Portfolio Solutions to power your investment lifecycle

Create customized strategies, analyze the drivers of performance and risk, and manage with flexibility.

Portfolio Solutions

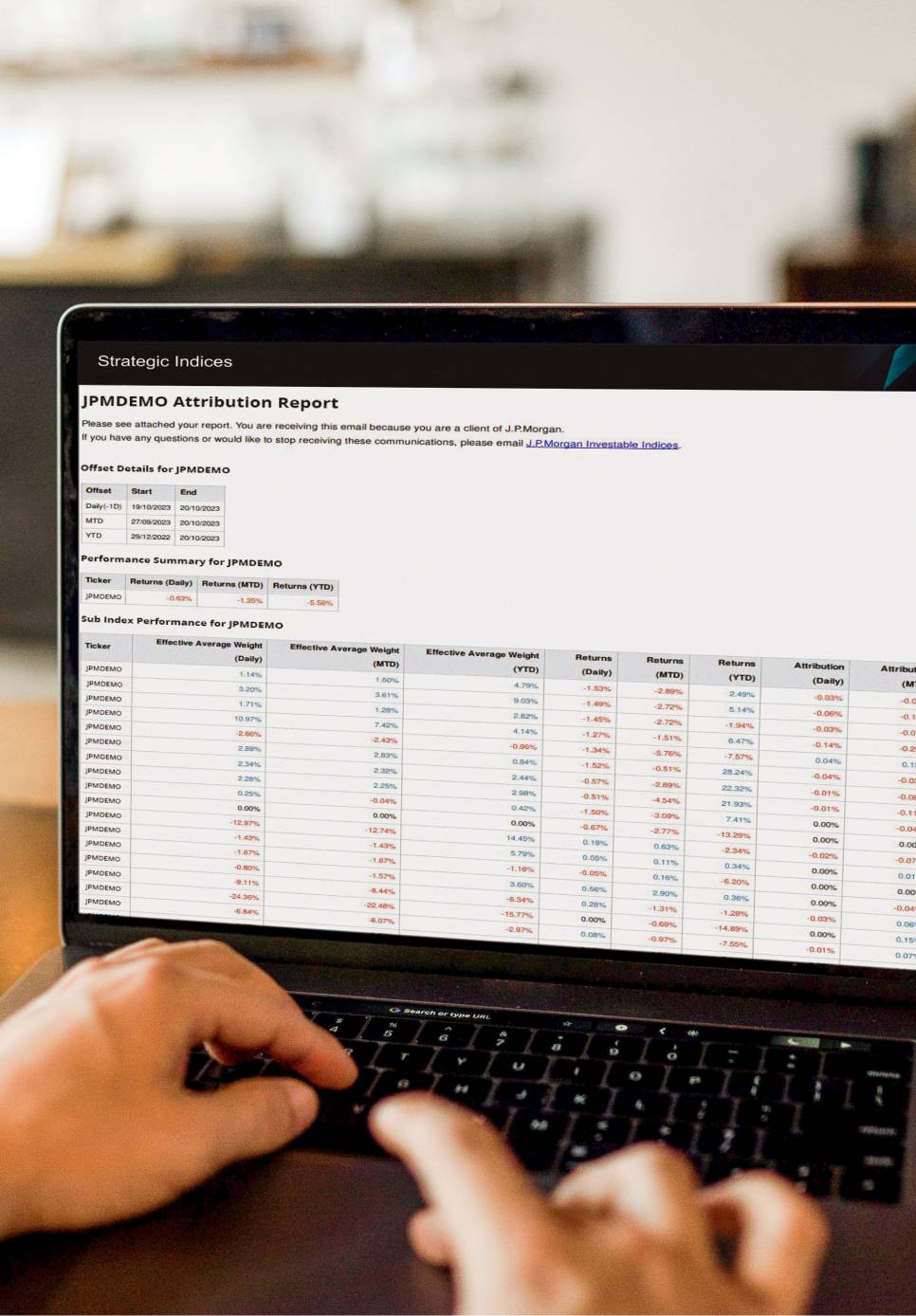

Strategic Indices

Portfolio Solutions

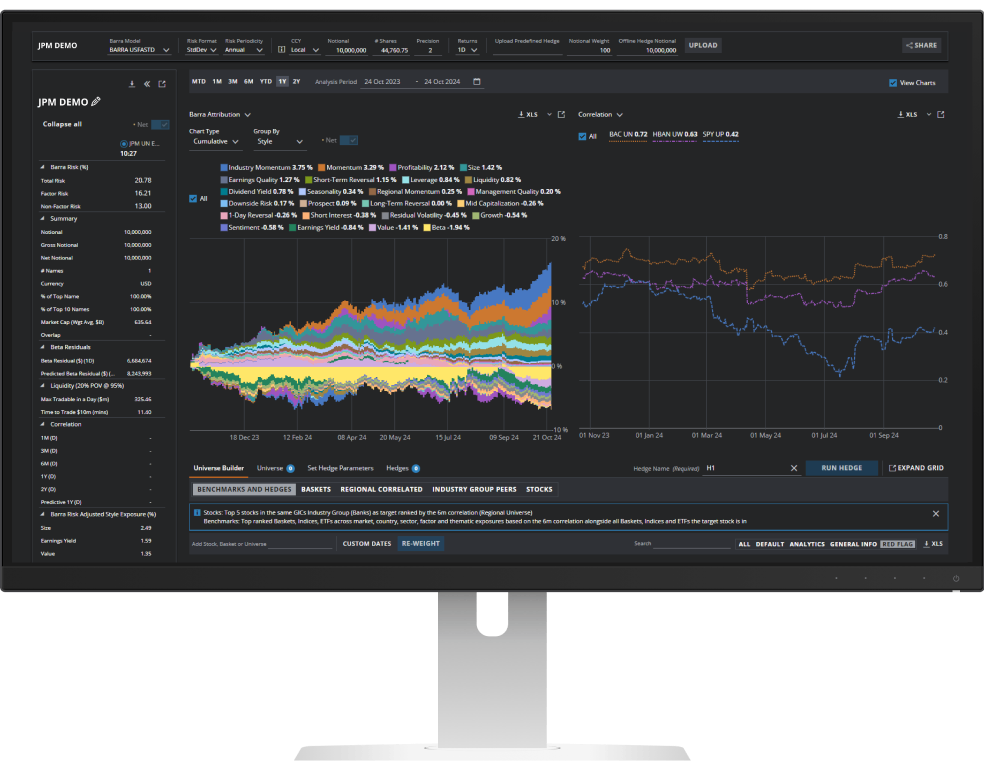

Nexus

Portfolio Solutions

Delta One

Portfolio Solutions

Financing Connect

Portfolio Solutions

Beta One

| VIDEO

| VIDEO

Key Vida Benefits

Cross-asset and multi-product

User-friendly access to J.P. Morgan’s Portfolio Solutions products, capabilities and content. Helping to assist you in meeting your performance objectives through a single, consistent interface.

Full lifecycle support

Full self-service capabilities from pre-trade to post-trade. Providing you flexibility and choice over the products and tools you use across the value chain.

Transparency

A suite of capabilities providing detailed analytics and data to assist you in your decision-making and help you achieve your performance objectives.

Key Vida Capabilities

PORTFOLIO SOLUTIONS

Questions

A barbell approach is used, offering electronic trading for efficiency while providing high-touch, customized solutions for complex client needs.

User experience is prioritized by involving clients early in the development process, ensuring products meet their needs and enhance engagement and satisfaction.

Customization at scale is key, allowing for bespoke solutions tailored to client needs, whether through specific payoffs, wrappers, or cross-asset combinations.

By maintaining local teams and fostering personal connections, adapting to jurisdictional needs, and leveraging face-to-face interactions to understand market dynamics.

Focus on creating common components across platforms while tailoring specific use cases, ensuring interoperability and continuous client feedback integration.

