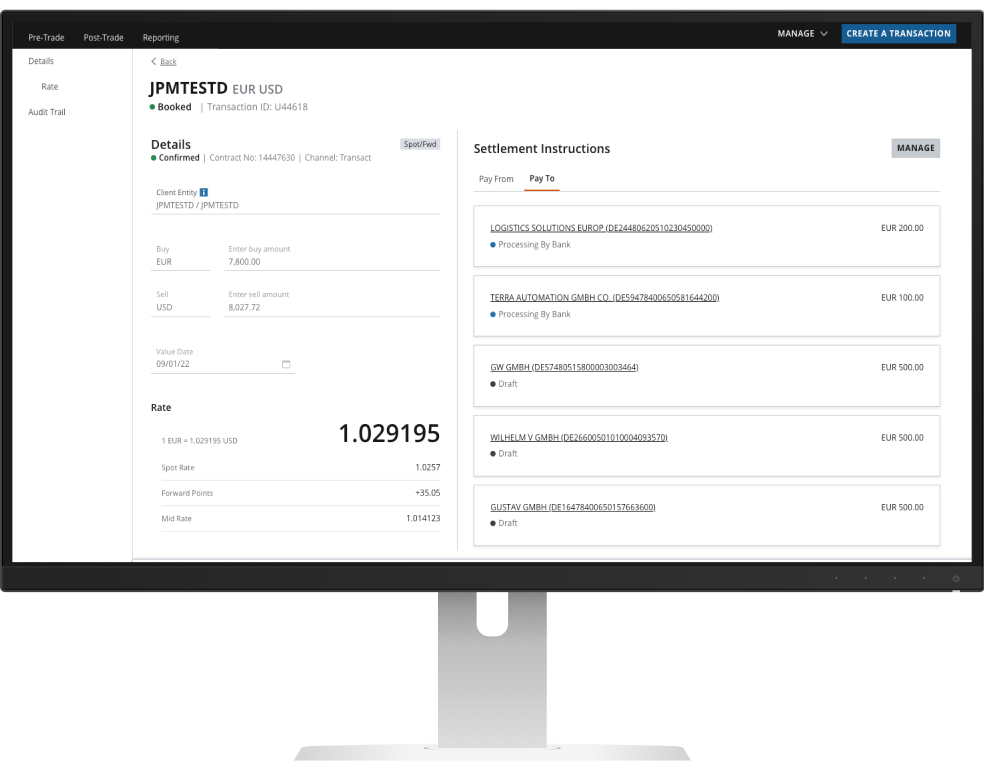

Transact spans the complete pre-trade, trade and post-trade workflow

Created to help you simplify and manage hedging, payments, and risk, this all-in-one custom-made FX platform provides end-to-end capabilities to execute and settle cross-border exposures, all accessed from a single login.

Key Transact Benefits

Consistent, sophisticated experience

Benefit from a consistent and global client experience. An all-in-one service, streamlining FX dealing, settlement and payment flows

Efficiency through consolidation

Transact consolidates the number of accounts maintained, aggregating FX trades and reducing costs

Global Reach

Transact is offered through our global hubs and local markets, matching the shape of your business

Transact Capabilities

More products in Pricing and Execution

Optimize how you use and extract data with flexible channel connectivity.

Available on the J.P. Morgan Markets Platform and through a multitude of additional channels to suit your needs.