Key Delta One Benefits

Portfolio hedging

Long and Long/Short portfolio hedging with the Delta One Optimizer. Optimize and iterate to create hedge solutions that aim for factor minimization, performance replication and more.

Single-stock hedging

Bespoke single-stock hedging leveraging the latest universe building and optimization techniques.

Thematics backtesting

Access the latest thematic content pieces and off-the-shelf baskets. Dynamically backtest signal-based thematic and factor baskets from scratch to express bespoke views through a user-driven custom product.

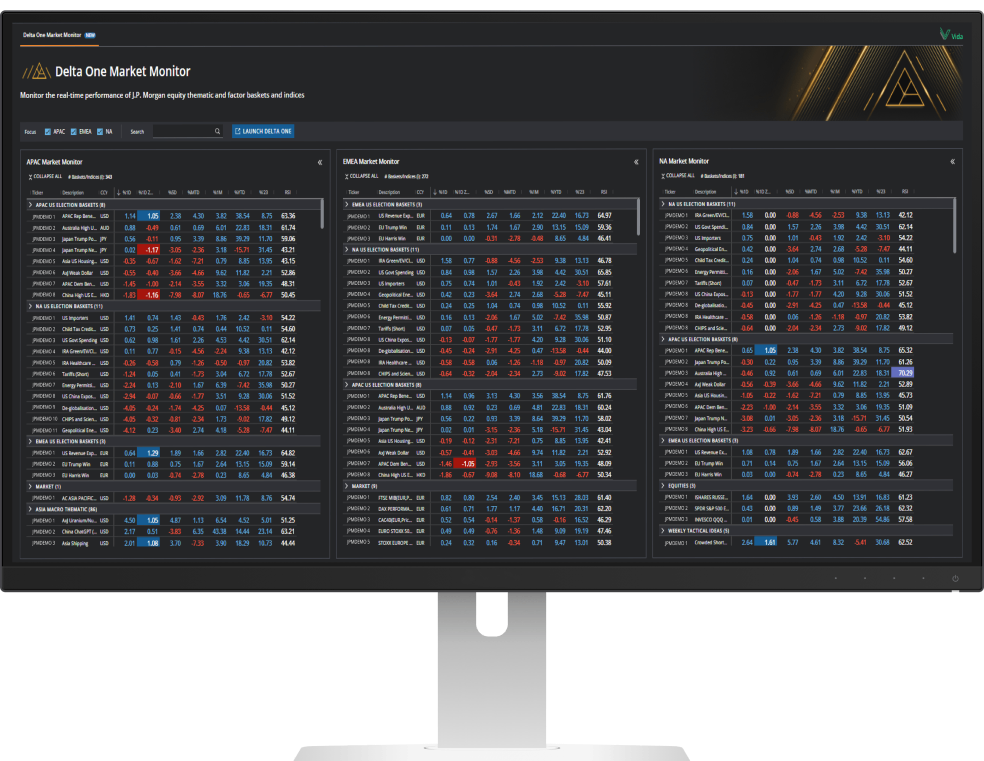

Key Delta One Capabilities

Available on the J.P. Morgan Markets Platform.