Video Interview

Get the real insights

Gurps Kharaud:

Hi, my name is Gurps Kharaud. I'm Global Head of Equities Digital Markets. And it's a pleasure for me to be joined by Rui Fernandes here, Head of Market Structuring, formerly Head of Equities, and then Credit Structuring, and now Head of Market Structuring. Rui, good to see you. Tell us a little bit about your role and how it's evolved. And congratulations again.

Rui Fernandes:

Thank you very much and nice to see you as well. I have an equities background. I've always been in a structuring capacity at J.P. Morgan. And recently, the firm decided or asked me to run structuring across markets, which really is about creating more innovative products across the full range of markets. We are complete, we're global, we are at scale, but there's always more innovation that we can do on behalf of our clients and for our business, to bring an ever-increasing degree of customization to the products and solutions that we deliver for clients, and how we build platforms and tools to facilitate that customization that's really important. And literally, so far, has been about meeting people, getting more in the weeds of products. It's a vast world of capabilities out there, both from a product, geographic, client-type perspective. So, learning a lot, having a lot of fun, and working out priorities in the areas that we want to focus on. So, so far so good.

Gurps Kharaud:

And you've been at J.P. Morgan for a number of years. And as we've touched on, you've seen your role evolve and grow. But take us way back to when you first joined J.P. Morgan. And way back, not meant to be anything to take events of. But take us back in terms of what was your first experience of J.P. Morgan and the trading floor.

Rui Fernandes:

So, I joined J.P. Morgan in 2007. A lot has changed since then. But back in 2007, when I first came to our building, this was in London, I went through my HR induction. And as I got in the elevator to go up to the trading floor, there was a man in the elevator who looked at me and said, "Hello, good morning, how are you?" It's nice. Said back to him, "Good, how are you?" And he had a certain aura, but I didn't know to be honest who he was, until a few weeks later I realized it was Jamie Dimon. So, literally, the first person that I spoke to at J.P. Morgan after my HR induction was Jamie, which is a great introduction to the firm.

Gurps Kharaud:

Yeah. I mean probably sharing some experience with my first interactions on the trading floor. I just remember the wall of noise. And you probably noticed this as well, how the trading floor has evolved over the years. It was like people shouting across the desk to each other. And you kind of walk in as a student from the library into this area with just the noise. There's six screens everywhere. How things have changed. How do you think the things have changed in markets over the years?

Rui Fernandes:

Clearly there's a lot less noise on a trading floor, which actually I miss. I miss the noise. Noise to me is action, is stuff happening. That being said, clearly, people interact today in a variety of different ways, not just shouting across the floor to each other. There's many tools, digital tools, whatnot, for people to communicate, which works, is very efficient. But part of me still misses the buzz of the trading floor. I mean, that said, when we go around different offices around the world, sometimes the foot bridge is different, offices are smaller, the trading floors are smaller, which actually makes it more compact. So, sometimes when I go to offices like Paris or Hong Kong, versus London or New York that have bigger trading floors, there's still a buzz and the noise because people are just sitting a lot more closely together. So, it's a real variety.

Gurps Kharaud:

I always find that the one thing that you really learn early on is just how global and transverse the firm is. And I think that just with the markets businesses, in terms of from the early morning until the late evening over here. When you're sitting in London and you see all of those different geographies, regions, cultures, how do you think that we adapt to different markets in different regions? And how are we trying to ensure we give the best level of service in all of these different countries we serve?

Rui Fernandes:

I mean, in the end, we are global, we are at scale, we are complete. So, that's all great. Quite unique J.P. Morgan setup. But at the end of the day, the client needs and the business needs are also very local. There is jurisdictional specific considerations, client considerations. We try to be very adapted to the local markets. And I think we do that by having teams on the ground. And for me, specifically, as I try to go around the world trying to find new areas of growth, new innovation for products, is really trying to talk to people, talk to J.P. Morgan people, talk to clients.

