Key Nexus Benefits

Single instrument

Nexus handles operational aspects including financing, borrow, cash flows, corporate actions, exchange membership, margining, settlement, clearing, reporting, administration and custody. This can help lower cost for investors and managers and increase speed of execution.

Wrapper flexibility

By creating a single reference instrument, it is possible to offer alternative payoffs linked to the same strategy depending on the type of management required. The platform offers a wide range of investable formats including swaps, notes, warrants, funds and the option component of a 3rd party issued note.

Multi-asset

Nexus offers a broad spectrum of reference assets which can be used as building blocks to help you create your customized strategies. These include single stocks, cash bonds and credit derivatives, indices, ETFs, listed equity futures and options, mutual funds, as well as J.P. Morgan future trackers on equities, FX, rates, credit and commodities.

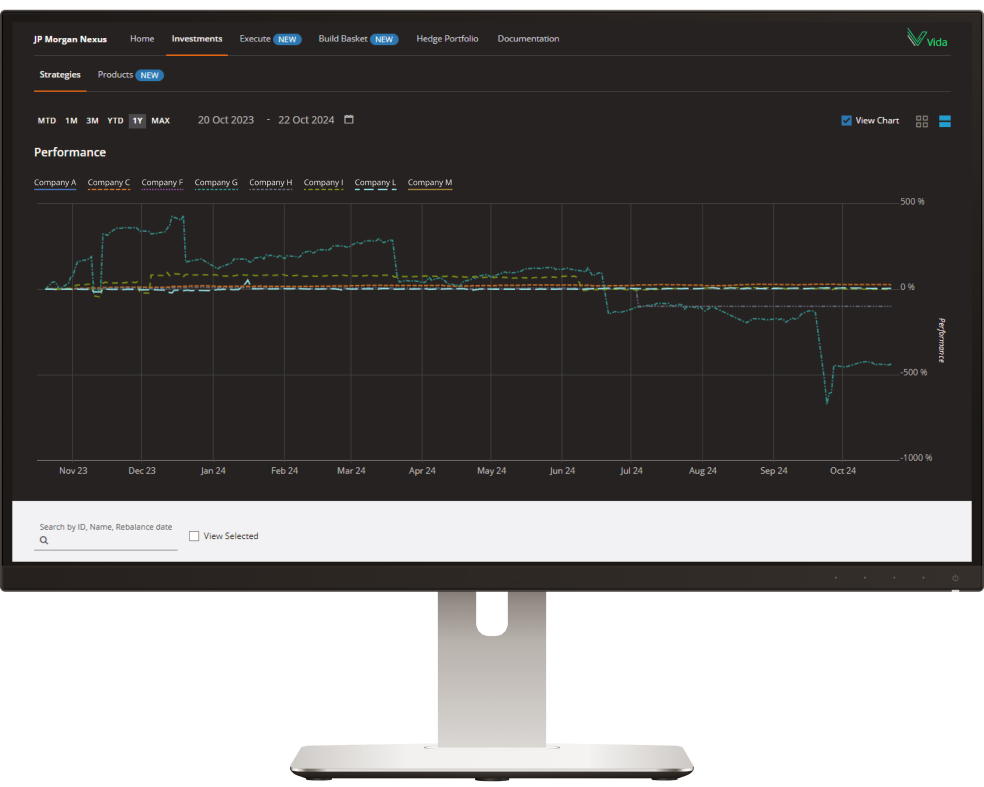

Nexus Capabilities

Available on the J.P. Morgan Markets Platform.