And even though we are all connected globally, I still find that there is no substitutes to sitting down face-to-face in a meeting, or over lunch, or a coffee or whatever informal setting, to really try to understand the dynamics on the ground and see how we can grow our business, how we can help clients. So, personally, even though traveling can be quite taxing. Especially now being based in New York, traveling to Asia can be somewhat complicated given time zones, but there's no substitute for that. And I try to travel as much as I can.

Gurps Kharaud:

Yeah. I think I always wonder which time zone you're in at any other time, but you always seem omnipresent. But I think to that point, I think it's one thing that you've really encouraged across the team, across all of us, is to really build that personal connection. Because at the end of the day, I think people look at markets in perhaps a cold light in terms of this ruthless environment that we're working in. But really, I think the most important thing is the long-standing relationships you build, the way that you can use those built of relationships to transform product, deliver that great service to clients. And I think the one thing that we really preach in J.P. Morgan is teamwork. I mean, beyond teamwork, what would you say is one of the top skills that you need to have to succeed in J.P. Morgan?

Rui Fernandes:

I think there's a baseline of teamwork, collaboration, innovative mindset, doing what's right for clients. All these things just come naturally to J.P. Morgan, and it's part of the fabric and the culture of the organization. I would say that really a differentiator is effectiveness of communication, because people are often very busy. They may come at it from a different starting point. And being able to articulate both kind of a medium to long-term vision about what we're trying to do, but also bringing it back to the present about the journey from where we are to what we want to build, and how we're going to build that, how we're going to bring the organization together to do that. The ability to communicate effectively across different types of people, different profiles, different knowledge bases is really critical. And I think J.P. Morgan as a firm really encourages that. And I do think, from my experience, it can make the difference.

Gurps Kharaud:

And what is probably the best advice that you would give to a new, shiny graduate that's coming into our organization today?

Rui Fernandes:

I would say take advantage of the immense set of opportunities at J.P. Morgan, but at the same time excel at your job today.

Gurps Kharaud:

Sorry to interrupt, but probably sharing my experience with you. I mean, we met... How long ago is it now? 11 years ago. And it probably took over a year before I joined J.P. Morgan. But I think that, that advice really resonates. I mean, you've always said to me, "Slow down, take your time, and the good things will happen." And I think that the right areas and opportunities always open for us all. But also as well, I mean, you and I, we've seen incredible transformation over that time from in terms of the things we were working on before versus what we're doing right now, and the influence of technology in a number of these things. I mean, that's one of the primary focuses that I have in my role. How would you say that technology has changed the markets business over the last 10 years?

Rui Fernandes:

Well, dramatically, but I'm going to actually just come back to something you said. I did tell you or advise you to sometimes slow down as you think about career progression, but I never told you to slow down in terms of delivering new products.

Gurps Kharaud:

100% true.

Rui Fernandes:

That was quite the opposite, just to clarify that for the record. But I think in terms of technology, it has changed. And that's even before we start talking about AI. Even before the advent of AI. Technology, certainly in a structuring capacity. Really the biggest change has been greater availability of data. I think that has really made a difference, data at one's fingertips that allows for back testing, analytics, pricing, in a much faster way. Computational power has also changed dramatically, so things that would take a while to analyze risk scenarios, et cetera. Back testing, we're able to do that much more quickly. Ultimately, what's also changed is the ability for us to interact with each other within J.P. Morgan and clients through digital means of communication. There's so many more ways of connecting to clients, whether it's for customization, pricing, execution. And that has really been an amazing trend, which is only going to accelerate.

Gurps Kharaud:

I think what you say about the communication, I think we've really taken that dramatic journey from much conversation over the phone and then we transfer to the email, to the chats. We're trying to give clients these tools to enable them to work effectively and explore our product sets, our services, our capabilities, and then collaborate with us on the tools. As we're talking about that collaboration, and we've spoken about how we can collaborate much more on digital channels, there's almost that communication level where it's the price quote execute, versus the part that where we're looking at the create, manage, analyze, and report. How would you say that those two differ in terms of the interactions that we have? And what do you think are the top three principles between both in those sides in terms of the qualities that clients are looking for?

Rui Fernandes:

I think we often talk about the barbelling of markets and how on one end of the spectrum, markets are increasingly electronic, where clients trade through electronic means. And that's a growing trend. Really very much equities-focused in the past, and that is growing across multiple asset classes. We are very focused on that as a firm. There's also the other side of the barbell, which is typically where structuring function operates, which is more high touch in nature. By high touch, I mean creating something specific bespoke for clients.

And our mantra on that side of the barbell, and you're smiling so you've heard it many times, is customization at scale. And customization means many things, but ultimately it's the ability for us to deliver to clients a product which is specific to the clients. Whether it is a particular payoff, whether it's a particular wrapper, whether it is combining one asset class with another in a way that is bespoke and customized for that client. We believe that is a strong differentiator today and going forward.

Gurps Kharaud:

And we often have this conversation about is technology disintermediating you in terms of the service that you give to clients. Do you agree with that?

Rui Fernandes:

Well, I mean I would very gladly be disintermediated from the back and forth with clients, that, back to your question, how have markets evolved over the last 10 years? We used to exchange a lot of Excel files. I think we were happy with that. I don't think the clients were happy with that. There's got to be a better way, rather than exchanging Excel files that sometimes you don't even remember the password anymore and the links don't work.

Gurps Kharaud:

Gone over the size limit.

Rui Fernandes:

Gone over the size limit. My inbox gets too full. I have to get an extension. So, all of that, I think is something that everyone will be glad to just see disappear, certainly clients. And let's not forget, we do what is best for the clients and we adapt to the way in which clients want to interact with us. And overwhelmingly, the feedback from clients is they want to be able to affect that customization themselves. In the end, though, we are still very much in the driving seat in terms of curating how that capability looks like to make sure it's appropriate for clients. We also need to make sure that the pricing models, the data, all the engines that sit behind that front end are constantly updated, they're up to scratch, the compute works.

But we also need to make sure that it's easy to use. And financial firms, and I'm careful how I say this, but have not historically done an amazing job at creating easy to use client front-end tools. I think that's changed dramatically. And we've seen it. And thanks to the great work of your team, amongst others, I think that's really been something that I've seen that transformation over the last, call it five or so years.

Gurps Kharaud:

I think you touched on a really good point about the user experience, the client journey. These kinds of things when we were talking about them five years ago, when we were saying that we need to interview clients before we actually built something for clients, I think that that's actually a dynamic shift to what we've done within our markets business as well. Really focusing on building a product that the client wants and feels part of the journey, rather than just giving them something and say, "Hey, use it and let us know your feedback." I mean, when we first built one of our recent products, we did I would say 25 client meetings before anyone wrote any code, did any designs. And it really pivoted our strategy from what we thought we wanted versus what actually the client wanted.

And building these products with clients obviously increases their penetration that you have with them. They feel that they're owners of the products. You take them on the journey. But I would say, how do you balance the different clients in the different asset classes? Because obviously, with you in your market structuring role, you started in equities, you moved to credit, now you do market structuring, so you're cross asset. How do you think we take the approach to building these solutions, not only for clients in a single asset class, but across asset classes? And how do you think that in digital solutions we are driving the synergy such we're not building the same thing again, and again and again?

Rui Fernandes:

It's a very good question. I think in an ideal world, you would have, let's say platform homogeneity and interoperability. That's kind of like the holy grail, where basically you build the same platform for everybody. The reality is, given the vastness of our markets business, the range of products, the range of clients, really these platforms have to be very specific to the use case that clients want to use those platforms for. So, there's a natural balance, slash, conflict that we need to optimize. I think the happy balance there is where we try to create common components, whether it's a data architecture, the models, the authentication, et cetera, that goes along with these client-facing platforms and try to have common components across all platforms, but then be very specific and very diligent about the use cases that we add onto these platforms.

So, back to your point about talking to clients about what's important for them. Take Vida as a platform which you and your team have built. I think that is really a good litmus test of how to build these platforms, in that Vida is a single platform unified, but the use cases currently in Vida are very specific to the type of client and the type of product. And we find that that is the right way to encourage clients to use the platform and to stick to the platform. Then there's also the element of ongoing innovation in terms of how we evolve these platforms. So, it's not just a client feedback upfront and when we build the platforms, day one. But it's also continuous enhancement, because the market changes, client needs change.

And obviously, the best feedback we get is from clients who are engaged. We see the traffic on a platform. And I've found clients to be extremely happy to give us detailed feedback. They want to participate in the build. Obviously, they have a degree of self-interest because they want the platform to work as well as it can for them, but they're also very keen to be part of the build of these platforms. And that's been a great experience for us.

Gurps Kharaud:

When we think about the next couple of years ahead, where do you see us going as we go in these digital journeys? And I know that often I joke about you with your crystal ball. And I always think you're very good at spotting the trends. But probably an opportune time to say, where do you think we're going in the next two to three years?

Rui Fernandes:

So, I don't have a crystal ball. I wish I did. But my crystal ball is really back to the point I was making earlier about ability to communicate. And that's really what the crystal ball is, ability to communicate with clients, internally with our stakeholders, sales, trading, technology, QR, our quantitative research team. All stakeholders are very important. And ideas about new products, new capabilities can really come from everywhere. So, you got to create an environment that encourages people to participate, because they feel they have skin in the game, they are rewarded for coming up with ideas, and that these ideas importantly can go from an idea to an actual product. That's where you come in.

Gurps Kharaud:

That's when you knock on my door.

Rui Fernandes:

To make sure that things actually get delivered. And when that virtuous cycle really works, it can really work. And we've seen it, and that's incredibly important. So, the crystal ball is really maintaining that feedback loop, that culture of collaboration, and people feeling, "I can come up with ideas and see them being put to practice." I think if you look at the next two, three, five years, there's an element of just, honestly, continuing to do what we are doing well, and that's to find very concrete use cases for clients that we're not addressing today, getting the kind feedback in terms of what capabilities they really want in granular detail, and go on and build it. And I think we're only at the start or maybe halfway through that journey across the entire markets division.

I think the other thing that is harder to do, but I think it will be increasingly important, and that's the two to three, to five year time horizon you're talking about, is the idea of interoperability in a seamless way. So, the markets business of J.P. Morgan is, of course, from a trading perspective, very asset class aligned. And we've spent a number of years creating more horizontal stripes, if you will, across these different markets. Digital markets is a very good example of that. And I think that will create greater interoperability across different tools that may be built for a specific asset class, for specific client target in mind, but being able to allow clients to toggle, if you will, between one application and another in a seamless way.

Because clients themselves, be it asset managers, hedge funds, asset owners, insurance companies, financial institutions, you name it, sovereign wealth, they are increasingly becoming more and more cross asset as well. So, that is really important. So, that's one thing. The second thing, coming back to AI, is AI. So, we spend a lot of time, effort as an organization or resources in AI. I think as we pivot from utilization and adoption of AI for internal efficiency, the next version of that will be for our client business in terms of new products, new capabilities that is client facing, that embeds AI.

Now, conceptually it sounds very interesting, of course, let's do that. But of course, there are a number of challenges, and not just the actual technology itself and how do we safely embed AI into our product. There's also regulatory challenges in terms of how do we actually do that in the context of a highly regulated financial services company. We've started doing that. And I personally believe that the next three, five years we'll see a huge acceleration in that trend.

Gurps Kharaud:

Now, we've spoken about AI. Now, what about one thing that we've spoken about quite a lot internally and externally? Tell us a little bit about IndexGPT.

Rui Fernandes:

I was waiting for that. So, IndexGPT, let me start from the very beginning. So, we have within the markets organization a large, well-established market-leading business in creating indices for clients. Indices that allow clients to express a certain view. Some of these indices can be very simple in nature. Simple in the sense of being beta type or enhanced beta exposure to a certain market or asset class, and can be also more complex indices that have dynamic rebalancing, and volatility triggers and things like that. So, we have a broad spectrum. It's a growing business. We call it the strategic index business of J.P. Morgan.

As part of that business, we've always been looking at ways to enhance products for kinds. And about three, four years ago, we started adding NLP, natural language processing capabilities to some of our indices that invest in single stocks, typically in the thematic index space. That was a very successful product. Still is. But back to the idea or the notion that innovation, you need to keep innovating. You can't really stand still. Of course, the question came, well, if you believe that large language models are the natural successor to first generation NLPs, not quite, but let's just go with that for a second. Then the challenge came to us of how do we embed large language models into some of our own product development capabilities and our own index capabilities.

We filed for a trademark about a year ago. We already had an idea of a product and how we were going to deliver that. We literally then spent the subsequent 10 to 12 months refining the product. We worked a lot with our research colleagues, our AI machine learning colleagues in the firm, both research, practitioners. We spend a fair amount of time with legal compliance because back to the point about how do you deliver AI in a client-facing product, as opposed to let's say internal optimization. It brings up a whole set of considerations that we need to be mindful of. So, then a lot of time we actually spoke to clients about that product, back to the notion that a lot of the innovation comes through an iterative process with clients.

But the critical thing is this: It is really the start of a journey. Sounds like a cliche, but it's true. We wanted to cross that Rubicon, if you will, of bringing AI techniques to our client-facing index business, which we did with IndexGPT. We are creating thematic indices that are enhanced, powered through large language models in terms of the stock selection that the models generate. But the applications, the possible further applications of that are vast. Now, the speed at which we do that is a function of our own understanding of these models, client adoption of some of these models, how regulators look at AI enhanced products, what's the framework for that. We're very mindful, very thoughtful about that, but the objective is clear.

The ability for us to embed AI and machine learning techniques into our product design, into our client-facing innovation is critical. So, Gurps, you and your team have built an incredible platform, Vida, that has had a lot of client adoption, a lot of success. But if you look beneath the surface, it has a very broad range of applications from the more liquid equity markets with Delta 1, to the more, there I say it, illiquid markets in private credit with financing connect. With such disparate applications, how did you manage to build a platform that is cohesive and that has the adoption that it has with clients?

Gurps Kharaud:

Thanks, Rui. I mean it has certainly been a journey. When we began this project, we started off serving our strategic index business. And our goal was to bring a multi asset platform to our clients. And that took us over two years. And where we really began was with the client. So, we did over 20 user interviews with our clients before we wrote any code. And I think that that is really the focus that we've had as we've established these different platforms and as the Vida platform has grown over the years. The focus has been on delivering the best possible platform for the client, with the client, and really taking their feedback on board.

Now the other thing I would say that as we've grown the platform, is we've really tried to extract ourself from the singular use case of the given clients in the given asset class, and in terms of what the sales want to deliver. And actually taken a step back and said, "What are the services and what are the capabilities, and how can we use the different services and capabilities that we've already built, be that charting, be that analysis, be that different features that we could have, like back testing, and bring that to the different sleeves of the business that we serve?"

So, what we try and look at is, actually, rather than the given function, how does that fit into the theme that we have, which are four, create, manage, analyze, and report? And you'd be amazed that when you take yourself out of the actual individual use case, you can really build synergies across those pillars. And we look at that not only from the client-facing standpoint in terms of the UI and the capabilities that they have, but also in terms of the architecture that we have and the services that we build internally to be able to extract those benefits for our clients. And what that's enabled us to do is take from it taking us two years to deliver a platform, to it now being nine months. And I know it should be six months or even three months.

Rui Fernandes:

Three.

Gurps Kharaud:

But that principle we've applied. And then when you actually bring that out and you look in terms of those services, you'll be amazed at the different dots that you can connect. And then the final thing I would say is our clients are increasingly cross asset, multi asset. They're servicing their clients in a variety of different ways. This isn't something that we're delivering as J.P. Morgan and saying, "Hey, look at all these platforms underneath this one hood." No, it actually is one singular platform, four portfolio solutions. And our clients really like that. And giving them those cross-selling capabilities, i.e, that they can come in from one area, come into another area and it really look, feel the same, they're still getting that high quality experience across all of those four capabilities we provide, I think that really resonates with clients.

And you'll be amazed that when we connect dots internally, say our equity salespeople talking to our credit salespeople, you can actually connect clients on that front as well. So, when they're going into their meetings, it's not like they're bringing the new name of this new platform that J.P. Morgan are trying to bring. No, this is Veda that has been there for a long time. Delivering for clients already serves another area of the business, and then that makes adoption much easier.

Rui Fernandes:

So, tell me a little bit about the team itself. What you're describing, there's a lot of interdisciplinarity, if you will, in terms of talking to quants, talking to structure, salespeople, clients, lawyers, even, when you think about disclaimers and things like that, and how do we bring those products to clients. So, how did you build your team? And how do you think about the types of profiles that you bring to your team that you've hired over the years?

Gurps Kharaud:

I think that the nature of the job is very transversal. So, I mean, we've debated this and spoken about this a lot. It's not like I can go externally and say, "I want this profile and find me all of these different people that do X, Y, Z job." J.P. Morgan, I would say, in the space that I look after, in equities, in terms of building this team, are really at the forefront. Now, that means when you're going first, that established profile doesn't necessarily exist as a template within the market. And I think that what we've tried to do with the team as we've built it, I mean when we really started is we were about five people, and now we're at 18, is to try and look at a range of different skill sets that we've got. We've got people from operations. We've got people from technology. We've got people who have done product in different asset classes,.we've got people who were working in trading.

All of these different skill sets have come together to build this team. And what that means, I think as a core, I'm really proud of that because I think we've got a range of different skill sets. I think we've got a range of different capabilities. And that means that you can bring different levels of expertise, depending upon the product that you want to do and the region you want to do. But I think that the qualities that I really look for, and it probably sounds a bit cliche, is hard work. I think that it's really important to have a real hardworking mentality. I think that there's an ability for people to want to do more and coining the J.P. Morgan markets phrase, Do more."

Don't sit in your box in terms of what you're just delivering at this piece. Think about how it's going to grow multi-year. Where are you going to go next? That's a question I often ask. And I think the final thing is enjoy your work. I mean, we can't work that hours that we do, spend the time that we do at the firm, unless you really enjoy your work, your colleagues, your peers, the people that you work with, the projects that you're doing. Enjoy yourself. Because time that we spend in the organization, in the firm, if you're not enjoying it, you won't stay here for a long time. So, I think enjoy it, have hard work, do more.

Rui Fernandes:

So, you've been at J.P. Morgan for 11 years. If you could pick one person to have lunch with at J.P. Morgan, who would it be?

Gurps Kharaud:

I would say the one person would definitely be Jamie. Now, why do I pick Jamie? I think there's a range of different reasons. I always find that whenever he's speaking live, you really have to seize those moments to listen to him. He's so educated. He speaks about a range of different topics from what he's doing at home to what he's doing at work, where does he see the market. I would really want to spend time with Jamie, ask him all of those burning questions in terms of where does he see the markets going, where does he see things evolving. He always has great perspectives. I think he's also very worldy. And I think really the most important part about Jamie that I really see coming across is his humbleness. I mean, he has some real key ethos and values that he preaches to us internally, but also externally.

Rui Fernandes, Head of Markets Structuring, and Gurps Kharaud, Global Head of Equities Digital Markets at J.P. Morgan, discuss their roles and the evolution of their careers.

They also explore the impact of technology on markets, the significance of building strong client relationships, and the role of AI in creating new products.

Available on the J.P. Morgan Markets Platform.

The complete markets platform. Get around-the-clock access to an advanced portfolio of digitized services, designed to put you in control.

FOR INSTITUTIONAL & PROFESSIONAL CLIENTS ONLY

SOME PRODUCT AND SERVICES LIKE SI360 & PRIVATE BANK EXECUTE ARE AVAILABLE TO NON-INSTITUTIONAL CLIENTS

© 2026 JPMorgan Chase & Co. All rights reserved.